Key Insights

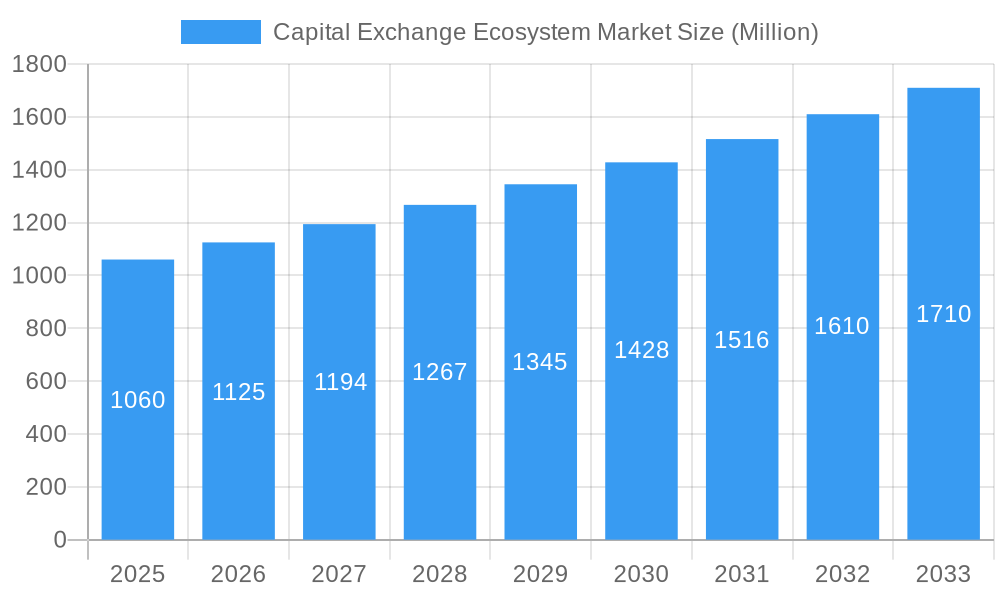

The global Capital Exchange Ecosystem market is experiencing robust growth, projected to reach $1.06 trillion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This expansion is driven by several key factors. Increased global trade and investment necessitate efficient and transparent capital exchange mechanisms, fueling demand for advanced trading platforms and technologies. The rise of fintech and the adoption of blockchain technology are streamlining transactions, enhancing security, and reducing operational costs, further stimulating market growth. Regulatory changes aimed at improving market transparency and investor protection are also contributing to a more robust and attractive ecosystem. The increasing adoption of algorithmic trading and high-frequency trading strategies by institutional investors is adding another layer of complexity and demand for sophisticated exchange infrastructure. Competition among established exchanges and the emergence of new, innovative players are driving innovation and pushing the boundaries of efficiency and accessibility within the capital markets.

Capital Exchange Ecosystem Market Market Size (In Billion)

The market's segmentation reflects the diverse nature of the capital exchange ecosystem. While specific segment data isn't provided, we can infer the presence of segments based on asset class (equities, bonds, derivatives), trading technology (algorithmic trading, high-frequency trading), and geographical location. Key players, such as the New York Stock Exchange, Japan Exchange Group, London Stock Exchange, Hong Kong Stock Exchange, Shanghai Stock Exchange, National Stock Exchange of India, Euronext, NASDAQ, Bombay Stock Exchange, and the Saudi Stock Exchange, compete intensely for market share through technological advancements, strategic partnerships, and geographical expansion. However, potential restraints include geopolitical instability, regulatory hurdles in emerging markets, and cybersecurity threats, which could impact the market's growth trajectory. The forecast period, 2025-2033, will likely witness a continued consolidation of market players, increased adoption of advanced technologies, and a growing focus on regulatory compliance and market integrity.

Capital Exchange Ecosystem Market Company Market Share

Capital Exchange Ecosystem Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Capital Exchange Ecosystem Market, encompassing market dynamics, industry trends, leading players, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for investors, industry stakeholders, and market entrants seeking to understand the intricacies of this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Capital Exchange Ecosystem Market Market Dynamics & Concentration

The Capital Exchange Ecosystem Market is a dynamic and evolving landscape shaped by a multifaceted interplay of influential factors. Understanding these dynamics is crucial for stakeholders seeking to navigate and capitalize on its growth and concentration trends. Key market dynamics influencing this ecosystem include:

-

Market Concentration: The market exhibits a moderate concentration, with established global powerhouses like the New York Stock Exchange, NASDAQ, and the London Stock Exchange commanding significant market share. However, a burgeoning trend towards the increasing prominence of regional exchanges is fostering a more diversified and competitive landscape. While precise figures fluctuate, it is estimated that the top 5 players collectively held approximately [Insert Latest Market Share Percentage Here, e.g., 65%] of the global market share in 2025, indicating room for growth among other participants.

-

Innovation Drivers: The relentless pace of technological advancement is a primary catalyst for innovation. Sophisticated technologies such as high-frequency trading (HFT), advanced algorithmic trading strategies, and the transformative potential of blockchain technology are fundamentally reshaping operational efficiencies, enhancing transparency, and democratizing access within the market.

-

Regulatory Frameworks: The operational terrain and growth trajectory of the Capital Exchange Ecosystem Market are significantly influenced by robust and evolving regulatory frameworks. These regulations, encompassing crucial areas like cybersecurity, data privacy, and the prevention of market manipulation, are paramount for maintaining market stability and investor confidence. While indispensable for integrity, these regulations can also present nuanced challenges and considerations for market expansion strategies.

-

Product Substitutes: The emergence and increasing sophistication of decentralized finance (DeFi) platforms and alternative trading systems (ATS) represent potential substitutes and complementary offerings. While their widespread adoption is still maturing, these innovations are beginning to offer alternative avenues for capital exchange, prompting traditional players to adapt and innovate.

-

End-User Trends: A significant and transformative shift is being driven by the burgeoning participation of retail investors. The substantial growth in investor bases, exemplified by the National Stock Exchange (NSE) which saw its investor base expand by 22% in 2023, growing from 70 million to 85.4 million, underscores a fundamental evolution. This trend highlights the increasing accessibility and growing appeal of capital markets to a broader demographic.

-

M&A Activities: The historical period (2019-2024) saw an average of [Insert Latest M&A Deal Average Here, e.g., 15] mergers and acquisitions annually within the Capital Exchange Ecosystem Market. This activity reflects ongoing consolidation and strategic expansion initiatives undertaken by leading players to secure market share and diversify their offerings. Such M&A trends are anticipated to persist throughout the forecast period, driven by the strategic imperative for growth and diversification.

Capital Exchange Ecosystem Market Industry Trends & Analysis

The Capital Exchange Ecosystem Market is experiencing significant growth driven by several factors. The increasing adoption of digital technologies has led to improved market efficiency and reduced transaction costs, fueling market expansion. Moreover, growing global financialization and the rise of retail investors have broadened the market's user base. Technological disruption, particularly through the implementation of artificial intelligence (AI) and machine learning (ML) in trading algorithms and risk management, is reshaping the competitive landscape. Consumer preferences are shifting towards increased transparency and accessibility, which in turn, influences the design of new trading platforms and services. Competitive dynamics are marked by a focus on innovation, efficiency, and client service. The market's CAGR is estimated at xx% for the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. The ongoing development and implementation of regulatory frameworks will significantly shape the market's future trajectory, particularly through the promotion of investor protection and market stability.

Leading Markets & Segments in Capital Exchange Ecosystem Market

The North American region continues to assert its dominance in the Capital Exchange Ecosystem Market, largely attributable to the deeply entrenched presence of preeminent exchanges like the New York Stock Exchange and NASDAQ, supported by a mature financial infrastructure and robust regulatory environment. However, the Asia-Pacific region is rapidly emerging as a significant growth engine, propelled by burgeoning economic expansion, increasing financial market liberalization, and a rapidly growing investor base.

Key Drivers of Regional Dominance and Growth:

- North America:

- A well-established and sophisticated regulatory framework fostering investor confidence.

- A highly developed and resilient financial infrastructure supporting diverse trading activities.

- Pioneering levels of technological advancement and adoption in financial services.

- The strategic presence and global influence of major, leading exchanges.

- Asia-Pacific:

- Exceptional rates of economic growth and increasing disposable incomes.

- A rapidly expanding middle class with growing investment capabilities.

- A significant surge in the participation of retail investors and increasing financial literacy.

- Proactive government initiatives and policies aimed at fostering financial market development and liberalization.

A detailed analysis reveals that while North America retains its leading position due to its established infrastructure and deep liquidity, the Asia-Pacific region presents remarkable growth potential. This is fueled by its rapidly expanding economies and a burgeoning, dynamic investor demographic. This ongoing competition and growth trajectory are actively reshaping the global landscape of the Capital Exchange Ecosystem Market.

Capital Exchange Ecosystem Market Product Developments

Recent product developments within the Capital Exchange Ecosystem Market are strongly characterized by the seamless integration of cutting-edge technologies. This includes the introduction and enhancement of sophisticated, user-centric trading platforms, the deployment of advanced risk management tools designed to mitigate volatility, and the implementation of powerful data analytics capabilities for deeper market insights. The overarching focus is on elevating the user experience, optimizing trading efficiency, and robustly mitigating inherent market risks. These advancements are strategically designed to attract a broader spectrum of investors, cater to evolving market demands, and foster increased competition, ultimately leading to improved service offerings across the ecosystem.

Key Drivers of Capital Exchange Ecosystem Market Growth

The robust growth of the Capital Exchange Ecosystem Market is propelled by a confluence of pivotal factors. Foremost among these are technological advancements, including the widespread adoption of AI-powered trading platforms and the disruptive potential of blockchain technology, which collectively enhance efficiency, transparency, and accessibility. Complementing these technological leaps are favorable macroeconomic conditions and proactive government policies designed to encourage investment and capital formation. Furthermore, the sustained and increasing participation of retail investors significantly broadens the market's user base and liquidity, acting as a potent catalyst for overall market expansion.

Challenges in the Capital Exchange Ecosystem Market Market

The Capital Exchange Ecosystem Market faces several challenges. These include stringent regulatory requirements, which can be complex and costly to comply with, impacting operational efficiency. Cybersecurity threats pose a significant risk, demanding robust security measures. Finally, intense competition among various market players requires continuous innovation to maintain market share. These challenges collectively influence the growth and dynamics of this sector.

Emerging Opportunities in Capital Exchange Ecosystem Market

The Capital Exchange Ecosystem Market presents a fertile ground for significant emerging opportunities. The continued evolution of technologies such as artificial intelligence (AI) and blockchain is paving the way for the development of innovative new products and services that can redefine market operations and investor engagement. Strategic partnerships and collaborations between established traditional exchanges and agile fintech companies are poised to accelerate market expansion and the introduction of novel solutions. Moreover, the ongoing expansion and liberalization of financial markets in emerging economies offer substantial potential for unlocking new revenue streams and establishing a global presence.

Leading Players in the Capital Exchange Ecosystem Market Sector

- New York Stock Exchange

- Japan Exchange Group

- London Stock Exchange

- Hong Kong Stock Exchange

- Shanghai Stock Exchange

- National Stock Exchange

- EURONEXT

- NASDAQ

- Bombay Stock Exchange

- Saudi Stock Exchange

List Not Exhaustive

Key Milestones in Capital Exchange Ecosystem Market Industry

- December 2023: Defiance ETFs launched the Defiance Israel Bond ETF (CHAI) on the New York Stock Exchange, providing access to the Israeli bond market. This broadened investment options and increased market liquidity.

- January 2024: The National Stock Exchange (NSE) witnessed a 22% surge in its investor base, reaching 85.4 Million, reflecting increased retail investor participation. This underscored the expanding reach of the capital markets.

Strategic Outlook for Capital Exchange Ecosystem Market Market

The Capital Exchange Ecosystem Market exhibits strong growth potential, driven by technological advancements, regulatory changes, and evolving investor preferences. Strategic partnerships, focusing on innovation and enhanced services, will be crucial for maintaining competitiveness. Expansion into emerging markets and the continued adoption of digital technologies will be vital for capturing significant market share and driving long-term growth.

Capital Exchange Ecosystem Market Segmentation

-

1. Market Composition

- 1.1. Primary

- 1.2. Secondary

-

2. Capital Market

- 2.1. Stocks

- 2.2. Bonds

-

3. Stock Type

- 3.1. Common and Preferred

- 3.2. Growth Stock

- 3.3. Value Stock

- 3.4. Defensive stock

-

4. Bond Type

- 4.1. Government

- 4.2. Corporate

- 4.3. Municiple

- 4.4. Mortgage

- 4.5. Other Bond Types

Capital Exchange Ecosystem Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Capital Exchange Ecosystem Market Regional Market Share

Geographic Coverage of Capital Exchange Ecosystem Market

Capital Exchange Ecosystem Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Automating all processes; Regulatory Landscape

- 3.3. Market Restrains

- 3.3.1. Automating all processes; Regulatory Landscape

- 3.4. Market Trends

- 3.4.1. Increasing Stock Exchanges Index affecting Capital Market Exchange Ecosystem

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Market Composition

- 5.1.1. Primary

- 5.1.2. Secondary

- 5.2. Market Analysis, Insights and Forecast - by Capital Market

- 5.2.1. Stocks

- 5.2.2. Bonds

- 5.3. Market Analysis, Insights and Forecast - by Stock Type

- 5.3.1. Common and Preferred

- 5.3.2. Growth Stock

- 5.3.3. Value Stock

- 5.3.4. Defensive stock

- 5.4. Market Analysis, Insights and Forecast - by Bond Type

- 5.4.1. Government

- 5.4.2. Corporate

- 5.4.3. Municiple

- 5.4.4. Mortgage

- 5.4.5. Other Bond Types

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Market Composition

- 6. North America Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Market Composition

- 6.1.1. Primary

- 6.1.2. Secondary

- 6.2. Market Analysis, Insights and Forecast - by Capital Market

- 6.2.1. Stocks

- 6.2.2. Bonds

- 6.3. Market Analysis, Insights and Forecast - by Stock Type

- 6.3.1. Common and Preferred

- 6.3.2. Growth Stock

- 6.3.3. Value Stock

- 6.3.4. Defensive stock

- 6.4. Market Analysis, Insights and Forecast - by Bond Type

- 6.4.1. Government

- 6.4.2. Corporate

- 6.4.3. Municiple

- 6.4.4. Mortgage

- 6.4.5. Other Bond Types

- 6.1. Market Analysis, Insights and Forecast - by Market Composition

- 7. South America Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Market Composition

- 7.1.1. Primary

- 7.1.2. Secondary

- 7.2. Market Analysis, Insights and Forecast - by Capital Market

- 7.2.1. Stocks

- 7.2.2. Bonds

- 7.3. Market Analysis, Insights and Forecast - by Stock Type

- 7.3.1. Common and Preferred

- 7.3.2. Growth Stock

- 7.3.3. Value Stock

- 7.3.4. Defensive stock

- 7.4. Market Analysis, Insights and Forecast - by Bond Type

- 7.4.1. Government

- 7.4.2. Corporate

- 7.4.3. Municiple

- 7.4.4. Mortgage

- 7.4.5. Other Bond Types

- 7.1. Market Analysis, Insights and Forecast - by Market Composition

- 8. Europe Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Market Composition

- 8.1.1. Primary

- 8.1.2. Secondary

- 8.2. Market Analysis, Insights and Forecast - by Capital Market

- 8.2.1. Stocks

- 8.2.2. Bonds

- 8.3. Market Analysis, Insights and Forecast - by Stock Type

- 8.3.1. Common and Preferred

- 8.3.2. Growth Stock

- 8.3.3. Value Stock

- 8.3.4. Defensive stock

- 8.4. Market Analysis, Insights and Forecast - by Bond Type

- 8.4.1. Government

- 8.4.2. Corporate

- 8.4.3. Municiple

- 8.4.4. Mortgage

- 8.4.5. Other Bond Types

- 8.1. Market Analysis, Insights and Forecast - by Market Composition

- 9. Middle East & Africa Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Market Composition

- 9.1.1. Primary

- 9.1.2. Secondary

- 9.2. Market Analysis, Insights and Forecast - by Capital Market

- 9.2.1. Stocks

- 9.2.2. Bonds

- 9.3. Market Analysis, Insights and Forecast - by Stock Type

- 9.3.1. Common and Preferred

- 9.3.2. Growth Stock

- 9.3.3. Value Stock

- 9.3.4. Defensive stock

- 9.4. Market Analysis, Insights and Forecast - by Bond Type

- 9.4.1. Government

- 9.4.2. Corporate

- 9.4.3. Municiple

- 9.4.4. Mortgage

- 9.4.5. Other Bond Types

- 9.1. Market Analysis, Insights and Forecast - by Market Composition

- 10. Asia Pacific Capital Exchange Ecosystem Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Market Composition

- 10.1.1. Primary

- 10.1.2. Secondary

- 10.2. Market Analysis, Insights and Forecast - by Capital Market

- 10.2.1. Stocks

- 10.2.2. Bonds

- 10.3. Market Analysis, Insights and Forecast - by Stock Type

- 10.3.1. Common and Preferred

- 10.3.2. Growth Stock

- 10.3.3. Value Stock

- 10.3.4. Defensive stock

- 10.4. Market Analysis, Insights and Forecast - by Bond Type

- 10.4.1. Government

- 10.4.2. Corporate

- 10.4.3. Municiple

- 10.4.4. Mortgage

- 10.4.5. Other Bond Types

- 10.1. Market Analysis, Insights and Forecast - by Market Composition

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 New York Stock Exchange

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Japan Exchange Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 London Stock Exchange

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HongKong Stock Exchange

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shanghai Stock Exchange

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 National Stock Exchange

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EURONEXT

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NASDAQ

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bombay Stock Exchange

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Saudi Stock Exchange**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 New York Stock Exchange

List of Figures

- Figure 1: Global Capital Exchange Ecosystem Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Capital Exchange Ecosystem Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Capital Exchange Ecosystem Market Revenue (Million), by Market Composition 2025 & 2033

- Figure 4: North America Capital Exchange Ecosystem Market Volume (Trillion), by Market Composition 2025 & 2033

- Figure 5: North America Capital Exchange Ecosystem Market Revenue Share (%), by Market Composition 2025 & 2033

- Figure 6: North America Capital Exchange Ecosystem Market Volume Share (%), by Market Composition 2025 & 2033

- Figure 7: North America Capital Exchange Ecosystem Market Revenue (Million), by Capital Market 2025 & 2033

- Figure 8: North America Capital Exchange Ecosystem Market Volume (Trillion), by Capital Market 2025 & 2033

- Figure 9: North America Capital Exchange Ecosystem Market Revenue Share (%), by Capital Market 2025 & 2033

- Figure 10: North America Capital Exchange Ecosystem Market Volume Share (%), by Capital Market 2025 & 2033

- Figure 11: North America Capital Exchange Ecosystem Market Revenue (Million), by Stock Type 2025 & 2033

- Figure 12: North America Capital Exchange Ecosystem Market Volume (Trillion), by Stock Type 2025 & 2033

- Figure 13: North America Capital Exchange Ecosystem Market Revenue Share (%), by Stock Type 2025 & 2033

- Figure 14: North America Capital Exchange Ecosystem Market Volume Share (%), by Stock Type 2025 & 2033

- Figure 15: North America Capital Exchange Ecosystem Market Revenue (Million), by Bond Type 2025 & 2033

- Figure 16: North America Capital Exchange Ecosystem Market Volume (Trillion), by Bond Type 2025 & 2033

- Figure 17: North America Capital Exchange Ecosystem Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 18: North America Capital Exchange Ecosystem Market Volume Share (%), by Bond Type 2025 & 2033

- Figure 19: North America Capital Exchange Ecosystem Market Revenue (Million), by Country 2025 & 2033

- Figure 20: North America Capital Exchange Ecosystem Market Volume (Trillion), by Country 2025 & 2033

- Figure 21: North America Capital Exchange Ecosystem Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Capital Exchange Ecosystem Market Volume Share (%), by Country 2025 & 2033

- Figure 23: South America Capital Exchange Ecosystem Market Revenue (Million), by Market Composition 2025 & 2033

- Figure 24: South America Capital Exchange Ecosystem Market Volume (Trillion), by Market Composition 2025 & 2033

- Figure 25: South America Capital Exchange Ecosystem Market Revenue Share (%), by Market Composition 2025 & 2033

- Figure 26: South America Capital Exchange Ecosystem Market Volume Share (%), by Market Composition 2025 & 2033

- Figure 27: South America Capital Exchange Ecosystem Market Revenue (Million), by Capital Market 2025 & 2033

- Figure 28: South America Capital Exchange Ecosystem Market Volume (Trillion), by Capital Market 2025 & 2033

- Figure 29: South America Capital Exchange Ecosystem Market Revenue Share (%), by Capital Market 2025 & 2033

- Figure 30: South America Capital Exchange Ecosystem Market Volume Share (%), by Capital Market 2025 & 2033

- Figure 31: South America Capital Exchange Ecosystem Market Revenue (Million), by Stock Type 2025 & 2033

- Figure 32: South America Capital Exchange Ecosystem Market Volume (Trillion), by Stock Type 2025 & 2033

- Figure 33: South America Capital Exchange Ecosystem Market Revenue Share (%), by Stock Type 2025 & 2033

- Figure 34: South America Capital Exchange Ecosystem Market Volume Share (%), by Stock Type 2025 & 2033

- Figure 35: South America Capital Exchange Ecosystem Market Revenue (Million), by Bond Type 2025 & 2033

- Figure 36: South America Capital Exchange Ecosystem Market Volume (Trillion), by Bond Type 2025 & 2033

- Figure 37: South America Capital Exchange Ecosystem Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 38: South America Capital Exchange Ecosystem Market Volume Share (%), by Bond Type 2025 & 2033

- Figure 39: South America Capital Exchange Ecosystem Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South America Capital Exchange Ecosystem Market Volume (Trillion), by Country 2025 & 2033

- Figure 41: South America Capital Exchange Ecosystem Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Capital Exchange Ecosystem Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Europe Capital Exchange Ecosystem Market Revenue (Million), by Market Composition 2025 & 2033

- Figure 44: Europe Capital Exchange Ecosystem Market Volume (Trillion), by Market Composition 2025 & 2033

- Figure 45: Europe Capital Exchange Ecosystem Market Revenue Share (%), by Market Composition 2025 & 2033

- Figure 46: Europe Capital Exchange Ecosystem Market Volume Share (%), by Market Composition 2025 & 2033

- Figure 47: Europe Capital Exchange Ecosystem Market Revenue (Million), by Capital Market 2025 & 2033

- Figure 48: Europe Capital Exchange Ecosystem Market Volume (Trillion), by Capital Market 2025 & 2033

- Figure 49: Europe Capital Exchange Ecosystem Market Revenue Share (%), by Capital Market 2025 & 2033

- Figure 50: Europe Capital Exchange Ecosystem Market Volume Share (%), by Capital Market 2025 & 2033

- Figure 51: Europe Capital Exchange Ecosystem Market Revenue (Million), by Stock Type 2025 & 2033

- Figure 52: Europe Capital Exchange Ecosystem Market Volume (Trillion), by Stock Type 2025 & 2033

- Figure 53: Europe Capital Exchange Ecosystem Market Revenue Share (%), by Stock Type 2025 & 2033

- Figure 54: Europe Capital Exchange Ecosystem Market Volume Share (%), by Stock Type 2025 & 2033

- Figure 55: Europe Capital Exchange Ecosystem Market Revenue (Million), by Bond Type 2025 & 2033

- Figure 56: Europe Capital Exchange Ecosystem Market Volume (Trillion), by Bond Type 2025 & 2033

- Figure 57: Europe Capital Exchange Ecosystem Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 58: Europe Capital Exchange Ecosystem Market Volume Share (%), by Bond Type 2025 & 2033

- Figure 59: Europe Capital Exchange Ecosystem Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Europe Capital Exchange Ecosystem Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: Europe Capital Exchange Ecosystem Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Europe Capital Exchange Ecosystem Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million), by Market Composition 2025 & 2033

- Figure 64: Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion), by Market Composition 2025 & 2033

- Figure 65: Middle East & Africa Capital Exchange Ecosystem Market Revenue Share (%), by Market Composition 2025 & 2033

- Figure 66: Middle East & Africa Capital Exchange Ecosystem Market Volume Share (%), by Market Composition 2025 & 2033

- Figure 67: Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million), by Capital Market 2025 & 2033

- Figure 68: Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion), by Capital Market 2025 & 2033

- Figure 69: Middle East & Africa Capital Exchange Ecosystem Market Revenue Share (%), by Capital Market 2025 & 2033

- Figure 70: Middle East & Africa Capital Exchange Ecosystem Market Volume Share (%), by Capital Market 2025 & 2033

- Figure 71: Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million), by Stock Type 2025 & 2033

- Figure 72: Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion), by Stock Type 2025 & 2033

- Figure 73: Middle East & Africa Capital Exchange Ecosystem Market Revenue Share (%), by Stock Type 2025 & 2033

- Figure 74: Middle East & Africa Capital Exchange Ecosystem Market Volume Share (%), by Stock Type 2025 & 2033

- Figure 75: Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million), by Bond Type 2025 & 2033

- Figure 76: Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion), by Bond Type 2025 & 2033

- Figure 77: Middle East & Africa Capital Exchange Ecosystem Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 78: Middle East & Africa Capital Exchange Ecosystem Market Volume Share (%), by Bond Type 2025 & 2033

- Figure 79: Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion), by Country 2025 & 2033

- Figure 81: Middle East & Africa Capital Exchange Ecosystem Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East & Africa Capital Exchange Ecosystem Market Volume Share (%), by Country 2025 & 2033

- Figure 83: Asia Pacific Capital Exchange Ecosystem Market Revenue (Million), by Market Composition 2025 & 2033

- Figure 84: Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion), by Market Composition 2025 & 2033

- Figure 85: Asia Pacific Capital Exchange Ecosystem Market Revenue Share (%), by Market Composition 2025 & 2033

- Figure 86: Asia Pacific Capital Exchange Ecosystem Market Volume Share (%), by Market Composition 2025 & 2033

- Figure 87: Asia Pacific Capital Exchange Ecosystem Market Revenue (Million), by Capital Market 2025 & 2033

- Figure 88: Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion), by Capital Market 2025 & 2033

- Figure 89: Asia Pacific Capital Exchange Ecosystem Market Revenue Share (%), by Capital Market 2025 & 2033

- Figure 90: Asia Pacific Capital Exchange Ecosystem Market Volume Share (%), by Capital Market 2025 & 2033

- Figure 91: Asia Pacific Capital Exchange Ecosystem Market Revenue (Million), by Stock Type 2025 & 2033

- Figure 92: Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion), by Stock Type 2025 & 2033

- Figure 93: Asia Pacific Capital Exchange Ecosystem Market Revenue Share (%), by Stock Type 2025 & 2033

- Figure 94: Asia Pacific Capital Exchange Ecosystem Market Volume Share (%), by Stock Type 2025 & 2033

- Figure 95: Asia Pacific Capital Exchange Ecosystem Market Revenue (Million), by Bond Type 2025 & 2033

- Figure 96: Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion), by Bond Type 2025 & 2033

- Figure 97: Asia Pacific Capital Exchange Ecosystem Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 98: Asia Pacific Capital Exchange Ecosystem Market Volume Share (%), by Bond Type 2025 & 2033

- Figure 99: Asia Pacific Capital Exchange Ecosystem Market Revenue (Million), by Country 2025 & 2033

- Figure 100: Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion), by Country 2025 & 2033

- Figure 101: Asia Pacific Capital Exchange Ecosystem Market Revenue Share (%), by Country 2025 & 2033

- Figure 102: Asia Pacific Capital Exchange Ecosystem Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 2: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 3: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 4: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 5: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 6: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 7: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 8: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 9: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 11: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 12: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 13: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 14: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 15: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 16: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 17: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 18: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 19: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 21: United States Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 23: Canada Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 25: Mexico Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 28: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 29: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 30: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 31: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 32: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 33: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 34: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 35: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: Brazil Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Brazil Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Argentina Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Argentina Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: Rest of South America Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of South America Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 44: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 45: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 46: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 47: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 48: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 49: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 50: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 51: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 53: United Kingdom Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: United Kingdom Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Germany Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Germany Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 57: France Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: France Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 59: Italy Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Italy Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 61: Spain Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Spain Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Russia Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Russia Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 65: Benelux Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Benelux Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 67: Nordics Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Nordics Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: Rest of Europe Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Europe Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 72: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 73: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 74: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 75: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 76: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 77: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 78: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 79: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 81: Turkey Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Turkey Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Israel Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Israel Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 85: GCC Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: GCC Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 87: North Africa Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: North Africa Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 89: South Africa Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: South Africa Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Middle East & Africa Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Middle East & Africa Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 93: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Market Composition 2020 & 2033

- Table 94: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Market Composition 2020 & 2033

- Table 95: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Capital Market 2020 & 2033

- Table 96: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Capital Market 2020 & 2033

- Table 97: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Stock Type 2020 & 2033

- Table 98: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Stock Type 2020 & 2033

- Table 99: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Bond Type 2020 & 2033

- Table 100: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Bond Type 2020 & 2033

- Table 101: Global Capital Exchange Ecosystem Market Revenue Million Forecast, by Country 2020 & 2033

- Table 102: Global Capital Exchange Ecosystem Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 103: China Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: China Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 105: India Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 106: India Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 107: Japan Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 108: Japan Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 109: South Korea Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 110: South Korea Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 111: ASEAN Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 112: ASEAN Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 113: Oceania Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 114: Oceania Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 115: Rest of Asia Pacific Capital Exchange Ecosystem Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 116: Rest of Asia Pacific Capital Exchange Ecosystem Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Capital Exchange Ecosystem Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Capital Exchange Ecosystem Market?

Key companies in the market include New York Stock Exchange, Japan Exchange Group, London Stock Exchange, HongKong Stock Exchange, Shanghai Stock Exchange, National Stock Exchange, EURONEXT, NASDAQ, Bombay Stock Exchange, Saudi Stock Exchange**List Not Exhaustive.

3. What are the main segments of the Capital Exchange Ecosystem Market?

The market segments include Market Composition, Capital Market, Stock Type, Bond Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Automating all processes; Regulatory Landscape.

6. What are the notable trends driving market growth?

Increasing Stock Exchanges Index affecting Capital Market Exchange Ecosystem.

7. Are there any restraints impacting market growth?

Automating all processes; Regulatory Landscape.

8. Can you provide examples of recent developments in the market?

In December 2023, Defiance ETFs, introduced the Defiance Israel Bond ETF (NYSE Arca: CHAI) to facilitate investors' access to the Israeli bond market. CHAI commenced trading on the New York Stock Exchange. The ETF, CHAI, mirrors the MCM (Migdal Capital Markets) BlueStar Israel Bond Index, enabling investors to tap into both Israel government and corporate bonds. This index specifically monitors the performance of bonds, denominated in USD and shekels, issued by either the Israeli government or Israeli corporations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Capital Exchange Ecosystem Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Capital Exchange Ecosystem Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Capital Exchange Ecosystem Market?

To stay informed about further developments, trends, and reports in the Capital Exchange Ecosystem Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence