Key Insights

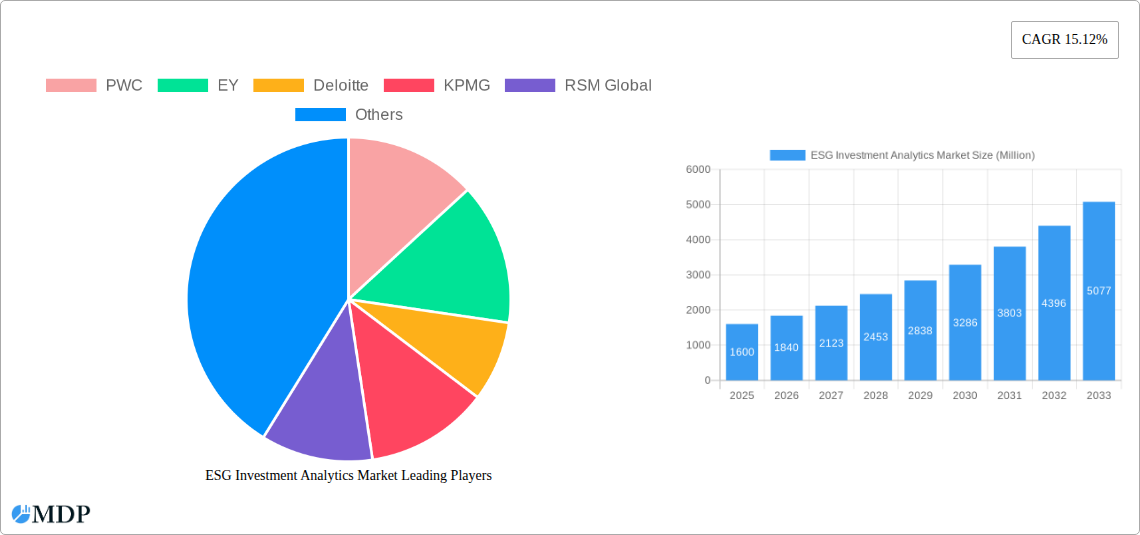

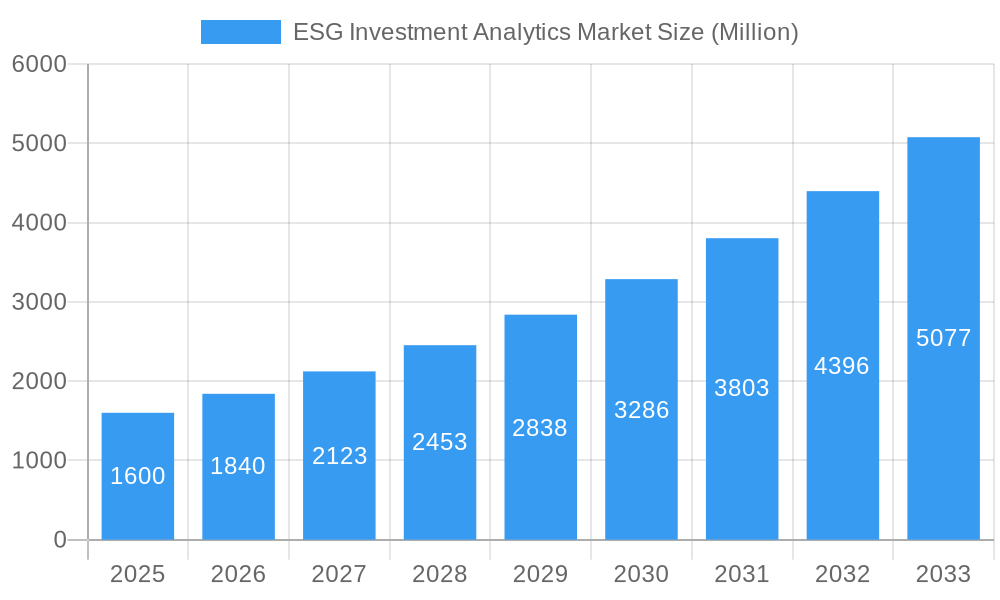

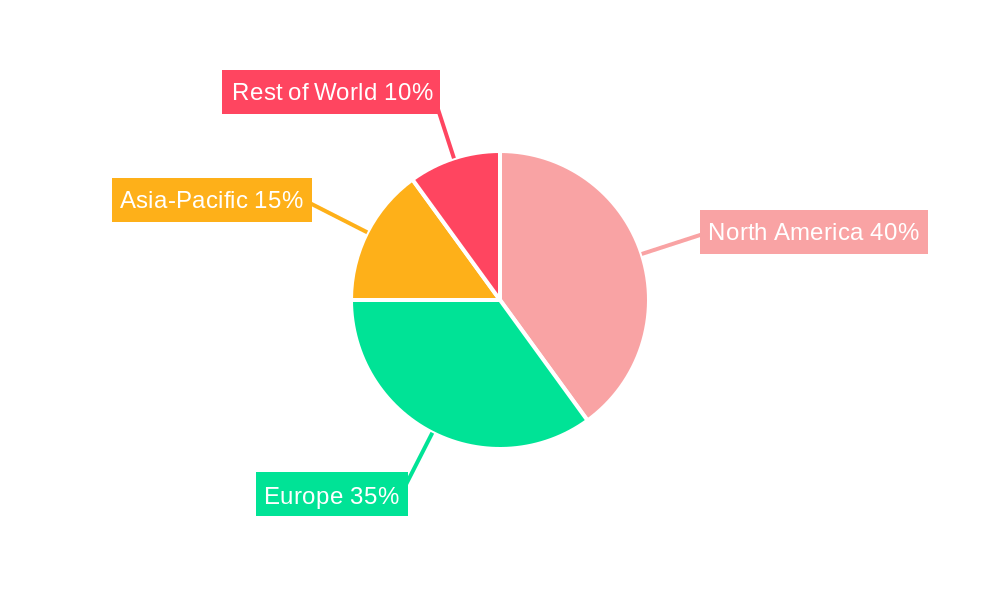

The ESG (Environmental, Social, and Governance) Investment Analytics market is experiencing robust growth, projected to reach \$1.60 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 15.12% from 2025 to 2033. This expansion is driven by increasing regulatory scrutiny of ESG performance, growing investor demand for sustainable investments, and the rising awareness of environmental and social risks among businesses. Key trends include the increasing adoption of AI and machine learning in ESG data analysis, the development of more sophisticated ESG rating methodologies, and a greater focus on integrating ESG factors into investment decision-making across all asset classes. While data availability and standardization remain challenges, the market is rapidly evolving to address these issues. The competitive landscape is characterized by a mix of large consulting firms (PwC, EY, Deloitte, KPMG), specialized ESG data providers (MSCI Inc., RepRisk, ISS ESG), and boutique consultancies (RSM Global, RPS Group, Crowe, Kroll), each offering a unique range of services and data solutions. The market's regional distribution likely reflects established financial centers and regulatory frameworks, with North America and Europe currently holding significant market shares. The continued growth trajectory suggests a promising future for the ESG Investment Analytics market, driven by the ongoing integration of ESG considerations into the mainstream of financial markets.

ESG Investment Analytics Market Market Size (In Billion)

The forecast period of 2025-2033 presents significant opportunities for market participants. Expanding regulatory requirements, particularly related to climate change disclosures, will further fuel demand for robust ESG analytics. Innovation in data collection, processing, and interpretation will be crucial for continued market expansion. Companies with advanced technology capabilities and comprehensive data sets are expected to maintain a competitive edge. Furthermore, partnerships between data providers and investment firms are likely to increase, fostering the seamless integration of ESG data into investment workflows. The ongoing evolution of ESG reporting standards and frameworks will necessitate continuous adaptation and innovation within the ESG Investment Analytics market, ensuring that providers are equipped to deliver timely, accurate, and relevant information to their clients.

ESG Investment Analytics Market Company Market Share

ESG Investment Analytics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the ESG Investment Analytics Market, projecting robust growth from 2025 to 2033. The study covers market dynamics, industry trends, leading players, and emerging opportunities, providing crucial insights for investors, stakeholders, and businesses operating within this rapidly evolving sector. The report leverages data from the historical period (2019-2024), focusing on the base year (2025) and offering forecasts until 2033. The market size is projected to reach xx Million by 2033.

ESG Investment Analytics Market Market Dynamics & Concentration

The ESG Investment Analytics Market is experiencing significant growth, driven by increasing regulatory scrutiny, heightened investor awareness of ESG factors, and the growing adoption of sustainable investment strategies. Market concentration is relatively high, with several large players dominating the landscape. However, the market also exhibits substantial room for new entrants, particularly those specializing in niche areas or offering innovative analytical tools.

Market Concentration: The market share of the top 5 players (PwC, EY, Deloitte, KPMG, and MSCI Inc.) is estimated at approximately 60% in 2025. This concentration is expected to remain relatively stable, though increased competition from smaller, specialized firms may slightly erode this dominance over the forecast period.

Innovation Drivers: The market is driven by technological advancements, such as AI and machine learning, which enhance data analysis and predictive capabilities. Furthermore, the development of standardized ESG reporting frameworks is facilitating greater data comparability and transparency, driving demand for sophisticated analytical tools.

Regulatory Frameworks: Stringent regulations across various jurisdictions are pushing companies to disclose ESG data, boosting the demand for ESG analytics solutions. The evolving regulatory environment is a key driver of market growth. For example, the EU's Sustainable Finance Disclosure Regulation (SFDR) is significantly impacting the market.

Product Substitutes: While there are limited direct substitutes, some firms use in-house solutions or simpler analytical tools, representing a potential constraint to market expansion.

End-User Trends: Institutional investors, such as pension funds and asset managers, are the primary drivers of demand. However, the increasing adoption of ESG principles by retail investors and corporations is broadening the market.

M&A Activities: The market has seen a steady stream of mergers and acquisitions in recent years, with an estimated xx M&A deals in the past 5 years. These activities are driven by the desire to expand market share and consolidate technological capabilities.

ESG Investment Analytics Market Industry Trends & Analysis

The ESG Investment Analytics Market is characterized by a robust CAGR of xx% during the forecast period (2025-2033). Market penetration, particularly within emerging markets, is expected to increase significantly. This expansion is fueled by a convergence of factors:

- Growing Awareness of ESG Risks & Opportunities: Investors are increasingly integrating ESG factors into their investment decisions, recognizing their impact on financial performance.

- Technological Disruptions: The incorporation of AI, machine learning, and big data analytics is enhancing the accuracy and efficiency of ESG assessments.

- Evolving Consumer Preferences: A growing segment of consumers actively supports companies demonstrating strong ESG performance.

- Competitive Dynamics: The market is fiercely competitive, with both established players and new entrants vying for market share through innovation and strategic partnerships. This dynamism accelerates market growth through improved services and better price points.

- Regulatory Changes: Global regulatory frameworks are constantly evolving, necessitating advanced analytics tools for compliance and reporting. Failure to adapt will severely impact revenue and market share.

Leading Markets & Segments in ESG Investment Analytics Market

The North American region dominates the ESG Investment Analytics Market, driven by a combination of factors:

- Stringent Regulations: North America has comparatively stringent environmental and social regulations.

- High Concentration of Institutional Investors: The region houses a significant portion of the world's largest asset management firms.

- Technological Advancements: North America is a hub for innovation in financial technology, providing a fertile ground for ESG analytics development.

Other key regions include Europe and Asia-Pacific, exhibiting notable growth driven by increasing regulatory pressure and growing investor interest in ESG factors. While North America currently holds a significant lead, the Asia-Pacific region is predicted to show higher growth rates in the coming years, spurred by economic development and increased regulatory focus.

- Key Drivers in North America:

- Robust regulatory environment pushing for ESG disclosure.

- High concentration of institutional investors actively pursuing ESG integration.

- Strong presence of tech companies driving innovation in ESG analytics.

- Key Drivers in Europe:

- EU's Sustainable Finance Disclosure Regulation (SFDR) driving significant demand.

- Growing awareness of ESG risks among European investors.

- Development of robust ESG reporting standards.

- Key Drivers in Asia-Pacific:

- Rising investor interest in sustainable investments.

- Increasing government support for ESG initiatives.

- Rapid economic growth and development across several markets.

ESG Investment Analytics Market Product Developments

Recent product innovations focus on integrating advanced analytics, including AI and machine learning, to provide more accurate, timely, and insightful ESG assessments. New products emphasize data visualization and user-friendly interfaces to facilitate better understanding and decision-making. The market is moving towards integrated platforms that combine ESG data analysis with portfolio management and risk assessment tools, offering comprehensive solutions to investors and corporations.

Key Drivers of ESG Investment Analytics Market Growth

The market's growth is propelled by several key factors:

- Increased Regulatory Scrutiny: Governments worldwide are imposing stricter ESG reporting regulations, making ESG analytics crucial for compliance.

- Growing Investor Demand: Investors are increasingly demanding ESG data to inform their investment decisions, driving demand for sophisticated analytical tools.

- Technological Advancements: AI and machine learning are significantly enhancing the accuracy and efficiency of ESG data analysis.

Challenges in the ESG Investment Analytics Market Market

Several challenges impede market growth:

- Data Inconsistency and Reliability: Inconsistencies and lack of standardization in ESG data pose a challenge to effective analysis.

- High Implementation Costs: Implementing ESG analytics solutions can be expensive for some companies, limiting market penetration.

- Lack of ESG Expertise: A shortage of skilled professionals capable of effectively interpreting and utilizing ESG data can hinder adoption.

Emerging Opportunities in ESG Investment Analytics Market

Significant long-term growth opportunities exist:

- Expansion into Emerging Markets: Growing investor interest in ESG in emerging markets presents considerable untapped potential.

- Development of Specialized Analytics: Creating niche ESG analytics solutions tailored to specific industries or investment strategies can unlock new revenue streams.

- Integration with other Financial Technologies: Integrating ESG analytics with other fintech solutions such as portfolio management and risk assessment tools enhances value proposition and attracts a broader clientele.

Key Milestones in ESG Investment Analytics Market Industry

- June 2023: ESG Book and Arcesium partnered to deliver market-leading sustainability data for institutional investors, significantly enhancing data availability and analytical capabilities.

- May 2023: Collective Artists Network and DialESG partnered to offer India's first comprehensive ESG solution, increasing awareness and driving adoption within the Indian market. This partnership expanded the reach of ESG solutions into a previously underserved market.

Strategic Outlook for ESG Investment Analytics Market Market

The ESG Investment Analytics Market is poised for sustained growth, driven by increasing regulatory pressure, heightened investor awareness, and ongoing technological advancements. Strategic partnerships, expansion into emerging markets, and the development of innovative analytical tools will be crucial for success in this dynamic sector. Focus on data accuracy, user-friendly interfaces, and integration with other financial technologies will shape the future of the market.

ESG Investment Analytics Market Segmentation

-

1. Type

- 1.1. Addressing ESG Expectations

- 1.2. Preparing ESG Reports

-

2. Application

- 2.1. Financial Industry

- 2.2. Consumer and Retail

ESG Investment Analytics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Russia

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

ESG Investment Analytics Market Regional Market Share

Geographic Coverage of ESG Investment Analytics Market

ESG Investment Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Focus on Corporate Social Responsibility

- 3.3. Market Restrains

- 3.3.1. Increased Focus on Corporate Social Responsibility

- 3.4. Market Trends

- 3.4.1. Increasing Consumer and Retail Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Addressing ESG Expectations

- 5.1.2. Preparing ESG Reports

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Financial Industry

- 5.2.2. Consumer and Retail

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Addressing ESG Expectations

- 6.1.2. Preparing ESG Reports

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Financial Industry

- 6.2.2. Consumer and Retail

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Addressing ESG Expectations

- 7.1.2. Preparing ESG Reports

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Financial Industry

- 7.2.2. Consumer and Retail

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Addressing ESG Expectations

- 8.1.2. Preparing ESG Reports

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Financial Industry

- 8.2.2. Consumer and Retail

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Addressing ESG Expectations

- 9.1.2. Preparing ESG Reports

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Financial Industry

- 9.2.2. Consumer and Retail

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Addressing ESG Expectations

- 10.1.2. Preparing ESG Reports

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Financial Industry

- 10.2.2. Consumer and Retail

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Addressing ESG Expectations

- 11.1.2. Preparing ESG Reports

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Financial Industry

- 11.2.2. Consumer and Retail

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 PWC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 EY

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Deloitte

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 KPMG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 RSM Global

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 RPS Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 MSCI Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Crowe

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 RepRisk

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ISS ESG

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Kroll**List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 PWC

List of Figures

- Figure 1: Global ESG Investment Analytics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global ESG Investment Analytics Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 17: Europe ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 21: Europe ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Pacific ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 29: Asia Pacific ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Pacific ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 33: Asia Pacific ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 40: South America ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 41: South America ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 44: South America ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 45: South America ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 49: South America ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 57: Middle East ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 63: United Arab Emirates ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 64: United Arab Emirates ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 65: United Arab Emirates ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: United Arab Emirates ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 67: United Arab Emirates ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 68: United Arab Emirates ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 69: United Arab Emirates ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: United Arab Emirates ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 71: United Arab Emirates ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 72: United Arab Emirates ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 73: United Arab Emirates ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: United Arab Emirates ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global ESG Investment Analytics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global ESG Investment Analytics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of North America ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of North America ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 23: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Germany ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Russia ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 35: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 37: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: India ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: India ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: China ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: China ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Japan ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Japan ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 48: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 49: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 51: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 53: Brazil ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Brazil ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Argentina ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Argentina ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of South America ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of South America ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 60: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 61: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 62: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 63: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 65: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 66: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 67: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 68: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 69: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: Saudi Arabia ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Saudi Arabia ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: South Africa ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ESG Investment Analytics Market?

The projected CAGR is approximately 15.12%.

2. Which companies are prominent players in the ESG Investment Analytics Market?

Key companies in the market include PWC, EY, Deloitte, KPMG, RSM Global, RPS Group, MSCI Inc, Crowe, RepRisk, ISS ESG, Kroll**List Not Exhaustive.

3. What are the main segments of the ESG Investment Analytics Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Focus on Corporate Social Responsibility.

6. What are the notable trends driving market growth?

Increasing Consumer and Retail Fueling the Market.

7. Are there any restraints impacting market growth?

Increased Focus on Corporate Social Responsibility.

8. Can you provide examples of recent developments in the market?

June 2023: ESG Book, a global leader, and Arcesium, a leading global financial technology firm, announced a new partnership to deliver market-leading sustainability data for institutional investors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ESG Investment Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ESG Investment Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ESG Investment Analytics Market?

To stay informed about further developments, trends, and reports in the ESG Investment Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence