Key Insights

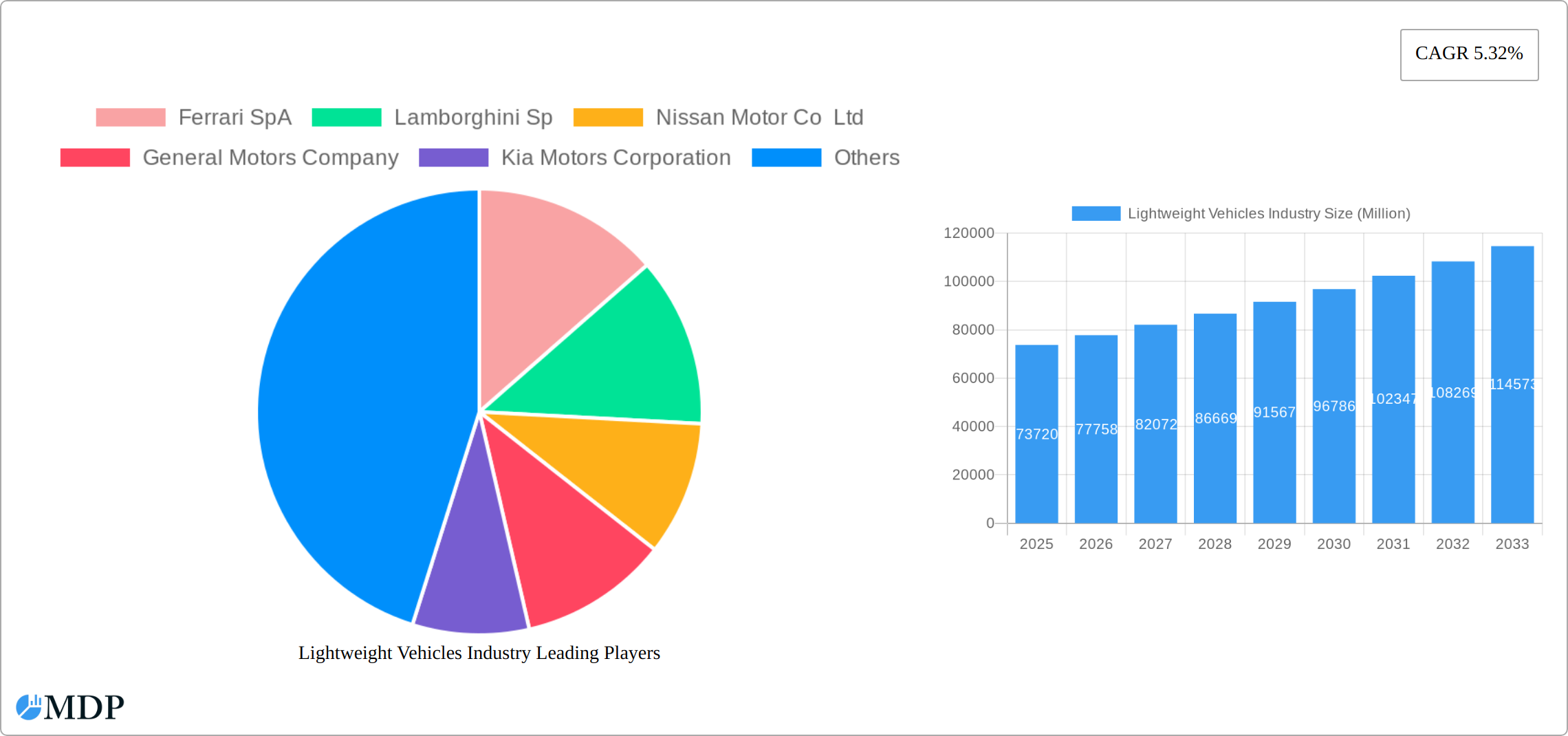

The lightweight vehicles market, valued at $73.72 billion in 2025, is projected to experience robust growth, driven by increasing demand for fuel efficiency and reduced emissions. The Compound Annual Growth Rate (CAGR) of 5.32% from 2025 to 2033 indicates a significant expansion of this market over the forecast period. Key drivers include stricter government regulations on fuel economy, the rising adoption of electric and hybrid vehicles which inherently benefit from lightweight materials, and the growing consumer preference for vehicles with improved performance and handling characteristics. Material innovations in carbon fiber and high-strength steel are further accelerating market growth, while advancements in glass fiber composites offer cost-effective alternatives. The passenger car segment currently dominates the market, but the sports car segment is poised for significant growth due to the emphasis on performance and lightweight design within this niche. Geographic distribution shows strong presence in North America and Europe, primarily driven by established automotive industries and stringent emission norms. However, the Asia-Pacific region, particularly China and India, presents substantial growth opportunities due to increasing vehicle sales and government initiatives supporting the adoption of fuel-efficient technologies.

Despite the positive outlook, challenges remain. The high cost of advanced lightweight materials like carbon fiber can hinder wider adoption, particularly in mass-market vehicles. Furthermore, the manufacturing complexity associated with these materials requires significant investment in specialized equipment and skilled labor. Successfully navigating these challenges will be crucial for industry players to capitalize on the long-term growth potential. The competitive landscape is dominated by major automotive manufacturers including Ferrari, Lamborghini, and established players like General Motors and Toyota, who are investing heavily in R&D to develop and integrate lightweight materials into their vehicle production. The market is likely to witness increased consolidation and strategic partnerships as companies seek to gain a competitive edge in this rapidly evolving sector.

Lightweight Vehicles Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Lightweight Vehicles Industry, projecting a market valuation of $XX Million by 2033. The study covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. Key players like Ferrari SpA, Lamborghini SpA, Nissan Motor Co Ltd, General Motors Company, Kia Motors Corporation, Hyundai Motor Co, Toyota Motor Corporation, Honda Motor Co Ltd, Volkswagen, and Ford Motor Company are analyzed, alongside key material types (Glass Fiber, Carbon Fiber, High-strength Steel, Other Material Types) and vehicle segments (Passenger Cars, Sports Cars). Gain actionable insights to navigate the evolving landscape of lightweight vehicle technology and seize strategic opportunities.

Lightweight Vehicles Industry Market Dynamics & Concentration

The lightweight vehicles market is undergoing a transformative period characterized by robust growth and increasing strategic consolidation. Mergers and acquisitions (M&A) activity has been a significant driver, with aggregate deal values reaching an estimated $XX Billion between 2019 and 2024, reflecting a strong appetite for market expansion and technological integration. Key innovation catalysts are multifaceted, encompassing breakthroughs in advanced materials science, particularly the widespread adoption of carbon fiber composites, high-strength aluminum alloys, and advanced polymers. Concurrently, stringent global fuel efficiency regulations and escalating environmental concerns are compelling manufacturers to prioritize weight reduction. This is further amplified by a growing consumer consciousness and demand for vehicles that offer superior fuel economy, reduced emissions, and enhanced performance.

Market concentration remains moderately distributed, with the top five industry leaders collectively commanding an estimated XX% of the global market share in 2024. This landscape is continually shaped by evolving regulatory frameworks, with emissions standards such as Euro 7 and CAFE (Corporate Average Fuel Economy) playing a pivotal role in dictating product development and market entry strategies. While traditional steel-bodied vehicles continue to represent a competitive segment, their market share is projected to gradually decline as the advantages of lightweight alternatives, including improved handling, acceleration, and energy efficiency, become more pronounced. Emerging end-user trends underscore a significant and accelerating preference for electric vehicles (EVs), which inherently benefit from weight reduction for improved range and performance, alongside a heightened emphasis on integrated safety systems and dynamic driving capabilities.

- Market Share: Top 5 players projected to hold XX% market share in 2024.

- M&A Activity: Over $XX Billion in deals recorded between 2019-2024, indicating consolidation.

- Key Innovation Drivers: Pervasive advancements in materials science, stringent environmental regulations, and strong consumer demand for efficiency.

- Regulatory Impact: Stringent emission and fuel economy standards are critical accelerators for market growth and technological innovation.

Lightweight Vehicles Industry Industry Trends & Analysis

The lightweight vehicles market is on a trajectory of significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period spanning from 2025 to 2033. This robust growth is underpinned by several interconnected factors. The accelerating adoption of electric vehicles (EVs) is a primary engine, as lightweight construction is paramount for optimizing battery range and overall vehicle efficiency. Complementing this, government incentives and subsidies designed to promote fuel-efficient and low-emission vehicles continue to stimulate demand. Furthermore, continuous innovation in lightweight materials, including the development of novel alloys, advanced composites, and high-performance polymers, is making these solutions more accessible and cost-effective.

Technological disruptions are profoundly reshaping the industry landscape. Advancements in battery technology are leading to lighter and more energy-dense power sources, while the integration of autonomous driving systems necessitates sophisticated lightweight structural components. Consumer preferences are demonstrably shifting towards vehicles that offer enhanced safety features, superior fuel efficiency, and seamless integration of cutting-edge technologies. The competitive dynamics within the market are intensifying, with established automotive giants actively collaborating with or acquiring innovative startups, and new entrants challenging the status quo through disruptive technologies and agile business models. The market penetration of advanced lightweight materials is anticipated to reach an impressive XX% by 2033, propelled by ongoing technological breakthroughs, economies of scale, and strategic cost-reduction initiatives across the value chain.

Leading Markets & Segments in Lightweight Vehicles Industry

The Asia-Pacific region is projected to dominate the lightweight vehicles market throughout the forecast period, driven by strong economic growth, increasing vehicle production, and supportive government policies. Within this region, China and Japan are expected to be the leading countries.

Key Drivers:

- Asia-Pacific: Strong economic growth, high vehicle production, and government incentives.

- China & Japan: Large domestic markets, established automotive industries.

Segment Dominance:

- Car Type: Passenger cars currently constitute the largest segment, but sports car segment is witnessing a significant growth due to the technological advancements and rising disposable income.

- Material Type: High-strength steel currently dominates the material type segment; however, carbon fiber is gaining traction due to its superior lightweight properties and improved performance characteristics.

Dominance Analysis: The dominance of Asia-Pacific stems from a confluence of factors including robust government support for green technologies, a large and growing middle class with increased disposable income, and a proactive automotive manufacturing sector leading innovation in the lightweight vehicles industry. The passenger car segment's prominence reflects the sheer volume of passenger vehicles produced globally.

Lightweight Vehicles Industry Product Developments

Recent product innovations include the development of lighter vehicle doors using carbon fiber and thermoplastic resins (Clemson University, Honda collaboration), and ultra-lightweight electric drivetrains (ZF's EVbeat concept). These advancements offer enhanced fuel efficiency, improved safety, and optimized vehicle performance. The market fit is strong, addressing increasing demand for environmentally friendly and technologically advanced vehicles. Competition is intensifying as companies strive to differentiate themselves through innovative lightweight solutions.

Key Drivers of Lightweight Vehicles Industry Growth

Several factors are driving the growth of the lightweight vehicles industry:

- Technological Advancements: Innovations in materials science, battery technology, and electric drivetrain systems.

- Economic Factors: Rising disposable incomes in emerging markets, government incentives for fuel-efficient vehicles.

- Regulatory Pressures: Stringent emission regulations and fuel economy standards globally. Examples include the EU's emission targets and US CAFE standards.

Challenges in the Lightweight Vehicles Industry Market

Despite its promising outlook, the lightweight vehicles market encounters several significant challenges that manufacturers and stakeholders must navigate:

- High Material Costs: The initial cost of advanced lightweight materials, such as carbon fiber composites and specialized aluminum alloys, often significantly exceeds that of traditional steel, impacting overall vehicle affordability.

- Supply Chain Complexities and Vulnerabilities: The global supply chains for specialized raw materials are intricate and can be susceptible to disruptions caused by geopolitical events, natural disasters, or trade disputes, leading to price volatility and availability issues.

- Technological Integration and Manufacturing Sophistication: The development, integration, and mass production of vehicles utilizing advanced lightweight materials and complex joining techniques require substantial investment in new manufacturing processes, specialized tooling, and highly skilled labor, thereby increasing upfront capital expenditure.

- Recyclability and End-of-Life Management: Ensuring the effective and sustainable recycling of mixed materials used in lightweight vehicles presents an ongoing challenge, requiring the development of new recycling technologies and infrastructure.

Emerging Opportunities in Lightweight Vehicles Industry

Significant opportunities exist for growth in the lightweight vehicles market. Strategic partnerships between automotive manufacturers and technology companies (like the Huawei and Changan Auto collaboration) are driving innovation. Breakthroughs in material science, such as the development of even lighter and stronger materials, will unlock new possibilities. Expansion into emerging markets with growing vehicle ownership rates presents considerable potential for market growth.

Leading Players in the Lightweight Vehicles Industry Sector

- Ferrari SpA

- Lamborghini SpA

- Nissan Motor Co Ltd

- General Motors Company

- Kia Motors Corporation

- Hyundai Motor Co

- Toyota Motor Corporation

- Honda Motor Co Ltd

- Volkswagen

- Ford Motor Company

Key Milestones in Lightweight Vehicles Industry Industry

- November 2023: Huawei partners with Changan Auto to develop automotive systems.

- August 2023: Clemson University, NETL, and Honda develop a 32% lighter vehicle door.

- June 2023: ZF unveils EVbeat, an ultra-lightweight electric vehicle concept.

- May 2022: Mercedes-AMG unveils Vision AMG, featuring a lightweight electric motor.

Strategic Outlook for Lightweight Vehicles Industry Market

The lightweight vehicles market is poised for substantial and sustained growth, driven by an interplay of accelerating technological advancements, increasingly stringent global environmental regulations, and a burgeoning consumer demand for vehicles that are both fuel-efficient and environmentally responsible. Success in this dynamic sector will hinge on strategic agility, with key differentiators including the formation of robust strategic partnerships, significant investments in research and development (R&D) to push the boundaries of material science and manufacturing processes, and proactive expansion into burgeoning global markets. The industry will continue its evolutionary path, with an intensified focus on the development and adoption of sustainable materials, the integration of sophisticated safety features to meet evolving consumer expectations, and the seamless incorporation of advanced technological functionalities.

The long-term outlook for the lightweight vehicles market is overwhelmingly positive. Companies that can effectively address the inherent challenges of material costs, supply chain complexities, and manufacturing sophistication, while simultaneously capitalizing on the immense opportunities presented by the global shift towards electrification and sustainable transportation, are exceptionally well-positioned for significant market penetration and profitability. The continued pursuit of innovative solutions that balance performance, cost, and environmental impact will define leadership in this transformative industry.

Lightweight Vehicles Industry Segmentation

-

1. Car Type

- 1.1. Passenger Cars

- 1.2. Sports Cars

-

2. Material Type

- 2.1. Glass Fiber

- 2.2. Carbon Fiber

- 2.3. High-strength Steel

- 2.4. Other Material Types

Lightweight Vehicles Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Lightweight Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Innovations and Material Advancements is Likely to Fuel Demand

- 3.3. Market Restrains

- 3.3.1. High Cost of Lightweight Materials is Anticipated to Restrict the Market Growth Potential

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Lightweight Passenger Cars

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lightweight Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Car Type

- 5.1.1. Passenger Cars

- 5.1.2. Sports Cars

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Glass Fiber

- 5.2.2. Carbon Fiber

- 5.2.3. High-strength Steel

- 5.2.4. Other Material Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Car Type

- 6. North America Lightweight Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Car Type

- 6.1.1. Passenger Cars

- 6.1.2. Sports Cars

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Glass Fiber

- 6.2.2. Carbon Fiber

- 6.2.3. High-strength Steel

- 6.2.4. Other Material Types

- 6.1. Market Analysis, Insights and Forecast - by Car Type

- 7. Europe Lightweight Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Car Type

- 7.1.1. Passenger Cars

- 7.1.2. Sports Cars

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Glass Fiber

- 7.2.2. Carbon Fiber

- 7.2.3. High-strength Steel

- 7.2.4. Other Material Types

- 7.1. Market Analysis, Insights and Forecast - by Car Type

- 8. Asia Pacific Lightweight Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Car Type

- 8.1.1. Passenger Cars

- 8.1.2. Sports Cars

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Glass Fiber

- 8.2.2. Carbon Fiber

- 8.2.3. High-strength Steel

- 8.2.4. Other Material Types

- 8.1. Market Analysis, Insights and Forecast - by Car Type

- 9. South America Lightweight Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Car Type

- 9.1.1. Passenger Cars

- 9.1.2. Sports Cars

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Glass Fiber

- 9.2.2. Carbon Fiber

- 9.2.3. High-strength Steel

- 9.2.4. Other Material Types

- 9.1. Market Analysis, Insights and Forecast - by Car Type

- 10. Middle East and Africa Lightweight Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Car Type

- 10.1.1. Passenger Cars

- 10.1.2. Sports Cars

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Glass Fiber

- 10.2.2. Carbon Fiber

- 10.2.3. High-strength Steel

- 10.2.4. Other Material Types

- 10.1. Market Analysis, Insights and Forecast - by Car Type

- 11. North America Lightweight Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Rest of North America

- 12. Europe Lightweight Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Lightweight Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. South America Lightweight Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Rest of South America

- 15. Middle East and Africa Lightweight Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 South Africa

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ferrari SpA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Lamborghini Sp

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Nissan Motor Co Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 General Motors Company

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kia Motors Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Hyundai Motor Co

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Toyota Motor Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Honda Motor Co Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Volkswagen

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Ford Motor Company

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Ferrari SpA

List of Figures

- Figure 1: Global Lightweight Vehicles Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Lightweight Vehicles Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Lightweight Vehicles Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Lightweight Vehicles Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Lightweight Vehicles Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Lightweight Vehicles Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Lightweight Vehicles Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Lightweight Vehicles Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Lightweight Vehicles Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Lightweight Vehicles Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Lightweight Vehicles Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Lightweight Vehicles Industry Revenue (Million), by Car Type 2024 & 2032

- Figure 13: North America Lightweight Vehicles Industry Revenue Share (%), by Car Type 2024 & 2032

- Figure 14: North America Lightweight Vehicles Industry Revenue (Million), by Material Type 2024 & 2032

- Figure 15: North America Lightweight Vehicles Industry Revenue Share (%), by Material Type 2024 & 2032

- Figure 16: North America Lightweight Vehicles Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Lightweight Vehicles Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Lightweight Vehicles Industry Revenue (Million), by Car Type 2024 & 2032

- Figure 19: Europe Lightweight Vehicles Industry Revenue Share (%), by Car Type 2024 & 2032

- Figure 20: Europe Lightweight Vehicles Industry Revenue (Million), by Material Type 2024 & 2032

- Figure 21: Europe Lightweight Vehicles Industry Revenue Share (%), by Material Type 2024 & 2032

- Figure 22: Europe Lightweight Vehicles Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Lightweight Vehicles Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Lightweight Vehicles Industry Revenue (Million), by Car Type 2024 & 2032

- Figure 25: Asia Pacific Lightweight Vehicles Industry Revenue Share (%), by Car Type 2024 & 2032

- Figure 26: Asia Pacific Lightweight Vehicles Industry Revenue (Million), by Material Type 2024 & 2032

- Figure 27: Asia Pacific Lightweight Vehicles Industry Revenue Share (%), by Material Type 2024 & 2032

- Figure 28: Asia Pacific Lightweight Vehicles Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Lightweight Vehicles Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Lightweight Vehicles Industry Revenue (Million), by Car Type 2024 & 2032

- Figure 31: South America Lightweight Vehicles Industry Revenue Share (%), by Car Type 2024 & 2032

- Figure 32: South America Lightweight Vehicles Industry Revenue (Million), by Material Type 2024 & 2032

- Figure 33: South America Lightweight Vehicles Industry Revenue Share (%), by Material Type 2024 & 2032

- Figure 34: South America Lightweight Vehicles Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Lightweight Vehicles Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Lightweight Vehicles Industry Revenue (Million), by Car Type 2024 & 2032

- Figure 37: Middle East and Africa Lightweight Vehicles Industry Revenue Share (%), by Car Type 2024 & 2032

- Figure 38: Middle East and Africa Lightweight Vehicles Industry Revenue (Million), by Material Type 2024 & 2032

- Figure 39: Middle East and Africa Lightweight Vehicles Industry Revenue Share (%), by Material Type 2024 & 2032

- Figure 40: Middle East and Africa Lightweight Vehicles Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Lightweight Vehicles Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lightweight Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Lightweight Vehicles Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 3: Global Lightweight Vehicles Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 4: Global Lightweight Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Lightweight Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Lightweight Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Lightweight Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Lightweight Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Lightweight Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Arab Emirates Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Lightweight Vehicles Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 28: Global Lightweight Vehicles Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 29: Global Lightweight Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of North America Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Lightweight Vehicles Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 34: Global Lightweight Vehicles Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 35: Global Lightweight Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of Europe Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Lightweight Vehicles Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 41: Global Lightweight Vehicles Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 42: Global Lightweight Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: China Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: India Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Korea Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Lightweight Vehicles Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 49: Global Lightweight Vehicles Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 50: Global Lightweight Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Brazil Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of South America Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Lightweight Vehicles Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 54: Global Lightweight Vehicles Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 55: Global Lightweight Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: United Arab Emirates Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Africa Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Middle East and Africa Lightweight Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lightweight Vehicles Industry?

The projected CAGR is approximately 5.32%.

2. Which companies are prominent players in the Lightweight Vehicles Industry?

Key companies in the market include Ferrari SpA, Lamborghini Sp, Nissan Motor Co Ltd, General Motors Company, Kia Motors Corporation, Hyundai Motor Co, Toyota Motor Corporation, Honda Motor Co Ltd, Volkswagen, Ford Motor Company.

3. What are the main segments of the Lightweight Vehicles Industry?

The market segments include Car Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 73.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Innovations and Material Advancements is Likely to Fuel Demand.

6. What are the notable trends driving market growth?

Increasing Demand for Lightweight Passenger Cars.

7. Are there any restraints impacting market growth?

High Cost of Lightweight Materials is Anticipated to Restrict the Market Growth Potential.

8. Can you provide examples of recent developments in the market?

In November 2023, Huawei is partnering with Changan Auto, a Chinese car manufacturer to create a new entity for the development of sophisticated automotive systems and components. In this joint venture, Huawei will hold a significant share with Changan Auto's ownership not surpassing 40%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lightweight Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lightweight Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lightweight Vehicles Industry?

To stay informed about further developments, trends, and reports in the Lightweight Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence