Key Insights

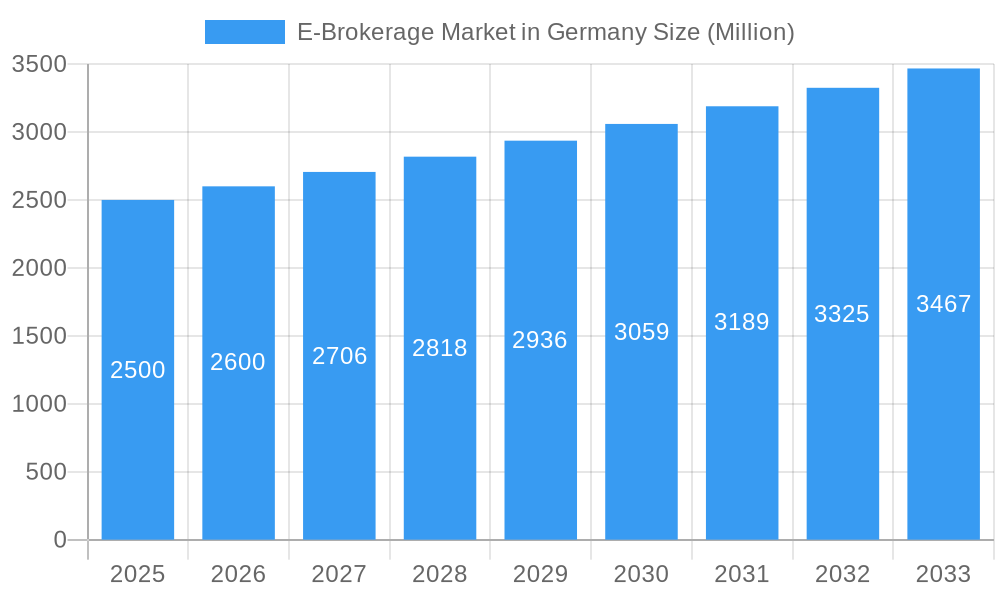

The German e-brokerage market is poised for robust expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 6.4%. The market size is estimated at 1 billion in the base year 2025. This significant growth trajectory is driven by increasing digital adoption and smartphone penetration, making online trading more accessible, especially for younger demographics. The competitive landscape is characterized by the ongoing trend of zero-commission services, exemplified by platforms like Trade Republic and Flatex, which are attracting a broader investor base. Established institutions such as Interactive Brokers, Comdirect Bank, and ING Diba, alongside agile fintech innovators, foster a dynamic and competitive environment. Regulatory clarity and investor education initiatives further bolster market growth. Potential challenges include market volatility, economic downturns, and intensified competition. Future developments will likely focus on enhancing user experience, platform security, and diversifying investment product offerings to meet evolving investor needs.

E-Brokerage Market in Germany Market Size (In Billion)

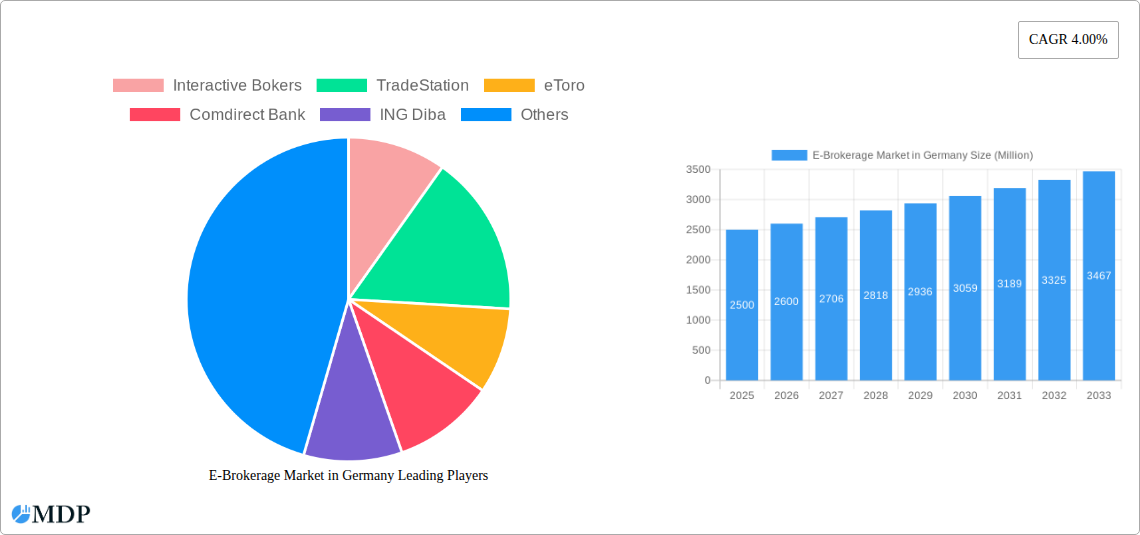

The German e-brokerage sector features a fragmented competitive environment, encompassing both traditional banking institutions and agile fintech companies. While platforms like Interactive Brokers and TradeStation cater to seasoned traders with advanced features, eToro and Trade Republic appeal to a wider audience through user-friendly interfaces and mobile-centric strategies. Regional adoption rates are expected to vary, with urban centers likely exhibiting higher penetration than rural areas. Future market expansion will be contingent upon technological advancements, evolving regulatory frameworks, and macroeconomic influences on investor confidence. Continued emphasis on investor education and transparency is vital for promoting responsible investment and ensuring sustained market maturity.

E-Brokerage Market in Germany Company Market Share

E-Brokerage Market in Germany: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the German e-brokerage market, encompassing market dynamics, industry trends, leading players, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for investors, industry stakeholders, and anyone seeking to understand the complexities and opportunities within this dynamic sector. Key players analyzed include Interactive Brokers, TradeStation, eToro, Comdirect Bank, ING Diba, Flatex, Trade Republic, Lynx, Onvista, Consors Bank, and Geno Broker (list not exhaustive).

E-Brokerage Market in Germany: Market Dynamics & Concentration

The German e-brokerage market is characterized by a blend of established players and emerging fintech disruptors. Market concentration is moderate, with a few dominant players holding significant market share, estimated at xx Million in 2025. However, the market is experiencing increased competition, driven by technological innovations and the entry of new players. Regulatory frameworks, including MiFID II, significantly influence market operations and compliance. Product substitutes, such as traditional brokerage services and robo-advisors, exert competitive pressure. End-user trends reveal a growing preference for mobile-first platforms and commission-free trading, while M&A activity remains relatively moderate, with an estimated xx merger and acquisition deals recorded during the historical period (2019-2024).

- Market Share (2025 Estimate): Comdirect Bank (xx%), Flatex (xx%), Trade Republic (xx%), others (xx%).

- M&A Deal Count (2019-2024): xx

- Key Regulatory Frameworks: MiFID II, BaFin regulations.

- Innovation Drivers: Mobile-first platforms, AI-powered trading tools, commission-free models.

E-Brokerage Market in Germany: Industry Trends & Analysis

The German e-brokerage market exhibits a strong growth trajectory, driven by several factors. The increasing adoption of online trading platforms by retail investors, fueled by a rise in digital literacy and the accessibility of online investment tools, is a key driver. Technological advancements, such as the proliferation of mobile trading apps and AI-powered investment strategies, are disrupting the traditional brokerage landscape. Furthermore, consumer preferences are shifting towards commission-free trading and personalized investment solutions. Competitive dynamics are characterized by fierce rivalry, particularly among established banks and emerging fintech companies, leading to continuous innovation and improved service offerings. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), with market penetration estimated to reach xx% by 2033.

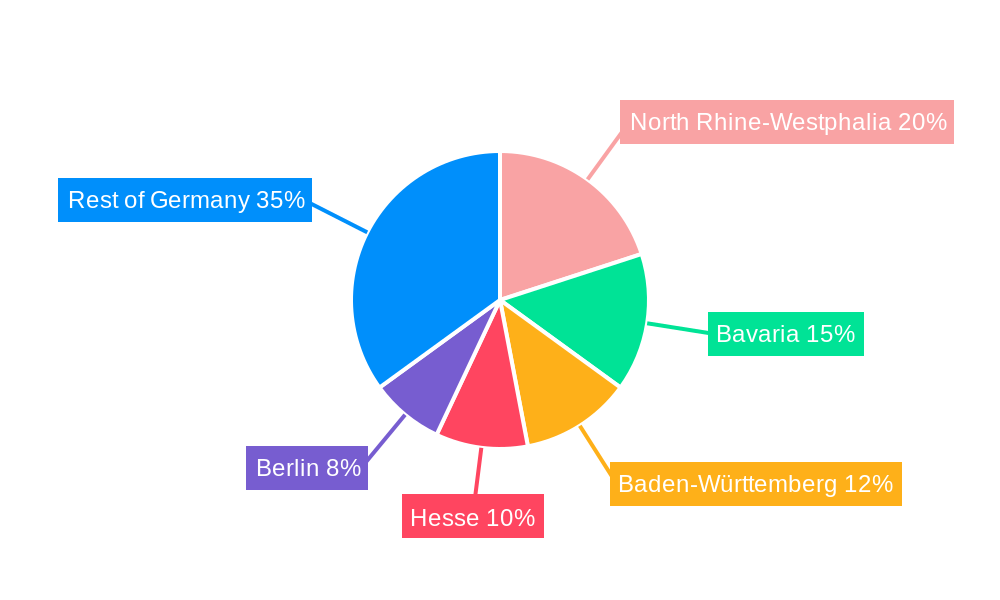

Leading Markets & Segments in E-Brokerage Market in Germany

The German e-brokerage market demonstrates relatively even regional distribution across the country, with no single dominant region. However, metropolitan areas with higher concentrations of affluent individuals and technologically savvy populations exhibit higher market penetration. The retail investor segment represents the largest market share, driven by the increasing accessibility of online trading platforms and the growing popularity of self-directed investing.

- Key Drivers for Retail Investor Segment Dominance:

- Increasing digital literacy among retail investors.

- Growing interest in self-directed investing.

- Availability of user-friendly mobile trading apps.

- Lower trading costs compared to traditional brokers.

E-Brokerage Market in Germany: Product Developments

Recent product developments in the German e-brokerage market highlight a strong focus on mobile-first experiences, fractional share trading, and the integration of AI-driven investment tools. Several platforms have introduced commission-free trading options, attracting a wider base of retail investors. The integration of robo-advisors and algorithmic trading tools caters to the growing demand for automated investment solutions. This trend aligns perfectly with the market’s emphasis on ease of use, cost-effectiveness, and personalized investment experiences.

Key Drivers of E-Brokerage Market in Germany Growth

Several factors are driving the expansion of the German e-brokerage market. These include the increasing digitalization of financial services, the rising popularity of online trading among retail investors, and the continuing development of innovative trading platforms. Furthermore, government initiatives promoting financial literacy and the availability of affordable trading options play a significant role. The emergence of cryptocurrencies and other digital assets also represents a new growth area for the market.

Challenges in the E-Brokerage Market in Germany Market

The German e-brokerage market faces several challenges. Stringent regulatory compliance requirements, including those related to data privacy and anti-money laundering, represent a significant hurdle. The intense competition among established and emerging players leads to price wars and margin compression. Security concerns related to cyberattacks and data breaches pose a considerable threat to consumer trust and operational stability. These factors can lead to decreased profitability and hinder market growth.

Emerging Opportunities in E-Brokerage Market in Germany

The German e-brokerage market presents several promising opportunities. The increasing adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML) can further personalize investment advice and automate trading processes. Strategic partnerships between established financial institutions and fintech companies can foster innovation and enhance service offerings. Expansion into new segments, such as the growing market for cryptocurrency trading, presents significant potential for future growth.

Leading Players in the E-Brokerage Market in Germany Sector

- Interactive Brokers

- TradeStation

- eToro

- Comdirect Bank

- ING Diba

- Flatex

- Trade Republic

- Lynx

- Onvista

- Consors Bank

- Geno Broker

Key Milestones in E-Brokerage Market in Germany Industry

- July 2022: Flatex becomes the Exclusive Online Brokerage Partner of the Police Union ('Gewerkschaft der Polizei, GdP') of North Rhine-Westphalia, expanding its client base and brand visibility within a significant demographic.

- January 2022: Comdirect Bank partners with ETC Group to offer crypto ETP-based savings plans, signifying an entry into the growing cryptocurrency investment market and attracting a new segment of tech-savvy investors.

Strategic Outlook for E-Brokerage Market in Germany Market

The German e-brokerage market is poised for significant growth in the coming years. Continued technological advancements, coupled with evolving investor preferences and strategic partnerships, will drive innovation and expand market reach. The potential for integration with other financial services, such as wealth management and insurance, presents further growth opportunities. The market is expected to witness increased consolidation, with larger players potentially acquiring smaller firms to enhance their market share and service offerings.

E-Brokerage Market in Germany Segmentation

-

1. Investor Type

- 1.1. Retail

- 1.2. Institutional

-

2. Broker Ownership Type

- 2.1. Local

- 2.2. Foreign

E-Brokerage Market in Germany Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-Brokerage Market in Germany Regional Market Share

Geographic Coverage of E-Brokerage Market in Germany

E-Brokerage Market in Germany REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment Culture is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Investment Culture is Driving the Market

- 3.4. Market Trends

- 3.4.1. Increase in Internet and Mobile Penetration in Germany is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investor Type

- 5.1.1. Retail

- 5.1.2. Institutional

- 5.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 5.2.1. Local

- 5.2.2. Foreign

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Investor Type

- 6. North America E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investor Type

- 6.1.1. Retail

- 6.1.2. Institutional

- 6.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 6.2.1. Local

- 6.2.2. Foreign

- 6.1. Market Analysis, Insights and Forecast - by Investor Type

- 7. South America E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investor Type

- 7.1.1. Retail

- 7.1.2. Institutional

- 7.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 7.2.1. Local

- 7.2.2. Foreign

- 7.1. Market Analysis, Insights and Forecast - by Investor Type

- 8. Europe E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investor Type

- 8.1.1. Retail

- 8.1.2. Institutional

- 8.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 8.2.1. Local

- 8.2.2. Foreign

- 8.1. Market Analysis, Insights and Forecast - by Investor Type

- 9. Middle East & Africa E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investor Type

- 9.1.1. Retail

- 9.1.2. Institutional

- 9.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 9.2.1. Local

- 9.2.2. Foreign

- 9.1. Market Analysis, Insights and Forecast - by Investor Type

- 10. Asia Pacific E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investor Type

- 10.1.1. Retail

- 10.1.2. Institutional

- 10.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 10.2.1. Local

- 10.2.2. Foreign

- 10.1. Market Analysis, Insights and Forecast - by Investor Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Interactive Bokers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TradeStation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 eToro

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Comdirect Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ING Diba

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Flatex

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trade Republic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lynx

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Onvista

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Consors Bank

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Geno Broker**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Interactive Bokers

List of Figures

- Figure 1: Global E-Brokerage Market in Germany Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 3: North America E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 4: North America E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 5: North America E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 6: North America E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 7: North America E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 9: South America E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 10: South America E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 11: South America E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 12: South America E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 13: South America E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 15: Europe E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 16: Europe E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 17: Europe E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 18: Europe E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 21: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 22: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 23: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 24: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 27: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 28: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 29: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 30: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 2: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 3: Global E-Brokerage Market in Germany Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 5: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 6: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 11: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 12: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 17: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 18: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 29: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 30: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 38: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 39: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-Brokerage Market in Germany?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the E-Brokerage Market in Germany?

Key companies in the market include Interactive Bokers, TradeStation, eToro, Comdirect Bank, ING Diba, Flatex, Trade Republic, Lynx, Onvista, Consors Bank, Geno Broker**List Not Exhaustive.

3. What are the main segments of the E-Brokerage Market in Germany?

The market segments include Investor Type, Broker Ownership Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1 billion as of 2022.

5. What are some drivers contributing to market growth?

Investment Culture is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Internet and Mobile Penetration in Germany is Driving the Market.

7. Are there any restraints impacting market growth?

Investment Culture is Driving the Market.

8. Can you provide examples of recent developments in the market?

July 2022: Flatex, Europe's leading online broker for retail investors, became the Exclusive Online Brokerage Partner of the Police Union ('Gewerkschaft der Polizei, GdP') of North Rhine-Westphalia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-Brokerage Market in Germany," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-Brokerage Market in Germany report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-Brokerage Market in Germany?

To stay informed about further developments, trends, and reports in the E-Brokerage Market in Germany, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence