Key Insights

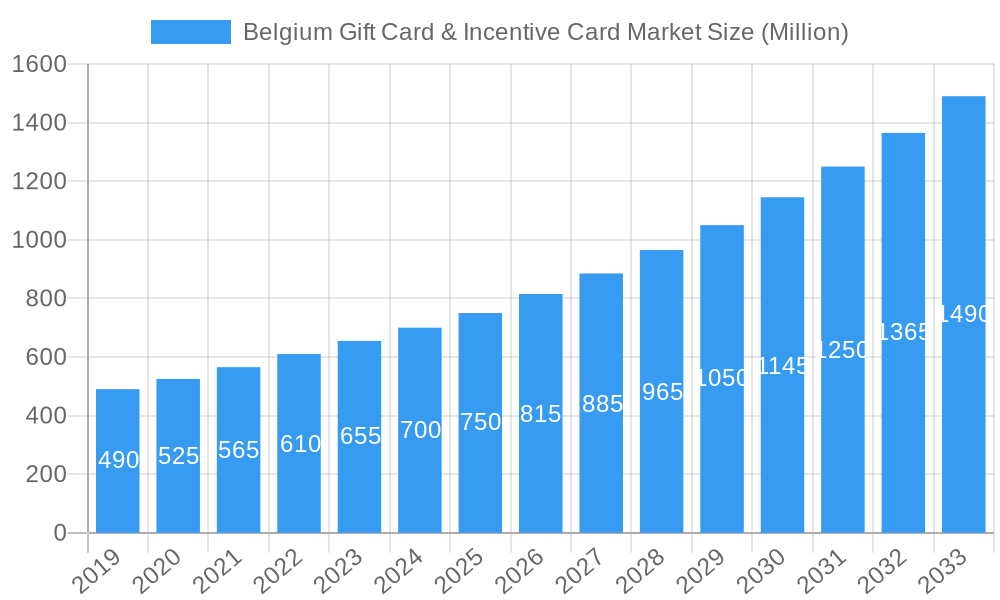

The Belgium Gift Card & Incentive Card Market is projected to reach 358.9 billion by 2025, driven by a CAGR of 11.5%. This growth is underpinned by evolving consumer spending, increasing adoption of digital payments, and corporate utilization for employee recognition and customer loyalty. The convenience of both closed-loop and open-loop systems fuels demand across e-commerce, retail, entertainment, and travel. Belgium's digitalization further supports market expansion, with online channels becoming a primary distribution avenue.

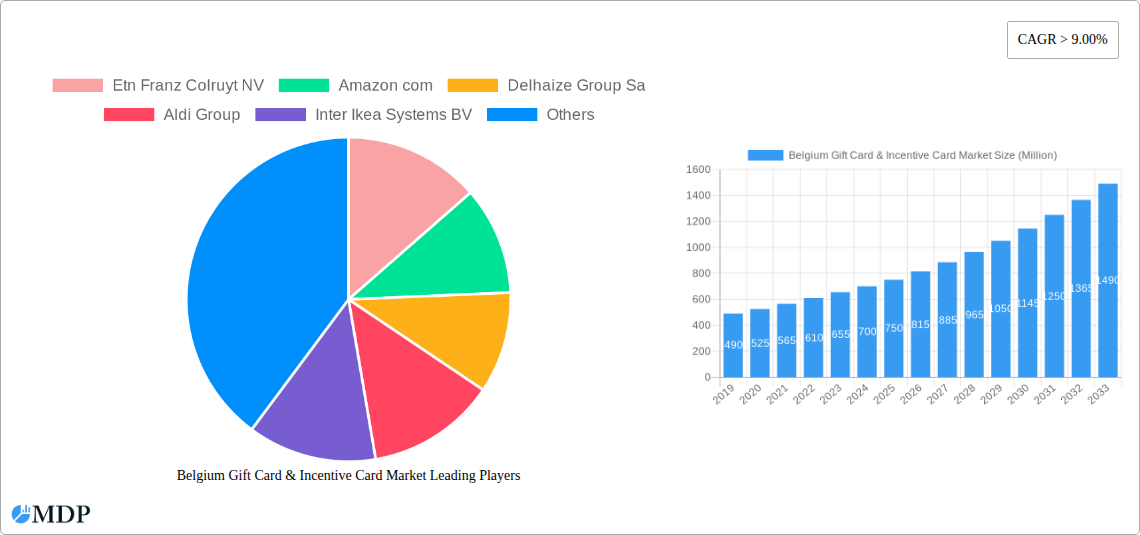

Belgium Gift Card & Incentive Card Market Market Size (In Billion)

Key growth catalysts include rising e-commerce penetration and strategic business deployment of incentive cards for employee morale and customer engagement. The market serves both retail consumers and corporate clients, with cards applicable to diverse spending categories, from necessities to discretionary purchases. Leading entities such as Etn Franz Colruyt NV, Amazon.com, and Delhaize Group SA influence market dynamics through innovation and partnerships. While regulatory shifts and competition from alternative digital payments present potential challenges, the overall outlook indicates sustained growth and increased market penetration in Belgium.

Belgium Gift Card & Incentive Card Market Company Market Share

This report delivers an in-depth analysis of the Belgium Gift Card & Incentive Card Market, providing critical insights for stakeholders. Covering the forecast period up to 2033, the study details market evolution, key trends, and strategic opportunities, informed by extensive primary and secondary research, including expert interviews and company filing analysis. The estimated market size for 2025 is 358.9 billion, with a projected Compound Annual Growth Rate (CAGR) of 11.5% from 2025 to 2033. Historical data from 2019–2024 provides a solid foundation for these projections.

Belgium Gift Card & Incentive Card Market Market Dynamics & Concentration

The Belgium Gift Card & Incentive Card Market exhibits a moderate to high concentration, with a few dominant players controlling a significant market share, estimated to be XX% in 2025. Innovation is primarily driven by technological advancements in payment processing, enhanced security features, and the increasing demand for personalized gifting solutions. Regulatory frameworks, particularly concerning consumer protection and anti-money laundering, play a crucial role in shaping market operations. Product substitutes include direct cash, loyalty programs, and digital gift vouchers. End-user trends indicate a growing preference for experiential gifts and seamless digital redemption. Mergers and acquisitions (M&A) activity has been moderate, with XX deals recorded between 2019–2024, primarily focused on consolidating market presence and acquiring technological capabilities. Notable M&A targets often include innovative fintech startups and established players seeking to expand their product portfolios or geographic reach.

Belgium Gift Card & Incentive Card Market Industry Trends & Analysis

The Belgium Gift Card & Incentive Card Market is experiencing robust growth, fueled by evolving consumer behaviors and corporate strategies. The increasing adoption of digital payment methods and the rise of e-commerce have significantly boosted the demand for online gift card purchases and redemptions. Consumers are increasingly seeking flexible and convenient gifting options, driving the popularity of open-loop cards and multi-brand gift cards. Corporates are leveraging incentive cards as powerful tools for employee rewards, sales incentives, and customer loyalty programs, recognizing their ability to drive engagement and boost productivity. Technological disruptions, such as the integration of blockchain for enhanced security and the development of mobile-first gifting platforms, are reshaping the competitive landscape. Market penetration is steadily increasing, with an estimated XX% of the Belgian population utilizing gift cards annually. The competitive dynamics are characterized by a blend of large multinational corporations and agile local players, each vying for market share through diverse product offerings and strategic partnerships. The market is projected to grow at a CAGR of XX% during the forecast period, reaching an estimated value of XX Million Euros by 2033. This growth is underpinned by continuous innovation in user experience and the expanding acceptance of gift cards across various retail and service sectors.

Leading Markets & Segments in Belgium Gift Card & Incentive Card Market

The Closed-loop Card segment currently dominates the Belgium Gift Card & Incentive Card Market, holding an estimated XX% market share in 2025. This dominance is attributed to the widespread acceptance and established brand loyalty associated with single-brand gift cards offered by major retailers and brands. However, the Open-loop Card segment is poised for significant growth, driven by increasing consumer demand for flexibility and choice.

Card Type:

- Closed-loop Card: Dominant due to established brand recognition and targeted promotions. Key drivers include brand loyalty programs and exclusive offers, contributing to a substantial market share.

- Open-loop Card: Experiencing rapid growth as consumers seek greater purchasing freedom. Increased adoption by financial institutions and third-party providers is expanding its reach.

Consumer Type:

- Retail Consumer: Represents the largest segment, driven by personal gifting occasions and self-purchasing for discounts. The convenience and perceived value of gift cards for personal shopping are key attractors.

- Corporate Consumer: Shows strong growth potential, particularly in employee recognition and customer loyalty programs. The tax efficiency and motivational impact of corporate incentive cards are significant drivers.

Spend Category:

- E-commerce & Department Stores: This is a leading spend category, reflecting the shift towards online shopping and the broad applicability of gift cards across diverse product ranges.

- Supermarket, Hypermarket and Convenience Store: A consistently strong performer due to the everyday nature of purchases and the convenience of using gift cards for essential items.

- Restaurants & Bars: Remains a popular choice for gifting and experiential purchases, benefiting from a growing dining-out culture.

- Entertainment & Gaming: Showing steady growth as consumers increasingly spend on leisure activities.

Distribution Channel:

- Online: The fastest-growing distribution channel, facilitated by the ease of purchase, instant delivery options, and wider accessibility. E-commerce platforms and direct brand websites are key players.

- Offline: Continues to be a significant channel, particularly for impulse purchases and as part of broader retail offerings. Traditional retail outlets, supermarkets, and convenience stores remain important touchpoints.

Belgium Gift Card & Incentive Card Market Product Developments

Product developments in the Belgium Gift Card & Incentive Card Market are increasingly focused on enhancing user experience and expanding functionality. Innovations include the integration of contactless payment capabilities, enabling gift cards to be used like debit cards at the point of sale. The rise of digital gift cards with personalized messaging and immediate delivery options caters to the growing demand for convenient and instant gifting. Furthermore, companies are developing sophisticated platforms that allow for easy management and tracking of incentive card programs for corporate clients. These developments aim to boost security, offer greater flexibility, and provide a more seamless and engaging experience for both gift-givers and recipients.

Key Drivers of Belgium Gift Card & Incentive Card Market Growth

Several factors are propelling the growth of the Belgium Gift Card & Incentive Card Market. The sustained shift towards e-commerce and digital transactions is a primary driver, making online gift card purchases and redemptions more accessible and convenient. Corporate adoption of incentive cards for employee motivation and customer loyalty programs continues to expand, offering a tangible and flexible reward solution. Favorable economic conditions and increased disposable income also contribute to higher consumer spending on gifts. Technological advancements, such as the development of mobile-first gift card solutions and enhanced security features, are further stimulating market expansion by improving user experience and trust.

Challenges in the Belgium Gift Card & Incentive Card Market Market

Despite its growth, the Belgium Gift Card & Incentive Card Market faces certain challenges. Regulatory complexities, including evolving consumer protection laws and anti-money laundering regulations, can impact operational efficiency and compliance costs. The increasing threat of fraud and security breaches necessitates continuous investment in robust security measures, adding to operational expenses. Intense competition from both established players and new entrants can lead to price wars and reduced profit margins. Furthermore, the potential for dormancy and breakage of unredeemed gift cards presents a financial risk for issuers and can lead to negative consumer perception if not managed effectively.

Emerging Opportunities in Belgium Gift Card & Incentive Card Market

Emerging opportunities in the Belgium Gift Card & Incentive Card Market are largely driven by technological innovation and evolving consumer preferences. The increasing demand for personalized and experiential gifting presents a significant opportunity for customized gift card solutions tied to specific experiences or services. The integration of gift cards with digital wallets and mobile payment platforms is set to enhance convenience and accessibility. Furthermore, strategic partnerships between gift card providers, e-commerce platforms, and loyalty program operators can unlock new revenue streams and expand market reach. The growing focus on sustainability also opens avenues for eco-friendly gift card options and responsible redemption practices.

Leading Players in the Belgium Gift Card & Incentive Card Market Sector

- Etn Franz Colruyt NV

- Amazon com

- Delhaize Group Sa

- Aldi Group

- Inter Ikea Systems BV

- Monizze

- Zalando

- PayPal

- Belgian Happiness

- Zero Latency

Key Milestones in Belgium Gift Card & Incentive Card Market Industry

- October 2021: For the first time in Belgium, Aldi introduced gift cards alongside the greeting card department in all 920 shops. Customers may activate the card and select a value when they pay for their purchases. The plastic card may then make contactless payments at the checkout.

- January 2022: Blackhawk Network, a branded payments provider, collaborated with supermarket retailer Carrefour Group to administer its branded third-party gift card program in France, Belgium, Poland, Italy, Spain, Romania, Argentina, and Brazil, expanding distribution globally. According to the joint release, the increased engagement with Blackhawk Network "will enable Carrefour Group to deliver worldwide efficiency and development from a single strategy." Carrefour will expand its present collaboration with major brands as part of the relationship.

Strategic Outlook for Belgium Gift Card & Incentive Card Market Market

The strategic outlook for the Belgium Gift Card & Incentive Card Market is optimistic, driven by continuous innovation and a growing acceptance of digital payment solutions. Companies are expected to focus on enhancing user experience through mobile-first platforms and personalized offerings. Expanding the acceptance network for open-loop cards and forging strategic alliances with emerging e-commerce players will be crucial for market penetration. The corporate segment presents a significant growth opportunity, with a focus on developing tailored incentive programs that align with employee engagement and retention strategies. Embracing contactless payment technologies and ensuring robust data security will be paramount for sustained growth and customer trust.

Belgium Gift Card & Incentive Card Market Segmentation

-

1. Card Type

- 1.1. Closed-loop Card

- 1.2. Open-loop Card

-

2. Consumer Type

- 2.1. Retail Consumer

- 2.2. Corporate Consumer

-

3. Spend Category

- 3.1. E-commerce & Department Stores

- 3.2. Resturants & Bars

- 3.3. Supermarket, Hypermarket and Convenience Store

- 3.4. Enteratinment & Gaming

- 3.5. Specialty Stores

- 3.6. Health & Wellness

- 3.7. Travel

- 3.8. Others

-

4. Distribution channel

- 4.1. Online

- 4.2. Offline

Belgium Gift Card & Incentive Card Market Segmentation By Geography

- 1. Belgium

Belgium Gift Card & Incentive Card Market Regional Market Share

Geographic Coverage of Belgium Gift Card & Incentive Card Market

Belgium Gift Card & Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. High adoption rate of smartphones

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Gift Card & Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. Closed-loop Card

- 5.1.2. Open-loop Card

- 5.2. Market Analysis, Insights and Forecast - by Consumer Type

- 5.2.1. Retail Consumer

- 5.2.2. Corporate Consumer

- 5.3. Market Analysis, Insights and Forecast - by Spend Category

- 5.3.1. E-commerce & Department Stores

- 5.3.2. Resturants & Bars

- 5.3.3. Supermarket, Hypermarket and Convenience Store

- 5.3.4. Enteratinment & Gaming

- 5.3.5. Specialty Stores

- 5.3.6. Health & Wellness

- 5.3.7. Travel

- 5.3.8. Others

- 5.4. Market Analysis, Insights and Forecast - by Distribution channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Etn Franz Colruyt NV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amazon com

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Delhaize Group Sa

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aldi Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Inter Ikea Systems BV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Monizze

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zalando

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PayPal

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Belgian Happiness

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zero Latency*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Etn Franz Colruyt NV

List of Figures

- Figure 1: Belgium Gift Card & Incentive Card Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Belgium Gift Card & Incentive Card Market Share (%) by Company 2025

List of Tables

- Table 1: Belgium Gift Card & Incentive Card Market Revenue billion Forecast, by Card Type 2020 & 2033

- Table 2: Belgium Gift Card & Incentive Card Market Revenue billion Forecast, by Consumer Type 2020 & 2033

- Table 3: Belgium Gift Card & Incentive Card Market Revenue billion Forecast, by Spend Category 2020 & 2033

- Table 4: Belgium Gift Card & Incentive Card Market Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 5: Belgium Gift Card & Incentive Card Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Belgium Gift Card & Incentive Card Market Revenue billion Forecast, by Card Type 2020 & 2033

- Table 7: Belgium Gift Card & Incentive Card Market Revenue billion Forecast, by Consumer Type 2020 & 2033

- Table 8: Belgium Gift Card & Incentive Card Market Revenue billion Forecast, by Spend Category 2020 & 2033

- Table 9: Belgium Gift Card & Incentive Card Market Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 10: Belgium Gift Card & Incentive Card Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Gift Card & Incentive Card Market?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Belgium Gift Card & Incentive Card Market?

Key companies in the market include Etn Franz Colruyt NV, Amazon com, Delhaize Group Sa, Aldi Group, Inter Ikea Systems BV, Monizze, Zalando, PayPal, Belgian Happiness, Zero Latency*List Not Exhaustive.

3. What are the main segments of the Belgium Gift Card & Incentive Card Market?

The market segments include Card Type, Consumer Type, Spend Category, Distribution channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 358.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

High adoption rate of smartphones.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2021 - For the first time in Belgium, Aldi has introduced gift cards alongside the greeting card department in all 920 shops. Customers may activate the card and select a value when they pay for their purchases. The plastic card may then make contactless payments at the checkout.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Gift Card & Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Gift Card & Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Gift Card & Incentive Card Market?

To stay informed about further developments, trends, and reports in the Belgium Gift Card & Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence