Key Insights

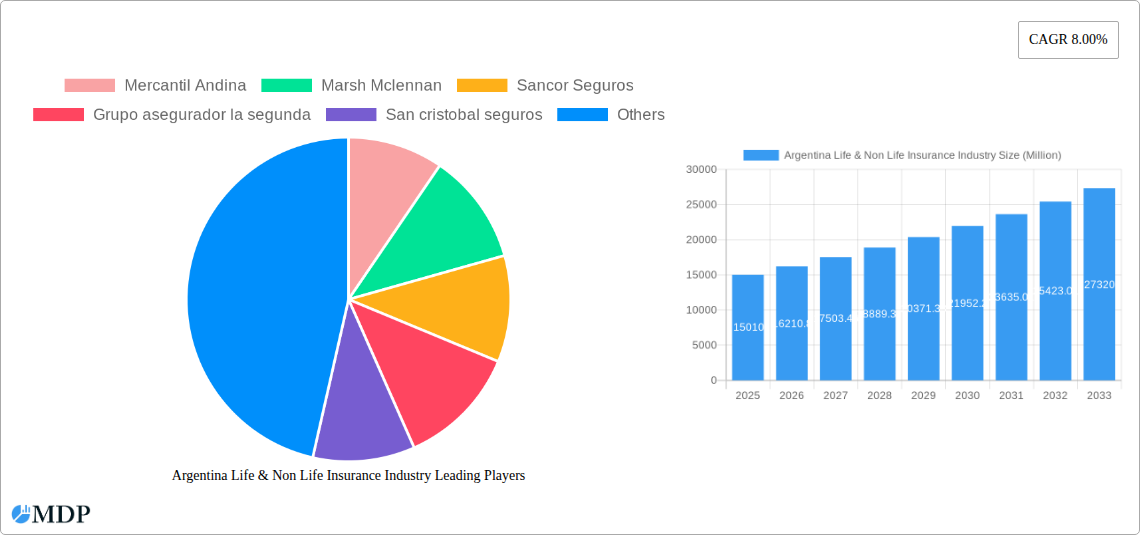

The Argentinan life and non-life insurance market, valued at $15.01 billion in 2025, exhibits robust growth potential. A compound annual growth rate (CAGR) of 8% from 2025 to 2033 projects significant expansion, reaching an estimated $29.7 billion by 2033. This growth is fueled by several key drivers. Increasing financial awareness among Argentinians, coupled with rising disposable incomes and a growing middle class, is driving demand for insurance products. Furthermore, government initiatives promoting financial inclusion and regulatory reforms aimed at improving market transparency contribute to this positive trajectory. However, economic volatility and inflation remain persistent challenges, potentially impacting consumer spending and insurance uptake. The market is segmented by product type (life and non-life), distribution channels (agents, brokers, online), and customer demographics. Leading players like Mercantil Andina, Marsh McLennan, and Sancor Seguros are strategically positioning themselves to capitalize on the growth opportunities, focusing on product innovation and digital transformation to cater to evolving consumer preferences. Competition is intense, with both domestic and international insurers vying for market share.

Argentina Life & Non Life Insurance Industry Market Size (In Billion)

The forecast period of 2025-2033 presents a complex landscape for the Argentinan insurance sector. While the projected growth is promising, insurers must navigate macroeconomic headwinds. Effective risk management strategies will be vital to withstand economic fluctuations, while continuous adaptation to technological advancements and changing consumer expectations is crucial for sustained success. The focus on digital channels and personalized products will be critical factors differentiating successful players from those lagging behind. The market is likely to witness consolidation as companies seek to achieve economies of scale and strengthen their market positions. This consolidation, coupled with strategic investments in technology and talent, will shape the future of the Argentinan life and non-life insurance industry.

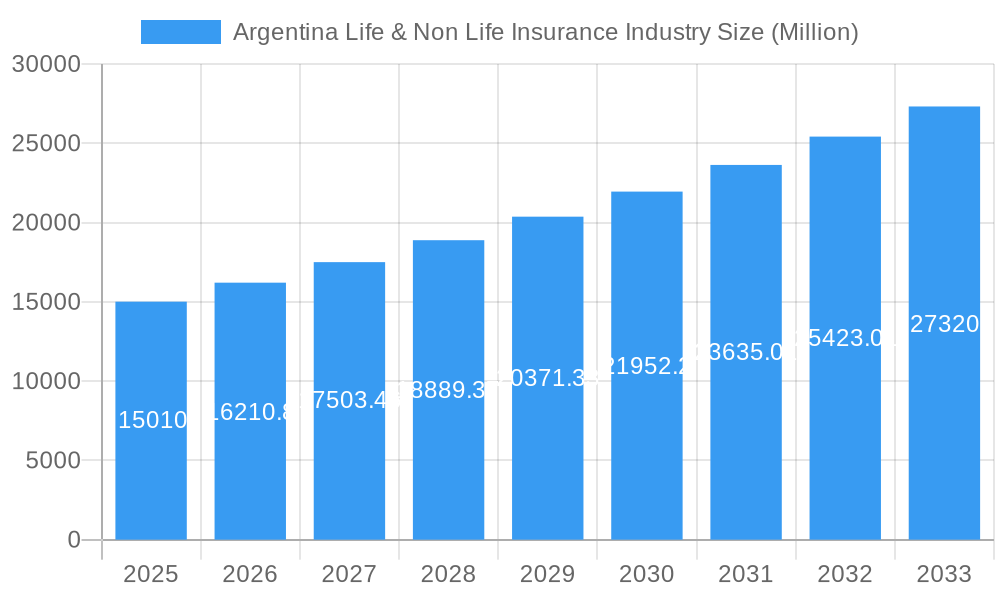

Argentina Life & Non Life Insurance Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Argentinan life and non-life insurance industry, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a base year of 2025, this report projects future growth, identifies key players, and explores emerging opportunities within this dynamic market. The report utilizes extensive data analysis, revealing market size, segmentation, and growth trajectories, providing actionable intelligence for strategic decision-making. Discover key trends, challenges, and opportunities shaping the future of insurance in Argentina.

Argentina Life & Non Life Insurance Industry Market Dynamics & Concentration

The Argentinan life and non-life insurance market exhibits a moderately concentrated landscape, with several key players holding significant market share. Mergers and acquisitions (M&A) activity has played a role in shaping this concentration, although the exact number of deals over the historical period (2019-2024) remains at xx. Market share data for the top five players in 2024 shows a combined share of approximately xx%, indicating a need for further analysis to truly understand industry dominance.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the Argentinan insurance sector in 2024 was xx, suggesting a [mention level of concentration - e.g., moderately concentrated] market.

- Innovation Drivers: Technological advancements, particularly in areas such as AI-driven pricing and digital distribution channels, are driving innovation. Regulatory changes further influence the pace of innovation and market transformation.

- Regulatory Framework: The regulatory landscape significantly impacts market dynamics, influencing product offerings, pricing, and overall competition. Specific regulations regarding solvency, capital requirements, and product approval are key considerations.

- Product Substitutes: The availability of alternative financial products, including investment options and mutual funds, presents a degree of competitive pressure on the insurance sector.

- End-User Trends: Increasing consumer awareness of risk management and the growing adoption of digital financial services are shaping demand for insurance products.

- M&A Activities: While precise figures for M&A activity (2019-2024) are unavailable (xx), there is evidence of consolidation, with larger players potentially acquiring smaller ones to enhance market share and product diversity. Future predictions on M&A activity will be made based on current trends.

Argentina Life & Non Life Insurance Industry Industry Trends & Analysis

The Argentinan life and non-life insurance market has experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024). Market penetration in 2024 stood at xx%, indicating significant growth potential. Several factors contribute to this growth:

- Economic Growth: The overall economic performance of Argentina significantly impacts insurance market growth. Periods of economic expansion typically drive higher insurance penetration rates.

- Technological Disruption: The adoption of Insurtech solutions and digital platforms are reshaping customer interactions, distribution channels, and operational efficiency within the industry. The digital transformation of the insurance landscape has increased at a xx% CAGR since 2019.

- Consumer Preferences: Changing consumer preferences and a growing demand for customized and digitally-accessible insurance products are influencing product development and distribution strategies across the industry.

- Competitive Dynamics: Intense competition among existing players and the entry of new players are driving innovation and shaping pricing strategies within the market.

Leading Markets & Segments in Argentina Life & Non Life Insurance Industry

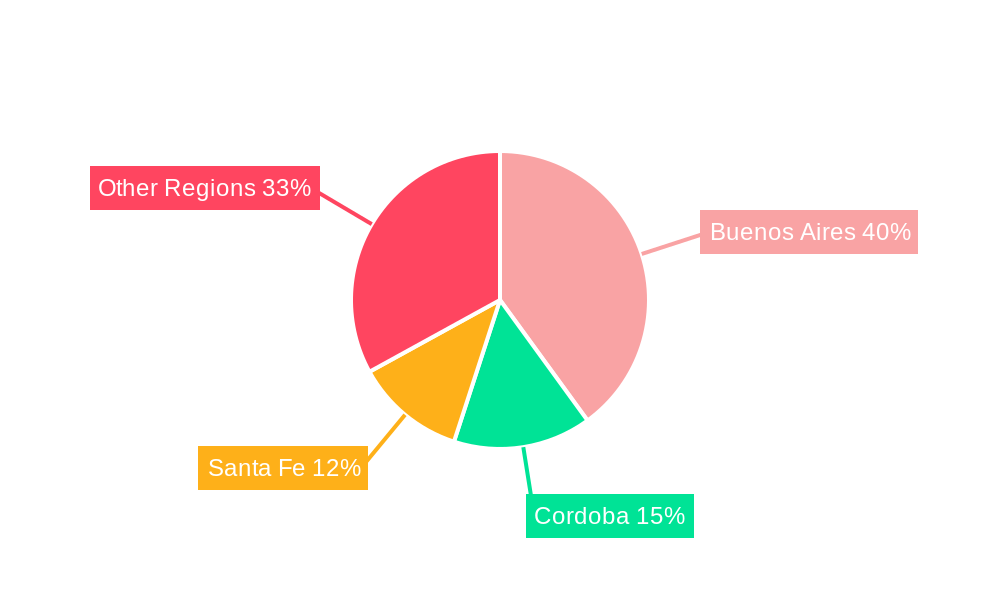

While detailed regional breakdowns require more specific data (xx), the Buenos Aires metropolitan area is likely the leading market for life and non-life insurance, driven by higher population density, economic activity, and purchasing power.

- Key Drivers for Buenos Aires Dominance:

- Higher Population Density: Concentrated population leads to a larger potential customer base.

- Economic Activity: A significant portion of Argentina's economic activity centers in this region.

- Higher Income Levels: Increased disposable income correlates with a higher propensity to purchase insurance products.

- Developed Infrastructure: Better infrastructure facilitates efficient distribution and service delivery.

The analysis of specific segments within life and non-life insurance (e.g., health, auto, property) requires more data. We predict that health insurance will likely be one of the fastest-growing segments due to an aging population and increasing awareness of healthcare costs.

Argentina Life & Non Life Insurance Industry Product Developments

Recent product innovations focus on leveraging technology to offer more personalized and efficient insurance solutions. AI-driven pricing models, digital platforms for policy purchasing and claims management, and the integration of wearable technology are key developments. These innovations aim to enhance customer experience and improve operational efficiency. The market fit of these new products is dependent on consumer adoption rates and regulatory approval.

Key Drivers of Argentina Life & Non Life Insurance Industry Growth

Several factors contribute to the projected growth of the Argentinan insurance market:

- Technological Advancements: AI-powered solutions, digital distribution channels, and data analytics are transforming the industry and boosting efficiency and customer experience.

- Economic Growth (Predicted): Positive economic forecasts for Argentina point towards increased consumer spending and a higher demand for insurance products. However, macroeconomic instability remains a key risk.

- Regulatory Support: Supportive regulatory policies encouraging financial inclusion and digitalization can accelerate market expansion.

Challenges in the Argentina Life & Non Life Insurance Industry Market

The Argentinan insurance sector faces several challenges:

- Economic Volatility: Macroeconomic instability and high inflation rates can negatively impact consumer spending and insurance demand. Quantifying this impact requires further economic modelling.

- Regulatory Hurdles: Complex regulatory environments and changes can create uncertainties for insurers and hinder market development.

- Competition: Intense competition from both domestic and international players puts pressure on pricing and profitability.

Emerging Opportunities in Argentina Life & Non Life Insurance Industry

Several opportunities exist for growth:

- Expanding Digital Channels: Increased digital penetration offers opportunities to reach a wider customer base and enhance customer experience.

- Strategic Partnerships: Collaboration among insurers, technology providers, and healthcare organizations can create innovative products and services.

- Market Expansion in Underserved Areas: Reaching previously underserved populations with targeted insurance offerings presents a significant growth opportunity.

Leading Players in the Argentina Life & Non Life Insurance Industry Sector

- Mercantil Andina

- Marsh Mclennan

- Sancor Seguros

- Grupo asegurador la segunda

- San cristobal seguros

- Chubb

- Parana Seguros

- Holando Seguros

- Experta Aseguradora de Riesgos del Trabajo S A

- Federacion Patronal Seguros

- Orbis Seguros

- Seguros Sura

Key Milestones in Argentina Life & Non Life Insurance Industry Industry

- June 2022: Seguros Sura partners with Akur8 to enhance AI-driven insurance pricing across Argentina, Chile, and Colombia. This significantly improves efficiency and accuracy in life insurance pricing.

- October 2022: La Segunda introduces three new crop insurance features for the 2022/23 campaign, increasing coverage and providing discounts, signifying innovation in agricultural insurance.

Strategic Outlook for Argentina Life & Non Life Insurance Industry Market

The Argentinan life and non-life insurance market presents significant long-term growth potential. Leveraging technological advancements, strategic partnerships, and effective risk management strategies will be crucial for success in this dynamic market. Focusing on consumer needs and adapting to the evolving regulatory environment are key for long-term sustainability and profitability. The projected CAGR for 2025-2033 is xx%, driven by increased penetration rates and economic growth.

Argentina Life & Non Life Insurance Industry Segmentation

-

1. Type

-

1.1. Life insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non- life insurance

- 1.2.1. Motor

- 1.2.2. Home

- 1.2.3. Marine

- 1.2.4. Health

- 1.2.5. Rest of Non-Life Insurance

-

1.1. Life insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Argentina Life & Non Life Insurance Industry Segmentation By Geography

- 1. Argentina

Argentina Life & Non Life Insurance Industry Regional Market Share

Geographic Coverage of Argentina Life & Non Life Insurance Industry

Argentina Life & Non Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Focus Towards Digitization in the Life Insurance and Non-life Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Life & Non Life Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non- life insurance

- 5.1.2.1. Motor

- 5.1.2.2. Home

- 5.1.2.3. Marine

- 5.1.2.4. Health

- 5.1.2.5. Rest of Non-Life Insurance

- 5.1.1. Life insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mercantil Andina

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Marsh Mclennan

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sancor Seguros

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Grupo asegurador la segunda

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 San cristobal seguros

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chubb

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Parana Seguros

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Holando Seguros

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Experta Aseguradora de Riesgos del Trabajo S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Federacion Patronal Seguros

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Orbis Seguros

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seguros Sura**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Mercantil Andina

List of Figures

- Figure 1: Argentina Life & Non Life Insurance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Argentina Life & Non Life Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Argentina Life & Non Life Insurance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Argentina Life & Non Life Insurance Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Life & Non Life Insurance Industry?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Argentina Life & Non Life Insurance Industry?

Key companies in the market include Mercantil Andina, Marsh Mclennan, Sancor Seguros, Grupo asegurador la segunda, San cristobal seguros, Chubb, Parana Seguros, Holando Seguros, Experta Aseguradora de Riesgos del Trabajo S A, Federacion Patronal Seguros, Orbis Seguros, Seguros Sura**List Not Exhaustive.

3. What are the main segments of the Argentina Life & Non Life Insurance Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.01 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Focus Towards Digitization in the Life Insurance and Non-life Insurance Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Seguros Sura collaborated with Akur8, an AI pricing platform, to boost its insurance pricing process across Argentina, Chile, and Colombia. This partnership will help Seguros Sura to automate the pricing process of their life insurance products to harmonize practices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Life & Non Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Life & Non Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Life & Non Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Argentina Life & Non Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence