Key Insights

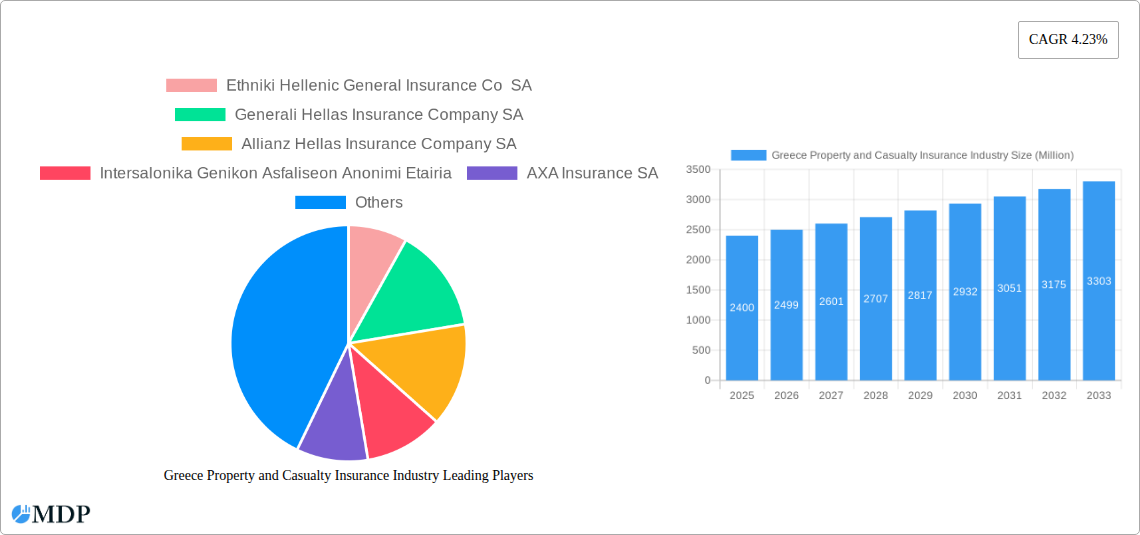

The Greek Property and Casualty (P&C) Insurance industry is poised for robust growth, with the market size currently estimated at €2,400 million. This sector is projected to expand at a compound annual growth rate (CAGR) of 4.23% from 2025 through 2033. This steady expansion is underpinned by several key drivers, including increasing consumer awareness regarding the importance of financial protection against unforeseen events, a growing demand for specialized insurance products, and a recovering Greek economy fostering greater disposable income. The P&C market is segmented across various insurance types, with Home and Motor insurance being dominant categories. Other insurance types, encompassing commercial lines, liability, and specialized coverage, are also gaining traction as businesses and individuals seek comprehensive protection. On the distribution front, direct channels are seeing significant uptake due to digital advancements and ease of access, while traditional agency and broker networks continue to play a crucial role in providing personalized advice and complex policy solutions.

Greece Property and Casualty Insurance Industry Market Size (In Billion)

Several significant trends are shaping the Greek P&C insurance landscape. The digital transformation is a paramount trend, with insurers investing heavily in online platforms, mobile applications, and InsurTech solutions to enhance customer experience, streamline underwriting, and improve claims processing. Personalized and usage-based insurance (UBI) products are also emerging, offering tailored coverage and potentially more affordable premiums. Moreover, a growing emphasis on cyber insurance and environmental, social, and governance (ESG) related risks reflects evolving societal and economic concerns. However, the industry faces certain restraints, including a competitive pricing environment, the need for ongoing regulatory adaptation, and potential economic headwinds that could impact consumer spending on insurance. Nevertheless, the inherent need for risk mitigation ensures a resilient demand for P&C insurance products in Greece. Key players such as Ethniki Hellenic General Insurance, Generali Hellas, and Allianz Hellas are actively navigating these dynamics, driving innovation and expanding their market presence.

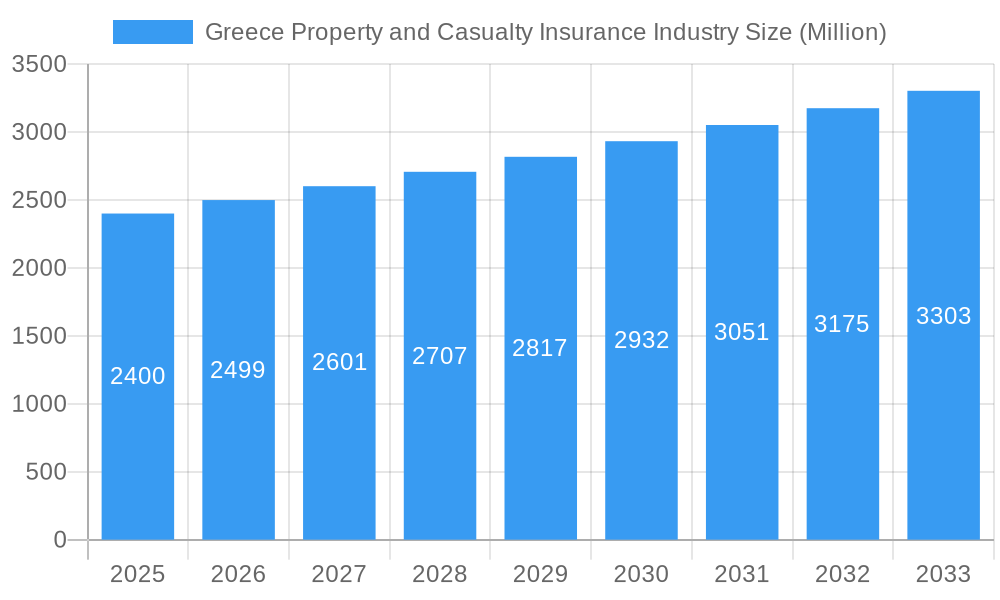

Greece Property and Casualty Insurance Industry Company Market Share

Greece Property and Casualty Insurance Industry Market Dynamics & Concentration

The Greek Property and Casualty (P&C) insurance market is characterized by a dynamic interplay of established players and evolving industry forces. Market concentration is moderate, with several key insurers holding significant market share. Key innovation drivers include the increasing demand for digital insurance solutions, the need for personalized products, and the imperative to adapt to climate-related risks. Regulatory frameworks, while generally stable, continue to emphasize consumer protection and solvency requirements. Product substitutes, such as self-insurance or alternative investment vehicles, exist but are less prevalent for core P&C needs. End-user trends are leaning towards a preference for transparent, convenient, and digitally accessible insurance products, particularly among younger demographics. Mergers & Acquisitions (M&A) activity, while not overtly rampant, plays a crucial role in market consolidation and strategic expansion. The number of significant M&A deals observed in the historical period is approximately 3, with key examples influencing market structure. Estimated market share distribution sees Ethniki Hellenic General Insurance Co SA and Generali Hellas Insurance Company SA as prominent leaders, each commanding between 15-20% of the market, followed closely by Allianz Hellas Insurance Company SA at 10-15%.

Greece Property and Casualty Insurance Industry Industry Trends & Analysis

The Greece Property and Casualty Insurance Industry is poised for substantial growth, driven by a confluence of economic recovery, increasing awareness of risk mitigation, and significant technological advancements. The Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be between 5.0% and 7.0%, reflecting a robust expansion trajectory. Market penetration, currently around 45% for P&C insurance products, is expected to climb to over 60% by 2033 as more households and businesses recognize the essential nature of insurance coverage. Technological disruptions are revolutionizing the sector, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) facilitating enhanced underwriting, claims processing, and personalized customer experiences. The development of InsurTech platforms is also a significant trend, offering innovative solutions that streamline operations and improve customer engagement. Consumer preferences are shifting towards digital channels for policy purchase, claims submission, and customer service, necessitating a strong online presence and mobile-first strategies from insurers. Competitive dynamics are intensifying, with both local and international players vying for market share. The emphasis on data analytics is becoming paramount for insurers to understand customer behavior, predict risks more accurately, and tailor product offerings. Furthermore, the growing impact of climate change is driving demand for specialized coverages, such as flood and earthquake insurance, creating new market segments and opportunities for innovation. The economic landscape, including factors like inflation and interest rates, will continue to influence premium pricing and investment strategies for insurance companies. The increasing adoption of IoT devices in homes and vehicles also presents opportunities for usage-based insurance models, further personalizing policies and incentivizing risk reduction. The overall market sentiment is optimistic, with a strong focus on digitalization, customer-centricity, and risk diversification as key pillars for future success in the Greek P&C insurance sector.

Leading Markets & Segments in Greece Property and Casualty Insurance Industry

The Motor Insurance segment stands as the dominant market within the Greece Property and Casualty Insurance Industry, consistently accounting for the largest share of premiums, estimated at over 40% of the total P&C market. This dominance is driven by mandatory third-party liability insurance requirements for all vehicle owners, a cornerstone of Greek traffic law. The robust automotive sector in Greece, despite occasional economic fluctuations, ensures a steady demand for comprehensive and third-party motor policies.

- Key Drivers for Motor Insurance Dominance:

- Mandatory Legislation: Legal obligations for third-party liability coverage are non-negotiable, ensuring a baseline demand.

- Vehicle Ownership Density: A significant number of registered vehicles in Greece, from passenger cars to commercial fleets, fuels the need for insurance.

- Economic Policies: Government incentives or regulations influencing vehicle purchases and usage directly impact motor insurance demand.

In terms of Insurance Type, Home Insurance represents the second-largest segment, contributing approximately 25-30% of the P&C market. This segment's growth is underpinned by increasing homeowner awareness of property risks, particularly in the wake of natural disasters like earthquakes and floods. Economic stability and improvements in the real estate market also positively influence demand for property insurance.

- Key Drivers for Home Insurance Growth:

- Natural Disaster Awareness: Increased frequency and severity of weather-related events and seismic activity heighten the perceived need for coverage.

- Mortgage Requirements: Lenders often mandate property insurance as a condition for home loans.

- Urbanization and Infrastructure Development: Growing urban centers and evolving construction standards necessitate robust property protection.

The Distribution Channel analysis reveals that Agency networks remain a cornerstone of the Greek P&C insurance market, capturing an estimated 35-40% of business. While digital channels are growing, the personalized advice and trusted relationships fostered by agents continue to be highly valued by a significant portion of the customer base, especially for complex policies.

- Key Drivers for Agency Dominance:

- Trust and Personalization: Consumers often prefer to discuss their insurance needs with a knowledgeable professional.

- Market Reach: Agency networks provide extensive geographical coverage across Greece.

- Complex Product Needs: For specialized or high-value policies, agent expertise is invaluable.

Brokers also play a vital role, particularly in the commercial P&C sector, accounting for around 20-25% of the market. Their expertise in sourcing tailored solutions for businesses and navigating complex risk portfolios makes them indispensable for corporate clients.

- Key Drivers for Broker Influence:

- Commercial Risk Specialization: Businesses often require bespoke insurance packages that brokers are adept at creating.

- Access to Global Markets: Brokers can connect Greek businesses with international insurance and reinsurance markets.

The Direct distribution channel is experiencing significant growth, driven by technological advancements and evolving consumer preferences for online transactions, representing about 25-30% of the market. This channel is particularly strong in the motor and simpler home insurance segments.

- Key Drivers for Direct Channel Growth:

- Digital Adoption: Increasing internet and smartphone penetration facilitates online purchasing.

- Cost Efficiency: Direct channels often offer more competitive pricing due to reduced overhead.

- Convenience: 24/7 accessibility and the ability to manage policies online appeal to modern consumers.

Other Insurance Types, encompassing a wide range of products from travel and health to liability and cyber insurance, collectively represent approximately 10-15% of the market. This segment is experiencing dynamic growth due to increasing diversification of risks and emerging consumer needs.

Greece Property and Casualty Insurance Industry Product Developments

The Greece Property and Casualty Insurance Industry is witnessing a surge in product innovation driven by technological advancements and evolving consumer demands. Insurers are increasingly leveraging data analytics and AI to offer personalized policies, particularly in motor and home insurance, with usage-based insurance (UBI) models gaining traction. There's a growing emphasis on parametric insurance for natural disaster coverage, providing automatic payouts based on predefined triggers, streamlining the claims process and enhancing customer experience. The development of integrated digital platforms that offer seamless policy management, claims submission, and customer support is a key competitive advantage. Furthermore, product offerings are expanding to cover emerging risks such as cyber threats and business interruption, reflecting the dynamic economic landscape and increased digitalization of businesses.

Key Drivers of Greece Property and Casualty Insurance Industry Growth

The growth of the Greece Property and Casualty Insurance Industry is propelled by several key factors. Technological advancements, including the adoption of AI, IoT, and advanced analytics, are driving efficiency, enabling personalized products, and improving customer engagement. Economically, a recovering Greek economy, coupled with increased disposable income and consumer confidence, is boosting demand for various insurance products, especially home and motor insurance. Regulatory reforms, aimed at modernizing the insurance sector and enhancing consumer protection, are also fostering a more stable and attractive market. Furthermore, a growing awareness of risk mitigation, particularly following natural disasters, is leading to increased uptake of P&C insurance.

Challenges in the Greece Property and Casualty Insurance Industry Market

The Greece Property and Casualty Insurance Industry faces several significant challenges. Regulatory hurdles, while aimed at consumer protection, can sometimes lead to increased compliance costs and slower product innovation. Natural catastrophes, including earthquakes and floods, pose a substantial risk, leading to increased claims payouts and potentially impacting insurer solvency. Competitive pressures from both established domestic players and international entrants, especially through digital channels, are intensifying, requiring insurers to constantly adapt their pricing and service models. Supply chain disruptions, affecting the cost of repairs for vehicles and properties, can also indirectly influence claims expenses and premium rates.

Emerging Opportunities in Greece Property and Casualty Insurance Industry

Emerging opportunities in the Greece Property and Casualty Insurance Industry are largely driven by technological innovation and evolving societal needs. The continued digitalization of the economy presents significant opportunities for InsurTech companies and traditional insurers to offer enhanced online services, streamline claims, and develop new digital-first products. The growing awareness of climate change is creating a demand for specialized insurance solutions for natural disasters, such as parametric insurance and coverage for renewable energy infrastructure. Strategic partnerships between insurers and technology providers, as well as collaborations within the broader financial ecosystem, can unlock new customer segments and service offerings. Market expansion strategies focusing on underserved segments or new risk areas, like cyber insurance, also represent considerable growth potential.

Leading Players in the Greece Property and Casualty Insurance Industry Sector

- Ethniki Hellenic General Insurance Co SA

- Generali Hellas Insurance Company SA

- Allianz Hellas Insurance Company SA

- Intersalonika Genikon Asfaliseon Anonimi Etairia

- AXA Insurance SA

- Groupama Phoenix Hellenic Insurance SA

- ERGO Insurance Company SA

- European Reliance General Insurance Co SA

- Interlife General Insurance Company SA

Key Milestones in Greece Property and Casualty Insurance Industry Industry

- December 2022: Chubb announced its intention to launch a new technology services center in Thessaloniki, Greece, in early 2023, signaling a commitment to leveraging innovative technologies to enhance customer experience and drive digital transformation within the Greek market.

- June 2023: The Ardonagh Group (Ardonagh) made a significant entry into the Greek market through the acquisition of a controlling interest in SRS Group of Companies (SRS). This strategic move bolstered Ardonagh's presence and offered a platform for growth within the Greek wholesale reinsurance brokerage and MGA landscape.

Strategic Outlook for Greece Property and Casualty Insurance Industry Market

The strategic outlook for the Greece Property and Casualty Insurance Industry is one of optimistic growth, underpinned by digitalization and a growing emphasis on risk management. Insurers are expected to continue investing in technology to enhance operational efficiency, personalize customer experiences, and develop innovative product offerings. The increasing demand for coverage against natural disasters and emerging risks like cyber threats presents significant opportunities. Strategic partnerships and a focus on customer-centricity will be crucial for market leaders to maintain their competitive edge. The market is anticipated to witness further consolidation and the rise of specialized InsurTech solutions, collectively driving the industry towards greater resilience and responsiveness to evolving economic and societal landscapes.

Greece Property and Casualty Insurance Industry Segmentation

-

1. Insurance Type

- 1.1. Home

- 1.2. Motor

- 1.3. Other Insurance Types

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Brokers

- 2.4. Other Distribution Channels

Greece Property and Casualty Insurance Industry Segmentation By Geography

- 1. Greece

Greece Property and Casualty Insurance Industry Regional Market Share

Geographic Coverage of Greece Property and Casualty Insurance Industry

Greece Property and Casualty Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Awareness of Risk Management

- 3.3. Market Restrains

- 3.3.1. Intense Competition and Regulatory Complexities

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration and Technological Advancements are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Greece Property and Casualty Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Home

- 5.1.2. Motor

- 5.1.3. Other Insurance Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Brokers

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Greece

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethniki Hellenic General Insurance Co SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Generali Hellas Insurance Company SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Allianz Hellas Insurance Company SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intersalonika Genikon Asfaliseon Anonimi Etairia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AXA Insurance SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Groupama Phoenix Hellenic Insurance SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ERGO Insurance Company SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 European Reliance General Insurance Co SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Interlife General Insurance Company SA**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Ethniki Hellenic General Insurance Co SA

List of Figures

- Figure 1: Greece Property and Casualty Insurance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Greece Property and Casualty Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Greece Property and Casualty Insurance Industry Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Greece Property and Casualty Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Greece Property and Casualty Insurance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Greece Property and Casualty Insurance Industry Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 5: Greece Property and Casualty Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Greece Property and Casualty Insurance Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greece Property and Casualty Insurance Industry?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the Greece Property and Casualty Insurance Industry?

Key companies in the market include Ethniki Hellenic General Insurance Co SA, Generali Hellas Insurance Company SA, Allianz Hellas Insurance Company SA, Intersalonika Genikon Asfaliseon Anonimi Etairia, AXA Insurance SA, Groupama Phoenix Hellenic Insurance SA, ERGO Insurance Company SA, European Reliance General Insurance Co SA, Interlife General Insurance Company SA**List Not Exhaustive.

3. What are the main segments of the Greece Property and Casualty Insurance Industry?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Awareness of Risk Management.

6. What are the notable trends driving market growth?

Rising Internet Penetration and Technological Advancements are Driving the Market.

7. Are there any restraints impacting market growth?

Intense Competition and Regulatory Complexities.

8. Can you provide examples of recent developments in the market?

December 2022: Chubb announced it was to launch a new technology services center in Thessaloniki, Greece, in early 2023 to deliver innovative technologies that enhance the customer experience, increase efficiency, and accelerate the company's digital transformation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greece Property and Casualty Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greece Property and Casualty Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greece Property and Casualty Insurance Industry?

To stay informed about further developments, trends, and reports in the Greece Property and Casualty Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence