Key Insights

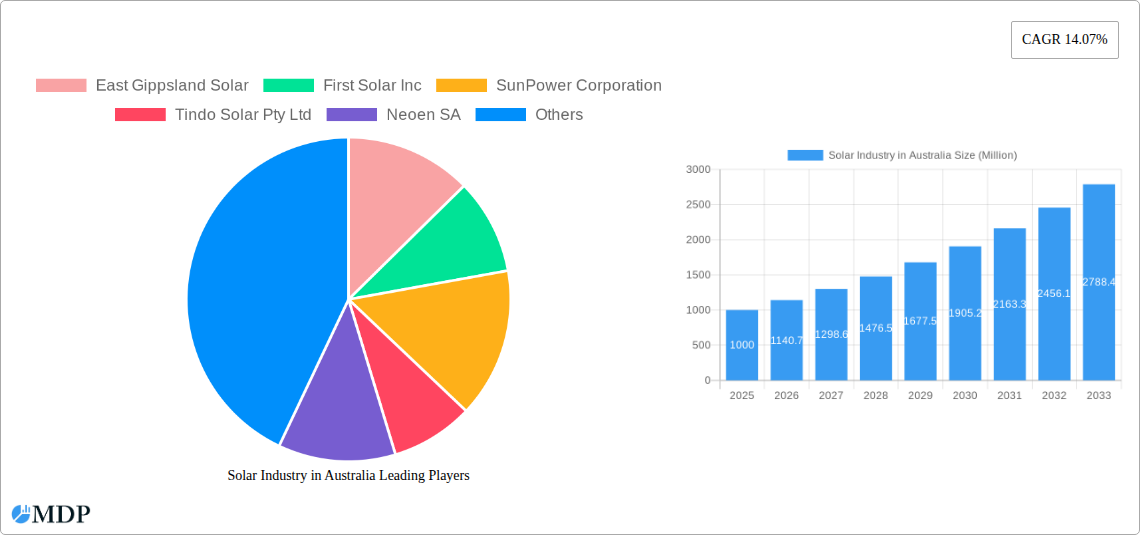

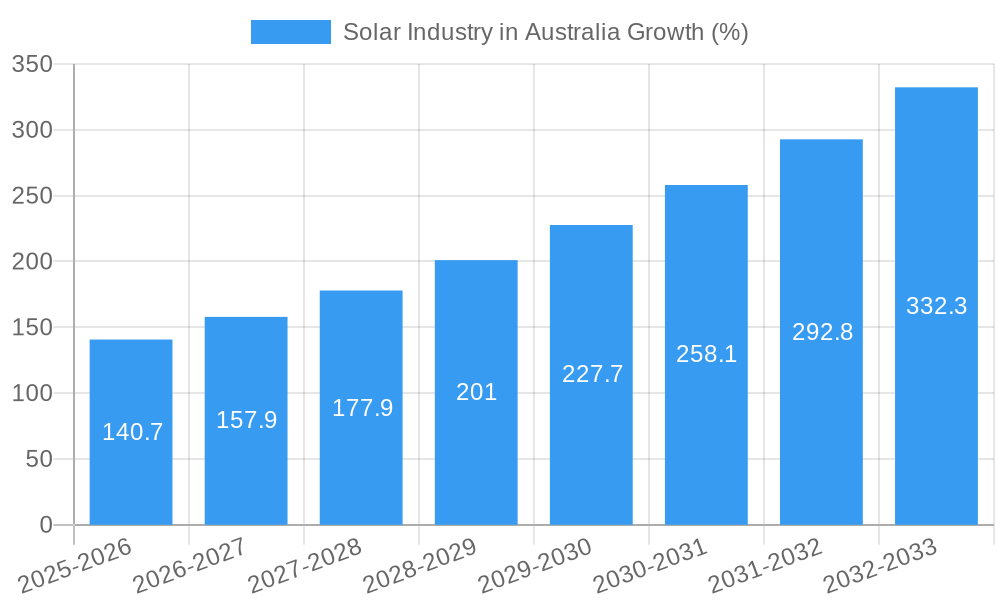

The Australian solar industry is experiencing robust growth, driven by increasing government incentives, falling solar panel prices, and rising consumer awareness of climate change. A compound annual growth rate (CAGR) of 14.07% from 2019-2033 indicates a significant expansion of the market. While precise market size figures for 2019-2024 are not provided, a reasonable estimation, considering the CAGR and a projected 2025 market size (which we will assume as $1 billion for illustrative purposes), suggests a substantial increase in market value over the forecast period. The dominance of utility-scale solar PV projects is expected to continue, although the non-utility segment (residential and commercial installations) will also show strong growth fuelled by government rebates and decreasing installation costs. Key players like First Solar, SunPower, and Trina Solar are actively involved, alongside several Australian companies, highlighting a blend of international and domestic investment.

Growth is further propelled by Australia's abundant sunshine and ambitious renewable energy targets. However, challenges remain, including land availability for large-scale projects, grid infrastructure limitations to accommodate intermittent renewable energy sources, and potential policy shifts. Nevertheless, the long-term outlook for the Australian solar market is positive, with continued technological advancements and increased investor confidence contributing to sustained growth. The market segmentation, encompassing both solar PV and CSP technologies, coupled with the clear distinction between utility and non-utility deployments, allows for targeted investment strategies and more nuanced market analysis. Continued diversification within the industry, incorporating innovations in energy storage and smart grid technologies, will likely enhance the sector's resilience and further stimulate growth in the coming years.

Australia's Solar Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of Australia's booming solar industry, offering invaluable insights for investors, industry stakeholders, and policymakers. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report unveils the market dynamics, leading players, and future trends shaping this dynamic sector. Discover key growth drivers, emerging opportunities, and potential challenges hindering the sector's expansion. The report leverages extensive data analysis, including market share estimations, CAGR projections, and M&A deal counts, to offer actionable intelligence.

Solar Industry in Australia Market Dynamics & Concentration

Australia's solar market is experiencing rapid growth, driven by supportive government policies, increasing consumer awareness of environmental sustainability, and declining solar technology costs. Market concentration is moderate, with several large players and numerous smaller companies competing across different segments. Innovation is primarily driven by advancements in PV technology, efficiency improvements, and energy storage solutions. The regulatory framework, while largely supportive, faces ongoing evolution to accommodate the rapid growth. Product substitutes include other renewable energy sources like wind and hydro, but solar's cost-competitiveness and versatility provide a significant advantage. End-user trends show a strong preference for rooftop solar installations in the residential and commercial sectors, alongside large-scale utility projects. M&A activity has been significant, with an estimated xx number of deals in the last 5 years, resulting in market consolidation and increased vertical integration. This resulted in a xx% market share for the top 5 players in 2024.

Solar Industry in Australia Industry Trends & Analysis

The Australian solar market exhibits robust growth, with a projected CAGR of xx% from 2025 to 2033. This expansion is fueled by several factors: increasing electricity prices, government incentives (e.g., Small-scale Renewable Energy Scheme), and a heightened focus on climate change mitigation. Technological advancements, particularly in PV efficiency and battery storage, are further accelerating market penetration. Consumer preferences are shifting towards higher efficiency panels, integrated energy storage solutions, and aesthetically pleasing designs. Competitive dynamics are intense, with companies vying for market share through pricing strategies, product innovation, and service offerings. Market penetration has increased significantly, with xx% of households adopting solar PV systems by 2024, and this is predicted to reach xx% by 2033.

Leading Markets & Segments in Solar Industry in Australia

The Australian solar market is characterized by a geographically diverse deployment, with significant growth observed across states and territories. However, New South Wales (NSW) and Victoria consistently lead in terms of installed capacity, driven by favorable economic policies, robust infrastructure, and high energy demand.

Type:

Solar Photovoltaic (PV): Dominates the market due to its cost-effectiveness, scalability, and technological maturity. CSP remains a niche segment with limited deployment.

Concentrated Solar Power (CSP): Faces challenges due to higher initial investment costs and technological complexities.

PV Deployment:

- Utility-scale: Large-scale solar farms are rapidly expanding, driven by government support and falling technology costs.

- Non-utility-scale: Residential and commercial rooftop installations remain a crucial segment, fueled by consumer adoption and government incentives.

Key Drivers: Government policies promoting renewable energy (e.g., Renewable Energy Targets), decreasing technology costs, and increasing consumer awareness of environmental and economic benefits contribute to segment dominance.

Solar Industry in Australia Product Developments

Recent product innovations focus on enhancing efficiency, durability, and aesthetics. High-efficiency monocrystalline PV modules are becoming increasingly prevalent, alongside advancements in energy storage technology, particularly lithium-ion batteries. These developments improve system performance, reliability, and overall value proposition for consumers. The market is also seeing increased integration of smart energy management systems, enabling optimized energy consumption and grid interaction.

Key Drivers of Solar Industry in Australia Growth

Several factors contribute to the growth of the Australian solar market. Government policies like the Renewable Energy Targets and state-based incentives play a crucial role. The decreasing cost of solar technology, driven by economies of scale and technological advancements, further enhances its competitiveness. Furthermore, increasing public awareness of climate change and a desire for energy independence fuels consumer adoption of solar energy. Finally, improved grid infrastructure in some areas supports the integration of renewable energy sources.

Challenges in the Solar Industry in Australia Market

Despite significant growth, the Australian solar market faces several challenges. Intermittency of solar power, requiring effective grid management and energy storage solutions, poses a significant obstacle. Supply chain disruptions, particularly impacting the availability of key components, can impact project timelines and costs. Furthermore, competitive pressures, including from established energy providers, necessitate continuous innovation and cost optimization.

Emerging Opportunities in Solar Industry in Australia

The future of the Australian solar market holds immense potential. Technological breakthroughs in perovskite solar cells and advanced energy storage solutions promise enhanced efficiency and cost reduction. Strategic partnerships between solar companies, energy retailers, and technology providers can facilitate market expansion and integration. The integration of solar power with other renewable energy sources, such as wind and hydro, creating hybrid energy systems offers a path toward increased reliability and energy security.

Leading Players in the Solar Industry in Australia Sector

- East Gippsland Solar

- First Solar Inc

- SunPower Corporation

- Tindo Solar Pty Ltd

- Neoen SA

- Infigen Energy Ltd

- Canadian Solar Inc

- GEM Energy

- Trina Solar Co Ltd

- AGL Energy Limited

(List Not Exhaustive)

Key Milestones in Solar Industry in Australia Industry

May 2023: The Australian Energy Market Operator (AEMO) awarded 1.12GW of capacity to solar projects as part of the NSW Electricity Infrastructure Roadmap, including 400MW to the Stubbo Solar Farm and 720MW to the New England Solar Farm. This signals a significant shift towards renewable energy sources.

January 2023: ACEN Australia awarded the EPC contract for the 520 MWdc Stubbo Solar project to PCL Construction, demonstrating substantial investment in large-scale solar projects.

Strategic Outlook for Solar Industry in Australia Market

The Australian solar market is poised for continued strong growth, driven by increasing demand, supportive government policies, and technological advancements. Strategic opportunities exist in large-scale solar farm development, integrated energy storage solutions, and the emergence of new technologies such as perovskite solar cells. Companies focusing on innovation, efficiency, and cost optimization are well-positioned to capture significant market share. The long-term outlook is exceptionally positive, with potential for Australia to become a global leader in renewable energy.

Solar Industry in Australia Segmentation

-

1. Type

- 1.1. Solar Photovoltaic (PV)

- 1.2. Concentrated Solar Power (CSP)

-

2. PV Deployment

- 2.1. Utlility

- 2.2. Non-utility

-

3. End User

- 3.1. Households

- 3.2. Commercial & Industrial

Solar Industry in Australia Segmentation By Geography

- 1. Australia

Solar Industry in Australia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment

- 3.3. Market Restrains

- 3.3.1. Uncertainty in the Rules Governing Energy Storage Operations and Ownership

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic (PV) to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solar Industry in Australia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solar Photovoltaic (PV)

- 5.1.2. Concentrated Solar Power (CSP)

- 5.2. Market Analysis, Insights and Forecast - by PV Deployment

- 5.2.1. Utlility

- 5.2.2. Non-utility

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Households

- 5.3.2. Commercial & Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 East Gippsland Solar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 First Solar Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SunPower Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tindo Solar Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Neoen SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Infigen Energy Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canadian Solar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GEM Energy

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Trina Solar Co Ltd*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AGL Energy Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 East Gippsland Solar

List of Figures

- Figure 1: Global Solar Industry in Australia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Australia Solar Industry in Australia Revenue (Million), by Country 2024 & 2032

- Figure 3: Australia Solar Industry in Australia Revenue Share (%), by Country 2024 & 2032

- Figure 4: Australia Solar Industry in Australia Revenue (Million), by Type 2024 & 2032

- Figure 5: Australia Solar Industry in Australia Revenue Share (%), by Type 2024 & 2032

- Figure 6: Australia Solar Industry in Australia Revenue (Million), by PV Deployment 2024 & 2032

- Figure 7: Australia Solar Industry in Australia Revenue Share (%), by PV Deployment 2024 & 2032

- Figure 8: Australia Solar Industry in Australia Revenue (Million), by End User 2024 & 2032

- Figure 9: Australia Solar Industry in Australia Revenue Share (%), by End User 2024 & 2032

- Figure 10: Australia Solar Industry in Australia Revenue (Million), by Country 2024 & 2032

- Figure 11: Australia Solar Industry in Australia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Solar Industry in Australia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Solar Industry in Australia Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Solar Industry in Australia Revenue Million Forecast, by PV Deployment 2019 & 2032

- Table 4: Global Solar Industry in Australia Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Solar Industry in Australia Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Solar Industry in Australia Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Global Solar Industry in Australia Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Global Solar Industry in Australia Revenue Million Forecast, by PV Deployment 2019 & 2032

- Table 9: Global Solar Industry in Australia Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Global Solar Industry in Australia Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solar Industry in Australia?

The projected CAGR is approximately 14.07%.

2. Which companies are prominent players in the Solar Industry in Australia?

Key companies in the market include East Gippsland Solar, First Solar Inc, SunPower Corporation, Tindo Solar Pty Ltd, Neoen SA, Infigen Energy Ltd, Canadian Solar Inc, GEM Energy, Trina Solar Co Ltd*List Not Exhaustive, AGL Energy Limited.

3. What are the main segments of the Solar Industry in Australia?

The market segments include Type, PV Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment.

6. What are the notable trends driving market growth?

Solar Photovoltaic (PV) to Register Significant Growth.

7. Are there any restraints impacting market growth?

Uncertainty in the Rules Governing Energy Storage Operations and Ownership.

8. Can you provide examples of recent developments in the market?

May 2023: The Australian Energy Market Operator (AEMO) announced the four winners of the tender as part of the NSW Electricity Infrastructure Roadmap. Solar energy projects dominated the given capacity, with 1.12GW awarded between the Stubbo Solar Farm with a capacity of 400MW and the New England Solar Farm with a total capacity of 720MW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solar Industry in Australia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solar Industry in Australia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solar Industry in Australia?

To stay informed about further developments, trends, and reports in the Solar Industry in Australia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence