Key Insights

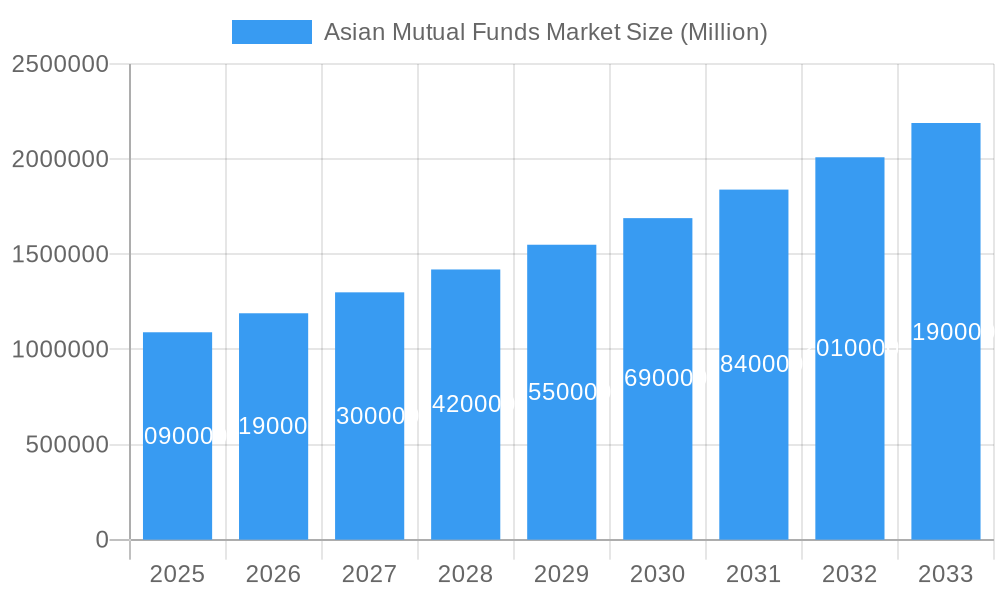

The Asian mutual funds market is experiencing substantial expansion, propelled by a growing middle class, increased disposable income, and heightened investment awareness. The market's Compound Annual Growth Rate (CAGR) of 12.1% underscores significant growth. The market size was estimated at $614 billion in the base year of 2025. Key growth drivers include supportive government regulations, the introduction of innovative fund products, and the expanding reach of digital investment platforms. Major asset management firms are capitalizing on these trends while addressing market volatility and regulatory shifts. Market segmentation is observed across investment strategies, investor types, and geographic regions. The forecast period (2025-2033) indicates sustained growth, influenced by global economic conditions and regional stability, attracting further international investment and innovation.

Asian Mutual Funds Market Market Size (In Billion)

The long-term outlook for the Asian mutual funds sector remains optimistic, driven by demographic trends and economic progress. Enhanced financial literacy, expanded access to financial education, and the proliferation of fintech solutions are expected to increase market penetration. The competitive environment will be shaped by industry consolidation, strategic alliances, and the adoption of advanced technologies. However, potential challenges include geopolitical uncertainties, economic downturns, and intensified regulatory oversight. Effective risk management, product diversification, and responsiveness to evolving investor demands will be critical for navigating this dynamic market.

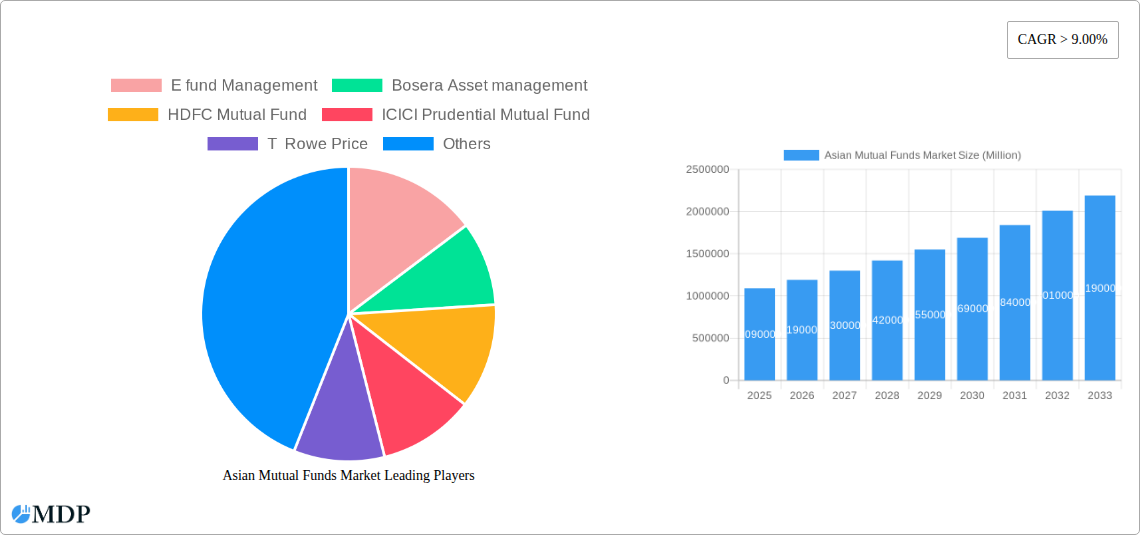

Asian Mutual Funds Market Company Market Share

Asian Mutual Funds Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asian Mutual Funds Market, covering market dynamics, industry trends, leading players, and future growth prospects from 2019 to 2033. The report leverages extensive data analysis to offer actionable insights for industry stakeholders, investors, and market entrants. With a base year of 2025 and a forecast period extending to 2033, this report is an invaluable resource for navigating the complexities of this rapidly evolving market. The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Asian Mutual Funds Market Dynamics & Concentration

The Asian mutual funds market is characterized by a dynamic interplay of several factors. Market concentration is moderately high, with a few dominant players capturing significant market share. However, the emergence of fintech and innovative fund offerings is fostering increased competition. Regulatory frameworks across Asian nations vary, influencing market entry and operations. Product substitution is minimal due to the unique risk-return profiles of various mutual fund categories. End-user trends show increasing preference for digitally accessible funds and those aligned with ESG (Environmental, Social, and Governance) principles. M&A activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024. Key players such as BlackRock and Fidelity are actively involved in strategic acquisitions to expand their market footprint and capabilities.

- Market Share: BlackRock and Fidelity hold approximately xx% and xx% of the market share, respectively (2024 estimates).

- M&A Deal Count: An estimated xx M&A deals were recorded between 2019 and 2024.

- Innovation Drivers: Fintech advancements, regulatory changes, and evolving investor preferences drive innovation.

Asian Mutual Funds Market Industry Trends & Analysis

The Asian mutual funds market has witnessed significant growth over the past few years, driven primarily by rising disposable incomes, increasing financial literacy, and favorable regulatory environments in certain regions. Technological advancements, specifically the rise of digital platforms and robo-advisors, have significantly improved accessibility and lowered barriers to entry for retail investors. Consumer preferences are shifting towards low-cost index funds, ESG-focused investments, and customized investment solutions. The competitive landscape is characterized by intense competition among established players and the emergence of new entrants leveraging technology and niche offerings. The CAGR for the market during the historical period (2019-2024) was approximately xx%, with market penetration estimated at xx%. Growth is expected to continue, albeit at a slightly moderated pace in the forecast period (2025-2033).

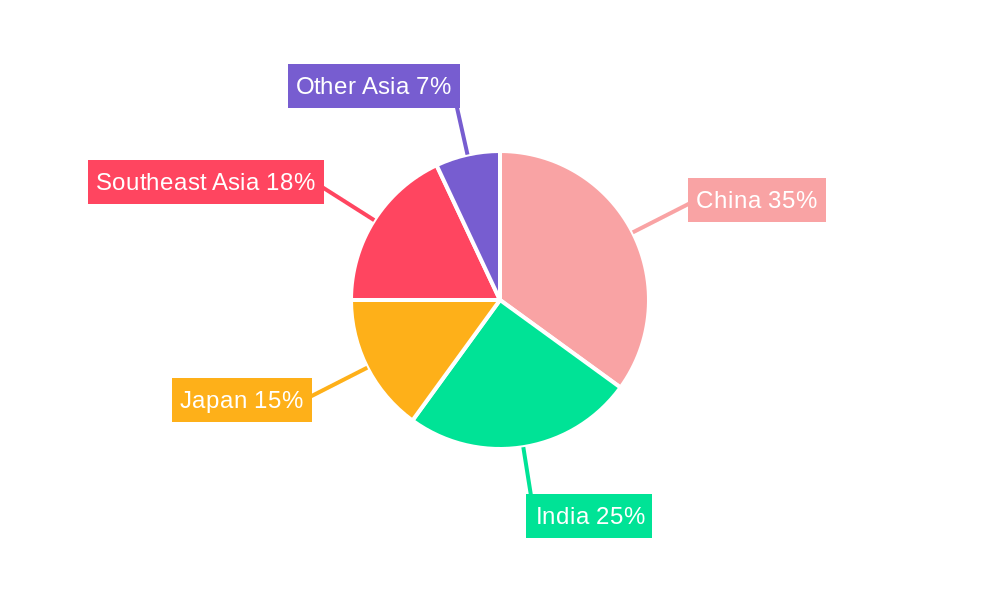

Leading Markets & Segments in Asian Mutual Funds Market

India and China represent the most dominant markets within Asia, accounting for approximately xx% of the total market in 2024. Their dominance stems from their substantial population bases, burgeoning middle class, and rapid economic growth. Other significant markets include Japan, South Korea, and Singapore. Within the product segments, Equity funds and Debt funds remain the most popular, commanding xx% and xx% of the market share, respectively (2024).

Key Drivers for India and China:

- Rapid Economic Growth: High GDP growth fuels increased investment opportunities and investor confidence.

- Growing Middle Class: A burgeoning middle class translates to a larger pool of potential investors.

- Government Initiatives: Supportive government policies and financial literacy campaigns bolster market growth.

- Technological Advancements: Increased internet and smartphone penetration expands market accessibility.

Asian Mutual Funds Market Product Developments

Recent product innovations center around digital investment platforms, AI-driven robo-advisors, and personalized investment solutions tailored to individual investor profiles and risk tolerance. These innovations enhance accessibility, reduce costs, and improve the overall investment experience. The trend towards ESG investing is also fueling the development of new sustainable and responsible investment products. These developments cater to evolving investor preferences and enhance the competitive landscape.

Key Drivers of Asian Mutual Funds Market Growth

Several key factors propel the Asian mutual funds market's growth. Technological advancements, like digital platforms and robo-advisors, enhance accessibility and reduce costs. Favorable economic conditions, including rising disposable incomes and increasing financial literacy, contribute significantly. Government initiatives promoting financial inclusion and investment education further boost market expansion. Finally, regulatory reforms that simplify investment procedures and protect investor interests contribute to market growth.

Challenges in the Asian Mutual Funds Market Market

The market faces challenges including regulatory complexities across different Asian nations, requiring companies to navigate diverse compliance requirements. Supply chain disruptions, albeit less impactful on the fund industry itself, can indirectly affect market sentiment. Furthermore, intense competition among existing players, both domestic and international, creates pricing pressures. These factors can hinder market expansion and profitability.

Emerging Opportunities in Asian Mutual Funds Market

The long-term growth of the Asian mutual funds market is fueled by several factors. Technological innovations, including the use of blockchain and AI, promise further enhanced efficiency and transparency. Strategic partnerships between financial institutions and technology firms can unlock new opportunities for innovation. Market expansion into underserved segments, particularly in rural areas and among younger demographics, presents significant potential for growth.

Leading Players in the Asian Mutual Funds Market Sector

- E fund Management

- Bosera Asset Management

- HDFC Mutual Fund

- ICICI Prudential Mutual Fund

- T Rowe Price

- BlackRock

- Goldman Sachs

- Matthews Asia Funds

- Fidelity Investments

- Invesco

- List Not Exhaustive

Key Milestones in Asian Mutual Funds Market Industry

- 2021: Fidelity International merged six funds, streamlining its offerings.

- 2022: HDFC Mutual Fund filed an SID with SEBI for India's first Defence Fund.

Strategic Outlook for Asian Mutual Funds Market Market

The future of the Asian mutual funds market is bright, characterized by sustained growth driven by technological advancements, increasing financial inclusion, and favorable regulatory changes. Strategic opportunities lie in leveraging technology to personalize investment solutions, catering to the growing demand for ESG investments, and expanding into underserved markets. The market presents significant potential for both established players and new entrants who can adapt to the evolving market dynamics and consumer preferences.

Asian Mutual Funds Market Segmentation

-

1. Fund Type

- 1.1. Equity

- 1.2. Bond

- 1.3. Hybrid

- 1.4. Money Market

- 1.5. Others

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Singapore

- 2.4. Taiwan

- 2.5. Hong Kong

- 2.6. Korea

- 2.7. Rest of Asia-Pacific

Asian Mutual Funds Market Segmentation By Geography

- 1. China

- 2. India

- 3. Singapore

- 4. Taiwan

- 5. Hong Kong

- 6. Korea

- 7. Rest of Asia Pacific

Asian Mutual Funds Market Regional Market Share

Geographic Coverage of Asian Mutual Funds Market

Asian Mutual Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising inflation will create opportunities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity

- 5.1.2. Bond

- 5.1.3. Hybrid

- 5.1.4. Money Market

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Singapore

- 5.2.4. Taiwan

- 5.2.5. Hong Kong

- 5.2.6. Korea

- 5.2.7. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Singapore

- 5.3.4. Taiwan

- 5.3.5. Hong Kong

- 5.3.6. Korea

- 5.3.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. China Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 6.1.1. Equity

- 6.1.2. Bond

- 6.1.3. Hybrid

- 6.1.4. Money Market

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Singapore

- 6.2.4. Taiwan

- 6.2.5. Hong Kong

- 6.2.6. Korea

- 6.2.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 7. India Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 7.1.1. Equity

- 7.1.2. Bond

- 7.1.3. Hybrid

- 7.1.4. Money Market

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Singapore

- 7.2.4. Taiwan

- 7.2.5. Hong Kong

- 7.2.6. Korea

- 7.2.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 8. Singapore Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 8.1.1. Equity

- 8.1.2. Bond

- 8.1.3. Hybrid

- 8.1.4. Money Market

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Singapore

- 8.2.4. Taiwan

- 8.2.5. Hong Kong

- 8.2.6. Korea

- 8.2.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 9. Taiwan Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 9.1.1. Equity

- 9.1.2. Bond

- 9.1.3. Hybrid

- 9.1.4. Money Market

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Singapore

- 9.2.4. Taiwan

- 9.2.5. Hong Kong

- 9.2.6. Korea

- 9.2.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 10. Hong Kong Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 10.1.1. Equity

- 10.1.2. Bond

- 10.1.3. Hybrid

- 10.1.4. Money Market

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Singapore

- 10.2.4. Taiwan

- 10.2.5. Hong Kong

- 10.2.6. Korea

- 10.2.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 11. Korea Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Fund Type

- 11.1.1. Equity

- 11.1.2. Bond

- 11.1.3. Hybrid

- 11.1.4. Money Market

- 11.1.5. Others

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Singapore

- 11.2.4. Taiwan

- 11.2.5. Hong Kong

- 11.2.6. Korea

- 11.2.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Fund Type

- 12. Rest of Asia Pacific Asian Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Fund Type

- 12.1.1. Equity

- 12.1.2. Bond

- 12.1.3. Hybrid

- 12.1.4. Money Market

- 12.1.5. Others

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. India

- 12.2.3. Singapore

- 12.2.4. Taiwan

- 12.2.5. Hong Kong

- 12.2.6. Korea

- 12.2.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Fund Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 E fund Management

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bosera Asset management

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HDFC Mutual Fund

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ICICI Prudential Mutual Fund

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 T Rowe Price

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BlackRock

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Goldman Sachs

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Matthews Asia Funds

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Fidelity Investments

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Invesco**List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 E fund Management

List of Figures

- Figure 1: Global Asian Mutual Funds Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 3: China Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 4: China Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: China Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: China Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 7: China Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: India Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 9: India Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 10: India Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: India Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: India Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 13: India Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Singapore Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 15: Singapore Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 16: Singapore Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Singapore Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Singapore Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Singapore Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Taiwan Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 21: Taiwan Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 22: Taiwan Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Taiwan Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Taiwan Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Taiwan Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Hong Kong Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 27: Hong Kong Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 28: Hong Kong Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Hong Kong Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Hong Kong Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Hong Kong Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Korea Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 33: Korea Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 34: Korea Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 35: Korea Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 36: Korea Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Korea Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of Asia Pacific Asian Mutual Funds Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 39: Rest of Asia Pacific Asian Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 40: Rest of Asia Pacific Asian Mutual Funds Market Revenue (billion), by Geography 2025 & 2033

- Figure 41: Rest of Asia Pacific Asian Mutual Funds Market Revenue Share (%), by Geography 2025 & 2033

- Figure 42: Rest of Asia Pacific Asian Mutual Funds Market Revenue (billion), by Country 2025 & 2033

- Figure 43: Rest of Asia Pacific Asian Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 2: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global Asian Mutual Funds Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 5: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 8: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 11: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 14: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 17: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 20: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Global Asian Mutual Funds Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 23: Global Asian Mutual Funds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Asian Mutual Funds Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Mutual Funds Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Asian Mutual Funds Market?

Key companies in the market include E fund Management, Bosera Asset management, HDFC Mutual Fund, ICICI Prudential Mutual Fund, T Rowe Price, BlackRock, Goldman Sachs, Matthews Asia Funds, Fidelity Investments, Invesco**List Not Exhaustive.

3. What are the main segments of the Asian Mutual Funds Market?

The market segments include Fund Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 614 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising inflation will create opportunities.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2022, HDFC Mutual Fund has filed a scheme information document (SID) with SEBI to come up with India's first Defence Fund. Called the HDFC Defence Fund, it will be an open-ended equity scheme that will be investing in defence & allied sector companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Mutual Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Mutual Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Mutual Funds Market?

To stay informed about further developments, trends, and reports in the Asian Mutual Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence