Key Insights

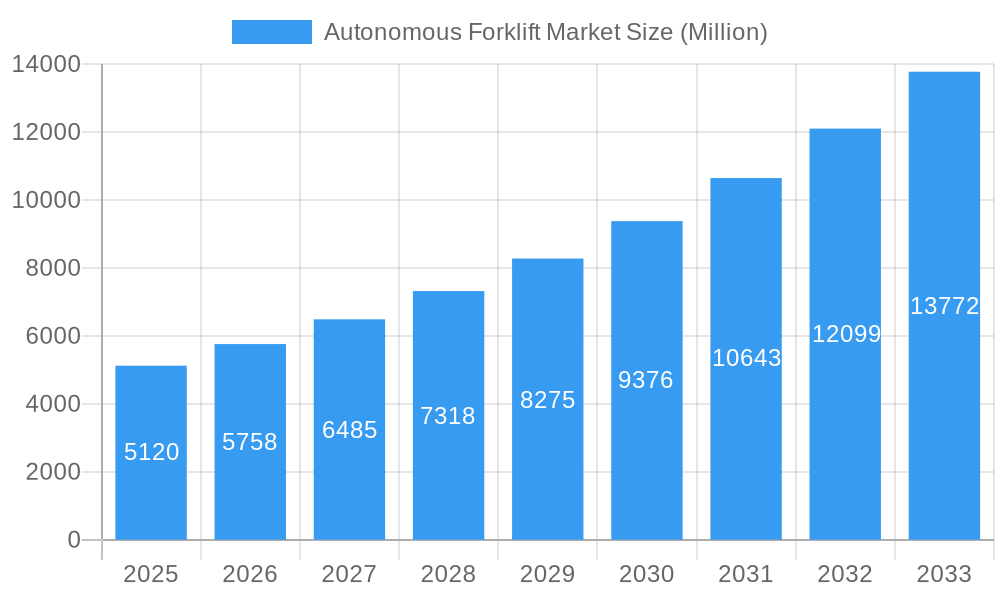

The Autonomous Forklift Market is experiencing robust growth, projected to reach a market size of $5.12 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.25% from 2025 to 2033. This expansion is driven by several key factors. Increased demand for improved efficiency and productivity within logistics and warehousing operations is a major catalyst. E-commerce growth necessitates faster order fulfillment, pushing businesses to adopt automation solutions like autonomous forklifts to optimize their supply chains. Furthermore, the rising cost of labor and the increasing difficulty in attracting and retaining skilled workers are compelling businesses to invest in autonomous systems to mitigate labor shortages. The market's segmentation reveals significant opportunities across various tonnage capacities, navigation technologies, and application areas. Electric propulsion systems are gaining traction due to their environmental benefits and lower operating costs, while laser guidance and vision guidance systems are leading the navigation technology segment due to their precision and reliability.

Autonomous Forklift Market Market Size (In Billion)

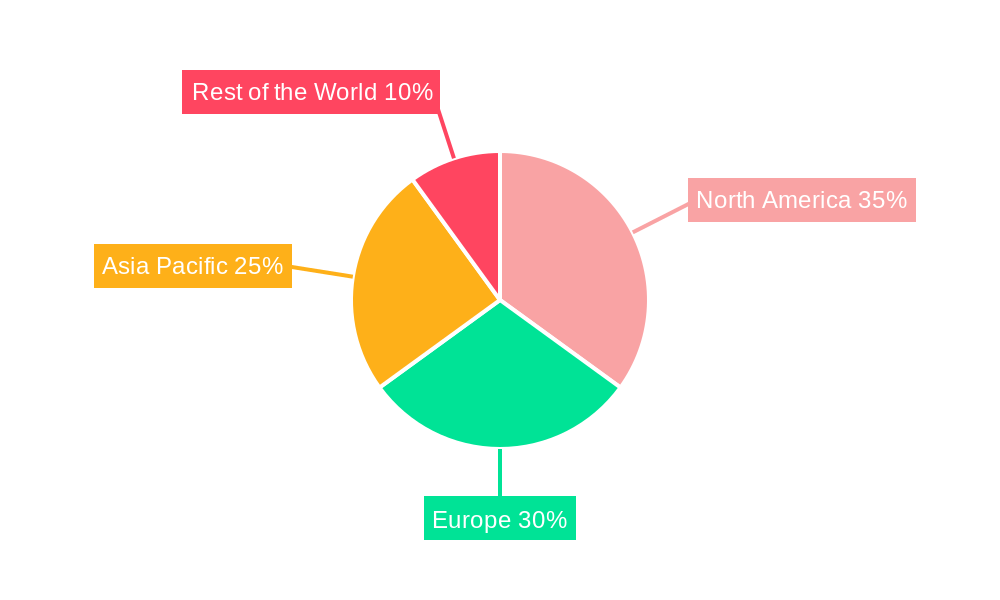

The market's geographical distribution shows strong growth across North America, Europe, and Asia-Pacific regions, particularly in countries with advanced manufacturing and logistics sectors. While established players like Jungheinrich AG, Hyster-Yale Group Inc., and Toyota Industries Corporation dominate the market, the emergence of innovative companies specializing in advanced navigation technologies and AI-driven solutions is fostering competition and innovation. Restraining factors include the high initial investment costs associated with implementing autonomous forklift systems and concerns about integration with existing warehouse management systems. However, the long-term cost savings, increased efficiency, and safety benefits are expected to outweigh these initial hurdles, further bolstering market growth throughout the forecast period. Continuous technological advancements, such as the development of more sophisticated AI and improved sensor technologies, are expected to further refine the capabilities of autonomous forklifts, leading to wider adoption across diverse industries.

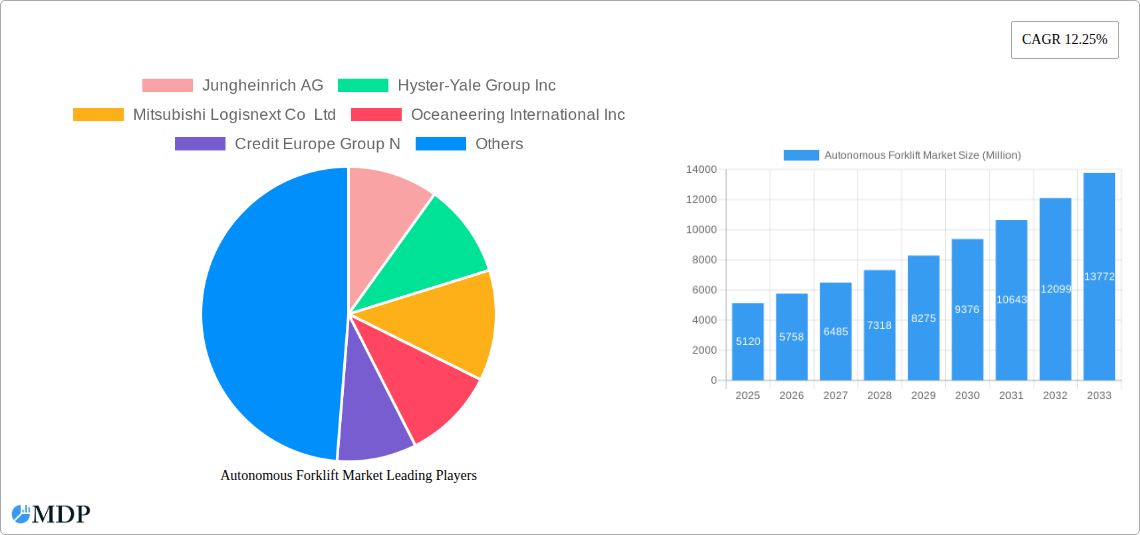

Autonomous Forklift Market Company Market Share

Autonomous Forklift Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Autonomous Forklift Market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The market is segmented by tonnage capacity, navigation technology, application, propulsion type, and type, providing a granular understanding of this rapidly evolving sector. Expected market value is xx Million by 2033.

Autonomous Forklift Market Market Dynamics & Concentration

The Autonomous Forklift Market is experiencing significant growth driven by the increasing demand for automation in logistics and manufacturing. Market concentration is moderate, with several key players vying for market share. Innovation in navigation technologies, particularly Laser Guidance and Vision Guidance, is a major driver. Regulatory frameworks, while still developing in some regions, are increasingly supportive of automation, encouraging adoption. Product substitutes, such as traditional forklifts, face pressure due to the efficiency and cost-saving benefits of autonomous solutions. End-user trends strongly favor automation to increase productivity and reduce labor costs. M&A activity in the sector has been steady, with xx deals recorded between 2019 and 2024, reflecting consolidation and expansion efforts by major players. Market share is currently distributed amongst the key players as follows (estimates for 2025):

- Jungheinrich AG: xx%

- Hyster-Yale Group Inc: xx%

- Mitsubishi Logisnext Co Ltd: xx%

- Other Players: xx%

Autonomous Forklift Market Industry Trends & Analysis

The Autonomous Forklift Market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This robust growth is fueled by several factors, including the rising adoption of automation in warehouses and manufacturing facilities to improve efficiency and reduce operational costs. Technological advancements, such as the development of sophisticated navigation systems and AI-powered control systems, are further driving market expansion. Consumer preferences are shifting towards autonomous solutions due to their improved safety features and reduced risk of human error. The competitive landscape is dynamic, with both established players and new entrants constantly innovating and vying for market share. Market penetration in key industries like logistics and warehousing is expected to reach xx% by 2033. This growth, however, faces challenges such as high initial investment costs and the need for robust infrastructure support.

Leading Markets & Segments in Autonomous Forklift Market

The Autonomous Forklift Market is geographically diverse, with significant growth opportunities across various regions. However, North America and Europe currently lead the market due to high adoption rates and advanced technological infrastructure. Within market segments, several are exhibiting particularly strong growth:

- By Tonnage Capacity: The Below 5 Tons segment currently dominates due to its applicability across a broad range of applications, followed by the 5-10 Tons segment. The Above 10 Tons segment is experiencing slower growth due to higher costs and more complex integration needs.

- By Navigation Technology: Laser Guidance and Vision Guidance hold the largest market share, owing to their precision and adaptability. However, other technologies, particularly Simultaneous Localization and Mapping (SLAM), are gaining traction.

- By Application: The Logistics and Warehousing sector accounts for the largest share, reflecting the strong need for automation in these areas. Manufacturing is also a significant application segment, with increasing adoption in diverse industries.

- By Propulsion Type: Electric forklifts are gaining significant traction, driven by environmental concerns and cost-effectiveness.

- By Type: Pallet Truck/Mover/Jack is the most widely adopted type of autonomous forklift.

Key drivers for regional dominance include favorable government policies, robust infrastructure, and a concentrated presence of key industry players.

Autonomous Forklift Market Product Developments

Recent product innovations focus on improving navigation accuracy, payload capacity, and operational efficiency. The introduction of advanced sensor technologies, AI-powered control systems, and enhanced safety features is driving the development of more sophisticated and versatile autonomous forklift models. For instance, Seegrid Corporation's Palion Lift CR1 showcases advancements in lift height and payload capacity, addressing the evolving needs of customers in warehousing, manufacturing, and logistics. This focus on enhanced capabilities directly translates to a stronger market fit and competitive advantage for manufacturers.

Key Drivers of Autonomous Forklift Market Growth

Several factors are driving the growth of the autonomous forklift market:

- Increased demand for automation: Businesses are seeking to increase efficiency, reduce labor costs, and improve safety.

- Technological advancements: Innovations in navigation, sensor, and AI technologies are enhancing the capabilities and reliability of autonomous forklifts.

- Favorable government regulations: Policies supporting automation adoption are fostering market growth.

- Rising e-commerce: The boom in online shopping is driving demand for efficient warehouse automation.

Challenges in the Autonomous Forklift Market Market

The market faces several challenges:

- High initial investment costs: The upfront cost of implementing autonomous forklift systems can be substantial.

- Safety concerns: Ensuring the safe operation of autonomous forklifts in dynamic environments is crucial.

- Integration complexities: Integrating autonomous forklifts into existing warehouse management systems can be complex.

- Lack of skilled labor: Operating and maintaining autonomous systems may require specialized training.

Emerging Opportunities in Autonomous Forklift Market

Significant opportunities exist for growth:

- Expansion into new markets: Emerging economies present significant potential for growth.

- Strategic partnerships: Collaborations between technology providers and logistics companies can accelerate adoption.

- Development of advanced features: Innovations in areas like energy efficiency and predictive maintenance will enhance market appeal.

Leading Players in the Autonomous Forklift Market Sector

- Jungheinrich AG

- Hyster-Yale Group Inc

- Mitsubishi Logisnext Co Ltd

- Oceaneering International Inc

- Credit Europe Group N

- HD Hyundai Construction Equipment

- Toyota Industries Corporation

- Balyo

- Vecna AFL

- Agilox Services GmbH

- Hangcha Group Co Ltd

- Kion Group AG

- Otto Motors

- Gridbots Technologies Private Limited

- Swisslog Holding AG

Key Milestones in Autonomous Forklift Market Industry

- February 2024: Seegrid Corporation launches the Palion Lift CR1 autonomous lift truck, featuring a 15’ lift height and 4,000lb payload capacity. This highlights advancements in payload capacity and lift height, potentially expanding the market reach to applications previously underserved.

- September 2023: Worldwide Flight Services (WFS) initiates a trial of Linde AGV forklift trucks at Barcelona Airport, demonstrating the growing interest in autonomous solutions within the aviation sector. A successful trial could expand adoption within the broader logistics and transportation industries.

- August 2023: Cyngn Inc. secures a pre-order agreement with Arauco for 100 autonomous electric forklifts, signifying growing corporate investment in automation and the environmental benefits of electric propulsion. This large-scale order shows considerable confidence in the technology and the market's growth trajectory.

Strategic Outlook for Autonomous Forklift Market Market

The Autonomous Forklift Market presents a compelling investment opportunity, with strong growth potential fueled by technological innovation, increasing demand for automation, and favorable regulatory environments. Strategic partnerships and focused investment in research and development will be crucial for companies aiming to capitalize on emerging opportunities and maintain a competitive edge. The market's future is bright, with significant potential for expansion into new applications and geographic markets.

Autonomous Forklift Market Segmentation

-

1. Tonnage Capacity

- 1.1. Below 5 Tons

- 1.2. 5-10 Tons

- 1.3. Above 10 Tons

-

2. Navigation Technology

- 2.1. Laser Guidance

- 2.2. Vision Guidance

- 2.3. Optical Tape Guidance

- 2.4. Magnetic Guidance

- 2.5. Inductive Guidance

- 2.6. Others (

-

3. Application

- 3.1. Logistics and Warehousing

- 3.2. Manufacturing

- 3.3. Material Handling

- 3.4. Others (Retail, etc.)

-

4. Propulsion Type

- 4.1. Electric

- 4.2. Diesel

- 4.3. Others (CNG, LPG, etc.)

-

5. Type

- 5.1. Pallet Truck/Mover/Jack

- 5.2. Pallet Stackers

- 5.3. Others (Forked AGV, etc.)

Autonomous Forklift Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Autonomous Forklift Market Regional Market Share

Geographic Coverage of Autonomous Forklift Market

Autonomous Forklift Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Warehousing and Logistics Sector to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Purchase Cost to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Logistics and Warehousing Sector is Expected to Gain Traction Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 5.1.1. Below 5 Tons

- 5.1.2. 5-10 Tons

- 5.1.3. Above 10 Tons

- 5.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 5.2.1. Laser Guidance

- 5.2.2. Vision Guidance

- 5.2.3. Optical Tape Guidance

- 5.2.4. Magnetic Guidance

- 5.2.5. Inductive Guidance

- 5.2.6. Others (

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Logistics and Warehousing

- 5.3.2. Manufacturing

- 5.3.3. Material Handling

- 5.3.4. Others (Retail, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.4.1. Electric

- 5.4.2. Diesel

- 5.4.3. Others (CNG, LPG, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Type

- 5.5.1. Pallet Truck/Mover/Jack

- 5.5.2. Pallet Stackers

- 5.5.3. Others (Forked AGV, etc.)

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 6. North America Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 6.1.1. Below 5 Tons

- 6.1.2. 5-10 Tons

- 6.1.3. Above 10 Tons

- 6.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 6.2.1. Laser Guidance

- 6.2.2. Vision Guidance

- 6.2.3. Optical Tape Guidance

- 6.2.4. Magnetic Guidance

- 6.2.5. Inductive Guidance

- 6.2.6. Others (

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Logistics and Warehousing

- 6.3.2. Manufacturing

- 6.3.3. Material Handling

- 6.3.4. Others (Retail, etc.)

- 6.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.4.1. Electric

- 6.4.2. Diesel

- 6.4.3. Others (CNG, LPG, etc.)

- 6.5. Market Analysis, Insights and Forecast - by Type

- 6.5.1. Pallet Truck/Mover/Jack

- 6.5.2. Pallet Stackers

- 6.5.3. Others (Forked AGV, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 7. Europe Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 7.1.1. Below 5 Tons

- 7.1.2. 5-10 Tons

- 7.1.3. Above 10 Tons

- 7.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 7.2.1. Laser Guidance

- 7.2.2. Vision Guidance

- 7.2.3. Optical Tape Guidance

- 7.2.4. Magnetic Guidance

- 7.2.5. Inductive Guidance

- 7.2.6. Others (

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Logistics and Warehousing

- 7.3.2. Manufacturing

- 7.3.3. Material Handling

- 7.3.4. Others (Retail, etc.)

- 7.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.4.1. Electric

- 7.4.2. Diesel

- 7.4.3. Others (CNG, LPG, etc.)

- 7.5. Market Analysis, Insights and Forecast - by Type

- 7.5.1. Pallet Truck/Mover/Jack

- 7.5.2. Pallet Stackers

- 7.5.3. Others (Forked AGV, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 8. Asia Pacific Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 8.1.1. Below 5 Tons

- 8.1.2. 5-10 Tons

- 8.1.3. Above 10 Tons

- 8.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 8.2.1. Laser Guidance

- 8.2.2. Vision Guidance

- 8.2.3. Optical Tape Guidance

- 8.2.4. Magnetic Guidance

- 8.2.5. Inductive Guidance

- 8.2.6. Others (

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Logistics and Warehousing

- 8.3.2. Manufacturing

- 8.3.3. Material Handling

- 8.3.4. Others (Retail, etc.)

- 8.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.4.1. Electric

- 8.4.2. Diesel

- 8.4.3. Others (CNG, LPG, etc.)

- 8.5. Market Analysis, Insights and Forecast - by Type

- 8.5.1. Pallet Truck/Mover/Jack

- 8.5.2. Pallet Stackers

- 8.5.3. Others (Forked AGV, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 9. Rest of the World Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 9.1.1. Below 5 Tons

- 9.1.2. 5-10 Tons

- 9.1.3. Above 10 Tons

- 9.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 9.2.1. Laser Guidance

- 9.2.2. Vision Guidance

- 9.2.3. Optical Tape Guidance

- 9.2.4. Magnetic Guidance

- 9.2.5. Inductive Guidance

- 9.2.6. Others (

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Logistics and Warehousing

- 9.3.2. Manufacturing

- 9.3.3. Material Handling

- 9.3.4. Others (Retail, etc.)

- 9.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.4.1. Electric

- 9.4.2. Diesel

- 9.4.3. Others (CNG, LPG, etc.)

- 9.5. Market Analysis, Insights and Forecast - by Type

- 9.5.1. Pallet Truck/Mover/Jack

- 9.5.2. Pallet Stackers

- 9.5.3. Others (Forked AGV, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Jungheinrich AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hyster-Yale Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Logisnext Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Oceaneering International Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Credit Europe Group N

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 HD Hyundai Construction Equipment

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Toyota Industries Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Balyo

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vecna AFL

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Agilox Services GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hangcha Group Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Kion Group AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Otto Motors

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Gridbots Technologies Private Limited

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Swisslog Holding AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Jungheinrich AG

List of Figures

- Figure 1: Global Autonomous Forklift Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 3: North America Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 4: North America Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 5: North America Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 6: North America Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 9: North America Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 10: North America Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 11: North America Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 15: Europe Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 16: Europe Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 17: Europe Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 18: Europe Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 21: Europe Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 22: Europe Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Europe Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 27: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 28: Asia Pacific Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 29: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 30: Asia Pacific Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Asia Pacific Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 33: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 34: Asia Pacific Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of the World Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 39: Rest of the World Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 40: Rest of the World Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 41: Rest of the World Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 42: Rest of the World Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 43: Rest of the World Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 44: Rest of the World Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 45: Rest of the World Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 46: Rest of the World Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 47: Rest of the World Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 48: Rest of the World Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Rest of the World Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 2: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 3: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 5: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Autonomous Forklift Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 8: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 9: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 11: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of North America Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 17: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 18: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Germany Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Italy Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 28: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 29: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 31: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: China Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Japan Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Korea Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Asia Pacific Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 39: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 40: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 42: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: South America Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Middle East and Africa Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Forklift Market?

The projected CAGR is approximately 12.25%.

2. Which companies are prominent players in the Autonomous Forklift Market?

Key companies in the market include Jungheinrich AG, Hyster-Yale Group Inc, Mitsubishi Logisnext Co Ltd, Oceaneering International Inc, Credit Europe Group N, HD Hyundai Construction Equipment, Toyota Industries Corporation, Balyo, Vecna AFL, Agilox Services GmbH, Hangcha Group Co Ltd, Kion Group AG, Otto Motors, Gridbots Technologies Private Limited, Swisslog Holding AG.

3. What are the main segments of the Autonomous Forklift Market?

The market segments include Tonnage Capacity, Navigation Technology, Application, Propulsion Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Warehousing and Logistics Sector to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

The Logistics and Warehousing Sector is Expected to Gain Traction Between 2024 and 2029.

7. Are there any restraints impacting market growth?

High Initial Purchase Cost to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Seegrid Corporation announced the launch of an autonomous lift truck, the Palion Lift CR1 model, to address evolving challenges in autonomous material handling for warehousing, manufacturing, and logistics customers. The Palion Lift CR1 boasts an impressive 15’ lift height and a robust 4,000lb payload capacity. Further, the company stated that the new model is equipped with its own proprietary state-of-the-art navigation technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Forklift Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Forklift Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Forklift Market?

To stay informed about further developments, trends, and reports in the Autonomous Forklift Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence