Key Insights

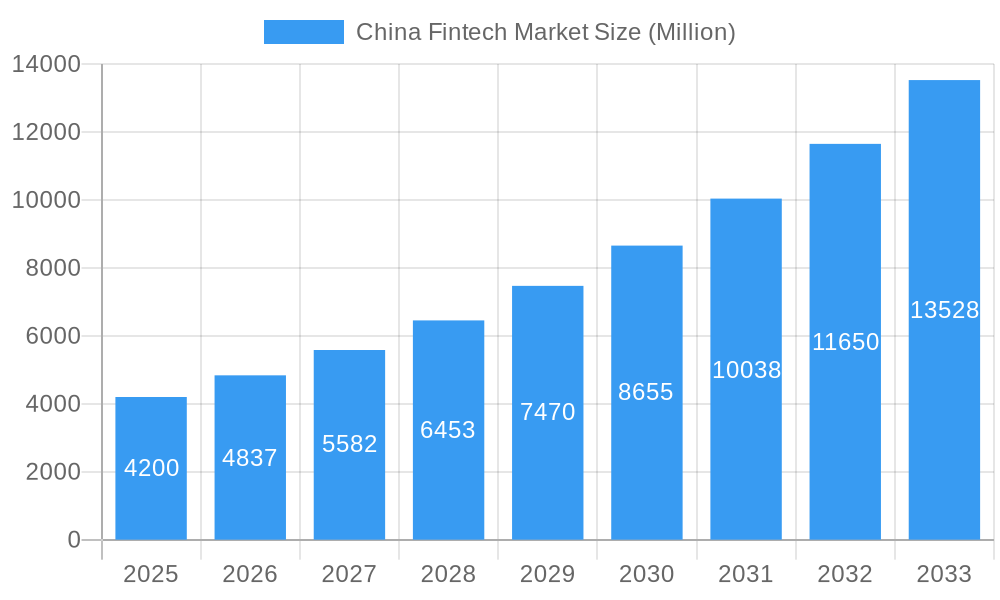

The China Fintech market, valued at $4.20 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.67% from 2025 to 2033. This explosive growth is fueled by several key factors. The widespread adoption of smartphones and internet penetration across China has created a fertile ground for digital payment solutions, a major segment within the Fintech sector. Furthermore, a burgeoning middle class with increasing financial sophistication is driving demand for personal finance management tools and alternative lending options. Government initiatives promoting financial inclusion and digital transformation also contribute to the market's expansion. The competitive landscape is intensely dynamic, with established players like Ant Financial, Tencent, and Ping An Technology vying for market share alongside innovative startups. The Asia-Pacific region, particularly China, dominates the market, benefiting from a large and rapidly evolving consumer base. Challenges remain, however, including regulatory hurdles and concerns around data security and privacy, requiring careful navigation by market participants.

China Fintech Market Market Size (In Billion)

Looking ahead, the future of the China Fintech market appears bright. Continued technological advancements, especially in areas like artificial intelligence (AI) and blockchain, will further enhance the efficiency and reach of Fintech services. The increasing integration of Fintech with other sectors, such as healthcare and e-commerce, will open up new avenues for growth. The market is also poised to see the emergence of innovative solutions addressing specific consumer needs, such as customized financial products and personalized investment strategies. While maintaining a competitive edge requires ongoing innovation and adaptation to evolving regulatory environments, the overall outlook for the China Fintech market is one of sustained and significant growth throughout the forecast period.

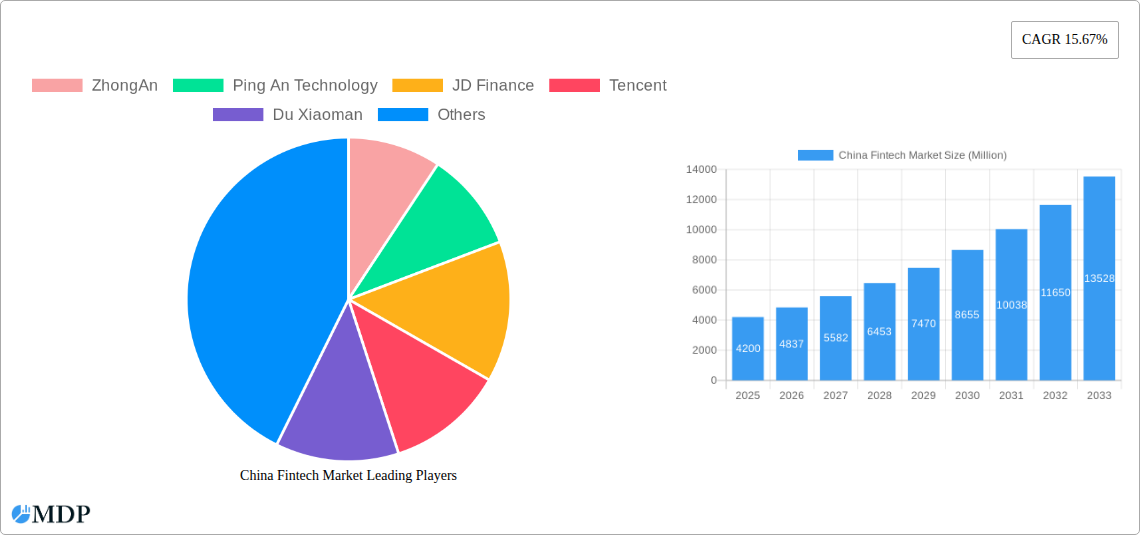

China Fintech Market Company Market Share

China Fintech Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic China Fintech market, covering the period 2019-2033, with a focus on 2025. It examines market dynamics, industry trends, leading players, and future growth opportunities, offering actionable insights for stakeholders across the fintech ecosystem. The report leverages extensive data analysis to project a robust market forecast, highlighting key segments and drivers shaping the future of fintech in China. This report is invaluable for investors, businesses, and policymakers seeking a clear understanding of this rapidly evolving landscape.

China Fintech Market Market Dynamics & Concentration

The China Fintech market, valued at xx Million in 2024, is characterized by intense competition and rapid innovation. Market concentration is high, with a few dominant players controlling significant market share. Ant Financial and Tencent, for instance, hold substantial portions of the digital payments and personal finance segments. However, a vibrant ecosystem of smaller, specialized fintech companies also contributes significantly to market growth.

Key Market Dynamics:

- High Innovation: Continuous advancements in AI, big data, and blockchain technologies are driving product innovation and service enhancement.

- Stringent Regulatory Framework: The evolving regulatory landscape, including policies on data privacy and financial security, significantly impacts market players' strategies.

- Product Substitutes: The emergence of alternative financial solutions and neobanks presents a competitive challenge to traditional players.

- Evolving Consumer Trends: Increasing digital adoption among Chinese consumers fuels demand for seamless and convenient fintech services.

- Mergers & Acquisitions (M&A): The market has witnessed a surge in M&A activities in recent years, aiming at consolidation and expansion. The number of M&A deals in 2024 reached approximately xx, signaling market consolidation trends. Market share analysis indicates a concentration among the top players, with the top 5 players holding approximately xx% of the total market share in 2024.

China Fintech Market Industry Trends & Analysis

The China Fintech market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at xx%, reflecting the ongoing digital transformation and increasing consumer adoption. This growth is fueled by rising smartphone penetration, robust internet infrastructure, and government support for digital finance initiatives. Market penetration in key segments like digital payments is already high but continues to expand into less-penetrated areas, driving overall market expansion. Technological disruptions like the rise of open banking and embedded finance are reshaping the competitive landscape. Consumer preferences are shifting towards personalized, customized, and convenient financial services, requiring fintech companies to adapt and innovate continuously. This competitive environment fosters innovation and efficiency, enhancing the user experience and driving market growth further.

Leading Markets & Segments in China Fintech Market

While the China Fintech market is geographically diverse, significant regional variations exist in adoption rates and growth potential. Tier-1 cities like Beijing and Shanghai exhibit higher penetration rates across segments, driven by higher digital literacy, and economic activity. However, considerable growth potential exists in lower-tier cities and rural areas as financial inclusion expands.

Dominant Segments:

- Digital Payments: This remains the largest segment, driven by widespread mobile penetration and the popularity of mobile payment platforms like Alipay and WeChat Pay. Key drivers include government initiatives promoting cashless transactions and the growth of e-commerce.

- Personal Finance: This segment includes wealth management, insurance, and lending services, witnessing significant growth as consumer demand for personalized financial solutions increases. Economic policies promoting financial literacy and accessible investment platforms fuel this segment's expansion.

- Alternative Lending: This sector is experiencing rapid growth due to the increasing demand for faster and more accessible credit options. Key drivers are innovative lending models, leveraging technology for credit scoring and risk assessment.

- Alternative Financing: This segment encompasses crowdfunding and peer-to-peer (P2P) lending, experiencing moderate growth with increased regulatory scrutiny.

China Fintech Market Product Developments

Recent product innovations focus on enhancing user experience, improving security, and expanding service offerings. Artificial intelligence (AI) powers personalized financial advice and fraud detection, while blockchain technology improves transparency and security in transactions. Embedded finance integrates financial services into non-financial platforms, expanding reach and creating new revenue streams. These technological advancements cater to the evolving needs of Chinese consumers, making fintech services more accessible and user-friendly.

Key Drivers of China Fintech Market Growth

Several factors are driving the China Fintech market's impressive growth. Technological advancements, such as AI, big data analytics, and blockchain, are optimizing financial processes and improving service efficiency. Robust economic growth and rising disposable incomes are increasing consumer spending and demand for convenient financial solutions. Government support for digital finance initiatives, promoting financial inclusion and innovation, is crucial.

Challenges in the China Fintech Market Market

The China Fintech market faces several challenges. The evolving regulatory landscape creates uncertainty and compliance burdens for businesses. Data privacy concerns and cybersecurity threats need continuous attention. Intense competition among numerous players necessitates constant innovation and adaptation to retain market share. These challenges impact market growth and profitability, requiring careful navigation and strategic responses.

Emerging Opportunities in China Fintech Market

The long-term outlook for the China Fintech market is positive. Technological breakthroughs, such as advancements in AI and blockchain, will continue to drive innovation. Strategic partnerships between established financial institutions and fintech startups will unlock new growth avenues. Expansion into under-served markets will broaden the market's reach, enhancing financial inclusion.

Leading Players in the China Fintech Market Sector

- ZhongAn

- Ping An Technology

- JD Finance

- Tencent

- Du Xiaoman

- Ant Financial

- Lufax

- Dianrong

- Tiger Brokers

- List Not Exhaustive

Key Milestones in China Fintech Market Industry

- July 2023: Flywire partnered with Tencent Financial Technology to expand Weixin Pay for international education payments. This significantly expands the reach and adoption of Weixin Pay in a niche market.

- February 2023: NBA and Ant Group formed a strategic partnership, potentially boosting Ant Group's brand image and expanding its reach into new user segments.

Strategic Outlook for China Fintech Market Market

The China Fintech market holds immense potential for future growth. Continued technological innovation, strategic partnerships, and expansion into new markets will drive market expansion. Focusing on customer experience, regulatory compliance, and addressing cybersecurity concerns will be essential for sustained success in this competitive landscape. The market is poised for significant expansion, offering lucrative opportunities for businesses and investors.

China Fintech Market Segmentation

-

1. China Transaction Volumes

- 1.1. Digital Payments

- 1.2. Personal Finance

- 1.3. Alternative Lending

- 1.4. Alternative Financing

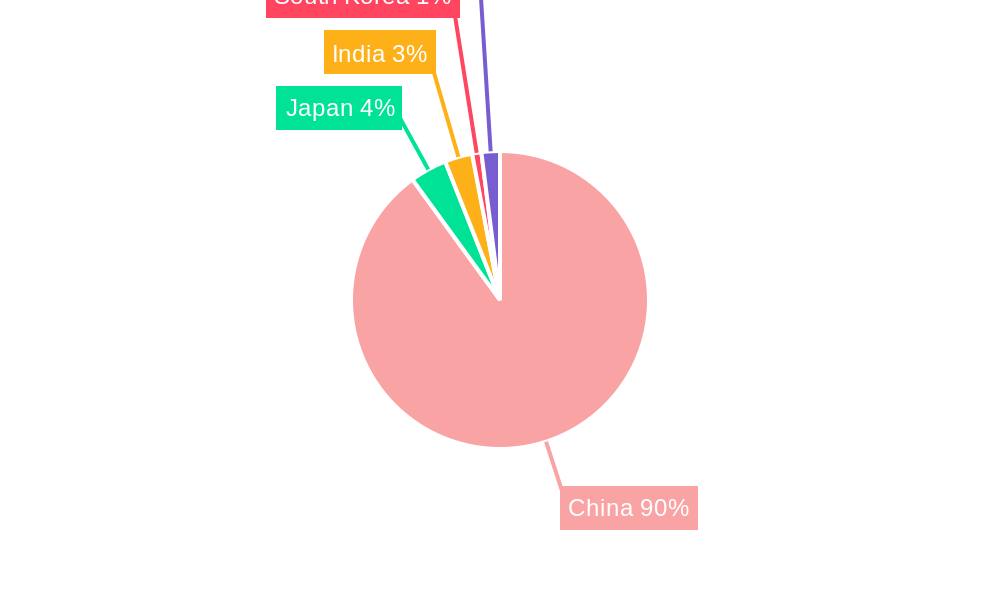

China Fintech Market Segmentation By Geography

- 1. China

China Fintech Market Regional Market Share

Geographic Coverage of China Fintech Market

China Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration is Driving the Market; The Rapid Progress in Technology has Paved the Way for Fintech Innovation

- 3.3. Market Restrains

- 3.3.1. Concerns about Data Security and Privacy; Increasing Competition is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increase in Digital Investments in the Fintech Industry is Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by China Transaction Volumes

- 5.1.1. Digital Payments

- 5.1.2. Personal Finance

- 5.1.3. Alternative Lending

- 5.1.4. Alternative Financing

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by China Transaction Volumes

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ZhongAn

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ping An Technology

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JD Finance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tencent

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Du Xiaoman

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ant Financial

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lufax

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dianrong

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tiger Brokers**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 ZhongAn

List of Figures

- Figure 1: China Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: China Fintech Market Revenue Million Forecast, by China Transaction Volumes 2020 & 2033

- Table 2: China Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: China Fintech Market Revenue Million Forecast, by China Transaction Volumes 2020 & 2033

- Table 4: China Fintech Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Fintech Market?

The projected CAGR is approximately 15.67%.

2. Which companies are prominent players in the China Fintech Market?

Key companies in the market include ZhongAn, Ping An Technology, JD Finance, Tencent, Du Xiaoman, Ant Financial, Lufax, Dianrong, Tiger Brokers**List Not Exhaustive.

3. What are the main segments of the China Fintech Market?

The market segments include China Transaction Volumes.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration is Driving the Market; The Rapid Progress in Technology has Paved the Way for Fintech Innovation.

6. What are the notable trends driving market growth?

Increase in Digital Investments in the Fintech Industry is Fueling the Market.

7. Are there any restraints impacting market growth?

Concerns about Data Security and Privacy; Increasing Competition is Restraining the Market.

8. Can you provide examples of recent developments in the market?

July 2023: Flywire, a software and global payments enablement firm, partnered with Tencent Financial Technology, Tencent's fintech division, to expand Weixin Pay. Chinese families and students who are financing their international education have the option to pay with WeChat Pay.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Fintech Market?

To stay informed about further developments, trends, and reports in the China Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence