Key Insights

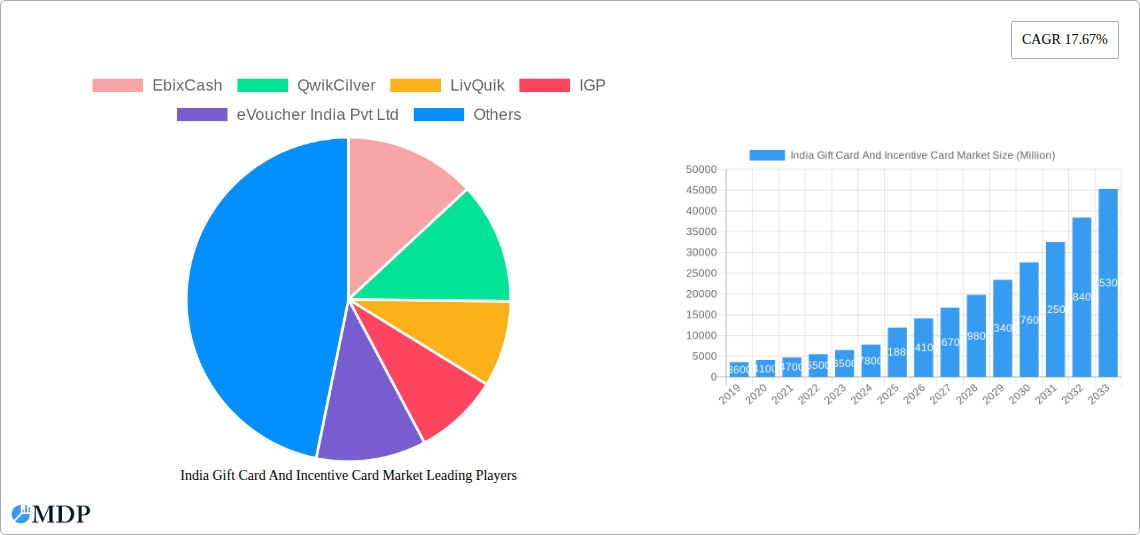

The Indian Gift Card and Incentive Card Market is poised for remarkable expansion, projected to reach a substantial USD 11880 Million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 17.67% during the study period. This accelerated growth is fueled by a confluence of factors, including the increasing digital penetration across India, a rising disposable income, and a growing preference for convenient and flexible gifting and reward solutions. The shift towards digital transactions and the burgeoning e-commerce sector have significantly boosted the adoption of e-gift cards, making them a preferred choice for both individuals and corporations. Furthermore, the evolving corporate landscape, with a greater emphasis on employee recognition and customer loyalty programs, is a significant driver, propelling the demand for incentive cards. These cards offer a personalized and efficient way for businesses to motivate their workforce and retain valuable clientele. The market's dynamism is also evident in the diverse segments it caters to.

India Gift Card And Incentive Card Market Market Size (In Billion)

The market is segmented into various card types, including e-gift cards and physical cards, catering to different consumer preferences. On the consumer front, both retail consumers and corporate consumers are key contributors, showcasing a broad spectrum of demand. Distribution channels are also diversified, with online platforms and offline retail outlets playing crucial roles in market accessibility. The key players operating within this dynamic ecosystem, such as EbixCash, QwikCilver, LivQuik, and Woohoo, are continuously innovating with new offerings and strategic partnerships to capture a larger market share. The increasing adoption of digital payment methods and the inherent convenience offered by gift and incentive cards are expected to further solidify the market's upward trajectory. The market's expansion is further bolstered by a supportive regulatory environment and the continuous introduction of user-friendly platforms, making it an attractive proposition for both consumers and businesses seeking efficient gifting and reward solutions in India.

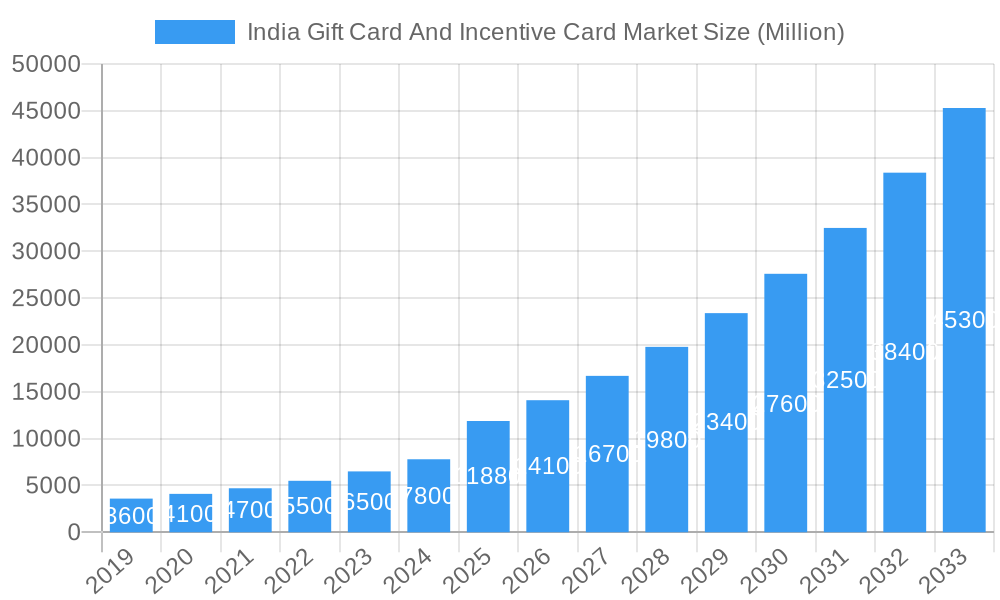

India Gift Card And Incentive Card Market Company Market Share

India Gift Card and Incentive Card Market: Comprehensive Analysis and Forecast (2019-2033)

This in-depth report provides a comprehensive analysis of the India Gift Card and Incentive Card Market, offering critical insights for industry stakeholders. Our research covers the historical period of 2019-2024, with a base year of 2025, and projects growth through the forecast period of 2025-2033. We delve into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, pivotal milestones, and a strategic outlook. This report is essential for businesses looking to understand and capitalize on the burgeoning Indian gift card and incentive card landscape, leveraging high-traffic keywords such as "India gift card market," "incentive card solutions India," "e-gift cards India," "corporate gifting India," and "gift card trends India."

India Gift Card And Incentive Card Market Market Dynamics & Concentration

The India Gift Card and Incentive Card Market exhibits a dynamic and evolving landscape characterized by moderate to high concentration, driven by a few key players who dominate market share, estimated to be around 65% amongst the top 5 entities. Innovation is a significant driver, with companies continuously introducing enhanced digital features and loyalty integrations to attract and retain customers. Regulatory frameworks, while evolving, are increasingly favoring consumer protection and digital transaction security, impacting how gift and incentive cards are issued and redeemed. Product substitutes, such as direct cash transfers and personalized gifting experiences, pose a competitive challenge, necessitating a focus on value-added services and unique brand partnerships. End-user trends show a clear shift towards convenience and personalization, with both retail consumers and corporate entities seeking flexible and easily redeemable options. Merger and acquisition (M&A) activities are sporadic but strategic, aimed at expanding market reach, acquiring technological capabilities, or consolidating market share. The number of significant M&A deals in the past three years is estimated at 3-5, indicating a maturing market where strategic consolidation is becoming more prevalent.

- Market Concentration: Dominated by a few large players, with top 5 entities holding approximately 65% market share.

- Innovation Drivers: Digital feature enhancement, loyalty program integration, personalized gifting solutions.

- Regulatory Frameworks: Focus on consumer protection, digital transaction security, and anti-fraud measures.

- Product Substitutes: Cash transfers, physical gifts, experiential gifting.

- End-User Trends: Preference for convenience, personalization, and seamless redemption processes.

- M&A Activities: Strategic acquisitions and partnerships to gain market access and technological prowess.

India Gift Card And Incentive Card Market Industry Trends & Analysis

The India Gift Card and Incentive Card Market is poised for substantial growth, driven by several intertwined industry trends and a robust analysis of market dynamics. The estimated Compound Annual Growth Rate (CAGR) for the market is approximately 18.5% over the forecast period (2025-2033). This impressive growth is fueled by the increasing disposable incomes across India, a growing preference for gifting convenience, and the widespread adoption of digital payment systems. Market penetration of gift cards, while still evolving, is projected to reach an estimated 45% of the urban population by 2030, indicating significant untapped potential. The surge in e-commerce has been a primary catalyst, making e-gift cards the most popular segment due to their instant delivery and wide redemption options. Corporate gifting also plays a crucial role, with businesses increasingly utilizing incentive cards for employee rewards, sales incentives, and client appreciation programs, recognizing their cost-effectiveness and perceived value. The digital transformation of retail and the rise of prepaid instruments as a secure and flexible payment method further bolster the market's expansion. Furthermore, the integration of gift cards with loyalty programs and the development of open-loop gift card systems, allowing redemption across multiple merchants, are enhancing their appeal. The COVID-19 pandemic accelerated the adoption of contactless and digital gifting solutions, a trend that continues to influence consumer behavior and market strategies. The evolving preferences of younger demographics, who are digitally native and seek personalized experiences, are also shaping the market's trajectory, pushing for more innovative and interactive gift card solutions. The market's resilience and adaptability to technological advancements, coupled with supportive government initiatives promoting digital payments, are strong indicators of sustained and accelerated growth in the coming years.

Leading Markets & Segments in India Gift Card And Incentive Card Market

The India Gift Card and Incentive Card Market is characterized by dominant segments and regions, each contributing significantly to the overall market expansion.

Dominant Card Type: E-Gift Cards E-gift cards are leading the market, projected to hold over 80% of the market share by 2028. This dominance is attributed to several key drivers:

- Instant Gratification: E-gift cards can be delivered instantly via email or SMS, catering to last-minute gifting needs and the demand for immediate gratification.

- Environmental Friendliness: Their digital nature reduces the carbon footprint associated with physical card production and distribution, aligning with growing environmental consciousness.

- Wider Reach and Accessibility: E-gift cards can be easily purchased and redeemed online, making them accessible to a broader customer base across diverse geographical locations.

- Customization and Personalization: Digital platforms allow for greater customization, including personalized messages, designs, and even the ability to select specific denominations.

- Integration with Digital Wallets: Seamless integration with popular digital wallets enhances convenience and ease of use for consumers.

Dominant Consumer Type: Retail Consumer The retail consumer segment accounts for a significant portion of the market, estimated at over 70%. This is driven by:

- Personal Gifting: Individuals extensively use gift cards for birthdays, anniversaries, festivals, and other personal occasions, offering a flexible gifting option.

- Self-Gifting: Consumers increasingly purchase gift cards for themselves to avail discounts or to manage their spending on specific categories.

- Brand Affinity: Consumers often prefer gift cards of their favorite brands, ensuring they receive products they desire.

- Promotional Offers: Retailers frequently offer attractive discounts and promotions on gift cards, further incentivizing retail consumer purchases.

Dominant Distribution Channel: Online The online distribution channel is the primary avenue for gift card sales, expected to account for approximately 85% of all transactions. This dominance is a consequence of:

- E-commerce Growth: The rapid expansion of e-commerce platforms in India has made online gift card purchases convenient and widely accessible.

- Convenience and Speed: Consumers can purchase and send gift cards anytime, anywhere, with immediate delivery.

- Wider Selection: Online platforms offer a broader array of brands and denominations compared to physical stores.

- Digital Payment Integration: Seamless integration with various digital payment methods, including UPI, credit/debit cards, and digital wallets, enhances the online purchasing experience.

- Reduced Overhead Costs: Online-only retailers benefit from lower operational costs, which can be passed on as competitive pricing.

Dominance Analysis: The synergy between e-gift cards, retail consumers, and online distribution channels creates a powerful ecosystem within the Indian market. This triumvirate caters to the modern consumer's demand for convenience, personalization, and instant access, driving significant market growth and solidifying the online segment's leadership. While physical cards and offline channels retain a niche presence, particularly for corporate gifting or specific in-store promotions, the overarching trend strongly favors digital solutions.

India Gift Card And Incentive Card Market Product Developments

Product development in the India Gift Card and Incentive Card Market is primarily focused on enhancing user experience and expanding utility. Innovations include the integration of gift cards with loyalty programs, allowing users to earn and redeem rewards seamlessly. Advanced features such as personalized e-card designs, variable denomination options, and scheduled deliveries are becoming standard. The rise of open-loop gift cards, usable across a wide network of merchants, is a significant development, offering unparalleled flexibility. Furthermore, companies are exploring the integration of blockchain technology for enhanced security and transparency in gift card transactions. These developments aim to offer greater convenience, personalization, and value to both consumers and corporate clients, thereby increasing market competitiveness.

Key Drivers of India Gift Card And Incentive Card Market Growth

The growth of the India Gift Card and Incentive Card Market is propelled by several key drivers. The accelerating digital transformation and widespread adoption of smartphones and internet connectivity are fundamental. The increasing disposable income of the Indian populace, coupled with a growing preference for convenient and flexible gifting solutions, is a significant economic factor. Government initiatives promoting digital payments, such as UPI, have created a favorable ecosystem for digital gift card transactions. The evolving corporate culture, with a greater emphasis on employee recognition and customer loyalty programs, is a substantial driver for the incentive card segment. Furthermore, the surge in e-commerce and the convenience offered by e-gift cards, especially during festive seasons and special occasions, continue to fuel market expansion.

Challenges in the India Gift Card And Incentive Card Market Market

Despite robust growth, the India Gift Card and Incentive Card Market faces several challenges. Regulatory hurdles and evolving compliance requirements can sometimes create complexities for new entrants and existing players. The inherent risk of fraud and security breaches associated with digital transactions necessitates continuous investment in robust security infrastructure, impacting operational costs. Intense competition among a growing number of players can lead to price wars and reduced profit margins. Consumer awareness and understanding of the full potential and usage of gift cards, particularly in Tier 2 and Tier 3 cities, still require significant effort. Lastly, managing the redemption infrastructure and ensuring seamless integration with diverse merchant POS systems can pose logistical challenges.

Emerging Opportunities in India Gift Card And Incentive Card Market

Emerging opportunities in the India Gift Card and Incentive Card Market are abundant, driven by innovation and market expansion. The untapped potential in rural and semi-urban areas presents a significant growth avenue for both physical and digital gift card solutions. Strategic partnerships between gift card providers, e-commerce platforms, and FinTech companies can unlock new customer segments and enhance product offerings. The increasing demand for personalized and experiential gifting opens doors for co-branded gift cards and curated gift experiences. Leveraging data analytics to understand consumer behavior and preferences can lead to more targeted marketing campaigns and customized product development. Furthermore, the exploration of gift cards as a payment instrument for specific services, such as education or healthcare, could represent a substantial future growth trajectory.

Leading Players in the India Gift Card And Incentive Card Market Sector

- EbixCash

- Qwikcilver

- LivQuik

- IGP

- eVoucher India Pvt Ltd

- Woohoo

- Zingoy

- Giftstoindia24x

- GyFTR

- You Got a Gift

Key Milestones in India Gift Card And Incentive Card Market Industry

- December 2023: Pine Labs’ Qwikcilver and Foodpanda collaborated to introduce Foodpanda Gift Cards, a more advanced solution that allows Foodpanda customers to redeem and check their purchases conveniently.

- October 2023: YES Bank, in partnership with ONDC, unveiled the ONDC Network Gift Card, which allows customers to buy items from various brands and sellers in a wide range of categories.

Strategic Outlook for India Gift Card And Incentive Card Market Market

The strategic outlook for the India Gift Card and Incentive Card Market is highly optimistic, with significant growth accelerators in place. Continued investment in technology, particularly in AI-powered personalization and blockchain for security, will be crucial. Expanding the reach into Tier 2 and Tier 3 cities through localized marketing and strategic partnerships with regional retailers presents a substantial opportunity. The development of innovative products tailored for specific industry needs, such as employee engagement platforms and influencer marketing tools, will further drive market penetration. Fostering stronger collaborations between FinTech companies, banks, and e-commerce players will create a more integrated and user-friendly ecosystem, solidifying the gift card and incentive card market's position as a vital component of India's digital economy.

India Gift Card And Incentive Card Market Segmentation

-

1. Card Type

- 1.1. E-Gift card

- 1.2. Physical card

-

2. Consumer Type

- 2.1. Retail Consumer

- 2.2. Corporate Consumer

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

India Gift Card And Incentive Card Market Segmentation By Geography

- 1. India

India Gift Card And Incentive Card Market Regional Market Share

Geographic Coverage of India Gift Card And Incentive Card Market

India Gift Card And Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Growth in the E-Commerce Market is Driving the Gift Card Industry

- 3.3. Market Restrains

- 3.3.1. Strong Growth in the E-Commerce Market is Driving the Gift Card Industry

- 3.4. Market Trends

- 3.4.1. The Thriving E-Commerce Market is Fueling the Growth of the Gift Card Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Gift Card And Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. E-Gift card

- 5.1.2. Physical card

- 5.2. Market Analysis, Insights and Forecast - by Consumer Type

- 5.2.1. Retail Consumer

- 5.2.2. Corporate Consumer

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EbixCash

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 QwikCilver

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LivQuik

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IGP

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 eVoucher India Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Woohoo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zingoy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Giftstoindia24x

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GyFTR

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 You Got a Gift**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EbixCash

List of Figures

- Figure 1: India Gift Card And Incentive Card Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Gift Card And Incentive Card Market Share (%) by Company 2025

List of Tables

- Table 1: India Gift Card And Incentive Card Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 2: India Gift Card And Incentive Card Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 3: India Gift Card And Incentive Card Market Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 4: India Gift Card And Incentive Card Market Volume Billion Forecast, by Consumer Type 2020 & 2033

- Table 5: India Gift Card And Incentive Card Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Gift Card And Incentive Card Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: India Gift Card And Incentive Card Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Gift Card And Incentive Card Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Gift Card And Incentive Card Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 10: India Gift Card And Incentive Card Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 11: India Gift Card And Incentive Card Market Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 12: India Gift Card And Incentive Card Market Volume Billion Forecast, by Consumer Type 2020 & 2033

- Table 13: India Gift Card And Incentive Card Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: India Gift Card And Incentive Card Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: India Gift Card And Incentive Card Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Gift Card And Incentive Card Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Gift Card And Incentive Card Market?

The projected CAGR is approximately 17.67%.

2. Which companies are prominent players in the India Gift Card And Incentive Card Market?

Key companies in the market include EbixCash, QwikCilver, LivQuik, IGP, eVoucher India Pvt Ltd, Woohoo, Zingoy, Giftstoindia24x, GyFTR, You Got a Gift**List Not Exhaustive.

3. What are the main segments of the India Gift Card And Incentive Card Market?

The market segments include Card Type, Consumer Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Growth in the E-Commerce Market is Driving the Gift Card Industry.

6. What are the notable trends driving market growth?

The Thriving E-Commerce Market is Fueling the Growth of the Gift Card Industry.

7. Are there any restraints impacting market growth?

Strong Growth in the E-Commerce Market is Driving the Gift Card Industry.

8. Can you provide examples of recent developments in the market?

In December 2023, Pine Labs’ Qwikcilver and Foodpanda collaborated to introduce Foodpanda Gift Cards, a more advanced solution that allows Foodpanda customers to redeem and check their purchases conveniently.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Gift Card And Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Gift Card And Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Gift Card And Incentive Card Market?

To stay informed about further developments, trends, and reports in the India Gift Card And Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence