Key Insights

The European pedestrian detection systems market is poised for significant expansion, propelled by heightened road safety imperatives and innovative sensor advancements. The market, valued at €15.46 billion in the base year of 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.15% through 2033. This growth is underpinned by several critical drivers. Increasing governmental mandates for advanced driver-assistance systems (ADAS) in new vehicle models are a primary demand accelerant. Concurrently, the accelerating adoption of autonomous vehicles (AVs), which critically depend on sophisticated pedestrian detection for safe operation, serves as a major market catalyst. Technological progress, including the refinement of sensor fusion methodologies integrating radar, cameras, and infrared sensors for enhanced accuracy and reliability, further contributes to market growth. Segmentation analysis indicates a prevailing preference for video-based systems due to their cost-effectiveness and straightforward integration. However, infrared and hybrid systems are anticipated to experience substantial growth, offering superior performance in adverse weather and low-light conditions. Key national markets in Europe include Germany, France, and the UK, driven by their strong automotive sectors and proactive road safety initiatives.

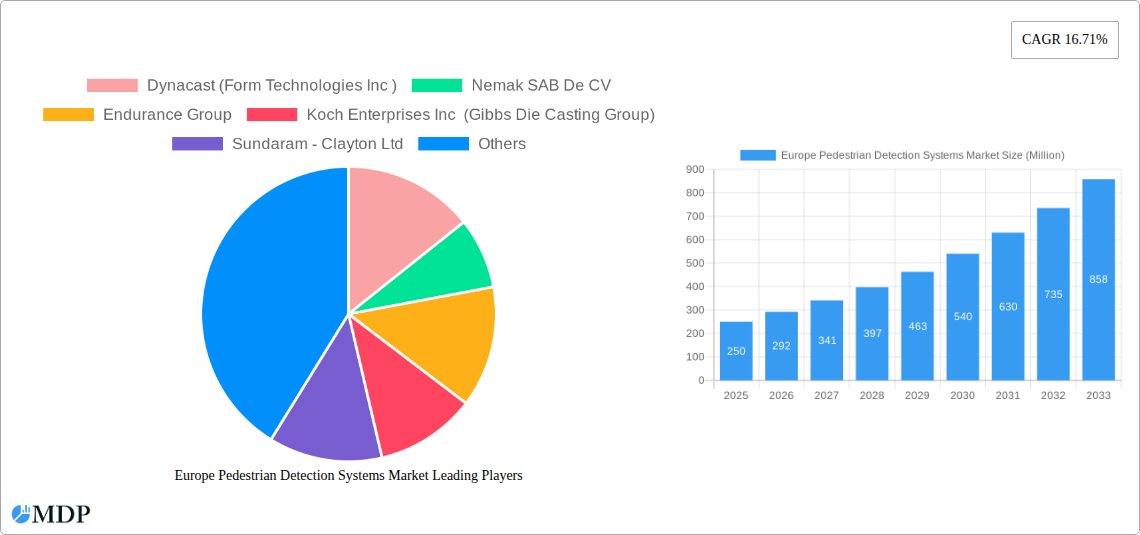

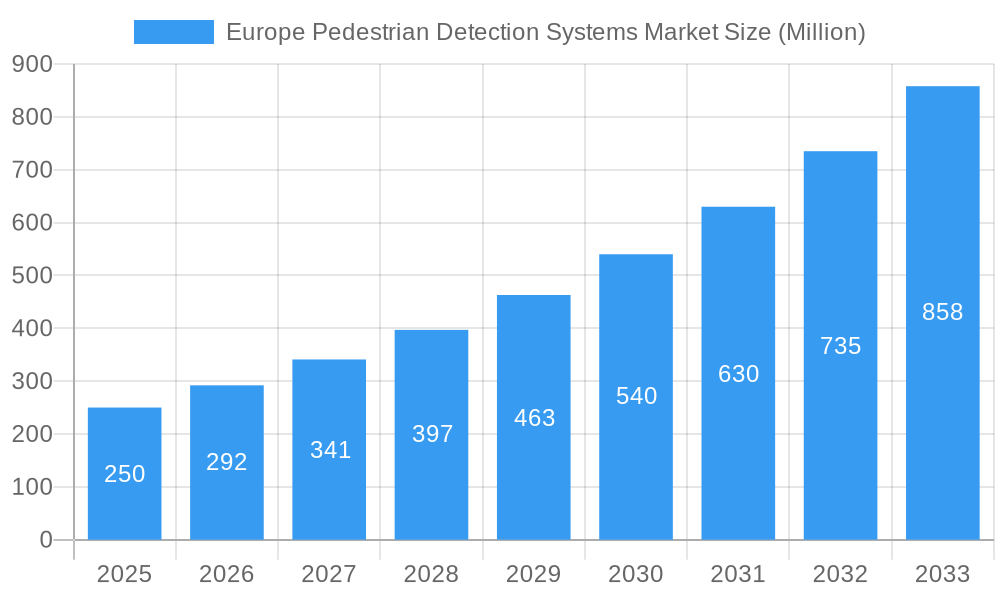

Europe Pedestrian Detection Systems Market Market Size (In Billion)

The competitive environment features a blend of established automotive suppliers and specialized technology developers. Leading entities are capitalizing on their manufacturing prowess to secure considerable market share, while agile, innovative startups are gaining traction, particularly in advanced sensor technology development. Market challenges include the substantial initial investment required for pedestrian detection system implementation and the potential for false detections in complex environmental scenarios. Nevertheless, the overarching trend towards enhanced vehicle safety and the escalating integration of ADAS and AV technologies are expected to overcome these obstacles, ensuring sustained robust growth for the European pedestrian detection systems market over the forecast period. Future market performance will be contingent on ongoing technological innovation, evolving regulatory frameworks, and the overall progression of autonomous vehicle deployment across the region.

Europe Pedestrian Detection Systems Market Company Market Share

Europe Pedestrian Detection Systems Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Pedestrian Detection Systems Market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, technological advancements, and future growth prospects. The market is segmented by Type (Video, Infrared, Hybrid, Other Types) and Component Type (Sensors, Radars, Cameras, Other Component Types), providing a granular understanding of market trends across various segments. The report projects a market value exceeding xx Million by 2033.

Europe Pedestrian Detection Systems Market Market Dynamics & Concentration

The Europe Pedestrian Detection Systems Market exhibits a moderately concentrated landscape, with key players vying for market share through innovation and strategic acquisitions. Market concentration is estimated at xx%, driven by the presence of established automotive suppliers and technology companies. Innovation in sensor technology, particularly in areas like AI-powered object recognition and improved radar systems, is a key driver. Stringent pedestrian safety regulations across European nations are further accelerating market growth. Product substitutes, while limited, include enhanced driver-assistance systems (ADAS) with improved visibility features. End-user trends indicate a strong preference for integrated systems that offer comprehensive pedestrian detection and collision avoidance. The past five years have seen xx M&A deals, indicating a consolidation trend within the industry, with larger companies acquiring smaller specialized firms to expand their product portfolios and technological capabilities.

- Market Share: Dominant players hold approximately xx% of the market share.

- M&A Activity: xx deals in the last 5 years, signaling industry consolidation.

- Regulatory Landscape: Stringent safety regulations are driving adoption.

- Innovation: Advancements in AI and sensor technology are key growth factors.

Europe Pedestrian Detection Systems Market Industry Trends & Analysis

The Europe Pedestrian Detection Systems Market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising pedestrian safety concerns, increasing government regulations mandating advanced safety features in vehicles, and the continuous improvement in the accuracy and reliability of pedestrian detection systems. Technological disruptions, primarily driven by the integration of AI and machine learning algorithms, are enhancing the performance of these systems, improving their ability to detect pedestrians under challenging conditions. Consumer preferences are shifting towards vehicles equipped with advanced safety features, including pedestrian detection, indicating high market penetration potential for this technology. Competitive dynamics are characterized by a mix of established automotive suppliers and emerging technology companies, driving innovation and price competition. Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

Leading Markets & Segments in Europe Pedestrian Detection Systems Market

Germany, the UK, and France represent the leading markets within Europe, driven by strong automotive industries, robust infrastructure, and supportive governmental policies promoting road safety. The Video-based pedestrian detection systems segment currently dominates the market due to relatively lower costs and established technology, although the Hybrid segment is anticipated to witness rapid growth due to enhanced accuracy and reliability. Within Component Types, the Camera segment holds the largest share of the market because of its versatility and integration with other ADAS technologies.

- Germany: Strong automotive industry, high technology adoption rates.

- UK: Robust infrastructure investment and safety regulations.

- France: Government initiatives promoting advanced driver-assistance systems.

- Dominant Segment (Type): Video systems, due to cost-effectiveness.

- Dominant Segment (Component): Cameras, due to versatility and integration.

Europe Pedestrian Detection Systems Market Product Developments

Recent product developments highlight the increasing integration of AI and machine learning into pedestrian detection systems. Companies are focusing on improving accuracy, reliability, and robustness under various weather conditions and lighting scenarios. The integration of these systems with other ADAS features, such as automatic emergency braking (AEB), enhances overall vehicle safety and adds significant competitive advantage. The market is witnessing a shift toward miniaturized and more energy-efficient sensors, contributing to lower production costs and increased adoption rates.

Key Drivers of Europe Pedestrian Detection Systems Market Growth

The growth of the Europe Pedestrian Detection Systems Market is primarily driven by increasing concerns regarding pedestrian safety, stringent government regulations mandating the installation of advanced safety systems in vehicles, and the continuous advancements in sensor technology, particularly in the areas of AI and machine learning. The rising adoption of electric vehicles and autonomous driving technologies further accelerates the demand for these systems, as safety becomes increasingly paramount.

Challenges in the Europe Pedestrian Detection Systems Market Market

Challenges include the high initial cost of implementation, the potential for false positives or negatives leading to accidents, and the complexity of integrating these systems into existing vehicle architectures. Supply chain disruptions caused by geopolitical instability and the semiconductor shortage are further hindering market expansion. Competitive pressures from established players and the emergence of new entrants further add complexity. The total impact of these factors can lower market growth by xx% in years with significant disruptions.

Emerging Opportunities in Europe Pedestrian Detection Systems Market

Emerging opportunities include the growing integration of pedestrian detection systems with other ADAS features, creating comprehensive safety suites. Strategic partnerships between automotive manufacturers and technology companies are opening avenues for innovation and expansion into new market segments. The increasing adoption of autonomous vehicles and the development of advanced sensor fusion technologies present substantial growth potential in the coming years.

Leading Players in the Europe Pedestrian Detection Systems Market Sector

- Dynacast (Form Technologies Inc )

- Nemak SAB De CV

- Endurance Group

- Koch Enterprises Inc (Gibbs Die Casting Group)

- Sundaram - Clayton Ltd

- Georg Fischer AG

- Ryobi Die Casting Inc

- Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- Officine Meccaniche Rezzatesi SpA

- Rockman Industries

- Engtek Group

- Shiloh Industries Ltd

Key Milestones in Europe Pedestrian Detection Systems Market Industry

- July 2022: Volvo Trucks launched Side Collision Avoidance Support, using twin radars to detect cyclists and pedestrians.

- February 2022: Skoda Auto announced over 200 pedestrian safety tests during vehicle development.

- January 2022: Ficosa plans to replace front mirrors with cameras in MAN commercial vehicles for improved pedestrian visibility.

Strategic Outlook for Europe Pedestrian Detection Systems Market Market

The Europe Pedestrian Detection Systems Market is poised for significant growth, driven by technological advancements, stringent safety regulations, and increasing consumer demand for advanced safety features. Strategic opportunities lie in developing innovative, cost-effective systems, focusing on improving accuracy and reliability under various operating conditions, and forging strategic partnerships to accelerate market penetration. The market's future potential is substantial, with opportunities for significant revenue growth and market share expansion for innovative players.

Europe Pedestrian Detection Systems Market Segmentation

-

1. Type

- 1.1. Video

- 1.2. Infrared

- 1.3. Hybrid

- 1.4. Other Types

-

2. Component Type

- 2.1. Sensors

- 2.2. Radars

- 2.3. Cameras

- 2.4. Other Component Types

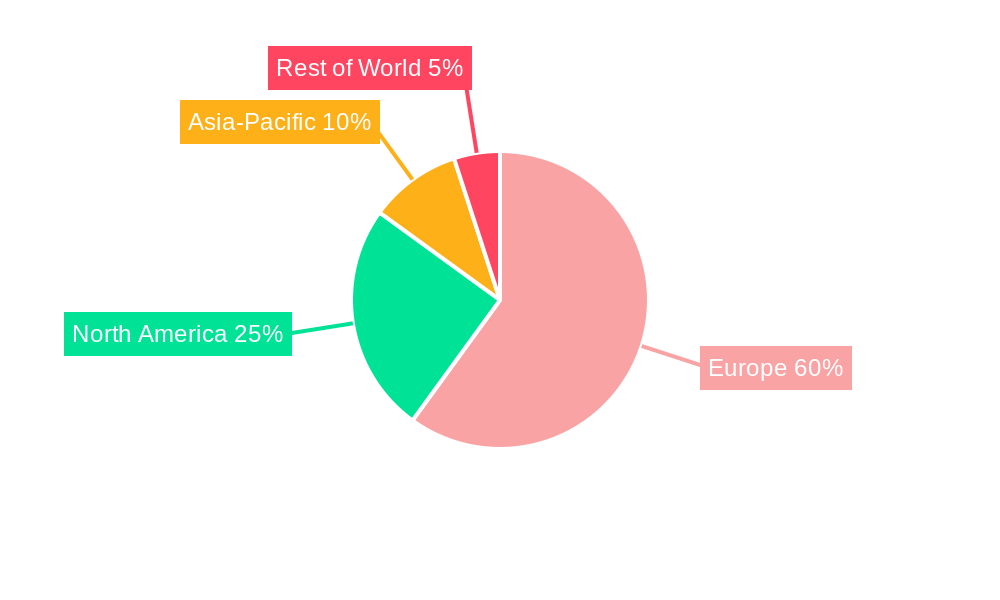

Europe Pedestrian Detection Systems Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Russia

- 5. Spain

- 6. Italy

- 7. Rest of Europe

Europe Pedestrian Detection Systems Market Regional Market Share

Geographic Coverage of Europe Pedestrian Detection Systems Market

Europe Pedestrian Detection Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of ADAS Systems Driving the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of ADAS Systems Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video

- 5.1.2. Infrared

- 5.1.3. Hybrid

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Sensors

- 5.2.2. Radars

- 5.2.3. Cameras

- 5.2.4. Other Component Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Spain

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Video

- 6.1.2. Infrared

- 6.1.3. Hybrid

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Sensors

- 6.2.2. Radars

- 6.2.3. Cameras

- 6.2.4. Other Component Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Video

- 7.1.2. Infrared

- 7.1.3. Hybrid

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Sensors

- 7.2.2. Radars

- 7.2.3. Cameras

- 7.2.4. Other Component Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Video

- 8.1.2. Infrared

- 8.1.3. Hybrid

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Sensors

- 8.2.2. Radars

- 8.2.3. Cameras

- 8.2.4. Other Component Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Russia Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Video

- 9.1.2. Infrared

- 9.1.3. Hybrid

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Sensors

- 9.2.2. Radars

- 9.2.3. Cameras

- 9.2.4. Other Component Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Video

- 10.1.2. Infrared

- 10.1.3. Hybrid

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Component Type

- 10.2.1. Sensors

- 10.2.2. Radars

- 10.2.3. Cameras

- 10.2.4. Other Component Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Italy Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Video

- 11.1.2. Infrared

- 11.1.3. Hybrid

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Component Type

- 11.2.1. Sensors

- 11.2.2. Radars

- 11.2.3. Cameras

- 11.2.4. Other Component Types

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Video

- 12.1.2. Infrared

- 12.1.3. Hybrid

- 12.1.4. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Component Type

- 12.2.1. Sensors

- 12.2.2. Radars

- 12.2.3. Cameras

- 12.2.4. Other Component Types

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Dynacast (Form Technologies Inc )

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nemak SAB De CV

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Endurance Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Koch Enterprises Inc (Gibbs Die Casting Group)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sundaram - Clayton Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Georg Fischer AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ryobi Die Casting Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Officine Meccaniche Rezzatesi SpA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Rockman Industries

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Engtek Group

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Shiloh Industries Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Dynacast (Form Technologies Inc )

List of Figures

- Figure 1: Europe Pedestrian Detection Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Pedestrian Detection Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 3: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 6: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 9: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 12: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 15: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 18: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 21: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 24: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pedestrian Detection Systems Market?

The projected CAGR is approximately 7.15%.

2. Which companies are prominent players in the Europe Pedestrian Detection Systems Market?

Key companies in the market include Dynacast (Form Technologies Inc ), Nemak SAB De CV, Endurance Group, Koch Enterprises Inc (Gibbs Die Casting Group), Sundaram - Clayton Ltd, Georg Fischer AG, Ryobi Die Casting Inc, Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG), Officine Meccaniche Rezzatesi SpA, Rockman Industries, Engtek Group, Shiloh Industries Ltd.

3. What are the main segments of the Europe Pedestrian Detection Systems Market?

The market segments include Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of ADAS Systems Driving the Market.

6. What are the notable trends driving market growth?

Increasing Adoption of ADAS Systems Driving the Market.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

July 2022: Volvo Trucks announced the launch of a new safety technology aimed at improving road safety. The device utilizes twin radars on each side of the truck to recognize when other road users, such as bicycles, enter the danger zone. Known as the Side Collision Avoidance Support system, it alerts the driver by flashing a red light on the appropriate side mirror when something is in the blind spot area. If the driver signals a lane change with the turn signal, the red light starts to flash, and an audible warning sound is emitted from the side of the potential accident. This provides the driver with timely information and the option to apply the brakes, allowing, for example, a bike to safely pass.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pedestrian Detection Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pedestrian Detection Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pedestrian Detection Systems Market?

To stay informed about further developments, trends, and reports in the Europe Pedestrian Detection Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence