Key Insights

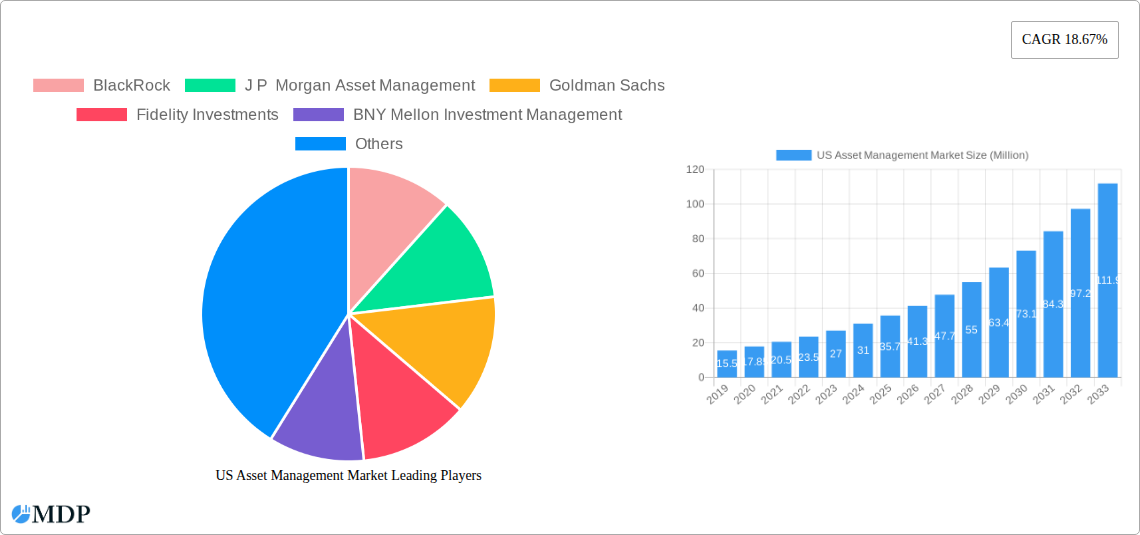

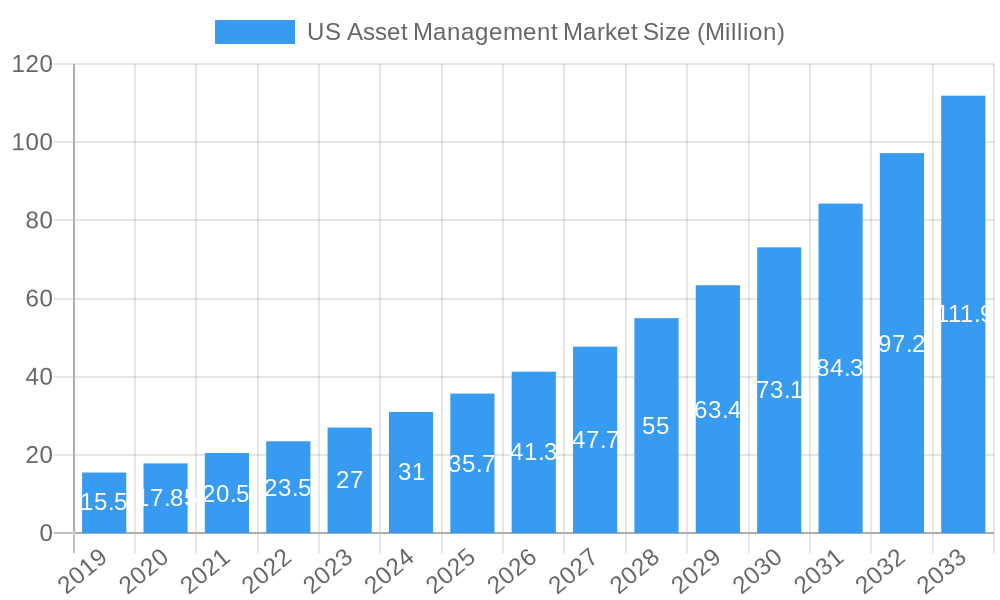

The US Asset Management Market is poised for substantial growth, projected to reach a market size of $48.22 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 18.67% anticipated to extend through 2033. This robust expansion is fueled by several key drivers, including increasing demand for diversified investment portfolios, a growing appetite for wealth management services driven by an aging population and rising disposable incomes, and the continuous innovation in investment strategies and financial technology. The market is witnessing a significant shift towards institutional investors like pension funds and insurance companies, alongside a persistent strong presence from retail investors seeking to secure their financial futures. Asset classes such as equities and fixed income continue to dominate, but there's a discernible trend towards increased allocation in alternative investments, driven by the pursuit of higher returns and diversification benefits.

US Asset Management Market Market Size (In Million)

Navigating this dynamic landscape, several leading players, including BlackRock, J.P. Morgan Asset Management, and Fidelity Investments, are at the forefront, continuously innovating to capture market share. However, the market also faces certain restraints, such as intense competition, evolving regulatory frameworks, and economic uncertainties that can impact investment performance and investor confidence. Technological advancements, particularly in areas like artificial intelligence and big data analytics, are revolutionizing how asset management firms operate, offering enhanced efficiency, personalized client experiences, and sophisticated risk management capabilities. The increasing focus on Environmental, Social, and Governance (ESG) investing is also a significant trend, shaping investment decisions and product development as investors prioritize sustainable and responsible financial practices.

US Asset Management Market Company Market Share

US Asset Management Market: Comprehensive Report & Analysis (2019-2033)

Unlock critical insights into the dynamic US Asset Management Market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides a definitive understanding of market trends, competitive landscapes, and future growth trajectories. Essential for investors, fund managers, financial institutions, and strategic decision-makers, this report details market segmentation by client type and asset class, highlights industry developments, and profiles leading players. Gain actionable intelligence to navigate the evolving financial services sector and capitalize on emerging opportunities.

US Asset Management Market Market Dynamics & Concentration

The US asset management market exhibits a high degree of concentration, with a few dominant players controlling a significant market share. In 2025, the top 5 firms are estimated to hold approximately 65% of the total market AUM, projected to reach over $50 Trillion. Innovation is primarily driven by technological advancements in AI and machine learning for portfolio optimization and client advisory services, alongside a growing demand for ESG-compliant investment strategies. The regulatory framework, overseen by entities like the SEC, continues to evolve, impacting compliance costs and product development. Product substitutes, such as direct investing and robo-advisors, are gaining traction but haven't significantly eroded the market share of traditional asset managers. End-user preferences are shifting towards customized solutions, alternative investments, and greater transparency. Merger and acquisition (M&A) activities, while not hyperactive, remain a key feature, with an estimated 10-15 significant M&A deals in the historical period 2019-2024, often focused on acquiring specialized capabilities or expanding into new client segments. The number of M&A deals is predicted to remain stable at around 12 per year during the forecast period.

US Asset Management Market Industry Trends & Analysis

The US asset management industry is poised for robust growth, driven by a confluence of factors including sustained economic expansion, increasing disposable incomes, and a growing awareness of the importance of long-term financial planning. The Compound Annual Growth Rate (CAGR) for the market is projected to be approximately 8.5% during the forecast period of 2025-2033. Technological disruptions are reshaping the industry, with widespread adoption of AI and big data analytics enabling hyper-personalized investment strategies, enhanced risk management, and improved operational efficiency. Cloud computing solutions are also facilitating scalability and data accessibility. Consumer preferences are increasingly leaning towards sustainable and impact investing, with a significant portion of assets being allocated to ESG-focused funds. This trend is not just a niche but a mainstream demand that asset managers must cater to. Competitive dynamics are intensifying, with traditional players facing pressure from FinTech startups and specialized alternative investment firms. Market penetration for actively managed funds, while historically strong, is seeing increasing competition from passive investment vehicles and ETFs, pushing active managers to demonstrate alpha generation and value. The shift towards fee compression also necessitates a focus on value-added services and unique investment propositions. The industry is also witnessing a significant inflow of assets from institutional investors such as pension funds and endowments, seeking diversification and professional management to meet their long-term liabilities.

Leading Markets & Segments in US Asset Management Market

Within the US Asset Management Market, the Equity asset class consistently dominates, accounting for an estimated 45% of total assets under management (AUM) in the base year 2025. This dominance is fueled by historical investor preference for growth-oriented investments and the strong performance of the US stock market. Following closely is Fixed Income, representing approximately 30% of AUM, which provides stability and income generation for a wide range of investors, particularly pension funds and insurance companies.

Client Type Dominance:

- Pension Funds: These institutional investors are a cornerstone of the asset management industry, driven by the need to secure long-term retirement income for their beneficiaries. Their demand for stable, income-generating assets and a sophisticated risk management approach makes them a critical client segment. Economic policies that encourage long-term savings and the solvency of pension plans directly influence their investment allocation.

- Retail Investors: While individually smaller, the sheer volume of retail investors, often channeled through mutual funds and ETFs, constitutes a significant portion of the market. Growing financial literacy and access to digital investment platforms are key drivers for this segment.

- Insurance Companies: These entities require asset management solutions to back their policy liabilities, often favoring fixed-income and lower-volatility assets to ensure policyholder payouts. Regulatory requirements surrounding solvency and capital reserves heavily influence their investment strategies.

- Banks: Banks utilize asset management services for their own proprietary investments and for managing client wealth, particularly high-net-worth individuals. Their demand is often driven by diversification needs and the pursuit of alpha.

- Other Client Types: This broad category includes endowments, foundations, and sovereign wealth funds, each with unique investment mandates and risk appetites.

Asset Class Dominance:

- Equity: The primary driver for equity dominance is its historical potential for capital appreciation. The robust performance of the US economy and the global appeal of US-listed companies continue to attract significant investment. Economic growth and corporate earnings are key influences.

- Fixed Income: This segment's appeal lies in its role as a diversifier and income generator. Factors like interest rate policies and inflation expectations significantly impact demand for fixed-income products.

- Alternative Investments: While currently a smaller segment, alternative investments, including private equity, hedge funds, and real estate, are experiencing rapid growth. Investor demand for uncorrelated returns and diversification, coupled with evolving regulatory frameworks, are key drivers. The total AUM in alternative investments is projected to grow at a CAGR of 10% during the forecast period.

- Cash/Money Market: This segment serves as a liquidity buffer and a safe haven during market uncertainty. Its demand is sensitive to interest rate movements and overall economic sentiment.

US Asset Management Market Product Developments

Product innovation in the US asset management market is largely centered on thematic investing, sustainable finance (ESG), and customized solutions. Asset managers are increasingly developing actively managed ETFs and liquid alternative strategies to cater to evolving investor demands for flexibility and diversification. The integration of AI and machine learning is enabling the creation of more sophisticated portfolio construction tools and personalized client reporting. These advancements offer competitive advantages by providing enhanced transparency, risk mitigation, and potential for superior risk-adjusted returns, appealing to both institutional and retail investors seeking innovative ways to meet their financial objectives.

Key Drivers of US Asset Management Market Growth

Several key drivers are propelling the growth of the US asset management market. Technological advancements, particularly in AI and big data analytics, are enabling greater efficiency, personalization, and risk management capabilities. The growing emphasis on Environmental, Social, and Governance (ESG) investing is a significant catalyst, attracting substantial capital from investors seeking ethical and sustainable returns. Furthermore, a rising global wealth, increasing life expectancies, and an aging population necessitating robust retirement planning are fundamental economic drivers. Regulatory changes, when they foster greater transparency and investor confidence, can also indirectly stimulate market growth.

Challenges in the US Asset Management Market Market

Despite its growth trajectory, the US asset management market faces several challenges. Intense competition, driven by both established players and emerging FinTech firms, leads to fee compression and necessitates constant innovation to maintain margins. Evolving regulatory landscapes require significant investment in compliance infrastructure and can create uncertainty. Furthermore, investor behavior is becoming more sophisticated, demanding greater transparency and demonstrable alpha, putting pressure on actively managed funds. The increasing complexity of financial markets and the need to manage a wider array of asset classes, including volatile alternatives, add to operational challenges. Supply chain issues, particularly concerning data integrity and cybersecurity, also pose risks.

Emerging Opportunities in US Asset Management Market

Emerging opportunities in the US asset management market are abundant. The continued demand for ESG-compliant products presents a vast avenue for growth, with new thematic funds and impact investing strategies attracting significant investor interest. The digitalization of financial services and the rise of alternative data sources offer significant potential for enhancing investment strategies and client engagement. Strategic partnerships between traditional asset managers and FinTech companies are creating innovative solutions and expanding market reach. Furthermore, the increasing need for personalized wealth management services, especially among burgeoning high-net-worth populations, provides fertile ground for tailored investment solutions. The expansion into less penetrated client segments and the development of innovative retirement income solutions also represent key growth catalysts.

Leading Players in the US Asset Management Market Sector

- BlackRock

- J P Morgan Asset Management

- Goldman Sachs

- Fidelity Investments

- BNY Mellon Investment Management

- The Vanguard Group

- State Street Global Advisors

- Pacific Investment Management Company LLC

- Franklin Templeton Investments

- Wellington Management Company LLC

Key Milestones in US Asset Management Market Industry

- August 2023: BlackRock Inc. acquired Kreos, a specialist in growth and risk-based financing for technology and healthcare enterprises, significantly enhancing BlackRock's private-market investment portfolio and market presence.

- January 2023: Fidelity Investments acquired Shoobx, a provider of automated equity management and financing software for private companies, bolstering Fidelity's offerings for early-stage and growing businesses.

Strategic Outlook for US Asset Management Market Market

The strategic outlook for the US asset management market is characterized by a continued pursuit of specialization, technological integration, and client-centricity. Growth accelerators will likely stem from the development of innovative ESG and thematic investment products, catering to a growing demand for sustainable and purpose-driven investments. The deepening integration of AI and machine learning will be crucial for enhancing operational efficiency, personalization, and risk management. Strategic partnerships and potential M&A activities will continue to shape the competitive landscape, enabling firms to acquire new capabilities and expand their market reach. The focus on delivering demonstrable value through enhanced alpha generation and superior client service will be paramount for sustained success in this evolving market.

US Asset Management Market Segmentation

-

1. Client Type

- 1.1. Retail

- 1.2. Pension Fund

- 1.3. Insurance Companies

- 1.4. Banks

- 1.5. Other Client Types

-

2. Asset Class

- 2.1. Equity

- 2.2. Fixed Income

- 2.3. Cash/Money Market

- 2.4. Alternative Investments

- 2.5. Other Asset Classes

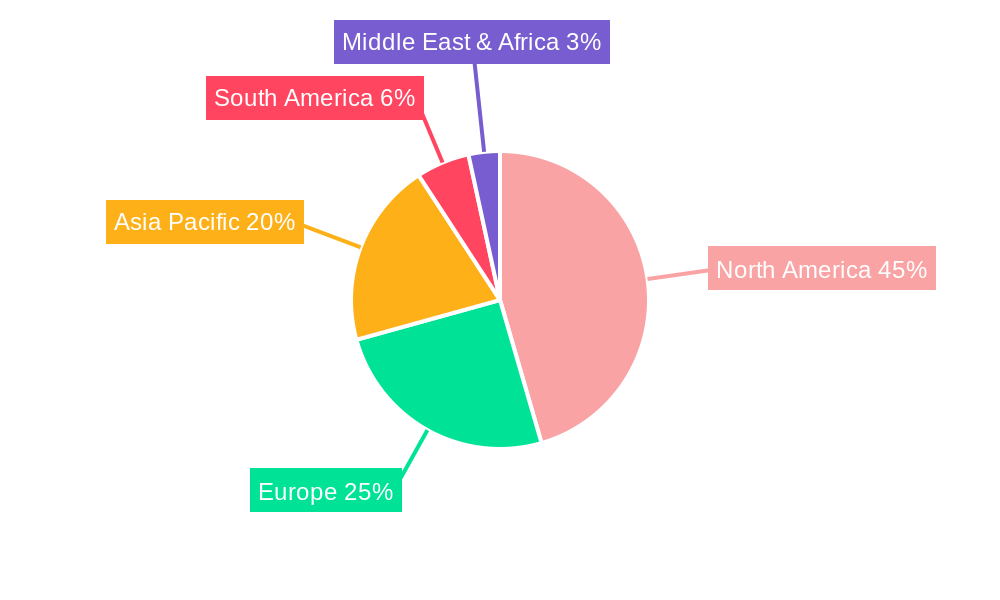

US Asset Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Asset Management Market Regional Market Share

Geographic Coverage of US Asset Management Market

US Asset Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rapid Growth in Advanced Technologies such as AI

- 3.2.2 IoT

- 3.2.3 Etc.

- 3.2.4 ; Increase in Wealth of HNI's is Driving the Market

- 3.3. Market Restrains

- 3.3.1 Rapid Growth in Advanced Technologies such as AI

- 3.3.2 IoT

- 3.3.3 Etc.

- 3.3.4 ; Increase in Wealth of HNI's is Driving the Market

- 3.4. Market Trends

- 3.4.1. US Portfolio Management Systems Market Set for Robust Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. Retail

- 5.1.2. Pension Fund

- 5.1.3. Insurance Companies

- 5.1.4. Banks

- 5.1.5. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Asset Class

- 5.2.1. Equity

- 5.2.2. Fixed Income

- 5.2.3. Cash/Money Market

- 5.2.4. Alternative Investments

- 5.2.5. Other Asset Classes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. North America US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. Retail

- 6.1.2. Pension Fund

- 6.1.3. Insurance Companies

- 6.1.4. Banks

- 6.1.5. Other Client Types

- 6.2. Market Analysis, Insights and Forecast - by Asset Class

- 6.2.1. Equity

- 6.2.2. Fixed Income

- 6.2.3. Cash/Money Market

- 6.2.4. Alternative Investments

- 6.2.5. Other Asset Classes

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. South America US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. Retail

- 7.1.2. Pension Fund

- 7.1.3. Insurance Companies

- 7.1.4. Banks

- 7.1.5. Other Client Types

- 7.2. Market Analysis, Insights and Forecast - by Asset Class

- 7.2.1. Equity

- 7.2.2. Fixed Income

- 7.2.3. Cash/Money Market

- 7.2.4. Alternative Investments

- 7.2.5. Other Asset Classes

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. Europe US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. Retail

- 8.1.2. Pension Fund

- 8.1.3. Insurance Companies

- 8.1.4. Banks

- 8.1.5. Other Client Types

- 8.2. Market Analysis, Insights and Forecast - by Asset Class

- 8.2.1. Equity

- 8.2.2. Fixed Income

- 8.2.3. Cash/Money Market

- 8.2.4. Alternative Investments

- 8.2.5. Other Asset Classes

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. Middle East & Africa US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. Retail

- 9.1.2. Pension Fund

- 9.1.3. Insurance Companies

- 9.1.4. Banks

- 9.1.5. Other Client Types

- 9.2. Market Analysis, Insights and Forecast - by Asset Class

- 9.2.1. Equity

- 9.2.2. Fixed Income

- 9.2.3. Cash/Money Market

- 9.2.4. Alternative Investments

- 9.2.5. Other Asset Classes

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Asia Pacific US Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. Retail

- 10.1.2. Pension Fund

- 10.1.3. Insurance Companies

- 10.1.4. Banks

- 10.1.5. Other Client Types

- 10.2. Market Analysis, Insights and Forecast - by Asset Class

- 10.2.1. Equity

- 10.2.2. Fixed Income

- 10.2.3. Cash/Money Market

- 10.2.4. Alternative Investments

- 10.2.5. Other Asset Classes

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BlackRock

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 J P Morgan Asset Management

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Goldman Sachs

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fidelity Investments

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BNY Mellon Investment Management

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Vanguard Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 State Street Global Advisors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pacific Investment Management Company LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Franklin Templeton Investments

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wellington Management Company LLC**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BlackRock

List of Figures

- Figure 1: Global US Asset Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global US Asset Management Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America US Asset Management Market Revenue (Million), by Client Type 2025 & 2033

- Figure 4: North America US Asset Management Market Volume (Trillion), by Client Type 2025 & 2033

- Figure 5: North America US Asset Management Market Revenue Share (%), by Client Type 2025 & 2033

- Figure 6: North America US Asset Management Market Volume Share (%), by Client Type 2025 & 2033

- Figure 7: North America US Asset Management Market Revenue (Million), by Asset Class 2025 & 2033

- Figure 8: North America US Asset Management Market Volume (Trillion), by Asset Class 2025 & 2033

- Figure 9: North America US Asset Management Market Revenue Share (%), by Asset Class 2025 & 2033

- Figure 10: North America US Asset Management Market Volume Share (%), by Asset Class 2025 & 2033

- Figure 11: North America US Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America US Asset Management Market Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America US Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America US Asset Management Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America US Asset Management Market Revenue (Million), by Client Type 2025 & 2033

- Figure 16: South America US Asset Management Market Volume (Trillion), by Client Type 2025 & 2033

- Figure 17: South America US Asset Management Market Revenue Share (%), by Client Type 2025 & 2033

- Figure 18: South America US Asset Management Market Volume Share (%), by Client Type 2025 & 2033

- Figure 19: South America US Asset Management Market Revenue (Million), by Asset Class 2025 & 2033

- Figure 20: South America US Asset Management Market Volume (Trillion), by Asset Class 2025 & 2033

- Figure 21: South America US Asset Management Market Revenue Share (%), by Asset Class 2025 & 2033

- Figure 22: South America US Asset Management Market Volume Share (%), by Asset Class 2025 & 2033

- Figure 23: South America US Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 24: South America US Asset Management Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: South America US Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America US Asset Management Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe US Asset Management Market Revenue (Million), by Client Type 2025 & 2033

- Figure 28: Europe US Asset Management Market Volume (Trillion), by Client Type 2025 & 2033

- Figure 29: Europe US Asset Management Market Revenue Share (%), by Client Type 2025 & 2033

- Figure 30: Europe US Asset Management Market Volume Share (%), by Client Type 2025 & 2033

- Figure 31: Europe US Asset Management Market Revenue (Million), by Asset Class 2025 & 2033

- Figure 32: Europe US Asset Management Market Volume (Trillion), by Asset Class 2025 & 2033

- Figure 33: Europe US Asset Management Market Revenue Share (%), by Asset Class 2025 & 2033

- Figure 34: Europe US Asset Management Market Volume Share (%), by Asset Class 2025 & 2033

- Figure 35: Europe US Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe US Asset Management Market Volume (Trillion), by Country 2025 & 2033

- Figure 37: Europe US Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe US Asset Management Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa US Asset Management Market Revenue (Million), by Client Type 2025 & 2033

- Figure 40: Middle East & Africa US Asset Management Market Volume (Trillion), by Client Type 2025 & 2033

- Figure 41: Middle East & Africa US Asset Management Market Revenue Share (%), by Client Type 2025 & 2033

- Figure 42: Middle East & Africa US Asset Management Market Volume Share (%), by Client Type 2025 & 2033

- Figure 43: Middle East & Africa US Asset Management Market Revenue (Million), by Asset Class 2025 & 2033

- Figure 44: Middle East & Africa US Asset Management Market Volume (Trillion), by Asset Class 2025 & 2033

- Figure 45: Middle East & Africa US Asset Management Market Revenue Share (%), by Asset Class 2025 & 2033

- Figure 46: Middle East & Africa US Asset Management Market Volume Share (%), by Asset Class 2025 & 2033

- Figure 47: Middle East & Africa US Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa US Asset Management Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Middle East & Africa US Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa US Asset Management Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific US Asset Management Market Revenue (Million), by Client Type 2025 & 2033

- Figure 52: Asia Pacific US Asset Management Market Volume (Trillion), by Client Type 2025 & 2033

- Figure 53: Asia Pacific US Asset Management Market Revenue Share (%), by Client Type 2025 & 2033

- Figure 54: Asia Pacific US Asset Management Market Volume Share (%), by Client Type 2025 & 2033

- Figure 55: Asia Pacific US Asset Management Market Revenue (Million), by Asset Class 2025 & 2033

- Figure 56: Asia Pacific US Asset Management Market Volume (Trillion), by Asset Class 2025 & 2033

- Figure 57: Asia Pacific US Asset Management Market Revenue Share (%), by Asset Class 2025 & 2033

- Figure 58: Asia Pacific US Asset Management Market Volume Share (%), by Asset Class 2025 & 2033

- Figure 59: Asia Pacific US Asset Management Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific US Asset Management Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: Asia Pacific US Asset Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific US Asset Management Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 3: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 4: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 5: Global US Asset Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global US Asset Management Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 9: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 10: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 11: Global US Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global US Asset Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: United States US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Canada US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 17: Mexico US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 20: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 21: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 22: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 23: Global US Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global US Asset Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Brazil US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Argentina US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 32: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 33: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 34: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 35: Global US Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global US Asset Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Germany US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: France US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Italy US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Spain US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Russia US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: Benelux US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Nordics US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 56: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 57: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 58: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 59: Global US Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global US Asset Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 61: Turkey US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Israel US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 65: GCC US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 67: North Africa US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: South Africa US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: Global US Asset Management Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 74: Global US Asset Management Market Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 75: Global US Asset Management Market Revenue Million Forecast, by Asset Class 2020 & 2033

- Table 76: Global US Asset Management Market Volume Trillion Forecast, by Asset Class 2020 & 2033

- Table 77: Global US Asset Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global US Asset Management Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 79: China US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 81: India US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Japan US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 85: South Korea US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 89: Oceania US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific US Asset Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific US Asset Management Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Asset Management Market?

The projected CAGR is approximately 18.67%.

2. Which companies are prominent players in the US Asset Management Market?

Key companies in the market include BlackRock, J P Morgan Asset Management, Goldman Sachs, Fidelity Investments, BNY Mellon Investment Management, The Vanguard Group, State Street Global Advisors, Pacific Investment Management Company LLC, Franklin Templeton Investments, Wellington Management Company LLC**List Not Exhaustive.

3. What are the main segments of the US Asset Management Market?

The market segments include Client Type, Asset Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth in Advanced Technologies such as AI. IoT. Etc.. ; Increase in Wealth of HNI's is Driving the Market.

6. What are the notable trends driving market growth?

US Portfolio Management Systems Market Set for Robust Growth.

7. Are there any restraints impacting market growth?

Rapid Growth in Advanced Technologies such as AI. IoT. Etc.. ; Increase in Wealth of HNI's is Driving the Market.

8. Can you provide examples of recent developments in the market?

In August 2023, BlackRock Inc., a prominent international credit asset manager, acquired Kreos. Kreos, renowned for its specialization in growth and risk-based financing for technology and healthcare enterprises, enhances BlackRock's market presence. This acquisition aligns with BlackRock's strategic objective of broadening its private-market investment portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Asset Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Asset Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Asset Management Market?

To stay informed about further developments, trends, and reports in the US Asset Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence