Key Insights

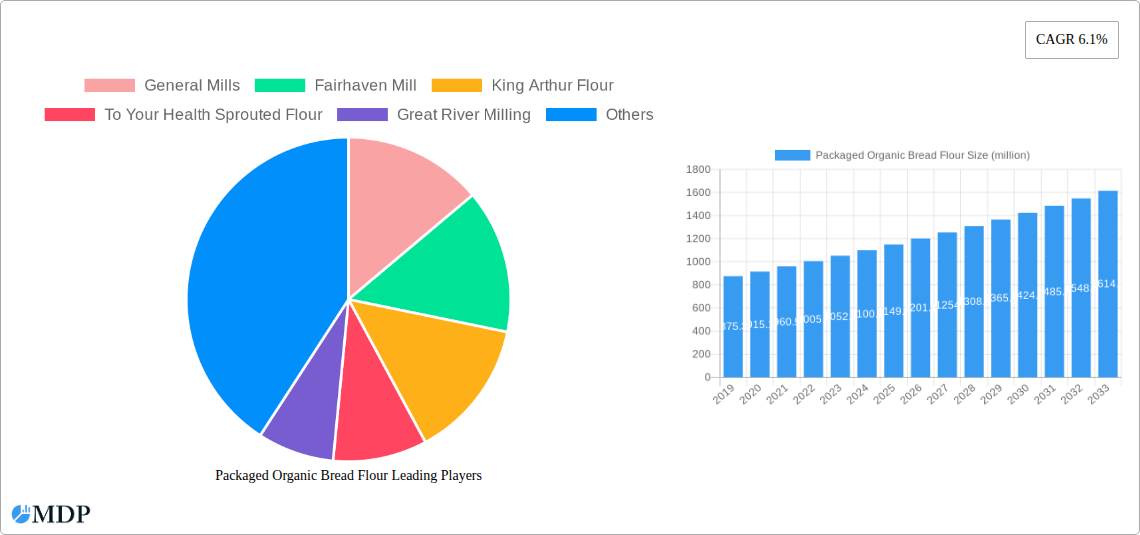

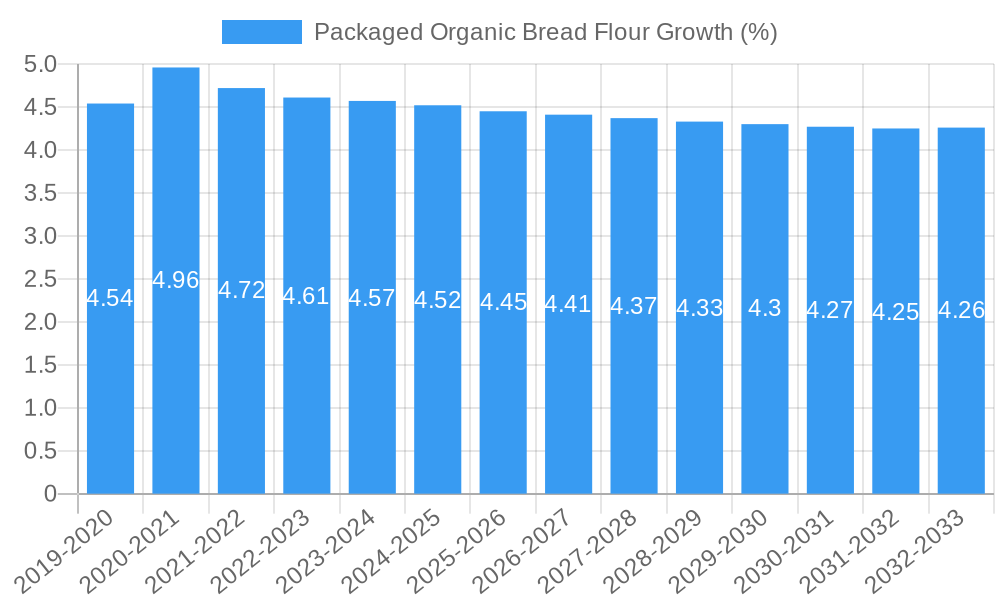

The global Packaged Organic Bread Flour market is poised for significant expansion, projected to reach approximately \$1227 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.1% anticipated throughout the forecast period of 2025-2033. This healthy growth trajectory is primarily fueled by a confluence of increasing consumer awareness regarding the health benefits associated with organic products, a rising demand for wholesome and natural food options, and a growing preference for home baking, particularly among younger demographics. The convenience and assured quality offered by packaged organic bread flour contribute to its appeal, making it a staple for health-conscious individuals and families. Furthermore, advancements in milling technologies and sustainable sourcing practices are enhancing the product's quality and accessibility, thereby driving market adoption.

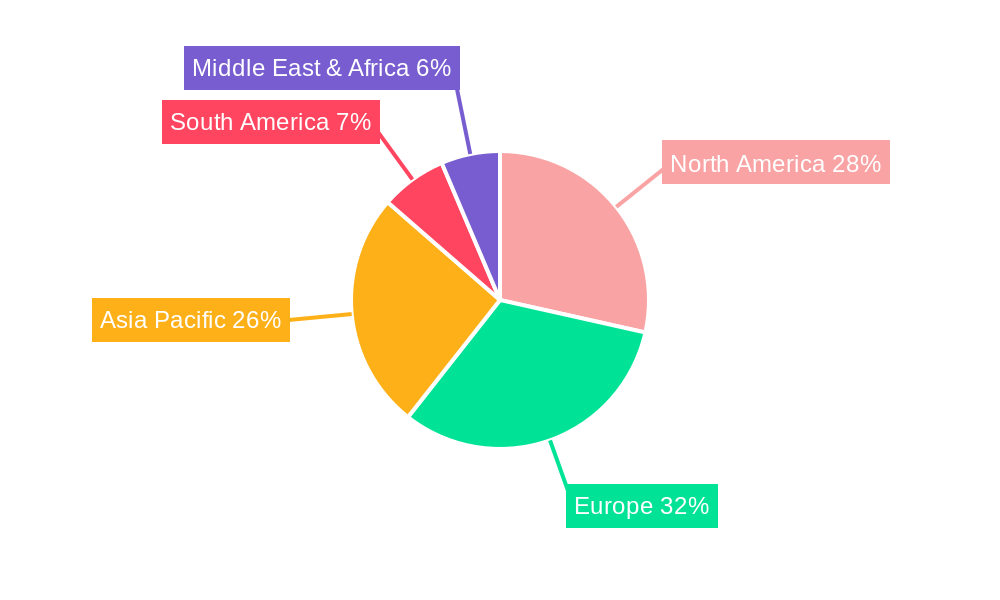

The market segmentation reveals a dynamic landscape, with the "Home" application segment expected to lead in demand due to the persistent trend of at-home culinary exploration and the desire for healthier food choices. Within the "Type" segment, both "Machine Mill Flour" and "Stone Mill Flour" are witnessing steady growth, catering to different consumer preferences for texture and perceived artisanal quality. Key industry players such as General Mills, King Arthur Flour, Bob's Red Mill, and Ardent Mills are actively investing in product innovation, sustainable packaging, and strategic marketing to capture a larger market share. The Asia Pacific region, driven by burgeoning economies like China and India and increasing disposable incomes, is emerging as a high-growth area, complementing established markets in North America and Europe.

Packaged Organic Bread Flour Market Dynamics & Concentration

The packaged organic bread flour market exhibits a moderate to high concentration, with key players like General Mills, King Arthur Flour, Bob's Red Mill, and Ardent Mills holding significant market share. The study indicates a combined market share of approximately 60 million for the top five companies in the base year 2025. Innovation drivers are primarily focused on enhanced nutritional profiles, gluten-free alternatives, and sustainable sourcing practices. Regulatory frameworks, particularly those pertaining to organic certification and food safety standards, play a crucial role in shaping market entry and product development. Product substitutes, such as conventional bread flour and alternative grain flours, present a competitive challenge, though the growing consumer preference for organic and healthier options mitigates this impact. End-user trends reveal a strong shift towards home baking and artisanal bread production, fueling demand for premium organic bread flour. Mergers and acquisitions (M&A) activities are moderate, with an estimated 25 M&A deals recorded between 2019 and 2024, primarily focused on consolidating supply chains and expanding product portfolios.

Packaged Organic Bread Flour Industry Trends & Analysis

The global packaged organic bread flour market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This robust growth is underpinned by a confluence of escalating consumer awareness regarding health and wellness, a heightened demand for clean-label products, and a burgeoning interest in home-based culinary pursuits. The market penetration of organic bread flour, which stood at an estimated 22% in 2024, is expected to climb steadily, driven by increasing disposable incomes and a greater availability of certified organic ingredients. Technological advancements in milling processes, such as the increased adoption of stone milling for superior texture and nutrient retention, are creating new product categories and enhancing consumer appeal. Furthermore, the rise of e-commerce platforms has significantly broadened market reach, enabling smaller, artisanal producers to connect with a wider customer base. The competitive landscape is characterized by a blend of established multinational corporations and agile, niche manufacturers, all vying for market dominance through product differentiation, strategic pricing, and effective marketing campaigns that highlight the inherent benefits of organic ingredients. The "farm-to-table" movement and a growing concern for sustainable agricultural practices further bolster the demand for packaged organic bread flour, as consumers increasingly seek transparency and ethical sourcing in their food choices. The commercial segment, encompassing bakeries and food service providers, is also experiencing a surge in demand, as businesses look to cater to the growing segment of health-conscious consumers and offer premium organic options on their menus. The continued innovation in product formulations, including the introduction of specialized organic bread flours for various baking needs (e.g., sourdough, whole wheat), will be a key determinant of market success.

Leading Markets & Segments in Packaged Organic Bread Flour

The North America region currently dominates the packaged organic bread flour market, driven by a mature consumer base with a high propensity for organic product adoption and a well-established health and wellness culture. Within North America, the United States stands out as the leading country, accounting for an estimated 35 million in market share in 2025. Key drivers for this dominance include robust economic policies that support organic agriculture, widespread availability of organic certification, and a strong infrastructure for distribution and retail.

In terms of Application, the Home segment is a significant growth engine. This is propelled by a persistent trend in home baking, amplified by post-pandemic lifestyle shifts and a growing desire for control over ingredients and nutritional content. Consumers are increasingly experimenting with artisanal bread making, sourdough cultures, and healthier baking alternatives, directly boosting demand for packaged organic bread flour in household settings. The estimated market share for the home application segment is projected to reach 28 million in 2025.

The Commercial application segment, while currently smaller, is witnessing rapid expansion. This growth is attributed to the increasing number of bakeries, cafes, and restaurants seeking to differentiate their offerings by incorporating premium, organic ingredients. The demand for organic bread flour in commercial settings is driven by a desire to meet the evolving preferences of a health-conscious clientele and to align with sustainability initiatives. This segment is projected to contribute 21 million to the market share in 2025.

Regarding Type, Machine Mill Flour currently holds a larger market share, estimated at 31 million in 2025. This is due to its widespread availability, consistent quality, and suitability for large-scale commercial production. However, Stone Mill Flour is experiencing a notable surge in popularity, particularly within the artisanal baking community and among consumers seeking superior texture, flavor, and nutrient retention. The perceived benefits of stone milling, which involves grinding grains between two stones, contribute to its premium positioning and a growing market share, projected to reach 18 million in 2025. The increasing availability of finely milled organic stone ground flours for home bakers is further fueling this segment's growth.

Packaged Organic Bread Flour Product Developments

Product innovation in the packaged organic bread flour sector is characterized by a focus on enhanced nutritional value, specialized formulations, and sustainable packaging. Companies are introducing flours enriched with vitamins and minerals, as well as developing gluten-free organic bread flour blends to cater to dietary needs. Innovations in milling techniques, such as stone milling and low-temperature grinding, are gaining traction for their ability to preserve the natural flavors and nutrients of grains. Competitive advantages are being forged through transparency in sourcing, highlighting regenerative agricultural practices, and offering unique grain varieties. The market is also seeing a trend towards smaller, more eco-friendly packaging options to appeal to environmentally conscious consumers.

Key Drivers of Packaged Organic Bread Flour Growth

The growth of the packaged organic bread flour market is primarily driven by increasing consumer awareness of health benefits associated with organic food consumption, leading to a preference for cleaner ingredient lists. The surge in home baking and artisanal bread-making trends, especially post-pandemic, has significantly boosted demand. Technological advancements in milling processes, such as stone milling, which preserves nutrients and enhances texture, are also key drivers. Furthermore, supportive government policies and certifications for organic products foster consumer trust and market expansion. Growing concerns about environmental sustainability and ethical sourcing practices encourage consumers to opt for organic products, thereby fueling market growth.

Challenges in the Packaged Organic Bread Flour Market

The packaged organic bread flour market faces several challenges. Regulatory hurdles and the stringent certification processes for organic products can be a barrier for new entrants and increase operational costs. Supply chain volatility, including potential shortages of organic grains due to climate change or agricultural issues, can impact availability and pricing. Intense competition from conventional bread flour and other alternative flours, often at lower price points, poses a significant restraint. Additionally, consumer price sensitivity remains a factor, as organic products typically command a premium. The complexity of ensuring consistent quality across different organic grain varieties can also be a challenge for manufacturers.

Emerging Opportunities in Packaged Organic Bread Flour

Emerging opportunities in the packaged organic bread flour market lie in the continuous development of specialized organic blends for diverse baking applications, such as high-protein, low-carb, or ancient grain varieties. Strategic partnerships between organic flour producers and artisanal bakeries or food service chains can unlock significant market potential. The growing demand for plant-based and vegan baking solutions presents an avenue for innovation in organic bread flour formulations. Furthermore, exploring new geographical markets with a rising interest in health and wellness can offer substantial growth prospects. Investing in sustainable packaging solutions and transparent supply chain communication will further enhance brand loyalty and market penetration.

Leading Players in the Packaged Organic Bread Flour Sector

- General Mills

- Fairhaven Mill

- King Arthur Flour

- To Your Health Sprouted Flour

- Great River Milling

- Ardent Mills

- Doves Farm

- Bay State Milling Company

- Bob's Red Mill

- Aryan International

- Archer Daniels Midland

- Shipton Mill

- Heilongjiang Beidahuang Group

Key Milestones in Packaged Organic Bread Flour Industry

- 2019: Increased consumer adoption of home baking, leading to a surge in demand for premium organic flours.

- 2020: COVID-19 pandemic accelerates home baking trends and highlights the importance of resilient food supply chains.

- 2021: Growing awareness of sustainable agriculture and regenerative farming practices influences consumer purchasing decisions.

- 2022: Introduction of innovative organic flour blends catering to specific dietary needs and baking techniques.

- 2023: Expansion of e-commerce platforms for organic food products, improving accessibility for consumers.

- 2024: Increased investment in research and development for advanced milling technologies to enhance nutritional content and texture.

Strategic Outlook for Packaged Organic Bread Flour Market

The strategic outlook for the packaged organic bread flour market is exceptionally positive, characterized by sustained growth driven by consumer demand for healthier, sustainably produced food products. Key growth accelerators include further innovation in specialized organic flour formulations, targeting niche markets and dietary needs, and the expansion into emerging economies where organic consciousness is on the rise. Strategic alliances with food service providers and direct-to-consumer models will enhance market reach and brand loyalty. Emphasis on transparent sourcing, regenerative agriculture, and eco-friendly packaging will continue to be critical differentiators, aligning with consumer values and securing long-term market leadership.

Packaged Organic Bread Flour Segmentation

-

1. Application

- 1.1. Home

- 1.2. Commercial

-

2. Type

- 2.1. Machine Mill Flour

- 2.2. Stone Mill Flour

Packaged Organic Bread Flour Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Packaged Organic Bread Flour REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Packaged Organic Bread Flour Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Machine Mill Flour

- 5.2.2. Stone Mill Flour

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Packaged Organic Bread Flour Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Home

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Machine Mill Flour

- 6.2.2. Stone Mill Flour

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Packaged Organic Bread Flour Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Home

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Machine Mill Flour

- 7.2.2. Stone Mill Flour

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Packaged Organic Bread Flour Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Home

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Machine Mill Flour

- 8.2.2. Stone Mill Flour

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Packaged Organic Bread Flour Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Home

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Machine Mill Flour

- 9.2.2. Stone Mill Flour

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Packaged Organic Bread Flour Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Home

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Machine Mill Flour

- 10.2.2. Stone Mill Flour

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 General Mills

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fairhaven Mill

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 King Arthur Flour

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 To Your Health Sprouted Flour

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Great River Milling

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ardent Mills

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Doves Farm

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bay State Milling Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bob's red mill

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aryan International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Archer Daniels Midland

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shipton Mill

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Heilongjiang Beidahuang Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 General Mills

List of Figures

- Figure 1: Global Packaged Organic Bread Flour Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Packaged Organic Bread Flour Revenue (million), by Application 2024 & 2032

- Figure 3: North America Packaged Organic Bread Flour Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Packaged Organic Bread Flour Revenue (million), by Type 2024 & 2032

- Figure 5: North America Packaged Organic Bread Flour Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Packaged Organic Bread Flour Revenue (million), by Country 2024 & 2032

- Figure 7: North America Packaged Organic Bread Flour Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Packaged Organic Bread Flour Revenue (million), by Application 2024 & 2032

- Figure 9: South America Packaged Organic Bread Flour Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Packaged Organic Bread Flour Revenue (million), by Type 2024 & 2032

- Figure 11: South America Packaged Organic Bread Flour Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Packaged Organic Bread Flour Revenue (million), by Country 2024 & 2032

- Figure 13: South America Packaged Organic Bread Flour Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Packaged Organic Bread Flour Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Packaged Organic Bread Flour Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Packaged Organic Bread Flour Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Packaged Organic Bread Flour Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Packaged Organic Bread Flour Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Packaged Organic Bread Flour Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Packaged Organic Bread Flour Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Packaged Organic Bread Flour Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Packaged Organic Bread Flour Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Packaged Organic Bread Flour Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Packaged Organic Bread Flour Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Packaged Organic Bread Flour Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Packaged Organic Bread Flour Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Packaged Organic Bread Flour Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Packaged Organic Bread Flour Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Packaged Organic Bread Flour Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Packaged Organic Bread Flour Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Packaged Organic Bread Flour Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Packaged Organic Bread Flour Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Packaged Organic Bread Flour Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Packaged Organic Bread Flour Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Packaged Organic Bread Flour Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Packaged Organic Bread Flour Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Packaged Organic Bread Flour Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Packaged Organic Bread Flour Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Packaged Organic Bread Flour Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Packaged Organic Bread Flour Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Packaged Organic Bread Flour Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Packaged Organic Bread Flour Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Packaged Organic Bread Flour Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Packaged Organic Bread Flour Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Packaged Organic Bread Flour Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Packaged Organic Bread Flour Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Packaged Organic Bread Flour Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Packaged Organic Bread Flour Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Packaged Organic Bread Flour Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Packaged Organic Bread Flour Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Packaged Organic Bread Flour Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaged Organic Bread Flour?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Packaged Organic Bread Flour?

Key companies in the market include General Mills, Fairhaven Mill, King Arthur Flour, To Your Health Sprouted Flour, Great River Milling, Ardent Mills, Doves Farm, Bay State Milling Company, Bob's red mill, Aryan International, Archer Daniels Midland, Shipton Mill, Heilongjiang Beidahuang Group.

3. What are the main segments of the Packaged Organic Bread Flour?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1227 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Packaged Organic Bread Flour," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Packaged Organic Bread Flour report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Packaged Organic Bread Flour?

To stay informed about further developments, trends, and reports in the Packaged Organic Bread Flour, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence