Key Insights

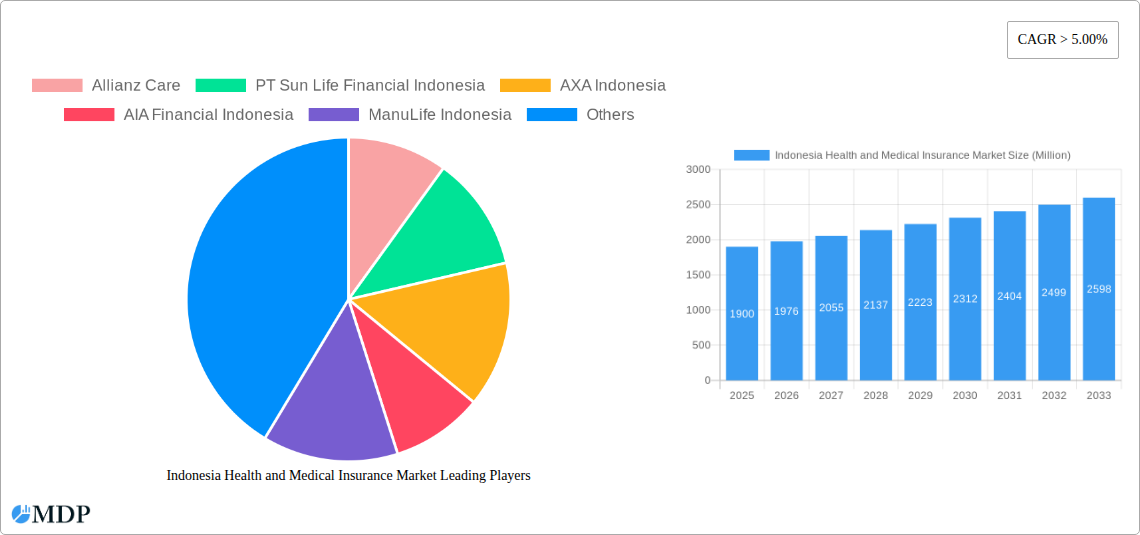

The Indonesian Health and Medical Insurance market is poised for significant expansion, projected to reach USD 1.9 billion in 2025 and grow at a healthy Compound Annual Growth Rate (CAGR) of 4.19% through 2033. This robust growth is primarily fueled by increasing awareness among the Indonesian population regarding the importance of comprehensive healthcare coverage, coupled with a rising disposable income that enables greater investment in health security. The burgeoning middle class, coupled with a growing preference for private healthcare services, further propels demand for health and medical insurance. Furthermore, government initiatives aimed at improving healthcare access and awareness, alongside the proactive engagement of insurance providers in developing tailored products for diverse segments, are key drivers of market penetration. The competitive landscape is characterized by the presence of both established international players and growing domestic insurers, all vying to capture market share by offering innovative solutions and enhanced customer service.

Indonesia Health and Medical Insurance Market Market Size (In Billion)

Despite the optimistic outlook, the market faces certain restraints. These include the affordability concerns for a significant portion of the population, the need for greater digital adoption and technological integration to streamline policy management and claims processing, and the persistent challenge of educating the public on the nuanced benefits of different insurance plans. However, the overarching trend is one of increasing demand for medical insurance, driven by the desire for financial protection against unexpected health expenses and access to quality medical care. The market segmentation reveals a dynamic interplay between production, consumption, import, and export activities, all contributing to the overall market value. Price trends are expected to reflect the inflationary pressures and the evolving competitive strategies of key players. The Indonesian market is the sole region of focus, underscoring its strategic importance and growth potential within Southeast Asia.

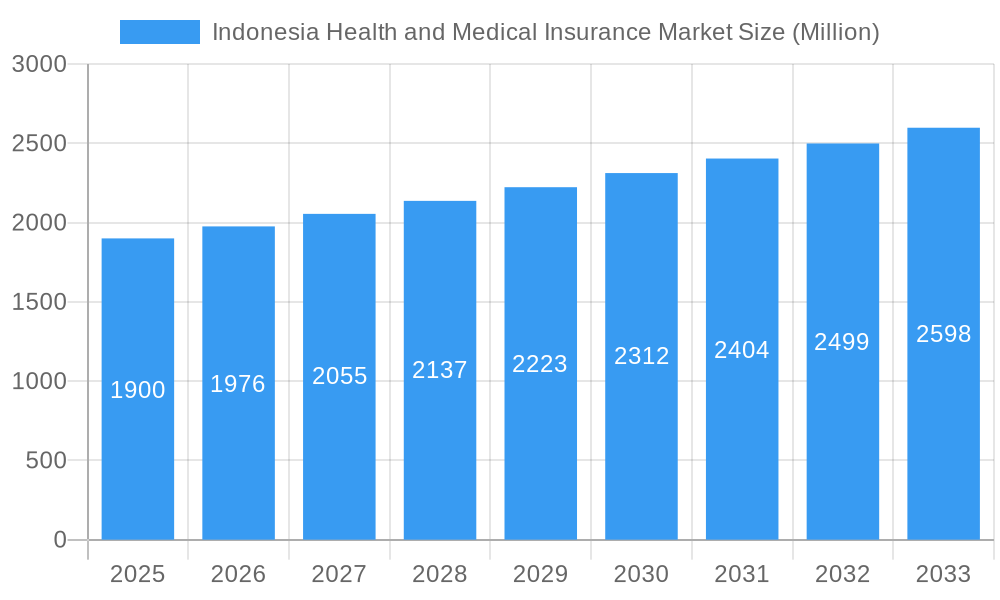

Indonesia Health and Medical Insurance Market Company Market Share

Dive deep into the dynamic Indonesia Health and Medical Insurance Market with this exhaustive report, covering the period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period extending to 2033. This analysis offers actionable insights into market dynamics, industry trends, leading players, and future strategic outlooks, essential for stakeholders navigating the Indonesian healthcare finance landscape. The report leverages high-traffic keywords such as "Indonesia health insurance," "medical insurance Indonesia," "life insurance Indonesia," and "healthcare finance Indonesia" to ensure maximum search visibility.

Indonesia Health and Medical Insurance Market Market Dynamics & Concentration

The Indonesia Health and Medical Insurance Market exhibits a moderate to high concentration, with a few key players dominating market share. Innovation drivers are primarily fueled by increasing healthcare expenditure, a growing middle class with rising disposable incomes, and a greater awareness of health and wellness. Regulatory frameworks, overseen by the Financial Services Authority (OJK), are continuously evolving to promote consumer protection and market stability, impacting product offerings and distribution channels. Product substitutes, such as out-of-pocket healthcare spending and government-backed health programs, remain significant but are increasingly being supplemented by private insurance solutions due to enhanced coverage and service. End-user trends indicate a strong preference for comprehensive coverage, including hospitalization, outpatient services, and critical illness protection. Mergers and acquisitions (M&A) activities, though not pervasive, are strategic maneuvers by larger entities to expand their market footprint and consolidate offerings. For instance, the market share of the top five players is estimated to be over 70 billion, with an average of xx M&A deals annually.

Indonesia Health and Medical Insurance Market Industry Trends & Analysis

The Indonesia Health and Medical Insurance Market is experiencing robust growth, driven by a confluence of factors that are reshaping the healthcare landscape. A significant growth driver is the escalating cost of healthcare services in Indonesia, making comprehensive medical insurance an essential financial planning tool for individuals and families alike. The penetration rate of health insurance, while still growing, is projected to reach approximately xx% by 2025, indicating substantial room for expansion. Technological disruptions are playing a pivotal role, with the advent of InsurTech solutions streamlining policy management, claims processing, and customer service. Digital platforms and mobile applications are enhancing accessibility and user experience, attracting a younger, tech-savvy demographic. Consumer preferences are shifting towards personalized insurance plans that cater to specific needs, such as critical illness coverage, maternity benefits, and dental care. The competitive dynamics within the market are intense, characterized by strategic partnerships, product innovation, and aggressive marketing campaigns by both established insurers and new entrants. The Compound Annual Growth Rate (CAGR) for the Indonesian health and medical insurance market is estimated to be a healthy xx% over the forecast period. Furthermore, the increasing prevalence of non-communicable diseases and a burgeoning elderly population further underscore the demand for robust health insurance solutions. The government's push for universal health coverage, while a positive step, also indirectly stimulates the private insurance market by creating a framework for supplementary and complementary products.

Leading Markets & Segments in Indonesia Health and Medical Insurance Market

The Indonesia Health and Medical Insurance Market sees a dominant presence across various segments, reflecting the nation's diverse healthcare needs and economic development.

- Production Analysis: The production of health and medical insurance products is heavily concentrated in urban centers like Jakarta, Surabaya, and Bandung, where disposable incomes are higher and awareness of insurance products is more prevalent. This concentration is driven by the accessibility of skilled workforces and advanced distribution networks.

- Consumption Analysis: Consumption is widespread, with a significant surge observed in tier-2 and tier-3 cities as digital penetration increases, making insurance products more accessible. The demand is fueled by rising health consciousness and the increasing cost of medical treatments.

- Import Market Analysis (Value & Volume): The import market for health and medical insurance in Indonesia is relatively nascent, primarily consisting of reinsurance services and specialized insurance products not readily available domestically. The value of these imports is estimated at approximately xx billion annually, with volume being moderate. Key drivers include the need for risk mitigation for large insurance portfolios and access to global expertise.

- Export Market Analysis (Value & Volume): Indonesia's export of health and medical insurance services is minimal. The focus remains on catering to the domestic market's growing needs.

- Price Trend Analysis: Price trends are influenced by factors such as the age and health profile of the insured, the scope of coverage, and the competitive landscape. Premiums are generally on an upward trajectory due to rising medical inflation, estimated at around xx% annually. However, innovative pricing models and bundled packages are emerging to offer more competitive options.

Indonesia Health and Medical Insurance Market Product Developments

Product innovation in the Indonesia Health and Medical Insurance Market is accelerating, with insurers focusing on developing customer-centric solutions. Key developments include the introduction of tele-health integrated insurance plans, offering seamless access to medical consultations and prescription services. Comprehensive critical illness policies, covering a wider spectrum of diseases and providing lump-sum payouts, are gaining traction. Furthermore, there's a growing trend towards flexible, modular insurance products that allow policyholders to customize coverage based on their life stages and financial capabilities. Competitive advantages are being carved out through enhanced digital platforms for policy management and claims, alongside partnerships with healthcare providers to offer discounted services and expedited treatment pathways. The market is witnessing a convergence of health and wellness programs with insurance, encouraging preventive care and healthier lifestyles.

Key Drivers of Indonesia Health and Medical Insurance Market Growth

The Indonesia Health and Medical Insurance Market is propelled by a potent combination of technological advancements, economic prosperity, and supportive regulatory initiatives.

- Economic Growth: A steadily expanding middle class with increased disposable income is a primary driver, enabling more individuals and families to afford health insurance.

- Rising Healthcare Costs: The escalating expenses associated with medical treatments and hospitalization make health insurance a crucial safeguard against financial distress.

- Technological Integration: The adoption of InsurTech is revolutionizing accessibility, policy management, and claims processing, making insurance more user-friendly and efficient.

- Government Initiatives: Policies aimed at improving healthcare access and promoting financial literacy indirectly encourage the uptake of private health insurance as a supplementary solution.

Challenges in the Indonesia Health and Medical Insurance Market Market

Despite its growth trajectory, the Indonesia Health and Medical Insurance Market faces several hurdles. Regulatory complexities and evolving compliance requirements can pose challenges for insurers. Supply chain issues within the healthcare sector, such as the availability of medical professionals and facilities, can impact the efficacy of insurance coverage. Intense competitive pressures from both domestic and international players necessitate continuous innovation and cost management. Furthermore, a segment of the population still lacks adequate awareness of the benefits of health insurance, leading to lower market penetration than its potential. The economic volatility in certain regions can also affect the purchasing power of consumers.

Emerging Opportunities in Indonesia Health and Medical Insurance Market

The Indonesia Health and Medical Insurance Market is ripe with emerging opportunities, fueled by technological breakthroughs and strategic market expansion. The increasing adoption of AI and big data analytics presents an opportunity to offer personalized insurance products and predictive health management solutions. Strategic partnerships between insurers, technology providers, and healthcare facilities can create integrated ecosystems that enhance service delivery and customer loyalty. The untapped potential in rural and semi-urban areas, coupled with government initiatives to expand healthcare access, offers a significant avenue for market penetration. Furthermore, the growing demand for specialized insurance, such as for expatriates or specific medical conditions, presents niche market opportunities.

Leading Players in the Indonesia Health and Medical Insurance Market Sector

The Indonesia Health and Medical Insurance Market Sector features a robust list of key companies, including but not limited to:

Allianz Care PT Sun Life Financial Indonesia AXA Indonesia AIA Financial Indonesia ManuLife Indonesia Prudential Indonesia Cigna Insurance PT Reasuransi Indonesia Utama (Persero) AVIVA PT Great Eastern Life Indonesia BNI Life BCA Life

Key Milestones in Indonesia Health and Medical Insurance Market Industry

- June 2022: Allianz Asia Pacific and HSBC solidified their strategic partnership with a 15-year extension, enabling HSBC to distribute Allianz insurance products, expanding Allianz's reach.

- April 2022: PT Sun Life Financial Indonesia, in a strategic alliance with PT Bank CIMB Niaga Tbk, leveraged CIMB Niaga's extensive network of 427 branches to offer Sun Life's comprehensive insurance solutions to seven (7) million customers across Indonesia.

Strategic Outlook for Indonesia Health and Medical Insurance Market Market

The strategic outlook for the Indonesia Health and Medical Insurance Market is overwhelmingly positive, driven by sustainable growth accelerators and a rapidly expanding demand base. The focus will remain on leveraging InsurTech to enhance customer experience and operational efficiency, thereby reducing administrative costs. Insurers are expected to pursue aggressive expansion strategies, targeting underserved segments and geographical regions through digital channels and strategic partnerships with financial institutions and healthcare providers. The development of innovative, needs-based products, particularly in critical illness, long-term care, and preventive health, will be crucial for capturing market share. Furthermore, a strong emphasis on financial literacy and awareness campaigns will be instrumental in driving higher insurance penetration rates, solidifying the market's robust future potential.

Indonesia Health and Medical Insurance Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Health and Medical Insurance Market Segmentation By Geography

- 1. Indonesia

Indonesia Health and Medical Insurance Market Regional Market Share

Geographic Coverage of Indonesia Health and Medical Insurance Market

Indonesia Health and Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Public Health Insurance is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Allianz Care

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Sun Life Financial Indonesia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AXA Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AIA Financial Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ManuLife Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Prudential Indonesia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cigna Insurance

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Reasuransi Indonesia Utama (Persero)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AVIVA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Great Eastern Life Indonesia**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BNI Life

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BCA Life

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Allianz Care

List of Figures

- Figure 1: Indonesia Health and Medical Insurance Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Health and Medical Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Health and Medical Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Health and Medical Insurance Market?

The projected CAGR is approximately 4.19%.

2. Which companies are prominent players in the Indonesia Health and Medical Insurance Market?

Key companies in the market include Allianz Care, PT Sun Life Financial Indonesia, AXA Indonesia, AIA Financial Indonesia, ManuLife Indonesia, Prudential Indonesia, Cigna Insurance, PT Reasuransi Indonesia Utama (Persero), AVIVA, PT Great Eastern Life Indonesia**List Not Exhaustive, BNI Life, BCA Life.

3. What are the main segments of the Indonesia Health and Medical Insurance Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

Public Health Insurance is Dominating the Market.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

June 2022: Allianz Asia Pacific and HSBC have signed a 15-year extension of their strategic partnership. As part of the partnership, HSBC will be distributing Allianz insurance products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Health and Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Health and Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Health and Medical Insurance Market?

To stay informed about further developments, trends, and reports in the Indonesia Health and Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence