Key Insights

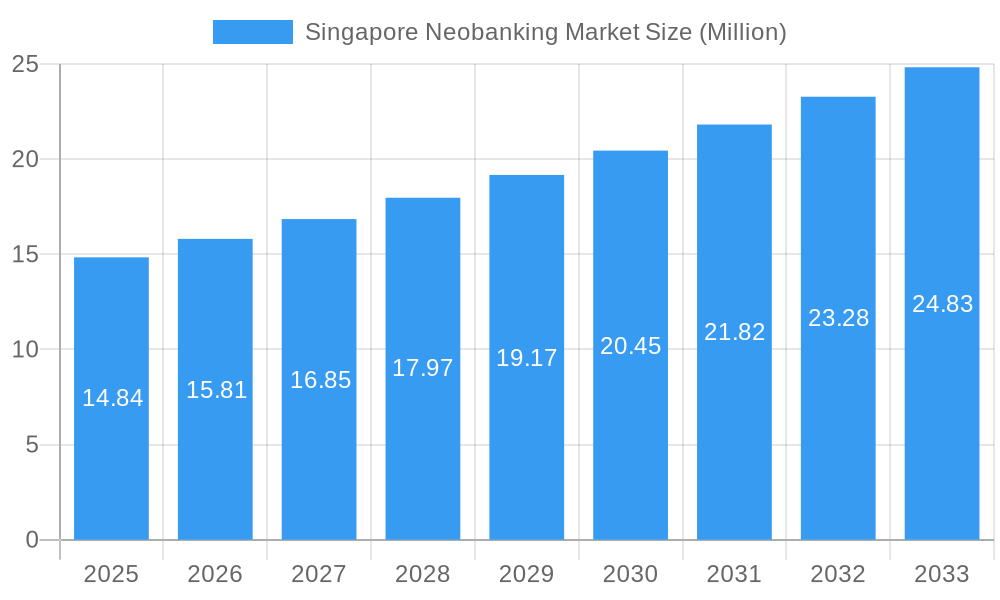

The Singapore neobanking market, valued at $14.84 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6.00% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of digital financial services among Singapore's tech-savvy population, coupled with the government's initiatives promoting fintech innovation, creates a fertile ground for neobanks. Furthermore, the demand for convenient, fee-transparent, and mobile-first banking solutions resonates strongly with younger demographics and busy professionals. Competition among established players like DBS DigiBank and emerging challengers such as TransferWise, Revolut, and Aspire fuels innovation, pushing the market forward. However, regulatory hurdles and the need to build robust cybersecurity infrastructure represent ongoing challenges. The market's segmentation is likely driven by the diverse needs of customers, with segments possibly categorized by age, income level, and specific financial needs (e.g., international money transfers, business banking). This dynamic market landscape suggests opportunities for both established financial institutions and innovative startups alike to capture significant market share.

Singapore Neobanking Market Market Size (In Million)

Looking forward, the Singapore neobanking market's trajectory hinges on several factors. Continued regulatory support and a focus on financial inclusion will be crucial for fostering further growth. The increasing integration of artificial intelligence (AI) and machine learning (ML) in providing personalized financial services will be a key differentiator. Furthermore, the development and adoption of open banking initiatives will enable greater interoperability and collaboration within the ecosystem. Neobanks’ success will depend on their ability to offer seamless customer experiences, provide competitive pricing, and effectively manage risk in an evolving regulatory landscape. The expansion into adjacent financial services, such as investments and insurance, will also be a key growth avenue for these institutions.

Singapore Neobanking Market Company Market Share

Singapore Neobanking Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Singapore neobanking market, projecting robust growth from 2025 to 2033. Leveraging data from the historical period (2019-2024) and the base year (2025), this report offers invaluable insights for investors, industry stakeholders, and businesses operating within or considering entry into this rapidly evolving sector. The report delves into market dynamics, competitive landscapes, technological advancements, and regulatory influences, offering a 360-degree view of the Singapore neobanking market's potential. Expect detailed analysis of leading players like TransferWise, YouTrip, DBS DigiBank, Revolut Ltd, Aspire, CurrencyFair, TransferGo, NeatBiz, Frank by OCBC, and Go Solo (list not exhaustive). Discover actionable strategies to navigate this exciting and lucrative market. The market is estimated to reach xx Million by 2025 and is expected to grow at a CAGR of xx% during the forecast period (2025-2033).

Singapore Neobanking Market Market Dynamics & Concentration

The Singapore neobanking market is a vibrant and rapidly evolving landscape, characterized by intense competition and a strong drive for innovation. Market concentration is currently assessed as **moderately concentrated**, with the top 5 players estimated to hold approximately 65-75% of the market share. This concentration is expected to intensify as ongoing consolidation and strategic acquisitions continue to reshape the competitive environment. Technological advancements, particularly in Artificial Intelligence (AI), blockchain, and the widespread adoption of open banking APIs, are the primary catalysts for this evolution, enabling neobanks to develop and deliver sophisticated, user-centric financial products and services. While the regulatory framework in Singapore remains robust, it is also adaptable, fostering an environment that balances innovation with prudent financial practices. Neobanks continue to differentiate themselves from traditional banks, which are increasingly offering their own digital solutions, by providing superior customer experiences, significantly lower fee structures, and more agile service delivery. The acceleration of Merger and Acquisition (M&A) activities is a testament to this dynamic, with an estimated 3-5 significant deals recorded in the past two years (2023-2024), underscoring the trend towards consolidation.

- Market Share: Top 5 players hold an estimated 65-75% of the market (2025 Estimate).

- M&A Activity: An estimated 3-5 significant deals in the last 2 years (2023-2024).

- Innovation Drivers: Advanced AI for personalization, blockchain for secure and efficient transactions, and robust Open Banking APIs for seamless integration.

- Regulatory Framework: The current regulatory landscape in Singapore is characterized by a forward-thinking approach, with the Monetary Authority of Singapore (MAS) actively promoting innovation through initiatives like regulatory sandboxes while maintaining stringent standards for consumer protection and financial stability.

Singapore Neobanking Market Industry Trends & Analysis

The Singapore neobanking market is experiencing exponential growth, driven by several key trends. Increasing smartphone penetration and digital literacy among the population are major factors, coupled with the growing preference for convenient, fee-transparent financial services. The market's CAGR during the historical period (2019-2024) was [Insert CAGR value]%, reflecting strong growth potential. Technological disruptions, particularly in areas like mobile payments and personalized financial management tools, are reshaping consumer expectations and driving innovation within the sector. The competitive landscape is intensifying, with both established neobanks and new entrants vying for market share. Market penetration for neobanking services in Singapore has reached [Insert Market Penetration Percentage] in 2025 and is projected to grow further.

Leading Markets & Segments in Singapore Neobanking Market

Within the Singapore neobanking market, the urban professional segment and the tech-savvy millennial and Gen Z demographic emerge as the dominant forces. This dominance is a direct reflection of high digital adoption rates, strong financial literacy, and a preference for agile and convenient financial solutions.

- Key Drivers:

- Pervasive Smartphone Penetration: Over 90% of the population owns smartphones, providing a direct channel for neobank services.

- High Digital Literacy Rates: A significant portion of the population is comfortable with and actively uses digital platforms for various aspects of their lives, including finance.

- Supportive Regulatory Environment: Government initiatives and a clear regulatory path encourage fintech innovation and neobank operations.

- Unmet Demand for Seamless, Transparent Financial Services: Consumers are increasingly seeking user-friendly interfaces, intuitive features, and transparent fee structures, which neobanks excel at providing.

- Governmental Push for a Smart Nation and Fintech Hub Status: Singapore's strategic vision actively supports the growth of digital economies and financial technology.

The pronounced leadership of these segments is primarily attributed to their inherent embrace of new technologies and their demand for personalized financial management tools. These digitally native consumers actively seek out neobanks that offer superior user experiences, innovative features such as budgeting tools and investment platforms, and a commitment to providing financial solutions that align with their dynamic lifestyles. The ability of neobanks to deliver these tailored solutions efficiently and cost-effectively solidifies their strong growth potential within these key market segments.

Singapore Neobanking Market Product Developments

The Singapore neobanking sector is characterized by a relentless pace of product innovation, driven by a keen understanding of evolving customer needs and the imperative to maintain a competitive edge. Recent groundbreaking developments include the integration of advanced AI-powered personalized financial advisory tools that offer real-time insights and actionable recommendations. Furthermore, neobanks are enhancing cross-border payment capabilities by leveraging cutting-edge technologies like blockchain for greater speed, security, and cost-effectiveness. Security is also a paramount focus, with the implementation of sophisticated features such as advanced biometric authentication and predictive fraud detection algorithms powered by machine learning. This unwavering commitment to elevating the user experience, bolstering security, and seamlessly integrating novel technologies is fundamental to the sustained competitive advantage of leading neobanks in the dynamic Singaporean market.

Key Drivers of Singapore Neobanking Market Growth

Several interconnected factors are fueling the robust expansion of the Singapore neobanking market. Firstly, the increasing penetration of digital technologies and a concerted push for financial inclusion are creating a substantial demand for accessible, intuitive, and user-friendly financial services. Secondly, the Singaporean government's proactive and supportive stance towards fintech innovation, manifested through favorable regulatory policies and initiatives like regulatory sandboxes, has cultivated a highly conducive ecosystem for neobank growth. Thirdly, rapid technological advancements, particularly in Artificial Intelligence (AI) for personalized services, blockchain for secure and efficient transactions, and the ubiquitous application of open banking APIs for seamless integration, are empowering neobanks to offer novel and more efficient financial solutions. Finally, a growing consumer preference for personalized, customized, and on-demand financial solutions is a significant accelerant, driving market expansion as neobanks increasingly cater to these specific demands.

Challenges in the Singapore Neobanking Market Market

The Singapore neobanking market faces certain challenges. Stringent regulatory compliance requirements can be costly and time-consuming for neobanks, potentially hindering market entry and expansion. Maintaining robust cybersecurity measures to safeguard customer data and prevent fraud is critical yet challenging, especially in the face of evolving cyber threats. Competition from both established traditional banks and other neobanks puts pressure on pricing and innovation, necessitating a strong focus on differentiation and value creation. The high costs associated with acquiring and retaining customers also pose a considerable hurdle.

Emerging Opportunities in Singapore Neobanking Market

Significant growth opportunities exist for neobanks in Singapore. Expanding into underserved segments like SMEs and the elderly population, utilizing AI for enhanced personalization and risk management, and developing innovative financial products tailored to specific consumer needs present exciting prospects. Strategic partnerships with other fintech companies and traditional financial institutions can create synergistic advantages and accelerate market penetration. Finally, exploring opportunities in cross-border payments and investments can further unlock substantial growth potential.

Leading Players in the Singapore Neobanking Market Sector

- TransferWise

- YouTrip

- DBS DigiBank

- Revolut Ltd

- Aspire

- CurrencyFair

- TransferGo

- NeatBiz

- Frank by OCBC

- Go Solo

Key Milestones in Singapore Neobanking Market Industry

- October 2022: Opal, a pioneering neobank in Asia (Singapore), secured a license and partnered with Choco Up for revenue-based financing. This signifies a landmark achievement in the regulatory landscape, potentially attracting further foreign investment.

- August 2022: Razorpay's acquisition of Ezetap strengthened its position in the POS and digital payments space, indirectly impacting the neobanking landscape by improving payment infrastructure.

Strategic Outlook for Singapore Neobanking Market Market

The Singapore neobanking market is poised for continued and significant growth, propelled by a confluence of factors including relentless technological innovation, a supportive and progressive regulatory environment, and a burgeoning consumer demand for sophisticated digital financial services. Strategic imperatives for future success lie in the deeper and more sophisticated leveraging of AI and data analytics to deliver hyper-personalized financial offerings that anticipate customer needs. Furthermore, there are substantial opportunities to expand into underserved niche segments, such as small and medium-sized enterprises (SMEs) or specific diaspora communities, and to forge strategic partnerships with established players to accelerate market penetration and broaden the scope of service offerings. The potential for outward expansion into burgeoning regional markets also significantly enhances the long-term growth trajectory and global influence of Singapore's neobanking sector.

Singapore Neobanking Market Segmentation

-

1. Account Type

- 1.1. Business Account

- 1.2. Savings Account

-

2. Services

- 2.1. Mobile Banking

- 2.2. Payments and Money Transfers

- 2.3. Savings Account

- 2.4. Loans

- 2.5. Other Sevices

-

3. Application Type

- 3.1. Personal

- 3.2. Enterprises

- 3.3. Other Applications

Singapore Neobanking Market Segmentation By Geography

- 1. Singapore

Singapore Neobanking Market Regional Market Share

Geographic Coverage of Singapore Neobanking Market

Singapore Neobanking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Digital Adoption among Consumers

- 3.3. Market Restrains

- 3.3.1. Increasing Digital Adoption among Consumers

- 3.4. Market Trends

- 3.4.1. Increasing Number of Partnership Banks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 5.1.1. Business Account

- 5.1.2. Savings Account

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Mobile Banking

- 5.2.2. Payments and Money Transfers

- 5.2.3. Savings Account

- 5.2.4. Loans

- 5.2.5. Other Sevices

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Personal

- 5.3.2. Enterprises

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TransferWise

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 YouTrip

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DBS Digi Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Revolut Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aspire

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CurrencyFair

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TransferGo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NeatBiz

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Frank by OCBC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Go Solo**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 TransferWise

List of Figures

- Figure 1: Singapore Neobanking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Neobanking Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Neobanking Market Revenue Million Forecast, by Account Type 2020 & 2033

- Table 2: Singapore Neobanking Market Volume Billion Forecast, by Account Type 2020 & 2033

- Table 3: Singapore Neobanking Market Revenue Million Forecast, by Services 2020 & 2033

- Table 4: Singapore Neobanking Market Volume Billion Forecast, by Services 2020 & 2033

- Table 5: Singapore Neobanking Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Singapore Neobanking Market Volume Billion Forecast, by Application Type 2020 & 2033

- Table 7: Singapore Neobanking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Singapore Neobanking Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Singapore Neobanking Market Revenue Million Forecast, by Account Type 2020 & 2033

- Table 10: Singapore Neobanking Market Volume Billion Forecast, by Account Type 2020 & 2033

- Table 11: Singapore Neobanking Market Revenue Million Forecast, by Services 2020 & 2033

- Table 12: Singapore Neobanking Market Volume Billion Forecast, by Services 2020 & 2033

- Table 13: Singapore Neobanking Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 14: Singapore Neobanking Market Volume Billion Forecast, by Application Type 2020 & 2033

- Table 15: Singapore Neobanking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Singapore Neobanking Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Neobanking Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Singapore Neobanking Market?

Key companies in the market include TransferWise, YouTrip, DBS Digi Bank, Revolut Ltd, Aspire, CurrencyFair, TransferGo, NeatBiz, Frank by OCBC, Go Solo**List Not Exhaustive.

3. What are the main segments of the Singapore Neobanking Market?

The market segments include Account Type, Services, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Digital Adoption among Consumers.

6. What are the notable trends driving market growth?

Increasing Number of Partnership Banks.

7. Are there any restraints impacting market growth?

Increasing Digital Adoption among Consumers.

8. Can you provide examples of recent developments in the market?

October 2022: Opal, a pioneering neo-bank in Asia (Singapore), became one of the first licensed institutions of its kind in the region. Opal has established a strategic partnership with Choco Up, a prominent player in revenue-based financing in Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Neobanking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Neobanking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Neobanking Market?

To stay informed about further developments, trends, and reports in the Singapore Neobanking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence