Key Insights

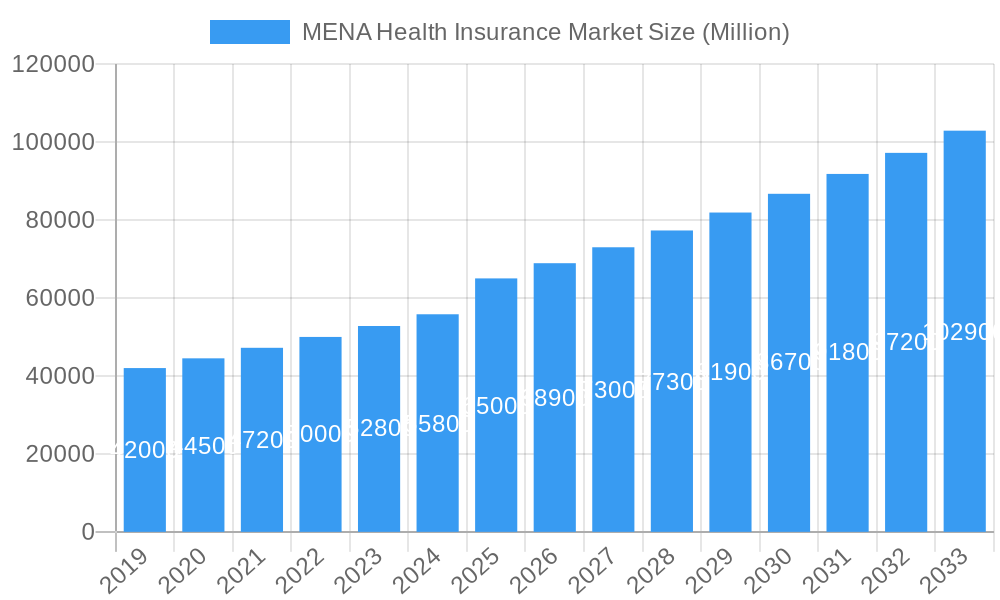

The MENA Health Insurance Market is poised for substantial growth, projected to reach an estimated market size of approximately USD 65,000 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This expansion is largely driven by an increasing awareness of health and wellness, rising disposable incomes, and a growing preference for comprehensive healthcare coverage across the region. Furthermore, government initiatives aimed at enhancing healthcare infrastructure and mandating health insurance policies for citizens and expatriates are significant catalysts. The market's dynamism is also fueled by evolving lifestyle patterns leading to a surge in non-communicable diseases, thereby increasing the demand for sophisticated medical treatments and insurance plans. Technological advancements in healthcare delivery, such as telemedicine and AI-powered diagnostics, are further shaping the landscape by improving accessibility and efficiency, which in turn boosts demand for health insurance.

MENA Health Insurance Market Market Size (In Billion)

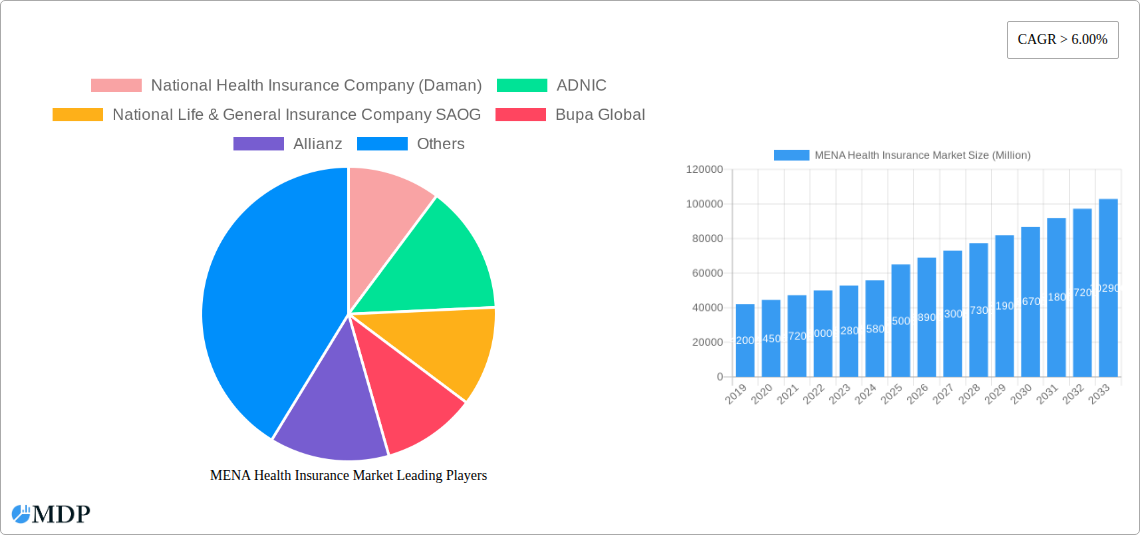

The market is segmented into Personal Insurance and Corporate Insurance, with Individual Policies and Group Policies forming key sub-segments. Within Personal Insurance, the rising middle class and increased individual health consciousness are driving demand. Corporate Insurance, conversely, is benefiting from a growing number of businesses recognizing the importance of employee welfare and retention through comprehensive health benefits. Key trends include a heightened focus on preventative care, a surge in demand for specialized medical treatments, and the integration of digital solutions for policy management and claims processing. However, the market faces restraints such as fluctuating regulatory frameworks across different MENA countries, and the relatively high cost of advanced medical procedures, which can impact affordability for some segments of the population. Despite these challenges, the strategic investments by leading companies like National Health Insurance Company (Daman), ADNIC, Bupa Global, and AXA Group, coupled with a strong commitment to innovation, are expected to propel the MENA Health Insurance Market forward.

MENA Health Insurance Market Company Market Share

MENA Health Insurance Market Report: Unlocking Growth & Opportunities (2019-2033)

Gain unparalleled insights into the rapidly expanding MENA Health Insurance Market with this comprehensive, SEO-optimized report. This definitive analysis covers the health insurance MENA, Middle East health insurance, and North Africa health insurance sectors from 2019 to 2033, with a deep dive into the base year 2025. Discover key market dynamics, industry trends, leading players, and emerging opportunities in this vital healthcare landscape.

MENA Health Insurance Market Market Dynamics & Concentration

The MENA Health Insurance Market is characterized by a moderate level of concentration, with a few dominant players holding significant market share. However, the market is experiencing increasing fragmentation due to the entry of new players and the diversification of product offerings. Innovation is a key driver, with insurers focusing on digital transformation, personalized plans, and value-added services to attract and retain customers. Regulatory frameworks are evolving, with governments increasingly mandating health insurance coverage and implementing reforms to improve healthcare accessibility and affordability. Product substitutes, such as out-of-pocket healthcare spending, are present but diminishing as mandatory insurance schemes become more prevalent. End-user trends indicate a growing demand for comprehensive coverage, especially among expatriate populations and the aging demographic. Mergers and acquisitions (M&A) are a notable aspect of market dynamics, with M&A deal counts steadily rising as larger entities seek to consolidate market presence and expand their portfolios. For instance, in October 2021, ADQ's acquisition of the remaining stake in Daman highlighted strategic consolidation within the region. The market share of leading players is constantly being reshaped by these strategic moves.

MENA Health Insurance Market Industry Trends & Analysis

The MENA Health Insurance Market is poised for robust growth, driven by a confluence of factors that are fundamentally reshaping healthcare access and delivery across the region. The projected CAGR for the forecast period (2025–2033) is xx%, indicating a significant expansion trajectory. A primary growth driver is the increasing mandatory health insurance regulations implemented by governments across various MENA countries, aiming to improve public health outcomes and reduce out-of-pocket healthcare expenditures. This is directly contributing to a rise in market penetration of health insurance policies. Technological disruptions are playing a pivotal role, with the adoption of InsurTech solutions, telemedicine, and digital health platforms enhancing customer experience, streamlining claims processing, and enabling more personalized health management programs. Consumer preferences are shifting towards greater control and transparency, demanding flexible, comprehensive plans that cater to diverse needs, including wellness programs and preventive care. The competitive dynamics are intensifying, with both established global insurers and agile local players vying for market share. This has led to a surge in product innovation and service differentiation. The growing expatriate population in key GCC countries, coupled with an increasing awareness of health and wellness, further fuels demand for high-quality health insurance solutions. Moreover, the economic diversification initiatives across the MENA region are fostering a more robust and sustainable demand for health insurance as a crucial component of employee benefits and individual financial planning. The increasing prevalence of lifestyle-related diseases is also contributing to a greater emphasis on comprehensive medical coverage.

Leading Markets & Segments in MENA Health Insurance Market

The MENA Health Insurance Market is segmented by policy type into Personal Insurance and Corporate Insurance, and by policy type into Individual Policy and Group Policy.

- Dominant Regions: The United Arab Emirates (UAE) and Saudi Arabia are leading the charge in terms of market size and growth within the MENA region.

- Economic Policies: Favorable economic policies, including strong government spending on healthcare infrastructure and a commitment to diversifying economies away from oil, are critical drivers.

- Infrastructure Development: Significant investments in state-of-the-art hospitals, clinics, and specialized medical facilities create a higher demand for health insurance to cover the costs of these advanced services.

- Country-Specific Dominance:

- United Arab Emirates (UAE): Mandatory health insurance laws in Dubai and Abu Dhabi have propelled the market forward. The presence of a large expatriate workforce also contributes significantly to the demand for comprehensive health insurance. The UAE's focus on becoming a regional healthcare hub further bolsters the insurance sector.

- Saudi Arabia: The Kingdom's Vision 2030 includes ambitious healthcare reforms, aiming to expand access and improve the quality of healthcare services. This has led to a surge in demand for both individual and corporate health insurance.

- Segment Dominance:

- Corporate Insurance: This segment is particularly dominant due to the large number of multinational corporations and local businesses operating in the region, many of which are mandated to provide health insurance for their employees.

- Key Drivers: Employer mandates, the need to attract and retain talent, and the rising cost of healthcare are primary drivers for corporate insurance growth.

- Group Policy: Closely linked to corporate insurance, group policies offer economies of scale and are a popular choice for employers.

- Key Drivers: Cost-effectiveness for employers, broader coverage options for employees, and simplified administration make group policies attractive.

- Personal Insurance & Individual Policy: While historically smaller than the corporate segment, personal insurance is witnessing steady growth.

- Key Drivers: Increasing individual awareness of healthcare costs, government initiatives promoting individual coverage, and the availability of more tailored and affordable individual plans are fueling this segment's expansion.

- Corporate Insurance: This segment is particularly dominant due to the large number of multinational corporations and local businesses operating in the region, many of which are mandated to provide health insurance for their employees.

MENA Health Insurance Market Product Developments

Product development in the MENA Health Insurance Market is increasingly focused on technological integration and customer-centricity. Insurers are launching innovative digital platforms that offer seamless policy management, online consultations via telemedicine, and access to a wide network of healthcare providers. There's a growing emphasis on preventative care and wellness programs integrated into policies, providing incentives for healthy lifestyles. Competitive advantages are being derived from bespoke plans catering to specific demographics, such as expatriates or individuals with pre-existing conditions, and the inclusion of value-added services like second medical opinions and global coverage options. These developments align with market trends towards personalized healthcare solutions and proactive health management.

Key Drivers of MENA Health Insurance Market Growth

The MENA Health Insurance Market is experiencing substantial growth driven by several key factors. Government mandates for health insurance coverage across various nations are a primary catalyst, ensuring wider access to healthcare services. The increasing awareness among individuals and corporations about the financial burden of medical expenses, coupled with the rising cost of healthcare, is significantly boosting demand. Technological advancements in InsurTech, including AI-powered claims processing and telemedicine, are enhancing efficiency and customer experience. Furthermore, the growing expatriate population in key regional economies necessitates comprehensive health coverage solutions. Economic diversification and robust healthcare infrastructure development are also creating a fertile ground for market expansion.

Challenges in the MENA Health Insurance Market Market

Despite its promising growth, the MENA Health Insurance Market faces several challenges. Regulatory complexities and varying compliance requirements across different countries can pose significant hurdles for insurers. The rising cost of healthcare services, including medical inflation and increased utilization, puts pressure on premium rates and profitability. Intense competition from both established global players and emerging local insurers can lead to price wars and reduced margins. Furthermore, fraud and abuse within the healthcare system can inflate costs and impact the overall sustainability of insurance schemes. Challenges in claims management and the need for robust digital infrastructure to support evolving customer expectations also present ongoing obstacles.

Emerging Opportunities in MENA Health Insurance Market

Emerging opportunities in the MENA Health Insurance Market are abundant and driven by several catalysts for long-term growth. The increasing adoption of InsurTech solutions presents a significant opportunity to enhance operational efficiency, personalize customer experiences, and develop innovative digital products. Strategic partnerships between insurance providers, healthcare providers, and technology companies can lead to integrated healthcare ecosystems. Market expansion into underpenetrated countries within the MENA region offers substantial untapped potential. The growing demand for specialized insurance products, such as critical illness cover, expatriate health insurance, and plans catering to specific chronic conditions, also presents lucrative avenues. Furthermore, a greater focus on preventive healthcare and wellness programs integrated into insurance offerings can drive customer loyalty and reduce long-term healthcare costs.

Leading Players in the MENA Health Insurance Market Sector

- National Health Insurance Company (Daman)

- ADNIC

- National Life & General Insurance Company SAOG

- Bupa Global

- Allianz

- Cigna

- Aetna Inc

- MetLife Services and Solutions LLC

- Misr Life Insurance

- AXA Group

- Delta Life Insurance Company Limited

- Dhofar Insurance Company SAOG

- Other Companies in the Market (6)

Key Milestones in MENA Health Insurance Market Industry

- October 2021: Abu Dhabi sovereign wealth fund, ADQ, acquired the remaining 20 percent equity stake of The National Health Insurance Company (Daman) from Munich Re. ADQ stated this acquisition would empower Daman to further advance its healthcare insurance offerings and build upon its operational excellence, innovative solutions, valuable products, and government partnerships.

- June 2021: ADNIC forged a strategic partnership with Ajman Free Zone, a hub for over 9,000 companies, investors, and entrepreneurs from more than 160 countries. This collaboration established a health insurance scheme for registered investors and entities, positioning ADNIC as a primary point of contact for all insurance-related services.

- February 2021: Health insurance provider Cigna introduced comprehensive family health coverage for expatriate employees within international small- or medium-sized enterprises (SMEs). This initiative aimed to ensure the well-being of expatriates and their family members by providing access to high-quality healthcare services regardless of their location.

Strategic Outlook for MENA Health Insurance Market Market

The strategic outlook for the MENA Health Insurance Market is overwhelmingly positive, driven by sustained demand for accessible and comprehensive healthcare solutions. Growth accelerators include the continued implementation of mandatory insurance regulations, the increasing adoption of advanced InsurTech for enhanced customer engagement and operational efficiency, and the strategic expansion into underserved markets within the region. Insurers are expected to focus on developing tailored products that address the specific needs of diverse populations, including expatriates and individuals with chronic conditions. Partnerships with healthcare providers and technology firms will be crucial for building integrated healthcare ecosystems. The market's trajectory suggests a future characterized by increased personalization, digital integration, and a stronger emphasis on preventive healthcare, all contributing to a more robust and sustainable insurance landscape in MENA.

MENA Health Insurance Market Segmentation

-

1. Type

- 1.1. Personal Insurance

- 1.2. Corporate Insurance

-

2. Policy Type

- 2.1. Individual Policy

- 2.2. Group Policy

MENA Health Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

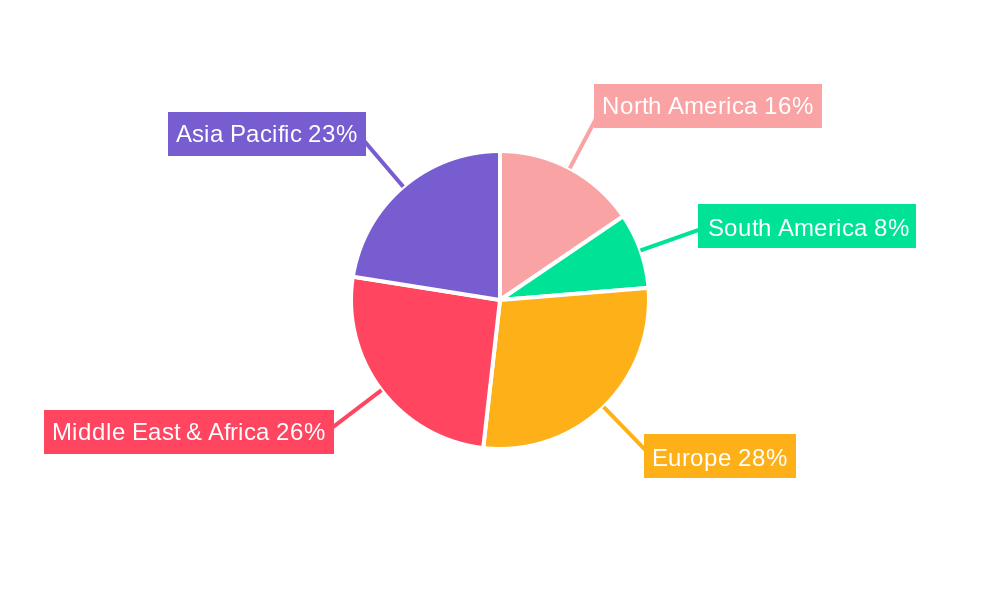

MENA Health Insurance Market Regional Market Share

Geographic Coverage of MENA Health Insurance Market

MENA Health Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Investments in the Egyptian Health Insurance System

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MENA Health Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Personal Insurance

- 5.1.2. Corporate Insurance

- 5.2. Market Analysis, Insights and Forecast - by Policy Type

- 5.2.1. Individual Policy

- 5.2.2. Group Policy

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America MENA Health Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Personal Insurance

- 6.1.2. Corporate Insurance

- 6.2. Market Analysis, Insights and Forecast - by Policy Type

- 6.2.1. Individual Policy

- 6.2.2. Group Policy

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America MENA Health Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Personal Insurance

- 7.1.2. Corporate Insurance

- 7.2. Market Analysis, Insights and Forecast - by Policy Type

- 7.2.1. Individual Policy

- 7.2.2. Group Policy

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe MENA Health Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Personal Insurance

- 8.1.2. Corporate Insurance

- 8.2. Market Analysis, Insights and Forecast - by Policy Type

- 8.2.1. Individual Policy

- 8.2.2. Group Policy

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa MENA Health Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Personal Insurance

- 9.1.2. Corporate Insurance

- 9.2. Market Analysis, Insights and Forecast - by Policy Type

- 9.2.1. Individual Policy

- 9.2.2. Group Policy

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific MENA Health Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Personal Insurance

- 10.1.2. Corporate Insurance

- 10.2. Market Analysis, Insights and Forecast - by Policy Type

- 10.2.1. Individual Policy

- 10.2.2. Group Policy

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 National Health Insurance Company (Daman)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ADNIC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 National Life & General Insurance Company SAOG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bupa Global

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Allianz

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cigna

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aetna Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MetLife Services and Solutions LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Misr Life Insurance

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AXA Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Delta Life Insurance Company Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dhofar Insurance Company SAOG*List Not Exhaustive 6 3 Other Companies in the Marke

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 National Health Insurance Company (Daman)

List of Figures

- Figure 1: Global MENA Health Insurance Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America MENA Health Insurance Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America MENA Health Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America MENA Health Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 5: North America MENA Health Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 6: North America MENA Health Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America MENA Health Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America MENA Health Insurance Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: South America MENA Health Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America MENA Health Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 11: South America MENA Health Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 12: South America MENA Health Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America MENA Health Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe MENA Health Insurance Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe MENA Health Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe MENA Health Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 17: Europe MENA Health Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 18: Europe MENA Health Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe MENA Health Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa MENA Health Insurance Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East & Africa MENA Health Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa MENA Health Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 23: Middle East & Africa MENA Health Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 24: Middle East & Africa MENA Health Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa MENA Health Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific MENA Health Insurance Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Asia Pacific MENA Health Insurance Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific MENA Health Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 29: Asia Pacific MENA Health Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 30: Asia Pacific MENA Health Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific MENA Health Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MENA Health Insurance Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global MENA Health Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 3: Global MENA Health Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global MENA Health Insurance Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global MENA Health Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 6: Global MENA Health Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global MENA Health Insurance Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global MENA Health Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 12: Global MENA Health Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global MENA Health Insurance Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global MENA Health Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 18: Global MENA Health Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global MENA Health Insurance Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global MENA Health Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 30: Global MENA Health Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global MENA Health Insurance Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global MENA Health Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 39: Global MENA Health Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific MENA Health Insurance Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MENA Health Insurance Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the MENA Health Insurance Market?

Key companies in the market include National Health Insurance Company (Daman), ADNIC, National Life & General Insurance Company SAOG, Bupa Global, Allianz, Cigna, Aetna Inc, MetLife Services and Solutions LLC, Misr Life Insurance, AXA Group, Delta Life Insurance Company Limited, Dhofar Insurance Company SAOG*List Not Exhaustive 6 3 Other Companies in the Marke.

3. What are the main segments of the MENA Health Insurance Market?

The market segments include Type, Policy Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Investments in the Egyptian Health Insurance System.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2021: Abu Dhabi sovereign wealth fund, ADQ, acquired the remaining 20 percent equity stake of The National Health Insurance Company (Daman) from Munich Re. ADQ said that acquiring the remaining stake will help Daman to further evolve in healthcare insurance and build on its operational excellence, innovative solutions, valuable products, and government partnerships.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MENA Health Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MENA Health Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MENA Health Insurance Market?

To stay informed about further developments, trends, and reports in the MENA Health Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence