Key Insights

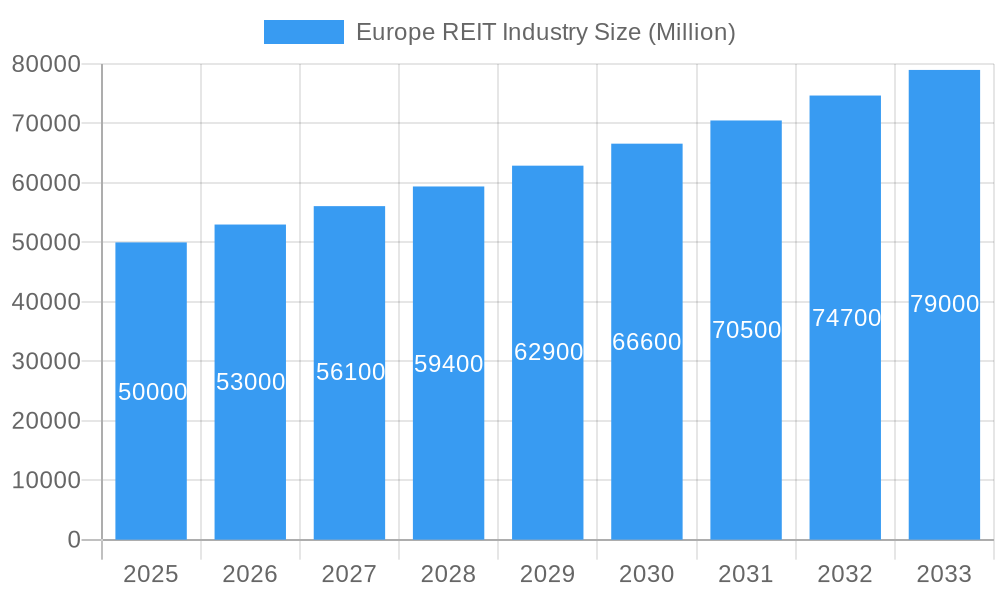

The European REIT (Real Estate Investment Trust) market, valued at approximately €XX million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 5.70% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing urbanization and population density across major European cities like London, Paris, and Amsterdam fuel demand for both residential and commercial real estate, particularly in prime locations. Secondly, favorable government policies supporting infrastructure development and investment in sustainable real estate contribute positively. Thirdly, the growing popularity of e-commerce continues to boost demand for modern logistics and warehousing facilities, benefiting Industrial REITs significantly. Finally, a sustained low-interest-rate environment makes REITs an attractive investment option for both institutional and individual investors seeking stable income streams. However, challenges remain. Economic downturns, geopolitical instability, and potential oversupply in specific sectors, such as office space in the post-pandemic era, could act as restraints to market growth. The market is segmented by sector (Retail, Industrial, Office, Residential, Diversified, and Other) and by country, with the United Kingdom, France, Germany, and the Netherlands representing significant national markets. The leading players include British Land, Unibail-Rodamco-Westfield, Hammerson, Landsec, and several major international investment firms.

Europe REIT Industry Market Size (In Billion)

The segmentation of the European REIT market allows for a nuanced understanding of growth dynamics. While Retail REITs may face headwinds due to the ongoing shift in consumer behavior towards online shopping, Industrial REITs and Residential REITs are anticipated to experience stronger growth due to the factors outlined above. The diversified REITs segment provides further diversification and resilience to the overall market. Growth within specific countries will depend on local economic conditions, regulatory frameworks, and the availability of attractive investment opportunities. However, the overall outlook for the European REIT market remains positive, with considerable potential for expansion over the forecast period (2025-2033). The continued expansion of the European economy and the increasing sophistication of the REIT sector suggest a bright future for this asset class, despite the anticipated challenges.

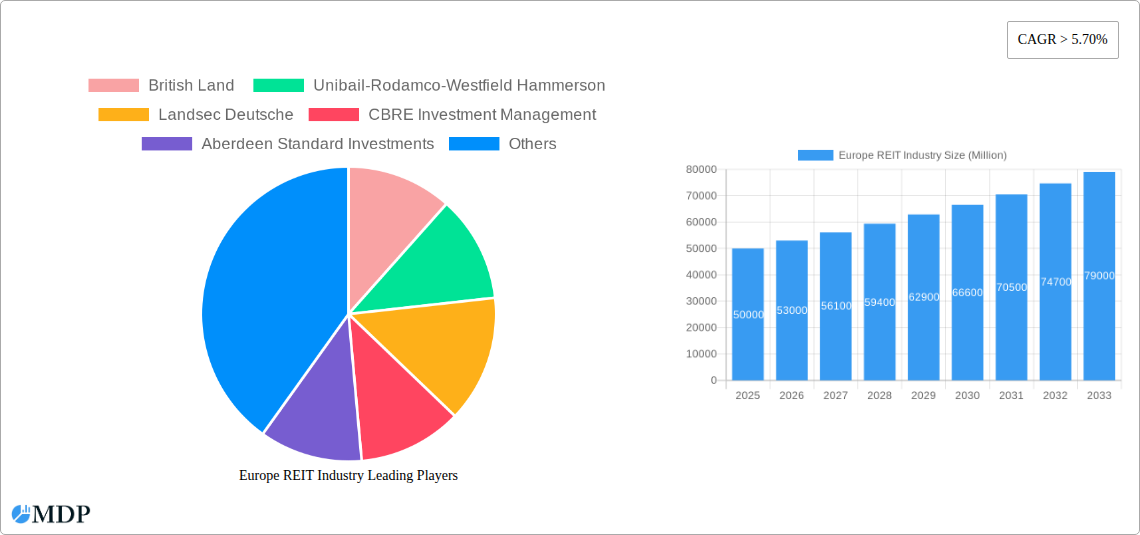

Europe REIT Industry Company Market Share

Europe REIT Industry: 2019-2033 Market Analysis and Forecast

This comprehensive report provides a detailed analysis of the European Real Estate Investment Trust (REIT) industry, covering market dynamics, leading players, investment trends, and future growth prospects from 2019 to 2033. The study period spans 2019-2024 (Historical Period), with 2025 serving as the base and estimated year, and a forecast period extending to 2033. This report is essential for investors, industry professionals, and strategic decision-makers seeking a thorough understanding of this dynamic market. The report leverages data analysis, insightful commentary and industry expertise. Total market size in 2025 is estimated at xx Million, with expected growth in subsequent years.

Europe REIT Industry Market Dynamics & Concentration

The European REIT market exhibits a moderately concentrated landscape, with several large players dominating specific segments and geographies. Market share is largely influenced by factors including historical performance, portfolio diversification, and access to capital. Innovation in the sector is driven by technological advancements such as proptech solutions for property management and leasing, data analytics for portfolio optimization, and sustainable building practices. Regulatory frameworks, including tax incentives and reporting requirements specific to each European country, significantly impact investment decisions and market access. Product substitutes, such as private equity real estate investments and direct property ownership, exert competitive pressure. End-user trends, particularly shifts in office space demand due to remote work and evolving retail preferences driven by e-commerce, are reshaping the market. Furthermore, mergers and acquisitions (M&A) activity has significantly altered the competitive landscape, demonstrating consolidation in the sector.

- Market Concentration: The top 5 players control approximately xx% of the market.

- M&A Activity: An average of xx M&A deals per year were observed between 2019 and 2024.

- Innovation Drivers: Proptech, data analytics, sustainable building practices.

- Regulatory Frameworks: Vary significantly across European countries, impacting investment attractiveness.

Europe REIT Industry Industry Trends & Analysis

The European REIT industry is experiencing dynamic shifts driven by several key factors. Market growth is influenced by macroeconomic conditions, including interest rates and economic growth in major European economies. Technological disruptions, encompassing the integration of PropTech and smart building technologies, are enhancing efficiency and improving asset management. Consumer preferences, particularly regarding sustainability and flexible workspace solutions, are reshaping demand across various sectors. Intense competition among established players and new entrants is fostering innovation and driving efficiency improvements. The Compound Annual Growth Rate (CAGR) for the industry is projected to be xx% during the forecast period (2025-2033). Market penetration of REITs in the overall European commercial real estate market is estimated at xx%.

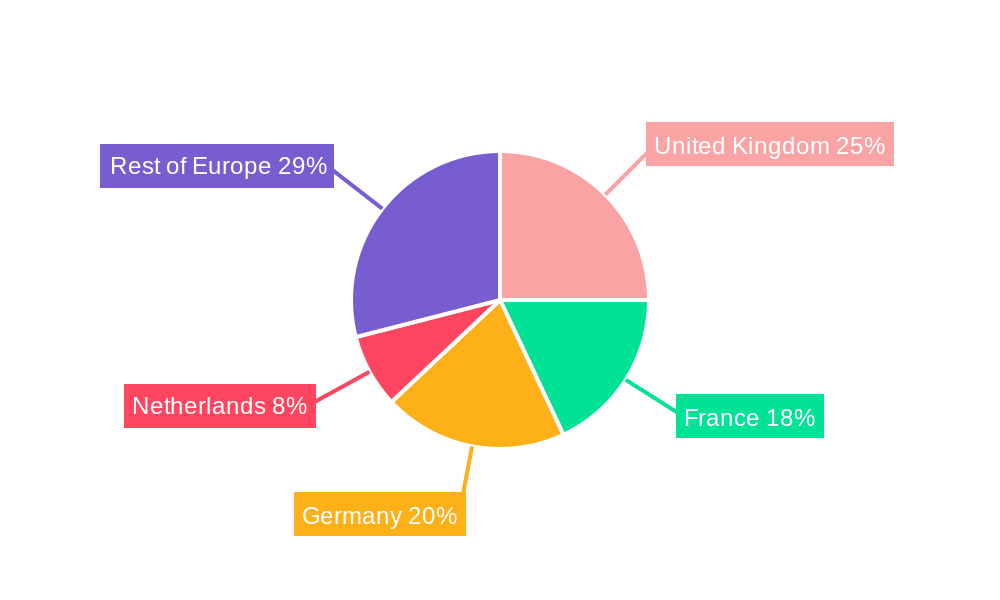

Leading Markets & Segments in Europe REIT Industry

The United Kingdom remains a dominant market for European REITs, driven by strong institutional investment, well-developed infrastructure, and a robust legal framework. France and the Netherlands also represent significant markets, attracting substantial investment in both office and retail segments. Within the sector, office and residential REITs are generally the largest, exhibiting strong performance and attracting significant investment. The retail REIT segment, while showing signs of recovery, remains impacted by the influence of e-commerce.

By Country:

- United Kingdom: Strong institutional investment, well-developed infrastructure.

- France: Significant investment in office and retail.

- Netherlands: High levels of investor confidence.

- Spain: Growing demand and recovery in specific markets.

- Germany: Market consolidation and investment opportunities.

By Sector of Exposure:

- Office REITs: High demand in select markets due to economic growth and recovery.

- Residential REITs: Steady growth in many markets due to increasing rental demand.

- Retail REITs: Experiencing challenges but showcasing signs of a gradual recovery.

Europe REIT Industry Product Developments

Recent product developments in the European REIT industry emphasize technological integration to enhance efficiency and sustainability. This includes the adoption of smart building technologies, data-driven asset management platforms, and energy-efficient building designs. These innovations are improving operational efficiency, lowering costs, and enhancing the appeal of REIT investments in a climate-conscious environment. These products directly respond to market needs such as increased transparency, improved tenant experiences, and more sustainable real estate portfolios.

Key Drivers of Europe REIT Industry Growth

The growth of the European REIT industry is propelled by several key factors. Strong economic performance across major European nations fuels demand for commercial and residential real estate. Favorable regulatory frameworks, including tax incentives and streamlined investment processes in some countries, stimulate investment in the REIT sector. Technological advancements, particularly within PropTech, are driving operational efficiencies and enhancing portfolio management.

Challenges in the Europe REIT Industry Market

The European REIT industry faces various challenges. Economic downturns in individual countries or across the broader European Union can negatively impact demand and rental income. Increasing interest rates increase the cost of debt financing and can reduce investor appetite. Intense competition amongst established REITs and alternative investment options creates pressure on pricing and profitability. Regulatory changes and differing regulations across nations pose additional challenges for pan-European operators.

Emerging Opportunities in Europe REIT Industry

Long-term growth opportunities for the European REIT sector reside in several key areas. The growing focus on sustainable real estate practices creates a premium for green buildings, increasing demand for eco-friendly assets. Expansion into emerging markets within Europe, and strategic partnerships with technology companies and PropTech firms, offer possibilities for growth and innovation.

Leading Players in the Europe REIT Industry Sector

Key Milestones in Europe REIT Industry Industry

- March 2023: Landsec secures 100% ownership of St David’s shopping centre, Cardiff. This consolidation signifies a strategic move towards portfolio optimization and improved control over a key asset.

- October 2022: Cromwell European REIT acquires assets in Denmark for EUR 15.8 Million, demonstrating expansion into new geographic markets.

- September 2022: Inbest and GPF create a new REIT to invest €600 Million in prime properties, highlighting increasing investor confidence and capital inflows into the sector.

Strategic Outlook for Europe REIT Industry Market

The European REIT market is poised for continued growth, driven by factors such as ongoing urbanization, evolving consumer preferences, and increasing institutional investment. Strategic opportunities exist in leveraging technological advancements to enhance operational efficiency, portfolio diversification across various sectors and geographies, and focusing on sustainable and ESG-compliant investments to capture growing investor demand. The market is likely to see further consolidation as larger players seek to increase their market share and optimize their portfolios.

Europe REIT Industry Segmentation

-

1. Sector of Exposure

- 1.1. Retail REITs

- 1.2. Industrial REITs

- 1.3. Office REITs

- 1.4. Residential REITs

- 1.5. Diversified REITs

- 1.6. Other Sector Specific REITs

Europe REIT Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe REIT Industry Regional Market Share

Geographic Coverage of Europe REIT Industry

Europe REIT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fund Inflows is Driving the ETF Market

- 3.3. Market Restrains

- 3.3.1. Underlying Fluctuations and Risks are Restraining the Market

- 3.4. Market Trends

- 3.4.1. United Kingdom as the Leader of REIT market in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe REIT Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector of Exposure

- 5.1.1. Retail REITs

- 5.1.2. Industrial REITs

- 5.1.3. Office REITs

- 5.1.4. Residential REITs

- 5.1.5. Diversified REITs

- 5.1.6. Other Sector Specific REITs

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Sector of Exposure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 British Land

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Unibail-Rodamco-Westfield Hammerson

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Landsec Deutsche

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CBRE Investment Management

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aberdeen Standard Investments

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wohnen SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vonovia SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 British Land

List of Figures

- Figure 1: Europe REIT Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe REIT Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe REIT Industry Revenue undefined Forecast, by Sector of Exposure 2020 & 2033

- Table 2: Europe REIT Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Europe REIT Industry Revenue undefined Forecast, by Sector of Exposure 2020 & 2033

- Table 4: Europe REIT Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: France Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe REIT Industry?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Europe REIT Industry?

Key companies in the market include British Land , Unibail-Rodamco-Westfield Hammerson , Landsec Deutsche, CBRE Investment Management , Aberdeen Standard Investments, Wohnen SE , Vonovia SE .

3. What are the main segments of the Europe REIT Industry?

The market segments include Sector of Exposure.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Fund Inflows is Driving the ETF Market.

6. What are the notable trends driving market growth?

United Kingdom as the Leader of REIT market in Europe.

7. Are there any restraints impacting market growth?

Underlying Fluctuations and Risks are Restraining the Market.

8. Can you provide examples of recent developments in the market?

March 2023: Landsec has secured 100% ownership of St David’s shopping centre, Cardiff, following its purchase of the debt secured against the 50% share of the asset previously owned by intu plc. Comprising separate transactions with two debt holders

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe REIT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe REIT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe REIT Industry?

To stay informed about further developments, trends, and reports in the Europe REIT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence