Key Insights

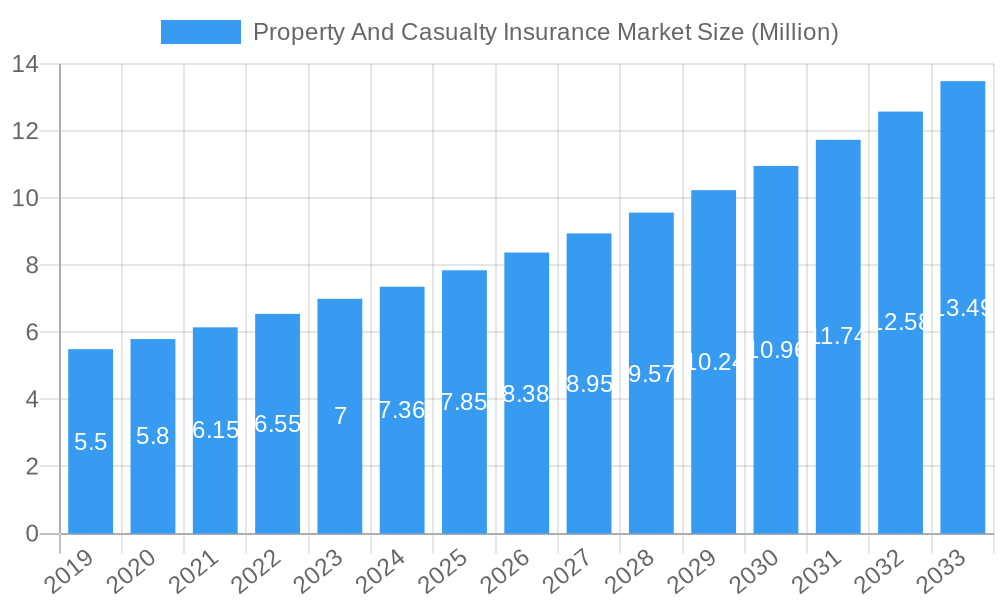

The global Property and Casualty (P&C) insurance market is projected for robust expansion, with a current market size of approximately $7.36 billion and an anticipated Compound Annual Growth Rate (CAGR) of over 6% between 2019 and 2033. This sustained growth trajectory is fueled by several key drivers, including increasing global economic activity, rising demand for comprehensive risk management solutions across various industries, and a growing awareness of the need for financial protection against natural disasters and unforeseen events. The P&C insurance sector is characterized by its dynamic nature, with continuous innovation in product offerings, digitalization of services, and evolving regulatory landscapes. Emerging markets, in particular, are expected to contribute significantly to this growth as their economies mature and insurance penetration rates climb. The market's resilience is also evident in its ability to adapt to changing consumer preferences and technological advancements, such as the integration of artificial intelligence and big data analytics for more accurate risk assessment and claims processing. This ongoing evolution ensures the P&C insurance market remains a vital component of the global financial ecosystem, providing essential security and stability for individuals and businesses alike.

Property And Casualty Insurance Market Market Size (In Million)

The forecast period of 2025-2033 indicates a period of accelerated opportunity, building upon the foundational growth observed from 2019-2024. The base year of 2025 sets a benchmark for future performance, with strategic initiatives and market trends already shaping the landscape. Key areas of focus for growth will likely include specialized insurance lines addressing emerging risks such as cyber threats, climate change-related perils, and supply chain disruptions. The competitive environment within the P&C insurance market is intensifying, prompting established players and new entrants to prioritize customer-centric approaches, efficient operational models, and the development of innovative digital platforms. This focus on enhancing customer experience, coupled with a commitment to underwriting excellence and prudent risk management, will be crucial for sustained profitability and market leadership. As the market matures, a greater emphasis on sustainability and Environmental, Social, and Governance (ESG) factors is also expected to influence product development and investment strategies, reflecting a broader societal shift towards responsible business practices.

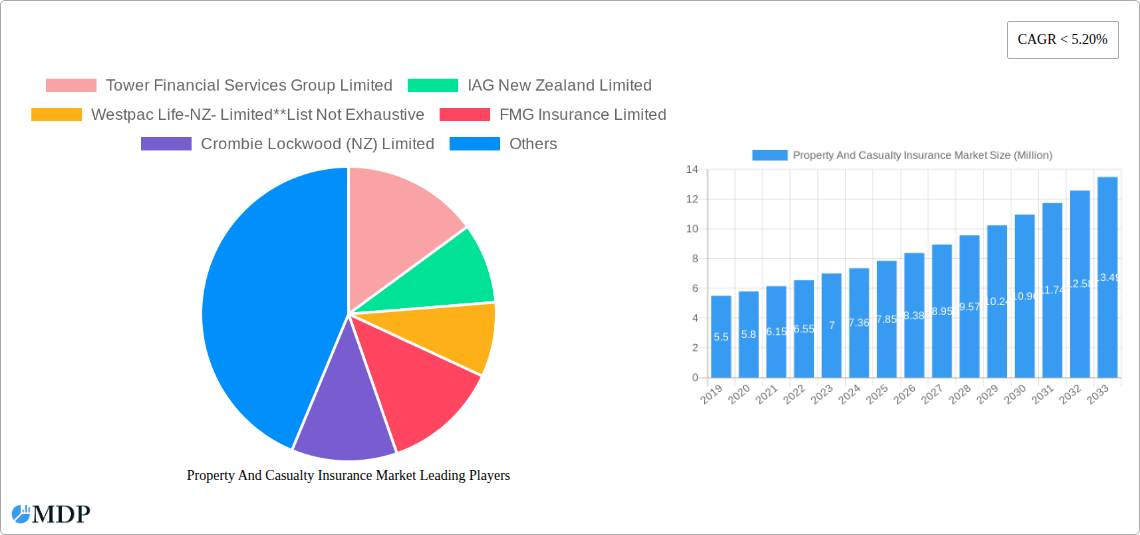

Property And Casualty Insurance Market Company Market Share

Unlock unparalleled insights into the dynamic Property and Casualty (P&C) Insurance Market with this exhaustive report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study delves deep into market dynamics, industry trends, leading segments, and strategic opportunities. Whether you're an investor, insurer, broker, or regulator, gain a competitive edge with actionable intelligence on New Zealand insurance, motor insurance, home insurance, direct insurance sales, and agency distribution channels.

Property And Casualty Insurance Market Market Dynamics & Concentration

The Property and Casualty Insurance Market is characterized by a moderate to high level of concentration, with a few dominant players holding significant market share. Innovation drivers include the integration of advanced analytics for risk assessment, the development of parametric insurance solutions, and the increasing adoption of IoT devices for proactive risk mitigation. Regulatory frameworks continue to evolve, with a focus on solvency, consumer protection, and data privacy, impacting operational strategies and product offerings. Product substitutes, while present in niche areas, are generally outpaced by the comprehensive coverage and trust associated with established P&C insurers. End-user trends reveal a growing demand for personalized policies, seamless digital experiences, and transparent claims processing. Mergers and acquisitions (M&A) remain a key strategy for market consolidation and expansion. For instance, industry developments highlight recent M&A activities, such as Howden New Zealand's expansion through the acquisition of Apex Insurance New Zealand. While specific M&A deal counts are proprietary, the trend indicates a strategic push for scale and diversification within the insurance market.

- Market Concentration: Dominated by a few key providers, with opportunities for specialized players.

- Innovation Drivers: Insurtech, AI-driven risk assessment, parametric solutions, IoT integration.

- Regulatory Frameworks: Evolving to enhance consumer protection and financial stability.

- Product Substitutes: Limited direct substitutes, focus on comprehensive P&C coverage.

- End-User Trends: Demand for personalization, digital-first, and efficient claims.

- M&A Activities: Strategic consolidation to gain market share and operational efficiencies.

Property And Casualty Insurance Market Industry Trends & Analysis

The Property and Casualty Insurance Market is poised for significant growth, driven by a confluence of factors including increasing property values, rising vehicle ownership, and the growing awareness of insurance's importance in mitigating financial risks. The global insurance market is witnessing a projected Compound Annual Growth Rate (CAGR) of xx%, indicating robust expansion over the forecast period of 2025–2033. Technological disruptions, particularly the proliferation of insurtech, are fundamentally reshaping how insurance products are designed, distributed, and managed. Artificial intelligence (AI) and machine learning are enabling more accurate risk underwriting, personalized pricing, and faster claims settlements. Furthermore, the adoption of telematics in the motor insurance sector is transforming driver behavior monitoring and premium calculation. Consumer preferences are increasingly leaning towards digital channels for policy purchases and servicing, demanding greater transparency, convenience, and self-service options. This shift necessitates insurers to invest heavily in digital transformation and customer experience platforms. The competitive landscape is intensifying, with both traditional insurers and new entrants vying for market share. The rise of embedded insurance, where P&C coverage is offered as an add-on to other products and services, is a significant trend, particularly in sectors like e-commerce and automotive. The New Zealand insurance market specifically is experiencing a surge in demand for natural disaster coverage, influenced by climate change and a higher frequency of extreme weather events. The home insurance segment, in particular, is seeing innovation in policy wording to cover a broader range of risks. The other insurance category, encompassing a wide array of specialized coverages like cyber insurance and professional indemnity, is also showing strong growth potential as businesses face evolving risks. The agency channel continues to play a crucial role, offering personalized advice and solutions, especially for complex commercial risks, while the direct channel is gaining traction for simpler, retail products. The banks channel also contributes significantly, leveraging existing customer relationships to offer bundled insurance products. The overall market penetration of P&C insurance is expected to increase as economies grow and awareness of risk management solutions deepens.

Leading Markets & Segments in Property And Casualty Insurance Market

The Property and Casualty Insurance Market exhibits distinct leadership across various segments and geographical regions. While the report focuses on the broader market, key indicators suggest that regions with high economic activity, developed infrastructure, and a robust regulatory environment typically dominate. Within the Insurance type segmentation, Home Insurance and Motor Insurance consistently represent the largest shares due to their widespread necessity and high volume of policies. The increasing urbanization and rising property values globally are key drivers for the Home Insurance segment. Similarly, the growth in vehicle ownership and the rising cost of vehicle repairs and replacements fuel the expansion of the Motor Insurance market. The Other In segment, encompassing a diverse range of specialized insurances such as commercial property, liability, and cyber insurance, is experiencing rapid growth driven by evolving business risks and increasing awareness among enterprises.

In terms of Channel of Distribution, the Agency channel has historically been a dominant force, providing personalized advice and tailored solutions, especially for complex commercial lines. However, the Direct channel is experiencing significant growth, propelled by digital adoption and the demand for convenient, online purchasing options for simpler policies. The Banks channel also holds substantial influence, leveraging established customer relationships to offer insurance products as part of broader financial services packages. Emerging markets and developing economies are witnessing a faster growth rate in the Direct and Banks channels as digital infrastructure improves and consumer trust in online platforms increases. Key drivers for the dominance of specific segments include economic policies that encourage property ownership and business growth, investments in infrastructure that lead to increased demand for construction and property insurance, and consumer demographics that favor specific insurance types. For instance, an aging population might drive demand for specialized health-related insurance within the "Other In" category, while a growing young workforce might boost motor insurance uptake.

Property And Casualty Insurance Market Product Developments

Product innovation within the Property and Casualty Insurance Market is largely driven by technological advancements and evolving risk landscapes. We are witnessing a rise in usage-based insurance (UBI) models, particularly in motor insurance, leveraging telematics data to offer personalized premiums based on driving behavior. Parametric insurance, triggered by predefined events like specific weather conditions, is gaining traction for its speed and efficiency in claims payout. Insurers are also developing more flexible and modular policy structures to cater to the diverse and changing needs of consumers and businesses. The integration of AI and IoT in property insurance is enabling predictive maintenance and real-time risk assessment, leading to proactive risk mitigation and enhanced customer value. These developments aim to provide more competitive advantages through tailored coverage, improved customer experience, and a more accurate reflection of risk.

Key Drivers of Property And Casualty Insurance Market Growth

The Property and Casualty Insurance Market is propelled by several key drivers. Economically, increasing disposable incomes and rising asset values, particularly in property and vehicles, directly translate to a greater demand for protective insurance coverage. Technological advancements, such as the widespread adoption of AI in underwriting and claims processing, enhance operational efficiency and enable more personalized product offerings. Regulatory frameworks that promote financial inclusion and encourage insurance uptake also play a significant role. Furthermore, a growing awareness of risk management, amplified by increasing incidents of natural disasters and cyber threats, is compelling individuals and businesses to seek robust P&C insurance solutions. The expansion of the digital distribution channel is also making insurance more accessible, thereby driving market growth.

Challenges in the Property And Casualty Insurance Market Market

Despite its growth potential, the Property and Casualty Insurance Market faces several challenges. Intense competition from both established players and emerging insurtech companies can lead to price wars and compressed profit margins. Evolving regulatory landscapes, while aimed at consumer protection, can also impose significant compliance costs and hinder innovation if not managed effectively. The increasing frequency and severity of extreme weather events due to climate change pose a substantial challenge for risk modeling and underwriting, potentially leading to increased claims payouts and profitability concerns. Supply chain disruptions can also impact the cost of repairs and replacements, indirectly affecting claims costs. Finally, attracting and retaining skilled talent in areas like data science and cybersecurity is crucial but can be challenging in a competitive job market.

Emerging Opportunities in Property And Casualty Insurance Market

Emerging opportunities in the Property and Casualty Insurance Market are manifold. The burgeoning gig economy and the rise of new business models present avenues for specialized insurance products. The increasing adoption of smart home technology and connected vehicles opens up possibilities for innovative, data-driven insurance solutions that reward proactive risk management. Furthermore, the growing awareness of environmental, social, and governance (ESG) factors presents opportunities for insurers to develop sustainable products and invest in climate resilience initiatives. Strategic partnerships with technology providers and other industries, such as real estate and automotive, can unlock new distribution channels and customer segments. The ongoing digital transformation within the sector continues to offer opportunities for enhancing customer experience and operational efficiency.

Leading Players in the Property And Casualty Insurance Market Sector

- Tower Financial Services Group Limited

- IAG New Zealand Limited

- Westpac Life-NZ- Limited

- FMG Insurance Limited

- Crombie Lockwood (NZ) Limited

- AIA International Limited

- Zurich Financial Services Australia Limited

- Aig Insurance New Zealand Limited

- Allianz Australia Insurance Limited

- Aon New Zealand

Key Milestones in Property And Casualty Insurance Market Industry

- September 2023: Howden New Zealand, a global insurance group, expanded its presence in New Zealand. They recently completed the acquisition of Apex Insurance New Zealand and its associated subsidiaries, enhancing their market reach and service offerings.

- July 2022: Chubb Life announced that Gail Costa will lead the company's life insurance operations in New Zealand that were recently acquired from Cigna. This strategic move signifies a shift in leadership and focus within the New Zealand life insurance sector.

Strategic Outlook for Property And Casualty Insurance Market Market

The strategic outlook for the Property and Casualty Insurance Market is one of sustained growth and evolving operational strategies. Insurers are expected to prioritize digital transformation to enhance customer engagement, streamline operations, and develop agile product offerings. A significant focus will be on leveraging data analytics and AI to improve risk assessment, pricing, and claims management, thereby enhancing profitability and customer satisfaction. Expansion into emerging markets and the development of specialized insurance products tailored to new risks, such as cyber threats and climate-related events, will be critical. Strategic partnerships and collaborations, particularly with insurtech firms and distribution partners, will play a pivotal role in expanding market reach and delivering innovative solutions. The market is poised for continued innovation, driven by the need to adapt to changing consumer expectations and the dynamic risk landscape.

Property And Casualty Insurance Market Segmentation

-

1. Insurance type

- 1.1. Home

- 1.2. Motor

- 1.3. Other In

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other ch

Property And Casualty Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

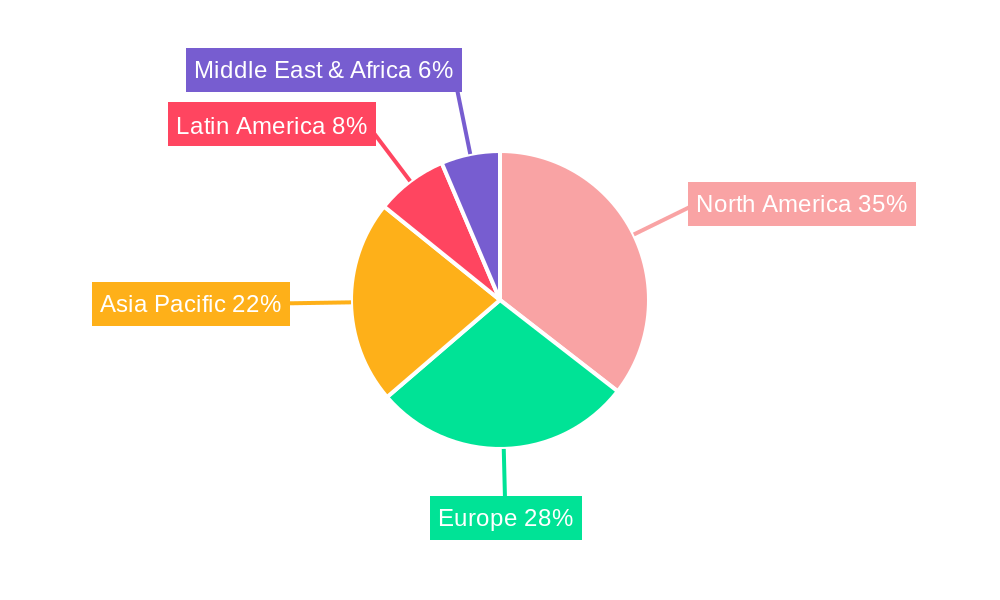

Property And Casualty Insurance Market Regional Market Share

Geographic Coverage of Property And Casualty Insurance Market

Property And Casualty Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Property Values is Driving the Market; Growing Awareness of the Need for Insurance Coverage

- 3.3. Market Restrains

- 3.3.1. Natural Disasters such as Earthquakes and Floods is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increase in New Residential Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Property And Casualty Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Home

- 5.1.2. Motor

- 5.1.3. Other In

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other ch

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. North America Property And Casualty Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 6.1.1. Home

- 6.1.2. Motor

- 6.1.3. Other In

- 6.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 6.2.1. Direct

- 6.2.2. Agency

- 6.2.3. Banks

- 6.2.4. Other ch

- 6.1. Market Analysis, Insights and Forecast - by Insurance type

- 7. South America Property And Casualty Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 7.1.1. Home

- 7.1.2. Motor

- 7.1.3. Other In

- 7.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 7.2.1. Direct

- 7.2.2. Agency

- 7.2.3. Banks

- 7.2.4. Other ch

- 7.1. Market Analysis, Insights and Forecast - by Insurance type

- 8. Europe Property And Casualty Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 8.1.1. Home

- 8.1.2. Motor

- 8.1.3. Other In

- 8.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 8.2.1. Direct

- 8.2.2. Agency

- 8.2.3. Banks

- 8.2.4. Other ch

- 8.1. Market Analysis, Insights and Forecast - by Insurance type

- 9. Middle East & Africa Property And Casualty Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 9.1.1. Home

- 9.1.2. Motor

- 9.1.3. Other In

- 9.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 9.2.1. Direct

- 9.2.2. Agency

- 9.2.3. Banks

- 9.2.4. Other ch

- 9.1. Market Analysis, Insights and Forecast - by Insurance type

- 10. Asia Pacific Property And Casualty Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 10.1.1. Home

- 10.1.2. Motor

- 10.1.3. Other In

- 10.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 10.2.1. Direct

- 10.2.2. Agency

- 10.2.3. Banks

- 10.2.4. Other ch

- 10.1. Market Analysis, Insights and Forecast - by Insurance type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tower Financial Services Group Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IAG New Zealand Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Westpac Life-NZ- Limited**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FMG Insurance Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Crombie Lockwood (NZ) Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AIA International Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zurich Financial Services Australia Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aig Insurance New Zealand Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Allianz Australia Insurance Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aon New Zealand

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tower Financial Services Group Limited

List of Figures

- Figure 1: Global Property And Casualty Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Property And Casualty Insurance Market Revenue (Million), by Insurance type 2025 & 2033

- Figure 3: North America Property And Casualty Insurance Market Revenue Share (%), by Insurance type 2025 & 2033

- Figure 4: North America Property And Casualty Insurance Market Revenue (Million), by Channel of Distribution 2025 & 2033

- Figure 5: North America Property And Casualty Insurance Market Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 6: North America Property And Casualty Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Property And Casualty Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Property And Casualty Insurance Market Revenue (Million), by Insurance type 2025 & 2033

- Figure 9: South America Property And Casualty Insurance Market Revenue Share (%), by Insurance type 2025 & 2033

- Figure 10: South America Property And Casualty Insurance Market Revenue (Million), by Channel of Distribution 2025 & 2033

- Figure 11: South America Property And Casualty Insurance Market Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 12: South America Property And Casualty Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Property And Casualty Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Property And Casualty Insurance Market Revenue (Million), by Insurance type 2025 & 2033

- Figure 15: Europe Property And Casualty Insurance Market Revenue Share (%), by Insurance type 2025 & 2033

- Figure 16: Europe Property And Casualty Insurance Market Revenue (Million), by Channel of Distribution 2025 & 2033

- Figure 17: Europe Property And Casualty Insurance Market Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 18: Europe Property And Casualty Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Property And Casualty Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Property And Casualty Insurance Market Revenue (Million), by Insurance type 2025 & 2033

- Figure 21: Middle East & Africa Property And Casualty Insurance Market Revenue Share (%), by Insurance type 2025 & 2033

- Figure 22: Middle East & Africa Property And Casualty Insurance Market Revenue (Million), by Channel of Distribution 2025 & 2033

- Figure 23: Middle East & Africa Property And Casualty Insurance Market Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 24: Middle East & Africa Property And Casualty Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Property And Casualty Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Property And Casualty Insurance Market Revenue (Million), by Insurance type 2025 & 2033

- Figure 27: Asia Pacific Property And Casualty Insurance Market Revenue Share (%), by Insurance type 2025 & 2033

- Figure 28: Asia Pacific Property And Casualty Insurance Market Revenue (Million), by Channel of Distribution 2025 & 2033

- Figure 29: Asia Pacific Property And Casualty Insurance Market Revenue Share (%), by Channel of Distribution 2025 & 2033

- Figure 30: Asia Pacific Property And Casualty Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Property And Casualty Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Property And Casualty Insurance Market Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 2: Global Property And Casualty Insurance Market Revenue Million Forecast, by Channel of Distribution 2020 & 2033

- Table 3: Global Property And Casualty Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Property And Casualty Insurance Market Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 5: Global Property And Casualty Insurance Market Revenue Million Forecast, by Channel of Distribution 2020 & 2033

- Table 6: Global Property And Casualty Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Property And Casualty Insurance Market Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 11: Global Property And Casualty Insurance Market Revenue Million Forecast, by Channel of Distribution 2020 & 2033

- Table 12: Global Property And Casualty Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Property And Casualty Insurance Market Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 17: Global Property And Casualty Insurance Market Revenue Million Forecast, by Channel of Distribution 2020 & 2033

- Table 18: Global Property And Casualty Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Property And Casualty Insurance Market Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 29: Global Property And Casualty Insurance Market Revenue Million Forecast, by Channel of Distribution 2020 & 2033

- Table 30: Global Property And Casualty Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Property And Casualty Insurance Market Revenue Million Forecast, by Insurance type 2020 & 2033

- Table 38: Global Property And Casualty Insurance Market Revenue Million Forecast, by Channel of Distribution 2020 & 2033

- Table 39: Global Property And Casualty Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Property And Casualty Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Property And Casualty Insurance Market?

The projected CAGR is approximately < 5.20%.

2. Which companies are prominent players in the Property And Casualty Insurance Market?

Key companies in the market include Tower Financial Services Group Limited, IAG New Zealand Limited, Westpac Life-NZ- Limited**List Not Exhaustive, FMG Insurance Limited, Crombie Lockwood (NZ) Limited, AIA International Limited, Zurich Financial Services Australia Limited, Aig Insurance New Zealand Limited, Allianz Australia Insurance Limited, Aon New Zealand.

3. What are the main segments of the Property And Casualty Insurance Market?

The market segments include Insurance type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Property Values is Driving the Market; Growing Awareness of the Need for Insurance Coverage.

6. What are the notable trends driving market growth?

Increase in New Residential Buildings.

7. Are there any restraints impacting market growth?

Natural Disasters such as Earthquakes and Floods is Restraining the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Howden New Zealand, a global insurance group, expanded its presence in New Zealand. They recently completed the acquisition of Apex Insurance New Zealand and its associated subsidiaries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Property And Casualty Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Property And Casualty Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Property And Casualty Insurance Market?

To stay informed about further developments, trends, and reports in the Property And Casualty Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence