Key Insights

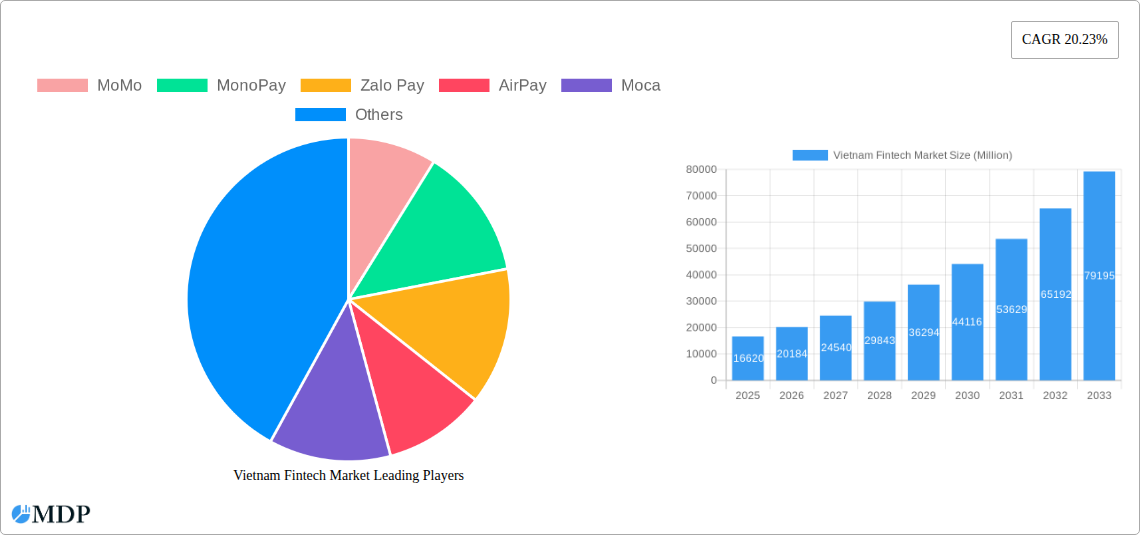

The Vietnam Fintech Market is poised for exceptional growth, with a projected market size of USD 16.62 billion by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 20.23% through 2033. This remarkable trajectory is fueled by a confluence of factors, primarily the burgeoning digital payment ecosystem. Online purchases are witnessing an unprecedented surge, driven by increasing internet penetration, a young, tech-savvy population, and a growing e-commerce landscape. Point of Sale (POS) transactions are also evolving rapidly as more businesses adopt digital payment solutions to enhance efficiency and customer experience. Beyond payments, significant growth is anticipated in Personal Finance, particularly in digital asset management services, as Vietnamese consumers become more sophisticated in managing their wealth. International remittance and money transfers are also a key driver, benefiting from the large Vietnamese diaspora and the increasing ease of cross-border digital transactions. Furthermore, the Alternative Financing segment, encompassing P2P lending, SME lending, and crowdfunding, is emerging as a vital source of capital for individuals and businesses, addressing traditional financing gaps. The Insurtech sector is also gaining traction, with a rising demand for accessible online life, health, motor, and general insurance products.

Vietnam Fintech Market Market Size (In Billion)

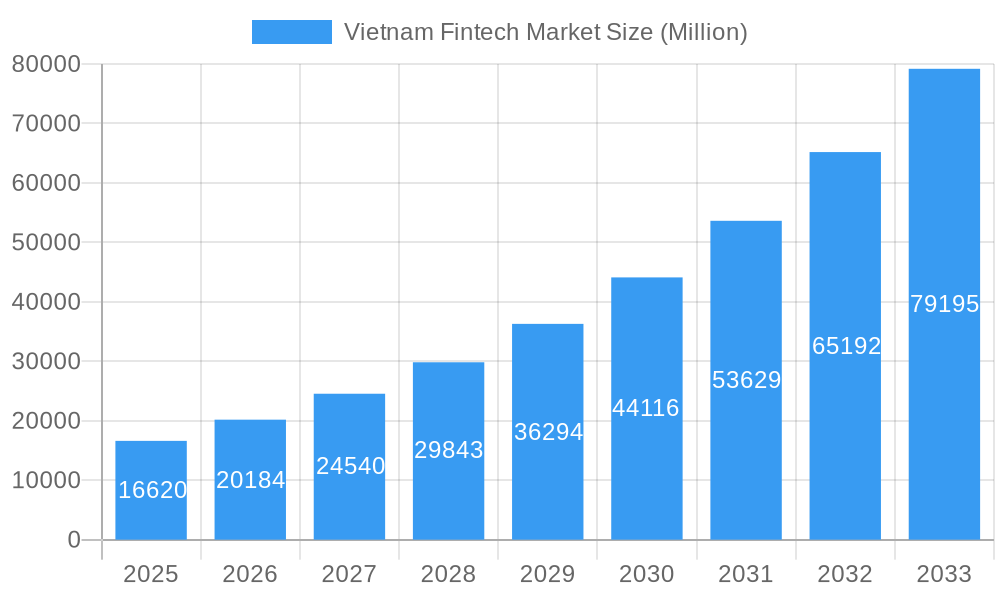

The market's dynamism is further propelled by innovative front-end Fintech solutions that are creating seamless user experiences. These include integrated banking and credit services, embedded e-commerce purchase financing, and other advanced digital financial platforms. Leading players like MoMo, MonoPay, Zalo Pay, AirPay, and Moca are at the forefront of this transformation, introducing novel solutions that cater to the evolving needs of Vietnamese consumers and businesses. The strategic focus on enhancing financial inclusion and digitizing traditional financial services is creating a fertile ground for sustained innovation and market expansion. While the market is overwhelmingly driven by domestic demand and innovation within Vietnam, the increasing global connectivity and the influx of foreign investment in the fintech sector are also contributing to its accelerated development. The forecast period is expected to witness intensified competition, strategic partnerships, and the emergence of new business models, all contributing to a more comprehensive and accessible digital financial ecosystem.

Vietnam Fintech Market Company Market Share

Dive into the booming Vietnam Fintech Market with our comprehensive report, offering in-depth analysis and actionable insights for stakeholders seeking to capitalize on the nation's rapid digital financial evolution. This report forecasts the market to reach an estimated [XX] Million by 2033, driven by a burgeoning young population, increasing smartphone penetration, and a government-backed push for digital economic growth. We meticulously analyze the Digital Payments, Personal Finance, Alternative Financing, and Insurtech segments, providing a granular view of sub-segments like Online Purchases, POS Purchases, Digital Asset Management Services, Remittance/International Money Transfers, P2P Lending, SME Lending, Crowdfunding, and various Online Insurance and B2C Financial Services Marketplaces. This study covers the Historical Period (2019-2024), Base Year (2025), and Forecast Period (2025-2033), offering a robust understanding of market dynamics, trends, and future trajectories.

Vietnam Fintech Market Market Dynamics & Concentration

The Vietnam Fintech Market exhibits a dynamic and evolving concentration, characterized by a blend of established players and agile startups vying for market share. Innovation drivers are primarily fueled by increasing consumer demand for convenient and accessible financial services, coupled with a supportive regulatory environment designed to foster fintech growth. Regulatory frameworks, while becoming more defined, continue to adapt to the rapid pace of innovation, presenting both opportunities and challenges. Product substitutes are emerging across all segments, with traditional banking services increasingly challenged by digital alternatives. End-user trends highlight a growing preference for mobile-first solutions, emphasizing user experience and personalization. Merger and acquisition (M&A) activities are becoming more prevalent as larger players seek to integrate innovative technologies and expand their customer base, with an estimated [XX] significant M&A deals anticipated during the forecast period. The market share distribution is dynamic, with key players like MoMo and Zalo Pay holding significant portions of the digital payments landscape, while specialized platforms are emerging in alternative financing and insurtech.

Vietnam Fintech Market Industry Trends & Analysis

The Vietnam Fintech Market is poised for remarkable growth, projected to expand at a Compound Annual Growth Rate (CAGR) of [XX]% from 2025 to 2033. This rapid expansion is underpinned by a confluence of powerful market growth drivers, including the nation's robust economic development and a progressively digital-savvy population. Technological disruptions are a constant force, with advancements in AI, blockchain, and big data analytics revolutionizing service delivery and operational efficiency. Consumer preferences are shifting decisively towards seamless, user-friendly digital interfaces, demanding personalized financial solutions and instant gratification. Competitive dynamics are intensifying, marked by strategic partnerships between traditional financial institutions and fintech innovators, as well as the emergence of new disruptive business models. Market penetration is rapidly increasing, with digital payment adoption expected to reach [XX]% by 2028, further propelling the overall fintech ecosystem. The government's commitment to digitalization and financial inclusion acts as a significant tailwind, fostering an environment conducive to sustained fintech innovation and adoption across diverse financial services.

Leading Markets & Segments in Vietnam Fintech Market

The Digital Payments segment is undeniably the dominant force within the Vietnam Fintech Market, driven by widespread adoption of online purchases and a significant increase in POS (Point of Sales) Purchases. This dominance is fueled by growing e-commerce penetration and a younger demographic eager to embrace cashless transactions.

- Digital Payments:

- Online Purchases: Experiencing exponential growth due to the rise of e-commerce platforms and increased internet accessibility.

- POS (Point of Sales) Purchases: Gaining traction as businesses adopt modern payment terminals, facilitating seamless in-store transactions.

The Personal Finance segment is also witnessing robust expansion, particularly in Digital Asset Management Services and Remittance/International Money Transfers.

- Personal Finance:

- Digital Asset Management Services: Empowering individuals to manage their investments and savings digitally, driven by a desire for greater control and accessibility.

- Remittance/International Money Transfers: Benefiting from a large overseas Vietnamese population and the need for efficient and cost-effective cross-border transactions.

The Alternative Financing sector, encompassing P2P Lending, SME Lending, and Crowdfunding, is emerging as a critical enabler of financial inclusion, particularly for underserved segments.

- Alternative Financing:

- P2P Lending: Providing accessible credit options for individuals and small businesses.

- SME Lending: Addressing the financing gap for Small and Medium-sized Enterprises, a vital component of Vietnam's economy.

- Crowdfunding: Offering new avenues for businesses and individuals to raise capital for various ventures.

The Insurtech segment, including Online Life Insurance, Online Health Insurance, Online Motor Insurance, and Online Other General Insurance, is poised for significant growth as awareness and adoption of digital insurance solutions increase.

- Insurtech:

- Online Life Insurance: Increasing accessibility and simplifying the purchase process for life insurance policies.

- Online Health Insurance: Offering convenient access to health coverage and claims processing.

- Online Motor Insurance: Streamlining the purchase and renewal of vehicle insurance.

- Online Other General Insurance: Expanding to cover a wider array of general insurance needs digitally.

The B2C Financial Services Marketplaces are crucial aggregators, connecting consumers with various financial products and services.

- B2C Financial Services Marketplaces:

- Banking and Credit: Platforms offering comparative services for banking products and credit facilities.

- Insurance: Aggregating insurance offerings from various providers.

- E-Commerce Purchase Financing: Facilitating immediate financing options for online purchases.

- Other Front-End Fintech Solutions: Integrating diverse fintech services for a holistic user experience.

Vietnam Fintech Market Product Developments

Product developments in the Vietnam Fintech Market are characterized by a strong emphasis on user experience, convenience, and technological integration. Companies are continuously innovating to offer seamless digital payment solutions, personalized financial planning tools, and accessible alternative financing options. Competitive advantages are being built through the integration of AI for predictive analytics and customer service, blockchain for enhanced security and transparency in transactions, and mobile-first design principles that cater to Vietnam's vast smartphone user base. The market is seeing the emergence of innovative applications that simplify complex financial processes, such as micro-investing platforms, digital lending solutions for SMEs, and digitized insurance policy management. These advancements are not only meeting evolving consumer demands but also actively shaping the future of financial services in Vietnam.

Key Drivers of Vietnam Fintech Market Growth

Several key drivers are propelling the Vietnam Fintech Market forward. Technologically, the widespread adoption of smartphones and increasing internet penetration are foundational. Economically, a growing middle class with rising disposable incomes and a strong demand for convenient financial services are significant contributors. Regulatory support from the Vietnamese government, aimed at fostering innovation and financial inclusion, plays a crucial role. For instance, initiatives promoting digital payments and the development of a national digital identity framework are accelerating market growth. Furthermore, a young, tech-savvy population is readily embracing new fintech solutions, driving demand across all segments.

Challenges in the Vietnam Fintech Market Market

Despite its rapid growth, the Vietnam Fintech Market faces several challenges. Regulatory hurdles, while evolving, can still present complexities for new entrants and innovative business models. Ensuring robust cybersecurity measures to protect sensitive financial data is paramount, and breaches can significantly erode consumer trust. Intense competitive pressures from both established financial institutions and agile fintech startups necessitate continuous innovation and efficient customer acquisition strategies. Issues related to digital literacy among certain demographics can also limit the adoption of more complex fintech services. Overcoming these challenges will require continued collaboration between regulators, industry players, and educational institutions.

Emerging Opportunities in Vietnam Fintech Market

Emerging opportunities in the Vietnam Fintech Market are abundant, driven by ongoing technological breakthroughs and strategic market expansion. The increasing adoption of open banking initiatives and APIs presents a fertile ground for the development of integrated financial ecosystems, fostering collaboration between banks and fintechs. Strategic partnerships, such as those observed between payment gateways and e-commerce platforms, are crucial for expanding customer reach and service offerings. Furthermore, the untapped potential in rural areas and among unbanked populations represents a significant growth avenue, with microfinance and digital savings solutions poised to gain traction. The government's focus on digital transformation and smart cities will likely create further demand for innovative fintech solutions in the coming years.

Leading Players in the Vietnam Fintech Market Sector

- MoMo

- MonoPay

- Zalo Pay

- AirPay

- Moca

- TIMA

- VayMuon

- TrustCircle

- Hudong

- TheBank

- WiCare

- Dwealth

Key Milestones in Vietnam Fintech Market Industry

- July 2023: Backbase, the world’s largest omni-channel bank, has partnered with OBC to accelerate its omni-channel banking transformation, as announced in a signing ceremony. This collaboration signifies a push towards enhanced digital banking experiences for customers.

- February 2022: Visa, the world’s largest digital payment company, partnered with VNPAY, a leading fintech company in Vietnam, to improve the digital payments ecosystem in Vietnam. This partnership aimed to expand digital payment acceptance and enhance transaction security.

Strategic Outlook for Vietnam Fintech Market Market

The strategic outlook for the Vietnam Fintech Market is exceptionally bright, characterized by continued innovation and significant growth acceleration. The market is expected to witness deeper integration of AI and blockchain technologies, enhancing personalization, security, and efficiency across all financial services. Strategic partnerships between traditional banks, fintechs, and e-commerce players will be pivotal in expanding customer reach and creating comprehensive financial ecosystems. The government's ongoing commitment to digitalization and financial inclusion will act as a powerful catalyst, unlocking opportunities in underserved segments and rural areas. Focus on developing user-centric products and robust data analytics will be crucial for sustained competitive advantage, positioning Vietnam as a leading fintech hub in Southeast Asia.

Vietnam Fintech Market Segmentation

-

1. Digital Payments

- 1.1. Online Purchases

- 1.2. POS (Point of Sales) Purchases

-

2. Personal Finance

- 2.1. Digital Asset Management Services

- 2.2. Remittance/ International Monet Transfers

-

3. Alternative Financing

- 3.1. P2P Lending

- 3.2. SME Lending

- 3.3. Crowdfun

-

4. Insurtech

- 4.1. Online Life Insurance

- 4.2. Online Health Insurance

- 4.3. Online Motor Insurance

- 4.4. Online Other General Insurance

-

5. B2C Financial Services Market Places

- 5.1. Banking and Credit

- 5.2. Insurance

- 5.3. E-Commerce Purchase Financing

- 5.4. Other Front-End Fintech Solutions

Vietnam Fintech Market Segmentation By Geography

- 1. Vietnam

Vietnam Fintech Market Regional Market Share

Geographic Coverage of Vietnam Fintech Market

Vietnam Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Digital Adoption and Smartphone Penetration4.; Young and Tech-Savvy Population

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Digital Adoption and Smartphone Penetration4.; Young and Tech-Savvy Population

- 3.4. Market Trends

- 3.4.1. Increasing Per Capita Income Witnessing Growth in Vietnam FinTech Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Digital Payments

- 5.1.1. Online Purchases

- 5.1.2. POS (Point of Sales) Purchases

- 5.2. Market Analysis, Insights and Forecast - by Personal Finance

- 5.2.1. Digital Asset Management Services

- 5.2.2. Remittance/ International Monet Transfers

- 5.3. Market Analysis, Insights and Forecast - by Alternative Financing

- 5.3.1. P2P Lending

- 5.3.2. SME Lending

- 5.3.3. Crowdfun

- 5.4. Market Analysis, Insights and Forecast - by Insurtech

- 5.4.1. Online Life Insurance

- 5.4.2. Online Health Insurance

- 5.4.3. Online Motor Insurance

- 5.4.4. Online Other General Insurance

- 5.5. Market Analysis, Insights and Forecast - by B2C Financial Services Market Places

- 5.5.1. Banking and Credit

- 5.5.2. Insurance

- 5.5.3. E-Commerce Purchase Financing

- 5.5.4. Other Front-End Fintech Solutions

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Digital Payments

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MoMo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MonoPay

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zalo Pay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AirPay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moca

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TIMA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VayMuon

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TrustCircle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hudong

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TheBank

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 WiCare

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dwealth**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 MoMo

List of Figures

- Figure 1: Vietnam Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Fintech Market Revenue Million Forecast, by Digital Payments 2020 & 2033

- Table 2: Vietnam Fintech Market Volume Billion Forecast, by Digital Payments 2020 & 2033

- Table 3: Vietnam Fintech Market Revenue Million Forecast, by Personal Finance 2020 & 2033

- Table 4: Vietnam Fintech Market Volume Billion Forecast, by Personal Finance 2020 & 2033

- Table 5: Vietnam Fintech Market Revenue Million Forecast, by Alternative Financing 2020 & 2033

- Table 6: Vietnam Fintech Market Volume Billion Forecast, by Alternative Financing 2020 & 2033

- Table 7: Vietnam Fintech Market Revenue Million Forecast, by Insurtech 2020 & 2033

- Table 8: Vietnam Fintech Market Volume Billion Forecast, by Insurtech 2020 & 2033

- Table 9: Vietnam Fintech Market Revenue Million Forecast, by B2C Financial Services Market Places 2020 & 2033

- Table 10: Vietnam Fintech Market Volume Billion Forecast, by B2C Financial Services Market Places 2020 & 2033

- Table 11: Vietnam Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Vietnam Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 13: Vietnam Fintech Market Revenue Million Forecast, by Digital Payments 2020 & 2033

- Table 14: Vietnam Fintech Market Volume Billion Forecast, by Digital Payments 2020 & 2033

- Table 15: Vietnam Fintech Market Revenue Million Forecast, by Personal Finance 2020 & 2033

- Table 16: Vietnam Fintech Market Volume Billion Forecast, by Personal Finance 2020 & 2033

- Table 17: Vietnam Fintech Market Revenue Million Forecast, by Alternative Financing 2020 & 2033

- Table 18: Vietnam Fintech Market Volume Billion Forecast, by Alternative Financing 2020 & 2033

- Table 19: Vietnam Fintech Market Revenue Million Forecast, by Insurtech 2020 & 2033

- Table 20: Vietnam Fintech Market Volume Billion Forecast, by Insurtech 2020 & 2033

- Table 21: Vietnam Fintech Market Revenue Million Forecast, by B2C Financial Services Market Places 2020 & 2033

- Table 22: Vietnam Fintech Market Volume Billion Forecast, by B2C Financial Services Market Places 2020 & 2033

- Table 23: Vietnam Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Vietnam Fintech Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Fintech Market?

The projected CAGR is approximately 20.23%.

2. Which companies are prominent players in the Vietnam Fintech Market?

Key companies in the market include MoMo, MonoPay, Zalo Pay, AirPay, Moca, TIMA, VayMuon, TrustCircle, Hudong, TheBank, WiCare, Dwealth**List Not Exhaustive.

3. What are the main segments of the Vietnam Fintech Market?

The market segments include Digital Payments, Personal Finance, Alternative Financing, Insurtech, B2C Financial Services Market Places.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.62 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Digital Adoption and Smartphone Penetration4.; Young and Tech-Savvy Population.

6. What are the notable trends driving market growth?

Increasing Per Capita Income Witnessing Growth in Vietnam FinTech Industry.

7. Are there any restraints impacting market growth?

4.; Increasing Digital Adoption and Smartphone Penetration4.; Young and Tech-Savvy Population.

8. Can you provide examples of recent developments in the market?

July 2023: Backbase, the world’s largest omni-channel bank, has partnered with OBC to accelerate its omni-channel banking transformation, as announced in a signing ceremony.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Fintech Market?

To stay informed about further developments, trends, and reports in the Vietnam Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence