Key Insights

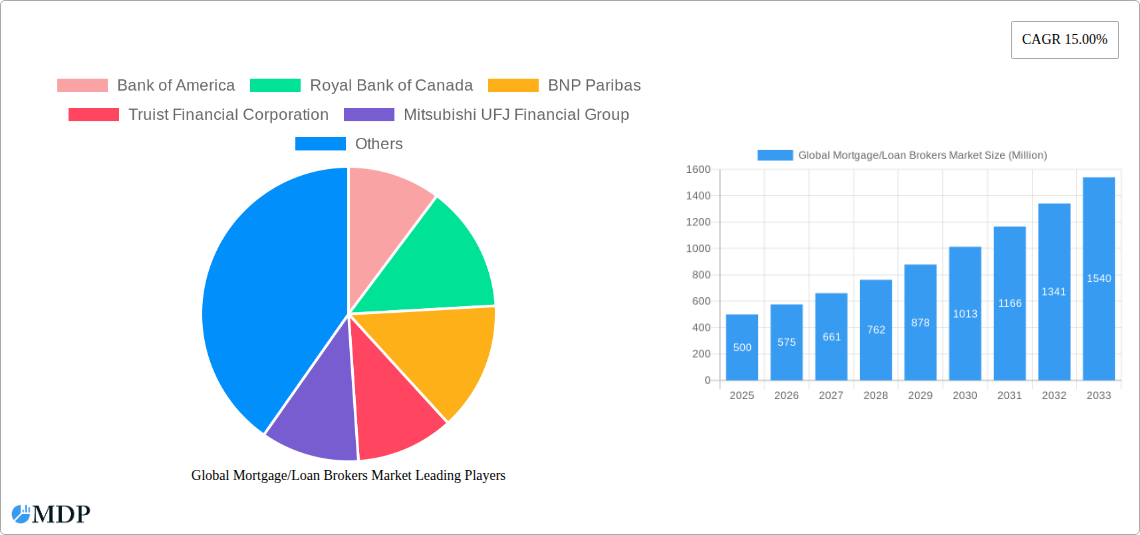

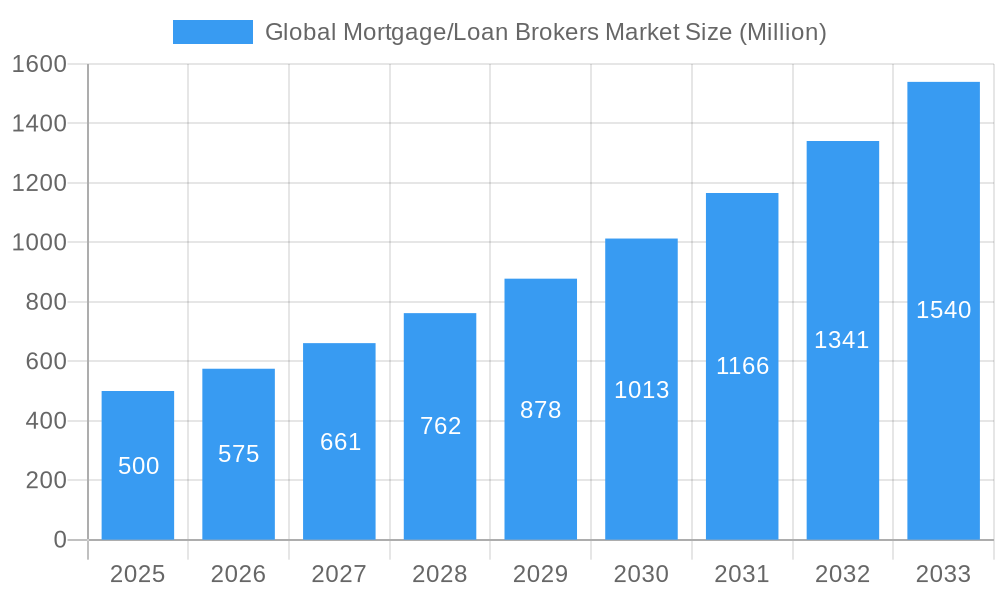

The global mortgage and loan broker market is poised for substantial expansion, projecting a 14% Compound Annual Growth Rate (CAGR) from a market size of $319.39 billion in the base year 2025. This robust growth is fueled by a confluence of factors, including escalating demand for homeownership, particularly among millennial and Gen Z demographics, who increasingly seek expert guidance through the intricate mortgage process. The proliferation of digital platforms and fintech innovations is further enhancing accessibility and efficiency in loan applications. Persistently low interest rates, while subject to economic fluctuations, continue to stimulate borrowing and contribute to market expansion. Moreover, the growing complexity of mortgage products and regulatory frameworks underscores the indispensable role of brokers in identifying optimal solutions for borrowers. Leading financial institutions such as Bank of America, Royal Bank of Canada, and BNP Paribas are strategically positioned to capitalize on this growth trajectory through their established networks and financial prowess. However, potential regulatory shifts and interest rate volatility present inherent challenges that necessitate adaptive strategies and advanced service offerings from brokers.

Global Mortgage/Loan Brokers Market Market Size (In Billion)

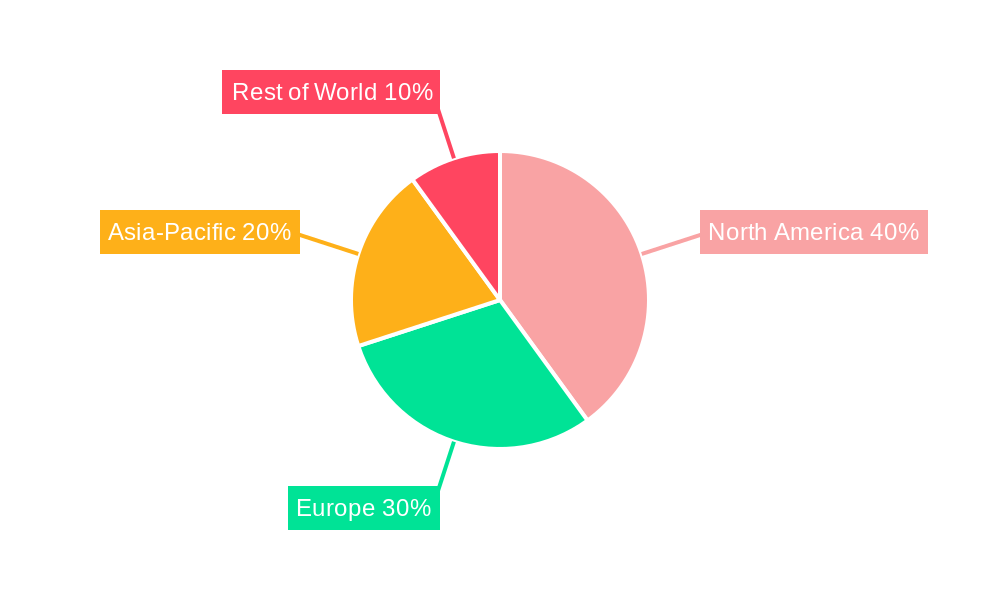

The market is characterized by intense competition among established financial institutions and agile fintech enterprises. To achieve success, companies must prioritize competitive interest rates, innovative service delivery, and superior customer experiences, necessitating strategic investments in technology and talent. Geographical market dynamics reveal significant shares held by North America and Europe, with future growth contingent upon effective regulatory environments, technological advancements, and sustained consumer confidence in the housing sector.

Global Mortgage/Loan Brokers Market Company Market Share

Global Mortgage/Loan Brokers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Global Mortgage/Loan Brokers Market, offering actionable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future potential. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Global Mortgage/Loan Brokers Market Market Dynamics & Concentration

The global mortgage/loan brokers market is characterized by a moderate level of concentration, with a few key players holding significant market share. However, the market also features a multitude of smaller, regional brokers, contributing to a dynamic competitive landscape. Market share analysis reveals that the top five players account for approximately xx% of the global market, with a gradual shift towards consolidation through mergers and acquisitions (M&A). The historical period (2019-2024) witnessed approximately xx M&A deals, indicating a trend of industry consolidation and expansion.

- Innovation Drivers: Technological advancements in fintech, particularly in areas like online lending platforms and AI-powered credit scoring, are driving innovation.

- Regulatory Frameworks: Stringent regulations regarding lending practices and consumer protection vary across geographies, influencing market dynamics.

- Product Substitutes: Alternative financing options, such as peer-to-peer lending and crowdfunding, pose a challenge to traditional mortgage brokers.

- End-User Trends: A growing preference for digital channels and personalized services is transforming the customer experience, demanding adaptation from brokers.

- M&A Activities: Consolidation is a prominent feature, with larger players acquiring smaller firms to expand their reach and service offerings.

Global Mortgage/Loan Brokers Market Industry Trends & Analysis

The global mortgage/loan brokers market is experiencing significant growth driven by several key factors. Increased urbanization, rising disposable incomes, and favorable government policies in various regions contribute to a high demand for mortgages. Technological advancements like online lending platforms and AI-driven tools are streamlining the mortgage process, attracting more customers. The market penetration of digital mortgage applications is increasing steadily, currently at xx%, and is expected to reach xx% by 2033. Competitive dynamics are largely shaped by factors like pricing strategies, service quality, and the ability to leverage technology for efficiency. The market's CAGR from 2025 to 2033 is estimated at xx%. Consumer preferences are shifting towards personalized service, quicker turnaround times, and transparency in the lending process.

Leading Markets & Segments in Global Mortgage/Loan Brokers Market

The North American region currently holds the largest market share, driven by strong economic growth, robust housing markets, and a high adoption rate of technology in the financial sector. Within North America, the United States holds the dominant position, fueled by its large population, relatively higher disposable income, and a mature real estate market.

- Key Drivers in North America:

- Strong economic growth and stable housing market.

- High consumer confidence and increased homeownership rates.

- Technological adoption and innovation within the finance sector.

- Favorable government policies supporting the housing market.

The dominance of North America is mainly attributed to the relatively advanced financial infrastructure and its strong regulatory framework. While other regions are witnessing significant growth, North America maintains its lead due to the combined factors of economic prosperity, technological advancements, and established market players.

Global Mortgage/Loan Brokers Market Product Developments

Recent product innovations focus on streamlining the mortgage application process through advanced technology and improving customer experience with personalized financial advice and digital platforms. This includes the development of user-friendly online portals, AI-powered credit scoring systems, and sophisticated risk assessment tools. These advancements aim to improve efficiency, reduce costs, and offer a better experience for consumers. The integration of blockchain technology for secure and transparent transaction processing is also emerging as a significant trend.

Key Drivers of Global Mortgage/Loan Brokers Market Growth

Several factors fuel the market's growth: a burgeoning global population and rising urbanization create a demand for housing. Favorable economic conditions in several regions increase disposable income and the ability to obtain mortgages. Technological advancements in the fintech space streamline the mortgage process, making it more accessible. Government initiatives and subsidies aimed at increasing homeownership rates in many countries further stimulate growth.

Challenges in the Global Mortgage/Loan Brokers Market Market

The market faces challenges such as stringent regulations, increased competition from online lenders and fintech companies, and fluctuating interest rates impacting affordability. Supply chain disruptions also impact the construction sector, potentially affecting the availability of mortgage-backed securities. The cybersecurity risk remains a major concern due to the increased reliance on digital platforms. The impact of these challenges is estimated to reduce the overall market growth by approximately xx% by 2033.

Emerging Opportunities in Global Mortgage/Loan Brokers Market

Long-term growth hinges on leveraging technological advancements, such as AI and machine learning, to enhance customer service and personalize loan offerings. Strategic partnerships between brokers, technology firms, and financial institutions can create efficient and scalable solutions. Expanding into emerging markets, particularly in developing economies with growing middle classes, presents substantial growth opportunities.

Leading Players in the Global Mortgage/Loan Brokers Market Sector

- Bank of America

- Royal Bank of Canada

- BNP Paribas

- Truist Financial Corporation

- Mitsubishi UFJ Financial Group

- PT Bank Central Asia Tbk

- Qatar National Bank

- Standard Chartered PLC

- China Zheshang Bank

- Federal National Mortgage Association (FNMA)

- List Not Exhaustive

Key Milestones in Global Mortgage/Loan Brokers Market Industry

- August 2022: Bank of America launched the Community Affordable Loan Solution, a new mortgage option for first-time homebuyers in specific markets, including a bank-provided down payment and no closing costs. This initiative significantly impacted the market by increasing accessibility to homeownership for underserved communities.

- November 2022: Following the acquisition of Exane, BNP Paribas expanded its operations in the United States. This expansion strengthened BNP Paribas's competitive position and broadened its reach in the global mortgage market.

Strategic Outlook for Global Mortgage/Loan Brokers Market Market

The future of the Global Mortgage/Loan Brokers Market is bright, driven by continued technological innovation, increasing demand for mortgages in developing economies, and the evolution of consumer preferences towards digital and personalized services. Brokers who embrace technology, build strategic partnerships, and adapt to changing regulatory landscapes will be well-positioned for success. The potential for market expansion in emerging economies, coupled with sustained demand in developed markets, points to substantial growth prospects in the years to come.

Global Mortgage/Loan Brokers Market Segmentation

-

1. Enterprise

- 1.1. Large

- 1.2. Small

- 1.3. Medium- sized

-

2. Application

- 2.1. Home Loans

- 2.2. Commercial and Industrial Loans

- 2.3. Vehicle Loans

- 2.4. Loans to Governments

- 2.5. Others

-

3. End - User

- 3.1. Businesses

- 3.2. Individuals

Global Mortgage/Loan Brokers Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. South America

Global Mortgage/Loan Brokers Market Regional Market Share

Geographic Coverage of Global Mortgage/Loan Brokers Market

Global Mortgage/Loan Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digitization is changing the future of Mortgage

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 5.1.1. Large

- 5.1.2. Small

- 5.1.3. Medium- sized

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home Loans

- 5.2.2. Commercial and Industrial Loans

- 5.2.3. Vehicle Loans

- 5.2.4. Loans to Governments

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End - User

- 5.3.1. Businesses

- 5.3.2. Individuals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 6. North America Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Enterprise

- 6.1.1. Large

- 6.1.2. Small

- 6.1.3. Medium- sized

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Home Loans

- 6.2.2. Commercial and Industrial Loans

- 6.2.3. Vehicle Loans

- 6.2.4. Loans to Governments

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End - User

- 6.3.1. Businesses

- 6.3.2. Individuals

- 6.1. Market Analysis, Insights and Forecast - by Enterprise

- 7. Europe Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Enterprise

- 7.1.1. Large

- 7.1.2. Small

- 7.1.3. Medium- sized

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Home Loans

- 7.2.2. Commercial and Industrial Loans

- 7.2.3. Vehicle Loans

- 7.2.4. Loans to Governments

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End - User

- 7.3.1. Businesses

- 7.3.2. Individuals

- 7.1. Market Analysis, Insights and Forecast - by Enterprise

- 8. Asia Pacific Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Enterprise

- 8.1.1. Large

- 8.1.2. Small

- 8.1.3. Medium- sized

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Home Loans

- 8.2.2. Commercial and Industrial Loans

- 8.2.3. Vehicle Loans

- 8.2.4. Loans to Governments

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End - User

- 8.3.1. Businesses

- 8.3.2. Individuals

- 8.1. Market Analysis, Insights and Forecast - by Enterprise

- 9. Middle East Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Enterprise

- 9.1.1. Large

- 9.1.2. Small

- 9.1.3. Medium- sized

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Home Loans

- 9.2.2. Commercial and Industrial Loans

- 9.2.3. Vehicle Loans

- 9.2.4. Loans to Governments

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End - User

- 9.3.1. Businesses

- 9.3.2. Individuals

- 9.1. Market Analysis, Insights and Forecast - by Enterprise

- 10. South America Global Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Enterprise

- 10.1.1. Large

- 10.1.2. Small

- 10.1.3. Medium- sized

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Home Loans

- 10.2.2. Commercial and Industrial Loans

- 10.2.3. Vehicle Loans

- 10.2.4. Loans to Governments

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End - User

- 10.3.1. Businesses

- 10.3.2. Individuals

- 10.1. Market Analysis, Insights and Forecast - by Enterprise

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bank of America

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Royal Bank of Canada

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BNP Paribas

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Truist Financial Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mitsubishi UFJ Financial Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PT Bank Central Asia Tbk

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qatar National Bank

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Standard Chartered PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 China Zheshang Bank

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Federal National Mortgage Association (FNMA)**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bank of America

List of Figures

- Figure 1: Global Global Mortgage/Loan Brokers Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Global Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 3: North America Global Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 4: North America Global Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Global Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Global Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 7: North America Global Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 8: North America Global Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Global Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 11: Europe Global Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 12: Europe Global Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Global Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Global Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 15: Europe Global Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 16: Europe Global Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Global Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 19: Asia Pacific Global Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 20: Asia Pacific Global Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Global Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Global Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 23: Asia Pacific Global Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 24: Asia Pacific Global Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Global Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 27: Middle East Global Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 28: Middle East Global Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East Global Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Global Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 31: Middle East Global Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 32: Middle East Global Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East Global Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Mortgage/Loan Brokers Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 35: South America Global Mortgage/Loan Brokers Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 36: South America Global Mortgage/Loan Brokers Market Revenue (billion), by Application 2025 & 2033

- Figure 37: South America Global Mortgage/Loan Brokers Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Global Mortgage/Loan Brokers Market Revenue (billion), by End - User 2025 & 2033

- Figure 39: South America Global Mortgage/Loan Brokers Market Revenue Share (%), by End - User 2025 & 2033

- Figure 40: South America Global Mortgage/Loan Brokers Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Global Mortgage/Loan Brokers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 2: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 4: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 6: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 8: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 10: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 12: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 14: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 16: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 18: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 20: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 22: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by End - User 2020 & 2033

- Table 24: Global Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Mortgage/Loan Brokers Market?

The projected CAGR is approximately 14%.

2. Which companies are prominent players in the Global Mortgage/Loan Brokers Market?

Key companies in the market include Bank of America, Royal Bank of Canada, BNP Paribas, Truist Financial Corporation, Mitsubishi UFJ Financial Group, PT Bank Central Asia Tbk, Qatar National Bank, Standard Chartered PLC, China Zheshang Bank, Federal National Mortgage Association (FNMA)**List Not Exhaustive.

3. What are the main segments of the Global Mortgage/Loan Brokers Market?

The market segments include Enterprise, Application, End - User.

4. Can you provide details about the market size?

The market size is estimated to be USD 319.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digitization is changing the future of Mortgage.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2022, Following the acquisition of Exane by the largest lender in the eurozone last year, BNP Paribas is extending its operation in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Mortgage/Loan Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Mortgage/Loan Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Mortgage/Loan Brokers Market?

To stay informed about further developments, trends, and reports in the Global Mortgage/Loan Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence