Key Insights

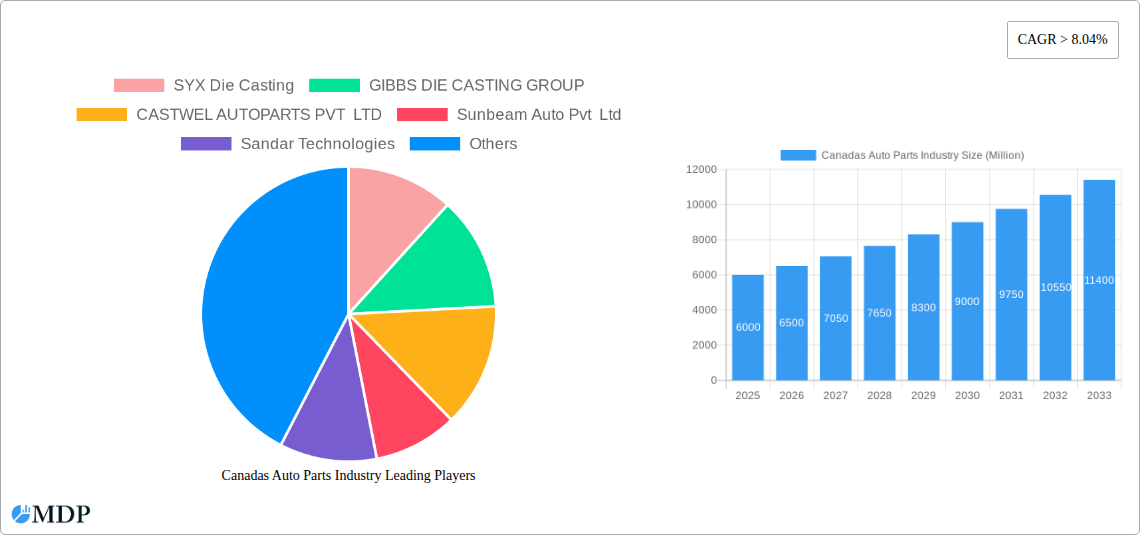

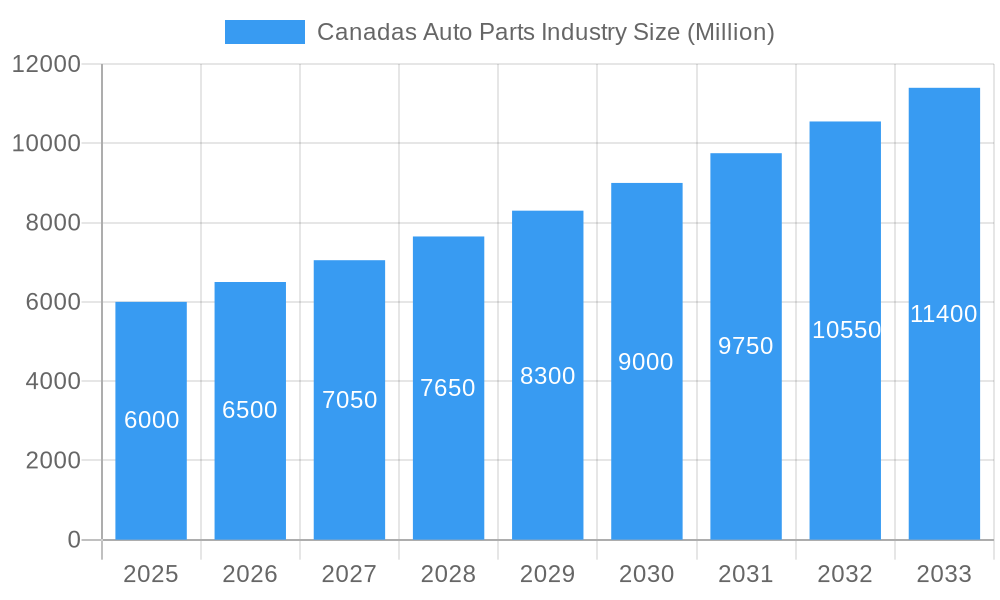

The Canadian automotive parts industry is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of 3.2%. This expansion is fueled by increasing vehicle production, rising consumer expenditure on automotive upgrades, and a significant surge in demand for electric vehicle (EV) components. The market's diversity, encompassing aluminum, zinc, and magnesium die castings for critical applications such as body assembly, engine parts, and transmission components, further underscores its potential. Pressure die casting remains the predominant manufacturing process, with emerging technologies like vacuum and semi-solid die casting driving innovation. Leading entities, including SYX Die Casting and GIBBS DIE CASTING GROUP, are strategically positioned to leverage this expanding market. The estimated market size for the Canadian automotive parts industry is projected to reach 16152.4 million by the base year 2025, reflecting its substantial economic contribution and future growth trajectory.

Canadas Auto Parts Industry Market Size (In Billion)

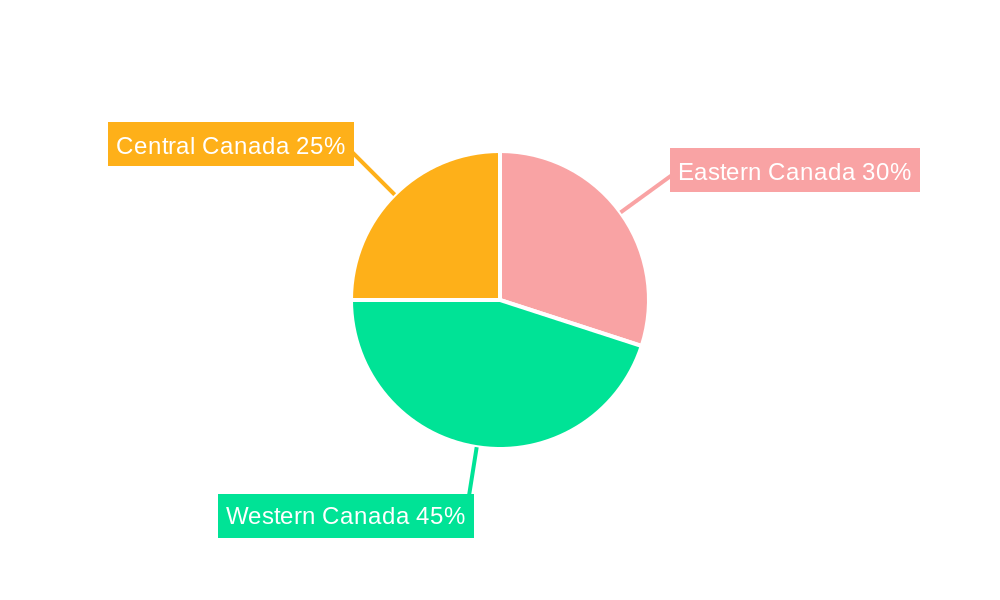

Regional market dynamics across Eastern, Western, and Central Canada indicate varied growth patterns influenced by manufacturing concentration and consumer demand. Western Canada, bolstered by established automotive manufacturing centers and its strategic proximity to the U.S. market, is anticipated to exhibit accelerated growth. All regional growth trajectories are expected to broadly align with the national CAGR. Key challenges, such as fluctuating raw material costs, global supply chain volatility, and evolving emission regulations, may pose headwinds. However, the long-term outlook for the Canadian automotive parts sector remains exceptionally positive, propelled by government initiatives supporting sustainable transportation and the rapid evolution of the EV sector. Granular market segmentation by production volume and specific component categories will enable more precise identification of high-growth opportunities.

Canadas Auto Parts Industry Company Market Share

Canada's Auto Parts Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of Canada's auto parts industry, covering market dynamics, leading players, emerging trends, and future growth prospects. With a focus on key segments including aluminum, zinc, and magnesium die castings, the report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans 2019-2033, with 2025 as the base and estimated year.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

Canada's Auto Parts Industry Market Dynamics & Concentration

Canada's auto parts industry exhibits a moderately concentrated market structure, with a few large players dominating certain segments while numerous smaller companies cater to niche applications. Market share is heavily influenced by factors such as technological capabilities, production capacity, and established supplier relationships with major OEMs. Innovation is crucial, driven by stricter emission standards, increasing demand for lightweight materials, and the integration of advanced driver-assistance systems (ADAS). The regulatory framework, including safety and environmental regulations, significantly impacts industry operations and investment decisions. Product substitutes, such as alternative materials and manufacturing processes, constantly challenge the market's established dynamics. End-user preferences shift toward higher fuel efficiency and enhanced safety features, influencing demand for specific auto parts. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total of xx M&A deals recorded between 2019 and 2024, resulting in a xx% increase in market concentration.

- Market Concentration: xx% (2024)

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Lightweighting, ADAS integration, emission regulations.

- Regulatory Framework: Safety standards, environmental regulations, trade policies.

Canada's Auto Parts Industry Industry Trends & Analysis

The Canadian auto parts industry has witnessed significant growth in recent years, propelled by rising vehicle production, increasing vehicle ownership, and government incentives promoting the adoption of cleaner technologies. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and is projected to reach xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of electric vehicles (EVs) and autonomous driving, are reshaping the industry landscape. Consumer preferences are increasingly focused on sustainability and vehicle connectivity, creating new opportunities for advanced materials and integrated systems. Competitive dynamics are intensifying, with both domestic and international players vying for market share through innovation, cost optimization, and strategic partnerships. Market penetration of lightweight materials like aluminum is increasing, exceeding xx% in 2024.

Leading Markets & Segments in Canada's Auto Parts Industry

The Canadian auto parts market is dominated by the Ontario region, owing to its well-established automotive manufacturing base and proximity to major OEMs. Within the segments:

- By Raw Material: Aluminum remains the dominant raw material, accounting for approximately xx% of the market in 2024, followed by Zinc (xx%) and Magnesium (xx%). The high demand for lightweight materials in automobiles is a key driver for Aluminum.

- By Application Type: Engine parts represent the largest application segment, followed by Body Assembly and Transmission parts. The growth in this segment is largely driven by increased vehicle production and the complexity of modern engines.

- By Production Process Type: Pressure die casting is the most prevalent production process, accounting for a significant majority of the market share due to its high efficiency and cost-effectiveness.

Key Drivers:

- Strong Automotive Manufacturing Base (Ontario): Concentrated automotive production facilities drive demand for locally sourced auto parts.

- Government Incentives: Policies supporting the adoption of cleaner technologies and domestic manufacturing enhance market growth.

- Proximity to US Market: Geographic proximity facilitates efficient cross-border trade and supply chain integration.

Canada's Auto Parts Industry Product Developments

Recent product innovations have focused on lightweighting technologies, utilizing materials like aluminum and magnesium to improve fuel efficiency. Advancements in die-casting processes, such as high-pressure die casting, enhance product precision and durability. Integration of sensors and electronics into auto parts is becoming increasingly common, enabling the adoption of advanced driver-assistance systems (ADAS). These developments are driven by the need to meet stringent emission regulations and enhance vehicle safety and performance. The market fit for these innovations is strong, given the growing demand for fuel-efficient and technologically advanced vehicles.

Key Drivers of Canada's Auto Parts Industry Growth

Several key factors are fueling the growth of Canada's auto parts industry:

- Technological Advancements: The development of lightweight materials, advanced manufacturing processes, and integrated electronics is driving innovation and market expansion.

- Economic Growth: Rising disposable incomes and increasing vehicle ownership fuel demand for auto parts.

- Government Support: Government initiatives promoting domestic manufacturing and the adoption of cleaner technologies are creating favorable market conditions.

- Increased Demand for EVs: The shift towards electric vehicles is creating a need for specialized components and driving innovation in battery technologies and powertrains.

Challenges in the Canada's Auto Parts Industry Market

The industry faces several challenges:

- Global Supply Chain Disruptions: The COVID-19 pandemic highlighted the vulnerability of global supply chains, impacting the availability of raw materials and components. This resulted in an estimated xx% increase in production costs in 2022.

- Intense Competition: Both domestic and international players compete for market share, leading to price pressures and the need for constant innovation.

- Environmental Regulations: Meeting increasingly stringent emission standards requires significant investment in new technologies and manufacturing processes.

Emerging Opportunities in Canada's Auto Parts Industry

Significant opportunities exist for growth:

- Technological Breakthroughs: Developments in lightweighting materials, battery technologies, and autonomous driving systems are creating new market segments and enhancing the demand for specialized auto parts.

- Strategic Partnerships: Collaborations between auto parts manufacturers and OEMs can accelerate innovation and enhance market penetration.

- Market Expansion: Increased focus on exporting Canadian-made auto parts to international markets can diversify revenue streams and drive growth.

Leading Players in the Canada's Auto Parts Industry Sector

- SYX Die Casting

- GIBBS DIE CASTING GROUP

- CASTWEL AUTOPARTS PVT LTD

- Sunbeam Auto Pvt Ltd

- Sandar Technologies

- Amtek Group

- ECO Die Castings

- Endurance Technologies Ltd

- ALUMINIUM DIE CASTING (CHINA) LTD

- Dynacast Inc

Key Milestones in Canada's Auto Parts Industry

- May 2023: Linamar Corporation announced a new giga casting facility in Welland, Ontario, signifying a major investment in high-pressure die casting technology and creating 200 new jobs.

- April 2023: Rheinmetall AG and Xiaomi partnered to manufacture automotive parts using high-pressure die casting, underscoring the growing demand for advanced manufacturing techniques.

Strategic Outlook for Canada's Auto Parts Industry Market

The Canadian auto parts industry is poised for continued growth, driven by technological advancements, increasing vehicle production, and government support. Strategic opportunities lie in specializing in niche segments, focusing on lightweighting and sustainable materials, and expanding into international markets. The industry's future success depends on adapting to the evolving automotive landscape, embracing technological innovations, and navigating global supply chain challenges. The market is expected to reach a value of xx Million by 2033.

Canadas Auto Parts Industry Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Raw Material

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Magnesium

- 2.4. Other Raw Materials

-

3. Application Type

- 3.1. Body Assembly

- 3.2. Engine Parts

- 3.3. Transmission Parts

- 3.4. Other Applications

Canadas Auto Parts Industry Segmentation By Geography

- 1. Canada

Canadas Auto Parts Industry Regional Market Share

Geographic Coverage of Canadas Auto Parts Industry

Canadas Auto Parts Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Automotive Segment will Drive The Market In Coming Year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canadas Auto Parts Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Magnesium

- 5.2.4. Other Raw Materials

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Body Assembly

- 5.3.2. Engine Parts

- 5.3.3. Transmission Parts

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SYX Die Casting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GIBBS DIE CASTING GROUP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CASTWEL AUTOPARTS PVT LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunbeam Auto Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandar Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amtek Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ECO Die Castings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Endurance Technologies Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ALUMINIUM DIE CASTING (CHINA) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SYX Die Casting

List of Figures

- Figure 1: Canadas Auto Parts Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Canadas Auto Parts Industry Share (%) by Company 2025

List of Tables

- Table 1: Canadas Auto Parts Industry Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 2: Canadas Auto Parts Industry Revenue million Forecast, by Raw Material 2020 & 2033

- Table 3: Canadas Auto Parts Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Canadas Auto Parts Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Canadas Auto Parts Industry Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 6: Canadas Auto Parts Industry Revenue million Forecast, by Raw Material 2020 & 2033

- Table 7: Canadas Auto Parts Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Canadas Auto Parts Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canadas Auto Parts Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Canadas Auto Parts Industry?

Key companies in the market include SYX Die Casting, GIBBS DIE CASTING GROUP, CASTWEL AUTOPARTS PVT LTD, Sunbeam Auto Pvt Ltd, Sandar Technologies, Amtek Group, ECO Die Castings, Endurance Technologies Ltd, ALUMINIUM DIE CASTING (CHINA) LTD, Dynacast Inc.

3. What are the main segments of the Canadas Auto Parts Industry?

The market segments include Production Process Type, Raw Material, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16152.4 million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand.

6. What are the notable trends driving market growth?

Automotive Segment will Drive The Market In Coming Year.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

May 2023: Linamar Corporation unveiled plans for a cutting-edge giga casting facility in Welland, Ontario. Spanning approximately 300,000 square feet, the plant will create employment for around 200 workers. The facility will house three 6,100-ton high-pressure die-cast machines, with the first installation scheduled for January 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canadas Auto Parts Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canadas Auto Parts Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canadas Auto Parts Industry?

To stay informed about further developments, trends, and reports in the Canadas Auto Parts Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence