Key Insights

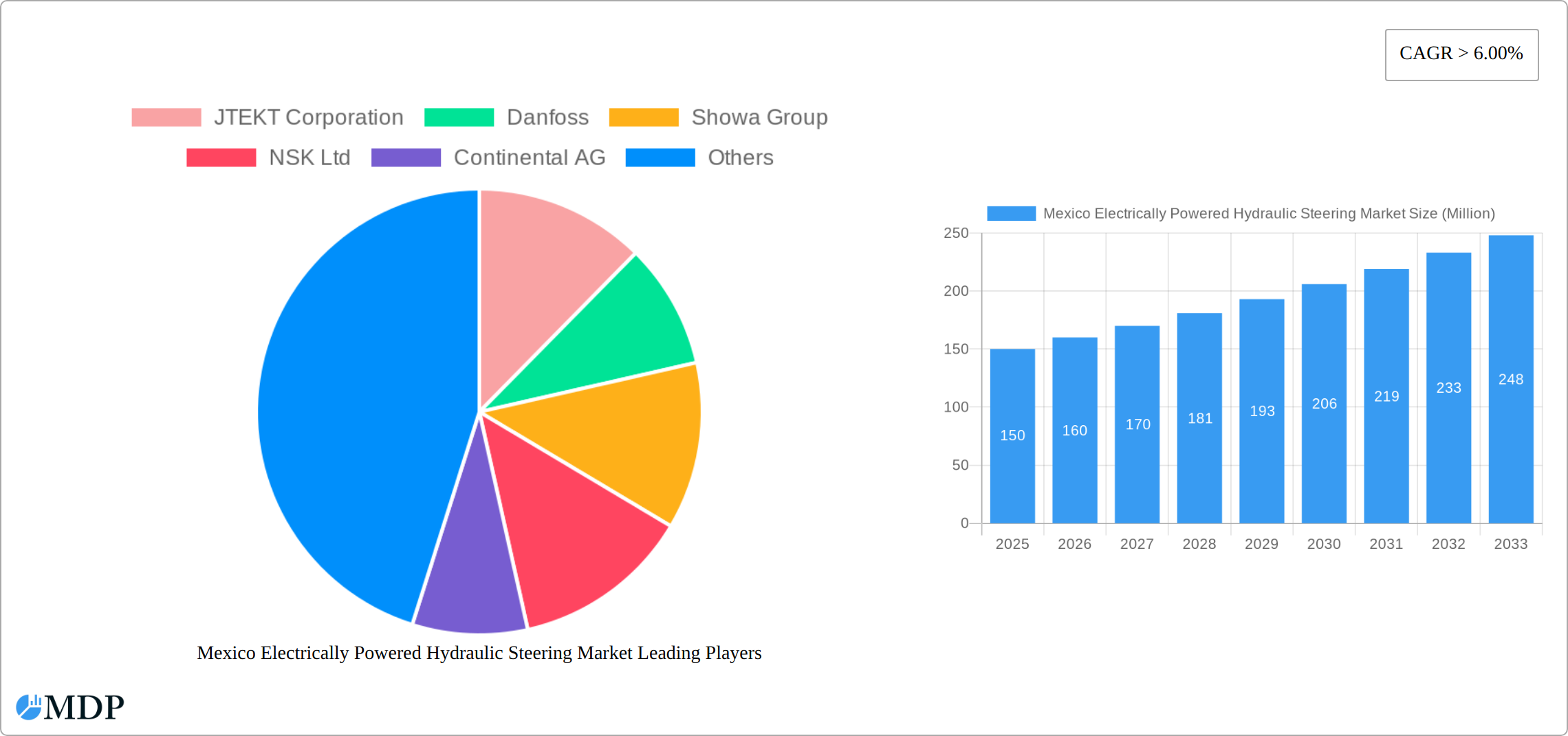

The Mexico electrically powered hydraulic steering market is experiencing robust growth, driven by the increasing adoption of advanced driver-assistance systems (ADAS) and the rising demand for fuel-efficient vehicles in the passenger and commercial vehicle sectors. The market's Compound Annual Growth Rate (CAGR) exceeding 6.00% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several factors, including stricter government regulations promoting fuel efficiency and emission reduction, a burgeoning automotive industry in Mexico, and the integration of electrically powered hydraulic steering systems into electric and hybrid vehicles. Key market segments include passenger vehicles, which currently dominate market share due to higher production volumes, and commercial vehicles, showing promising growth potential as technology adoption increases in this sector. Component-wise, steering motors and sensors are the primary revenue generators, while the 'other components' segment represents a smaller but growing market segment encompassing electronic control units and power electronics. Leading players like JTEKT Corporation, Danfoss, and Continental AG are investing heavily in R&D to enhance system efficiency, reliability, and integration with other vehicle systems.

Looking ahead to 2033, the market is projected to continue its expansion, albeit potentially at a slightly moderated CAGR as the market matures. The continued growth will be influenced by factors such as government incentives for electric vehicle adoption, increasing investment in automotive manufacturing within Mexico, and the ongoing development of more sophisticated and integrated steering systems. However, challenges remain, including the relatively high initial cost of implementing these systems compared to traditional hydraulic steering, and potential supply chain disruptions impacting component availability. Nevertheless, the long-term outlook for the Mexico electrically powered hydraulic steering market remains positive, driven by the overarching trends towards automation, improved fuel efficiency, and enhanced safety features in vehicles. Market segmentation strategies focusing on specific vehicle types and component needs will be crucial for sustained success within this dynamic market.

Mexico Electrically Powered Hydraulic Steering Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico Electrically Powered Hydraulic Steering Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on the 2025-2033 forecast, this report unravels the market's dynamics, trends, and future potential. Benefit from data-driven analysis, exploring key segments, leading players, and emerging opportunities in the vibrant Mexican automotive sector. Maximize your understanding of this rapidly evolving market and gain a competitive edge.

Mexico Electrically Powered Hydraulic Steering Market Market Dynamics & Concentration

The Mexico Electrically Powered Hydraulic Steering market, valued at xx Million in 2024, is characterized by a moderately consolidated landscape. Key players, including JTEKT Corporation, Danfoss, Showa Group, NSK Ltd, Continental AG, Nexteer Automotive, Robert Bosch GmbH, Thyssenkrupp Presta AG, Mando Corporation, and ZF Friedrichshafen AG, hold significant market share, with the top 5 companies accounting for approximately xx%. Market concentration is expected to remain relatively stable over the forecast period (2025-2033), although strategic acquisitions and partnerships could reshape the competitive dynamics.

- Innovation Drivers: The increasing demand for fuel-efficient vehicles and stricter emission regulations are driving innovation in electrically powered hydraulic steering systems. Advancements in sensor technology and electronic control units are key factors.

- Regulatory Frameworks: Mexican government initiatives promoting automotive manufacturing and the adoption of advanced technologies are influencing market growth. However, compliance costs associated with new regulations may pose challenges for some players.

- Product Substitutes: Electric power steering (EPS) systems present a significant competitive threat, but electrically powered hydraulic steering offers advantages in specific applications, particularly in larger commercial vehicles.

- End-User Trends: The growing preference for enhanced safety features and improved fuel economy among consumers is boosting the demand for sophisticated steering systems.

- M&A Activities: The past five years (2019-2024) witnessed approximately xx M&A deals in the broader automotive component sector in Mexico, indicating consolidation trends and potential future activity in the electrically powered hydraulic steering market.

Mexico Electrically Powered Hydraulic Steering Market Industry Trends & Analysis

The Mexico Electrically Powered Hydraulic Steering (EHPS) Market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of [Insert Specific CAGR % Here, e.g., 7.2%] during the forecast period of 2025-2033. This growth is underpinned by a confluence of powerful market forces. Mexico's burgeoning automotive manufacturing sector, characterized by increasing production volumes of both passenger and commercial vehicles, forms a primary growth engine. Simultaneously, the accelerating integration of Advanced Driver-Assistance Systems (ADAS) across vehicle segments is creating a heightened demand for sophisticated steering solutions. EHPS systems, with their inherent ability to seamlessly integrate with and enhance ADAS functionalities, are thus at the forefront of this technological evolution. Consumer preferences are also shifting towards vehicles offering superior safety features, enhanced driving comfort, and improved fuel efficiency, all of which EHPS contributes to. Despite these positive indicators, the market faces headwinds from volatile raw material prices, particularly for metals and electronic components, and the potential for global supply chain vulnerabilities. The market penetration of EHPS in passenger vehicles is estimated to be around [Insert Specific % Here, e.g., 35%] in 2025, with projections reaching approximately [Insert Specific % Here, e.g., 65%] by 2033. In contrast, the adoption rate in the commercial vehicle segment is considerably lower, largely attributable to higher initial system costs and the distinct operational demands of these vehicles.

Leading Markets & Segments in Mexico Electrically Powered Hydraulic Steering Market

The passenger vehicle segment dominates the Mexican electrically powered hydraulic steering market, accounting for approximately xx% of the total market value in 2025. This is primarily attributed to the higher volume of passenger car production compared to commercial vehicles.

By Vehicle Type:

- Passenger Vehicles: High volume production, increasing ADAS adoption, and growing consumer demand drive this segment's dominance.

- Commercial Vehicles: This segment exhibits slower growth due to higher initial investment costs and specialized requirements, though it's expected to see increased adoption due to stringent fuel efficiency regulations.

By Component Type:

- Steering Motor: This is the largest component segment, comprising approximately xx% of the market, reflecting the core functionality of the system.

- Sensors: The growing importance of ADAS features is driving the growth of the sensor segment.

- Other Components: This includes supporting components such as control units and hydraulic valves.

Key Drivers:

- Favorable government policies promoting automotive manufacturing.

- Growing investment in automotive infrastructure and supply chains.

- Increasing domestic demand for fuel-efficient vehicles.

Mexico Electrically Powered Hydraulic Steering Market Product Developments

Recent product innovations focus on enhancing efficiency, reducing weight, and integrating advanced features. This includes the development of more compact and lightweight steering motors, the incorporation of advanced sensors for improved responsiveness and safety, and the integration of these systems with ADAS functionalities. These advancements are enhancing the competitive landscape by allowing manufacturers to offer more efficient and feature-rich products to meet evolving market demands.

Key Drivers of Mexico Electrically Powered Hydraulic Steering Market Growth

The upward trajectory of the Mexican EHPS market is propelled by a robust set of catalysts:

- Technological Advancements: Continuous innovation is leading to the development of more compact, efficient, and feature-rich EHPS systems. This includes advancements in sensor technology, electric motor design, and control algorithms that improve performance and reduce energy consumption. The seamless integration with electronic stability control (ESC) and other safety systems is a significant driver.

- Stringent Government Regulations: Increasing global and national mandates for improved fuel economy and enhanced vehicle safety standards are playing a pivotal role. EHPS contributes to fuel efficiency by disengaging the electric motor when not assisting and directly supports safety through its precise control and integration with active safety features like lane-keeping assist.

- Robust Growth in Vehicle Production: Mexico's established position as a global automotive manufacturing hub, with a strong export orientation, directly translates to a larger addressable market for EHPS. The consistent influx of investment in automotive plants further solidifies this driver.

- Evolving Consumer Demand: Modern car buyers are increasingly seeking a refined driving experience characterized by effortless steering, advanced safety features, and better fuel economy. EHPS systems deliver on these expectations, contributing to a more comfortable, responsive, and safer drive.

- ADAS Integration: The widespread adoption of ADAS technologies, such as adaptive cruise control, automated parking, and emergency braking, necessitates steer-by-wire capabilities or highly responsive steering systems, making EHPS a natural fit.

Challenges in the Mexico Electrically Powered Hydraulic Steering Market Market

Despite the promising outlook, the Mexican EHPS market navigates several significant hurdles:

- High Initial Investment and Perceived Cost: The upfront cost of implementing EHPS technology remains a barrier, particularly for entry-level vehicles and cost-sensitive segments of the commercial vehicle market. While long-term operational savings exist, the initial outlay can be a deterrent.

- Supply Chain Vulnerabilities and Geopolitical Risks: The reliance on global supply chains for specialized electronic components and raw materials makes the market susceptible to disruptions caused by trade disputes, natural disasters, or geopolitical instability, impacting production timelines and costs.

- Intensifying Competition from Pure EPS Systems: Fully electric power steering (EPS) systems, which eliminate the hydraulic component entirely, offer a compelling alternative. EPS systems are generally lighter, more energy-efficient, and have a simpler architecture, posing a significant competitive challenge to EHPS.

- Volatility in Raw Material Prices: Fluctuations in the prices of essential raw materials, such as copper, aluminum, and rare earth elements used in electric motors and electronic components, can significantly impact manufacturing costs and profit margins for EHPS producers.

- Technical Complexity and Maintenance: The sophisticated nature of EHPS systems can lead to higher maintenance costs and require specialized training for technicians, which may be a concern for fleet operators and individual vehicle owners.

Emerging Opportunities in Mexico Electrically Powered Hydraulic Steering Market

Long-term growth prospects are promising due to anticipated technological breakthroughs, strategic partnerships between automotive manufacturers and component suppliers, and expansion into new vehicle segments and applications. The increasing integration with autonomous driving technologies and the ongoing development of more sustainable and efficient systems present significant growth opportunities.

Leading Players in the Mexico Electrically Powered Hydraulic Steering Market Sector

- JTEKT Corporation

- Danfoss

- Showa Group

- NSK Ltd

- Continental AG

- Nexteer Automotive

- Robert Bosch GmbH

- Thyssenkrupp Presta AG

- Mando Corporation

- ZF Friedrichshafen AG

Key Milestones in Mexico Electrically Powered Hydraulic Steering Market Industry

- 2020: Introduction of a new, more efficient steering motor by a major player.

- 2022: A significant M&A deal involving two key component suppliers.

- 2023: Launch of a new ADAS-integrated electrically powered hydraulic steering system.

- 2024: Implementation of stricter emission regulations impacting the market.

Strategic Outlook for Mexico Electrically Powered Hydraulic Steering Market Market

The strategic outlook for the Mexico Electrically Powered Hydraulic Steering Market is overwhelmingly positive, fueled by a dynamic interplay of technological innovation, supportive regulatory frameworks, and the sustained expansion of the nation's automotive industry. To thrive in this evolving landscape, market participants must prioritize strategic initiatives. Key among these will be substantial investments in research and development to pioneer next-generation EHPS technologies that offer enhanced efficiency, reduced cost, and superior integration capabilities with emerging automotive trends like autonomous driving. Forging strong strategic partnerships with original equipment manufacturers (OEMs) and technology providers will be crucial for market penetration and collaborative innovation. Furthermore, companies that can effectively navigate supply chain complexities, explore localization opportunities for components, and optimize their manufacturing processes to achieve cost efficiencies will be best positioned for sustained growth and competitive advantage. The continued evolution of ADAS and increasing consumer demand for safety and comfort will solidify EHPS's role as a vital steering technology in Mexico's automotive future.

Mexico Electrically Powered Hydraulic Steering Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Component Type

- 2.1. Steering Motor

- 2.2. Sensors

- 2.3. Other Components

Mexico Electrically Powered Hydraulic Steering Market Segmentation By Geography

- 1. Mexico

Mexico Electrically Powered Hydraulic Steering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising EV Sales to Fuel Automotive PCB Demand

- 3.3. Market Restrains

- 3.3.1. Complex Design and Integration Challenges

- 3.4. Market Trends

- 3.4.1. Advancements in Electric Power Steering (EPS) Technology Phasing Out the Electro-Hydraulic System

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Electrically Powered Hydraulic Steering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Steering Motor

- 5.2.2. Sensors

- 5.2.3. Other Components

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JTEKT Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Danfoss

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Showa Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NSK Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nexteer Automotive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thyssenkrupp Presta AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mando Corporatio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ZF Friedrichshafen AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JTEKT Corporation

List of Figures

- Figure 1: Mexico Electrically Powered Hydraulic Steering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Electrically Powered Hydraulic Steering Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Electrically Powered Hydraulic Steering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Electrically Powered Hydraulic Steering Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Mexico Electrically Powered Hydraulic Steering Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 4: Mexico Electrically Powered Hydraulic Steering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico Electrically Powered Hydraulic Steering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Mexico Electrically Powered Hydraulic Steering Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 7: Mexico Electrically Powered Hydraulic Steering Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 8: Mexico Electrically Powered Hydraulic Steering Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Electrically Powered Hydraulic Steering Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Mexico Electrically Powered Hydraulic Steering Market?

Key companies in the market include JTEKT Corporation, Danfoss, Showa Group, NSK Ltd, Continental AG, Nexteer Automotive, Robert Bosch GmbH, Thyssenkrupp Presta AG, Mando Corporatio, ZF Friedrichshafen AG.

3. What are the main segments of the Mexico Electrically Powered Hydraulic Steering Market?

The market segments include Vehicle Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising EV Sales to Fuel Automotive PCB Demand.

6. What are the notable trends driving market growth?

Advancements in Electric Power Steering (EPS) Technology Phasing Out the Electro-Hydraulic System.

7. Are there any restraints impacting market growth?

Complex Design and Integration Challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Electrically Powered Hydraulic Steering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Electrically Powered Hydraulic Steering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Electrically Powered Hydraulic Steering Market?

To stay informed about further developments, trends, and reports in the Mexico Electrically Powered Hydraulic Steering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence