Key Insights

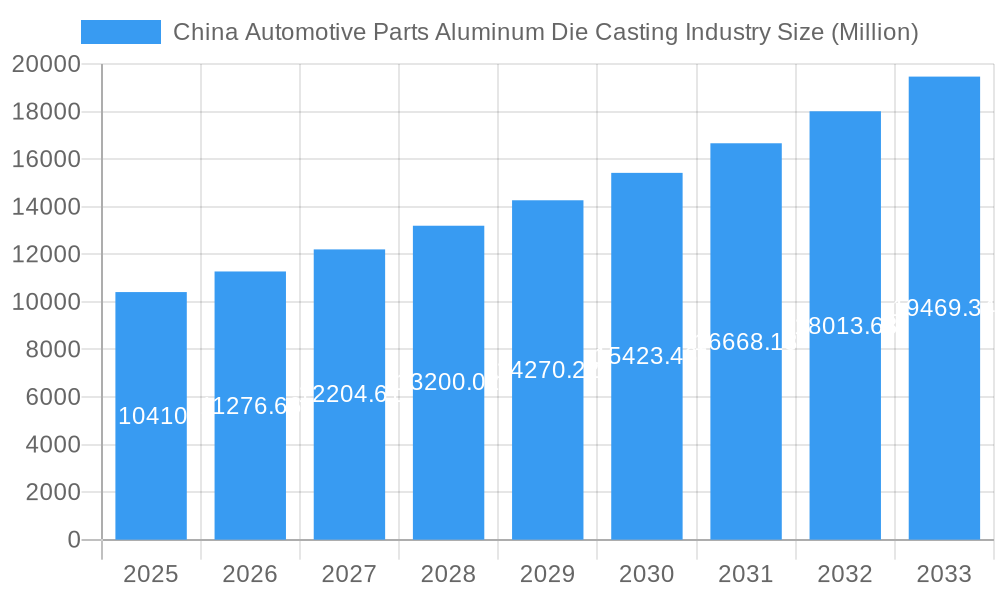

The China automotive parts aluminum die casting market, valued at $10.41 billion in 2025, is projected to experience robust growth, driven by the country's burgeoning automotive sector and increasing demand for lightweight vehicles. A compound annual growth rate (CAGR) of 8.26% from 2025 to 2033 indicates a significant expansion, reaching an estimated $20 billion by 2033. This growth is fueled by several key factors. Firstly, stringent government regulations promoting fuel efficiency and emission reductions are pushing automakers to adopt lightweight materials like aluminum, boosting the demand for die casting components. Secondly, advancements in die casting technologies, particularly in high-pressure die casting and semi-solid die casting, are improving the quality, precision, and production efficiency of automotive parts. This leads to cost savings and better performance, further fueling market expansion. Finally, the increasing adoption of electric vehicles (EVs) in China presents a significant opportunity for the aluminum die casting industry, as EVs require more lightweight components for better battery range and overall efficiency.

China Automotive Parts Aluminum Die Casting Industry Market Size (In Billion)

However, the market also faces certain challenges. Rising raw material costs, particularly aluminum prices, can impact profitability. Intense competition among both domestic and international players necessitates continuous innovation and cost optimization strategies. Additionally, maintaining consistent quality and meeting stringent quality standards demanded by automotive OEMs is crucial for sustained success in this competitive landscape. Major players like KSPG AG, Montupet SA, and Nemak are strategically positioning themselves to capitalize on these opportunities, investing in advanced technologies and expanding their production capacities to meet the rising demand. The market segmentation, with significant demand across engine parts, transmission components, and body parts, showcases the wide-ranging applications of aluminum die casting in the automotive industry. The dominance of pressure die casting currently reflects established manufacturing practices but the growth of other techniques like semi-solid die casting underlines the ongoing technological evolution of the industry.

China Automotive Parts Aluminum Die Casting Industry Company Market Share

China Automotive Parts Aluminum Die Casting Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China automotive parts aluminum die casting industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The report covers market dynamics, leading players, key trends, and future growth opportunities, utilizing data from 2019 to 2024 (historical period) and projecting trends through 2033 (forecast period), with 2025 serving as the base and estimated year. The report's findings are based on rigorous research and analysis, encompassing a multitude of factors influencing industry growth. Discover key market segments, emerging technologies, competitive landscapes, and strategic recommendations to capitalize on lucrative opportunities in this burgeoning sector. The report specifically analyzes the market's evolution, considering factors such as production process types (Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semi-solid Die Casting) and application types (Engine Parts, Transmission Components, Body Parts, Other Application Types).

China Automotive Parts Aluminum Die Casting Industry Market Dynamics & Concentration

The China automotive parts aluminum die casting industry is characterized by a moderately concentrated market, with a discernible number of major players commanding substantial market share. This dynamic is complemented by the presence of a vibrant ecosystem of smaller, specialized manufacturers, fostering a competitive and innovative landscape. A pivotal driver of industry evolution is the relentless pursuit of innovation, marked by continuous advancements in die-casting technology that enhance both operational efficiency and product quality. The sector's trajectory is significantly shaped by stringent government regulations, particularly concerning emissions standards and vehicle safety, which compel manufacturers to adopt more sustainable and robust practices. Aluminum's inherent advantages – its lightweight nature and cost-effectiveness relative to traditional materials like steel – present a formidable barrier against product substitutes. The escalating global and domestic demand for lightweight vehicles, a direct response to fuel efficiency mandates and evolving consumer preferences, serves as a powerful catalyst for the industry's sustained growth. Strategic mergers and acquisitions (M&A) remain a frequent occurrence, indicative of ongoing consolidation and strategic alignment within the sector. For the period 2019-2024, it is estimated that approximately [Insert Number] M&A deals were finalized, contributing to a market share concentration estimated at around [Insert Percentage]%. The leading five enterprises are projected to collectively hold over [Insert Percentage]% of the total market share.

- Market Concentration: Moderately concentrated, with dominant players holding significant sway, yet a dynamic array of smaller competitors fuels robust market activity and specialization.

- Innovation Drivers: Continuous advancements in die-casting technologies, including automation and precision engineering, coupled with the overarching trend towards vehicle lightweighting and the burgeoning demand for electric vehicle (EV) components.

- Regulatory Framework: Increasingly stringent emissions and safety standards are not only regulatory hurdles but also potent catalysts for technological innovation and the adoption of advanced manufacturing processes.

- Product Substitutes: The threat of substitutes is minimal, as aluminum's unique combination of lightweight properties, durability, and cost-effectiveness positions it as a highly competitive material for automotive components.

- End-User Trends: The accelerating demand for fuel-efficient, lightweight vehicles, and the exponential growth of the electric vehicle (EV) market are primary drivers influencing component design and material selection.

- M&A Activity: Significant merger and acquisition activity observed between 2019 and 2024 underscores a strategic imperative for market consolidation, economies of scale, and enhanced competitive positioning.

China Automotive Parts Aluminum Die Casting Industry Industry Trends & Analysis

The China automotive parts aluminum die casting industry has witnessed robust growth over the past five years, with a compound annual growth rate (CAGR) of approximately xx% during the historical period (2019-2024). This growth is fueled by several key factors, including the expansion of the automotive sector, particularly the surge in electric vehicle production. Technological advancements, such as high-pressure die casting and semi-solid die casting, enable the production of more complex and lightweight components, thus driving market penetration. Changing consumer preferences, emphasizing fuel efficiency and vehicle safety, further contribute to the growth. The industry faces intense competitive pressure, with both domestic and international players vying for market share. This competition fosters innovation and drives down costs. The market penetration rate for aluminum die-cast parts in the automotive sector is estimated at xx% in 2025, with projections for a significant increase in the forecast period.

Leading Markets & Segments in China Automotive Parts Aluminum Die Casting Industry

The dominant region within the Chinese automotive parts aluminum die casting industry is the coastal region, encompassing provinces like Guangdong, Jiangsu, and Zhejiang, driven by established automotive manufacturing hubs and robust infrastructure. Within production processes, Pressure Die Casting holds the largest segment share due to its cost-effectiveness and adaptability. In terms of application, Engine Parts currently dominates, followed by Transmission Components. However, the Body Parts segment is expected to experience accelerated growth due to the increasing adoption of lightweighting strategies in vehicle design.

- Key Drivers for Coastal Regions:

- Well-established automotive manufacturing clusters.

- Developed infrastructure and logistics networks.

- Proximity to key automotive suppliers.

- Access to skilled labor.

- Dominant Production Process: Pressure Die Casting (Cost-effective and versatile)

- Leading Application Segment: Engine Parts (High volume, established market)

- Fastest Growing Segment: Body Parts (Lightweighting trends in vehicle design)

China Automotive Parts Aluminum Die Casting Industry Product Developments

Recent product innovations within the China automotive parts aluminum die casting industry are sharply focused on elevating the performance, efficiency, and sustainability of cast aluminum components. A significant advancement is the widespread adoption of high-pressure die casting techniques, enabling the production of highly intricate parts with exceptionally thin walls. This technological leap directly translates into substantial weight reductions for critical automotive assemblies, contributing to overall vehicle fuel economy. Furthermore, the integration of semi-solid die casting processes is yielding components with finer grain structures, thereby enhancing their mechanical strength, durability, and fatigue resistance. These sophisticated improvements are expanding the application spectrum of aluminum die castings beyond traditional engine blocks and transmission housings, permeating critical areas such as chassis components, structural elements, and advanced thermal management systems. This enhanced performance, coupled with an unwavering focus on cost-effectiveness, significantly strengthens the market appeal and competitiveness of these cutting-edge, innovative products.

Key Drivers of China Automotive Parts Aluminum Die Casting Industry Growth

The robust growth trajectory of the China automotive parts aluminum die casting industry is underpinned by a confluence of powerful driving forces. Foremost among these is the sustained and rapid expansion of China's domestic automotive market, which, when combined with proactive government initiatives championing the widespread adoption of electric vehicles (EVs), generates an insatiable demand for lightweight, high-performance components. Complementing this market pull are significant technological advancements in die casting methodologies. Innovations such as sophisticated high-pressure die casting and advanced automation solutions are not only streamlining production but are also instrumental in elevating the precision, consistency, and quality of manufactured parts. Finally, a supportive and forward-thinking government policy landscape, which actively promotes domestic manufacturing excellence and fosters a climate conducive to technological innovation, provides a critical impetus that further stimulates and sustains the industry's impressive growth.

Challenges in the China Automotive Parts Aluminum Die Casting Industry Market

The industry faces several challenges. Fluctuations in raw material prices (aluminum) can impact profitability. Maintaining a robust and reliable supply chain presents ongoing difficulties, exacerbated by global geopolitical uncertainties. Intense competition from both domestic and international players necessitates continuous innovation and cost optimization. Regulatory compliance regarding emissions and safety standards requires significant investment. These factors, cumulatively, can impact industry growth by approximately xx% annually, as per preliminary estimations.

Emerging Opportunities in China Automotive Parts Aluminum Die Casting Industry

Significant opportunities exist for long-term growth. The continued rise of electric vehicles (EVs) presents a substantial demand for lightweight and high-performance aluminum die-cast components. Strategic partnerships between die-casters and automotive manufacturers can foster innovation and improve supply chain efficiency. Expanding into new applications, such as battery enclosures and charging components for EVs, will broaden the industry's reach. Technological breakthroughs in die casting processes will continue to enhance the quality and capabilities of aluminum parts.

Leading Players in the China Automotive Parts Aluminum Die Casting Industry Sector

- KSPG AG

- Montupet SA

- Rheinmetall AG

- Ryobi Die Casting Inc

- Interplex Holdings Ltd

- Nemak

- Sandhar Group

- Linamar Corporation

- Shiloh Industries

- Alcoa Inc

- Faist Group

- George Fischer Ltd

- Koch Enterprises

Key Milestones in China Automotive Parts Aluminum Die Casting Industry Industry

- August 2023: Dongfeng Electronic Technology Co., Ltd. unveiled ambitious plans to secure CNY 1.4 billion (approximately USD 192.4 million) in funding. This capital infusion is earmarked for strategic investments in pioneering 3-in-1 and 5-in-1 integrated die-casting technologies specifically designed for the rapidly evolving EV powertrain sector.

- April 2023: In a significant strategic alliance, Rheinmetall AG partnered with Xiaomi to spearhead the production of advanced high-pressure die-cast parts for vehicle suspension systems. This collaboration is set to commence production in 2024, marking a key step in integrating cutting-edge manufacturing capabilities.

- March 2022: Georg Fischer Casting Solutions celebrated the successful completion of its state-of-the-art new plant located in Shenyang, China. The facility commenced its production operations by the end of 2022, signifying an expansion of global manufacturing capacity and commitment to the Chinese market.

Strategic Outlook for China Automotive Parts Aluminum Die Casting Industry Market

The strategic outlook for the China automotive parts aluminum die casting industry is unequivocally positive and poised for substantial expansion over the coming years. This optimism is primarily fueled by the persistent, robust growth witnessed in the global and domestic automotive sectors, with a particular emphasis on the accelerating adoption of electric vehicles (EVs), which inherently demand lightweight and advanced component solutions. Key strategic opportunities abound for industry participants who are adept at embracing and integrating cutting-edge technological advancements, fostering synergistic collaborations with upstream and downstream partners, and proactively expanding their product portfolios into emerging and novel automotive applications. Companies that demonstrate agility in effectively navigating complex supply chain dynamics and possess the foresight to adapt swiftly to evolving regulatory landscapes will undoubtedly be best positioned to achieve sustained success and market leadership. The projected growth trajectory of this dynamic market signals a significant expansion and maturation in the next decade, presenting compelling and attractive prospects for a wide array of investors and active industry participants alike.

China Automotive Parts Aluminum Die Casting Industry Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-solid Die Casting

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Body Parts

- 2.4. Other Application Types

China Automotive Parts Aluminum Die Casting Industry Segmentation By Geography

- 1. China

China Automotive Parts Aluminum Die Casting Industry Regional Market Share

Geographic Coverage of China Automotive Parts Aluminum Die Casting Industry

China Automotive Parts Aluminum Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Use of Lightweight Material in the Automotive Industry to Drives the Market

- 3.3. Market Restrains

- 3.3.1. Rising Aluminum Prices Hindering the Market Growth -

- 3.4. Market Trends

- 3.4.1. Body Parts Segment is Expected to Register High Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Parts Aluminum Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Body Parts

- 5.2.4. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KSPG AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Montupet SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rheinmetall AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ryobi Die Casting Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Interplex Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nemak

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sandhar Group*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Linamar Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shiloh Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alcoa Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Faist Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 George Fischer Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Koch Enterprises

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 KSPG AG

List of Figures

- Figure 1: China Automotive Parts Aluminum Die Casting Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Automotive Parts Aluminum Die Casting Industry Share (%) by Company 2025

List of Tables

- Table 1: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 2: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 5: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Parts Aluminum Die Casting Industry?

The projected CAGR is approximately 8.26%.

2. Which companies are prominent players in the China Automotive Parts Aluminum Die Casting Industry?

Key companies in the market include KSPG AG, Montupet SA, Rheinmetall AG, Ryobi Die Casting Inc, Interplex Holdings Ltd, Nemak, Sandhar Group*List Not Exhaustive, Linamar Corporation, Shiloh Industries, Alcoa Inc, Faist Group, George Fischer Ltd, Koch Enterprises.

3. What are the main segments of the China Automotive Parts Aluminum Die Casting Industry?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Use of Lightweight Material in the Automotive Industry to Drives the Market.

6. What are the notable trends driving market growth?

Body Parts Segment is Expected to Register High Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

Rising Aluminum Prices Hindering the Market Growth -.

8. Can you provide examples of recent developments in the market?

August 2023: Dongfeng Electronic Technology Co., Ltd. announced its plans to raise CNY 1.4 billion (USD 192.4 million). The fund is scheduled to transform 3-in-1 and 5-in-1 die-casting technology and improve the manufacturing capacity of EV powertrain and core components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Parts Aluminum Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Parts Aluminum Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Parts Aluminum Die Casting Industry?

To stay informed about further developments, trends, and reports in the China Automotive Parts Aluminum Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence