Key Insights

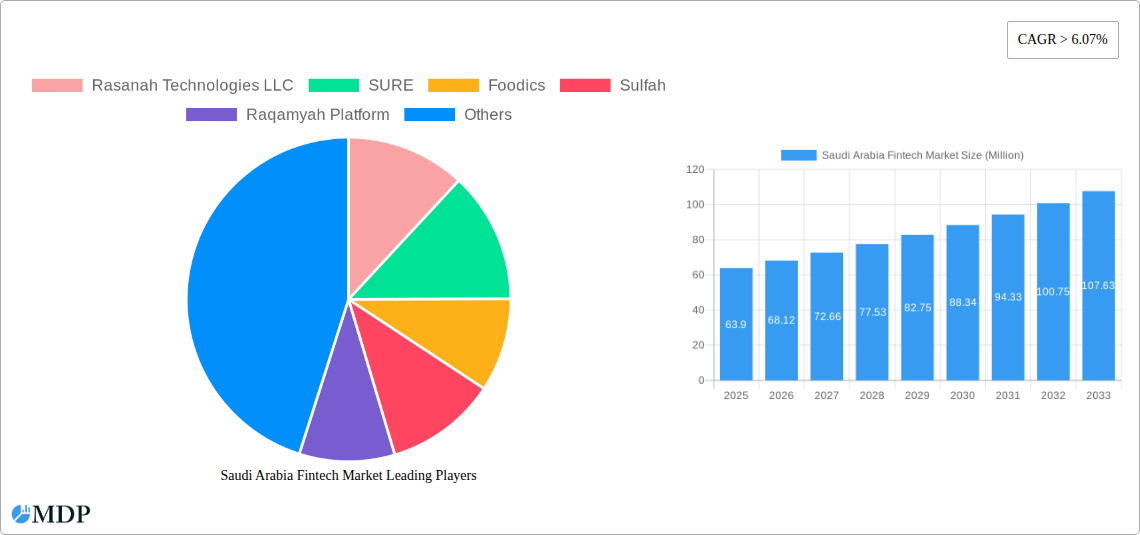

The Saudi Arabian Fintech market is experiencing robust growth, projected to reach a market size of $63.90 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6.07% from 2025 to 2033. This expansion is fueled by several key drivers. The Saudi Arabian government's Vision 2030 initiative, aimed at diversifying the economy and promoting digital transformation, is a significant catalyst. Increased smartphone penetration, rising internet usage, and a young, tech-savvy population create a fertile ground for fintech adoption. Furthermore, a burgeoning e-commerce sector and the government's push for cashless transactions are driving demand for innovative financial services. The market is segmented by various services, including payment gateways, digital lending platforms, and investment platforms, each contributing to the overall growth. Competition is intensifying with both established players and new entrants vying for market share. Companies like Rasanah Technologies LLC, SURE, Foodics, and Tamara are prominent examples of the thriving ecosystem. While challenges such as regulatory hurdles and cybersecurity concerns exist, the overall outlook for the Saudi Arabian Fintech market remains exceptionally positive, promising substantial growth throughout the forecast period.

Saudi Arabia Fintech Market Market Size (In Million)

The market's growth trajectory is expected to remain strong throughout the forecast period (2025-2033). The continued expansion of digital infrastructure, coupled with supportive government policies and increasing financial inclusion initiatives, will further accelerate adoption. Key trends include the increasing prevalence of mobile payments, the rise of open banking, and the growing use of artificial intelligence and machine learning in financial services. While challenges remain, such as addressing consumer trust and data privacy issues, the potential for innovation and market expansion is substantial. The Saudi Arabian Fintech market's success hinges on addressing these challenges and capitalizing on opportunities presented by technological advancements and favorable regulatory environments. The market’s future is bright, promising significant returns for investors and innovative solutions for consumers.

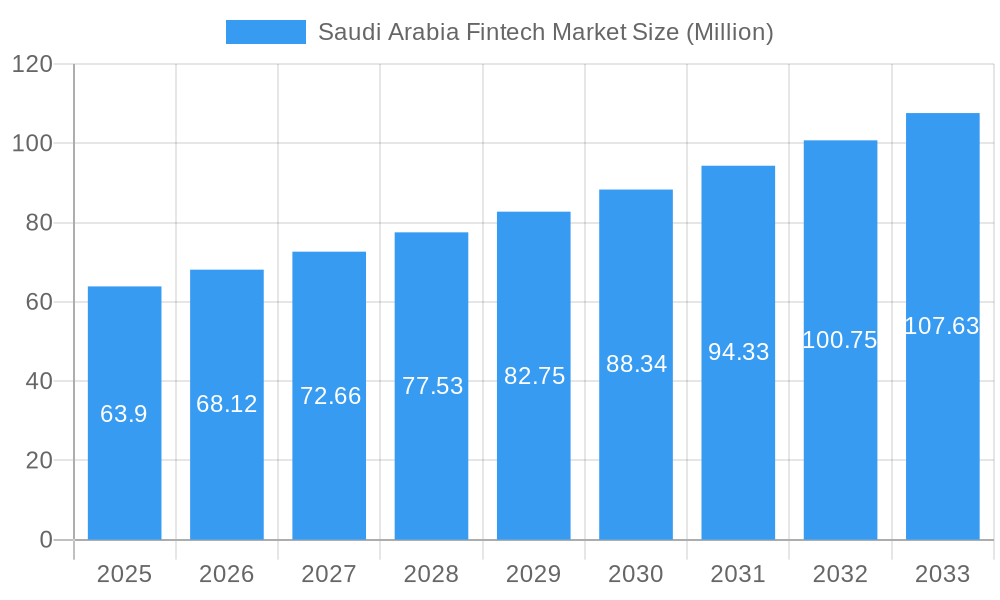

Saudi Arabia Fintech Market Company Market Share

Saudi Arabia Fintech Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Saudi Arabia Fintech market, covering the period 2019-2033. With a focus on market size, trends, key players, and future opportunities, this report is an essential resource for investors, industry stakeholders, and anyone seeking to understand this rapidly evolving sector. The report utilizes data from the historical period (2019-2024), the base year (2025), and provides forecasts for the period 2025-2033. The total market value in 2025 is estimated at xx Million.

Saudi Arabia Fintech Market Dynamics & Concentration

The Saudi Arabian Fintech market exhibits a moderately concentrated landscape with a few dominant players and a burgeoning number of startups. Market concentration is expected to evolve as the market matures, influenced by mergers and acquisitions (M&A) activity and regulatory changes. The market is driven by rapid technological advancements, a young and tech-savvy population, and government initiatives promoting digital transformation. Regulatory frameworks, though evolving, provide a supportive environment for innovation. Substitutes for traditional financial services are increasingly attractive due to the convenience and efficiency offered by Fintech solutions. End-user trends show a strong preference for mobile-based financial services and digital payment options.

- Market Share: The top three players (xx, xx, and xx) account for an estimated xx% of the market share in 2025.

- M&A Activity: The number of M&A deals in the Saudi Arabian Fintech sector increased by xx% between 2021 and 2022, indicating a trend of consolidation.

Saudi Arabia Fintech Market Industry Trends & Analysis

The Saudi Arabian Fintech market is experiencing robust growth, driven by increasing smartphone penetration, rising internet usage, and a supportive regulatory environment fostered by the Saudi Arabian Monetary Authority (SAMA). Technological disruptions, such as the adoption of AI and blockchain, are reshaping the industry. Consumer preferences are shifting towards seamless, personalized, and secure digital financial services. Competitive dynamics are intense, with both established players and new entrants vying for market share. The Compound Annual Growth Rate (CAGR) for the market is projected at xx% during the forecast period (2025-2033). Market penetration of Fintech solutions is expected to reach xx% by 2033.

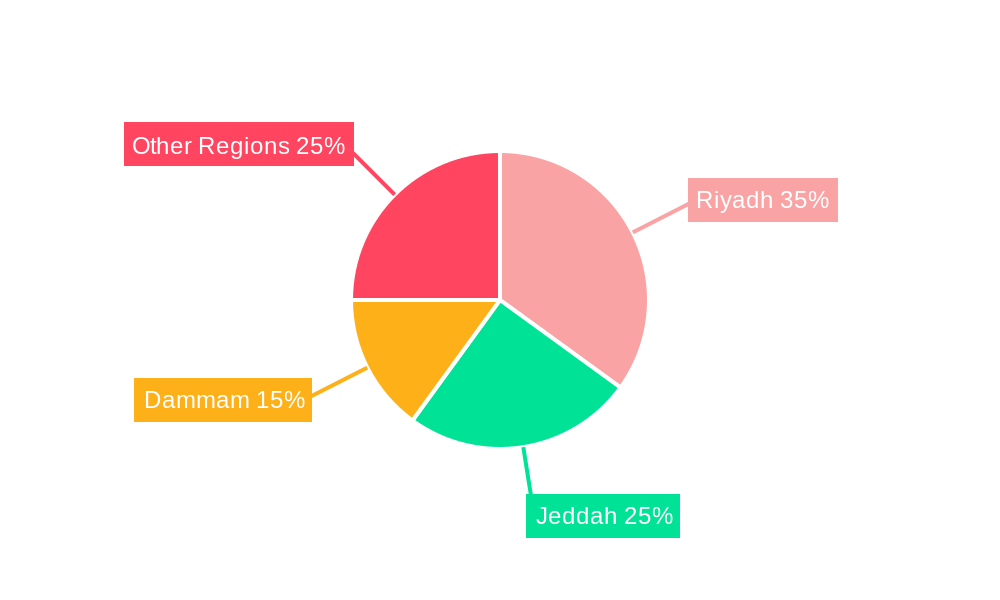

Leading Markets & Segments in Saudi Arabia Fintech Market

The Riyadh region dominates the Saudi Arabian Fintech market, driven by factors such as higher concentration of financial institutions, greater technological infrastructure, and a significant young and tech-savvy population. Other major cities such as Jeddah and Dammam also contribute significantly to the market growth.

- Key Drivers for Riyadh's Dominance:

- Robust ICT Infrastructure

- Presence of Major Financial Institutions

- Government Support for Fintech Innovation

- Concentrated Talent Pool

- Detailed Dominance Analysis: Riyadh’s dominance stems from its status as the nation's financial and technological hub. Its well-developed infrastructure, coupled with a substantial pool of skilled professionals and supportive governmental policies, creates a fertile ground for Fintech innovation and growth. This results in a higher concentration of Fintech companies and transactions compared to other regions.

Saudi Arabia Fintech Market Product Developments

The Saudi Arabian Fintech market is witnessing rapid product innovation, with a focus on developing solutions tailored to the needs of the local market. This includes advancements in mobile payments, digital lending platforms, and Islamic finance technology. The emphasis is on user-friendly interfaces, enhanced security features, and seamless integration with existing financial systems. These advancements directly impact the market by addressing existing gaps and improving financial inclusion.

Key Drivers of Saudi Arabia Fintech Market Growth

Several factors contribute to the growth of the Saudi Arabian Fintech market. Firstly, government initiatives such as Vision 2030 are actively promoting digital transformation and financial inclusion. Secondly, technological advancements in AI, machine learning, and blockchain are enabling the development of innovative Fintech solutions. Finally, increasing smartphone penetration and internet usage among the population are creating a favorable environment for the adoption of digital financial services.

Challenges in the Saudi Arabia Fintech Market

Despite the positive growth trajectory, the Saudi Arabian Fintech market faces challenges such as the need for enhanced cybersecurity measures, navigating the regulatory landscape, and fostering a culture of trust among consumers. Addressing these issues requires collaboration between Fintech companies, regulators, and consumers to establish robust security standards and build consumer confidence. The estimated cost of addressing cybersecurity vulnerabilities is projected to reach xx Million annually by 2030.

Emerging Opportunities in Saudi Arabia Fintech Market

The Saudi Arabian Fintech market presents significant long-term growth opportunities. The expansion of digital financial services into underserved rural areas, the development of innovative solutions for SMEs, and strategic partnerships between Fintech companies and traditional financial institutions all contribute to the positive outlook. Furthermore, the integration of blockchain technology for secure and transparent transactions opens doors to numerous opportunities.

Leading Players in the Saudi Arabia Fintech Market Sector

- Rasanah Technologies LLC

- SURE

- Foodics

- Sulfah

- Raqamyah Platform

- Maalem Financing Company

- Skyband

- Saudi Fintech Company

- Fleap

- Tamara

- List Not Exhaustive

Key Milestones in Saudi Arabia Fintech Market Industry

- February 2023: Hala acquires Paymennt.com, expanding its omnichannel payment capabilities and boosting payment processing by over 250% year-on-year.

- January 2022: SAMA licenses 15 new Fintech companies, bringing the total number of licensed entities to 45.

Strategic Outlook for Saudi Arabia Fintech Market Market

The Saudi Arabian Fintech market is poised for continued strong growth, fueled by government support, technological advancements, and increasing consumer adoption. Strategic partnerships, focus on innovation, and expansion into new market segments will be crucial for success. The market's future potential is significant, presenting lucrative opportunities for both established players and new entrants.

Saudi Arabia Fintech Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Marketplaces

- 1.4. Online Insurance & Insurance Marketplaces

Saudi Arabia Fintech Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Fintech Market Regional Market Share

Geographic Coverage of Saudi Arabia Fintech Market

Saudi Arabia Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Faster Transaction Drives the Market; Cost Reduction Drives the Market

- 3.3. Market Restrains

- 3.3.1. Faster Transaction Drives the Market; Cost Reduction Drives the Market

- 3.4. Market Trends

- 3.4.1. Digital Transformation and Regulatory Support Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Marketplaces

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rasanah Technologies LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SURE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Foodics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sulfah

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Raqamyah Platform

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Maalem Financing Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skyband

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saudi Fintech Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fleap

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tamara**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rasanah Technologies LLC

List of Figures

- Figure 1: Saudi Arabia Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 2: Saudi Arabia Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 3: Saudi Arabia Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Fintech Market Revenue Million Forecast, by Service Proposition 2020 & 2033

- Table 6: Saudi Arabia Fintech Market Volume Billion Forecast, by Service Proposition 2020 & 2033

- Table 7: Saudi Arabia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Fintech Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Fintech Market?

The projected CAGR is approximately > 6.07%.

2. Which companies are prominent players in the Saudi Arabia Fintech Market?

Key companies in the market include Rasanah Technologies LLC, SURE, Foodics, Sulfah, Raqamyah Platform, Maalem Financing Company, Skyband, Saudi Fintech Company, Fleap, Tamara**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Fintech Market?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Faster Transaction Drives the Market; Cost Reduction Drives the Market.

6. What are the notable trends driving market growth?

Digital Transformation and Regulatory Support Driving the Market.

7. Are there any restraints impacting market growth?

Faster Transaction Drives the Market; Cost Reduction Drives the Market.

8. Can you provide examples of recent developments in the market?

February 2023: Hala, a fintech company in Saudi Arabia, purchased Paymennt.com, a payments service provider based in the United Arab Emirates. With this acquisition, Hala can handle omnichannel payments, integrate digital payments into its product offerings, and help its SME clients become more visible online. According to a press release by Wamda, the platform's payment processing increased by more than 250% yearly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Fintech Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence