Key Insights

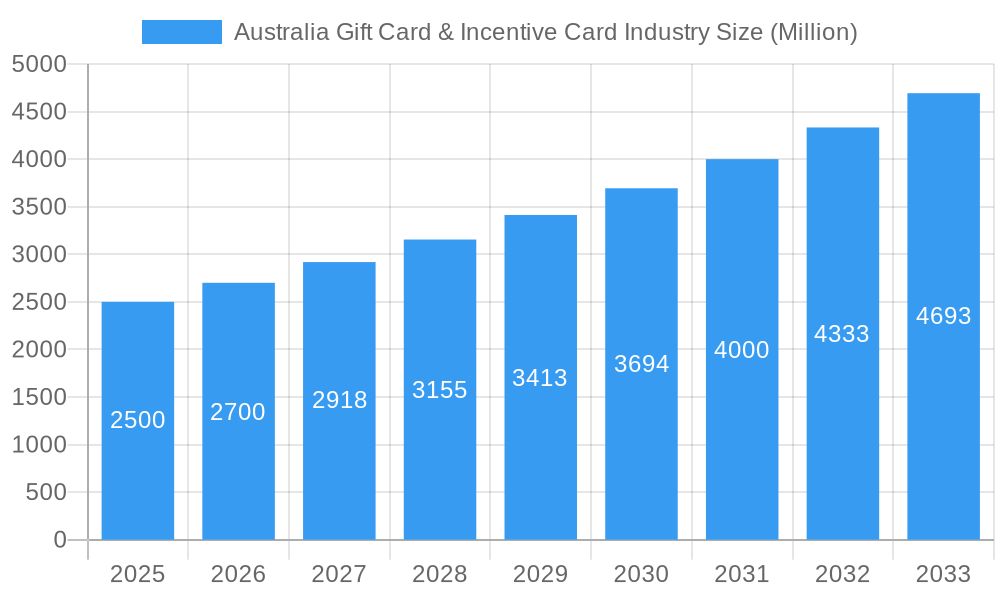

The Australian gift card and incentive card market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 9.6%. This robust growth, from a market size of $8.22 billion in the base year 2025, is underpinned by evolving consumer preferences and technological advancements. The surge in e-gift card adoption and the integration of digital platforms are revolutionizing purchasing and delivery, enhancing convenience. Corporate incentive programs and employee rewards are also substantial contributors to market volume. Key drivers include the inherent flexibility of gift cards, strategic marketing by major retailers and financial institutions, and a prevailing trend towards experiential and versatile gifting solutions. While economic volatility presents a potential challenge, the market demonstrates resilience, integrated across numerous gifting occasions. Key players such as Wesfarmers, Woolworths, and Coles lead in the retail segment, complemented by prominent providers like Blackhawk Network and iChoose in processing and platform solutions.

Australia Gift Card & Incentive Card Industry Market Size (In Billion)

Market segmentation in Australia's gift card and incentive card sector highlights a dual landscape of dominant retail entities and specialized service providers. Large retailers capitalize on their established store networks and brand loyalty to promote proprietary gift cards. Concurrently, specialized firms offer advanced processing capabilities, platform technologies, and diversified merchant portfolios, catering to a broader spectrum of gifting needs. Regional market penetration varies, influenced by population distribution and consumer spending patterns. The forecast period from 2025 to 2033 anticipates sustained growth, propelled by ongoing digital innovation and a growing consumer preference for digital gift card formats. Increased market consolidation through mergers and acquisitions is expected as businesses aim to enhance market share and operational efficiency.

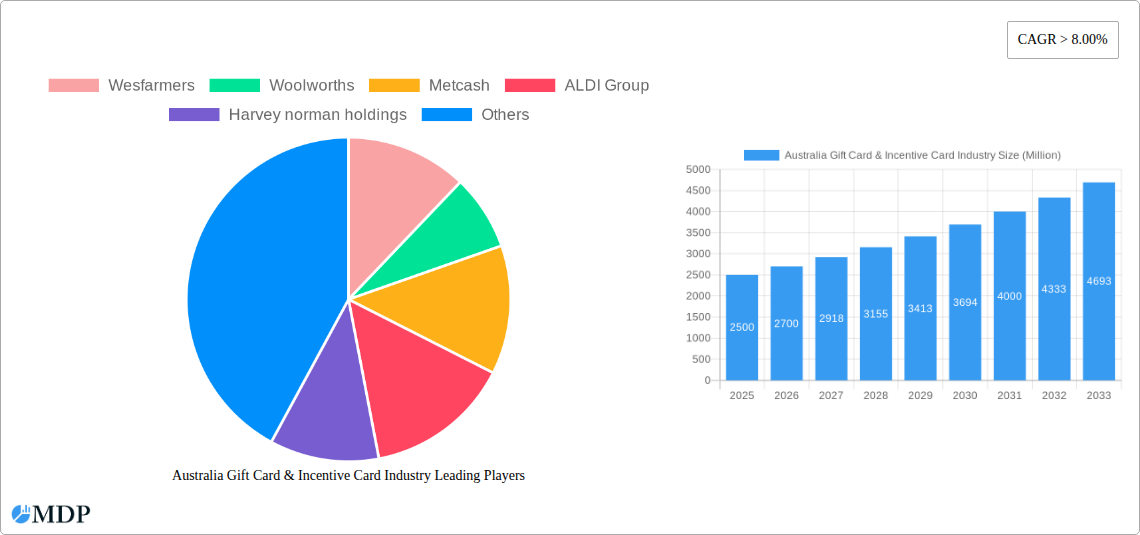

Australia Gift Card & Incentive Card Industry Company Market Share

Australia Gift Card & Incentive Card Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Australian gift card and incentive card industry, covering market dynamics, trends, leading players, and future growth opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and businesses seeking to understand and capitalize on this dynamic market. The total market size in 2025 is estimated at $XX Million.

Australia Gift Card & Incentive Card Industry Market Dynamics & Concentration

The Australian gift card and incentive card market is characterized by a moderate level of concentration, with key players holding significant market share. Wesfarmers, Woolworths, and Coles collectively account for an estimated xx% of the market in 2025. However, the market also features a number of smaller players, including niche providers and specialized incentive program operators. Innovation is driven by the need for enhanced security features, mobile integration, and personalized gifting experiences. The regulatory framework is relatively stable, though evolving consumer privacy regulations will require ongoing adaptation. Product substitutes, such as digital vouchers and experiences, are gaining traction. M&A activity has been relatively modest in recent years, with an estimated xx deals completed between 2019 and 2024. End-user trends indicate a growing preference for digital gift cards and personalized incentive programs.

- Market Share: Wesfarmers (xx%), Woolworths (xx%), Coles (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Enhanced security, mobile integration, personalization.

Australia Gift Card & Incentive Card Industry Industry Trends & Analysis

The Australian gift card and incentive card market is experiencing steady growth, driven by increasing consumer spending, the rise of e-commerce, and the popularity of experiential gifts. The Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025 to 2033, resulting in a market size of $XX Million by 2033. Technological disruptions, such as the adoption of blockchain technology for enhanced security and traceability, are reshaping the industry. Consumer preferences are shifting towards digital gift cards and personalized rewards programs. Competitive dynamics are characterized by a mix of intense competition among major players and opportunities for smaller, niche players to carve out specialized market segments. Market penetration of digital gift cards is expected to reach xx% by 2033.

Leading Markets & Segments in Australia Gift Card & Incentive Card Industry

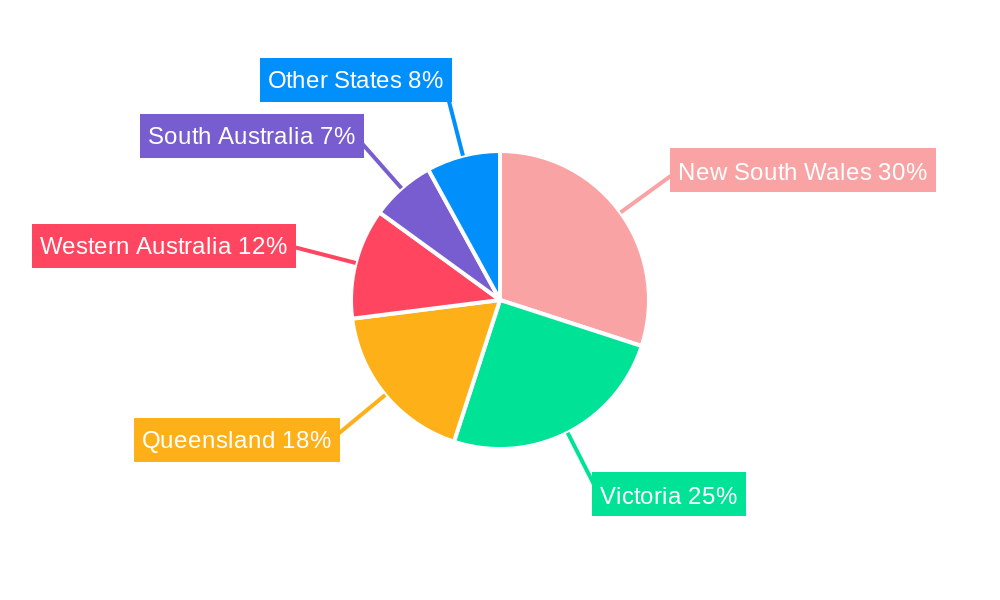

The major segment within the Australian gift card and incentive card market is the retail sector, accounting for an estimated xx% of the market value. This is fueled by the wide adoption of gift cards by major retailers as a promotional tool and a convenient gift-giving option. The strongest performing regions are the major metropolitan areas, driven by high population density and greater consumer spending.

- Key Drivers of Retail Segment Dominance:

- High consumer spending in metropolitan areas.

- Wide adoption of gift cards by major retailers.

- Convenience and ease of use for consumers.

Australia Gift Card & Incentive Card Industry Product Developments

Recent product innovations include the integration of loyalty programs with gift cards, the development of personalized digital gift cards with customizable messages and images, and the introduction of multi-brand gift cards offering greater flexibility to consumers. These innovations enhance the overall consumer experience, increasing the attractiveness of gift cards as a gifting and reward option. The integration of mobile wallets is also a key development.

Key Drivers of Australia Gift Card & Incentive Card Industry Growth

Several factors contribute to the growth of the Australian gift card and incentive card market. The rising popularity of e-commerce is driving the adoption of digital gift cards. The increasing use of incentive programs by businesses to reward employees and customers is also a key factor. Finally, government initiatives promoting cashless transactions contribute to the overall growth of the industry.

Challenges in the Australia Gift Card & Incentive Card Industry Market

The industry faces challenges such as fraud prevention, regulatory compliance concerning data privacy and security, and maintaining a competitive pricing landscape. The supply chain for physical gift cards can also pose logistical challenges. Increased competition from alternative gifting options such as experiences and subscriptions is also putting pressure on margins.

Emerging Opportunities in Australia Gift Card & Incentive Card Industry

The integration of gift cards with mobile wallets and payment platforms presents significant opportunities for growth. Strategic partnerships between retailers and financial institutions could further expand market reach. Expansion into new market segments, such as corporate gifting and personalized incentive programs, presents further growth avenues. Technological advancements in security and personalization will continue to unlock new potential.

Leading Players in the Australia Gift Card & Incentive Card Industry Sector

- Wesfarmers

- Woolworths

- Metcash

- ALDI Group

- Harvey Norman Holdings

- JB Hi-Fi

- Apple

- Giftpay

- The Good Guys

- Coles

- Australia Post

- Blackhawk Network

- iChoose

- Karta

Key Milestones in Australia Gift Card & Incentive Card Industry Industry

- December 2022: Wesfarmers OneDigital and The Walt Disney Company announced an exclusive subscription bundle combining Disney+ and OnePass. This boosted the appeal of OnePass, driving sales across Wesfarmers' retail brands.

- June 2022: Metcash Limited's new distribution centre signifies investment in supply chain efficiency, potentially impacting market pricing and product availability.

Strategic Outlook for Australia Gift Card & Incentive Card Market

The Australian gift card and incentive card market is poised for continued growth, driven by technological advancements, changing consumer preferences, and strategic partnerships. Opportunities exist in personalized gifting, enhanced security features, and integration with loyalty programs. Focusing on customer experience and embracing digital innovation will be crucial for success in this competitive landscape.

Australia Gift Card & Incentive Card Industry Segmentation

-

1. Consumer

- 1.1. Individual

-

1.2. Corporate

- 1.2.1. Small scale

- 1.2.2. Mid-tier

- 1.2.3. Large enterprise

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. Product

- 3.1. E-gift card

- 3.2. Physical card

Australia Gift Card & Incentive Card Industry Segmentation By Geography

- 1. Australia

Australia Gift Card & Incentive Card Industry Regional Market Share

Geographic Coverage of Australia Gift Card & Incentive Card Industry

Australia Gift Card & Incentive Card Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Digital Wallet Adoption in Australia is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Gift Card & Incentive Card Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 5.1.1. Individual

- 5.1.2. Corporate

- 5.1.2.1. Small scale

- 5.1.2.2. Mid-tier

- 5.1.2.3. Large enterprise

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. E-gift card

- 5.3.2. Physical card

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wesfarmers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Woolworths

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Metcash

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ALDI Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harvey norman holdings

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jb Hi-Fi

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Apple

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gift pay

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The good guys

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Coles

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Australia post

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Blackhawk network

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ichoose

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Karta**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Wesfarmers

List of Figures

- Figure 1: Australia Gift Card & Incentive Card Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Gift Card & Incentive Card Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 2: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 6: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Gift Card & Incentive Card Industry?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Australia Gift Card & Incentive Card Industry?

Key companies in the market include Wesfarmers, Woolworths, Metcash, ALDI Group, Harvey norman holdings, Jb Hi-Fi, Apple, Gift pay, The good guys, Coles, Australia post, Blackhawk network, ichoose, Karta**List Not Exhaustive.

3. What are the main segments of the Australia Gift Card & Incentive Card Industry?

The market segments include Consumer, Distribution Channel, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.22 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Digital Wallet Adoption in Australia is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Wesfarmers OneDigital and The Walt Disney Company announced an exclusive new subscription bundle combining Disney+ and OnePass for $14.99 a month.OnePass provides benefits across Wesfarmers retail brands, including free delivery on eligible purchases from Kmart, Target, Catch, and Bunnings Warehouse, as well as exclusive deals and in-store savings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Gift Card & Incentive Card Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Gift Card & Incentive Card Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Gift Card & Incentive Card Industry?

To stay informed about further developments, trends, and reports in the Australia Gift Card & Incentive Card Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence