Key Insights

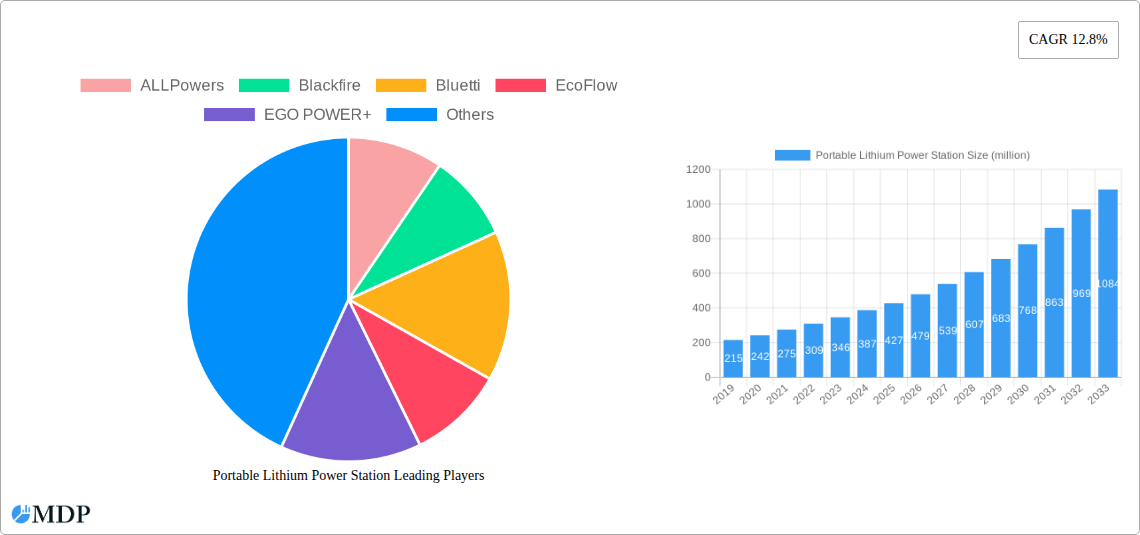

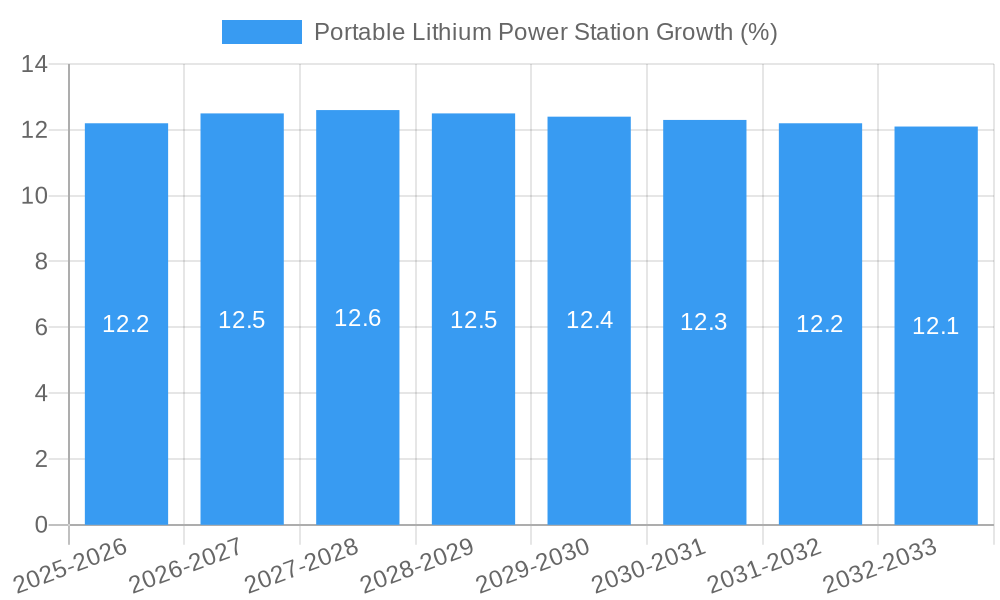

The global Portable Lithium Power Station market is experiencing robust expansion, projected to reach a significant value of $427 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 12.8%. This dynamic growth is primarily fueled by a confluence of factors. The increasing demand for reliable and portable power solutions in outdoor recreational activities, such as camping, RVing, and tailgating, is a major driver. Furthermore, the growing adoption of renewable energy sources and the desire for off-grid power independence are propelling market growth. As consumers become more environmentally conscious and seek sustainable alternatives to traditional generators, portable lithium power stations offer a clean and quiet energy solution. The ongoing advancements in battery technology, leading to lighter, more powerful, and longer-lasting units, are also making these devices increasingly attractive to a wider consumer base. The escalating frequency of power outages due to extreme weather events further underscores the utility and necessity of these portable power solutions, driving consistent demand.

The market is characterized by a competitive landscape with key players like ALLPowers, Bluetti, EcoFlow, and Jackery, who are continuously innovating to introduce advanced features and expand their product portfolios. Emerging trends include the integration of smart technology for remote monitoring and control, faster charging capabilities, and enhanced durability for rugged outdoor use. While the market exhibits strong growth potential, certain restraints need to be considered. The relatively high initial cost compared to traditional generators can be a barrier for some consumers. Additionally, supply chain disruptions and the fluctuating prices of raw materials, particularly lithium, can impact manufacturing costs and product availability. Despite these challenges, the market for portable lithium power stations is poised for sustained growth, driven by technological innovation, increasing consumer awareness, and the undeniable need for dependable portable energy across various applications.

Here is an SEO-optimized, engaging report description for the "Portable Lithium Power Station Market," incorporating high-traffic keywords and structured as requested.

Portable Lithium Power Station Market Dynamics & Concentration

The global portable lithium power station market is exhibiting dynamic shifts and evolving concentration patterns. Driven by an escalating demand for reliable and sustainable off-grid power solutions, the market is witnessing a surge in innovation and a highly competitive landscape. Key innovation drivers include advancements in battery technology, faster charging capabilities, and the integration of smart features for enhanced user experience and grid connectivity. Regulatory frameworks, particularly those promoting renewable energy adoption and battery safety standards, are playing a crucial role in shaping market entry and product development. While product substitutes like traditional generators exist, the growing environmental consciousness and the inherent advantages of lithium-ion power stations, such as portability, quiet operation, and zero emissions, are diminishing their competitive threat. End-user trends show a strong preference for lightweight, high-capacity units for outdoor recreation, emergency preparedness, and powering electronic devices in remote locations. Mergers and Acquisitions (M&A) activities, while not yet at a dominant level, are expected to increase as larger players seek to consolidate market share and acquire innovative technologies. The market concentration is moderate, with a few key players holding significant shares, but the increasing number of new entrants and specialized product offerings indicates a healthy competitive environment. Recent M&A deal counts indicate a growing interest from established electronics and energy companies looking to capitalize on this expanding sector.

Portable Lithium Power Station Industry Trends & Analysis

The portable lithium power station industry is poised for substantial growth, propelled by a confluence of technological advancements, evolving consumer preferences, and a global push towards sustainable energy solutions. The Compound Annual Growth Rate (CAGR) is projected to reach an impressive xx% over the forecast period of 2025–2033, signifying robust expansion. Market penetration is steadily increasing, particularly in regions with a high incidence of outdoor activities and a growing awareness of emergency preparedness needs. Technological disruptions are at the forefront of this growth, with continuous improvements in lithium-ion battery energy density, charging efficiency, and lifespan. The development of advanced inverter technologies and the integration of IoT capabilities for remote monitoring and control are further enhancing the appeal of these devices. Consumer preferences are shifting towards more portable, lightweight, and user-friendly power stations with higher output capacities to cater to a wider range of applications, from camping trips to powering home appliances during outages. The competitive dynamics are characterized by intense product differentiation, with companies vying for market dominance through feature-rich offerings, competitive pricing, and strong brand building. The rising adoption of electric vehicles (EVs) also presents a significant synergistic trend, as portable power stations can serve as complementary energy storage solutions. Furthermore, the increasing frequency of extreme weather events globally is bolstering the demand for reliable backup power, solidifying the market's upward trajectory. The overall industry sentiment is highly optimistic, driven by a clear demand for versatile, sustainable, and mobile power solutions.

Leading Markets & Segments in Portable Lithium Power Station

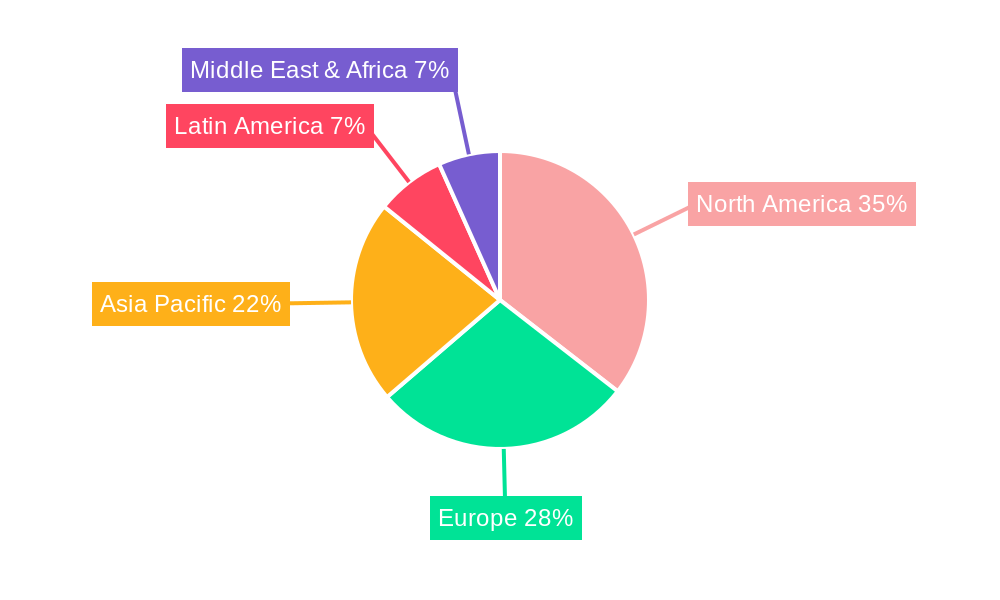

The portable lithium power station market is experiencing dominant growth across several key regions and segments, driven by specific economic policies, infrastructure development, and evolving consumer needs.

Dominant Region: North America

- Key Drivers:

- High Disposable Income: A significant portion of the population in North America possesses the disposable income to invest in premium portable power solutions for recreational and emergency preparedness needs.

- Outdoor Recreation Culture: The strong culture of camping, RVing, van life, and other outdoor activities in countries like the United States and Canada fuels a consistent demand for portable energy sources.

- Emergency Preparedness Awareness: Increased awareness and concern regarding power outages due to severe weather events, natural disasters, and grid instability have made portable power stations a critical component of household emergency kits.

- Technological Adoption: North America is a leading adopter of new technologies, readily embracing advanced features and smart functionalities offered by portable power stations.

- Favorable Regulatory Environment: Government initiatives promoting renewable energy and energy independence, coupled with lenient regulations for consumer electronics, support market growth.

Dominant Country: United States

- High Disposable Income: A significant portion of the population in North America possesses the disposable income to invest in premium portable power solutions for recreational and emergency preparedness needs.

- Outdoor Recreation Culture: The strong culture of camping, RVing, van life, and other outdoor activities in countries like the United States and Canada fuels a consistent demand for portable energy sources.

- Emergency Preparedness Awareness: Increased awareness and concern regarding power outages due to severe weather events, natural disasters, and grid instability have made portable power stations a critical component of household emergency kits.

- Technological Adoption: North America is a leading adopter of new technologies, readily embracing advanced features and smart functionalities offered by portable power stations.

- Favorable Regulatory Environment: Government initiatives promoting renewable energy and energy independence, coupled with lenient regulations for consumer electronics, support market growth.

The United States stands out as the largest and most influential market within North America and globally. The sheer size of the population, coupled with the factors listed above, creates an immense consumer base for portable lithium power stations. The robust e-commerce infrastructure ensures widespread accessibility, allowing consumers to easily purchase these devices online. Furthermore, the increasing prevalence of off-grid living and the growing adoption of solar energy systems for residential use directly correlate with the demand for complementary portable power storage.

Dominant Segment: Application: Outdoor Recreation

- Key Drivers:

- Portability and Convenience: The inherent portability of lithium power stations makes them ideal companions for camping, hiking, tailgating, and other outdoor pursuits where traditional power sources are unavailable.

- Versatile Powering: These devices can simultaneously power multiple gadgets, from smartphones and laptops to portable refrigerators and lighting, enhancing the comfort and functionality of outdoor experiences.

- Environmental Consciousness: Growing awareness of environmental impact among outdoor enthusiasts favors the use of emission-free and quiet portable power stations over gasoline-powered generators.

- Technological Integration: The integration of features like solar charging capabilities further appeals to eco-conscious consumers looking for sustainable off-grid power.

Dominant Segment: Type: High-Capacity Power Stations

- Key Drivers:

- Extended Usage Needs: High-capacity power stations (typically above 500Wh) cater to users who require prolonged power for extended trips, larger appliances, or multiple devices.

- Emergency Preparedness: During prolonged power outages, high-capacity units provide essential power for refrigerators, medical equipment, and communication devices, making them a critical backup solution.

- Growing Appliance Load: As consumers rely more on portable electronics and even larger appliances in off-grid scenarios, the demand for higher power output and storage capacity escalates.

- Technological Advancements: Improvements in battery technology have made it feasible to pack more energy into more compact and manageable units, making high-capacity options increasingly attractive and accessible.

Portable Lithium Power Station Product Developments

- Portability and Convenience: The inherent portability of lithium power stations makes them ideal companions for camping, hiking, tailgating, and other outdoor pursuits where traditional power sources are unavailable.

- Versatile Powering: These devices can simultaneously power multiple gadgets, from smartphones and laptops to portable refrigerators and lighting, enhancing the comfort and functionality of outdoor experiences.

- Environmental Consciousness: Growing awareness of environmental impact among outdoor enthusiasts favors the use of emission-free and quiet portable power stations over gasoline-powered generators.

- Technological Integration: The integration of features like solar charging capabilities further appeals to eco-conscious consumers looking for sustainable off-grid power.

- Key Drivers:

- Extended Usage Needs: High-capacity power stations (typically above 500Wh) cater to users who require prolonged power for extended trips, larger appliances, or multiple devices.

- Emergency Preparedness: During prolonged power outages, high-capacity units provide essential power for refrigerators, medical equipment, and communication devices, making them a critical backup solution.

- Growing Appliance Load: As consumers rely more on portable electronics and even larger appliances in off-grid scenarios, the demand for higher power output and storage capacity escalates.

- Technological Advancements: Improvements in battery technology have made it feasible to pack more energy into more compact and manageable units, making high-capacity options increasingly attractive and accessible.

Portable Lithium Power Station Product Developments

The portable lithium power station market is experiencing rapid product innovation focused on enhancing user convenience, power output, and sustainability. Companies are introducing lighter, more compact units with increased energy density, enabling longer runtimes and the ability to power a wider array of devices. Advanced fast-charging technologies, including solar integration and rapid AC charging, significantly reduce downtime. Smart features such as app-controlled monitoring, predictive maintenance alerts, and customizable power output settings are becoming standard. Competitive advantages are being forged through robust battery management systems, superior thermal regulation for enhanced safety and longevity, and the development of modular designs for expandable capacity. This continuous stream of product developments is driving market adoption across diverse applications.

Key Drivers of Portable Lithium Power Station Growth

The growth of the portable lithium power station market is propelled by several key factors. Technologically, advancements in lithium-ion battery chemistry are yielding higher energy densities, faster charging speeds, and extended lifecycles. Economically, the declining cost of battery components and increasing consumer disposable income make these devices more accessible. Regulatory tailwinds, including government incentives for renewable energy adoption and stringent emissions standards for traditional generators, further encourage the shift towards cleaner portable power solutions. The increasing popularity of outdoor recreation, coupled with growing concerns about grid reliability and a desire for emergency preparedness, also fuels consistent demand.

Challenges in the Portable Lithium Power Station Market

Despite robust growth, the portable lithium power station market faces several challenges. Regulatory hurdles, particularly concerning battery shipping and disposal regulations across different regions, can complicate global distribution and increase operational costs. Supply chain disruptions, especially for critical battery components and semiconductors, can lead to production delays and price volatility. Intense competitive pressures, characterized by a crowded marketplace and aggressive pricing strategies, can impact profit margins for manufacturers. Furthermore, consumer education regarding safe usage, proper maintenance, and understanding power output versus capacity remains an ongoing effort to ensure optimal product performance and customer satisfaction.

Emerging Opportunities in Portable Lithium Power Station

Emerging opportunities in the portable lithium power station market are primarily driven by technological breakthroughs and strategic market expansion. The development of solid-state battery technology promises even higher energy densities, faster charging, and enhanced safety, which could revolutionize product design and performance. Strategic partnerships between portable power station manufacturers and solar panel companies, EV manufacturers, and outdoor gear brands can unlock new distribution channels and co-branded product offerings. Market expansion into developing economies with increasing electrification needs and a growing middle class presents significant untapped potential. Furthermore, the integration of these power stations into smart home ecosystems and their use as distributed energy resources for grid stabilization offer long-term growth avenues.

Leading Players in the Portable Lithium Power Station Sector

- ALLPowers

- Blackfire

- Bluetti

- EcoFlow

- EGO POWER+

- Goal Zero

- Greenway Power

- Jackery

- Li Power

- Lion Energy

- Midland Radio

- Nexpow

- Westinghouse Electric Corporation

Key Milestones in Portable Lithium Power Station Industry

- 2019: Increased consumer adoption of portable power stations for camping and RVing.

- 2020: Launch of higher capacity units (over 1000Wh) catering to home backup needs.

- 2021: Significant advancements in solar charging integration and efficiency.

- 2022: Growing market entry of smart features and app-controlled functionalities.

- 2023: Widespread recognition of portable power stations for emergency preparedness.

- 2024: Introduction of more durable and ruggedized models for extreme outdoor use.

- 2025: Expected integration of faster charging technologies (e.g., GaN).

- 2026: Potential for modular power station designs allowing for expandable battery capacity.

- 2027: Anticipated improvements in battery lifespan and cycle life.

- 2028: Increased focus on sustainable manufacturing and battery recycling initiatives.

- 2029: Emergence of portable power stations with bidirectional charging capabilities.

- 2030: Market consolidation through strategic acquisitions and partnerships.

- 2031: Development of ultra-fast charging solutions approaching minutes for a full charge.

- 2032: Widespread adoption in commercial and industrial applications for temporary power needs.

- 2033: Next-generation battery chemistries offering superior performance and reduced environmental impact.

Strategic Outlook for Portable Lithium Power Station Market

The strategic outlook for the portable lithium power station market remains exceptionally positive, driven by a sustained demand for reliable, portable, and sustainable energy solutions. Key growth accelerators include continued technological innovation in battery technology, leading to enhanced performance and affordability. The expansion of smart features and connectivity will further differentiate products and improve user experience. Strategic partnerships with key players in the renewable energy and outdoor industries will broaden market reach. Furthermore, the increasing global awareness and necessity for emergency preparedness and off-grid power will provide a constant demand impetus. Companies that focus on product diversification, cost optimization, and building strong brand loyalty are well-positioned to capitalize on the substantial future market potential.

Portable Lithium Power Station Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Portable Lithium Power Station Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Portable Lithium Power Station REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Portable Lithium Power Station Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Portable Lithium Power Station Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Portable Lithium Power Station Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Portable Lithium Power Station Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Portable Lithium Power Station Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Portable Lithium Power Station Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ALLPowers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Blackfire

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bluetti

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EcoFlow

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EGO POWER+

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Goal Zero

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Greenway Power

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jackery

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Li Power

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lion Energy

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Midland Radio

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nexpow

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Westinghouse Electric Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 ALLPowers

List of Figures

- Figure 1: Global Portable Lithium Power Station Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Portable Lithium Power Station Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: undefined Portable Lithium Power Station Revenue (million), by Application 2024 & 2032

- Figure 4: undefined Portable Lithium Power Station Volume (K), by Application 2024 & 2032

- Figure 5: undefined Portable Lithium Power Station Revenue Share (%), by Application 2024 & 2032

- Figure 6: undefined Portable Lithium Power Station Volume Share (%), by Application 2024 & 2032

- Figure 7: undefined Portable Lithium Power Station Revenue (million), by Type 2024 & 2032

- Figure 8: undefined Portable Lithium Power Station Volume (K), by Type 2024 & 2032

- Figure 9: undefined Portable Lithium Power Station Revenue Share (%), by Type 2024 & 2032

- Figure 10: undefined Portable Lithium Power Station Volume Share (%), by Type 2024 & 2032

- Figure 11: undefined Portable Lithium Power Station Revenue (million), by Country 2024 & 2032

- Figure 12: undefined Portable Lithium Power Station Volume (K), by Country 2024 & 2032

- Figure 13: undefined Portable Lithium Power Station Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Portable Lithium Power Station Volume Share (%), by Country 2024 & 2032

- Figure 15: undefined Portable Lithium Power Station Revenue (million), by Application 2024 & 2032

- Figure 16: undefined Portable Lithium Power Station Volume (K), by Application 2024 & 2032

- Figure 17: undefined Portable Lithium Power Station Revenue Share (%), by Application 2024 & 2032

- Figure 18: undefined Portable Lithium Power Station Volume Share (%), by Application 2024 & 2032

- Figure 19: undefined Portable Lithium Power Station Revenue (million), by Type 2024 & 2032

- Figure 20: undefined Portable Lithium Power Station Volume (K), by Type 2024 & 2032

- Figure 21: undefined Portable Lithium Power Station Revenue Share (%), by Type 2024 & 2032

- Figure 22: undefined Portable Lithium Power Station Volume Share (%), by Type 2024 & 2032

- Figure 23: undefined Portable Lithium Power Station Revenue (million), by Country 2024 & 2032

- Figure 24: undefined Portable Lithium Power Station Volume (K), by Country 2024 & 2032

- Figure 25: undefined Portable Lithium Power Station Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Portable Lithium Power Station Volume Share (%), by Country 2024 & 2032

- Figure 27: undefined Portable Lithium Power Station Revenue (million), by Application 2024 & 2032

- Figure 28: undefined Portable Lithium Power Station Volume (K), by Application 2024 & 2032

- Figure 29: undefined Portable Lithium Power Station Revenue Share (%), by Application 2024 & 2032

- Figure 30: undefined Portable Lithium Power Station Volume Share (%), by Application 2024 & 2032

- Figure 31: undefined Portable Lithium Power Station Revenue (million), by Type 2024 & 2032

- Figure 32: undefined Portable Lithium Power Station Volume (K), by Type 2024 & 2032

- Figure 33: undefined Portable Lithium Power Station Revenue Share (%), by Type 2024 & 2032

- Figure 34: undefined Portable Lithium Power Station Volume Share (%), by Type 2024 & 2032

- Figure 35: undefined Portable Lithium Power Station Revenue (million), by Country 2024 & 2032

- Figure 36: undefined Portable Lithium Power Station Volume (K), by Country 2024 & 2032

- Figure 37: undefined Portable Lithium Power Station Revenue Share (%), by Country 2024 & 2032

- Figure 38: undefined Portable Lithium Power Station Volume Share (%), by Country 2024 & 2032

- Figure 39: undefined Portable Lithium Power Station Revenue (million), by Application 2024 & 2032

- Figure 40: undefined Portable Lithium Power Station Volume (K), by Application 2024 & 2032

- Figure 41: undefined Portable Lithium Power Station Revenue Share (%), by Application 2024 & 2032

- Figure 42: undefined Portable Lithium Power Station Volume Share (%), by Application 2024 & 2032

- Figure 43: undefined Portable Lithium Power Station Revenue (million), by Type 2024 & 2032

- Figure 44: undefined Portable Lithium Power Station Volume (K), by Type 2024 & 2032

- Figure 45: undefined Portable Lithium Power Station Revenue Share (%), by Type 2024 & 2032

- Figure 46: undefined Portable Lithium Power Station Volume Share (%), by Type 2024 & 2032

- Figure 47: undefined Portable Lithium Power Station Revenue (million), by Country 2024 & 2032

- Figure 48: undefined Portable Lithium Power Station Volume (K), by Country 2024 & 2032

- Figure 49: undefined Portable Lithium Power Station Revenue Share (%), by Country 2024 & 2032

- Figure 50: undefined Portable Lithium Power Station Volume Share (%), by Country 2024 & 2032

- Figure 51: undefined Portable Lithium Power Station Revenue (million), by Application 2024 & 2032

- Figure 52: undefined Portable Lithium Power Station Volume (K), by Application 2024 & 2032

- Figure 53: undefined Portable Lithium Power Station Revenue Share (%), by Application 2024 & 2032

- Figure 54: undefined Portable Lithium Power Station Volume Share (%), by Application 2024 & 2032

- Figure 55: undefined Portable Lithium Power Station Revenue (million), by Type 2024 & 2032

- Figure 56: undefined Portable Lithium Power Station Volume (K), by Type 2024 & 2032

- Figure 57: undefined Portable Lithium Power Station Revenue Share (%), by Type 2024 & 2032

- Figure 58: undefined Portable Lithium Power Station Volume Share (%), by Type 2024 & 2032

- Figure 59: undefined Portable Lithium Power Station Revenue (million), by Country 2024 & 2032

- Figure 60: undefined Portable Lithium Power Station Volume (K), by Country 2024 & 2032

- Figure 61: undefined Portable Lithium Power Station Revenue Share (%), by Country 2024 & 2032

- Figure 62: undefined Portable Lithium Power Station Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Portable Lithium Power Station Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Portable Lithium Power Station Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Portable Lithium Power Station Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Portable Lithium Power Station Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Portable Lithium Power Station Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Portable Lithium Power Station Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Portable Lithium Power Station Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Portable Lithium Power Station Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Portable Lithium Power Station Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Portable Lithium Power Station Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Portable Lithium Power Station Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Portable Lithium Power Station Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Portable Lithium Power Station Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Portable Lithium Power Station Volume K Forecast, by Country 2019 & 2032

- Table 15: Global Portable Lithium Power Station Revenue million Forecast, by Application 2019 & 2032

- Table 16: Global Portable Lithium Power Station Volume K Forecast, by Application 2019 & 2032

- Table 17: Global Portable Lithium Power Station Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Portable Lithium Power Station Volume K Forecast, by Type 2019 & 2032

- Table 19: Global Portable Lithium Power Station Revenue million Forecast, by Country 2019 & 2032

- Table 20: Global Portable Lithium Power Station Volume K Forecast, by Country 2019 & 2032

- Table 21: Global Portable Lithium Power Station Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Portable Lithium Power Station Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Portable Lithium Power Station Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Portable Lithium Power Station Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Portable Lithium Power Station Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Portable Lithium Power Station Volume K Forecast, by Country 2019 & 2032

- Table 27: Global Portable Lithium Power Station Revenue million Forecast, by Application 2019 & 2032

- Table 28: Global Portable Lithium Power Station Volume K Forecast, by Application 2019 & 2032

- Table 29: Global Portable Lithium Power Station Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Portable Lithium Power Station Volume K Forecast, by Type 2019 & 2032

- Table 31: Global Portable Lithium Power Station Revenue million Forecast, by Country 2019 & 2032

- Table 32: Global Portable Lithium Power Station Volume K Forecast, by Country 2019 & 2032

- Table 33: Global Portable Lithium Power Station Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Portable Lithium Power Station Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Portable Lithium Power Station Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Portable Lithium Power Station Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Portable Lithium Power Station Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Portable Lithium Power Station Volume K Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portable Lithium Power Station?

The projected CAGR is approximately 12.8%.

2. Which companies are prominent players in the Portable Lithium Power Station?

Key companies in the market include ALLPowers, Blackfire, Bluetti, EcoFlow, EGO POWER+, Goal Zero, Greenway Power, Jackery, Li Power, Lion Energy, Midland Radio, Nexpow, Westinghouse Electric Corporation.

3. What are the main segments of the Portable Lithium Power Station?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 427 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portable Lithium Power Station," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portable Lithium Power Station report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portable Lithium Power Station?

To stay informed about further developments, trends, and reports in the Portable Lithium Power Station, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence