Key Insights

The Latin American payments market is poised for significant expansion, driven by increasing digital adoption, a growing fintech ecosystem, and rising e-commerce penetration. The market is projected to reach $787.74 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 10.13%. Key growth accelerators include expanding financial inclusion, a preference for digital transactions over cash, and the proliferation of mobile wallets and Buy Now Pay Later (BNPL) services. While regulatory complexities and infrastructure gaps present challenges, innovation and strategic initiatives are fostering a positive market outlook. The market encompasses diverse payment types, user segments, and key geographies, with leading companies actively shaping the competitive landscape.

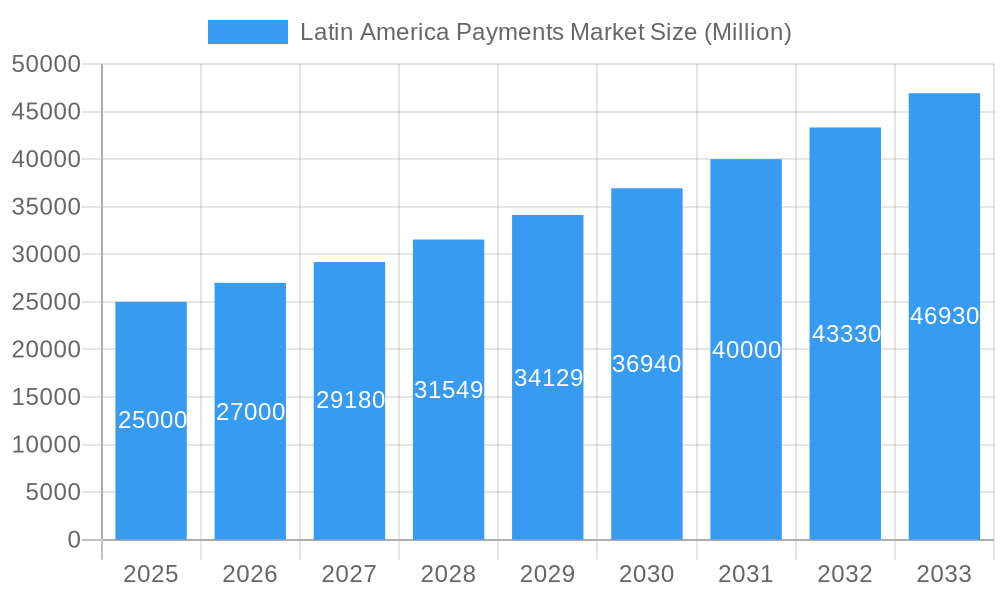

Latin America Payments Market Market Size (In Billion)

Sustained growth is underpinned by evolving consumer preferences and rapid technological advancements. Significant untapped potential exists within the region's underserved populations. Increased accessibility to digital financial services will attract new entrants and foster innovative solutions. Cybersecurity and regulatory compliance remain critical considerations, but strategic collaborations and technological advancements are expected to mitigate these risks. Future expansion will be contingent on continued digitalization, government support for financial inclusion, and enhanced digital infrastructure. The dynamic competitive environment offers opportunities for both established players and emerging businesses. The market's trajectory is shaped by a synergy of consumer demand, technological progress, and favorable economic conditions.

Latin America Payments Market Company Market Share

Latin America Payments Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America payments market, offering invaluable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's dynamics, trends, leading players, and future potential. Discover key growth drivers, emerging opportunities, and significant challenges shaping this rapidly evolving landscape. The report features detailed analysis of major players like Nubank, Uala, Ebanx, RecargaPay, Clip, Bitso, Konfio, Wilobank, Addi, and Vortx (list not exhaustive). This is a must-read for investors, businesses, and anyone seeking to understand the lucrative possibilities within the Latin American payments sector.

Latin America Payments Market Market Dynamics & Concentration

The Latin American payments market is experiencing significant transformation, driven by technological innovation, evolving regulatory frameworks, and shifting consumer preferences. Market concentration is moderate, with a few dominant players and numerous smaller, specialized firms. The market share of the top 5 players in 2024 was approximately 60%, indicating opportunities for both consolidation and disruptive innovation.

- Innovation Drivers: The widespread adoption of smartphones, increasing internet penetration, and the rise of fintech startups are key drivers of market innovation.

- Regulatory Frameworks: Varying regulatory environments across Latin American countries create both opportunities and challenges for market participants. Recent initiatives aimed at promoting financial inclusion are fostering growth.

- Product Substitutes: The emergence of alternative payment methods, such as cryptocurrencies and mobile wallets, presents both competitive pressures and opportunities for established players.

- End-User Trends: The growing preference for digital and contactless payments, fueled by younger generations' tech-savviness, is reshaping the market landscape.

- M&A Activities: The number of M&A deals in the Latin American payments market increased by xx% between 2020 and 2024, indicating a trend toward consolidation and expansion. xx major deals were recorded in 2024.

Latin America Payments Market Industry Trends & Analysis

The Latin American payments market is characterized by robust growth, driven by factors such as increasing financial inclusion, rising e-commerce adoption, and the expanding mobile banking sector. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration of digital payments is steadily increasing, with xx% of transactions occurring digitally in 2024, projected to reach xx% by 2033.

Technological disruptions, such as the widespread adoption of open banking APIs and the integration of blockchain technology, are significantly impacting the market's competitive dynamics. Consumer preferences are shifting towards convenient, secure, and cost-effective payment solutions, fueling the demand for innovative products and services. The increasing competition among established players and new fintech entrants is leading to greater price transparency and improved service offerings for consumers.

Leading Markets & Segments in Latin America Payments Market

Brazil and Mexico represent the largest markets within the Latin American payments sector, accounting for approximately xx% of the total market value in 2024. Their dominance is attributed to a combination of factors:

- Brazil: Large population, high smartphone penetration, and a well-developed e-commerce ecosystem.

- Mexico: Rapid growth in e-commerce, increasing financial inclusion initiatives, and a large underserved population.

Other key markets include Colombia, Argentina, and Chile. The fastest-growing segment is mobile payments, driven by high mobile penetration rates and the increasing adoption of mobile wallets.

- Key Drivers for Brazil and Mexico:

- Robust economic growth

- Expanding middle class

- Favorable government policies supporting financial inclusion

- Development of robust digital infrastructure

Latin America Payments Market Product Developments

The Latin America payments landscape is experiencing a dynamic evolution driven by cutting-edge product developments. Key innovations include the rapid advancement and widespread adoption of sophisticated mobile payment platforms, offering users unparalleled convenience and accessibility. To bolster trust and safeguard transactions, there's a significant integration of biometric authentication methods, from fingerprint scanning to facial recognition, providing a robust layer of security. Furthermore, the proliferation of Buy Now, Pay Later (BNPL) services is reshaping consumer purchasing habits, making goods and services more attainable and driving impulse purchases. These advancements collectively underscore the market's commitment to elevating the user experience, reinforcing transaction security, and proactively addressing the shifting preferences of the Latin American consumer. The ultimate competitive advantage will be secured by providers who can consistently deliver seamless, secure, and exceptionally affordable payment solutions meticulously designed to resonate with the unique economic and cultural nuances of the Latin American region.

Key Drivers of Latin America Payments Market Growth

A confluence of potent factors is propelling the substantial growth of the Latin American payments market. At the forefront are significant technological advancements, particularly the exponential growth in smartphone penetration and widespread access to mobile internet, which have cultivated an ideal ecosystem for the rapid adoption of digital payment solutions. Complementing this, robust economic growth, especially evident in economic powerhouses like Brazil and Mexico, has translated into increased disposable incomes and enhanced spending power, directly fueling the demand for more convenient and efficient payment methods. Moreover, the proactive stance of governments in implementing supportive regulations that champion financial inclusion and foster healthy competition has been instrumental in cultivating a more conducive and growth-oriented environment for the entire payments sector.

Challenges in the Latin America Payments Market Market

Despite significant growth potential, the Latin American payments market faces several challenges. High levels of unbanked populations in some countries limit the reach of digital payment solutions. Furthermore, varying regulatory frameworks across countries create complexities for businesses operating across multiple markets. The prevalence of informal economies in some regions also presents challenges in terms of data security and transparency. Finally, intense competition amongst market players creates price pressure and necessitates ongoing investment in innovation.

Emerging Opportunities in Latin America Payments Market

The Latin American payments market is brimming with significant and promising long-term growth opportunities. The ever-expanding realm of e-commerce, coupled with the accelerating adoption of digital banking services, is creating an insatiable demand for innovative and versatile payment solutions. A particularly fertile ground for untapped potential lies in the formation of strategic partnerships between established, trusted financial institutions and agile fintech startups, a synergy that could unlock substantial market value. The ongoing development and enhancement of robust digital infrastructure across the region are critical enablers that will facilitate the broader and more inclusive adoption of digital payment methods. Moreover, the vast untapped potential within underserved markets and rural areas presents a compelling frontier for further growth and financial inclusion.

Key Milestones in Latin America Payments Market Industry

- July 2021: Z1, a digital bank targeting Latin American Gen Zers, secured USD 2.5 Million in funding. This highlights the growing interest in fintech solutions tailored to younger demographics.

- June 2021: Conductor, a payments and banking-as-a-service platform, expanded into Mexico, signaling the increasing regional focus of key players.

Strategic Outlook for Latin America Payments Market Market

The Latin American payments market holds immense future potential, driven by sustained economic growth, increasing digital adoption, and supportive regulatory environments. Strategic partnerships, technological advancements, and focused expansion into underserved markets will be key growth accelerators. The market is poised for continued expansion, driven by the increasing demand for seamless, secure, and cost-effective payment solutions across the region. Companies that adapt quickly to evolving consumer preferences and technological advancements will be best positioned to capture significant market share.

Latin America Payments Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Marketplaces

- 1.4. Online Insurance & Insurance Marketplaces

- 1.5. Others

Latin America Payments Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Payments Market Regional Market Share

Geographic Coverage of Latin America Payments Market

Latin America Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 Brazil and Mexico

- 3.4.2 are Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Payments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Marketplaces

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nubank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Uala

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ebanx

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RecargaPay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Clip

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bitso

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Konfio

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wilobank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Addi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vortx**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nubank

List of Figures

- Figure 1: Latin America Payments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Payments Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Payments Market Revenue billion Forecast, by Service Proposition 2020 & 2033

- Table 2: Latin America Payments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Latin America Payments Market Revenue billion Forecast, by Service Proposition 2020 & 2033

- Table 4: Latin America Payments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Brazil Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Argentina Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Chile Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Colombia Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Peru Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Venezuela Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Ecuador Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Bolivia Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Paraguay Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Payments Market?

The projected CAGR is approximately 10.13%.

2. Which companies are prominent players in the Latin America Payments Market?

Key companies in the market include Nubank, Uala, Ebanx, RecargaPay, Clip, Bitso, Konfio, Wilobank, Addi, Vortx**List Not Exhaustive.

3. What are the main segments of the Latin America Payments Market?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 787.74 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Brazil and Mexico. are Dominating the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2021 - Z1, a digital bank geared at Latin American GenZers based in Sao Paulo, has secured USD 2.5 million in a round led by Homebrew in the United States. Z1 is a digital banking software designed specifically for teenagers and young people. The company was formed on the idea that Brazilian and Latin American teenagers may become more financially independent by using its app and linked prepaid card. Z1 is focused on Brazil but the startup has plans to expand into other countries in Latin America over time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Payments Market?

To stay informed about further developments, trends, and reports in the Latin America Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence