Key Insights

The German gift card and incentive card market demonstrates significant growth potential, fueled by rising consumer expenditure and the inherent convenience, flexibility, and broad retail acceptance of these payment instruments. Projections indicate a compound annual growth rate (CAGR) of 8.5%, with the market size expected to reach 78.9 billion by 2025. The market is segmented by distribution channel (online and offline), product type (e-gift cards and physical cards), and consumer type (retail and corporate). The online segment is experiencing accelerated expansion, driven by the surge in e-commerce and digital gifting preferences, particularly for e-gift cards due to their immediate delivery and user-friendliness. Key contributors to market size and competitiveness include major players such as Amazon, Rossmann, Schwarz Gruppe, dm-drogerie markt, and IKEA. The increasing utilization of gift cards by corporations for employee incentives and rewards further propels market expansion. Despite potential challenges like economic fluctuations impacting consumer spending and evolving preferences, the market outlook remains positive, with sustained growth anticipated throughout the forecast period. Established retailers and the integration of gift cards into loyalty programs are crucial drivers of this momentum, supported by Germany's robust retail infrastructure and a digitally adept populace.

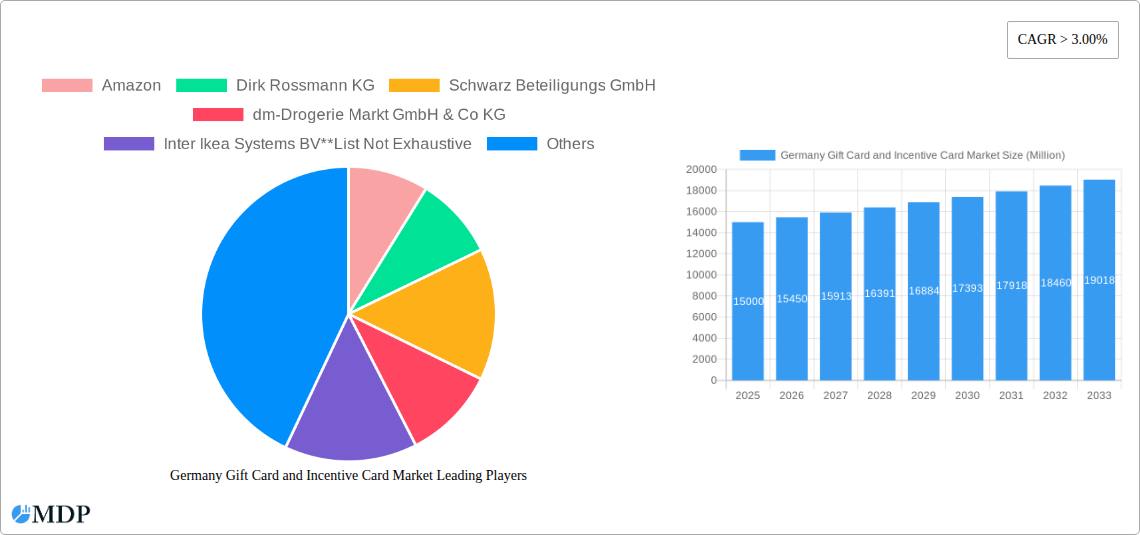

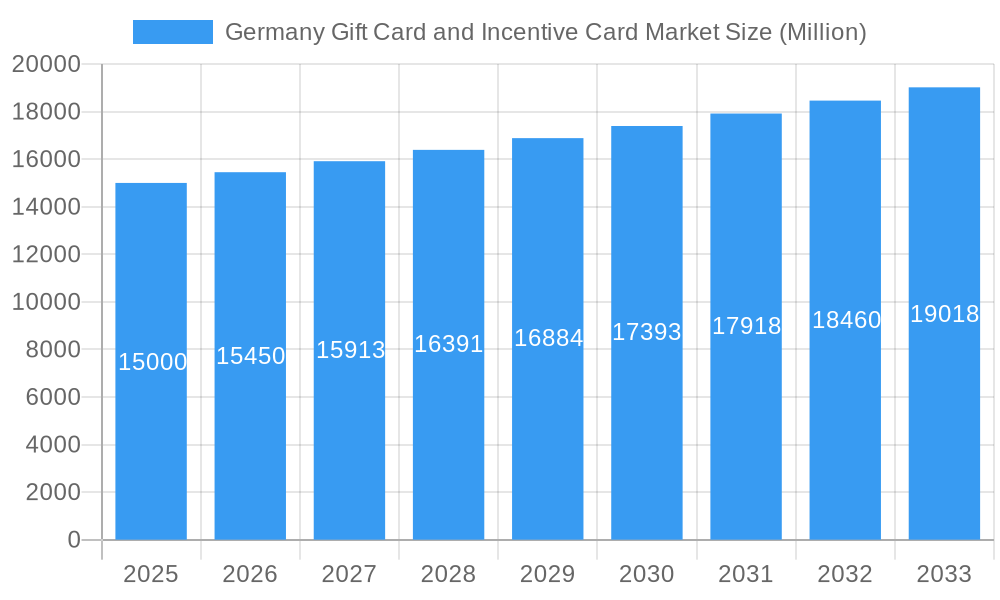

Germany Gift Card and Incentive Card Market Market Size (In Billion)

The competitive landscape features a blend of large retailers and dedicated gift card providers. Strategies for differentiation center on offering a wide array of products, innovative designs, and integrated loyalty programs to enhance customer acquisition and retention. Regional market dynamics are influenced by local consumer behaviors and purchasing habits. Future growth is expected to be stimulated by technological advancements, including personalized gift card options and enhanced mobile payment integration. The sustained success of the market depends on industry participants' ability to adapt to evolving consumer demands, capitalize on technological innovation, and maintain competitive pricing. The corporate segment is poised for continued robust growth as businesses increasingly value gift cards for effective employee engagement and reward initiatives.

Germany Gift Card and Incentive Card Market Company Market Share

Germany Gift Card and Incentive Card Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany Gift Card and Incentive Card Market, covering the period from 2019 to 2033. With a focus on market dynamics, industry trends, leading players, and future opportunities, this report is an essential resource for industry stakeholders, investors, and businesses seeking to understand and capitalize on this rapidly evolving market. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects growth through the forecast period (2025-2033). The market size is valued in Millions.

Germany Gift Card and Incentive Card Market Market Dynamics & Concentration

The German gift card and incentive card market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is relatively high, with major players like Amazon, Schwarz Beteiligungs GmbH (Lidl & Kaufland), and Rewe Group holding significant market share. However, the market also exhibits considerable fragmentation, particularly in the offline segment, with numerous smaller retailers offering gift cards. Innovation is a key driver, with ongoing developments in digital gift cards, mobile payment integration, and loyalty programs. The regulatory framework, while generally favorable, is subject to evolving data privacy regulations and financial transaction laws. Product substitutes, such as direct cash payments or experiences, pose a competitive threat. End-user trends lean towards increasing digital adoption and convenience-oriented solutions. The level of M&A activity is moderate, with an estimated xx number of deals occurring between 2019-2024, mostly involving smaller players consolidating within regional markets. Market share data reveals Amazon holds approximately xx% of the online market, while Schwarz Beteiligungs GmbH commands approximately xx% of the offline market. This concentration is expected to remain relatively stable throughout the forecast period, though we anticipate increased competition from fintech companies.

Germany Gift Card and Incentive Card Market Industry Trends & Analysis

The German gift card and incentive card market is experiencing robust growth, driven primarily by increasing consumer spending, the rise of e-commerce, and the growing popularity of digital gift cards. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%, and is projected to reach xx% during the forecast period (2025-2033). Technological disruptions, such as the integration of blockchain technology and mobile wallets, are transforming the way gift cards are purchased, redeemed, and managed. Consumer preferences are shifting towards personalized and experience-based gift cards, influencing the product offerings of major players. Competitive dynamics are intense, with key players constantly innovating to attract and retain customers. Market penetration of digital gift cards is rising steadily, with xx% of the total gift card market estimated to be digital in 2025. This trend is expected to continue due to increased smartphone penetration and consumer familiarity with digital payment methods.

Leading Markets & Segments in Germany Gift Card and Incentive Card Market

The German gift card market is predominantly driven by retail consumers, representing approximately xx% of the total market in 2025. The online distribution channel is rapidly gaining traction, with its share projected to reach xx% by 2033 due to convenience and wide reach. Within product types, e-gift cards are growing at a faster pace compared to physical cards.

Key Drivers for Online Segment:

- Increased internet and smartphone penetration.

- Convenience of online purchasing and delivery.

- Wider selection and variety of gift cards.

Key Drivers for Retail Consumer Segment:

- Gift-giving occasions throughout the year.

- Convenience and ease of use.

- Wide availability across different retail stores.

Dominance Analysis: While the offline segment currently holds a larger market share due to established retail presence, the online segment is showing rapid growth, posing a significant challenge to the dominance of traditional retail channels. The Retail consumer segment maintains its leading position due to strong consumer spending and consistent gift-giving culture in Germany.

Germany Gift Card and Incentive Card Market Product Developments

Recent product innovations focus on enhancing convenience, personalization, and security features. The integration of loyalty programs into gift cards is gaining popularity. Technological advancements, such as QR code-based redemption and mobile wallet integration, are making gift cards more user-friendly and accessible. Furthermore, the rise of experience-based gift cards and personalized gifting options further cater to evolving consumer preferences and provide a stronger competitive advantage to companies offering more tailored products.

Key Drivers of Germany Gift Card and Incentive Card Market Growth

Several key factors are driving the growth of the German gift card and incentive card market. These include the increasing adoption of digital technologies, leading to seamless online transactions and enhanced user experience. Furthermore, strong consumer spending and a robust economy provide a fertile ground for gift card purchases. Favorable government regulations promoting e-commerce and digital payments also play a role. Lastly, innovative marketing strategies by market players effectively promote gift cards as attractive gifting options.

Challenges in the Germany Gift Card and Incentive Card Market Market

The market faces challenges such as maintaining security against fraud, ensuring regulatory compliance related to data privacy and financial transactions, and managing the complexities of cross-border transactions. Supply chain disruptions, especially prevalent in recent years, could impact the availability of physical gift cards. Furthermore, intense competition from both established players and new entrants demands continuous innovation and efficient cost management.

Emerging Opportunities in Germany Gift Card and Incentive Card Market

The growing adoption of blockchain technology presents significant opportunities for enhancing security, transparency, and efficiency in gift card transactions. Strategic partnerships between gift card providers and financial technology (Fintech) companies can expand market reach and service offerings. Moreover, the expansion into niche markets, such as offering gift cards for specific experiences or tailored gift cards for corporate incentives, presents significant growth potential.

Leading Players in the Germany Gift Card and Incentive Card Market Sector

- Amazon

- Dirk Rossmann KG

- Schwarz Beteiligungs GmbH

- dm-Drogerie Markt GmbH & Co KG

- Inter Ikea Systems BV

- Tengelmann Group

- Aldi Group

- Rewe Group

- Globus Holding GmbH & Co

- Edeka Zentral AG & Co KG

Key Milestones in Germany Gift Card and Incentive Card Market Industry

- October 2021: Coinsbee.com partners with Binance Pay, expanding its product offerings to include over 2,000 gift cards from various e-commerce platforms and in-store credit options. This significantly expands the market reach and availability of gift cards.

- September 2021: BetMGM partners with TAPPP to distribute gift cards through major retail chains. This broadened distribution channel increases the accessibility of gift cards for a wider customer base.

Strategic Outlook for Germany Gift Card and Incentive Card Market Market

The future of the German gift card and incentive card market looks promising. Continued technological advancements, evolving consumer preferences, and strategic collaborations will drive market growth. Companies that can adapt quickly to emerging trends, particularly within the digital space, and offer innovative and personalized solutions will be best positioned to capitalize on future opportunities. The market's overall potential is substantial, with substantial growth anticipated in both the online and offline segments.

Germany Gift Card and Incentive Card Market Segmentation

-

1. Product

- 1.1. E-Gift Card

- 1.2. Physical Card

-

2. Consumer

- 2.1. Retail Consumer

- 2.2. Corporate Consumer

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

Germany Gift Card and Incentive Card Market Segmentation By Geography

- 1. Germany

Germany Gift Card and Incentive Card Market Regional Market Share

Geographic Coverage of Germany Gift Card and Incentive Card Market

Germany Gift Card and Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Robust growth in the e-commerce sector expected to drive gift card market share in Germany

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. E-Gift Card

- 5.1.2. Physical Card

- 5.2. Market Analysis, Insights and Forecast - by Consumer

- 5.2.1. Retail Consumer

- 5.2.2. Corporate Consumer

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dirk Rossmann KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schwarz Beteiligungs GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 dm-Drogerie Markt GmbH & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Inter Ikea Systems BV**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tengelmann Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aldi Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rewe Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Globus Holding GmbH & Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Edeka Zentral AG & Co KG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Germany Gift Card and Incentive Card Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Gift Card and Incentive Card Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Gift Card and Incentive Card Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Germany Gift Card and Incentive Card Market Revenue billion Forecast, by Consumer 2020 & 2033

- Table 3: Germany Gift Card and Incentive Card Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Germany Gift Card and Incentive Card Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Germany Gift Card and Incentive Card Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Germany Gift Card and Incentive Card Market Revenue billion Forecast, by Consumer 2020 & 2033

- Table 7: Germany Gift Card and Incentive Card Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Germany Gift Card and Incentive Card Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Gift Card and Incentive Card Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Germany Gift Card and Incentive Card Market?

Key companies in the market include Amazon, Dirk Rossmann KG, Schwarz Beteiligungs GmbH, dm-Drogerie Markt GmbH & Co KG, Inter Ikea Systems BV**List Not Exhaustive, Tengelmann Group, Aldi Group, Rewe Group, Globus Holding GmbH & Co, Edeka Zentral AG & Co KG.

3. What are the main segments of the Germany Gift Card and Incentive Card Market?

The market segments include Product, Consumer, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Robust growth in the e-commerce sector expected to drive gift card market share in Germany.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

Oct 2021: Coinsbee.com joins forces with Binance Pay. Coinsbee currently offers 2,000 different products, and the range is expanding daily. Purchase gift cards from e-commerce staples such as Amazon, or buy cards that can be used as credit cards in-store like Cash to Code.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Gift Card and Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Gift Card and Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Gift Card and Incentive Card Market?

To stay informed about further developments, trends, and reports in the Germany Gift Card and Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence