Key Insights

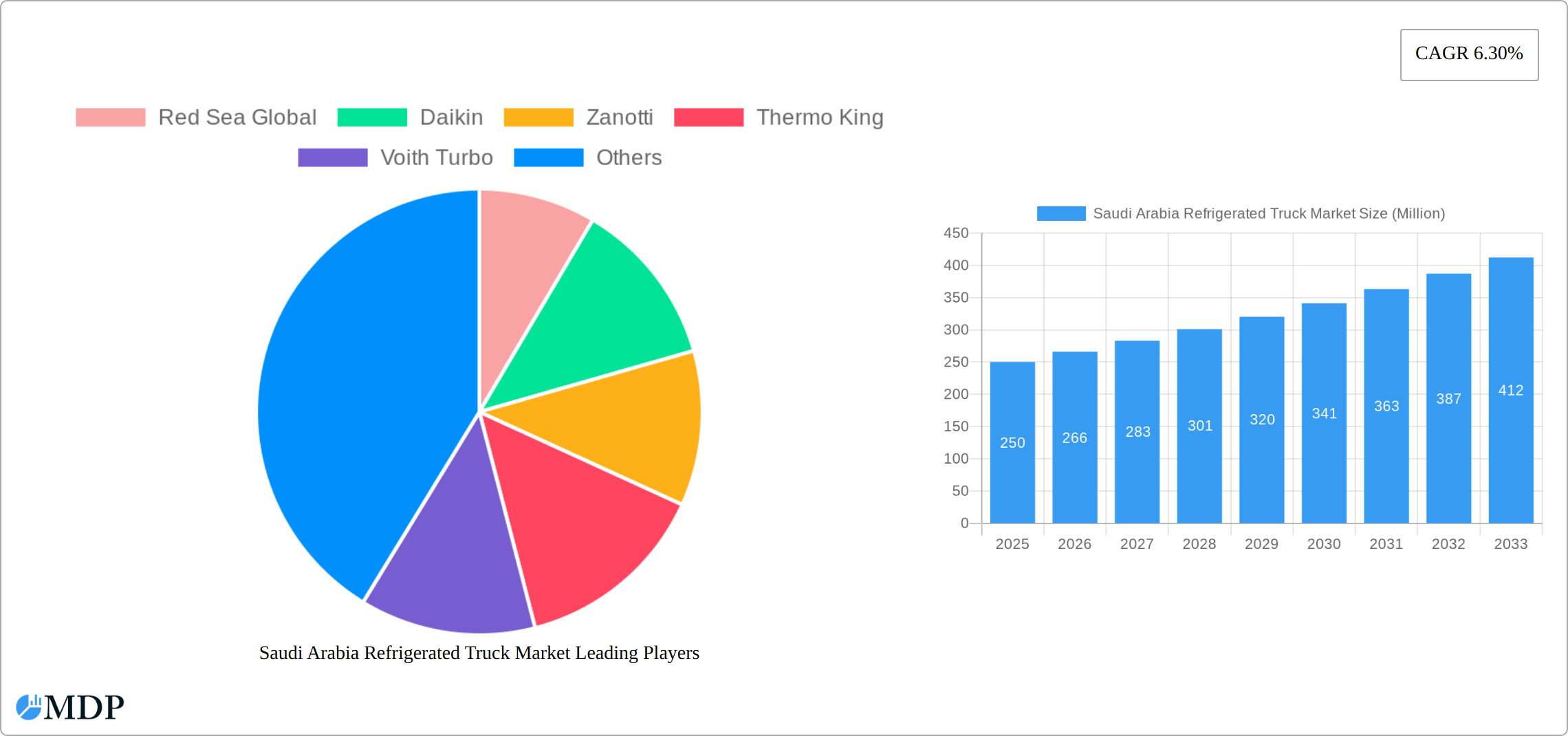

The Saudi Arabian refrigerated truck market, valued at $250 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.30% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage sector, coupled with increasing demand for temperature-sensitive pharmaceuticals and healthcare products, necessitates efficient cold chain logistics. Furthermore, the Kingdom's ambitious Vision 2030 initiative, focused on diversifying the economy and improving infrastructure, significantly contributes to this growth. Expansion of the agricultural sector and a growing population are also increasing the demand for refrigerated transportation. The market is segmented by vehicle type (LCV, MCV, HCV), tonnage capacity (less than 10 tons, 10-20 tons, more than 20 tons), and end-user (food and beverages, agriculture, healthcare, and others). Competition is fierce, with both international players like Carrier Transicold and Thermo King, and domestic companies like Red Sea Global vying for market share. While the initial market size is relatively small, the projected CAGR suggests substantial growth potential over the forecast period, making it an attractive market for investment.

Challenges exist, however. Fluctuations in fuel prices and the overall economic climate can impact market growth. The relatively high initial investment cost of refrigerated trucks might pose a barrier to entry for smaller companies. Furthermore, technological advancements, like the integration of IoT and advanced refrigeration systems, will shape future market dynamics. The Saudi Arabian government's initiatives to improve infrastructure and logistics efficiency are mitigating some of these challenges, creating a more favorable environment for refrigerated truck operators. The market's segmentation offers diverse opportunities for companies to specialize in specific vehicle types or end-user industries, leading to increased market penetration. Ultimately, the market's future success hinges on the continued economic growth of Saudi Arabia and the successful implementation of infrastructure improvements.

Saudi Arabia Refrigerated Truck Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Saudi Arabia refrigerated truck market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report delivers a robust understanding of current market dynamics and future growth trajectories. The market is segmented by vehicle type (LCV, MCV, HCV), tonnage capacity (less than 10 tons, 10-20 tons, more than 20 tons), and end-user (food and beverages, agriculture, healthcare and pharmaceuticals, other). The report’s analysis considers key players such as Red Sea Global, Daikin, Zanotti, Thermo King, Voith Turbo, Emerald Transportation Solutions, Frigoblock, Carrier Transicold, ISUZU, Foton Group, and others, providing a complete picture of market competition and performance. The total market value is estimated to reach XX Million by 2025.

Saudi Arabia Refrigerated Truck Market Dynamics & Concentration

The Saudi Arabia refrigerated truck market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market is driven by continuous innovation in refrigeration technologies, stringent regulatory frameworks ensuring food safety, and the increasing demand for temperature-sensitive goods across various end-use sectors. Product substitution is minimal, with refrigerated trucks remaining the primary solution for temperature-controlled transportation. Growth is largely propelled by the expansion of the food and beverage, healthcare, and e-commerce sectors. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on expanding market reach and acquiring technological expertise. The top 5 players cumulatively hold an estimated xx% market share, reflecting a consolidated but not overly dominated market structure.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Innovation Drivers: Technological advancements in refrigeration systems, fuel efficiency, and telematics.

- Regulatory Framework: Stringent regulations on food safety and transportation standards.

- Product Substitutes: Limited viable substitutes currently available.

- End-User Trends: Growing demand from food & beverage, healthcare, and e-commerce sectors.

- M&A Activities: Approximately xx M&A deals between 2019 and 2024.

Saudi Arabia Refrigerated Truck Market Industry Trends & Analysis

The Saudi Arabia refrigerated truck market is poised for substantial and sustained growth, with projections indicating a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025-2033. This robust expansion is propelled by a confluence of powerful economic and societal drivers. Foremost among these is the rapidly escalating demand from the food and beverage sector, encompassing everything from fresh produce and dairy to frozen goods and pharmaceuticals. Complementing this, significant investments in logistics infrastructure, including modern warehousing and efficient transportation networks, are creating a more conducive environment for cold chain operations. The accelerated adoption of e-commerce, particularly for groceries and time-sensitive items, is further amplifying the need for reliable refrigerated transport.

Technological advancements are playing a pivotal role in reshaping the market. The integration of Internet of Things (IoT) sensors and advanced telematics systems is revolutionizing operational efficiency by providing real-time monitoring of temperature, location, and vehicle performance. This enhanced cold chain visibility not only minimizes spoilage but also assures product integrity throughout the supply chain. Consumer preferences are increasingly leaning towards the assurance of superior quality and safety for temperature-sensitive goods, driving demand for technologically advanced and dependable refrigerated solutions. The competitive landscape is dynamic, featuring a healthy mix of established international players and emerging domestic companies, fostering an environment of continuous innovation and competitive pricing. The gradual adoption of eco-friendly refrigerants and more energy-efficient refrigeration units signifies a growing awareness of sustainability within the industry. The market value is projected to reach an impressive USD 850 Million by 2033.

Leading Markets & Segments in Saudi Arabia Refrigerated Truck Market

The food and beverage sector firmly establishes itself as the largest and most influential end-user segment, directly fueling significant demand for refrigerated trucks across the Kingdom. Within the vehicle type classification, the heavy commercial vehicle (HCV) segment commands a dominant market share. This is attributed to their superior capacity for transporting larger volumes of goods over extended inter-city and regional routes, which is crucial for the nation's extensive supply chains. Furthermore, the 10-20 tons tonnage capacity segment within refrigerated trucks is experiencing substantial traction, striking a balance between volume and maneuverability for various logistical needs. The key drivers underpinning the dominance of these segments are intrinsically linked to the nation's economic trajectory and strategic priorities:

- Vision 2030 & Economic Diversification: Government initiatives under Vision 2030, focusing on bolstering non-oil sectors, are significantly investing in infrastructure development and enhancing the overall efficiency of the logistics sector, directly benefiting refrigerated transport.

- Expansive Infrastructure Development: The continuous expansion and modernization of road networks, coupled with the establishment of advanced logistics hubs and distribution centers across the country, are critical enablers for efficient cold chain operations.

- Evolving Consumer Demands: A growing population with increasing disposable income, coupled with a rising demand for a wider variety of fresh, premium, and imported food products, including those requiring strict temperature control, is a primary market stimulant.

- Healthcare Sector Expansion: The burgeoning healthcare sector, with its increasing need for the reliable transport of pharmaceuticals, vaccines, and other temperature-sensitive medical supplies, is a significant and growing contributor to demand.

The continued dominance of HCVs and the food and beverage sector underscores the foundational structure of Saudi Arabia's logistics network and the nation's concerted efforts to modernize its food supply chain for enhanced safety, efficiency, and accessibility. The rapid growth in e-commerce penetration and the ongoing expansion of healthcare infrastructure are projected to further invigorate demand for refrigerated trucks across an increasingly diverse range of segments in the coming years.

Saudi Arabia Refrigerated Truck Market Product Developments

Recent product developments focus on enhancing fuel efficiency, integrating advanced refrigeration technologies (e.g., electric refrigeration units), and incorporating telematics for improved fleet management. These innovations aim to reduce operational costs, improve cold chain integrity, and enhance overall sustainability. The market is witnessing a growing trend towards environmentally friendly refrigerants, driven by stricter emission regulations. New models are designed for improved maneuverability and durability, catering to the specific needs of the Saudi Arabian landscape.

Key Drivers of Saudi Arabia Refrigerated Truck Market Growth

The Saudi Arabia refrigerated truck market's growth is propelled by several key factors:

- Economic Growth: Steady economic expansion driving increased consumption of temperature-sensitive goods.

- Infrastructure Development: Government investments in transportation infrastructure enhance logistics efficiency.

- Technological Advancements: Innovation in refrigeration technology leads to improved efficiency and cost savings.

- Regulatory Support: Stricter food safety regulations necessitate the use of refrigerated transportation.

Challenges in the Saudi Arabia Refrigerated Truck Market Market

The market faces certain challenges including:

- High Initial Investment Costs: The purchase and maintenance of refrigerated trucks can be expensive.

- Fuel Price Volatility: Fluctuations in fuel prices impact operational costs.

- Supply Chain Disruptions: Global events can disrupt the supply of components and vehicles.

- Driver Shortages: A shortage of skilled drivers can affect logistics efficiency.

Emerging Opportunities in Saudi Arabia Refrigerated Truck Market

The Saudi Arabia refrigerated truck market is ripe with emerging opportunities poised to drive further innovation and expansion:

- Transition to Sustainable Mobility: The global and national push towards sustainability presents a significant opportunity for the adoption of electric and alternative fuel refrigerated trucks. These vehicles offer reduced emissions and lower operating costs, aligning with Saudi Arabia's environmental goals and creating a niche for advanced, eco-friendly solutions.

- Synergistic Strategic Partnerships: Fostering robust collaborations between specialized logistics providers, technology companies, and refrigeration equipment manufacturers can unlock novel and integrated solutions. These partnerships can focus on developing smart cold chain management platforms, optimizing route planning with real-time data, and offering end-to-end temperature-controlled logistics services.

- Untapped Market Potential in Growing Sectors: The continued surge in e-commerce, particularly for perishable goods, and the significant expansion of the healthcare and pharmaceutical sectors, present substantial opportunities for market penetration into previously underserved regions and specialized logistics niches.

- Data Analytics and AI Integration: Leveraging data analytics and artificial intelligence (AI) for predictive maintenance, demand forecasting, and route optimization can enhance operational efficiency, reduce waste, and improve customer satisfaction, creating a competitive edge for early adopters.

- Specialized Cold Chain Solutions: There is a growing demand for specialized refrigerated transport solutions for niche products like high-value seafood, exotic fruits, and temperature-sensitive chemicals, opening avenues for companies offering tailored services.

Leading Players in the Saudi Arabia Refrigerated Truck Market Sector

- Red Sea Global

- Daikin

- Zanotti

- Thermo King

- Voith Turbo

- Emerald Transportation Solutions

- Frigoblock

- Carrier Transicold

- ISUZU

- Foton Group

- Hino Motors

- Hyundai Motor Company

- King Long

- Scania AB

Key Milestones in Saudi Arabia Refrigerated Truck Market Industry

- 2020: Introduction of stricter emission standards for commercial vehicles.

- 2022: Launch of several new models of fuel-efficient refrigerated trucks by major players.

- 2023: Increased investment in cold chain infrastructure by the government.

- 2024: Several mergers and acquisitions within the refrigerated truck sector.

Strategic Outlook for Saudi Arabia Refrigerated Truck Market Market

The Saudi Arabia refrigerated truck market is poised for continued robust growth, driven by economic expansion, infrastructure development, and technological innovation. Strategic opportunities exist for players to focus on fuel-efficient and sustainable solutions, expanding into underserved markets, and leveraging technological advancements to enhance operational efficiency and cold chain visibility. The market’s long-term potential remains substantial, offering attractive prospects for both domestic and international players.

Saudi Arabia Refrigerated Truck Market Segmentation

-

1. Vehicle Type

- 1.1. Light Commercial Vehicle (LCV)

- 1.2. Medium Commercial Vehicle (MCV)

- 1.3. Heavy Commercial Vehicle (HCV)

-

2. Tonnage Capacity

- 2.1. Less than 10 tons

- 2.2. 10-20 tons

- 2.3. More than 20 tons

-

3. End User

- 3.1. Food and Beverages

- 3.2. Agriculture

- 3.3. Healthcare and Pharmaceuticals

- 3.4. Other End Users

Saudi Arabia Refrigerated Truck Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Refrigerated Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for temperature-controlled logistics

- 3.3. Market Restrains

- 3.3.1. High initial investment and operational costs

- 3.4. Market Trends

- 3.4.1. Heavy Commercial Vehicle (HCV) increase the Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Refrigerated Truck Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Light Commercial Vehicle (LCV)

- 5.1.2. Medium Commercial Vehicle (MCV)

- 5.1.3. Heavy Commercial Vehicle (HCV)

- 5.2. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 5.2.1. Less than 10 tons

- 5.2.2. 10-20 tons

- 5.2.3. More than 20 tons

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Food and Beverages

- 5.3.2. Agriculture

- 5.3.3. Healthcare and Pharmaceuticals

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

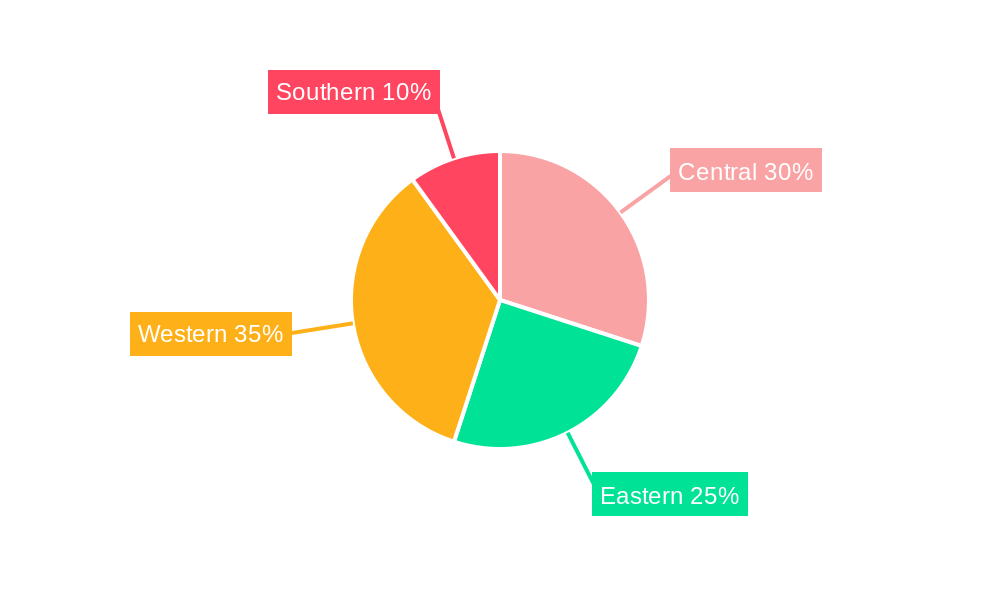

- 6. Central Saudi Arabia Refrigerated Truck Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Refrigerated Truck Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Refrigerated Truck Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Refrigerated Truck Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Red Sea Global

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Daikin

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Zanotti

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Thermo King

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Voith Turbo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Emerald Transportation Solutions

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Frigoblock

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Carrier Transicold

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 ISUZU*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Foton Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Red Sea Global

List of Figures

- Figure 1: Saudi Arabia Refrigerated Truck Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Refrigerated Truck Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Refrigerated Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Refrigerated Truck Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Saudi Arabia Refrigerated Truck Market Revenue Million Forecast, by Tonnage Capacity 2019 & 2032

- Table 4: Saudi Arabia Refrigerated Truck Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Saudi Arabia Refrigerated Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Refrigerated Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Central Saudi Arabia Refrigerated Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Eastern Saudi Arabia Refrigerated Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Western Saudi Arabia Refrigerated Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Saudi Arabia Refrigerated Truck Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Refrigerated Truck Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: Saudi Arabia Refrigerated Truck Market Revenue Million Forecast, by Tonnage Capacity 2019 & 2032

- Table 13: Saudi Arabia Refrigerated Truck Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Saudi Arabia Refrigerated Truck Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Refrigerated Truck Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Saudi Arabia Refrigerated Truck Market?

Key companies in the market include Red Sea Global, Daikin, Zanotti, Thermo King, Voith Turbo, Emerald Transportation Solutions, Frigoblock, Carrier Transicold, ISUZU*List Not Exhaustive, Foton Group.

3. What are the main segments of the Saudi Arabia Refrigerated Truck Market?

The market segments include Vehicle Type, Tonnage Capacity, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 250 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for temperature-controlled logistics.

6. What are the notable trends driving market growth?

Heavy Commercial Vehicle (HCV) increase the Demand in the Market.

7. Are there any restraints impacting market growth?

High initial investment and operational costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Refrigerated Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Refrigerated Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Refrigerated Truck Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Refrigerated Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence