Key Insights

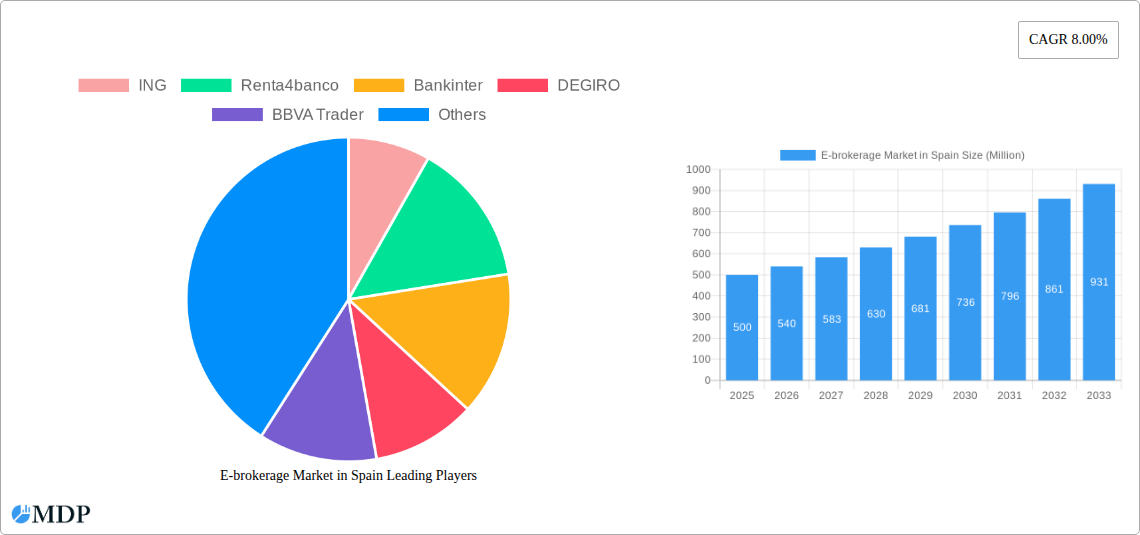

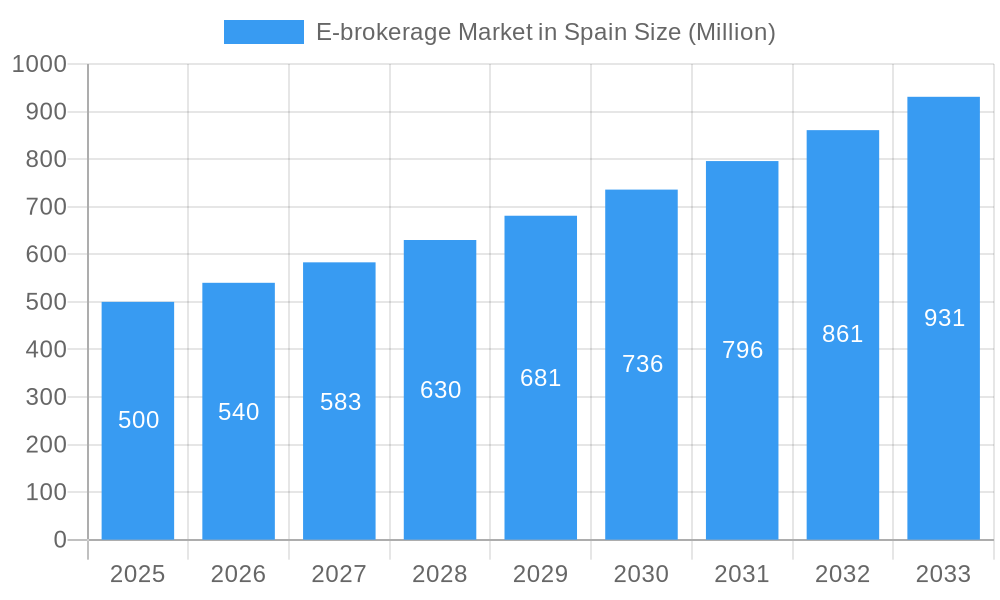

The Spanish e-brokerage market is projected for substantial growth, with a Compound Annual Growth Rate (CAGR) of 11.5% from 2025 to 2033. This expansion is attributed to increased internet and smartphone adoption, a burgeoning tech-savvy youth demographic, and a rising demand for accessible, cost-effective investment solutions. The sector attracts both incumbent financial institutions and agile fintech firms, fostering innovation in platform features, trading tools, and customer support. Leading participants, including ING, Renta4banco, Bankinter, DEGIRO, and BBVA Trader, alongside international brokers, are driving competitive advancements. Despite potential regulatory shifts and economic uncertainties, the market's trajectory is positive, propelled by the democratization of investing and widespread adoption of online trading. The market is anticipated to segment by investor type (retail and institutional) and investment product (stocks, bonds, ETFs, derivatives). With an estimated market size of €15.37 billion in the base year 2025, significant growth is expected throughout the forecast period, supported by ongoing technological enhancements, personalized investment guidance, and competitive commission rates.

E-brokerage Market in Spain Market Size (In Billion)

The competitive arena is characterized by established banks utilizing their existing client networks and newer, technology-driven e-brokers attracting investors with intuitive interfaces and novel functionalities. Future market success hinges on regulatory adherence, robust cybersecurity, and the continuous development of advanced investment tools. Expanding into underrepresented demographics and regions within Spain will be vital for sustained growth. The increasing emphasis on sustainable and ethical investing will also shape service offerings and available investment products. Strategic collaborations, mergers, and acquisitions are expected to redefine the competitive landscape.

E-brokerage Market in Spain Company Market Share

Unlock Growth Opportunities: Spain's E-brokerage Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic E-brokerage market in Spain, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the estimated year 2025. Discover key trends, competitive landscapes, and growth projections to navigate this evolving sector effectively.

E-brokerage Market in Spain Market Dynamics & Concentration

The Spanish e-brokerage market is characterized by a blend of established players and emerging competitors, creating a dynamic landscape shaped by technological advancements, regulatory changes, and evolving investor preferences. Market concentration is moderate, with several key players holding significant shares, but also with room for smaller, specialized firms to thrive. The market's overall value in 2024 is estimated at xx Million, with a projected value of xx Million by 2033.

Key Market Dynamics:

- Market Concentration: While precise market share data for individual players is confidential, the market shows a concentration of players with ING, Renta4banco and Bankinter holding significant portions of the market. However, the presence of numerous smaller brokers indicates a competitive environment.

- Innovation Drivers: The continuous evolution of trading platforms, the integration of AI-powered tools, and the increasing adoption of mobile trading apps are driving innovation.

- Regulatory Framework: The Spanish regulatory environment influences operational strategies and compliance requirements for e-brokerage firms. Changes to regulations impact operational costs and market access.

- Product Substitutes: Traditional brokerage services and investment platforms pose competitive pressure, though the convenience and cost-effectiveness of e-brokerage continue to attract users.

- End-User Trends: Growing digital literacy, the rise of retail investing, and the increasing demand for diversified investment options are fueling market growth.

- M&A Activities: The recent merger of DeGiro with flatexDEGIRO Bank AG exemplifies the significant M&A activity in the European e-brokerage sector, with at least xx significant deals recorded in the historical period (2019-2024). This activity will likely continue shaping the Spanish market.

E-brokerage Market in Spain Industry Trends & Analysis

The Spanish e-brokerage market is experiencing robust growth driven by several key factors. The compound annual growth rate (CAGR) from 2025 to 2033 is projected to be xx%, indicating substantial expansion. Increased market penetration among younger demographics and the rising adoption of digital financial services contribute significantly to this growth. Technological disruptions, particularly the rise of mobile trading and AI-powered investment tools, are reshaping consumer preferences and creating new opportunities for innovation. Intense competition among established players and new entrants is fostering a dynamic market with frequent price adjustments and innovative service offerings.

Market growth is further stimulated by:

- Technological advancements: Sophisticated trading platforms, AI-driven analytical tools, and the increasing integration of robo-advisors are reshaping the investment landscape, appealing to both experienced and novice traders.

- Shifting consumer preferences: Ease of access, lower fees, and greater transparency are key factors influencing consumers' choice of e-brokerage platforms over traditional methods.

- Competitive dynamics: Price wars, innovative product offerings, and the continuous strive to enhance user experience are defining characteristics of the current competitive environment.

Leading Markets & Segments in E-brokerage Market in Spain

The Spanish e-brokerage market displays strong growth across various segments, with no single region or segment overwhelmingly dominating. However, the urban areas show higher adoption rates of online brokerage due to higher internet penetration and financial literacy.

Key Drivers of Regional/Segment Dominance:

- Economic Policies: Government initiatives promoting financial inclusion and digitalization stimulate market growth.

- Infrastructure: Robust internet infrastructure and mobile penetration are crucial for accessibility and usability of e-brokerage platforms.

- Financial Literacy: Higher financial literacy among the population leads to greater adoption of online investment options.

E-brokerage Market in Spain Product Developments

The e-brokerage sector in Spain witnesses consistent product innovation, driven by technological advancements and evolving investor needs. New features include enhanced trading platforms with advanced charting tools and AI-driven analytics, mobile apps with streamlined interfaces, and the integration of robo-advisors for automated investment management. These improvements aim to cater to diverse investor profiles, from beginners to seasoned traders, creating a more inclusive and accessible market.

Key Drivers of E-brokerage Market in Spain Growth

Several factors fuel the growth trajectory of the Spanish e-brokerage market. Technological advancements, like user-friendly mobile apps and AI-powered tools, are simplifying investments. Favorable economic conditions and supportive government policies further encourage participation. The increasing financial literacy and digital adoption among the population also contributes to this market's expansion.

Challenges in the E-brokerage Market in Spain Market

Despite its strong growth potential, the Spanish e-brokerage market encounters obstacles. Stringent regulatory compliance burdens smaller firms, impacting their competitiveness. The market faces intense competition, requiring continuous innovation and cost optimization. Cybersecurity threats and the need to maintain investor confidence also present ongoing challenges.

Emerging Opportunities in E-brokerage Market in Spain

Future growth is driven by technological breakthroughs, specifically the increased use of blockchain technology and the integration of innovative fintech solutions. Strategic partnerships with financial institutions and expansion into underserved markets offer further avenues for growth. Moreover, the rising popularity of sustainable and ethical investment opportunities presents a significant expansion potential.

Leading Players in the E-brokerage Market in Spain Sector

- ING

- Renta4banco

- Bankinter

- DEGIRO

- BBVA Trader

- IC Market

- AVA Trade

- FP Market

- tastyworks

- Pepperstone

- List Not Exhaustive

Key Milestones in E-brokerage Market in Spain Industry

- April 2020: German Flatex completes its 100% acquisition of DeGiro for 250 Million EURO.

- Early 2021: DeGiro BV merges with flatexDEGIRO Bank AG, creating Europe's largest online brokerage with its own banking license.

- July 2021: Interactive Brokers launches a simplified flat-fee structure for stock trading in Europe, targeting individual investors.

Strategic Outlook for E-brokerage Market in Spain Market

The Spanish e-brokerage market holds significant long-term potential, driven by continued digitalization, rising investor participation, and the increasing adoption of innovative trading technologies. Strategic partnerships, expansion into new market segments (e.g., sustainable investing), and investments in cybersecurity and data analytics will be crucial for sustained growth and market leadership.

E-brokerage Market in Spain Segmentation

-

1. Investor

- 1.1. Retail

- 1.2. Institutional

-

2. Operation

- 2.1. Domestic

- 2.2. Foreign

E-brokerage Market in Spain Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-brokerage Market in Spain Regional Market Share

Geographic Coverage of E-brokerage Market in Spain

E-brokerage Market in Spain REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Financial Products contribute to highest percentage of Family assets of Spanish

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investor

- 5.1.1. Retail

- 5.1.2. Institutional

- 5.2. Market Analysis, Insights and Forecast - by Operation

- 5.2.1. Domestic

- 5.2.2. Foreign

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Investor

- 6. North America E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investor

- 6.1.1. Retail

- 6.1.2. Institutional

- 6.2. Market Analysis, Insights and Forecast - by Operation

- 6.2.1. Domestic

- 6.2.2. Foreign

- 6.1. Market Analysis, Insights and Forecast - by Investor

- 7. South America E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investor

- 7.1.1. Retail

- 7.1.2. Institutional

- 7.2. Market Analysis, Insights and Forecast - by Operation

- 7.2.1. Domestic

- 7.2.2. Foreign

- 7.1. Market Analysis, Insights and Forecast - by Investor

- 8. Europe E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investor

- 8.1.1. Retail

- 8.1.2. Institutional

- 8.2. Market Analysis, Insights and Forecast - by Operation

- 8.2.1. Domestic

- 8.2.2. Foreign

- 8.1. Market Analysis, Insights and Forecast - by Investor

- 9. Middle East & Africa E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investor

- 9.1.1. Retail

- 9.1.2. Institutional

- 9.2. Market Analysis, Insights and Forecast - by Operation

- 9.2.1. Domestic

- 9.2.2. Foreign

- 9.1. Market Analysis, Insights and Forecast - by Investor

- 10. Asia Pacific E-brokerage Market in Spain Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investor

- 10.1.1. Retail

- 10.1.2. Institutional

- 10.2. Market Analysis, Insights and Forecast - by Operation

- 10.2.1. Domestic

- 10.2.2. Foreign

- 10.1. Market Analysis, Insights and Forecast - by Investor

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ING

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renta4banco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bankinter

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DEGIRO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BBVA Trader

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IC Market

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AVA Trade

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FP Market

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 tastyworks

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pepperstone**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ING

List of Figures

- Figure 1: Global E-brokerage Market in Spain Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 3: North America E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 4: North America E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 5: North America E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 6: North America E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 7: North America E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 9: South America E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 10: South America E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 11: South America E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 12: South America E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 13: South America E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 15: Europe E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 16: Europe E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 17: Europe E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 18: Europe E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 21: Middle East & Africa E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 22: Middle East & Africa E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 23: Middle East & Africa E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 24: Middle East & Africa E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific E-brokerage Market in Spain Revenue (billion), by Investor 2025 & 2033

- Figure 27: Asia Pacific E-brokerage Market in Spain Revenue Share (%), by Investor 2025 & 2033

- Figure 28: Asia Pacific E-brokerage Market in Spain Revenue (billion), by Operation 2025 & 2033

- Figure 29: Asia Pacific E-brokerage Market in Spain Revenue Share (%), by Operation 2025 & 2033

- Figure 30: Asia Pacific E-brokerage Market in Spain Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific E-brokerage Market in Spain Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 2: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 3: Global E-brokerage Market in Spain Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 5: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 6: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 11: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 12: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 17: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 18: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 29: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 30: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global E-brokerage Market in Spain Revenue billion Forecast, by Investor 2020 & 2033

- Table 38: Global E-brokerage Market in Spain Revenue billion Forecast, by Operation 2020 & 2033

- Table 39: Global E-brokerage Market in Spain Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific E-brokerage Market in Spain Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-brokerage Market in Spain?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the E-brokerage Market in Spain?

Key companies in the market include ING, Renta4banco, Bankinter, DEGIRO, BBVA Trader, IC Market, AVA Trade, FP Market, tastyworks, Pepperstone**List Not Exhaustive.

3. What are the main segments of the E-brokerage Market in Spain?

The market segments include Investor, Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.37 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Financial Products contribute to highest percentage of Family assets of Spanish.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In early 2021, DeGiro BV merged with flatexDEGIRO Bank AG, creating the largest online foreclosure broker in Europe with its own banking license. Also in April 2020, German Flatex completes its 100% acquisition of DeGiro. The Deal value of the acquisition was 250 EURO million. With this Flatex Degiro become the leading online broker in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-brokerage Market in Spain," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-brokerage Market in Spain report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-brokerage Market in Spain?

To stay informed about further developments, trends, and reports in the E-brokerage Market in Spain, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence