Key Insights

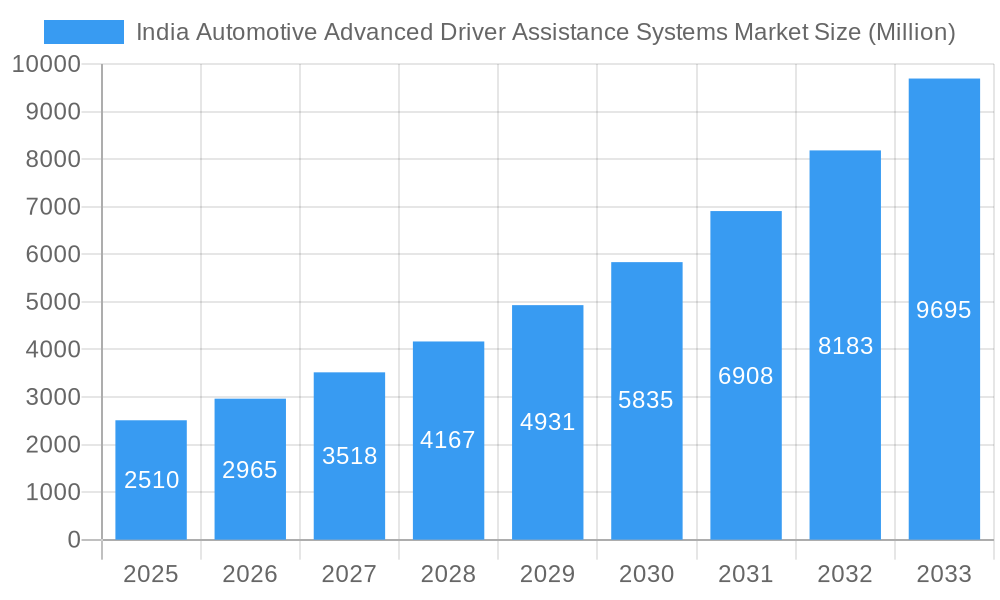

The India Automotive Advanced Driver Assistance Systems (ADAS) market is experiencing robust growth, projected to reach \$2.51 billion by 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 18.33% from 2025 to 2033. This expansion is driven by increasing vehicle production, rising disposable incomes fueling demand for advanced vehicle features, and stringent government regulations promoting road safety. The rising adoption of connected car technologies and the increasing awareness of ADAS functionalities among consumers are further contributing to market growth. Technological advancements, such as the integration of artificial intelligence and machine learning into ADAS, are enhancing system capabilities and driving market penetration. The market is segmented by technology (Adaptive Cruise Control, Lane Departure Warning, Automated Emergency Braking, etc.), vehicle type (passenger cars, commercial vehicles), and type of ADAS system (parking assist, driver monitoring). While the initial investment in ADAS technology can be high, the long-term benefits in terms of enhanced safety and reduced accident rates are driving adoption, particularly among premium vehicle segments. Regional variations exist, with urban areas and more developed states like Maharashtra, Tamil Nadu, and Gujarat exhibiting faster adoption rates compared to less developed regions. Key players like Hyundai Mobis, Mobileye, Infineon Technologies, and Bosch are actively investing in research and development, driving innovation and expanding their market presence in India.

India Automotive Advanced Driver Assistance Systems Market Market Size (In Billion)

The competitive landscape is characterized by both established international players and domestic companies. The increasing focus on localization and partnerships to cater to the specific needs of the Indian automotive market is a noteworthy trend. Challenges such as high initial costs, infrastructure limitations, and varying levels of technological awareness across the country need to be addressed for sustained market growth. However, the overall outlook for the India ADAS market remains positive, with significant opportunities for growth in the coming years driven by technological advancements, government support, and an increasing preference for advanced safety features among consumers. The forecast period of 2025-2033 anticipates continued strong growth, fueled by expanding middle-class purchasing power and the ongoing development of the Indian automotive industry.

India Automotive Advanced Driver Assistance Systems Market Company Market Share

India Automotive Advanced Driver Assistance Systems (ADAS) Market Report: 2019-2033

Unlocking the Potential of India's Booming ADAS Market: A Comprehensive Analysis from 2019-2033

This comprehensive report provides an in-depth analysis of the India Automotive Advanced Driver Assistance Systems (ADAS) market, offering invaluable insights for stakeholders across the automotive value chain. From market dynamics and leading players to emerging opportunities and future trends, this report is your go-to resource for understanding and capitalizing on this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The base year for this analysis is 2025, covering the historical period (2019-2024) and extending to 2033.

India Automotive Advanced Driver Assistance Systems Market Market Dynamics & Concentration

The Indian ADAS market is characterized by increasing market concentration, driven by the expansion of major global players and strategic partnerships. The market share held by the top 5 players in 2024 was approximately xx%, indicating a moderately consolidated landscape. Innovation is a key driver, with companies continuously developing advanced features such as autonomous emergency braking (AEB), lane departure warning (LDW), and adaptive cruise control (ACC). The regulatory framework, although still evolving, is increasingly supportive of ADAS adoption, emphasizing safety standards and encouraging technological advancements. The substitution effect from traditional safety features is noticeable, with ADAS systems offering more comprehensive and proactive safety measures. End-user preferences are shifting towards vehicles equipped with ADAS functionalities, particularly among younger demographics and luxury car buyers. The last five years have witnessed xx M&A deals, highlighting the strategic importance of ADAS in the Indian automotive landscape. Key M&A activities include:

- Strategic acquisitions to expand product portfolios and market reach.

- Partnerships for technology integration and localized production.

India Automotive Advanced Driver Assistance Systems Market Industry Trends & Analysis

The Indian ADAS market is experiencing robust growth fueled by several factors. Rising disposable incomes and a growing middle class are driving demand for advanced vehicle features. Technological advancements, such as the development of more cost-effective sensors and software, are making ADAS technologies more accessible. Consumer preferences are evolving, with safety and convenience becoming paramount considerations in vehicle purchases. The increasing adoption of connected car technologies is further enhancing the capabilities of ADAS systems. The competitive landscape is dynamic, with both domestic and international players vying for market share. This intense competition is leading to continuous innovation and price reductions, making ADAS more affordable. Market penetration of ADAS features varies significantly across vehicle segments; penetration is highest in premium vehicles and gradually increasing in the mass market segment.

Leading Markets & Segments in India Automotive Advanced Driver Assistance Systems Market

The India Automotive Advanced Driver Assistance Systems (ADAS) market is experiencing robust expansion, with specific segments and regions emerging as key growth drivers. The increasing adoption of ADAS is fueled by a confluence of factors including technological maturation, heightened consumer safety consciousness, and supportive governmental initiatives. The dominant segments are characterized by their tangible benefits and increasing affordability, making them attractive to both manufacturers and end-users.

-

Adaptive Cruise Control (ACC): The widespread adoption of ACC is largely attributable to significant advancements in radar and camera technologies, which have lowered production costs and enhanced system performance. Consumers are increasingly recognizing ACC's role in improving driving comfort and safety, especially on highways. Advanced radar-based ACC systems are at the forefront of this growth, offering superior object detection and adaptive speed capabilities.

-

Camera-based ADAS: The declining cost of high-resolution cameras, coupled with their versatility in enabling a wide array of ADAS functions (such as lane keeping assist, traffic sign recognition, and pedestrian detection), has cemented their dominance. The integration of camera systems into both passenger and commercial vehicles is on an upward trajectory, driven by their crucial role in building more sophisticated and interconnected safety suites.

-

Parking Assist Systems: With escalating urbanization and a growing vehicle parc in Indian cities, the demand for intelligent parking solutions is surging. Features like automatic parking, surround-view cameras, and parking sensors are becoming indispensable for navigating congested urban environments, thereby driving substantial growth in this segment.

The prevailing dominance of these segments is further reinforced by several overarching factors:

- Favorable Government Policies: Proactive government policies, such as the push for higher vehicle safety standards and initiatives promoting automotive innovation, are creating a fertile ground for ADAS technologies to flourish. The emphasis on road safety indirectly encourages the integration of ADAS features.

- Improving Infrastructure: Continuous investments in upgrading India's road infrastructure, including better road markings and signage, directly enhance the effectiveness and reliability of ADAS features, making them more practical and appealing to a wider audience.

- Rising Urbanization: The relentless pace of urbanization leads to increased traffic density and complex driving scenarios in metropolitan areas. This surge in congestion naturally fuels the demand for ADAS functionalities that assist drivers in managing these challenges, particularly parking and maintaining safe distances.

India Automotive Advanced Driver Assistance Systems Market Product Developments

The landscape of the India Automotive Advanced Driver Assistance Systems (ADAS) market is being dynamically shaped by a wave of innovative product developments. The industry is witnessing a clear trend towards the creation of more intelligent, integrated, and adaptable ADAS solutions. Key technological advancements such as sensor fusion (combining data from multiple sensors like cameras, radar, and lidar), the application of artificial intelligence (AI), and machine learning (ML) are significantly enhancing the performance, accuracy, and predictive capabilities of these systems. These sophisticated algorithms allow ADAS to better understand and respond to diverse and often unpredictable driving conditions prevalent in India. The market is increasingly moving towards highly integrated ADAS architectures, where individual safety and convenience functions are seamlessly interwoven into a unified system. This holistic approach ensures that different ADAS features work in concert, delivering a more comprehensive and effective safety net for drivers. Such advancements are not only elevating the performance standards of vehicles but also significantly boosting consumer confidence and accelerating the market's overall growth trajectory.

Key Drivers of India Automotive Advanced Driver Assistance Systems Market Growth

Several factors are driving the growth of the Indian ADAS market. Technological advancements are making these systems more affordable and accessible. Government regulations emphasizing vehicle safety are further driving adoption. Increasing consumer awareness about the benefits of ADAS features, including improved safety and convenience, is also playing a significant role. The growing automotive sector itself, driven by economic growth and a rising middle class, creates a larger potential market. The rising demand for enhanced safety features in both passenger and commercial vehicles is another key driver.

Challenges in the India Automotive Advanced Driver Assistance Systems Market Market

Despite the market's significant potential, several challenges hinder its growth. High initial costs of ADAS technology are a major barrier to entry. The lack of comprehensive infrastructure and inadequate road conditions can affect the performance and effectiveness of these systems. Maintaining robust supply chains is also a hurdle. Furthermore, the varying road conditions and traffic scenarios in India need the systems to be robust and adaptable. This requires additional investments in research and development to ensure optimal performance under India-specific conditions.

Emerging Opportunities in India Automotive Advanced Driver Assistance Systems Market

The Indian ADAS market offers substantial long-term growth opportunities. Technological breakthroughs are continuously improving the functionality and cost-effectiveness of ADAS, leading to higher adoption rates. Strategic partnerships between global technology providers and domestic automakers are further accelerating market penetration. Moreover, the expanding automotive industry presents a large addressable market. The focus on improving road safety regulations provides a favorable regulatory environment. The growth of the commercial vehicle segment, coupled with the adoption of connected technologies, presents a vast and underserved opportunity.

Leading Players in the India Automotive Advanced Driver Assistance Systems Market Sector

- Hyundai Mobis

- Mobileye

- Infineon Technologies

- Delphi Automotive

- Aisin Seiki Co Ltd

- Continental AG

- Robert Bosch GmbH

- Hella KGAA Hueck & Co

- Magna International

- DENSO Corporation

- WABCO Vehicle Control Services

- ZF Friedrichshafen AG

Key Milestones in India Automotive Advanced Driver Assistance Systems Market Industry

- June 2022: ZF Group further solidified its presence and capabilities in the Indian ADAS ecosystem with the inauguration of its new Tech Center in Hyderabad. This strategic move is aimed at fostering local R&D and accelerating the development of advanced driver assistance systems tailored for the Indian market.

- January 2023: Kia Motors showcased a significant leap in connected car technology by integrating ADAS features within its UVO platform. This development highlights the growing synergy between infotainment systems and advanced safety functionalities, enhancing the overall user experience and safety quotient.

- January 2024: A landmark partnership was announced between Mobileye and Mahindra & Mahindra for the integration of next-generation EyeQ 6 systems. This collaboration signals a profound commitment to advancing autonomous driving capabilities in India and represents a major step towards embedding higher levels of ADAS integration and sophistication within Indian vehicles.

Strategic Outlook for India Automotive Advanced Driver Assistance Systems Market Market

The strategic outlook for the India Automotive Advanced Driver Assistance Systems (ADAS) market is exceptionally promising, poised for substantial and sustained growth. This optimistic forecast is underpinned by several critical drivers: continuous technological innovation, the increasing alignment of government policies with automotive safety enhancements, and a rapidly evolving consumer preference for advanced safety and convenience features. The market is expected to witness a surge in strategic collaborations and significant investments in research and development (R&D), which will be instrumental in driving further innovation and expanding the market's reach. A key strategic imperative for sustained growth will be the development of cost-effective and India-specific ADAS solutions that cater to the unique driving conditions, regulatory landscape, and economic realities of the country. Such localized approaches will be crucial for achieving widespread market penetration and democratizing access to advanced automotive safety. Consequently, this dynamic market presents a compelling and lucrative opportunity for global and domestic players to capitalize on the escalating demand for sophisticated safety and comfort technologies within the burgeoning Indian automotive industry.

India Automotive Advanced Driver Assistance Systems Market Segmentation

-

1. Type

-

1.1. Parking Assist System

- 1.1.1. Night Vision System

- 1.1.2. Blind Spot Detection

- 1.1.3. Advanced Automatic Emergency Braking System

- 1.1.4. Collision Warning

- 1.1.5. Driver Drowsiness Alert

- 1.1.6. Traffic Sign Recognition

- 1.1.7. Lane Departure Warning

- 1.1.8. Adaptive Cruise Control

-

1.2. By Technology

- 1.2.1. Radar

- 1.2.2. LiDAR

- 1.2.3. Camera

-

1.3. By Vehicle Type

- 1.3.1. Passenger Cars

- 1.3.2. Commercial Vehicles

-

1.1. Parking Assist System

India Automotive Advanced Driver Assistance Systems Market Segmentation By Geography

- 1. India

India Automotive Advanced Driver Assistance Systems Market Regional Market Share

Geographic Coverage of India Automotive Advanced Driver Assistance Systems Market

India Automotive Advanced Driver Assistance Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Concerns About Road Safety and Government Initiatives To Enhance Demand In The Market?; Growing Adoption of New Technologies?

- 3.3. Market Restrains

- 3.3.1. High Cost and Limited Penetration Rate?

- 3.4. Market Trends

- 3.4.1. Growing Demand For ADAS Features In Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive Advanced Driver Assistance Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Parking Assist System

- 5.1.1.1. Night Vision System

- 5.1.1.2. Blind Spot Detection

- 5.1.1.3. Advanced Automatic Emergency Braking System

- 5.1.1.4. Collision Warning

- 5.1.1.5. Driver Drowsiness Alert

- 5.1.1.6. Traffic Sign Recognition

- 5.1.1.7. Lane Departure Warning

- 5.1.1.8. Adaptive Cruise Control

- 5.1.2. By Technology

- 5.1.2.1. Radar

- 5.1.2.2. LiDAR

- 5.1.2.3. Camera

- 5.1.3. By Vehicle Type

- 5.1.3.1. Passenger Cars

- 5.1.3.2. Commercial Vehicles

- 5.1.1. Parking Assist System

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hyundai Mobis*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mobileye

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Infineon Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Delphi Automotive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aisin Seiki Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hella KGAA Hueck & Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Magna International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DENSO Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 WABCO Vehicle Control Services

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ZF Friedrichshafen AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Hyundai Mobis*List Not Exhaustive

List of Figures

- Figure 1: India Automotive Advanced Driver Assistance Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Automotive Advanced Driver Assistance Systems Market Share (%) by Company 2025

List of Tables

- Table 1: India Automotive Advanced Driver Assistance Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Automotive Advanced Driver Assistance Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: India Automotive Advanced Driver Assistance Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: India Automotive Advanced Driver Assistance Systems Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive Advanced Driver Assistance Systems Market?

The projected CAGR is approximately 18.33%.

2. Which companies are prominent players in the India Automotive Advanced Driver Assistance Systems Market?

Key companies in the market include Hyundai Mobis*List Not Exhaustive, Mobileye, Infineon Technologies, Delphi Automotive, Aisin Seiki Co Ltd, Continental AG, Robert Bosch GmbH, Hella KGAA Hueck & Co, Magna International, DENSO Corporation, WABCO Vehicle Control Services, ZF Friedrichshafen AG.

3. What are the main segments of the India Automotive Advanced Driver Assistance Systems Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Concerns About Road Safety and Government Initiatives To Enhance Demand In The Market?; Growing Adoption of New Technologies?.

6. What are the notable trends driving market growth?

Growing Demand For ADAS Features In Vehicles.

7. Are there any restraints impacting market growth?

High Cost and Limited Penetration Rate?.

8. Can you provide examples of recent developments in the market?

January 2024: Mobileye announced a partnership with Mahindra & Mahindra Ltd to provide multiple solutions based on Mobileye's next-generation EyeQ 6 systems-on-chip and sensing and mapping software, intending to build a full-stack autonomous driving system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive Advanced Driver Assistance Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive Advanced Driver Assistance Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive Advanced Driver Assistance Systems Market?

To stay informed about further developments, trends, and reports in the India Automotive Advanced Driver Assistance Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence