Key Insights

The Norwegian Property and Casualty (P&C) insurance market is projected for robust expansion, driven by increasing property values, heightened consumer awareness of insurance needs, and the escalating impact of climate-related risks demanding enhanced coverage for weather events. Technological integration, including telematics and AI for risk assessment and claims, further fuels market growth.

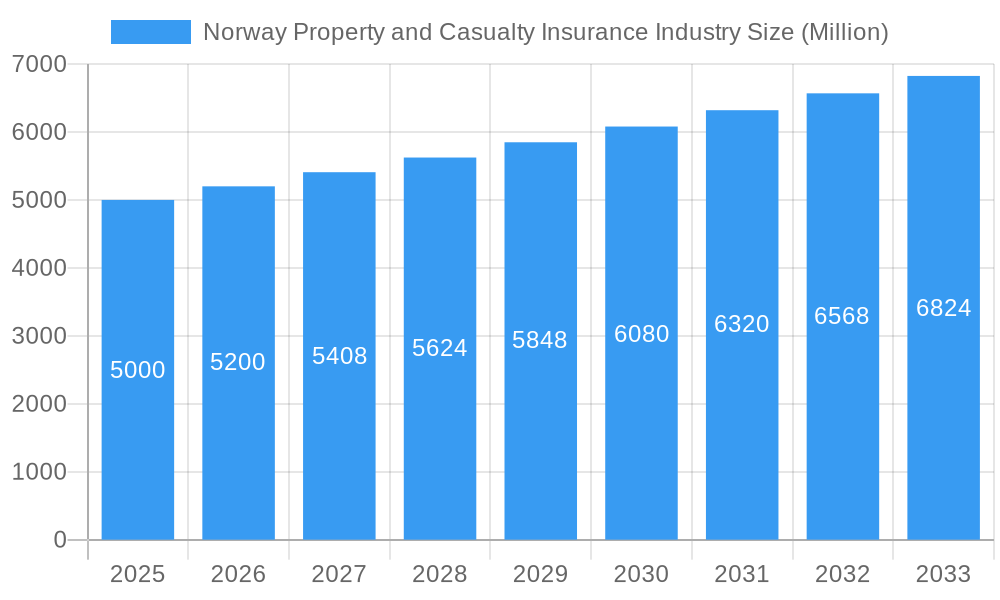

Norway Property and Casualty Insurance Industry Market Size (In Million)

Key market metrics include a projected market size of €2533.39 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.4% from 2025 to 2033. Despite this positive outlook, regulatory shifts and intense competition from established insurers like Gjensidige Forsikring ASA, Tryg Forsikring, and Fremtind Forsikring AS present significant challenges.

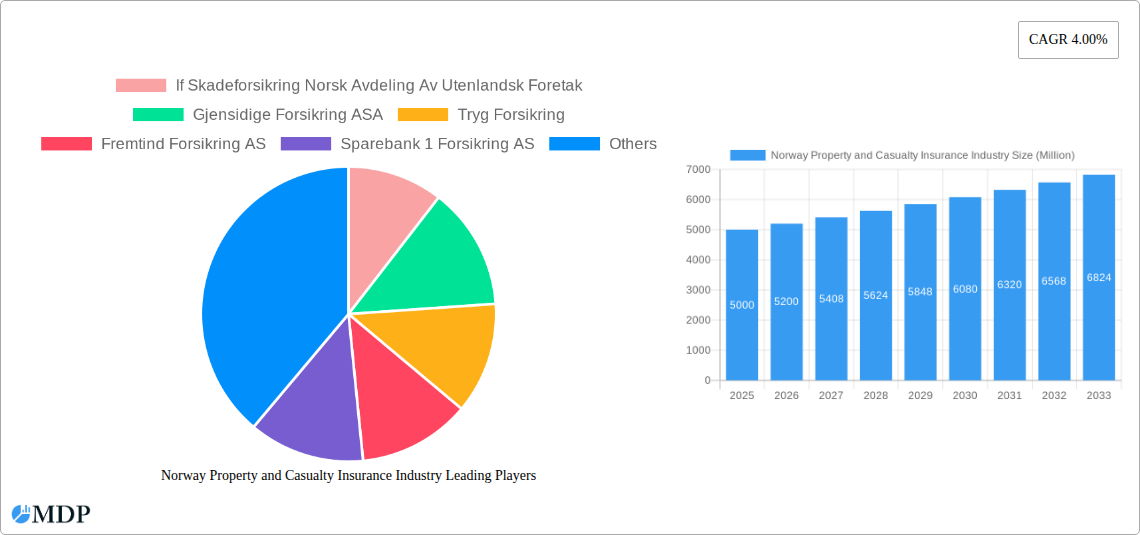

Norway Property and Casualty Insurance Industry Company Market Share

Opportunities lie in market segmentation, catering to specialized needs across residential and commercial properties, various coverage types, and distinct customer demographics. During the forecast period (2025-2033), insurers are expected to prioritize digitalization for operational efficiency and enhanced customer engagement. Strategic adaptation to emerging risks, such as cyber threats, will necessitate innovative products and risk management solutions.

The competitive environment remains concentrated, with major players focusing on diversification and service expansion. Gradual increases in insurance penetration are anticipated, supported by rising disposable incomes and growing awareness of insurance benefits. Effective navigation of these dynamic market forces will be crucial for the sustained success of Norwegian P&C insurers.

Norway Property and Casualty Insurance Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Norwegian Property and Casualty (P&C) insurance market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, key players, growth drivers, and future opportunities, equipping stakeholders with the knowledge needed to navigate this dynamic sector. With a focus on key market segments and incorporating data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report includes detailed financial projections, market sizing and forecasts, in Millions, and explores the impact of recent M&A activity and technological advancements.

Norway Property and Casualty Insurance Industry Market Dynamics & Concentration

The Norwegian P&C insurance market exhibits a moderate level of concentration, with several large players dominating the landscape. Market share data reveals that Gjensidige Forsikring ASA, Tryg Forsikring, and Fremtind Forsikring AS collectively account for approximately xx% of the total market (2024 data). The market’s dynamic nature is influenced by several key factors:

Innovation Drivers: Technological advancements, particularly in data analytics and AI, are driving product innovation and operational efficiency. Insurers are increasingly adopting digital platforms to enhance customer experience and streamline processes.

Regulatory Frameworks: The Norwegian Financial Supervisory Authority (Finanstilsynet) plays a crucial role in shaping the regulatory environment, impacting product offerings and risk management practices. Compliance with evolving regulations is a significant factor shaping market dynamics.

Product Substitutes: The emergence of alternative risk financing mechanisms and peer-to-peer insurance platforms poses a challenge to traditional insurers, leading to increased competition and innovation.

End-User Trends: Growing awareness of insurance needs, coupled with increased online penetration, is shifting customer expectations towards digital-first solutions and personalized services.

M&A Activities: The market has witnessed significant M&A activity in recent years. For example, Gjensidige Forsikring's acquisition of Falck's Road-side Assistance demonstrates the industry’s consolidation trend. Over the historical period (2019-2024), approximately xx M&A deals were recorded.

Norway Property and Casualty Insurance Industry Industry Trends & Analysis

The Norwegian P&C insurance market is expected to experience steady growth over the forecast period (2025-2033), driven by several factors. The compound annual growth rate (CAGR) is projected to be xx% during this period. Market penetration is currently at xx%, with significant potential for expansion.

Key growth drivers include:

Rising disposable incomes: Increasing affluence fuels demand for insurance products, particularly in areas like motor and property insurance.

Technological disruptions: Digitalization and Insurtech are transforming the industry, leading to improved efficiency, enhanced customer engagement, and innovative product offerings.

Changing consumer preferences: Customers are increasingly demanding personalized experiences, seamless digital interactions, and transparent pricing, creating opportunities for insurers to leverage data and technology to meet these expectations.

Competitive dynamics: The intense rivalry among established insurers and emerging players fosters innovation and enhances customer choice. However, this also leads to pressure on pricing and profitability.

Leading Markets & Segments in Norway Property and Casualty Insurance Industry

The Norwegian P&C insurance market is largely concentrated in urban areas, driven by higher population density and property values. Key drivers for this dominance include:

Economic policies: Government policies promoting economic stability and growth indirectly support the insurance market.

Infrastructure: Well-developed infrastructure in urban areas facilitates efficient claims processing and service delivery.

Within segments, motor insurance consistently dominates the market, owing to the high car ownership rates and associated risks. Other significant segments include property, liability, and health insurance. The dominance of motor insurance is attributed to:

- High car ownership rates.

- Mandatory motor insurance.

- Rising vehicle values.

Norway Property and Casualty Insurance Industry Product Developments

Technological advancements are driving product innovation in the Norwegian P&C insurance market. Telematics-based insurance products are gaining traction, offering customized premiums based on driving behavior. Insurers are also integrating AI and machine learning for fraud detection, risk assessment, and claims processing. These developments are aimed at improving efficiency, enhancing customer experience, and providing more competitive pricing.

Key Drivers of Norway Property and Casualty Insurance Industry Growth

Several factors are expected to drive the growth of the Norwegian P&C insurance market:

Technological advancements: AI, Big Data, and IoT technologies are creating opportunities for personalized products, better risk management, and enhanced customer service.

Economic growth: Continued economic expansion will lead to increased demand for insurance products across various segments.

Favorable regulatory environment: A stable regulatory framework provides a conducive environment for industry growth and investment.

Challenges in the Norway Property and Casualty Insurance Industry Market

The Norwegian P&C insurance market faces several challenges:

Intense competition: The market’s competitiveness is driving pressure on pricing and profitability.

Regulatory hurdles: Compliance requirements and evolving regulations can impact operational efficiency and profitability.

Cybersecurity risks: Increased digitalization increases vulnerability to cyberattacks and data breaches, posing significant financial and reputational risks.

Emerging Opportunities in Norway Property and Casualty Insurance Industry

The Norwegian P&C insurance market presents several promising long-term growth opportunities. The increasing adoption of digital technologies presents opportunities for insurers to leverage data analytics to improve customer service and develop innovative products. Strategic partnerships with Insurtech firms can unlock new opportunities in areas such as personalized risk assessment and fraud detection. Expansion into niche markets, such as specialized insurance products, also offers significant potential for growth.

Leading Players in the Norway Property and Casualty Insurance Industry Sector

- If Skadeforsikring Norsk Avdeling Av Utenlandsk Foretak (website unavailable)

- Gjensidige Forsikring ASA

- Tryg Forsikring

- Fremtind Forsikring AS

- Sparebank 1 Forsikring AS

- Frende Forsikring

- Tide Forsikring AS

- Codan Forsikring

- Eika Forsikring (website unavailable)

Key Milestones in Norway Property and Casualty Insurance Industry Industry

- August 2021: Erika Forsikring partnered with Simplify, integrating Documentbot and Emailbot technologies.

- February 2022: Gjensidige Forsikring acquired Falck's Road-side Assistance Nordic and Baltic operations.

Strategic Outlook for Norway Property and Casualty Insurance Industry Market

The Norwegian P&C insurance market is poised for continued growth, driven by technological innovation, economic expansion, and evolving consumer preferences. Insurers that adapt to the changing market dynamics, embrace digital transformation, and focus on customer-centric strategies will be best positioned to capitalize on the emerging opportunities and secure a strong market position in the years to come. The market presents opportunities for both organic growth and strategic acquisitions, creating a dynamic environment for industry participants.

Norway Property and Casualty Insurance Industry Segmentation

-

1. Product Type

- 1.1. Property Insurance

- 1.2. Motor Insurance

- 1.3. Others

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Others

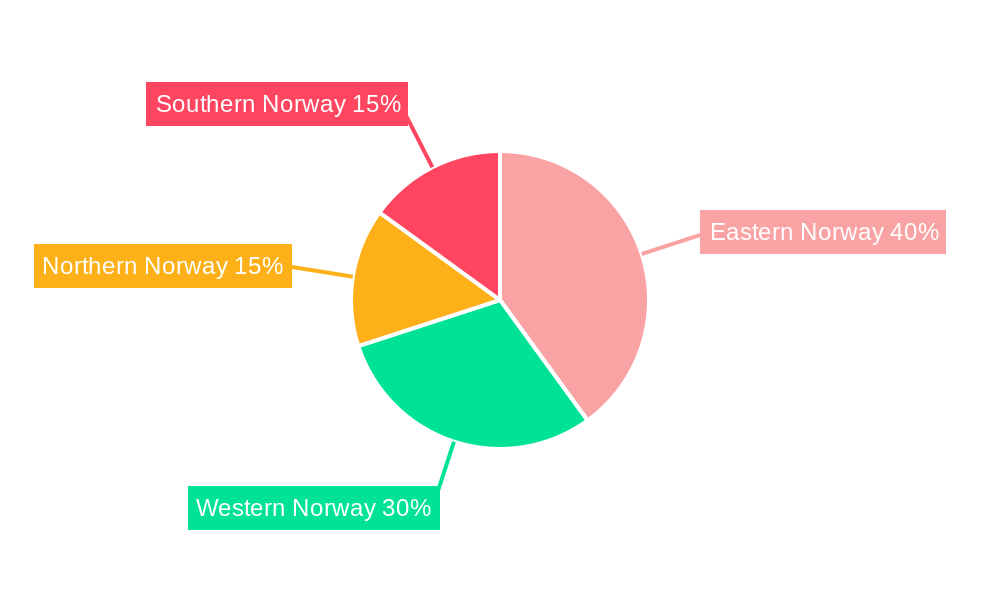

Norway Property and Casualty Insurance Industry Segmentation By Geography

- 1. Norway

Norway Property and Casualty Insurance Industry Regional Market Share

Geographic Coverage of Norway Property and Casualty Insurance Industry

Norway Property and Casualty Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Number of Registered Passenger Car is Driving the Motor Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Property and Casualty Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Property Insurance

- 5.1.2. Motor Insurance

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 If Skadeforsikring Norsk Avdeling Av Utenlandsk Foretak

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gjensidige Forsikring ASA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tryg Forsikring

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fremtind Forsikring AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sparebank 1 Forsikring AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Frende Forsikring

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tide Forsikring AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Codan Forsikring

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eika Forsikring*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 If Skadeforsikring Norsk Avdeling Av Utenlandsk Foretak

List of Figures

- Figure 1: Norway Property and Casualty Insurance Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Norway Property and Casualty Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Norway Property and Casualty Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Property and Casualty Insurance Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Norway Property and Casualty Insurance Industry?

Key companies in the market include If Skadeforsikring Norsk Avdeling Av Utenlandsk Foretak, Gjensidige Forsikring ASA, Tryg Forsikring, Fremtind Forsikring AS, Sparebank 1 Forsikring AS, Frende Forsikring, Tide Forsikring AS, Codan Forsikring, Eika Forsikring*List Not Exhaustive.

3. What are the main segments of the Norway Property and Casualty Insurance Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2533.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increased Number of Registered Passenger Car is Driving the Motor Insurance.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In February 2022, Gjensidige Forsikring completed the acquisition of Falck's Road-side Assistance Nordic and Baltic. The relevant authorities approved the transaction, which is in accordance with the terms of the agreement entered into between the parties in December 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Property and Casualty Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Property and Casualty Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Property and Casualty Insurance Industry?

To stay informed about further developments, trends, and reports in the Norway Property and Casualty Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence