Key Insights

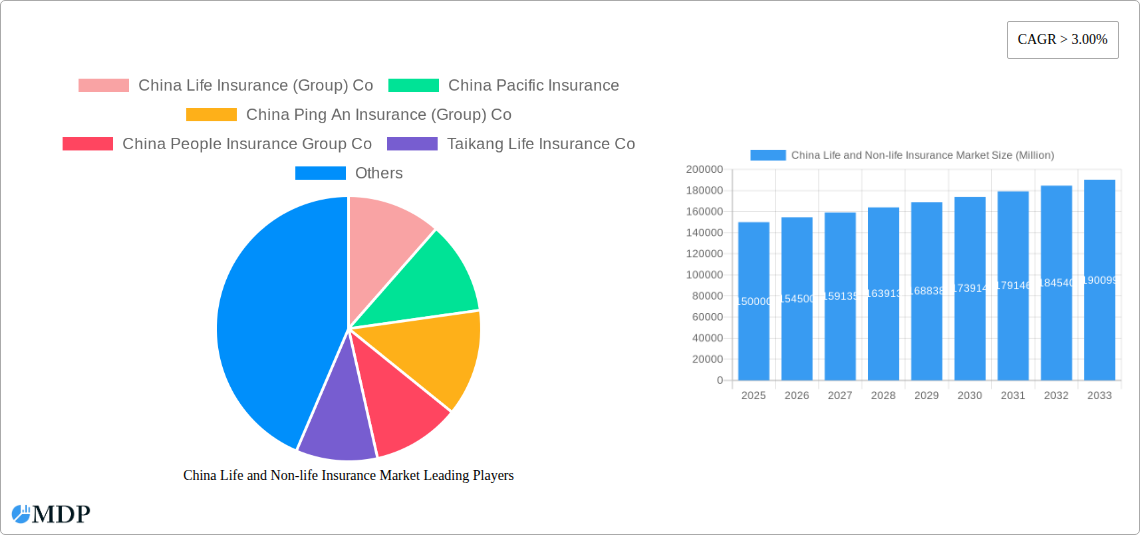

The China Life and Non-Life Insurance Market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 3.52% from its base year of 2024, reaching an estimated market size of 883.7 billion by 2033. This growth is propelled by a confluence of factors, including rising disposable incomes, an expanding middle class, and heightened consumer awareness regarding financial security. Government-led initiatives promoting financial inclusion and the strategic development of the insurance sector further bolster this upward trajectory. The market is granularly segmented by product categories (life, health, property, and more), distribution channels (online, agent, broker), and diverse geographic regions. Leading entities such as China Life Insurance, China Ping An Insurance, and China Pacific Insurance command substantial market presence, capitalizing on their expansive distribution networks and strong brand equity. Nevertheless, the market navigates challenges posed by intense competition and evolving regulatory frameworks. A discernible trend towards digitalization is reshaping the industry, with insurers actively integrating technology to elevate customer experiences and optimize operational efficiencies. This technological evolution necessitates agile adaptation by insurers to maintain competitive advantage. Furthermore, the increasing incidence of chronic diseases and escalating healthcare demands are anticipated to drive substantial growth within the health insurance segment.

China Life and Non-life Insurance Market Market Size (In Billion)

The forecast period (2025-2033) foresees sustained market advancement, albeit with potential fluctuations influenced by macroeconomic shifts and governmental policies. While the market benefits from a vast addressable audience and considerable growth prospects, enduring success will be contingent upon insurers' strategic agility in innovation, delivery of personalized products, and adept navigation of regulatory environments. The competitive milieu underscores the imperative for strategic investments in technology, talent development, and product diversification to secure market share and ensure sustainable profitability. The expanding penetration of insurance services in rural China presents a compelling growth opportunity in the upcoming years. Addressing information asymmetry and fostering greater financial literacy among the populace will be crucial in unlocking the market's complete potential.

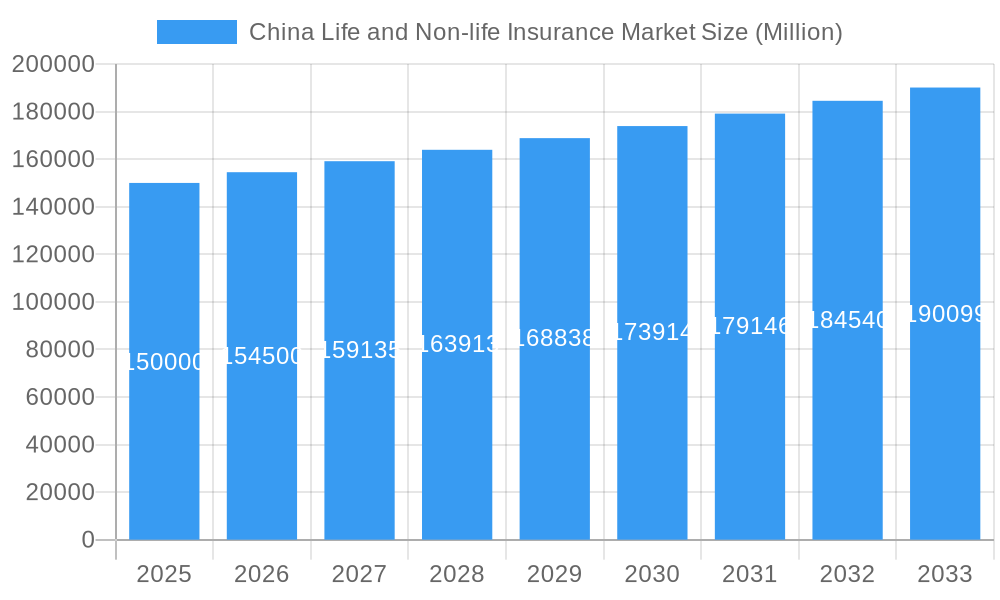

China Life and Non-life Insurance Market Company Market Share

Unlock the Potential: A Comprehensive Analysis of China's Life and Non-Life Insurance Market (2019-2033)

This in-depth report provides a comprehensive analysis of China's dynamic life and non-life insurance market, offering invaluable insights for investors, insurers, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market trends, competitive landscapes, and future growth opportunities. Discover key market dynamics, leading players like China Life Insurance (Group) Co, China Pacific Insurance, and China Ping An Insurance (Group) Co, and understand the strategic imperatives shaping this multi-billion-dollar sector. The report is packed with actionable data and forecasts, enabling informed decision-making in this rapidly evolving market. Expect detailed breakdowns of market size (in Millions), CAGR projections, and market share analysis.

China Life and Non-life Insurance Market Market Dynamics & Concentration

The Chinese life and non-life insurance market is characterized by a high degree of concentration, with a few dominant players commanding significant market share. Market concentration is further influenced by stringent regulatory frameworks and ongoing mergers and acquisitions (M&A) activities. Innovation, driven by technological advancements and evolving consumer preferences, plays a vital role in shaping the competitive landscape.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating a consolidated market structure.

- Innovation Drivers: Digitalization, AI-powered solutions, and personalized insurance products are key drivers of innovation.

- Regulatory Framework: Government regulations significantly influence market entry, product offerings, and pricing strategies.

- Product Substitutes: Alternative financial products and investment options represent potential substitutes for traditional insurance products.

- End-User Trends: Growing awareness of risk management and increasing disposable incomes fuel demand for insurance products.

- M&A Activities: The past five years have witnessed xx M&A deals, highlighting the strategic importance of consolidation and expansion in this sector. This has resulted in significant shifts in market share among key players. For example, AIA Group's 24.99% stake in China Post Life Insurance (Jan 2022) illustrates the trend toward strategic partnerships and acquisitions.

China Life and Non-life Insurance Market Industry Trends & Analysis

The Chinese life and non-life insurance market demonstrates robust growth, driven by several factors. Market expansion is fueled by a burgeoning middle class, increasing health consciousness, and government initiatives promoting financial inclusion. Technological disruption is reshaping the industry, with digital platforms and AI-powered solutions transforming customer experience and operational efficiency. Consumer preferences are shifting towards personalized and digitally enabled insurance products.

- Market Growth Drivers: Rising disposable incomes, expanding middle class, increasing health awareness, and government support for insurance penetration are key growth drivers.

- Technological Disruptions: Digitalization, AI, and big data analytics are transforming product development, distribution, and customer service.

- Consumer Preferences: Demand for personalized, flexible, and digitally accessible insurance products is growing.

- Competitive Dynamics: Intense competition among established players and new entrants necessitates continuous innovation and strategic partnerships.

- CAGR: The market is projected to experience a CAGR of xx% during the forecast period (2025-2033).

- Market Penetration: Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

Leading Markets & Segments in China Life and Non-life Insurance Market

The dominant segment within the Chinese life and non-life insurance market is currently the life insurance segment, driven by factors including increasing longevity and government initiatives aimed at improving social security. While the non-life segment is also experiencing growth, life insurance presently dominates overall market size.

Key Drivers of Life Insurance Dominance:

- Government Policies: Initiatives supporting retirement planning and social security contribute to market growth.

- Economic Growth: Rising disposable incomes allow individuals to allocate more resources to life insurance planning.

- Demographic Trends: China's aging population further fuels demand for retirement and longevity-related insurance products.

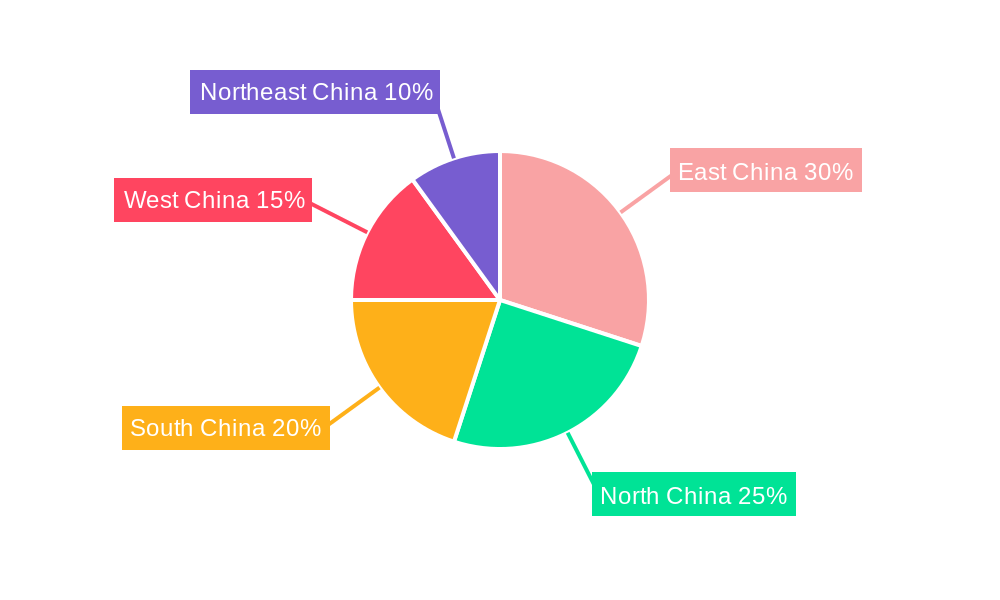

The geographical spread of market dominance indicates that major urban centers contribute significantly to the total market volume.

China Life and Non-life Insurance Market Product Developments

Recent product innovations focus on integrating technology and addressing specific customer needs. Digital insurance platforms offer convenient policy purchases and claims management. Personalized products cater to specific lifestyle, health, and risk profiles. These advancements improve customer experience and expand market reach, enhancing competitive advantages. Insurtech partnerships further accelerate innovation.

Key Drivers of China Life and Non-life Insurance Market Growth

Technological advancements (AI, big data analytics), a robust expanding economy, and supportive government policies are pivotal drivers of market growth. The government's initiatives promoting financial inclusion and social security contribute significantly to expanding market access and demand. Economic growth generates higher disposable incomes, empowering consumers to prioritize insurance protection.

Challenges in the China Life and Non-life Insurance Market Market

Regulatory complexities, supply chain disruptions (especially regarding claims processing), and intense competition pose significant challenges. Stringent regulatory requirements for market entry and product approval add to operational costs. Maintaining profitability in a highly competitive market necessitates cost optimization and innovative product offerings.

Emerging Opportunities in China Life and Non-life Insurance Market

Technological breakthroughs, particularly in AI and blockchain, present significant opportunities. Strategic partnerships between established insurers and fintech companies are expanding product offerings and improving service delivery. Expanding market reach into less-penetrated regions offers substantial growth potential.

Leading Players in the China Life and Non-life Insurance Market Sector

- China Life Insurance (Group) Co

- China Pacific Insurance

- China Ping An Insurance (Group) Co

- China People Insurance Group Co

- Taikang Life Insurance Co

- Xinhua Insurance

- American International Assurance Co Ltd

- Sunshine Insurance

- Funde Sino Life

- China Taiping Insurance Group Co

Key Milestones in China Life and Non-life Insurance Market Industry

- April 2022: China Life Insurance Co and Tokio Marine Newa Insurance Co partnered to cross-sell products, expanding distribution channels.

- January 2022: AIA Group acquired a 24.99% stake in China Post Life Insurance, significantly altering market dynamics.

Strategic Outlook for China Life and Non-life Insurance Market Market

The Chinese life and non-life insurance market exhibits tremendous long-term growth potential. Strategic partnerships, technological innovation, and expansion into underserved markets will shape future success. Companies that leverage data analytics and personalized product offerings will be best positioned to capitalize on this growth.

China Life and Non-life Insurance Market Segmentation

-

1. Insurance type

- 1.1. Life Insurance

- 1.2. Non-life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

China Life and Non-life Insurance Market Segmentation By Geography

- 1. China

China Life and Non-life Insurance Market Regional Market Share

Geographic Coverage of China Life and Non-life Insurance Market

China Life and Non-life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market

- 3.4. Market Trends

- 3.4.1. Digital Transformation is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Life and Non-life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.2. Non-life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Life Insurance (Group) Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Pacific Insurance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Ping An Insurance (Group) Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China People Insurance Group Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Taikang Life Insurance Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Xinhua Insurance

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 American International Assurance Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sunshine Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Funde Sino Life

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Taiping Insurance Group Co **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China Life Insurance (Group) Co

List of Figures

- Figure 1: China Life and Non-life Insurance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Life and Non-life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: China Life and Non-life Insurance Market Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 2: China Life and Non-life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: China Life and Non-life Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Life and Non-life Insurance Market Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 5: China Life and Non-life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: China Life and Non-life Insurance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Life and Non-life Insurance Market?

The projected CAGR is approximately 3.52%.

2. Which companies are prominent players in the China Life and Non-life Insurance Market?

Key companies in the market include China Life Insurance (Group) Co, China Pacific Insurance, China Ping An Insurance (Group) Co, China People Insurance Group Co, Taikang Life Insurance Co, Xinhua Insurance, American International Assurance Co Ltd, Sunshine Insurance, Funde Sino Life, China Taiping Insurance Group Co **List Not Exhaustive.

3. What are the main segments of the China Life and Non-life Insurance Market?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 883.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market.

6. What are the notable trends driving market growth?

Digital Transformation is Driving the Market.

7. Are there any restraints impacting market growth?

Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market.

8. Can you provide examples of recent developments in the market?

April 2022: China Life Insurance Co and Tokio Marine Newa Insurance Co have recently formed a partnership to cross-sell their insurance products. Under the partnership, China Life's 15,000 sales agents would receive training from Tokio Marine Newa for them to become licensed Tokio Marine sales agents. Once licensed, these sales agents can market Tokio Marine's non-life products, including motor, fire, and travel insurance to their clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Life and Non-life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Life and Non-life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Life and Non-life Insurance Market?

To stay informed about further developments, trends, and reports in the China Life and Non-life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence