Key Insights

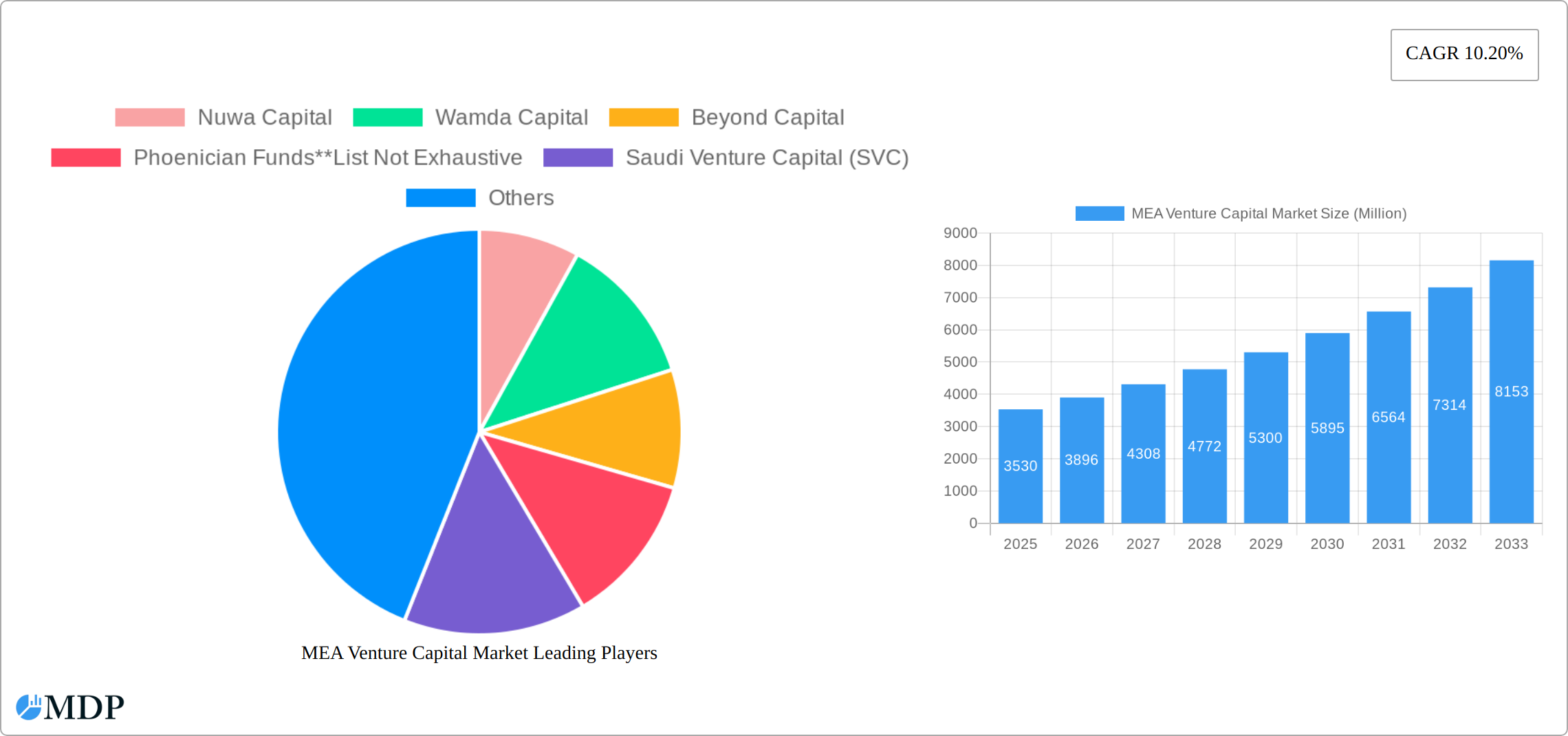

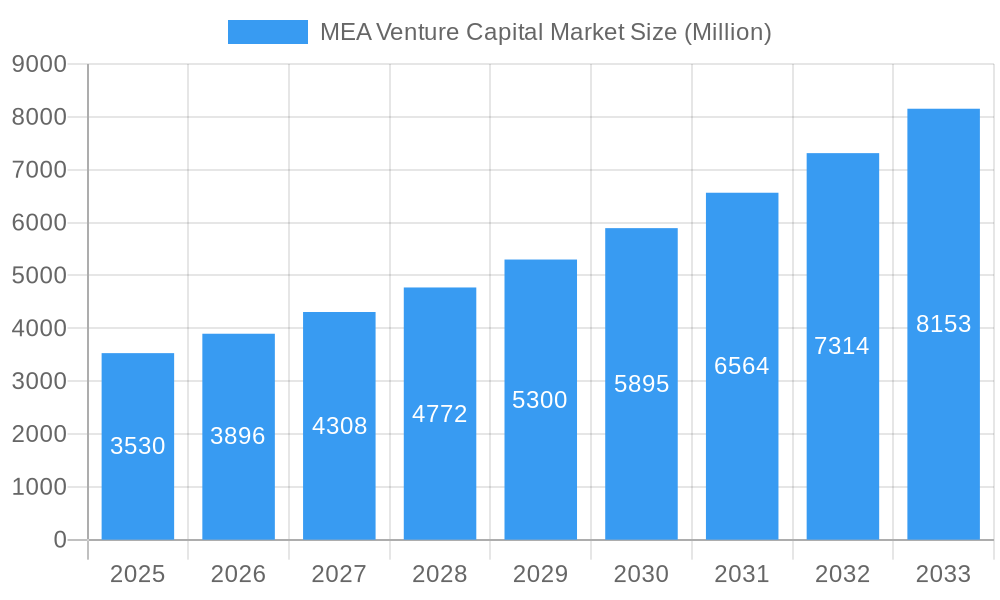

The Middle East and Africa (MEA) venture capital market is experiencing robust growth, projected to reach a market size of $3.53 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 10.20% from 2025 to 2033. This surge is driven by several factors. Firstly, a burgeoning startup ecosystem, fueled by government initiatives promoting entrepreneurship and digital transformation across sectors like fintech, e-commerce, and healthcare in countries such as the UAE and Saudi Arabia, is attracting significant investment. Secondly, the presence of established and emerging venture capital firms like Nuwa Capital, Wamda Capital, and Algebra Ventures, coupled with increasing participation from international investors, signifies a growing confidence in the region's potential. Furthermore, strategic investments in sectors with high growth potential, such as technology and logistics, are accelerating market expansion. While regulatory challenges and a relatively smaller pool of angel investors compared to more mature markets present some restraints, the overall outlook remains highly positive.

MEA Venture Capital Market Market Size (In Billion)

The continued growth trajectory is expected to be fueled by several key trends. Increasing digital adoption across the region, coupled with a young and tech-savvy population, will create new opportunities for innovative startups. Furthermore, the diversification of the regional economy, away from its traditional reliance on oil, is driving investment into technology-enabled solutions across various sectors. The increasing availability of funding through government-backed initiatives and a growing number of accelerator and incubator programs will further support the expansion of the venture capital market. While economic fluctuations in certain MEA countries could pose challenges, the long-term prospects for venture capital investment remain bright, particularly given the substantial untapped potential across various industries and the region's strategic geographical location.

MEA Venture Capital Market Company Market Share

MEA Venture Capital Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) Venture Capital market, covering the period from 2019 to 2033. It offers invaluable insights for investors, entrepreneurs, and industry stakeholders seeking to understand the market dynamics, growth opportunities, and challenges within this rapidly evolving landscape. The report leverages extensive data analysis and expert insights to provide a 360-degree view of the MEA Venture Capital market, incorporating key segments like Real Estate, Financial Services, Food & Beverage, Healthcare, Transport and Logistics, IT and ITeS, and Education, and examining both local and international investors. With a focus on key players such as Nuwa Capital, Wamda Capital, Beyond Capital, and Phoenician Funds (list not exhaustive), this report is an essential resource for navigating the complexities of this dynamic market.

MEA Venture Capital Market Market Dynamics & Concentration

The MEA venture capital market exhibits a complex interplay of factors driving its growth and shaping its competitive landscape. Market concentration is relatively moderate, with a few dominant players and a larger number of smaller, niche firms. Innovation is a key driver, fueled by a burgeoning startup ecosystem and government initiatives promoting technological advancement. Regulatory frameworks vary across the region, influencing investment flows and deal structures. While there are limited direct product substitutes for venture capital, alternative funding sources like angel investors and crowdfunding pose competitive pressures. End-user trends, including a growing preference for tech-enabled solutions and sustainable business models, are shaping investment priorities. Mergers and acquisitions (M&A) activity remains relatively low compared to more mature markets, but is increasing, indicating consolidation and strategic expansion within the sector.

- Market Share: The top 5 players hold an estimated xx% market share in 2025, while the remaining xx% is distributed amongst numerous smaller firms.

- M&A Deal Counts: An estimated xx M&A deals are anticipated in 2025, showcasing a xx% increase from 2024.

MEA Venture Capital Market Industry Trends & Analysis

The MEA venture capital market is experiencing robust growth, driven by a confluence of factors. A young and expanding population, coupled with rising disposable incomes and increasing internet penetration, fuels demand for innovative products and services. Technological disruptions, particularly in fintech, e-commerce, and healthcare, are creating exciting investment opportunities. Consumer preferences are shifting towards digital solutions and sustainable practices, influencing investment strategies. The competitive landscape is dynamic, with both local and international investors vying for promising startups. This competition is fostering innovation and driving down valuations in certain segments. The Compound Annual Growth Rate (CAGR) for the MEA venture capital market is projected to be xx% during the forecast period (2025-2033), with market penetration reaching xx% by 2033.

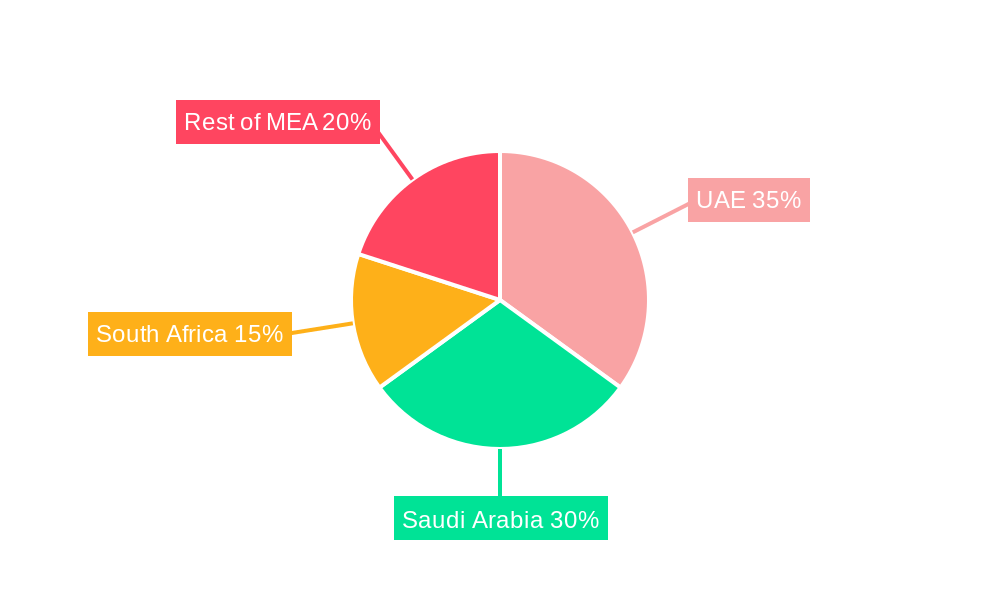

Leading Markets & Segments in MEA Venture Capital Market

The UAE and Saudi Arabia currently dominate the MEA venture capital market, driven by strong government support for innovation, robust infrastructure, and a favorable regulatory environment. Within the industry segments, IT and ITeS, followed by Fintech, attract the lion's share of investment. The Real Estate sector, while showing promising growth potential, remains comparatively less attractive for venture capital funding.

Key Drivers for UAE and Saudi Arabia:

- Pro-business government policies and supportive regulatory frameworks.

- Well-developed infrastructure and access to talent.

- Strong economic growth and high levels of foreign direct investment (FDI).

- Focus on technological innovation and digital transformation initiatives.

Dominance Analysis: The IT and ITeS sector's dominance is attributed to its high growth potential, relatively lower capital intensity, and significant opportunities to create scalable businesses. The strength of the Fintech sector is due to the increasing penetration of mobile banking and the growing demand for digital financial services. Local investors are increasingly active across several sectors, while International Investors focus on high growth areas like IT and ITeS and Fintech.

MEA Venture Capital Market Product Developments

Product innovation in the MEA venture capital market is primarily driven by technological advancements and the need for tailored investment solutions. This includes the development of specialized funds focusing on specific industry verticals (e.g., cleantech, agritech) and innovative financing structures (e.g., revenue-based financing, convertible notes). These developments enhance the competitive advantage of venture capital firms by enabling them to better cater to the diverse needs of startups in the region. The focus is on solutions that improve operational efficiency and reduce risk for startups, while accelerating their growth trajectory.

Key Drivers of MEA Venture Capital Market Growth

Several key factors contribute to the sustained growth of the MEA venture capital market. Technological advancements across diverse sectors are creating numerous investment opportunities. Favorable government policies and initiatives aimed at boosting entrepreneurship are attracting both domestic and international capital. Furthermore, the region's growing population and expanding middle class are fueling demand for innovative goods and services, generating more investment opportunities.

Challenges in the MEA Venture Capital Market Market

Despite the growth potential, the MEA venture capital market faces several challenges. Regulatory hurdles and bureaucratic processes can sometimes hinder investment flows. Supply chain disruptions, particularly during times of global uncertainty, can negatively impact the performance of portfolio companies. Competition from established players and alternative financing sources further complicates the landscape. These challenges are estimated to reduce overall investment volume by approximately xx Million in 2025.

Emerging Opportunities in MEA Venture Capital Market

Long-term growth in the MEA venture capital market is supported by several promising factors. Technological breakthroughs in areas like artificial intelligence and renewable energy are presenting lucrative opportunities. Strategic partnerships between established corporations and startups are fostering innovation and creating mutually beneficial outcomes. Expansion into underserved markets within the region holds significant potential for significant returns. The establishment of regional and international partnerships is expected to stimulate this growth.

Leading Players in the MEA Venture Capital Market Sector

- Nuwa Capital

- Wamda Capital

- Beyond Capital

- Phoenician Funds

- Saudi Venture Capital (SVC)

- Falt6Labs Bahrain

- Global ventures

- Vision Ventures

- Algebra Ventures

- 500 Startups

Key Milestones in MEA Venture Capital Market Industry

- February 2023: Saudi Venture Capital Investment Company launches a USD 1 Million income growth fund (SVC Sukuk Fund). This initiative significantly boosts the availability of capital for Saudi Arabian startups.

- February 2023: Flat6Labs completes the first close of its USD 20 Million 'Startup Seed Fund' in Saudi Arabia, with participation from the Saudi Venture Capital Company (SVC) and the 'Jada' Fund of Funds. This collaboration highlights the increasing alignment between government-backed funds and private investors in the region.

Strategic Outlook for MEA Venture Capital Market Market

The MEA venture capital market is poised for significant growth over the next decade. The ongoing digital transformation, coupled with supportive government policies, will continue to attract investment. Strategic partnerships and the emergence of innovative investment models will further enhance the market's potential. Focusing on sectors with high growth potential, such as fintech and renewable energy, will be crucial for maximizing returns in this dynamic market. The market is expected to reach a value of approximately xx Million by 2033.

MEA Venture Capital Market Segmentation

-

1. Type

- 1.1. Local Investors

- 1.2. International Investors

-

2. Industry

- 2.1. Real Estate

- 2.2. Financial Services

- 2.3. Food & Beverage

- 2.4. Healthcare

- 2.5. Transport and Logistics

- 2.6. IT and ITeS

- 2.7. Education

- 2.8. Other Industries (Energy, etc.)

MEA Venture Capital Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Venture Capital Market Regional Market Share

Geographic Coverage of MEA Venture Capital Market

MEA Venture Capital Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Leading Share of Passenger Vehicles in Car Sales; Quick Processing of Loan through Digital Banking

- 3.3. Market Restrains

- 3.3.1. Rising Interest Rates Affecting New Auto Buyers Demand for Loan

- 3.4. Market Trends

- 3.4.1. The United Arab Emirates Attracts Higher Investments in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Local Investors

- 5.1.2. International Investors

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Real Estate

- 5.2.2. Financial Services

- 5.2.3. Food & Beverage

- 5.2.4. Healthcare

- 5.2.5. Transport and Logistics

- 5.2.6. IT and ITeS

- 5.2.7. Education

- 5.2.8. Other Industries (Energy, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America MEA Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Local Investors

- 6.1.2. International Investors

- 6.2. Market Analysis, Insights and Forecast - by Industry

- 6.2.1. Real Estate

- 6.2.2. Financial Services

- 6.2.3. Food & Beverage

- 6.2.4. Healthcare

- 6.2.5. Transport and Logistics

- 6.2.6. IT and ITeS

- 6.2.7. Education

- 6.2.8. Other Industries (Energy, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America MEA Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Local Investors

- 7.1.2. International Investors

- 7.2. Market Analysis, Insights and Forecast - by Industry

- 7.2.1. Real Estate

- 7.2.2. Financial Services

- 7.2.3. Food & Beverage

- 7.2.4. Healthcare

- 7.2.5. Transport and Logistics

- 7.2.6. IT and ITeS

- 7.2.7. Education

- 7.2.8. Other Industries (Energy, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe MEA Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Local Investors

- 8.1.2. International Investors

- 8.2. Market Analysis, Insights and Forecast - by Industry

- 8.2.1. Real Estate

- 8.2.2. Financial Services

- 8.2.3. Food & Beverage

- 8.2.4. Healthcare

- 8.2.5. Transport and Logistics

- 8.2.6. IT and ITeS

- 8.2.7. Education

- 8.2.8. Other Industries (Energy, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa MEA Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Local Investors

- 9.1.2. International Investors

- 9.2. Market Analysis, Insights and Forecast - by Industry

- 9.2.1. Real Estate

- 9.2.2. Financial Services

- 9.2.3. Food & Beverage

- 9.2.4. Healthcare

- 9.2.5. Transport and Logistics

- 9.2.6. IT and ITeS

- 9.2.7. Education

- 9.2.8. Other Industries (Energy, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific MEA Venture Capital Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Local Investors

- 10.1.2. International Investors

- 10.2. Market Analysis, Insights and Forecast - by Industry

- 10.2.1. Real Estate

- 10.2.2. Financial Services

- 10.2.3. Food & Beverage

- 10.2.4. Healthcare

- 10.2.5. Transport and Logistics

- 10.2.6. IT and ITeS

- 10.2.7. Education

- 10.2.8. Other Industries (Energy, etc.)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nuwa Capital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wamda Capital

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Beyond Capital

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Phoenician Funds**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Saudi Venture Capital (SVC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Falt6Labs Bahrain

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Global ventures

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vision Ventures

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Algebra Ventures

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 500 Startups

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nuwa Capital

List of Figures

- Figure 1: Global MEA Venture Capital Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America MEA Venture Capital Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America MEA Venture Capital Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America MEA Venture Capital Market Revenue (Million), by Industry 2025 & 2033

- Figure 5: North America MEA Venture Capital Market Revenue Share (%), by Industry 2025 & 2033

- Figure 6: North America MEA Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America MEA Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America MEA Venture Capital Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America MEA Venture Capital Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America MEA Venture Capital Market Revenue (Million), by Industry 2025 & 2033

- Figure 11: South America MEA Venture Capital Market Revenue Share (%), by Industry 2025 & 2033

- Figure 12: South America MEA Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America MEA Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe MEA Venture Capital Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe MEA Venture Capital Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe MEA Venture Capital Market Revenue (Million), by Industry 2025 & 2033

- Figure 17: Europe MEA Venture Capital Market Revenue Share (%), by Industry 2025 & 2033

- Figure 18: Europe MEA Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe MEA Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa MEA Venture Capital Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa MEA Venture Capital Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa MEA Venture Capital Market Revenue (Million), by Industry 2025 & 2033

- Figure 23: Middle East & Africa MEA Venture Capital Market Revenue Share (%), by Industry 2025 & 2033

- Figure 24: Middle East & Africa MEA Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa MEA Venture Capital Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific MEA Venture Capital Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific MEA Venture Capital Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific MEA Venture Capital Market Revenue (Million), by Industry 2025 & 2033

- Figure 29: Asia Pacific MEA Venture Capital Market Revenue Share (%), by Industry 2025 & 2033

- Figure 30: Asia Pacific MEA Venture Capital Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific MEA Venture Capital Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Venture Capital Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global MEA Venture Capital Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 3: Global MEA Venture Capital Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global MEA Venture Capital Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global MEA Venture Capital Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 6: Global MEA Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global MEA Venture Capital Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global MEA Venture Capital Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 12: Global MEA Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global MEA Venture Capital Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global MEA Venture Capital Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 18: Global MEA Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global MEA Venture Capital Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global MEA Venture Capital Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 30: Global MEA Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global MEA Venture Capital Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global MEA Venture Capital Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 39: Global MEA Venture Capital Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific MEA Venture Capital Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Venture Capital Market?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the MEA Venture Capital Market?

Key companies in the market include Nuwa Capital, Wamda Capital, Beyond Capital, Phoenician Funds**List Not Exhaustive, Saudi Venture Capital (SVC), Falt6Labs Bahrain, Global ventures, Vision Ventures, Algebra Ventures, 500 Startups.

3. What are the main segments of the MEA Venture Capital Market?

The market segments include Type, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Leading Share of Passenger Vehicles in Car Sales; Quick Processing of Loan through Digital Banking.

6. What are the notable trends driving market growth?

The United Arab Emirates Attracts Higher Investments in the region.

7. Are there any restraints impacting market growth?

Rising Interest Rates Affecting New Auto Buyers Demand for Loan.

8. Can you provide examples of recent developments in the market?

February 2023: Saudi Venture Capital Investment Company launches a USD 1 million income growth fund. The Company launched a close-ended income and capital growth fund - SVC Sukuk Fund.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Venture Capital Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Venture Capital Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Venture Capital Market?

To stay informed about further developments, trends, and reports in the MEA Venture Capital Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence