Key Insights

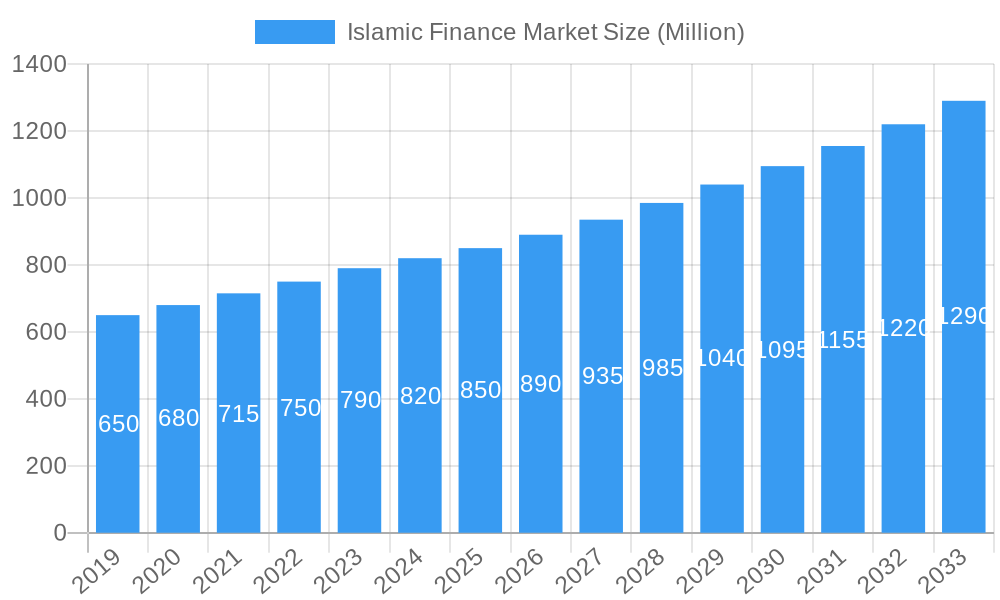

The Islamic finance market is experiencing robust expansion, projected to reach an impressive market size of approximately $850 million by 2025, with a compound annual growth rate (CAGR) exceeding 10.00% through 2033. This surge is driven by a confluence of factors, including increasing global awareness and acceptance of Sharia-compliant financial products, growing disposable incomes in key Muslim-majority regions, and supportive government initiatives aimed at fostering Islamic finance ecosystems. The market's dynamism is further fueled by significant investments in digital transformation within the sector, enhancing accessibility and customer experience. Key growth drivers include the expanding youth demographic with a preference for ethical and socially responsible investments, alongside a rising demand for Sharia-compliant wealth management solutions. The development of innovative Islamic financial instruments, such as Sharia-compliant fintech solutions and sustainable sukuk, is also playing a pivotal role in attracting both individual and institutional investors.

Islamic Finance Market Market Size (In Million)

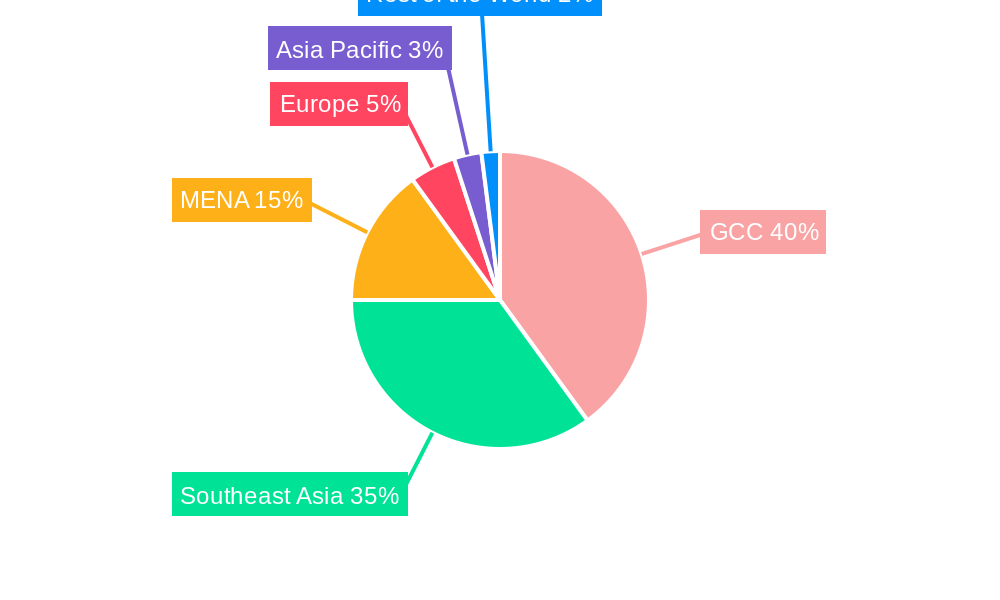

The market is segmented across several crucial areas, with the Financial Sector, encompassing Islamic Banking and Islamic Insurance (Takaful), representing the largest and most influential segments. The issuance of Islamic Bonds (Sukuk) is also a significant contributor to market growth, facilitating large-scale infrastructure and development projects. Other Islamic Financial Institutions (OIFI's) and Islamic Funds further diversify the market, catering to a broader range of investor needs. Geographically, the GCC region, led by Saudi Arabia and the UAE, and Southeast Asia, with Malaysia and Indonesia at the forefront, are the dominant markets. However, emerging opportunities are also being witnessed in MENA, Europe, and the wider Asia Pacific region. While the market exhibits strong growth, potential restraints include regulatory complexities in certain jurisdictions and the need for greater standardization of Sharia compliance across different markets. Nevertheless, the overarching trend is one of sustained and accelerating growth, driven by strong demand and innovation.

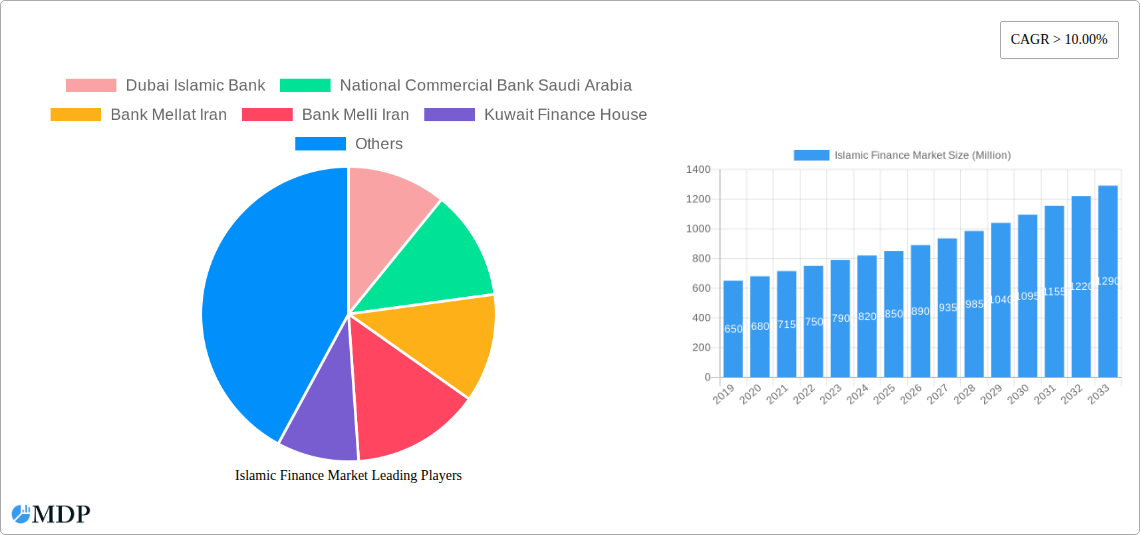

Islamic Finance Market Company Market Share

Unlocking Growth: A Comprehensive Analysis of the Islamic Finance Market (2019-2033)

This in-depth report provides a strategic overview of the global Islamic Finance Market, forecasting significant growth from 2019 to 2033, with a base and estimated year of 2025. It offers actionable insights for stakeholders seeking to navigate and capitalize on the evolving landscape of Sharia-compliant financial products and services. The report delves into market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, and the competitive strategies of key players. Leverage high-traffic keywords like "Islamic banking," "Sukuk market," "Takaful," "Sharia-compliant finance," and "ethical investing" to enhance search visibility and attract industry professionals, investors, and policymakers.

Islamic Finance Market Market Dynamics & Concentration

The Islamic Finance Market exhibits a dynamic and increasingly concentrated landscape. Innovation drivers are primarily fueled by advancements in fintech solutions and the growing demand for ethical and socially responsible investing (SRI) options. Regulatory frameworks continue to mature, with central bank initiatives and international standardization efforts playing a crucial role in fostering trust and expanding market reach. Product substitutes, while present in conventional finance, are increasingly being met with sophisticated Islamic alternatives, diminishing their competitive edge. End-user trends point towards a growing segment of millennial and Gen Z investors seeking Sharia-compliant options, coupled with a rising awareness of ethical financial practices among a broader consumer base. Mergers and acquisitions (M&A) are a significant indicator of market consolidation and strategic expansion, with numerous deals aimed at achieving scale and enhancing service offerings. For instance, the acquisition of Ahli United Bank by Kuwait Finance House, with an estimated asset base of 115 billion USD, signifies a major consolidation event. M&A deal counts are projected to increase as larger institutions seek to acquire innovative fintech startups and smaller Sharia-compliant entities, aiming to capture a larger market share, which is estimated to be in the hundreds of billions of USD.

Islamic Finance Market Industry Trends & Analysis

The Islamic Finance Market is experiencing robust growth, driven by a confluence of factors including favorable demographic shifts, increasing per capita income in key Muslim-majority regions, and a heightened global awareness of ethical and sustainable finance. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is estimated to be in the XX% range, signaling substantial expansion. Technological disruptions are at the forefront, with blockchain technology revolutionizing Sukuk issuance and Sharia-compliant payment gateways transforming the accessibility of financial services. Artificial intelligence (AI) is being leveraged for enhanced risk management, personalized financial advice, and fraud detection within Islamic financial institutions. Consumer preferences are evolving, with a strong demand for user-friendly digital platforms, customized financial products, and transparent Sharia compliance mechanisms. Competitive dynamics are intensifying, with both established Islamic banks and newer, agile fintech players vying for market share. Market penetration is steadily increasing, particularly in emerging economies, as financial literacy and access to Sharia-compliant products expand. The global Islamic banking sector alone is estimated to be worth over XX trillion USD, with significant growth anticipated in the coming decade. The Takaful market, while smaller, is also projected for substantial expansion, driven by increasing demand for ethical insurance solutions. The Sukuk market is a key growth engine, with ongoing issuances supporting infrastructure development and corporate financing needs, contributing an estimated XX billion USD annually to the global economy.

Leading Markets & Segments in Islamic Finance Market

The Middle East and North Africa (MENA) region stands as the dominant market for Islamic finance, with countries like Saudi Arabia, the UAE, and Malaysia leading the charge. This dominance is attributed to a combination of factors: robust economic policies supporting Islamic finance, significant government initiatives to promote Sharia-compliant products, and a large Muslim population with a strong preference for ethical financial dealings.

Financial Sector Dominance:

- Islamic Banking: This segment continues to be the bedrock of Islamic finance, witnessing consistent growth driven by strong consumer demand and supportive regulatory environments. Banks such as Dubai Islamic Bank and National Commercial Bank Saudi Arabia are at the forefront, expanding their product portfolios and digital offerings. The total assets of Islamic banking are estimated to exceed XX trillion USD globally.

- Islamic Insurance (Takaful): The Takaful sector is experiencing a significant uptick, driven by increasing awareness of ethical insurance principles and a growing middle class seeking Sharia-compliant risk management solutions. Growth in this segment is projected to be in the XX% CAGR range.

- Islamic Bonds (Sukuk): The Sukuk market has emerged as a critical instrument for financing infrastructure projects and corporate needs. Its growth is propelled by governments and corporations seeking Sharia-compliant funding avenues. The global Sukuk market size is estimated to reach XX trillion USD by 2025.

- Other Islamic Financial Institutions (OIFI's): This broad category includes Islamic investment funds, microfinance institutions, and wealth management firms that adhere to Sharia principles. Their expansion is fueled by the growing demand for diversified ethical investment options and tailored financial services.

- Islamic Funds: The Islamic funds segment is experiencing a surge in popularity, attracting both institutional and retail investors seeking Sharia-compliant investment opportunities. Growth in this segment is driven by the increasing availability of diverse fund options and enhanced investor education.

Key drivers for the dominance of these segments and regions include strong government backing, proactive central bank policies, the establishment of dedicated regulatory bodies, and a cultural inclination towards ethical financial practices. The development of robust Sharia advisory boards and Sharia-compliant technology solutions further solidifies their leading positions.

Islamic Finance Market Product Developments

Product innovation in the Islamic Finance Market is characterized by a strong focus on digital integration and Sharia compliance. Key developments include the introduction of Sharia-compliant digital payment solutions, enhanced online Sukuk issuance platforms, and the proliferation of ethical investment funds with diversified asset classes. Technological trends like AI-powered robo-advisors and blockchain-based Sharia certification are providing competitive advantages by improving efficiency, transparency, and accessibility. Market fit is being optimized through the development of personalized financial products catering to specific demographic needs, such as micro-Takaful for low-income populations and Sharia-compliant mortgages for aspiring homeowners.

Key Drivers of Islamic Finance Market Growth

The Islamic Finance Market's growth is propelled by several interconnected factors. Technological advancements, particularly in fintech, are enhancing accessibility and efficiency, making Sharia-compliant products more competitive and user-friendly. Economic growth in key Muslim-majority countries, coupled with rising disposable incomes, fuels demand for sophisticated financial services. Favorable regulatory frameworks and government initiatives that actively promote Islamic finance, such as the establishment of specialized Islamic banking windows and the introduction of supportive tax policies, are critical accelerators. Furthermore, a growing global awareness and preference for ethical and sustainable investing are driving mainstream adoption of Sharia-compliant financial instruments. The increasing number of younger demographics entering the financial market, who are often more inclined towards ethical and digital financial solutions, also represents a significant growth driver.

Challenges in the Islamic Finance Market Market

Despite its robust growth, the Islamic Finance Market faces several challenges. Regulatory fragmentation across different jurisdictions can create complexities for international operations and product standardization, impacting market efficiency and cross-border investments. Limited awareness and understanding of Sharia-compliant products among some consumer segments can hinder wider adoption, necessitating continuous educational outreach. Talent scarcity in specialized Sharia finance expertise poses a challenge for institutions aiming to innovate and expand their services. Operational inefficiencies and higher compliance costs compared to conventional finance can also present a competitive disadvantage. Moreover, the supply chain for ethical financial products is still developing, and the availability of sophisticated Sharia-compliant investment opportunities may not always match demand, particularly in niche markets.

Emerging Opportunities in Islamic Finance Market

Catalysts driving long-term growth in the Islamic Finance Market are abundant. Technological breakthroughs, such as the increasing integration of blockchain for transparent and efficient Sukuk issuance and the application of AI for personalized Sharia-compliant wealth management, present significant opportunities. Strategic partnerships between Islamic financial institutions and conventional fintech companies can foster innovation and expand market reach. Market expansion strategies into untapped geographies, particularly in regions with growing Muslim populations and increasing interest in ethical finance, offer substantial potential. The growing global focus on Environmental, Social, and Governance (ESG) investing aligns perfectly with the principles of Islamic finance, opening doors for collaboration and the development of innovative ESG-compliant Islamic financial products. The development of digital Islamic banking ecosystems and Sharia-compliant crowdfunding platforms are also poised to drive significant future growth.

Leading Players in the Islamic Finance Market Sector

- Dubai Islamic Bank

- National Commercial Bank Saudi Arabia

- Bank Mellat Iran

- Bank Melli Iran

- Kuwait Finance House

- Bank Maskan Iran

- Qatar Islamic Bank

- Abu Dhabi Islamic Bank

- May Bank Islamic

- CIMB Islamic Bank

Key Milestones in Islamic Finance Market Industry

- January 2023: Abu Dhabi Islamic Bank (ADIB) significantly increased its ownership in ADIB Egypt to over 52.607% by acquiring an additional 2.4% stake, signaling strategic consolidation and expansion within the North African market.

- July 2022: Kuwait Finance House (KFH) agreed to acquire Bahrain-based Ahli United Bank (AUB) through a share swap deal, creating a banking powerhouse with an estimated 115 billion USD in assets, positioning it as the seventh largest bank in the Gulf region and underscoring the trend of consolidation and strategic mergers.

Strategic Outlook for Islamic Finance Market Market

The strategic outlook for the Islamic Finance Market is exceptionally positive, driven by its alignment with global trends towards ethical and sustainable finance. Growth accelerators include the continued digitalization of financial services, enabling greater accessibility and a more seamless customer experience for Sharia-compliant products. The deepening integration of Islamic finance principles with Environmental, Social, and Governance (ESG) investing frameworks presents a significant opportunity for market expansion and the attraction of a broader investor base. Further development of innovative Sukuk instruments and Takaful products tailored to evolving market needs will also be crucial. Strategic collaborations between established institutions and agile fintech firms will foster innovation and enhance competitiveness, solidifying the market's position as a robust and ethical alternative in the global financial landscape. The market is poised for continued substantial growth, estimated to reach XX trillion USD by 2033.

Islamic Finance Market Segmentation

-

1. Financial Sector

- 1.1. Islamic Banking

- 1.2. Islamic Insurance : Takaful

- 1.3. Islamic Bonds 'Sukuk'

- 1.4. Other Islamic Financial Institution (OIFI's)

- 1.5. Islamic Funds

Islamic Finance Market Segmentation By Geography

-

1. GCC

- 1.1. Saudi Arabia

- 1.2. UAE

- 1.3. Qatar

- 1.4. Kuwait

- 1.5. Bahrain

- 1.6. Oman

-

2. MENA

- 2.1. Iran

- 2.2. Egypt

- 2.3. Rest of Middle East

- 3. Southeast Asia

-

4. Malaysia

- 4.1. Indonesia

- 4.2. Brunei

- 4.3. Pakistan

- 4.4. Rest of Southeast Asia and Asia Pacific

-

5. Europe

- 5.1. United Kingdom

- 5.2. Ieland

- 5.3. Italy

- 5.4. Rest of Europe

- 6. Rest of the World

Islamic Finance Market Regional Market Share

Geographic Coverage of Islamic Finance Market

Islamic Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Malaysia is the top Score Value for Islamic Finance Development Indicator

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 5.1.1. Islamic Banking

- 5.1.2. Islamic Insurance : Takaful

- 5.1.3. Islamic Bonds 'Sukuk'

- 5.1.4. Other Islamic Financial Institution (OIFI's)

- 5.1.5. Islamic Funds

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. GCC

- 5.2.2. MENA

- 5.2.3. Southeast Asia

- 5.2.4. Malaysia

- 5.2.5. Europe

- 5.2.6. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6. GCC Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6.1.1. Islamic Banking

- 6.1.2. Islamic Insurance : Takaful

- 6.1.3. Islamic Bonds 'Sukuk'

- 6.1.4. Other Islamic Financial Institution (OIFI's)

- 6.1.5. Islamic Funds

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7. MENA Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7.1.1. Islamic Banking

- 7.1.2. Islamic Insurance : Takaful

- 7.1.3. Islamic Bonds 'Sukuk'

- 7.1.4. Other Islamic Financial Institution (OIFI's)

- 7.1.5. Islamic Funds

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8. Southeast Asia Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8.1.1. Islamic Banking

- 8.1.2. Islamic Insurance : Takaful

- 8.1.3. Islamic Bonds 'Sukuk'

- 8.1.4. Other Islamic Financial Institution (OIFI's)

- 8.1.5. Islamic Funds

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9. Malaysia Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9.1.1. Islamic Banking

- 9.1.2. Islamic Insurance : Takaful

- 9.1.3. Islamic Bonds 'Sukuk'

- 9.1.4. Other Islamic Financial Institution (OIFI's)

- 9.1.5. Islamic Funds

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10. Europe Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10.1.1. Islamic Banking

- 10.1.2. Islamic Insurance : Takaful

- 10.1.3. Islamic Bonds 'Sukuk'

- 10.1.4. Other Islamic Financial Institution (OIFI's)

- 10.1.5. Islamic Funds

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11. Rest of the World Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11.1.1. Islamic Banking

- 11.1.2. Islamic Insurance : Takaful

- 11.1.3. Islamic Bonds 'Sukuk'

- 11.1.4. Other Islamic Financial Institution (OIFI's)

- 11.1.5. Islamic Funds

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dubai Islamic Bank

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 National Commercial Bank Saudi Arabia

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bank Mellat Iran

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bank Melli Iran

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kuwait Finance House

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bank Maskan Iran

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Qatar Islamic Bank

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Abu Dhabi Islamic Bank

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 May Bank Islamic

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 CIMB Islamic Bank**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Dubai Islamic Bank

List of Figures

- Figure 1: Islamic Finance Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Islamic Finance Market Share (%) by Company 2025

List of Tables

- Table 1: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 2: Islamic Finance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 4: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Saudi Arabia Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: UAE Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Qatar Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Kuwait Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Bahrain Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Oman Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 12: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Iran Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Egypt Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Middle East Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 17: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 19: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Indonesia Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Brunei Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Pakistan Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Southeast Asia and Asia Pacific Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 25: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: United Kingdom Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Ieland Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Italy Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Islamic Finance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Islamic Finance Market Revenue undefined Forecast, by Financial Sector 2020 & 2033

- Table 31: Islamic Finance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Islamic Finance Market?

The projected CAGR is approximately 11.6%.

2. Which companies are prominent players in the Islamic Finance Market?

Key companies in the market include Dubai Islamic Bank, National Commercial Bank Saudi Arabia, Bank Mellat Iran, Bank Melli Iran, Kuwait Finance House, Bank Maskan Iran, Qatar Islamic Bank, Abu Dhabi Islamic Bank, May Bank Islamic, CIMB Islamic Bank**List Not Exhaustive.

3. What are the main segments of the Islamic Finance Market?

The market segments include Financial Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Malaysia is the top Score Value for Islamic Finance Development Indicator.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Abu Dhabi Islamic Bank (ADIB) has increased its ownership in ADIB Egypt to more than 52%. The UAE-based bank has acquired 9.6 million shares from the National Investment Bank (NIB), representing 2.4% of ADIB Egypt's share capital, the bank told the Abu Dhabi Securities Exchange (ADX). The deal has raised ADIB UAE's ownership in the Egyptian unit to 52.607%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Islamic Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Islamic Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Islamic Finance Market?

To stay informed about further developments, trends, and reports in the Islamic Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence