Key Insights

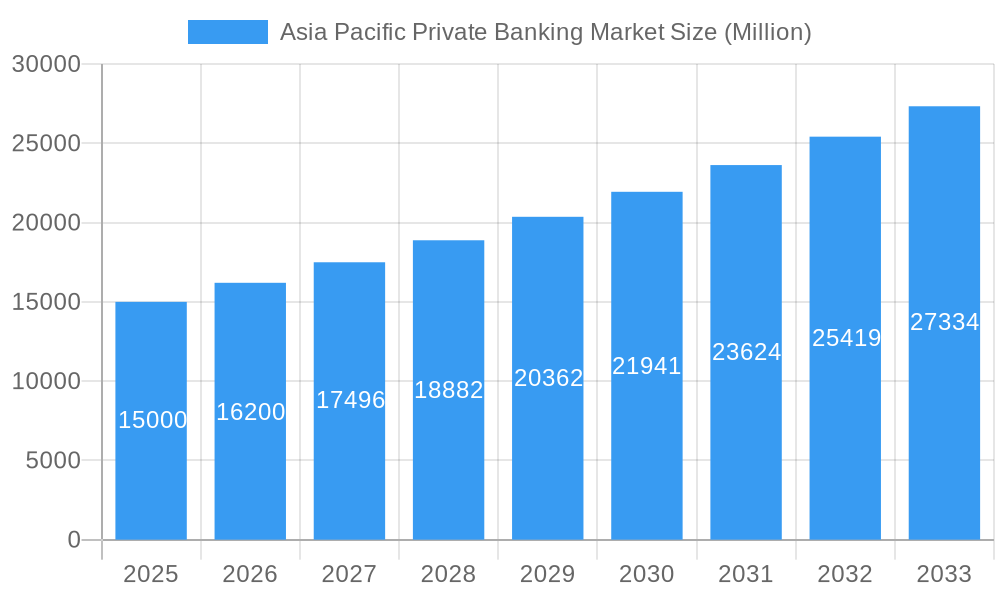

The Asia Pacific private banking market is poised for substantial growth, propelled by an expanding High-Net-Worth Individual (HNWI) demographic, escalating wealth accumulation, and a heightened demand for advanced wealth management solutions. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.4% from 2025 to 2033. Key growth catalysts include the region's rapid economic expansion, especially within emerging economies like China and India, complemented by supportive governmental policies fostering financial inclusion and investment. The increasing integration of digital platforms and technological innovations in wealth management further accelerates market expansion. Potential market restraints include geopolitical volatility and evolving regulatory landscapes. Market segmentation addresses the diverse requirements of HNWIs, offering tailored services for specific demographics and investment preferences. Leading financial institutions such as UBS, Credit Suisse, and HSBC are engaged in competitive strategies to increase market share through enhanced product portfolios, expanded regional footprints, and the adoption of cutting-edge technologies. A notable trend is the move towards personalized and comprehensive wealth management, incorporating investment advisory, estate planning, and family office services. Additionally, a growing emphasis on sustainable and responsible investing is influencing investment strategies across the Asia Pacific private banking sector.

Asia Pacific Private Banking Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market expansion, potentially at a slightly moderated rate compared to the historical period (2019-2024) due to global economic conditions and intensified competition. Nevertheless, the long-term outlook remains optimistic, supported by the region's demographic trends and robust economic fundamentals. Based on reported CAGRs and market dynamics, the market size is estimated to reach 505.61 billion by 2025. Analyzing the performance of key players and regional growth patterns offers a comprehensive perspective on market trends and future opportunities, facilitating strategic decision-making for businesses operating in the Asia Pacific private banking industry.

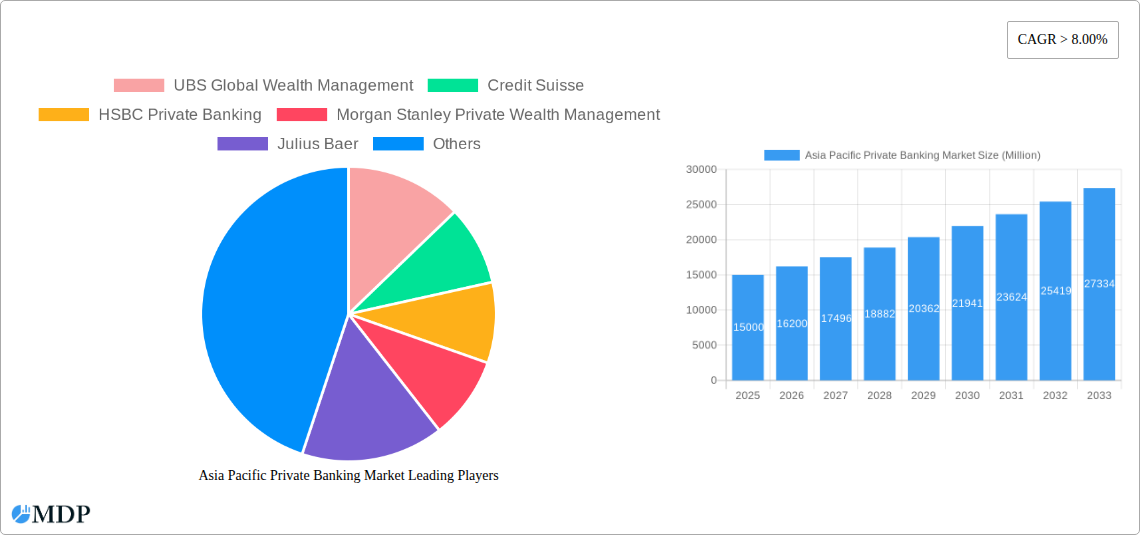

Asia Pacific Private Banking Market Company Market Share

Asia Pacific Private Banking Market Report: 2019-2033

Dive deep into the lucrative Asia Pacific private banking market with this comprehensive report, offering invaluable insights for strategic decision-making. This in-depth analysis covers the period 2019-2033, with a focus on 2025, providing a detailed understanding of market dynamics, trends, and future growth potential. The report is designed for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving landscape. Expect actionable data, strategic recommendations, and a clear picture of the competitive landscape, including market share analysis and emerging opportunities. The market size is projected to reach xx Million by 2033.

Asia Pacific Private Banking Market Dynamics & Concentration

The Asia Pacific private banking market exhibits a moderately concentrated landscape, dominated by global players and regional banking giants. Key factors shaping this dynamic environment include:

Market Concentration: While precise market share figures for individual players are proprietary, UBS Global Wealth Management, Credit Suisse, HSBC Private Banking, Morgan Stanley Private Wealth Management, Julius Baer, J P Morgan Private Bank, Bank of Singapore, Goldman Sachs Private Wealth Management, Citi Bank, and DBS hold significant market share, but the market also includes many smaller niche players. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated structure.

Innovation Drivers: The rise of fintech, digital banking solutions, and personalized wealth management services are key drivers of innovation. Competition among established players and the emergence of new entrants are pushing for continuous improvements in product offerings and customer experiences.

Regulatory Frameworks: Varying regulatory environments across the Asia Pacific region significantly impact market dynamics. Compliance with anti-money laundering (AML) regulations and Know Your Customer (KYC) guidelines is paramount, impacting operational costs and strategies.

Product Substitutes: The rise of robo-advisors and other digital investment platforms presents a degree of substitution for traditional private banking services, particularly within the mass affluent segment.

End-User Trends: Increasing wealth creation in the region, coupled with changing demographics and consumer preferences towards personalized wealth management solutions, are shaping market demand.

M&A Activities: The last five years have witnessed a moderate level of mergers and acquisitions (M&A) activity in the Asia Pacific private banking sector, with xx deals recorded between 2019 and 2024. These transactions primarily focused on expansion into new markets and enhancing technological capabilities.

Asia Pacific Private Banking Market Industry Trends & Analysis

The Asia Pacific private banking market is experiencing robust growth, driven by several key factors:

The market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors:

Rising High-Net-Worth Individuals (HNWIs): The region boasts a rapidly expanding HNWI population, creating significant demand for sophisticated wealth management services.

Technological Disruption: Fintech innovations, including digital platforms, AI-powered investment tools, and blockchain technology, are transforming the delivery of private banking services, enhancing efficiency and customer experience. Market penetration of digital private banking services is estimated at xx% in 2025, projected to increase to xx% by 2033.

Shifting Consumer Preferences: Clients increasingly demand personalized financial planning, customized investment solutions, and seamless digital experiences, driving innovation and competition.

Competitive Dynamics: Intense competition among global and regional players is leading to continuous product innovation, service enhancements, and strategic partnerships. This dynamic competition is a key driver of market growth.

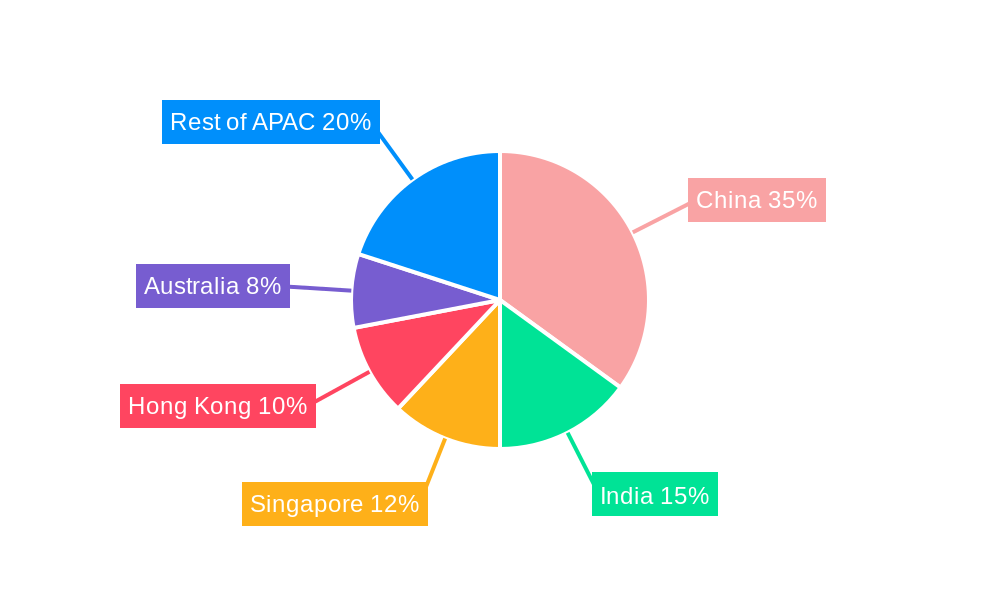

Leading Markets & Segments in Asia Pacific Private Banking Market

Within the Asia Pacific region, several markets and segments are driving significant growth:

Dominant Regions/Countries: Hong Kong, Singapore, and Australia consistently rank among the leading markets, fueled by robust economic growth, developed financial infrastructure, and large HNW populations. China, India, and other Southeast Asian nations show significant growth potential.

Key Drivers:

- Strong Economic Growth: Sustained economic growth in several key markets creates a fertile ground for wealth creation and increased demand for private banking services.

- Favorable Regulatory Environment: Countries with investor-friendly regulations and robust legal frameworks attract significant private banking activity.

- Developed Financial Infrastructure: Well-established financial infrastructure and sophisticated regulatory frameworks play a crucial role in the attractiveness of certain markets.

- High HNWI Concentration: Regions with concentrated populations of high-net-worth individuals and ultra-high-net-worth individuals naturally attract more private banking business.

Detailed dominance analysis reveals that Hong Kong and Singapore, due to their well-established financial hubs and established regulatory frameworks, continue to capture significant market share. However, the growth of other markets, particularly in mainland China and Southeast Asia, is rapidly changing the landscape.

Asia Pacific Private Banking Market Product Developments

Recent product innovations focus on leveraging technology to enhance service delivery and personalization. This includes the development of sophisticated digital platforms offering comprehensive investment solutions, robo-advisory services, and customized wealth management tools. The competitive advantage increasingly lies in providing seamless digital experiences coupled with personalized financial advice. The integration of AI and machine learning for portfolio management and risk assessment is also gaining traction.

Key Drivers of Asia Pacific Private Banking Market Growth

Several factors fuel the growth of the Asia Pacific private banking market:

- Technological Advancements: Fintech innovations and digitalization are transforming how private banking services are delivered, creating more efficient and personalized experiences.

- Economic Expansion: Consistent economic growth in many parts of the Asia Pacific region is leading to significant wealth creation and increased demand for sophisticated wealth management solutions.

- Favorable Regulatory Environment: Many countries within the region are actively encouraging the growth of the financial services sector through favorable regulations and supportive policies.

Challenges in the Asia Pacific Private Banking Market

The market faces several challenges:

- Regulatory Compliance: Stricter AML/KYC regulations and data privacy requirements increase operational costs and complexity.

- Geopolitical Uncertainty: Regional geopolitical instability and economic volatility pose risks to investment portfolios and overall market stability.

- Intense Competition: Fierce competition among established players and the emergence of new fintech entrants put pressure on profit margins and require continuous innovation. This leads to a need for differentiation and adaptation to maintain market share.

Emerging Opportunities in Asia Pacific Private Banking Market

The Asia Pacific private banking market presents several significant long-term opportunities:

- Expansion into Underserved Markets: Many high-growth economies within the region remain underserved by private banking, offering considerable potential for expansion and market penetration.

- Strategic Partnerships: Collaborations between established private banks and fintech companies could lead to innovative service offerings and enhanced customer experiences.

- Technological Breakthroughs: Continued innovation in areas like AI, blockchain, and data analytics could dramatically transform the industry and unlock new growth opportunities.

Leading Players in the Asia Pacific Private Banking Market Sector

Key Milestones in Asia Pacific Private Banking Market Industry

- November 2022: SBC Global Private Banking launched its discretionary digital platform (DPM) in Asia, marking a significant step towards mobile-first private banking.

- February 2023: GXS, a digital bank majority-owned by Grab, expanded its services, highlighting the increasing influence of fintech in the private banking landscape and the growing appetite for innovative digital banking solutions, particularly in Southeast Asia, offering high interest rates on time deposits (3.48%) compared to regular savings accounts (0.08%). This emphasizes the changing dynamics within the market and the growing competition from digital-first banking models.

Strategic Outlook for Asia Pacific Private Banking Market

The Asia Pacific private banking market is poised for significant growth over the next decade. Strategic opportunities exist for players that can effectively leverage technology, embrace personalized service models, and expand into underserved markets. Focusing on digital innovation, strategic partnerships, and tailored financial solutions for the region's diverse client base will be crucial for success. The market's future potential hinges on the ability of players to adapt to evolving client expectations and navigate the challenges of a rapidly changing regulatory environment.

Asia Pacific Private Banking Market Segmentation

-

1. Type

- 1.1. Asset Management Service

- 1.2. Insurance Service

- 1.3. Trust Service

- 1.4. Tax Consulting

- 1.5. Real Estate Consulting

-

2. Application

- 2.1. Personal

- 2.2. Enterprise

Asia Pacific Private Banking Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Private Banking Market Regional Market Share

Geographic Coverage of Asia Pacific Private Banking Market

Asia Pacific Private Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Insurance Business in Asia Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Private Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Asset Management Service

- 5.1.2. Insurance Service

- 5.1.3. Trust Service

- 5.1.4. Tax Consulting

- 5.1.5. Real Estate Consulting

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal

- 5.2.2. Enterprise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UBS Global Wealth Management

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Credit Suisse

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HSBC Private Banking

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Morgan Stanley Private Wealth Management

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Julius Baer

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 J P Morgan Private Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bank of Singapore

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goldman Sachs Private Wealth Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Citi Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DBS**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UBS Global Wealth Management

List of Figures

- Figure 1: Asia Pacific Private Banking Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Private Banking Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Private Banking Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Private Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Asia Pacific Private Banking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Private Banking Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Private Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Asia Pacific Private Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Private Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Private Banking Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Asia Pacific Private Banking Market?

Key companies in the market include UBS Global Wealth Management, Credit Suisse, HSBC Private Banking, Morgan Stanley Private Wealth Management, Julius Baer, J P Morgan Private Bank, Bank of Singapore, Goldman Sachs Private Wealth Management, Citi Bank, DBS**List Not Exhaustive.

3. What are the main segments of the Asia Pacific Private Banking Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 505.61 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Insurance Business in Asia Pacific.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: GXS, a digital bank majority owned by Grab, operator of Southeast Asia's ubiquitous super app, expanded services since opening in September. GXS's app hardly looks like a banking app. The app updates GXS account holders with daily reports on how much interest their deposits have accrued. While a regular savings account offers 0.08% interest, time deposits, opened for specific purposes such as travel or layaway purchases, earn 3.48%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Private Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Private Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Private Banking Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Private Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence