Key Insights

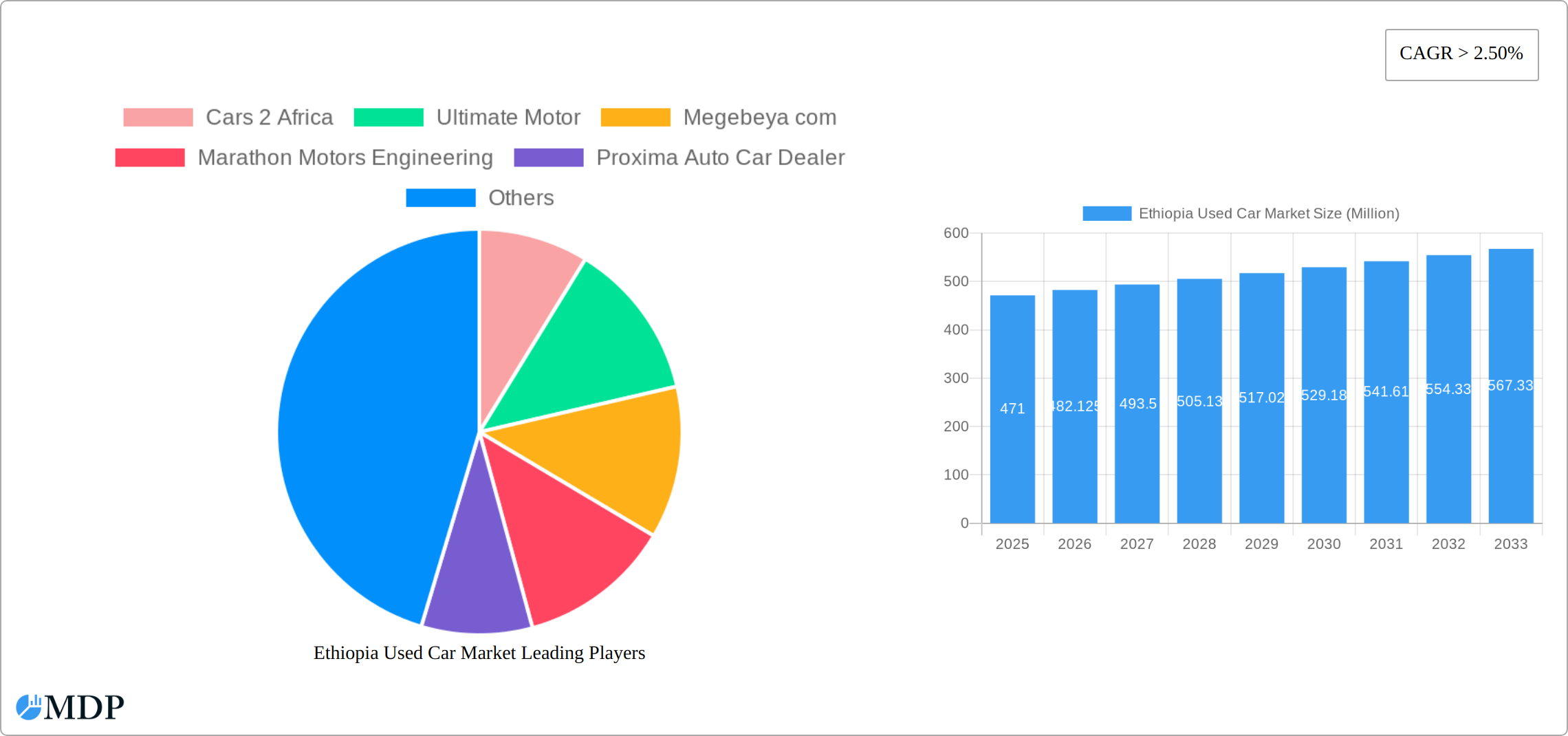

The Ethiopian used car market, valued at $471 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 2.50% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes and a burgeoning middle class are driving increased demand for personal transportation. The limited availability and high cost of new vehicles further bolster the used car market's appeal. The market is segmented by vehicle type (hatchbacks, sedans, SUVs, MUVs), vendor type (organized and unorganized dealerships), and fuel type (gasoline, diesel, electric, and alternative fuels). SUVs and MUVs are likely to dominate the market due to their suitability for Ethiopia's diverse terrains and family-oriented preferences. The organized sector is expected to gradually increase its market share as consumer preference shifts towards greater transparency and assurance. The increasing availability of electric and alternative fuel vehicles, though currently a smaller segment, represents a significant future growth opportunity.

Government policies and infrastructure development will also play a vital role in shaping the market's trajectory. Increased investment in road networks and public transportation could influence consumer choices. Challenges remain, including the inconsistent quality of used vehicles imported into the country and the potential for fraudulent practices within the unorganized sector. Addressing these challenges through improved regulatory oversight and consumer awareness campaigns will be crucial for sustainable growth. The presence of established players like Cars 2 Africa, Ultimate Motor, and others indicates a competitive market landscape, although the unorganized sector remains a significant component. Future market expansion hinges on economic stability, infrastructure improvements, and the continuous adaptation to evolving consumer needs and technological advancements in the automotive sector.

Ethiopia Used Car Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Ethiopia used car market, offering invaluable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast extending to 2033. The study encompasses market size estimations in Millions, key market segments, leading players, and future growth opportunities. This report is essential for understanding the current landscape and navigating the future trajectory of Ethiopia's used car market.

Ethiopia Used Car Market Market Dynamics & Concentration

The Ethiopian used car market, valued at xx Million in 2024, is experiencing significant growth driven by increasing urbanization, rising disposable incomes, and a burgeoning middle class. Market concentration is relatively fragmented, with several players competing across organized and unorganized segments. However, organized players like Cars 2 Africa and Ultimate Motor are increasingly gaining market share through investments in technology and improved customer service. The unorganized sector still holds a substantial portion (xx%) of the market. Innovation drivers include the introduction of online platforms facilitating used car sales and financing options. The regulatory framework, while evolving, presents both opportunities and challenges, with ongoing efforts to streamline import processes and enhance consumer protection. Product substitutes, such as public transport and ride-hailing services, exert competitive pressure, particularly within the lower end of the market. The M&A landscape has seen xx deals in the last five years, indicating a potential for consolidation and increased market concentration in the coming years. End-user trends showcase a growing preference for SUVs and hatchbacks, reflecting changing lifestyle preferences and family needs.

- Market Share (2024): Organized Sector: xx%, Unorganized Sector: xx%

- M&A Deal Count (2019-2024): xx

- Key Regulatory Frameworks: Import duties, vehicle inspection standards, consumer protection laws.

Ethiopia Used Car Market Industry Trends & Analysis

The Ethiopia used car market is demonstrating significant dynamism, projected to maintain a robust Compound Annual Growth Rate (CAGR) of **[Insert Projected CAGR]%** from 2025 to 2033, building on its strong historical performance of **[Insert Historical CAGR]%** between 2019 and 2024. This upward trajectory is underpinned by a confluence of favorable factors. Rising disposable incomes and an expanding middle class are directly contributing to increased vehicle ownership rates. Simultaneously, ongoing investments in national infrastructure are making vehicle usage more practical and appealing. Furthermore, proactive government initiatives aimed at fostering economic expansion are indirectly benefiting the automotive sector. The market is also being reshaped by technological advancements; the proliferation of online marketplaces has revolutionized how vehicles are bought and sold, enhancing transparency and accessibility. Mobile payment systems are further streamlining transactions, making them more convenient for consumers. In terms of consumer preferences, there's a discernible shift towards more fuel-efficient models, driven by both economic considerations and growing environmental awareness. Safety features are also becoming a paramount concern for Ethiopian car buyers. The competitive arena is a vibrant mix of well-established, organized dealerships and a multitude of smaller, unorganized players. However, the influence and market penetration of organized dealers are steadily increasing, especially within the key urban centers, as they offer greater trust and a wider selection of vehicles.

Leading Markets & Segments in Ethiopia Used Car Market

The Addis Ababa region dominates the Ethiopian used car market, accounting for xx% of total sales in 2024. This dominance is attributable to factors such as higher population density, greater disposable income, and improved infrastructure.

Dominant Vehicle Types:

- SUVs: High demand due to their versatility and perceived safety.

- Hatchbacks: Popular for their fuel efficiency and affordability.

Dominant Vendor Types:

- Organized: Increasingly gaining market share through professional services and improved trust.

- Unorganized: Still a significant part of the market, offering lower prices but less transparency.

Dominant Fuel Types:

- Gasoline: Continues to be the most widely used fuel type.

- Diesel: Significant market share, especially in commercial vehicles.

Key Drivers:

- Economic Growth: Rising disposable incomes fuel demand for personal vehicles.

- Improved Infrastructure: Better roads and transportation networks expand market accessibility.

- Government Policies: Investment incentives and import duty adjustments influence market dynamics.

Ethiopia Used Car Market Product Developments

Recent product developments focus on fuel efficiency, safety features, and technological integration. The growing adoption of online platforms for car sales reflects a key market trend. While electric and alternative fuel vehicles are still nascent in the Ethiopian market, their future potential is significant, given growing global concerns around environmental sustainability. The market fit for these vehicles will depend heavily on the development of appropriate charging infrastructure and government incentives.

Key Drivers of Ethiopia Used Car Market Growth

Several factors contribute to the growth of the Ethiopian used car market:

- Rising Disposable Incomes: A growing middle class is increasing demand for personal vehicles.

- Government Initiatives: Investment incentives and policy reforms are making vehicle imports more accessible.

- Technological Advancements: Online platforms are facilitating easier and more transparent transactions.

Challenges in the Ethiopia Used Car Market Market

The Ethiopian used car market faces several challenges:

- Regulatory Hurdles: Complex import procedures and fluctuating duties can impact supply.

- Supply Chain Issues: Dependence on imports can create vulnerability to global supply chain disruptions.

- Competition: Intense competition among various players, both organized and unorganized.

Emerging Opportunities in Ethiopia Used Car Market

The Ethiopian used car market is ripe with untapped potential, presenting several compelling opportunities for stakeholders to capitalize on:

- Digital Transformation of Sales: The accelerating pace of digital adoption across Ethiopia opens up substantial avenues for the expansion and optimization of online sales platforms. Leveraging advanced e-commerce strategies and virtual showrooms can reach a broader customer base and streamline the purchasing process.

- Innovative Financing Solutions: A significant opportunity lies in the development and expansion of accessible and flexible vehicle financing options. Partnering with financial institutions to offer tailored loan products, leasing schemes, and installment plans can unlock a vast segment of potential buyers previously limited by upfront costs.

- Growth in Sustainable Mobility: As global trends shift towards environmental consciousness, government support and incentives for the adoption of electric vehicles (EVs) and hybrid models present a burgeoning market segment. Early movers in offering quality used EVs and charging infrastructure solutions can establish a strong foothold.

- Specialized Market Niches: Exploring opportunities in niche segments, such as commercial vehicles, fleet sales for businesses, or even classic car restoration, can cater to specific demands and offer differentiated value propositions.

Leading Players in the Ethiopia Used Car Market Sector

The Ethiopian used car market features a diverse range of participants, with the following entities being notable for their presence and impact:

- Cars 2 Africa

- Ultimate Motor

- Megebeya.com

- Marathon Motors Engineering

- Proxima Auto Car Dealer

- Nyala Motors

- ALEM INTERNATIONAL PL

Key Milestones in Ethiopia Used Car Market Industry

- May 2023: The Ministry of Finance of Ethiopia introduced new investment incentives, including provisions for the duty-free import of vehicles. This pivotal announcement significantly influenced market dynamics by boosting the supply of used vehicles, which in turn led to more competitive pricing and greater affordability for consumers.

- July 2023: Volkswagen AG announced an expansion of its operational footprint within Ethiopia. A key element of this expansion includes a strong focus on offering enhanced financing options for both new and used vehicles. This initiative is anticipated to further stimulate demand by making vehicle ownership more attainable for a wider demographic.

Strategic Outlook for Ethiopia Used Car Market Market

The Ethiopian used car market is on a trajectory of sustained growth, propelled by robust economic expansion, increasing urbanization, and the evolving preferences of the consumer base. To thrive in this increasingly competitive landscape, strategic acumen will be paramount. Key success factors will include forging strategic partnerships across the value chain, embracing technological advancements to enhance operational efficiency and customer engagement, and implementing targeted marketing strategies that resonate with the local market. Players who demonstrate agility in adapting to shifting consumer needs, particularly the growing demand for fuel-efficient and safe vehicles, and who can effectively navigate the evolving regulatory environment, are poised for significant success. The development and widespread availability of robust financing schemes, with a particular emphasis on catering to the emerging interest in electric vehicles and other eco-friendly options, will be crucial in shaping the long-term trajectory and unlocking the full potential of this dynamic market.

Ethiopia Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles (SUVs)

- 1.4. Multi-Purpose Vehicles (MUVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Alternative Fuel Vehicles

Ethiopia Used Car Market Segmentation By Geography

- 1. Ethiopia

Ethiopia Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand For Used Cars Compared To New Cars

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Online Infrastructure witnessing major growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ethiopia Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles (SUVs)

- 5.1.4. Multi-Purpose Vehicles (MUVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Alternative Fuel Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Ethiopia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cars 2 Africa

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ultimate Motor

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Megebeya com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marathon Motors Engineering

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Proxima Auto Car Dealer

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nyala Motors

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALEM INTERNATIONAL PL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Cars 2 Africa

List of Figures

- Figure 1: Ethiopia Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ethiopia Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Ethiopia Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ethiopia Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Ethiopia Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Ethiopia Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Ethiopia Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Ethiopia Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Ethiopia Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 8: Ethiopia Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 9: Ethiopia Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 10: Ethiopia Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethiopia Used Car Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Ethiopia Used Car Market?

Key companies in the market include Cars 2 Africa, Ultimate Motor, Megebeya com, Marathon Motors Engineering, Proxima Auto Car Dealer, Nyala Motors, ALEM INTERNATIONAL PL.

3. What are the main segments of the Ethiopia Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 471 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand For Used Cars Compared To New Cars.

6. What are the notable trends driving market growth?

Online Infrastructure witnessing major growth.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

July 2023: Volkswagen AG announced the expansion of its operations in Ethiopia. The company is looking for a financial partner that provides loan and finance options to buy new and used vehicles in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ethiopia Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ethiopia Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ethiopia Used Car Market?

To stay informed about further developments, trends, and reports in the Ethiopia Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence