Key Insights

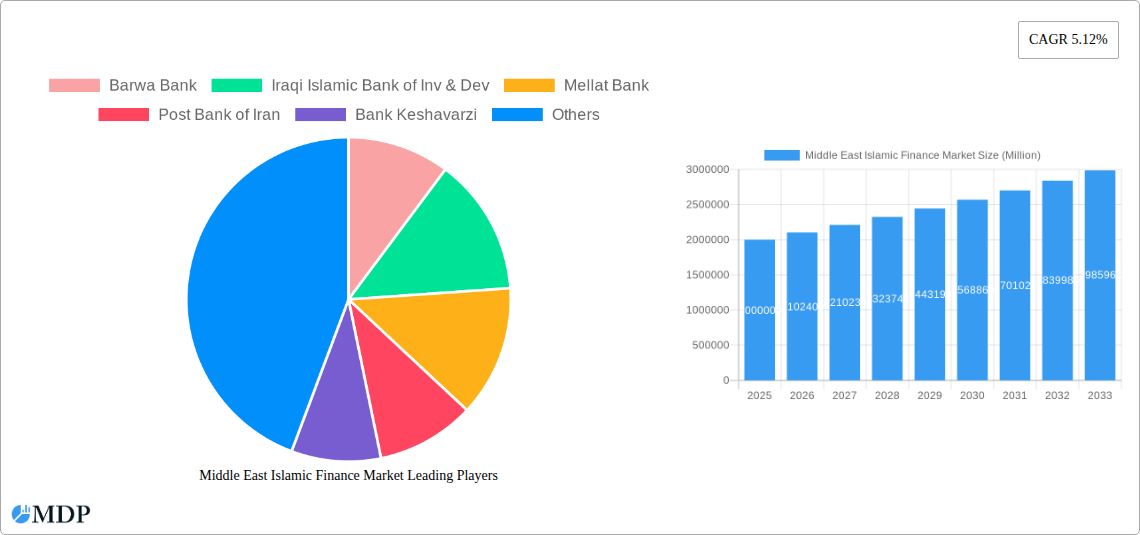

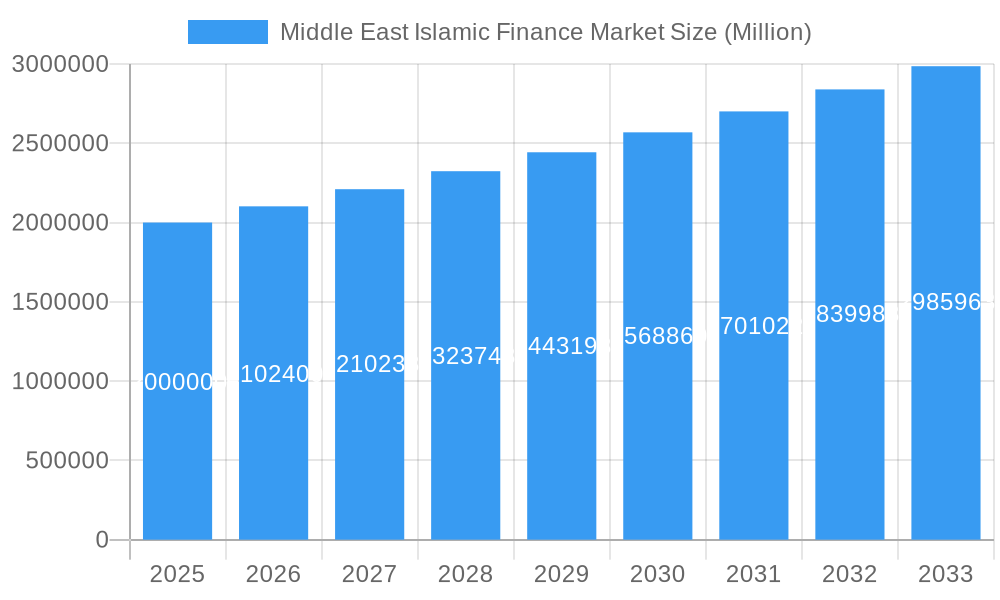

The Middle East Islamic finance market, currently valued at approximately $2 trillion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.12% from 2025 to 2033. This expansion is fueled by several key drivers. The region's predominantly Muslim population provides a substantial and naturally inclined consumer base for Sharia-compliant financial products and services. Furthermore, supportive government policies and regulations across various Middle Eastern countries are actively promoting the growth of the Islamic finance sector. Increased awareness and acceptance of Islamic finance principles among both individuals and corporations are also contributing significantly. The increasing demand for ethical and socially responsible investments aligns perfectly with the core tenets of Islamic finance, further propelling market expansion. Competition among established players like Barwa Bank, Iraqi Islamic Bank of Investment & Development, Mellat Bank, and others, along with the entry of new players, is fostering innovation and driving down costs, making Islamic finance more accessible.

Middle East Islamic Finance Market Market Size (In Million)

However, the market's growth is not without its challenges. Regulatory inconsistencies across different countries in the Middle East can create complexities for financial institutions operating across borders. A lack of standardized accounting practices and limited access to sophisticated financial technology (FinTech) solutions in certain regions are also potential restraints. Despite these challenges, the overall outlook remains positive. The continued focus on infrastructure development, diversification of the regional economies, and the growing youth population, eager to embrace modern financial services, are expected to significantly contribute to the market's continued growth throughout the forecast period. The segmentation of the market (data not provided) will likely reflect different product offerings like Islamic banking, takaful (Islamic insurance), and sukuk (Islamic bonds), each with its own growth trajectory. The diverse range of participating banks demonstrates the breadth of the market and its potential for future expansion.

Middle East Islamic Finance Market Company Market Share

Middle East Islamic Finance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East Islamic Finance Market, covering market dynamics, industry trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is crucial for investors, financial institutions, and industry stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market. The report analyzes a market valued at XX Million in 2025 and projects substantial growth to XX Million by 2033, achieving a CAGR of XX%.

Middle East Islamic Finance Market Market Dynamics & Concentration

The Middle East Islamic finance market exhibits a complex interplay of factors influencing its concentration and growth. Market share is currently dominated by a few key players, with the top five banks holding an estimated XX% of the market. However, increasing competition from smaller, agile fintech firms is challenging the established order. Innovation in Islamic financial products, driven by technological advancements and evolving consumer needs, is a major driver of market expansion. Regulatory frameworks, particularly those concerning Sharia compliance, play a critical role in shaping market behavior and influencing investor confidence. The presence of substitute financial products (conventional banking) introduces competitive pressure. End-user trends show a growing preference for digital banking solutions and a demand for greater transparency and accessibility. M&A activity in the sector has been moderate over the historical period (2019-2024), with approximately XX deals recorded, indicating a strategic focus on consolidation and expansion among major players.

Middle East Islamic Finance Market Industry Trends & Analysis

The Middle East Islamic finance market is experiencing robust growth fueled by several key factors. Increasing religious awareness and the growing preference for Sharia-compliant financial products are primary drivers. Technological disruptions, particularly the rise of fintech and digital banking platforms, are enhancing efficiency and accessibility for a wider range of customers. Consumer preferences are shifting towards personalized financial solutions and greater transparency in financial transactions. The competitive landscape is increasingly dynamic, with both established players and new entrants vying for market share. This competition is driving innovation in product development and service delivery. Market penetration of Islamic finance products continues to grow, particularly in retail banking and investment sectors, further contributing to the overall market expansion. The sector's CAGR during the forecast period (2025-2033) is projected to be XX%, demonstrating substantial growth potential.

Leading Markets & Segments in Middle East Islamic Finance Market

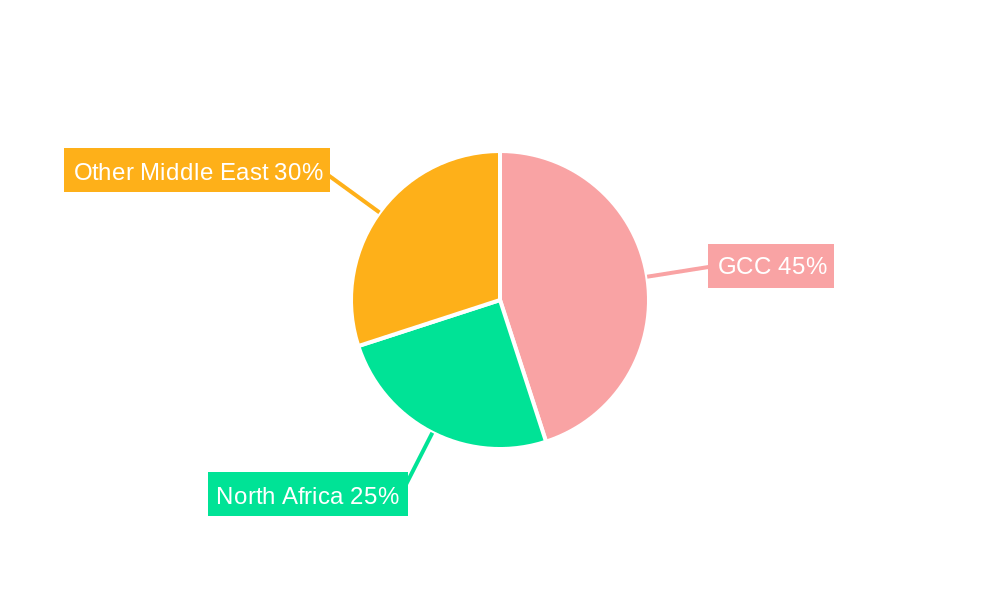

The Saudi Arabian market currently holds a dominant position in the Middle East Islamic finance sector, largely driven by strong government support for the industry and a substantial domestic population aligned with Islamic principles. Other key regional markets include the UAE, Kuwait, and Bahrain.

Key Drivers of Saudi Arabia's Dominance:

- Strong Government Support: Proactive government policies promoting Islamic finance.

- Large Population Base: A significant population base adhering to Islamic principles.

- Robust Infrastructure: Well-developed financial infrastructure supporting industry growth.

- Significant Investment in Fintech: Investment in innovative financial technologies.

The Sukuk market represents a significant segment, followed by Islamic banking and Takaful (Islamic insurance). The dominance of Saudi Arabia stems from a combination of favourable regulatory environments, economic strength, and a large population embracing Islamic financial products. Other countries are catching up through strategic initiatives and investments in infrastructure.

Middle East Islamic Finance Market Product Developments

Recent product developments in the Middle East Islamic finance market reflect a growing focus on technological innovation and customer-centric solutions. The integration of fintech solutions, such as mobile banking and online platforms, has expanded accessibility and efficiency. New product offerings, including tailored investment vehicles and Sharia-compliant wealth management services, cater to the diverse needs of the customer base. This adaptation to evolving technological trends ensures continued market relevance and competitiveness.

Key Drivers of Middle East Islamic Finance Market Growth

The growth of the Middle East Islamic finance market is driven by a confluence of technological, economic, and regulatory factors. Technological advancements like blockchain technology and AI enhance efficiency and transparency. Economic growth in the region, coupled with increasing disposable incomes, fuels demand for financial services. Supportive government regulations and initiatives further accelerate market expansion.

Challenges in the Middle East Islamic Finance Market Market

The Middle East Islamic finance market faces several challenges. Strict Sharia compliance requirements can complicate product development and increase operational costs. The fluctuating global economic climate can significantly impact investor sentiment and market stability. Competition from conventional banking institutions remains a persistent challenge. Addressing these challenges requires a proactive approach focused on regulatory streamlining, product innovation, and effective risk management.

Emerging Opportunities in Middle East Islamic Finance Market

Several emerging opportunities are poised to drive long-term growth. The increasing adoption of digital technologies, including AI and blockchain, presents immense potential for enhancing efficiency and accessibility. Strategic partnerships between Islamic financial institutions and technology companies can further expand product offerings and reach. Market expansion into untapped segments, including microfinance and sustainable finance, offers considerable scope for future growth. The development of innovative Sharia-compliant financial products tailored to specific needs offers considerable market potential.

Leading Players in the Middle East Islamic Finance Market Sector

- Barwa Bank

- Iraqi Islamic Bank of Inv & Dev

- Mellat Bank

- Post Bank of Iran

- Bank Keshavarzi

- Abu Dhabi Commercial Bank

- Saudi British Bank

- Riyad Bank List Not Exhaustive

Key Milestones in Middle East Islamic Finance Market Industry

- September 2023: The Abu Dhabi Securities Exchange (ADX) partnered with Sharjah Islamic Bank (SIB) to improve IPO subscription access for investors, signifying enhanced market accessibility and investor confidence.

- March 2023: Aafaq Islamic Finance's partnership with Rasmala broadened product offerings and provided advisory services, indicating strategic collaborations driving product innovation and market expansion.

Strategic Outlook for Middle East Islamic Finance Market Market

The Middle East Islamic finance market is poised for significant growth, driven by technological advancements, supportive government policies, and evolving consumer preferences. Strategic partnerships and product innovation are critical for capturing market share and driving long-term success. Focusing on sustainability and ethical investment practices will further enhance the industry's appeal and attract new investors. The market's future potential lies in adapting to technological advancements, promoting financial inclusion, and continuously refining Sharia-compliant products to meet the changing needs of a diverse customer base.

Middle East Islamic Finance Market Segmentation

-

1. Financial Sector

- 1.1. Islamic Banking

- 1.2. Islamic Insurance 'Takaful'

- 1.3. Islamic Bonds 'Sukuk'

- 1.4. Other Fi

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. Qatar

- 2.3. Iraq

- 2.4. Iran

- 2.5. United Arab Emirates

- 2.6. Rest of Middle East

Middle East Islamic Finance Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Qatar

- 3. Iraq

- 4. Iran

- 5. United Arab Emirates

- 6. Rest of Middle East

Middle East Islamic Finance Market Regional Market Share

Geographic Coverage of Middle East Islamic Finance Market

Middle East Islamic Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Muslim Population is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Growing Muslim Population is Driving the Market

- 3.4. Market Trends

- 3.4.1. Growing Fintech Digital Sukuk

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 5.1.1. Islamic Banking

- 5.1.2. Islamic Insurance 'Takaful'

- 5.1.3. Islamic Bonds 'Sukuk'

- 5.1.4. Other Fi

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. Qatar

- 5.2.3. Iraq

- 5.2.4. Iran

- 5.2.5. United Arab Emirates

- 5.2.6. Rest of Middle East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Qatar

- 5.3.3. Iraq

- 5.3.4. Iran

- 5.3.5. United Arab Emirates

- 5.3.6. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6. Saudi Arabia Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 6.1.1. Islamic Banking

- 6.1.2. Islamic Insurance 'Takaful'

- 6.1.3. Islamic Bonds 'Sukuk'

- 6.1.4. Other Fi

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. Qatar

- 6.2.3. Iraq

- 6.2.4. Iran

- 6.2.5. United Arab Emirates

- 6.2.6. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7. Qatar Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 7.1.1. Islamic Banking

- 7.1.2. Islamic Insurance 'Takaful'

- 7.1.3. Islamic Bonds 'Sukuk'

- 7.1.4. Other Fi

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. Qatar

- 7.2.3. Iraq

- 7.2.4. Iran

- 7.2.5. United Arab Emirates

- 7.2.6. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8. Iraq Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 8.1.1. Islamic Banking

- 8.1.2. Islamic Insurance 'Takaful'

- 8.1.3. Islamic Bonds 'Sukuk'

- 8.1.4. Other Fi

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. Qatar

- 8.2.3. Iraq

- 8.2.4. Iran

- 8.2.5. United Arab Emirates

- 8.2.6. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9. Iran Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 9.1.1. Islamic Banking

- 9.1.2. Islamic Insurance 'Takaful'

- 9.1.3. Islamic Bonds 'Sukuk'

- 9.1.4. Other Fi

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. Qatar

- 9.2.3. Iraq

- 9.2.4. Iran

- 9.2.5. United Arab Emirates

- 9.2.6. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10. United Arab Emirates Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 10.1.1. Islamic Banking

- 10.1.2. Islamic Insurance 'Takaful'

- 10.1.3. Islamic Bonds 'Sukuk'

- 10.1.4. Other Fi

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. Qatar

- 10.2.3. Iraq

- 10.2.4. Iran

- 10.2.5. United Arab Emirates

- 10.2.6. Rest of Middle East

- 10.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11. Rest of Middle East Middle East Islamic Finance Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 11.1.1. Islamic Banking

- 11.1.2. Islamic Insurance 'Takaful'

- 11.1.3. Islamic Bonds 'Sukuk'

- 11.1.4. Other Fi

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Saudi Arabia

- 11.2.2. Qatar

- 11.2.3. Iraq

- 11.2.4. Iran

- 11.2.5. United Arab Emirates

- 11.2.6. Rest of Middle East

- 11.1. Market Analysis, Insights and Forecast - by Financial Sector

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Barwa Bank

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Iraqi Islamic Bank of Inv & Dev

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Mellat Bank

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Post Bank of Iran

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bank Keshavarzi

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Abu Dhabi Commercial Bank

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Saudi British Bank

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Riyad Bank**List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Barwa Bank

List of Figures

- Figure 1: Global Middle East Islamic Finance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Middle East Islamic Finance Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 4: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 5: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 6: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 7: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 8: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 9: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 11: Saudi Arabia Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Saudi Arabia Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 13: Saudi Arabia Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Saudi Arabia Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Qatar Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 16: Qatar Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 17: Qatar Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 18: Qatar Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 19: Qatar Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 20: Qatar Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 21: Qatar Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 22: Qatar Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 23: Qatar Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Qatar Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: Qatar Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Qatar Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Iraq Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 28: Iraq Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 29: Iraq Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 30: Iraq Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 31: Iraq Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 32: Iraq Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 33: Iraq Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 34: Iraq Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 35: Iraq Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Iraq Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 37: Iraq Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Iraq Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Iran Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 40: Iran Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 41: Iran Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 42: Iran Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 43: Iran Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 44: Iran Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 45: Iran Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Iran Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 47: Iran Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Iran Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Iran Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Iran Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 52: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 53: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 54: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 55: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 56: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 57: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 58: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 59: United Arab Emirates Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 60: United Arab Emirates Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: United Arab Emirates Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: United Arab Emirates Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Financial Sector 2025 & 2033

- Figure 64: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Financial Sector 2025 & 2033

- Figure 65: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Financial Sector 2025 & 2033

- Figure 66: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Financial Sector 2025 & 2033

- Figure 67: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Geography 2025 & 2033

- Figure 68: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Geography 2025 & 2033

- Figure 69: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 70: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Geography 2025 & 2033

- Figure 71: Rest of Middle East Middle East Islamic Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Rest of Middle East Middle East Islamic Finance Market Volume (Trillion), by Country 2025 & 2033

- Figure 73: Rest of Middle East Middle East Islamic Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Rest of Middle East Middle East Islamic Finance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 2: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 3: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 5: Global Middle East Islamic Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 8: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 9: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 11: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 14: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 15: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 17: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 20: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 21: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 23: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 26: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 27: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 29: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 32: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 33: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 35: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: Global Middle East Islamic Finance Market Revenue Million Forecast, by Financial Sector 2020 & 2033

- Table 38: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Financial Sector 2020 & 2033

- Table 39: Global Middle East Islamic Finance Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 40: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Geography 2020 & 2033

- Table 41: Global Middle East Islamic Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Middle East Islamic Finance Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Islamic Finance Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Middle East Islamic Finance Market?

Key companies in the market include Barwa Bank, Iraqi Islamic Bank of Inv & Dev, Mellat Bank, Post Bank of Iran, Bank Keshavarzi, Abu Dhabi Commercial Bank, Saudi British Bank, Riyad Bank**List Not Exhaustive.

3. What are the main segments of the Middle East Islamic Finance Market?

The market segments include Financial Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Muslim Population is Driving the Market.

6. What are the notable trends driving market growth?

Growing Fintech Digital Sukuk.

7. Are there any restraints impacting market growth?

Growing Muslim Population is Driving the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Abu Dhabi Securities Exchange (ADX) collaborated with Sharjah Islamic Bank (SIB) to enhance and streamline access to Initial Public Offering (IPO) subscriptions for investors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Islamic Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Islamic Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Islamic Finance Market?

To stay informed about further developments, trends, and reports in the Middle East Islamic Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence