Key Insights

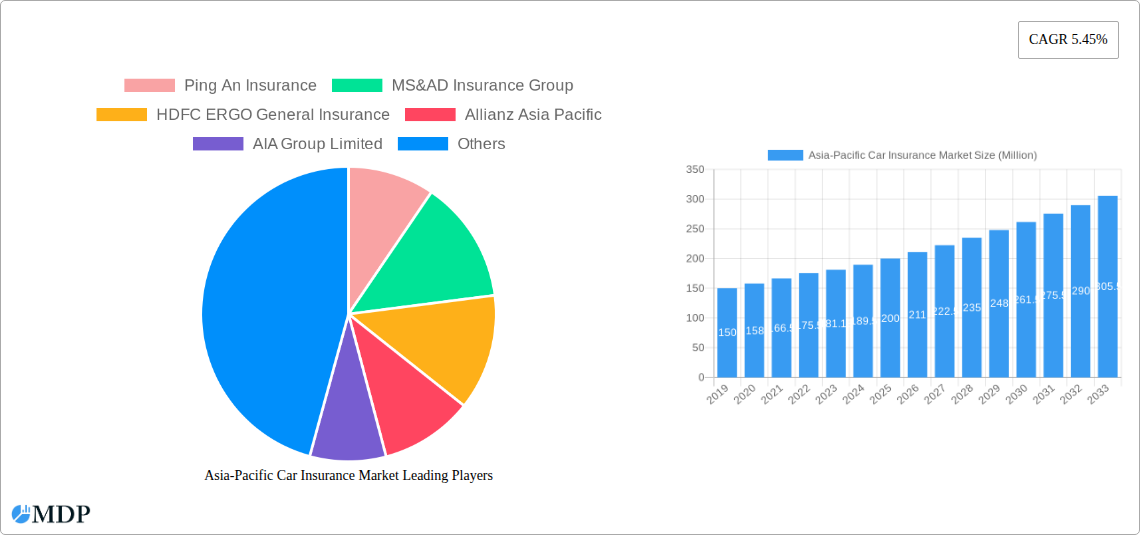

The Asia-Pacific car insurance market is experiencing robust growth, projected to reach a significant valuation by 2033. With a current market size of USD 181.18 million and a compelling Compound Annual Growth Rate (CAGR) of 5.45% between 2025 and 2033, the sector demonstrates substantial potential. This expansion is primarily driven by increasing vehicle ownership across the region, particularly in emerging economies like India and Southeast Asian nations, where a growing middle class is affording personal and commercial vehicles. Furthermore, evolving consumer awareness regarding financial protection against vehicle-related risks, coupled with the expansion of digital platforms for insurance sales and policy management, is fueling market penetration. The introduction of innovative insurance products tailored to specific needs, such as usage-based insurance and enhanced coverage options, is also contributing to this upward trajectory.

Asia-Pacific Car Insurance Market Market Size (In Million)

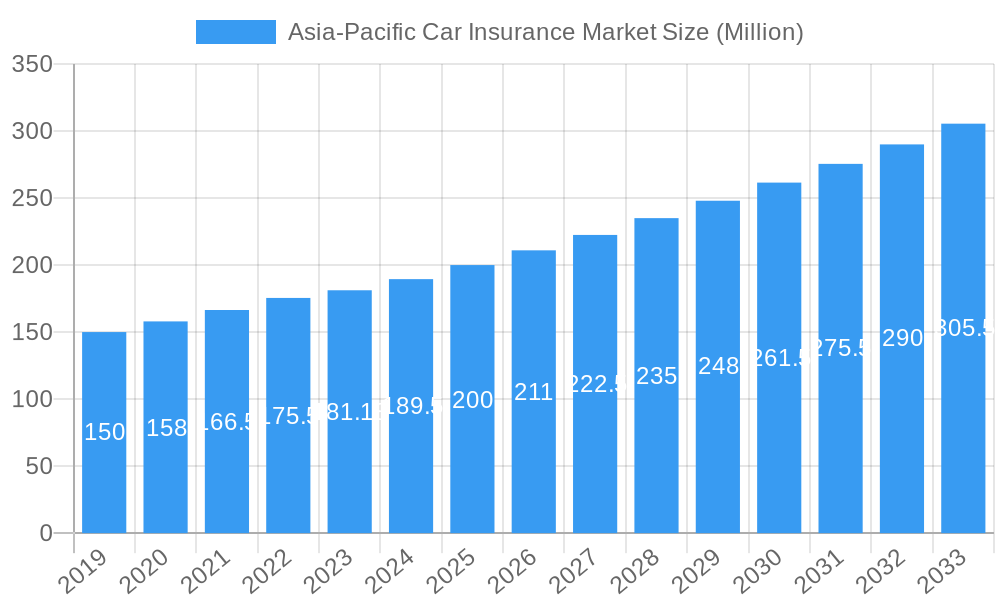

The market is segmented across various coverage types, with Third-Party Liability Coverage forming a foundational segment, while Collision, Comprehensive, and Other Optional Coverages represent significant growth areas as consumers seek broader protection. The application landscape is bifurcated between Personal Vehicles and Commercial Vehicles, with both demonstrating consistent demand. Distribution channels are diversifying, moving beyond traditional individual agents and brokers to embrace direct sales, partnerships with banks, and a rapidly growing online segment, underscoring the digital transformation within the insurance industry. Key players like Ping An Insurance, MS&AD Insurance Group, and HDFC ERGO General Insurance are actively shaping the market through strategic investments, product innovation, and geographical expansion across dynamic regions such as China, Japan, India, and Australia, positioning them to capitalize on the burgeoning opportunities in the Asia-Pacific car insurance landscape.

Asia-Pacific Car Insurance Market Company Market Share

This in-depth report provides a definitive analysis of the Asia-Pacific Car Insurance Market, offering critical insights for stakeholders seeking to navigate this dynamic sector. With a comprehensive study period from 2019 to 2033, a base year of 2025, and a forecast period extending from 2025 to 2033, this report leverages historical data from 2019-2024 to deliver actionable intelligence. Discover key market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, and the strategic outlook for prominent players. This report is your indispensable guide to understanding the evolution and future trajectory of the Asia-Pacific car insurance landscape, covering essential aspects like car insurance, motor insurance, auto insurance, vehicle insurance, digital insurance, telematics insurance, Asia Pacific, China car insurance, India car insurance, and Southeast Asia auto insurance. The projected market size for the Asia-Pacific Car Insurance Market is USD 250,000 Million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Asia-Pacific Car Insurance Market Market Dynamics & Concentration

The Asia-Pacific car insurance market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share. However, the increasing entry of insurtech startups and traditional insurers expanding their digital offerings are fostering a more competitive environment. Innovation drivers are primarily fueled by technological advancements such as artificial intelligence (AI), telematics, and the Internet of Things (IoT), enabling personalized pricing, risk assessment, and enhanced customer experiences. Regulatory frameworks across different Asia-Pacific countries present a complex but evolving picture, with initiatives aimed at improving consumer protection, promoting fair competition, and encouraging digital adoption. Product substitutes, while limited in the core insurance offering, are emerging in the form of usage-based insurance (UBI) and micro-insurance products. End-user trends are shifting towards greater demand for convenience, digital accessibility, and value-added services. Mergers and acquisition (M&A) activities, while not at an extremely high volume, are strategically focused on expanding market reach, acquiring technological capabilities, and consolidating market share. For instance, recent M&A activities have focused on acquiring digital distribution channels and innovative underwriting platforms. The market share of the top 5 players is estimated to be around 60% in 2025. The number of significant M&A deals in the past three years is approximately 15.

- Market Concentration: Moderately concentrated with a strong presence of established insurers and growing insurtech players.

- Innovation Drivers: AI, telematics, IoT, big data analytics, blockchain for claims processing.

- Regulatory Frameworks: Evolving regulations promoting digital insurance, data privacy, and consumer protection in countries like China, India, and Australia.

- Product Substitutes: Usage-based insurance (UBI), pay-as-you-drive (PAYD), pay-how-you-drive (PHYD) models, and embedded insurance solutions.

- End-User Trends: Demand for seamless digital experiences, personalized premiums, instant claims settlement, and integrated mobility services.

- M&A Activities: Strategic acquisitions focused on technology, market expansion, and digital capabilities.

Asia-Pacific Car Insurance Market Industry Trends & Analysis

The Asia-Pacific car insurance market is poised for substantial growth, driven by a burgeoning middle class, increasing vehicle ownership, and a rising awareness of the necessity of financial protection against road risks. The Compound Annual Growth Rate (CAGR) for this market is projected to be XX% over the forecast period. Economic growth in key markets such as China, India, and Southeast Asian nations directly correlates with increased disposable incomes, leading to higher vehicle purchases and, consequently, a greater demand for car insurance. Technological disruptions are at the forefront of transforming the industry. The widespread adoption of smartphones and the internet has paved the way for sophisticated online car insurance platforms and mobile applications, offering consumers greater transparency, ease of comparison, and quicker policy issuance. Telematics technology, leveraging GPS and sensors in vehicles, is enabling insurers to gather real-time driving data, facilitating the development of usage-based insurance (UBI) and pay-as-you-drive (PAYD) policies, which are gaining traction for their personalized premium structures. This shift towards data-driven underwriting and claims processing enhances efficiency and accuracy. Consumer preferences are rapidly evolving; individuals are no longer satisfied with traditional, one-size-fits-all insurance products. There is a growing demand for flexible, tailored coverage options that align with individual driving habits and vehicle usage. The ease of purchasing and managing policies online is also a significant factor influencing consumer choices. Insurers are investing heavily in digital transformation to meet these expectations, streamline customer journeys, and reduce operational costs. Competitive dynamics are intensifying as both incumbent insurers and new entrants vie for market share. Insurtech startups are leveraging agile business models and advanced technologies to disrupt traditional approaches, forcing established players to innovate and adapt. Partnerships between insurers, automotive manufacturers, and technology providers are becoming increasingly common, creating integrated ecosystems that offer a wider range of services beyond basic insurance. The penetration rate of car insurance in the Asia-Pacific region is currently estimated at XX%, with significant variations across countries, indicating substantial room for expansion. The market is also witnessing a growing interest in comprehensive and collision coverage due to rising vehicle values and a desire for complete protection.

Leading Markets & Segments in Asia-Pacific Car Insurance Market

The Asia-Pacific car insurance market is characterized by significant regional dominance and diverse segment penetration. China and India are leading the charge, accounting for a substantial portion of the market share due to their massive populations, rapid economic development, and escalating vehicle ownership. China's car insurance market, in particular, benefits from a vast number of vehicles and a growing middle class with increasing disposable income. India's market is driven by government initiatives promoting financial inclusion and mandatory third-party liability coverage.

Within coverage types, Collision/Comprehensive/Other Optional Coverage is a significant and growing segment, reflecting a rising consumer desire for holistic protection beyond basic legal requirements. As vehicle values increase and accident rates fluctuate, policyholders are increasingly opting for broader coverage to safeguard their investments. While Third-Party Liability Coverage remains a foundational and legally mandated segment in many countries, the demand for optional coverages is on an upward trajectory.

The Personal Vehicles segment overwhelmingly dominates the application landscape, driven by the sheer volume of private car ownership across the region. However, the Commercial Vehicles segment is also experiencing steady growth, fueled by the expansion of logistics, e-commerce, and various business operations that rely on fleets of vehicles.

Distribution channels are experiencing a significant digital transformation. While Individual Agents and Brokers have historically played a crucial role, the Online channel is rapidly gaining prominence. The convenience, transparency, and competitive pricing offered through online platforms are attracting a growing number of consumers, especially younger demographics. Direct Sales by insurers and partnerships with Banks also contribute to the distribution mix.

Dominant Region: China and India, owing to their large populations and economic growth.

Key Country Drivers:

- China: High vehicle density, increasing disposable income, government support for insurance penetration.

- India: Growing middle class, mandatory third-party insurance, rise in digital adoption.

- Southeast Asia: Rapidly expanding automotive markets, increasing urbanization, and a growing awareness of insurance benefits.

Dominant Coverage Segment:

- Collision/Comprehensive/Other Optional Coverage: Driven by rising vehicle values, desire for complete protection, and increased risk awareness.

- Key Drivers: Economic prosperity, technological advancements in vehicle safety, and evolving consumer preferences for peace of mind.

Dominant Application Segment:

- Personal Vehicles: Reflects the massive consumer car ownership across the region.

- Key Drivers: Urbanization, rising middle-class incomes, improved road infrastructure, and increasing accessibility to automotive financing.

Dominant Distribution Channel:

- Online: Driven by convenience, transparency, competitive pricing, and the digital-first behavior of younger generations.

- Key Drivers: Mobile penetration, ease of comparison, instant policy issuance, and the growth of insurtech platforms.

Asia-Pacific Car Insurance Market Product Developments

The Asia-Pacific car insurance market is witnessing a wave of product innovation centered around digital accessibility and personalized offerings. Insurers are increasingly developing fully digital, mobile telematics-based motor policies that utilize real-time driving data to offer dynamically calculated premiums and rewards for safe driving. Innovations like the 'Switch' product by Edelweiss General Insurance exemplify this trend, enabling automated policy activation based on vehicle motion and expansion toward real-time driving scores. Furthermore, strategic partnerships are fostering the development of data-driven, self-insured car insurance solutions, enhancing underwriting accuracy and customer value propositions. These developments are making car insurance more responsive to individual needs, promoting safer driving habits, and streamlining the claims process through advanced technology integration.

Key Drivers of Asia-Pacific Car Insurance Market Growth

Several key drivers are propelling the growth of the Asia-Pacific car insurance market. Economically, rising disposable incomes and a burgeoning middle class in countries like China and India are leading to increased vehicle ownership, directly boosting demand for car insurance. Technologically, the widespread adoption of telematics, AI, and big data analytics is enabling insurers to offer personalized premiums, improve risk assessment, and streamline claims processing, making insurance more attractive and efficient. Regulatory frameworks, such as mandatory third-party liability coverage in many nations, provide a foundational demand. Furthermore, the increasing focus on digital insurance platforms and online car insurance is enhancing accessibility and convenience for consumers. The growing awareness of the financial implications of road accidents and the desire for comprehensive protection also contribute significantly to market expansion.

Challenges in the Asia-Pacific Car Insurance Market Market

Despite robust growth, the Asia-Pacific car insurance market faces several challenges. Regulatory hurdles and variations in compliance requirements across different countries can complicate market entry and product standardization. Intense competition from both established players and agile insurtech startups puts pressure on profit margins and necessitates continuous innovation. Customer acquisition costs remain high, particularly in acquiring new customers for digital platforms. Fraudulent claims continue to be a persistent issue, impacting profitability and driving up the cost of premiums for all policyholders. Furthermore, underdeveloped insurance penetration in some emerging economies, coupled with low insurance literacy, poses a barrier to wider adoption. The evolving nature of vehicle technology, including autonomous driving features, presents new underwriting complexities and potential risks that insurers are still grappling with.

Emerging Opportunities in Asia-Pacific Car Insurance Market

Emerging opportunities in the Asia-Pacific car insurance market are abundant, largely driven by technological advancements and evolving consumer needs. The continued growth of telematics-based insurance and usage-based insurance (UBI) presents a significant avenue for personalized pricing and incentivizing safe driving behavior. Strategic partnerships between insurers, automotive manufacturers, and mobility service providers offer fertile ground for developing integrated embedded insurance solutions and comprehensive automotive ecosystems. The increasing adoption of electric vehicles (EVs) and new energy vehicles (NEVs) creates a demand for specialized insurance products catering to their unique repair needs and battery warranties. Furthermore, the expansion of online car insurance platforms and the utilization of AI for customer service and claims processing present opportunities to enhance customer experience and operational efficiency. The vast untapped market potential in developing economies within the region also offers significant growth prospects for insurers willing to adapt their offerings and distribution strategies.

Leading Players in the Asia-Pacific Car Insurance Market Sector

- Ping An Insurance

- MS&AD Insurance Group

- HDFC ERGO General Insurance

- Allianz Asia Pacific

- AIA Group Limited

- Zurich Insurance Group

- PICC

- Tokio Marine

- Sompo Japan Nipponkoa Insurance

- National Insurance Company

- TATA AIG General Insurance

- Bajaj Allianz General Insurance

- SBI General Insurance

- IAG (Insurance Australia Group)

Key Milestones in Asia-Pacific Car Insurance Market Industry

- July 2022: Edelweiss General Insurance launched 'Switch,' a fully digital, mobile telematics-based motor insurance policy. This innovation facilitates automatic activation when a vehicle is driven and expands toward real-time driving scores and dynamically calculated premiums.

- July 2023: Lexasure Financial Group partnered with My Car Consultant Pte. Ltd. to offer its data-driven, self-insured car insurance solutions across South and Southeast Asia, leveraging insurtech and automotive solutions.

Strategic Outlook for Asia-Pacific Car Insurance Market Market

The strategic outlook for the Asia-Pacific car insurance market is overwhelmingly positive, driven by a confluence of accelerating growth accelerators. The persistent rise in vehicle ownership, coupled with an increasing appreciation for robust financial protection, forms the bedrock of sustained demand. Technological innovation, particularly in the realm of telematics, AI-powered underwriting, and digital distribution channels, will continue to reshape the competitive landscape, enabling more personalized and efficient insurance solutions. Strategic partnerships and collaborations will be pivotal for expanding market reach, enhancing product offerings, and creating integrated mobility ecosystems. Insurers that can effectively leverage data analytics to understand evolving customer preferences and adapt to dynamic regulatory environments will be best positioned for success. The focus on seamless customer journeys, from policy purchase to claims settlement, will be a key differentiator, with significant investment in digital platforms and customer service technologies. The market's trajectory suggests a move towards more proactive risk management and value-added services, moving beyond traditional insurance coverage to become a comprehensive partner in vehicle ownership.

Asia-Pacific Car Insurance Market Segmentation

-

1. Coverage

- 1.1. Third-Party Liability Coverage

- 1.2. Collision/Comprehensive/Other Optional Coverage

-

2. Application

- 2.1. Personal Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Individual Agents

- 3.3. Brokers

- 3.4. Banks

- 3.5. Online

- 3.6. Other Distribution Channels

Asia-Pacific Car Insurance Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Car Insurance Market Regional Market Share

Geographic Coverage of Asia-Pacific Car Insurance Market

Asia-Pacific Car Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in the Region; China and India Driving the Market with Higher Car Accident Events

- 3.3. Market Restrains

- 3.3.1. Lower Value of Non Life Insurance Penetration in the Region; Decline in Car Insurance Premium Rates with Government Regulations

- 3.4. Market Trends

- 3.4.1. China Leading the Asia Pacific Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Third-Party Liability Coverage

- 5.1.2. Collision/Comprehensive/Other Optional Coverage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Individual Agents

- 5.3.3. Brokers

- 5.3.4. Banks

- 5.3.5. Online

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ping An Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MS&AD Insurance Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HDFC ERGO General Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Allianz Asia Pacific

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AIA Group Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zurich Insurance Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PICC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tokio Marine

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sompo Japan Nipponkoa Insurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 National Insurance Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TATA AIG General Insurance**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bajaj Allianz General Insurance

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SBI General Insurance

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 IAG (Insurance Australia Group)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Ping An Insurance

List of Figures

- Figure 1: Asia-Pacific Car Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Car Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 2: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 6: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Asia-Pacific Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Car Insurance Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Asia-Pacific Car Insurance Market?

Key companies in the market include Ping An Insurance, MS&AD Insurance Group, HDFC ERGO General Insurance, Allianz Asia Pacific, AIA Group Limited, Zurich Insurance Group, PICC, Tokio Marine, Sompo Japan Nipponkoa Insurance, National Insurance Company, TATA AIG General Insurance**List Not Exhaustive, Bajaj Allianz General Insurance, SBI General Insurance, IAG (Insurance Australia Group).

3. What are the main segments of the Asia-Pacific Car Insurance Market?

The market segments include Coverage, Application , Distribution Channel .

4. Can you provide details about the market size?

The market size is estimated to be USD 181.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in the Region; China and India Driving the Market with Higher Car Accident Events.

6. What are the notable trends driving market growth?

China Leading the Asia Pacific Market.

7. Are there any restraints impacting market growth?

Lower Value of Non Life Insurance Penetration in the Region; Decline in Car Insurance Premium Rates with Government Regulations.

8. Can you provide examples of recent developments in the market?

July 2022: Edelweiss General Insurance launched a comprehensive motor insurance product named 'Switch' which exists as a fully digital, mobile telematics-based motor policy that detects motion and automatically activates insurance when the vehicle is driven. This resulted in further expansion toward real-time driving scores and dynamically calculated premium-based car insurance services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Car Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Car Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Car Insurance Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Car Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence