Key Insights

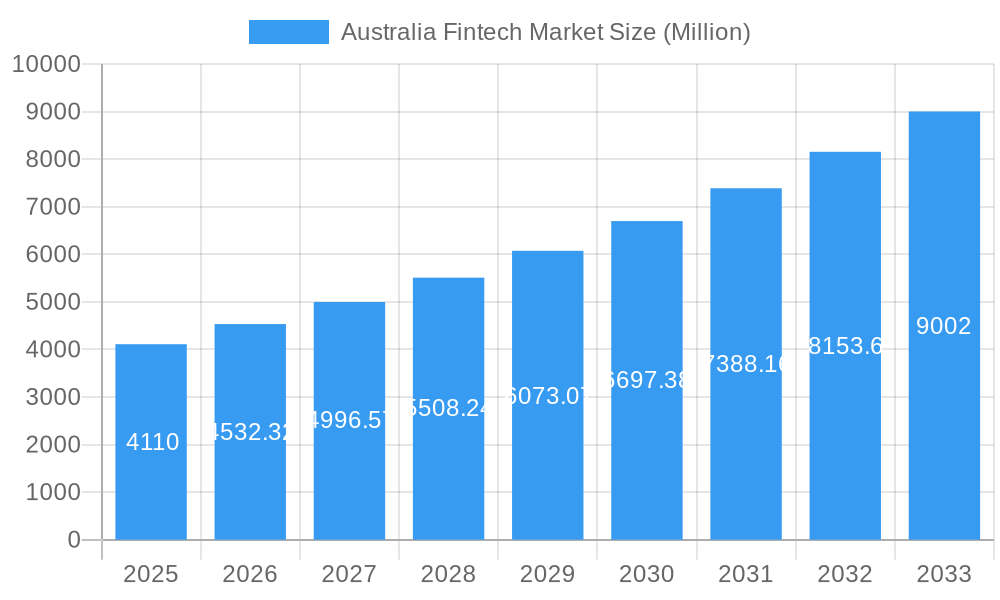

The Australian Fintech market, valued at $4.11 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.32% from 2025 to 2033. This expansion is fueled by several key drivers. Rising smartphone penetration and internet usage are creating a larger pool of digitally-savvy consumers embracing convenient financial solutions. Furthermore, the Australian government's supportive regulatory environment and initiatives promoting digital transformation are fostering innovation and attracting significant investment in the sector. Increased demand for seamless payment solutions, personalized financial management tools, and open banking capabilities are further bolstering market growth. Competition within the sector is intense, with established players like Afterpay Touch and newer entrants like Airwallex vying for market share. The market's segmentation likely encompasses various fintech niches such as payments, lending, investment management, and insurance technology, each with its unique growth trajectory. While challenges exist, such as cybersecurity concerns and data privacy regulations, the overall outlook remains positive, driven by a confluence of technological advancements and evolving consumer preferences.

Australia Fintech Market Market Size (In Billion)

The significant growth in the Australian Fintech market is expected to continue through 2033, driven by increased adoption of mobile payments, the expansion of open banking initiatives, and a growing preference for digital financial services. The presence of both established international and homegrown players like Zeller Australia, Judo Bank, and Wise contributes to a dynamic and competitive landscape. While regulatory hurdles and potential economic downturns pose some risk, the overall trend towards digitalization and the increasing sophistication of financial technologies strongly suggest continued expansion and innovation within the Australian Fintech market. Strategic partnerships between fintech companies and traditional financial institutions are also likely to further accelerate growth.

Australia Fintech Market Company Market Share

Australia Fintech Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic Australian Fintech market, covering the period from 2019 to 2033. It examines market dynamics, industry trends, leading players, and future growth opportunities, offering actionable insights for stakeholders across the Fintech ecosystem. With a focus on key segments and emerging technologies, this report is an essential resource for investors, businesses, and policymakers seeking to understand and navigate the rapidly evolving Australian Fintech landscape. The report utilizes data up to 2024, with projections extending to 2033, using 2025 as the base and estimated year. The market size is expressed in Millions of Australian Dollars (AUD).

Australia Fintech Market Market Dynamics & Concentration

The Australian Fintech market exhibits a high degree of dynamism, characterized by rapid innovation, intense competition, and significant consolidation through mergers and acquisitions (M&A). Market concentration is moderate, with a few major players holding substantial market share, while numerous smaller firms compete in niche segments. The market's growth is driven by factors such as increasing smartphone penetration, rising digital literacy, government support for Fintech innovation, and a favorable regulatory environment (with caveats discussed later). However, challenges remain, including regulatory hurdles, cybersecurity concerns, and the need for robust consumer data protection measures.

Key Market Dynamics:

- Innovation Drivers: Open banking initiatives, advancements in AI and machine learning, the rise of blockchain technology, and the increasing adoption of cloud computing are driving innovation.

- Regulatory Framework: The Australian Securities and Investments Commission (ASIC) plays a crucial role in regulating the Fintech sector, balancing innovation with consumer protection.

- Product Substitutes: Traditional financial services remain a significant competitor, though Fintech solutions often offer greater convenience, speed, and lower costs.

- End-User Trends: Consumers increasingly demand personalized financial services, seamless digital experiences, and greater transparency and control over their financial data.

- M&A Activities: The number of M&A deals in the Australian Fintech market has increased significantly in recent years, reflecting industry consolidation and strategic expansion efforts. We estimate xx M&A deals in 2024, with a projected xx in 2025. Market share for the top 5 players is estimated at xx% in 2025.

Australia Fintech Market Industry Trends & Analysis

The Australian Fintech market is in a phase of dynamic expansion, fueled by a confluence of powerful trends. The accelerating adoption of mobile-first banking solutions and the ubiquitous rise of digital payment systems are fundamental to this growth. Furthermore, the explosive popularity of Buy Now Pay Later (BNPL) services is fundamentally reshaping consumer spending habits and creating significant market opportunities. Technological advancements, most notably the transformative impact of open banking APIs and the increasing integration of blockchain technology, are not just reshaping the competitive landscape but are actively driving innovation and efficiency across the financial services sector. Consumers are increasingly gravitating towards financial services that are not only convenient and readily accessible but also highly personalized and transparent, presenting Fintech firms with a clear mandate for differentiation and customer-centricity. The market is characterized by a vibrant ecosystem, marked by intense competition among established financial institutions and agile, innovative startups vying for market share. We project a robust Compound Annual Growth Rate (CAGR) of [Insert XX%] for the forecast period (2025-2033), with market penetration expected to reach a significant [Insert XX%] by 2033, underscoring the immense potential of this sector.

Leading Markets & Segments in Australia Fintech Market

While the Australian Fintech market exhibits a degree of geographical concentration, the most significant growth trajectories are currently being observed in major metropolitan hubs such as Sydney and Melbourne. These centers benefit from a higher density of technology-focused businesses and a larger, more digitally adept consumer base. Currently, the payments segment stands as the market's powerhouse, followed closely by the rapidly expanding lending and wealth management sectors. These segments are benefiting from increased digitalization and a growing demand for efficient, accessible financial tools.

Key Drivers of Market Dominance:

- Economic Policies: Proactive government initiatives, including targeted grants and attractive tax incentives designed to foster Fintech innovation, have been instrumental in nurturing market growth and encouraging investment in new ventures.

- Infrastructure: Australia's well-established and advanced digital infrastructure, characterized by widespread high-speed internet access and sophisticated telecommunications networks, provides a critical foundation for the seamless expansion and adoption of Fintech services.

- Regulatory Environment: While a degree of regulatory oversight is present, Australia's comparatively flexible and forward-thinking regulatory framework actively encourages experimentation and innovation, thereby attracting substantial domestic and international investment.

Australia Fintech Market Product Developments

Recent product developments focus on enhancing user experience, improving security, and expanding the range of financial services available through digital channels. Innovation in areas such as AI-powered financial advice, blockchain-based payment systems, and personalized investment solutions is shaping the competitive landscape. The market is witnessing a clear trend towards the integration of multiple financial services within a single platform, providing users with a more holistic and convenient experience.

Key Drivers of Australia Fintech Market Growth

The sustained and vigorous growth of the Australian Fintech market is propelled by a multifaceted array of factors. Pervasive technological advancements, particularly the integration of Artificial Intelligence (AI), blockchain technology, and cloud computing, are empowering the creation of groundbreaking financial products and services that cater to evolving consumer needs. Australia's strong economic performance has translated into increased consumer disposable income and heightened investment activity, consequently fueling a greater demand for innovative Fintech solutions. Furthermore, supportive government policies, such as the ongoing implementation of open banking initiatives, are actively cultivating a conducive regulatory environment where Fintech firms can not only survive but thrive and innovate rapidly.

Challenges in the Australia Fintech Market Market

Despite the growth potential, the Australian Fintech market faces several challenges. Regulatory hurdles, such as compliance requirements and licensing issues, can hinder the expansion of Fintech businesses. Cybersecurity threats and data breaches pose a significant risk to consumer trust and the stability of the financial system. Intense competition from both established financial institutions and new entrants requires Fintech firms to constantly innovate and differentiate themselves to survive. The cost of compliance represents a significant burden, estimated to impact market growth by xx% annually.

Emerging Opportunities in Australia Fintech Market

The Australian Fintech market presents several exciting long-term growth opportunities. The increasing adoption of embedded finance, which integrates financial services into non-financial applications, creates new avenues for market expansion. Strategic partnerships between Fintech firms and traditional financial institutions are fostering innovation and accelerating the adoption of new technologies. Further expansion into under-served markets, such as regional areas, will present significant growth potential.

Leading Players in the Australia Fintech Market Sector

- Zeller Australia Pty Ltd

- Paytron Pty Ltd

- mx51 Pty Ltd

- Airwallex Pty Ltd

- Athena Mortgage Pty Ltd

- DiviPay

- Judo Bank

- Afterpay Touch

- Sofi

- Wise

- Stripe

- List Not Exhaustive

Key Milestones in Australia Fintech Market Industry

- February 2023: Fintech disruptor Zeller launched an integrated suite of financial tools, including a new transaction account, a debit card, and a dedicated app. This strategic move directly challenges the dominance of incumbent banks within the crucial small business sector.

- March 2023: Global payments platform Airwallex significantly expanded its reach by securing a crucial payment business license in China. This achievement was facilitated by their acquisition of Guangzhou Shang Wu Tong Network Technology Co., Ltd., marking a pivotal step in their international growth strategy.

Strategic Outlook for Australia Fintech Market Market

The Australian Fintech market is unequivocally positioned for a decade of sustained and impressive growth. This optimistic outlook is underpinned by the ongoing, widespread adoption of digital technologies across all facets of financial services, coupled with progressive and supportive regulatory developments. The escalating consumer demand for novel, user-friendly, and efficient financial solutions will act as a powerful catalyst for market expansion. Key strategic imperatives for firms navigating this landscape will include fostering strategic partnerships, engaging in mergers and acquisitions to consolidate market position, and actively exploring opportunities for expansion into new domestic and international markets. The pervasive integration of advanced technologies such as AI and blockchain is poised to fundamentally transform the industry, unlocking unprecedented opportunities for businesses and dramatically enhancing the overall user experience for consumers.

Australia Fintech Market Segmentation

-

1. Service proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Marketplaces

- 1.4. Online Insurance & Insurance Marketplaces

- 1.5. Other Service Propositions

Australia Fintech Market Segmentation By Geography

- 1. Australia

Australia Fintech Market Regional Market Share

Geographic Coverage of Australia Fintech Market

Australia Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digital ID Framework Witnessing Growth in Australia Fintech Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Marketplaces

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.1.5. Other Service Propositions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zeller Australia Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Paytron Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 mx51 Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Airwallex Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Athena Mortgage Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DiviPay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Judo bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Afterpay Touch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sofi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wise

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Stripe**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Zeller Australia Pty Ltd

List of Figures

- Figure 1: Australia Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 2: Australia Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 3: Australia Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Australia Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 6: Australia Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 7: Australia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Australia Fintech Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Fintech Market?

The projected CAGR is approximately 10.32%.

2. Which companies are prominent players in the Australia Fintech Market?

Key companies in the market include Zeller Australia Pty Ltd, Paytron Pty Ltd, mx51 Pty Ltd, Airwallex Pty Ltd, Athena Mortgage Pty Ltd, DiviPay, Judo bank, Afterpay Touch, Sofi, Wise, Stripe**List Not Exhaustive.

3. What are the main segments of the Australia Fintech Market?

The market segments include Service proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.11 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digital ID Framework Witnessing Growth in Australia Fintech Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Financial platform Airwallex secured a payment business license in China, following the successful acquisition of a 100% stake in Guangzhou Shang Wu Tong Network Technology Co., Ltd., an information and online payment services company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Fintech Market?

To stay informed about further developments, trends, and reports in the Australia Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence