Key Insights

The European Banking-as-a-Service (BaaS) market is poised for substantial growth, driven by the escalating demand for embedded finance and the innovation of fintech companies. Projecting a CAGR of 26.5%, the market is estimated to reach 1674.36 million by 2024. Key growth drivers include widespread digitalization, the imperative for streamlined financial service integration, and regulatory frameworks that encourage innovation. The market is segmented by service type (payment processing, lending, account opening), deployment mode (cloud, on-premise), and enterprise size (SMEs, large enterprises). Leading providers like Solarisbank, Bankable, and Treezor are instrumental in this expansion, offering tailored BaaS solutions. The proliferation of open banking APIs is further accelerating market adoption. Despite ongoing considerations regarding data security and regulatory compliance, the market outlook remains exceptionally strong.

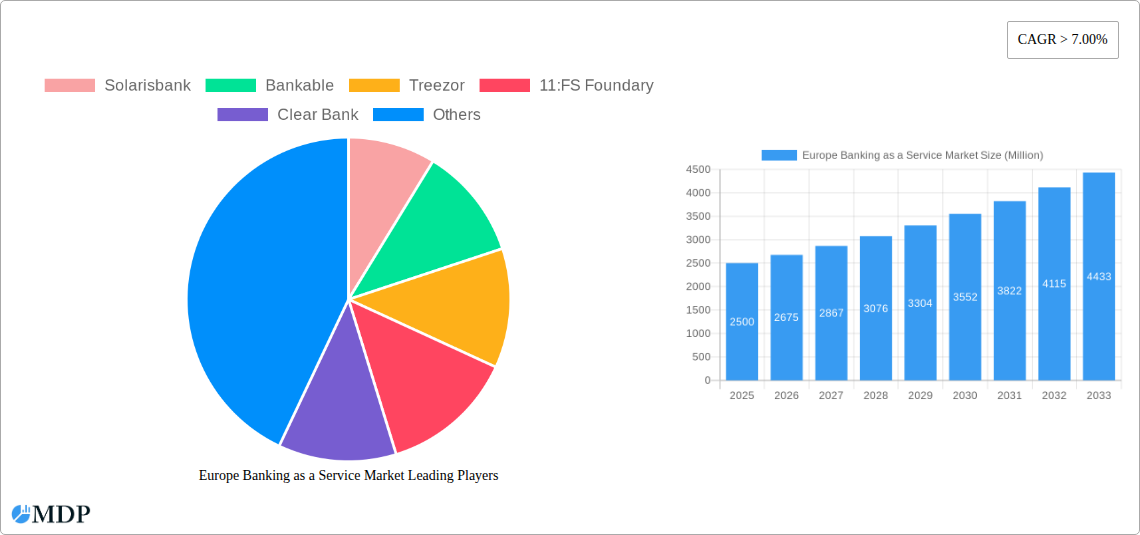

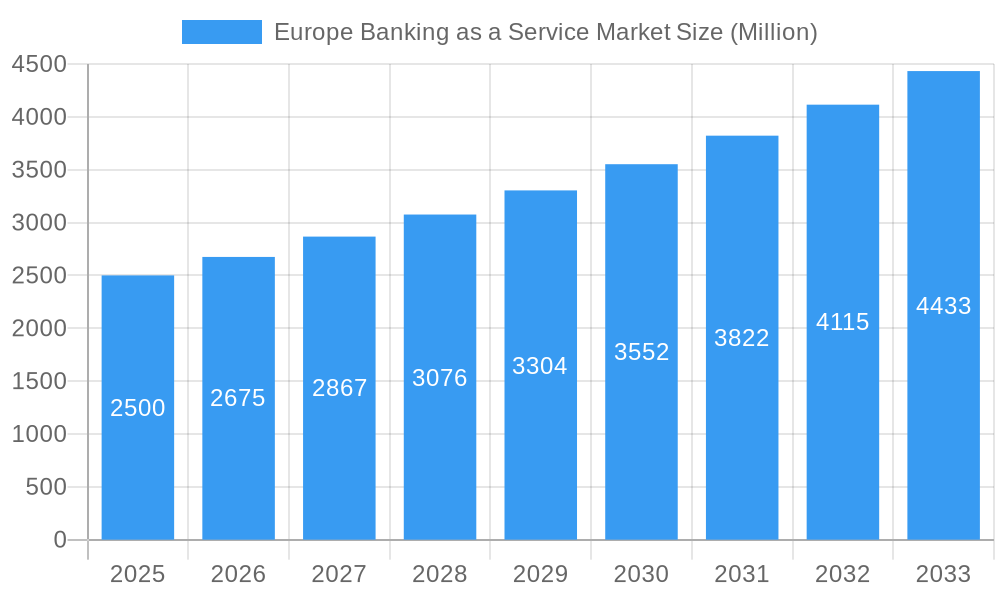

Europe Banking as a Service Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market expansion, fueled by the increasing integration of digital banking solutions across European sectors. Strategic collaborations between established financial institutions and agile fintech firms will be a significant catalyst. The market's evolution is evident in the diverse specializations of BaaS providers catering to niche requirements. While adoption rates vary geographically, overall market penetration is expected to climb steadily. This upward trend is propelled by the demand for flexible and adaptable financial services across industries such as e-commerce, retail, transportation, and healthcare. Continued investment in cutting-edge technologies and strategic alliances will underscore future market expansion.

Europe Banking as a Service Market Company Market Share

Europe Banking as a Service Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Banking as a Service (BaaS) market, offering invaluable insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report leverages extensive data from the historical period (2019-2024) to deliver accurate projections and actionable recommendations. The estimated market size in 2025 is projected at xx Million. Discover key trends, competitive landscapes, and growth opportunities within this rapidly evolving sector.

Europe Banking as a Service Market Market Dynamics & Concentration

The Europe BaaS market is characterized by a dynamic interplay of factors influencing its concentration and growth trajectory. Market concentration is currently [Insert Market Concentration Metric, e.g., moderately concentrated, with the top 5 players holding xx% market share]. Innovation is a key driver, with ongoing development of API-driven solutions, embedded finance offerings, and the integration of advanced technologies like AI and blockchain. Regulatory frameworks, particularly PSD2 and related directives, significantly impact market structure and operations. The presence of substitute financial services, such as traditional banking models, constantly challenges BaaS providers. End-user preferences are shifting towards seamless digital banking experiences, fueling demand for BaaS solutions. M&A activity is relatively high, with [Insert Number] deals recorded between 2019 and 2024, reflecting consolidation and strategic expansion efforts.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A activity: [Insert Number] M&A deals recorded between 2019 and 2024.

- Innovation Drivers: API-led solutions, embedded finance, AI/blockchain integration.

- Regulatory Influence: PSD2 and other European regulations significantly shape market dynamics.

Europe Banking as a Service Market Industry Trends & Analysis

The Europe BaaS market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological advancements, particularly cloud computing and microservices architectures, are significantly improving the scalability and efficiency of BaaS platforms. Consumer preference for personalized and digitally native financial services further fuels market expansion. The increasing adoption of open banking initiatives enhances interoperability and ecosystem development. Competitive dynamics are characterized by both collaboration and competition, with established players forming strategic partnerships and new entrants disrupting the market with innovative offerings. Market penetration is expected to reach xx% by 2033, indicating substantial growth potential.

Leading Markets & Segments in Europe Banking as a Service Market

[Insert Dominant Region/Country, e.g., The United Kingdom] currently dominates the Europe BaaS market. This leadership stems from several key factors:

- Strong regulatory environment: Supportive open banking policies driving innovation.

- Developed Fintech ecosystem: High concentration of innovative BaaS providers and fintech companies.

- High digital adoption: Significant proportion of the population using digital financial services.

- Robust infrastructure: Well-established digital infrastructure facilitating seamless integration.

[Insert Analysis of dominance, providing justification for the chosen region/country, including market size and growth projections]. The [Insert Dominant Segment, e.g., SME segment] is also a significant contributor to market growth due to [Explain Reasons].

Europe Banking as a Service Market Product Developments

Recent product innovations in the Europe BaaS market focus on enhanced security features, improved API integrations, and customizable solutions tailored to specific industry needs. The rise of embedded finance solutions allows businesses to integrate financial services directly into their offerings. These technological advancements increase the market fit for BaaS, attracting a wider range of clients and driving market expansion. The emphasis on cloud-native platforms and microservices architecture enhances scalability and efficiency, making BaaS solutions more attractive for businesses of all sizes.

Key Drivers of Europe Banking as a Service Market Growth

Several factors drive the growth of the Europe BaaS market. These include:

- Technological advancements: Cloud computing, AI, and open banking APIs enhance scalability and functionality.

- Regulatory support: Open banking initiatives and favorable regulatory landscapes promote innovation and competition.

- Increased demand for digital financial services: Consumer preference for seamless and personalized experiences.

- Strategic partnerships: Collaboration between banks and fintech companies facilitates market expansion.

Challenges in the Europe Banking as a Service Market Market

The Europe BaaS market faces several challenges:

- Regulatory complexities: Navigating diverse national regulations and compliance requirements.

- Data security and privacy concerns: Ensuring the protection of sensitive customer data.

- Competition from established players: Traditional banks offering similar services pose a challenge.

- Integration complexities: Integrating BaaS solutions with legacy systems can be challenging and costly.

Emerging Opportunities in Europe Banking as a Service Market

Significant long-term growth opportunities exist within the Europe BaaS market. The adoption of new technologies, such as blockchain for enhanced security and AI for personalized financial services, will drive innovation and market expansion. Strategic partnerships between banks and fintech companies will foster collaboration and create new value propositions. Expansion into underserved markets and the development of specialized BaaS solutions for specific industries present further avenues for growth.

Leading Players in the Europe Banking as a Service Market Sector

- Solarisbank

- Bankable

- Treezor

- 11:FS Foundary

- Clear Bank

- Unnax

- Cambr

- Railsbank

- Deposits Solutions

- Fidor Bank

- True Layer

- FintechOS

- List Not Exhaustive

Key Milestones in Europe Banking as a Service Market Industry

- July 22, 2021: Bankable partnered with Paysafe, launching integrated omnichannel banking services. This significantly expanded Bankable's reach and service offerings.

- May 05, 2022: Solarisbank partnered with Snowflake to enhance its cloud infrastructure. This move boosted Solarisbank's operational efficiency and data management capabilities.

Strategic Outlook for Europe Banking as a Service Market Market

The future of the Europe BaaS market is bright. Continued technological advancements, coupled with supportive regulatory frameworks and increasing consumer demand for digital financial services, will drive substantial growth. Strategic partnerships and mergers and acquisitions will further consolidate the market and enhance the capabilities of existing players. The focus on innovation, security, and regulatory compliance will be crucial for success in this rapidly evolving landscape. The market is poised for significant expansion, with substantial opportunities for both established players and new entrants.

Europe Banking as a Service Market Segmentation

-

1. Component

- 1.1. Platform

-

1.2. Service

- 1.2.1. Professional Service

- 1.2.2. Managed Service

-

2. Type

- 2.1. API Based BaaS

- 2.2. Cloud Based BaaS

-

3. Enterprise

- 3.1. Large Enterprise

- 3.2. Small & Medium Enterprise

-

4. End User

- 4.1. Banks

- 4.2. Fintech Corporations/NBFC

- 4.3. Others

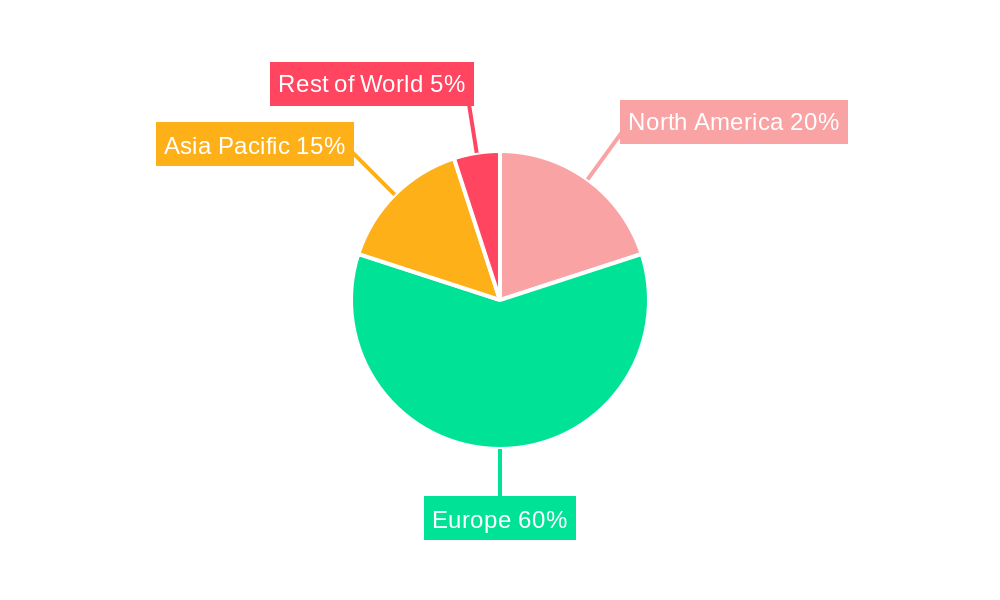

Europe Banking as a Service Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Banking as a Service Market Regional Market Share

Geographic Coverage of Europe Banking as a Service Market

Europe Banking as a Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Embedded Finance Driving Banking as a Service.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Banking as a Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Service

- 5.1.2.1. Professional Service

- 5.1.2.2. Managed Service

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. API Based BaaS

- 5.2.2. Cloud Based BaaS

- 5.3. Market Analysis, Insights and Forecast - by Enterprise

- 5.3.1. Large Enterprise

- 5.3.2. Small & Medium Enterprise

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Banks

- 5.4.2. Fintech Corporations/NBFC

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Solarisbank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bankable

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Treezor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 11

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.1 Solarisbank

List of Figures

- Figure 1: Europe Banking as a Service Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Banking as a Service Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Banking as a Service Market Revenue million Forecast, by Component 2020 & 2033

- Table 2: Europe Banking as a Service Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Europe Banking as a Service Market Revenue million Forecast, by Enterprise 2020 & 2033

- Table 4: Europe Banking as a Service Market Revenue million Forecast, by End User 2020 & 2033

- Table 5: Europe Banking as a Service Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Banking as a Service Market Revenue million Forecast, by Component 2020 & 2033

- Table 7: Europe Banking as a Service Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Europe Banking as a Service Market Revenue million Forecast, by Enterprise 2020 & 2033

- Table 9: Europe Banking as a Service Market Revenue million Forecast, by End User 2020 & 2033

- Table 10: Europe Banking as a Service Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Banking as a Service Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Banking as a Service Market?

The projected CAGR is approximately 26.5%.

2. Which companies are prominent players in the Europe Banking as a Service Market?

Key companies in the market include Solarisbank, Bankable, Treezor, 11:FS Foundary, Clear Bank, Unnax, Cambr, Rails bank, Deposits Solutions, Fidor Bank, True Layer, FintechOS**List Not Exhaustive.

3. What are the main segments of the Europe Banking as a Service Market?

The market segments include Component, Type, Enterprise, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1674.36 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Demand for Embedded Finance Driving Banking as a Service..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On May 05, 2022, Solaris bank announced that it would partner with Snowflake, the Data Cloud company, to double down on creating a cloud-fluent organization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Banking as a Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Banking as a Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Banking as a Service Market?

To stay informed about further developments, trends, and reports in the Europe Banking as a Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence