Key Insights

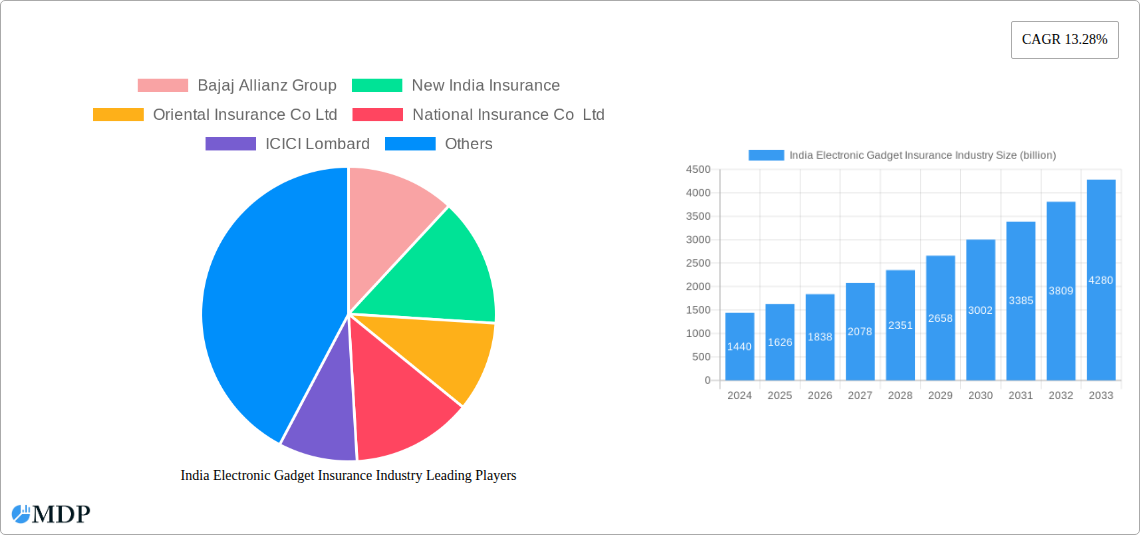

The Indian Electronic Gadget Insurance market is poised for substantial growth, projected to reach $1.44 billion in 2024. This robust expansion is driven by an anticipated Compound Annual Growth Rate (CAGR) of 13.28% over the forecast period. The burgeoning adoption of electronic devices across all demographics, coupled with increasing consumer awareness regarding protection against unforeseen damage, loss, or theft, are key catalysts. The market is segmented by coverage types including Physical Damage, Electronic Damage, Data Protection, Virus Protection, and Theft Protection, catering to a diverse range of electronic devices such as Laptops, Computers, Cameras, Mobile Devices, and Tablets. End-users span both the Corporate sector, seeking to safeguard valuable business assets, and the Individual segment, looking to protect personal investments in technology. The rising dependency on electronic gadgets for daily life and professional activities further solidifies the demand for comprehensive insurance solutions.

India Electronic Gadget Insurance Industry Market Size (In Billion)

Several significant trends are shaping the India Electronic Gadget Insurance Industry. The increasing sophistication of cyber threats and the growing importance of data privacy are boosting the demand for robust Data Protection and Virus Protection coverage. Furthermore, the proliferation of smartphones and wearable technology, along with the continuous release of new, high-value gadgets, are creating new avenues for market expansion. While the market benefits from these drivers, certain restraints exist, such as a degree of price sensitivity among consumers and the need for greater clarity and simplification in policy offerings. However, the strong economic growth in India, increasing disposable incomes, and a rising comfort level with digital transactions and insurance products are expected to outweigh these challenges, propelling the market towards its projected trajectory. Key players like Bajaj Allianz Group, New India Insurance, ICICI Lombard, and Policybazar are actively innovating and expanding their offerings to capture this dynamic market.

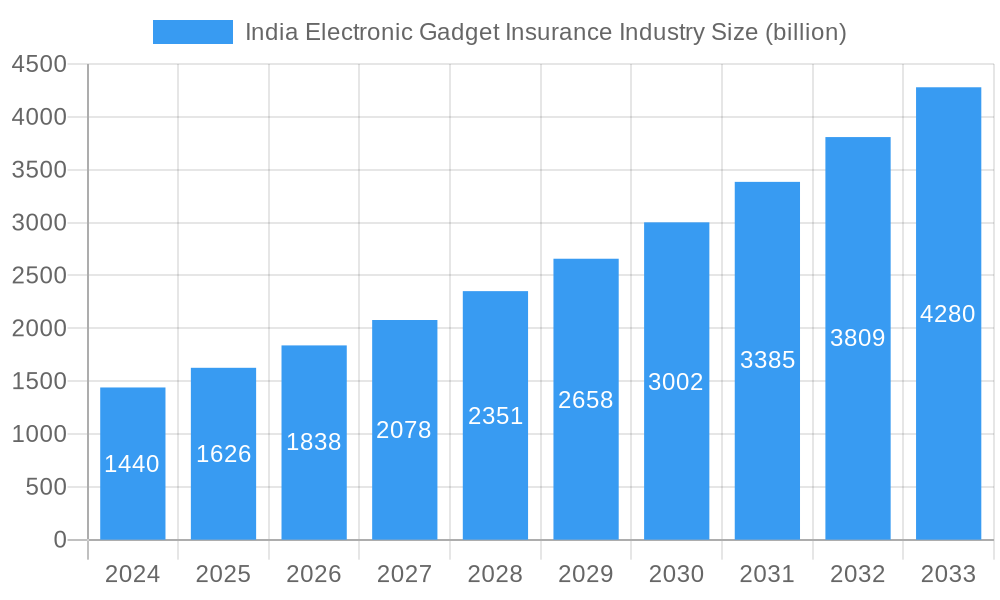

India Electronic Gadget Insurance Industry Company Market Share

India Electronic Gadget Insurance Industry Report: Unlocking Billion-Dollar Growth Opportunities

Dive into the burgeoning India Electronic Gadget Insurance industry, a sector poised for monumental expansion. This comprehensive report offers an in-depth analysis of market dynamics, key trends, leading players, and future outlook, providing invaluable insights for stakeholders seeking to capitalize on this billion-dollar market. With an estimated USD 50 billion market size in 2025, projected to reach USD 150 billion by 2033, driven by a CAGR of xx%, this report is your definitive guide to navigating the evolving landscape of electronic gadget protection in India.

India Electronic Gadget Insurance Industry Market Dynamics & Concentration

The India Electronic Gadget Insurance market is characterized by a moderate to high concentration, with established public sector insurers like New India Insurance, Oriental Insurance Co Ltd, and National Insurance Co Ltd holding significant sway alongside prominent private players such as Bajaj Allianz Group, ICICI Lombard, and HDFC Ergo. Innovation is a key driver, fueled by the rapid adoption of advanced technologies and the increasing value of consumer electronics. Regulatory frameworks, primarily governed by IRDAI, are evolving to foster fair competition and consumer protection. Product substitutes, such as extended warranties and manufacturer guarantees, exist but often lack the comprehensive coverage offered by dedicated insurance products. End-user trends indicate a growing demand from both individual consumers and corporate entities, driven by the indispensable nature of electronic devices in daily life and business operations. Merger and acquisition (M&A) activities, while not yet at a fever pitch, are anticipated to increase as larger players seek to consolidate market share and acquire innovative insurtech capabilities.

- Market Concentration: Moderate to High, with a blend of public and private sector dominance.

- Innovation Drivers: Rapid tech adoption, increasing gadget value, emergence of insurtech.

- Regulatory Framework: Governed by IRDAI, with evolving consumer protection and competition policies.

- Product Substitutes: Extended warranties, manufacturer guarantees.

- End-User Trends: Growing demand from both individual and corporate segments.

- M&A Activities: Anticipated to increase for market consolidation and capability acquisition.

India Electronic Gadget Insurance Industry Industry Trends & Analysis

The India Electronic Gadget Insurance industry is experiencing robust growth, underpinned by several significant trends. The ever-increasing penetration of smartphones, laptops, and other smart devices, coupled with their rising price points, has created a substantial addressable market for insurance solutions. Market penetration is projected to increase from xx% in 2024 to xx% by 2033, reflecting a growing consumer awareness of the need for financial protection against unforeseen damages or losses. Technological disruptions, particularly the rise of digital insurance startups like ACKO, are reshaping the distribution and claims management processes. These players are leveraging data analytics and AI to offer more personalized and efficient customer experiences, moving towards a digital-native insurance ecosystem. Consumer preferences are shifting towards convenience, transparency, and immediate service, with online purchase platforms and app-based claims gaining significant traction. Competitive dynamics are intensifying, forcing established insurers to innovate and embrace digital transformation to remain relevant. The embedded insurance model, where gadget insurance is offered as an add-on during the purchase of electronic devices, is a particularly strong growth driver, integrating protection seamlessly into the consumer journey.

- Market Growth Drivers: Increasing gadget ownership, rising device costs, growing consumer awareness.

- Technological Disruptions: Rise of insurtech, AI-driven underwriting, digital claims processing.

- Consumer Preferences: Demand for convenience, transparency, digital channels, and instant service.

- Competitive Dynamics: Intensifying competition, digital transformation imperative for incumbents.

- Embedded Insurance: Significant growth catalyst through seamless integration with device purchases.

- Market Penetration: Projected to grow from xx% to xx% between 2024 and 2033.

- Compound Annual Growth Rate (CAGR): xx% for the forecast period of 2025–2033.

Leading Markets & Segments in India Electronic Gadget Insurance Industry

The Mobile Devices segment, encompassing smartphones and feature phones, currently dominates the India Electronic Gadget Insurance market, accounting for an estimated xx% of the total market share in 2025. This dominance is attributed to the sheer volume of mobile device ownership across all socio-economic strata in India and the critical role these devices play in daily communication, work, and entertainment. Following closely are Laptops and Computers, driven by the sustained demand for personal and professional use, and the increasing adoption of hybrid work models.

Within coverage types, Physical Damage and Electronic Damage are the most sought-after, addressing the common fears of accidental drops, liquid spills, and internal malfunctions. However, Theft Protection is also a significant driver, particularly in urban centers. The growing concern over data privacy and the increasing reliance on digital services are also boosting the demand for Data Protection and Virus Protection coverage, albeit at a nascent stage.

Geographically, the Tier-1 and Tier-2 cities represent the leading markets due to higher disposable incomes, greater access to technology, and a more developed awareness of insurance products. Economic policies promoting digital India and increasing disposable incomes significantly contribute to this segment's dominance. Infrastructure development, including robust internet connectivity, further supports the growth of digital insurance platforms catering to these urban centers.

- Dominant Device Type: Mobile Devices (Smartphones, Feature Phones) – xx% market share in 2025.

- Key Drivers: High penetration, essential communication tool, rising device costs.

- Leading Coverage Types:

- Physical Damage

- Electronic Damage

- Theft Protection

- Emerging Coverage: Data Protection, Virus Protection.

- Dominant End-User Segment: Individual Consumers – driven by widespread device ownership and personal risk aversion.

- Substantial Growth: Corporate segment for employee device protection and business continuity.

- Leading Geographic Markets: Tier-1 and Tier-2 cities.

- Key Drivers: Higher disposable income, technology adoption, insurance awareness, digital infrastructure.

India Electronic Gadget Insurance Industry Product Developments

Product innovation in the India Electronic Gadget Insurance sector is focused on creating more comprehensive and user-friendly policies. Insurers are increasingly bundling physical damage, electronic breakdown, and theft coverage into single, attractive packages. The integration of data protection and virus protection features is a key trend, catering to the growing digital footprint of users. SyskaGadjet Secure is an example of a company specializing in such integrated solutions. Policies are becoming more modular, allowing consumers to customize coverage based on their specific needs and the value of their devices. The development of AI-powered diagnostic tools for assessing device condition at the time of purchase or claim is also enhancing product accuracy and customer trust.

Key Drivers of India Electronic Gadget Insurance Industry Growth

The rapid growth of the India Electronic Gadget Insurance industry is propelled by several interconnected factors. The exponential rise in smartphone and other smart device penetration across India, coupled with the increasing average selling price of these gadgets, creates a larger insurable asset base. The growing awareness among consumers about the risks of accidental damage, theft, and electronic malfunctions is a significant driver. Government initiatives promoting digitalization and financial inclusion indirectly support the growth of online insurance platforms. Furthermore, the increasing adoption of embedded insurance models by device manufacturers and e-commerce platforms makes obtaining coverage more accessible and convenient for consumers.

Challenges in the India Electronic Gadget Insurance Industry Market

Despite its promising growth trajectory, the India Electronic Gadget Insurance market faces several challenges. Low insurance penetration and lack of awareness in rural and semi-urban areas remain significant hurdles. Fraudulent claims present a persistent concern for insurers, impacting profitability and potentially leading to higher premiums. Regulatory complexities and evolving compliance requirements can pose challenges for new entrants and smaller players. Intense price competition among insurers can lead to margin pressures. Additionally, the rapid obsolescence of electronic devices requires insurers to constantly update their risk assessment models and policy terms.

Emerging Opportunities in India Electronic Gadget Insurance Industry

The India Electronic Gadget Insurance industry is ripe with emerging opportunities. The untapped potential in Tier-3 cities and rural markets presents a vast growth avenue for insurers who can develop localized distribution strategies and affordable product offerings. The increasing adoption of Internet of Things (IoT) devices will create a new category of insurable assets, demanding specialized insurance solutions. Strategic partnerships with device manufacturers, e-commerce giants, and fintech companies can unlock new customer segments and distribution channels, as exemplified by ACKO's success in embedded insurance. The development of usage-based insurance models, leveraging telematics and device data, can offer personalized premiums and enhance risk management.

Leading Players in the India Electronic Gadget Insurance Industry Sector

- Bajaj Allianz Group

- New India Insurance

- Oriental Insurance Co Ltd

- National Insurance Co Ltd

- ICICI Lombard

- HDFC Ergo

- Times Global

- Policybazar

- SyskaGadjet Secure

Key Milestones in India Electronic Gadget Insurance Industry Industry

- March 2022: Airtel Payments Bank customers can now buy smartphone insurance from ICICI Lombard General Insurance Company on the Airtel Thanks app, strengthening its digital insurance offering.

- 2021: Digital insurance startup, ACKO, became the 34th unicorn of 2021 with a $255 million Series D fundraiser, highlighting its pioneering role in direct-to-consumer auto and embedded gadget insurance across major digital platforms.

Strategic Outlook for India Electronic Gadget Insurance Industry Market

The strategic outlook for the India Electronic Gadget Insurance market is exceptionally bright, driven by a convergence of increasing device ownership, rising consumer affluence, and a heightened awareness of risk mitigation. Future growth will be accelerated by the continued embrace of digitalization and insurtech innovations, enabling more streamlined customer journeys and efficient claims processing. Strategic collaborations between insurers, device manufacturers, and online marketplaces will be crucial for expanding reach and embedding insurance seamlessly into the product lifecycle. The market will likely see an increased focus on product customization and value-added services, moving beyond basic protection to include elements like data recovery and cybersecurity support. As the Indian economy continues to grow and disposable incomes rise, the demand for comprehensive and accessible electronic gadget insurance is set to reach unprecedented levels, solidifying its position as a vital component of the country's financial services landscape.

India Electronic Gadget Insurance Industry Segmentation

-

1. Coverage Type

- 1.1. Physical Damage

- 1.2. Electronic Damage

- 1.3. Data Protection

- 1.4. Virus Protection

- 1.5. Theft Protection

-

2. Device Type

- 2.1. Laptops

- 2.2. Computers

- 2.3. Cameras

- 2.4. Mobile Devices

- 2.5. Tablet

-

3. End User

- 3.1. Corporate

- 3.2. Individual

India Electronic Gadget Insurance Industry Segmentation By Geography

- 1. India

India Electronic Gadget Insurance Industry Regional Market Share

Geographic Coverage of India Electronic Gadget Insurance Industry

India Electronic Gadget Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Digitalization is Increasing Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Electronic Gadget Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 5.1.1. Physical Damage

- 5.1.2. Electronic Damage

- 5.1.3. Data Protection

- 5.1.4. Virus Protection

- 5.1.5. Theft Protection

- 5.2. Market Analysis, Insights and Forecast - by Device Type

- 5.2.1. Laptops

- 5.2.2. Computers

- 5.2.3. Cameras

- 5.2.4. Mobile Devices

- 5.2.5. Tablet

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Corporate

- 5.3.2. Individual

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bajaj Allianz Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 New India Insurance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oriental Insurance Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Insurance Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ICICI Lombard

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HDFC Ergo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Times Global

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Policybazar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SyskaGadjet Secure**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Bajaj Allianz Group

List of Figures

- Figure 1: India Electronic Gadget Insurance Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Electronic Gadget Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: India Electronic Gadget Insurance Industry Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 2: India Electronic Gadget Insurance Industry Revenue billion Forecast, by Device Type 2020 & 2033

- Table 3: India Electronic Gadget Insurance Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: India Electronic Gadget Insurance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India Electronic Gadget Insurance Industry Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 6: India Electronic Gadget Insurance Industry Revenue billion Forecast, by Device Type 2020 & 2033

- Table 7: India Electronic Gadget Insurance Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: India Electronic Gadget Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Electronic Gadget Insurance Industry?

The projected CAGR is approximately 13.28%.

2. Which companies are prominent players in the India Electronic Gadget Insurance Industry?

Key companies in the market include Bajaj Allianz Group, New India Insurance, Oriental Insurance Co Ltd, National Insurance Co Ltd, ICICI Lombard, HDFC Ergo, Times Global, Policybazar, SyskaGadjet Secure**List Not Exhaustive.

3. What are the main segments of the India Electronic Gadget Insurance Industry?

The market segments include Coverage Type, Device Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.44 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Digitalization is Increasing Demand.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

ln March 2022,Airtel Payments Bank customers can now buy smartphone insurance from ICICI Lombard General Insurance Company on the Airtel Thanks app. With this, Airtel Payments Bank has further strengthened its insurance offering available on its digital platform

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Electronic Gadget Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Electronic Gadget Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Electronic Gadget Insurance Industry?

To stay informed about further developments, trends, and reports in the India Electronic Gadget Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence