Key Insights

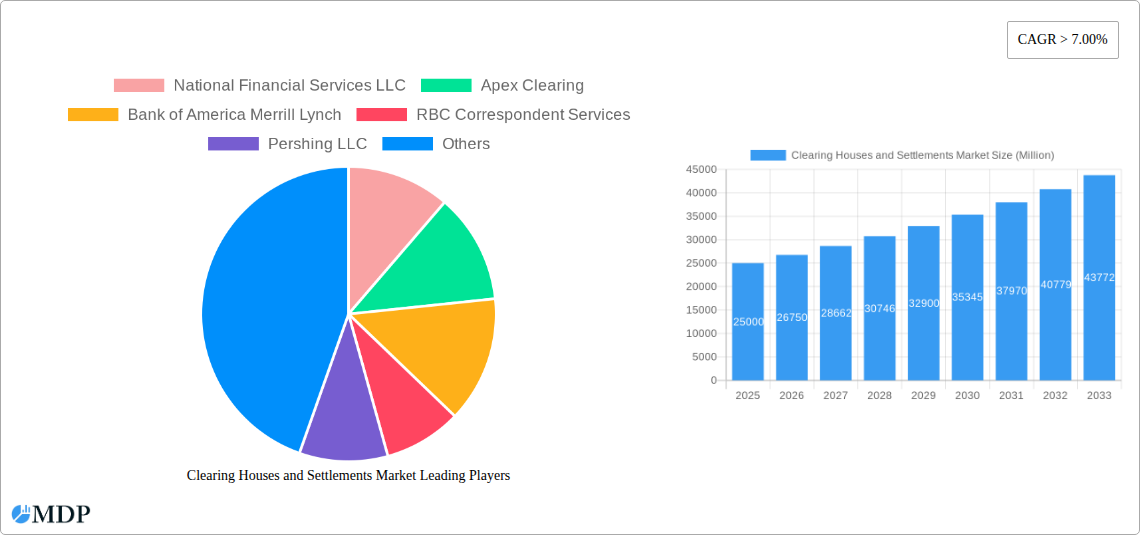

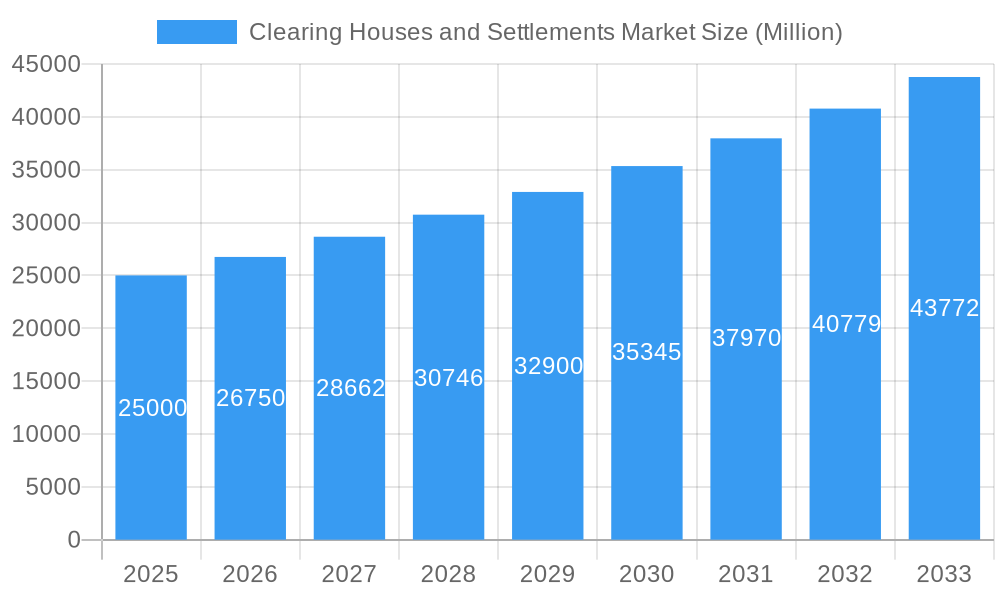

The global Clearing Houses and Settlements Market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 8% from a base year of 2025. This robust growth trajectory is driven by several key factors. Increased automation and digitization within financial institutions are accelerating the adoption of advanced clearing and settlement systems, thereby enhancing operational efficiency and mitigating risk. The escalating volume of global financial transactions, particularly in electronic payments and securities trading, mandates sophisticated clearing house infrastructure. Furthermore, stringent regulatory compliance requirements, designed to bolster financial market stability and combat fraud, are compelling institutions to invest in resilient clearing and settlement solutions. The market's segmentation, encompassing outward and inward clearing houses, along with service types such as TARGET, SEPA, and EBICS, reflects the diverse needs and technological preferences of a broad client base. Prominent industry leaders, including National Financial Services LLC, Apex Clearing, and J P Morgan Clearing Corp, are actively influencing the market through technological innovation and strategic acquisitions.

Clearing Houses and Settlements Market Market Size (In Billion)

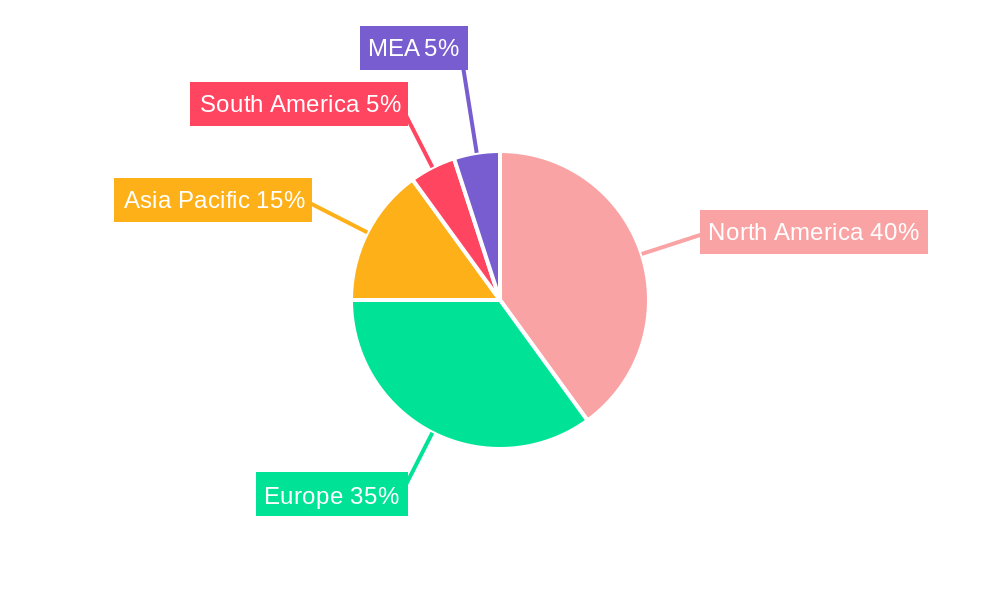

Geographically, North America, Europe, and Asia-Pacific currently dominate the market, attributed to their established financial hubs and advanced infrastructure. However, emerging markets in Asia-Pacific and South America present substantial growth opportunities, fueled by increasing economic activity and the rapid adoption of electronic financial transactions. The competitive environment is characterized by a dynamic interplay between established entities and agile fintech firms offering novel clearing and settlement solutions. Continued emphasis on technological advancements, regulatory adherence, and strategic market expansion will be pivotal for sustained success in this evolving landscape. Given the projected CAGR and prevailing market dynamics, the market size is anticipated to reach $150 billion by the end of the forecast period, with notable contributions from both mature and developing economies.

Clearing Houses and Settlements Market Company Market Share

Clearing Houses and Settlements Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Clearing Houses and Settlements Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report unveils the market's dynamics, trends, and future prospects. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report includes detailed analysis across key segments, including Outward Clearing House, Inward Clearing House, TARGET, SEPA, EBICS, and Other Services, and profiles leading players such as National Financial Services LLC, Apex Clearing, Bank of America Merrill Lynch, and more.

Clearing Houses and Settlements Market Market Dynamics & Concentration

The Clearing Houses and Settlements Market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. In 2024, the top five players collectively controlled approximately xx% of the market. Market concentration is influenced by factors such as stringent regulatory requirements, high capital investments needed for infrastructure, and the specialized expertise required for efficient clearing and settlement operations. Innovation drivers include the adoption of blockchain technology, AI-powered risk management systems, and the increasing demand for faster and more cost-effective transaction processing. Regulatory frameworks, such as those enforced by bodies like the SEC and various central banks, significantly impact market operations. While there are few direct substitutes for clearing houses, increasing automation and the emergence of decentralized finance (DeFi) platforms represent indirect competitive pressures. End-user trends reveal a growing preference for real-time settlements and enhanced transparency. M&A activity in the sector has been moderate, with approximately xx deals recorded between 2019 and 2024, primarily driven by strategic expansions and technological integrations.

- Market Share (2024): Top 5 players - xx%

- M&A Deal Count (2019-2024): xx

Clearing Houses and Settlements Market Industry Trends & Analysis

The Clearing Houses and Settlements Market is experiencing robust growth fueled by several key factors. The increasing volume of global financial transactions, driven by e-commerce expansion and cross-border payments, is a primary growth driver. Technological advancements, such as the implementation of distributed ledger technology (DLT) and improved cybersecurity measures, are streamlining processes and enhancing efficiency. The demand for faster and more reliable settlement systems is pushing market innovation, leading to the adoption of real-time gross settlement (RTGS) systems. Competitive dynamics are shaped by the ongoing consolidation within the industry, with larger players seeking to acquire smaller firms to expand their market reach and service offerings. Consumer preferences are increasingly focused on transparency, security, and cost-effectiveness. The market penetration of advanced clearing technologies, such as AI-driven fraud detection and blockchain-based solutions, is expected to increase significantly in the coming years. The CAGR for the market during the forecast period is estimated at xx%.

Leading Markets & Segments in Clearing Houses and Settlements Market

The North American region currently dominates the Clearing Houses and Settlements Market, driven by a well-developed financial infrastructure, a large volume of financial transactions, and the presence of key market players. Within the market segmentation:

- Type: Outward clearing houses currently hold a larger market share than inward clearing houses due to the higher volume of outgoing transactions.

- Service: TARGET and SEPA services dominate the market, reflecting their widespread adoption in Europe. However, the usage of EBICS and other specialized services is growing steadily.

Key Drivers for Dominance:

- North America: Strong regulatory environment, technological advancement, established financial institutions.

- Europe (TARGET, SEPA): High adoption rates driven by regulatory mandates and established payment infrastructure.

The dominance of these segments is largely due to high transaction volumes, robust regulatory frameworks, and technological advancements.

Clearing Houses and Settlements Market Product Developments

Recent product innovations focus on enhancing security, speed, and cost-effectiveness of clearing and settlement processes. The integration of blockchain technology promises to revolutionize transaction processing by enhancing transparency, reducing latency, and minimizing counterparty risk. New applications are emerging in areas such as digital asset clearing and settlement, catering to the growing cryptocurrency market. These advancements offer significant competitive advantages to firms that can effectively integrate and utilize these technologies.

Key Drivers of Clearing Houses and Settlements Market Growth

The growth of the Clearing Houses and Settlements Market is propelled by several key factors:

- Technological advancements: The adoption of blockchain technology, AI, and machine learning is streamlining operations and increasing efficiency.

- Economic growth: Expanding global trade and increasing financial transactions are driving market demand.

- Regulatory changes: Stringent regulations aimed at enhancing financial stability are creating opportunities for specialized clearing services.

Challenges in the Clearing Houses and Settlements Market Market

The Clearing Houses and Settlements Market faces certain challenges, including:

- Regulatory hurdles: Compliance with complex and evolving regulations can be costly and time-consuming.

- Cybersecurity threats: The increasing reliance on digital systems makes the industry vulnerable to cyberattacks.

- Competitive pressures: The market is becoming increasingly competitive, with new players entering the space. These factors could potentially impact market growth by xx% by 2030 if not addressed proactively.

Emerging Opportunities in Clearing Houses and Settlements Market

The Clearing Houses and Settlements Market presents exciting long-term growth opportunities:

- Technological breakthroughs: The potential of blockchain and AI to transform the industry is immense.

- Strategic partnerships: Collaborations between fintech companies and traditional financial institutions can foster innovation.

- Market expansion: Emerging economies present significant growth potential for clearing house services.

Leading Players in the Clearing Houses and Settlements Market Sector

Key Milestones in Clearing Houses and Settlements Market Industry

- November 2022: Finxact and KPMG's partnership to modernize banking cores signifies a shift towards embedded finance and technological upgrades within the industry.

- December 2022: Airwallex and Plaid's collaboration streamlines ACH payments, highlighting the increasing integration of fintech solutions for enhanced efficiency and security.

- January 2023: The Clearing House's leadership transition signals a focus on adapting to evolving market dynamics and technological changes.

Strategic Outlook for Clearing Houses and Settlements Market Market

The Clearing Houses and Settlements Market is poised for continued growth, driven by technological innovation, regulatory changes, and increasing global financial activity. Strategic opportunities lie in leveraging emerging technologies like blockchain and AI to enhance efficiency, security, and transparency. Furthermore, strategic partnerships and expansions into new markets will be crucial for long-term success. The market shows strong potential for significant expansion, particularly in developing economies and within the burgeoning digital asset space.

Clearing Houses and Settlements Market Segmentation

-

1. Type

- 1.1. Outward Clearing House

- 1.2. Inward Clearing House

-

2. Service

- 2.1. TARGET2

- 2.2. SEPA

- 2.3. EBICS

-

2.4. Other Services

- 2.4.1. EURO1

- 2.4.2. CCBM

Clearing Houses and Settlements Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Clearing Houses and Settlements Market Regional Market Share

Geographic Coverage of Clearing Houses and Settlements Market

Clearing Houses and Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Target2 is Driving Europe's Clearing and Settlements Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Outward Clearing House

- 5.1.2. Inward Clearing House

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. TARGET2

- 5.2.2. SEPA

- 5.2.3. EBICS

- 5.2.4. Other Services

- 5.2.4.1. EURO1

- 5.2.4.2. CCBM

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Outward Clearing House

- 6.1.2. Inward Clearing House

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. TARGET2

- 6.2.2. SEPA

- 6.2.3. EBICS

- 6.2.4. Other Services

- 6.2.4.1. EURO1

- 6.2.4.2. CCBM

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Outward Clearing House

- 7.1.2. Inward Clearing House

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. TARGET2

- 7.2.2. SEPA

- 7.2.3. EBICS

- 7.2.4. Other Services

- 7.2.4.1. EURO1

- 7.2.4.2. CCBM

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Outward Clearing House

- 8.1.2. Inward Clearing House

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. TARGET2

- 8.2.2. SEPA

- 8.2.3. EBICS

- 8.2.4. Other Services

- 8.2.4.1. EURO1

- 8.2.4.2. CCBM

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Outward Clearing House

- 9.1.2. Inward Clearing House

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. TARGET2

- 9.2.2. SEPA

- 9.2.3. EBICS

- 9.2.4. Other Services

- 9.2.4.1. EURO1

- 9.2.4.2. CCBM

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Outward Clearing House

- 10.1.2. Inward Clearing House

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. TARGET2

- 10.2.2. SEPA

- 10.2.3. EBICS

- 10.2.4. Other Services

- 10.2.4.1. EURO1

- 10.2.4.2. CCBM

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 National Financial Services LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Apex Clearing

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bank of America Merrill Lynch

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 RBC Correspondent Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pershing LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 J P Morgan Clearing Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FOLIOfn Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goldman Sachs Execution and Clearing LP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 StoneX

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Southwest Securities Inc*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 National Financial Services LLC

List of Figures

- Figure 1: Global Clearing Houses and Settlements Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 5: North America Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 11: Europe Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 12: Europe Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 17: Asia Pacific Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 18: Asia Pacific Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 23: Latin America Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 24: Latin America Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Clearing Houses and Settlements Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Clearing Houses and Settlements Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Clearing Houses and Settlements Market Revenue (billion), by Service 2025 & 2033

- Figure 29: Middle East and Africa Clearing Houses and Settlements Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: Middle East and Africa Clearing Houses and Settlements Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Clearing Houses and Settlements Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 3: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 9: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 12: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 15: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Clearing Houses and Settlements Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Clearing Houses and Settlements Market?

Key companies in the market include National Financial Services LLC, Apex Clearing, Bank of America Merrill Lynch, RBC Correspondent Services, Pershing LLC, J P Morgan Clearing Corp, FOLIOfn Inc, Goldman Sachs Execution and Clearing LP, StoneX, Southwest Securities Inc*List Not Exhaustive.

3. What are the main segments of the Clearing Houses and Settlements Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 150 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Target2 is Driving Europe's Clearing and Settlements Market.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

January 2023: The Clearing House (TCH) announced that President and CEO Jim Aramanda will be retiring in early 2023, after 15 years leading the company. Aramanda will be succeeded by David Watson, who most recently served as Chief Product Officer of Swift.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Clearing Houses and Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Clearing Houses and Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Clearing Houses and Settlements Market?

To stay informed about further developments, trends, and reports in the Clearing Houses and Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence