Key Insights

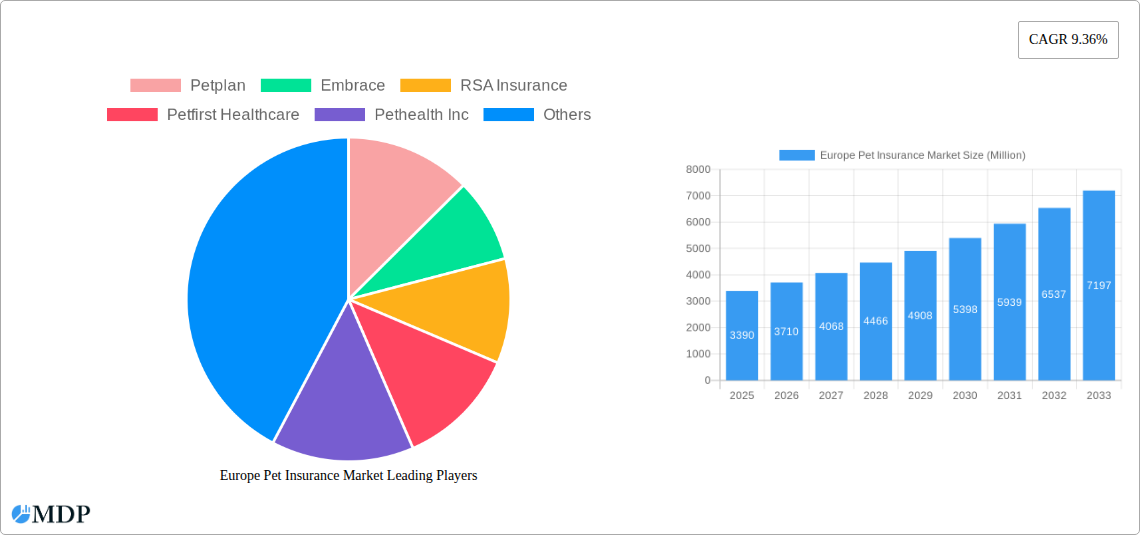

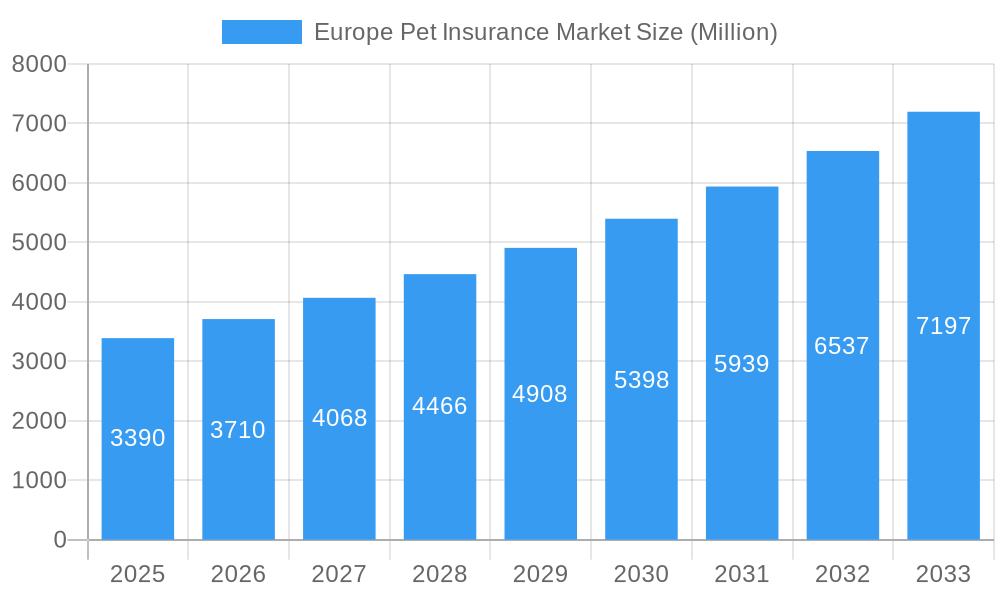

The European pet insurance market is experiencing robust growth, projected to reach a market size of €3.39 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 9.36% from 2019 to 2033. This expansion is fueled by several key drivers. Increasing pet ownership across Europe, coupled with rising pet humanization—treating pets as family members—is a primary factor. Owners are increasingly willing to invest in their pets' health and well-being, leading to higher demand for comprehensive insurance coverage. Furthermore, advancements in veterinary care, offering more sophisticated treatments and procedures, contribute to rising insurance claim costs, ultimately boosting market value. The growing awareness of potential veterinary expenses, particularly for chronic conditions or unforeseen accidents, also motivates pet owners to secure insurance protection. Competitive pricing strategies by insurance providers and the introduction of innovative product offerings, such as bundled packages incorporating wellness plans, are further stimulating market growth. However, factors such as economic downturns and the potential for fraud could act as market restraints. The market is segmented by various pet types (dogs, cats, etc.), insurance coverage levels (basic, comprehensive), and distribution channels (online, offline). Key players like Petplan, Embrace, RSA Insurance, and others are competing intensely, leading to product innovation and strategic partnerships.

Europe Pet Insurance Market Market Size (In Billion)

Looking ahead to the forecast period (2025-2033), the European pet insurance market is poised for continued expansion. The increasing affordability of pet insurance, driven by competition and evolving product designs, will likely attract a larger segment of pet owners. The rise of digital platforms and online insurance distribution will also play a crucial role in market penetration. The market is expected to benefit from favorable regulatory environments in several European countries, making it easier for insurers to operate and reach a wider consumer base. However, successful navigation of potential challenges, such as managing increasing claim costs and addressing concerns around policy transparency, will be crucial for sustained growth.

Europe Pet Insurance Market Company Market Share

Europe Pet Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Pet Insurance Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The European pet insurance market is projected to reach xx Million by 2033, presenting significant growth potential. This report is essential for understanding the current landscape and navigating the future of this rapidly evolving sector.

Europe Pet Insurance Market Dynamics & Concentration

The European pet insurance market is characterized by a moderate level of concentration, with several key players vying for market share. Market leaders, such as Petplan, Embrace, and RSA Insurance, hold a significant portion of the overall market, while numerous smaller regional players and niche providers contribute to the overall landscape. The market is witnessing increasing consolidation through mergers and acquisitions (M&A) activities, as evidenced by recent deals like Trupanion's acquisition of PetExpert. This trend reflects the strategic imperative to expand market reach and enhance service offerings.

- Market Concentration: While precise market share figures for individual players vary and are not publicly available for all companies, the top 5 players likely account for approximately xx% of the total market.

- Innovation Drivers: Technological advancements in pet healthcare, data analytics, and insurance technology (Insurtech) are driving innovation. Telemedicine and personalized pet insurance products are gaining traction.

- Regulatory Frameworks: Varying regulatory environments across European countries influence market dynamics and product offerings. Compliance with data privacy regulations, such as GDPR, is paramount.

- Product Substitutes: While pet insurance offers comprehensive coverage, alternatives like savings accounts or limited-coverage plans exist. However, the increasing awareness of pet healthcare costs is driving adoption of comprehensive pet insurance.

- End-User Trends: Rising pet ownership, increased humanization of pets, and growing awareness of potential veterinary expenses are key consumer trends driving market growth.

- M&A Activities: The number of M&A deals in the European pet insurance market is gradually increasing, reflecting a consolidating industry landscape. Over the period 2019-2024, an estimated xx M&A deals were recorded.

Europe Pet Insurance Market Industry Trends & Analysis

The Europe Pet Insurance Market exhibits robust growth, driven by several interconnected factors. The market has experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising pet ownership across Europe, particularly in urban areas, alongside a surge in pet humanization. Consumers are increasingly viewing their pets as family members, leading to greater willingness to invest in their healthcare. Technological advancements, like telemedicine integration into pet insurance plans, further contribute to market expansion. Competitive dynamics are characterized by both established insurers expanding their pet insurance portfolios and the emergence of Insurtech startups offering innovative digital solutions. Market penetration of pet insurance varies across European countries, with higher penetration rates in countries like Sweden (90% of dogs, 50% of cats) compared to others, indicating significant untapped potential in several markets.

Leading Markets & Segments in Europe Pet Insurance Market

While data on specific market share by country and segment is proprietary, the UK and Germany are likely the leading markets in terms of total premium revenue, followed by France and other Western European countries. The dominance of these countries can be attributed to several key factors:

- High Pet Ownership Rates: The UK and Germany boast high rates of pet ownership, creating a large potential customer base.

- Higher Disposable Incomes: Relatively higher disposable incomes in these regions support the affordability of pet insurance.

- Developed Veterinary Infrastructure: Well-developed veterinary infrastructure supports the provision of high-quality pet healthcare services, which in turn are frequently covered by pet insurance plans.

- Greater Awareness of Pet Insurance: Consumer awareness and acceptance of pet insurance are greater in established markets, fostering higher adoption rates.

The dog segment is likely the largest segment in terms of revenue followed by cats due to larger average premiums for dogs.

Europe Pet Insurance Market Product Developments

The pet insurance market is witnessing the rise of innovative products, such as customizable coverage plans tailored to individual pet needs and breeds. Technological advancements, such as AI-powered claims processing and telehealth integration, are enhancing the customer experience and operational efficiency. The focus is shifting towards preventative care coverage and wellness programs, reflecting a proactive approach to pet healthcare. These product innovations are designed to improve market fit and competitiveness by addressing specific customer needs and preferences.

Key Drivers of Europe Pet Insurance Market Growth

Several key drivers fuel the growth trajectory of the Europe Pet Insurance Market. Firstly, the escalating cost of veterinary care is motivating pet owners to seek financial protection. Secondly, a rising awareness of pet health and wellness, coupled with humanization trends, is fostering demand. Thirdly, the development of innovative insurance products catering to diverse needs significantly impacts market expansion. Finally, technological advancements, like AI-driven claim processing, improve efficiency and customer satisfaction.

Challenges in the Europe Pet Insurance Market

The Europe Pet Insurance Market faces several challenges. Varying regulatory frameworks across European nations present complexity for providers. The cost of veterinary treatment remains a significant factor driving premiums, potentially impacting customer affordability. Furthermore, intense competition amongst providers, both from established players and Insurtech entrants, puts pressure on pricing and profitability. These factors collectively represent significant hurdles to navigate for consistent market expansion.

Emerging Opportunities in Europe Pet Insurance Market

Several factors suggest significant long-term growth potential in the Europe Pet Insurance Market. The expanding pet ownership base, particularly among younger demographics, presents significant opportunities. The increasing penetration of digital technologies offers scope for innovative product development and improved customer engagement. Strategic partnerships with veterinary clinics and pet healthcare providers are likely to enhance service offerings. Finally, expansion into underserved markets across Europe could open significant avenues for growth.

Leading Players in the Europe Pet Insurance Market Sector

- Petplan

- Embrace

- RSA Insurance

- Petfirst Healthcare

- Pethealth Inc

- Protectapet

- AGILA

- Petsecure

- Hartville Group

- NSM Insurance Group

List Not Exhaustive

Key Milestones in Europe Pet Insurance Market Industry

- November 2022: Trupanion acquires Royal Blue s.r.o., parent company of PetExpert, marking its second European acquisition. This significantly strengthens Trupanion's position in the European market.

- February 2023: Agria Petinsure launches in Ireland, aiming to increase pet insurance penetration. This highlights the untapped potential within the Irish market and emphasizes the growing importance of pet insurance across Europe.

Strategic Outlook for Europe Pet Insurance Market Market

The future of the Europe Pet Insurance Market looks promising, with continued growth anticipated due to increasing pet ownership, rising veterinary costs, and the development of innovative insurance products. Strategic partnerships, technological advancements, and expansion into new markets will be key to unlocking further growth potential. Companies that focus on providing personalized, tech-enabled solutions are best positioned to capture significant market share in the years to come.

Europe Pet Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Accident & Illness

- 1.2. Accident Only

-

2. Policy Type

- 2.1. Lifetime Coverage

- 2.2. Non-Lifetime Coverage

-

3. Animal Type

- 3.1. Dogs

- 3.2. Cats

- 3.3. Other Animal Types

-

4. Provider

- 4.1. Public

- 4.2. Private

-

5. Distribution Channel

- 5.1. Insurance Agency

- 5.2. Bancassurance

- 5.3. Brokers

- 5.4. Direct Sales

Europe Pet Insurance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

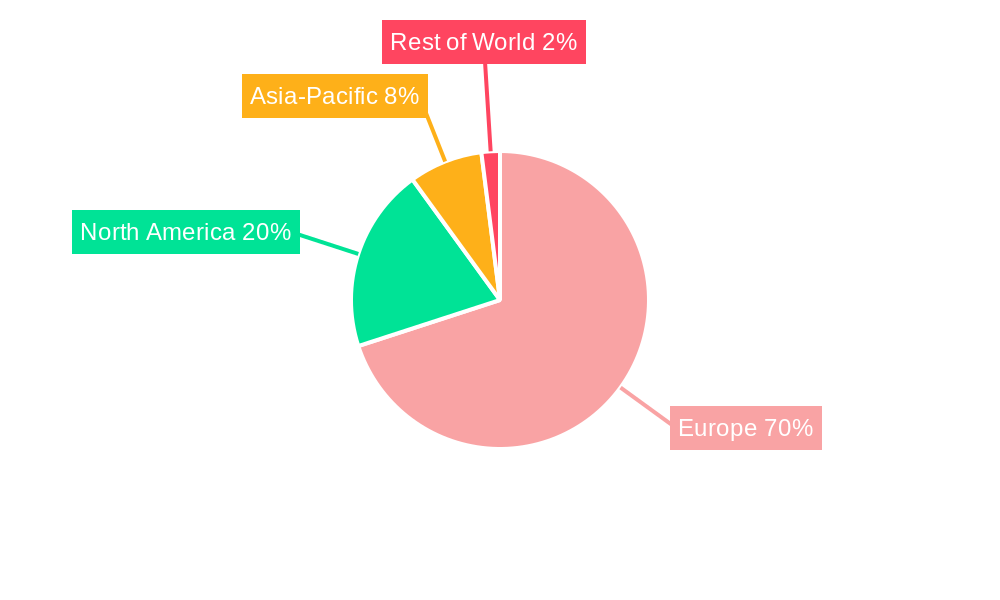

Europe Pet Insurance Market Regional Market Share

Geographic Coverage of Europe Pet Insurance Market

Europe Pet Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing trend of Dog Insurance Premiums in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pet Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Accident & Illness

- 5.1.2. Accident Only

- 5.2. Market Analysis, Insights and Forecast - by Policy Type

- 5.2.1. Lifetime Coverage

- 5.2.2. Non-Lifetime Coverage

- 5.3. Market Analysis, Insights and Forecast - by Animal Type

- 5.3.1. Dogs

- 5.3.2. Cats

- 5.3.3. Other Animal Types

- 5.4. Market Analysis, Insights and Forecast - by Provider

- 5.4.1. Public

- 5.4.2. Private

- 5.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.5.1. Insurance Agency

- 5.5.2. Bancassurance

- 5.5.3. Brokers

- 5.5.4. Direct Sales

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Petplan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Embrace

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RSA Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Petfirst Healthcare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pethealth Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Protectapet

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AGILA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petsecure

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hartville Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NSM Insurance Group**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Petplan

List of Figures

- Figure 1: Europe Pet Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pet Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pet Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Europe Pet Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 3: Europe Pet Insurance Market Revenue Million Forecast, by Policy Type 2020 & 2033

- Table 4: Europe Pet Insurance Market Volume Billion Forecast, by Policy Type 2020 & 2033

- Table 5: Europe Pet Insurance Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 6: Europe Pet Insurance Market Volume Billion Forecast, by Animal Type 2020 & 2033

- Table 7: Europe Pet Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 8: Europe Pet Insurance Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 9: Europe Pet Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Pet Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Pet Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Europe Pet Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 13: Europe Pet Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 14: Europe Pet Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 15: Europe Pet Insurance Market Revenue Million Forecast, by Policy Type 2020 & 2033

- Table 16: Europe Pet Insurance Market Volume Billion Forecast, by Policy Type 2020 & 2033

- Table 17: Europe Pet Insurance Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 18: Europe Pet Insurance Market Volume Billion Forecast, by Animal Type 2020 & 2033

- Table 19: Europe Pet Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 20: Europe Pet Insurance Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 21: Europe Pet Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Pet Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Pet Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Pet Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Germany Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: France Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Italy Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Spain Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Netherlands Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Netherlands Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Belgium Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Belgium Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Sweden Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Sweden Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Norway Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Norway Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Poland Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Poland Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Denmark Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Denmark Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pet Insurance Market?

The projected CAGR is approximately 9.36%.

2. Which companies are prominent players in the Europe Pet Insurance Market?

Key companies in the market include Petplan, Embrace, RSA Insurance, Petfirst Healthcare, Pethealth Inc, Protectapet, AGILA, Petsecure, Hartville Group, NSM Insurance Group**List Not Exhaustive.

3. What are the main segments of the Europe Pet Insurance Market?

The market segments include Insurance Type, Policy Type, Animal Type, Provider, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.39 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing trend of Dog Insurance Premiums in Europe.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: The new brand Agria Petinsure, formerly Petinsure, is entering the Irish market with a clear mission. Currently, the insurance rate for dogs in the Irish market is approximately 10%-15%, while the rate for cats is approximately 5%. It is estimated that 90% of dogs and 50% of cats in Sweden have pet insurance. Agria Petinsure believes that the same safety should be available for all Irish pets, and pet owners should enjoy peace of mind if their pet needs medical treatment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pet Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pet Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pet Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Pet Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence