Key Insights

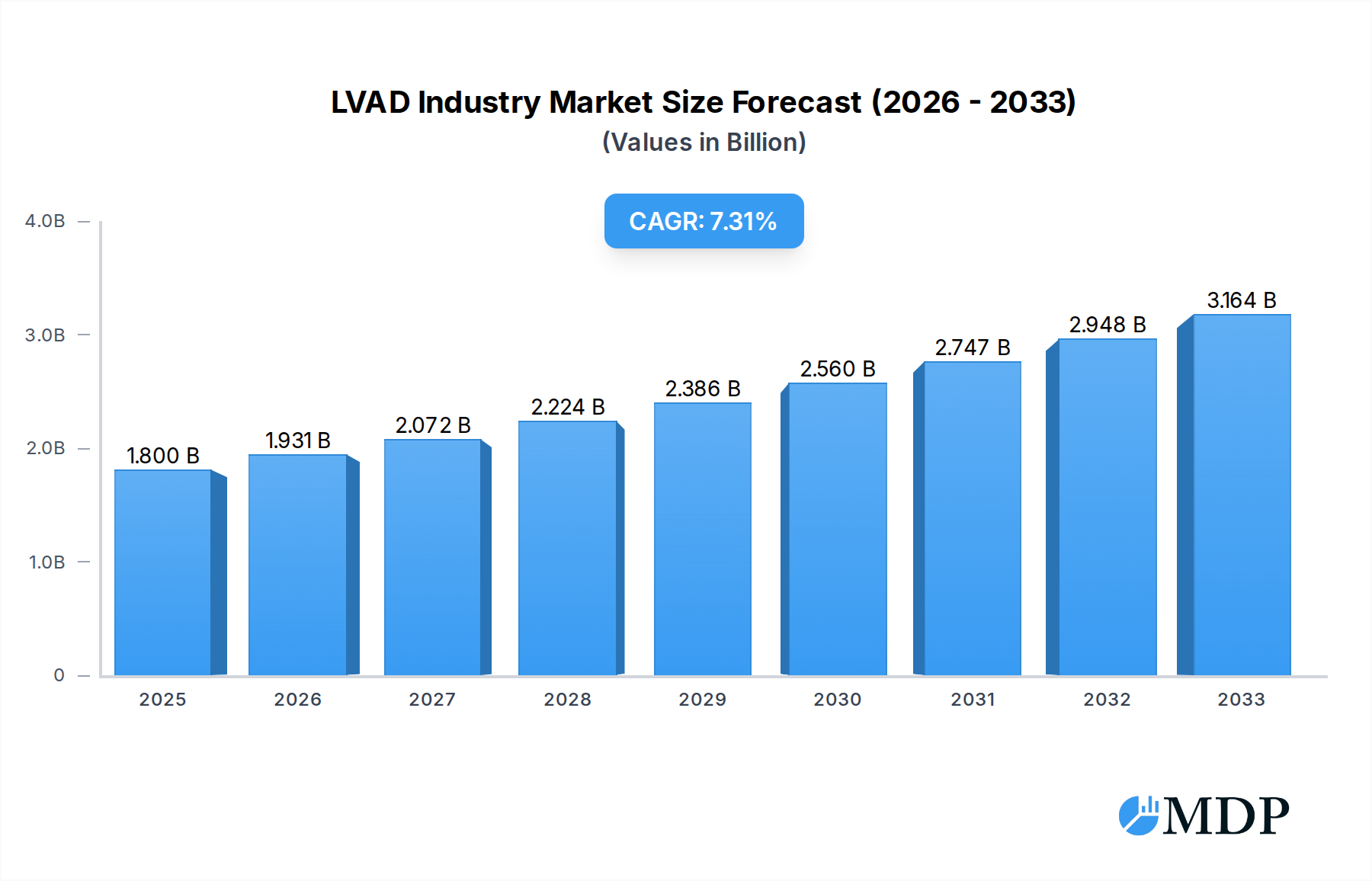

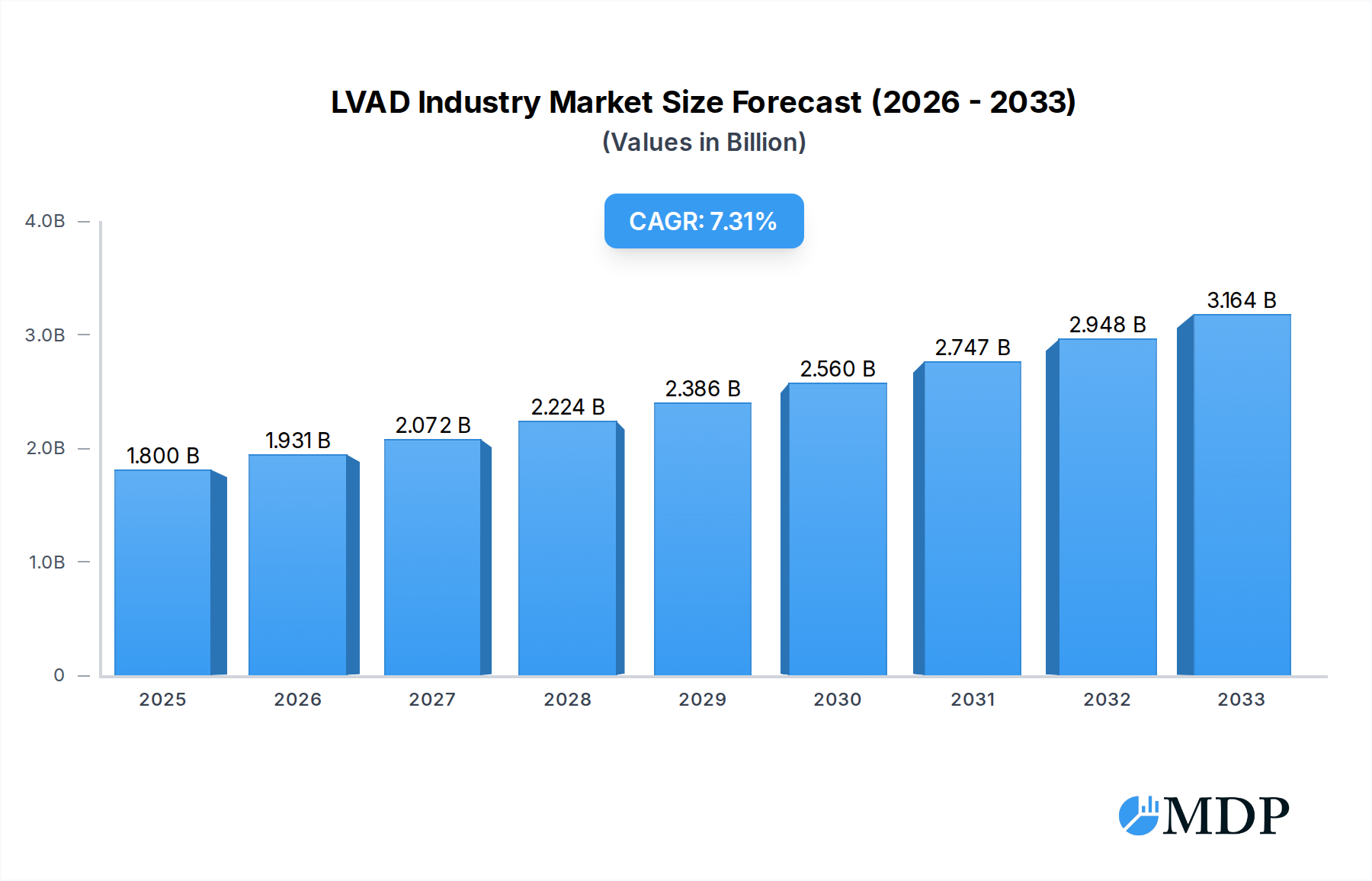

The global Ventricular Assist Device (VAD) market, encompassing Left Ventricular Assist Devices (LVADs), Right Ventricular Assist Devices (RVADs), and Biventricular Assist Devices (BIVADs), is poised for significant expansion. With a current market size estimated at $1.8 Billion in 2025, the industry is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 7.23% through 2033. This impressive growth is primarily fueled by the escalating prevalence of heart failure, an aging global population, and advancements in VAD technology, offering a lifeline to patients awaiting heart transplants or those with advanced heart failure requiring destination therapy. The increasing demand for minimally invasive procedures and the development of more durable and reliable devices are also key drivers propelling market expansion.

LVAD Industry Market Size (In Billion)

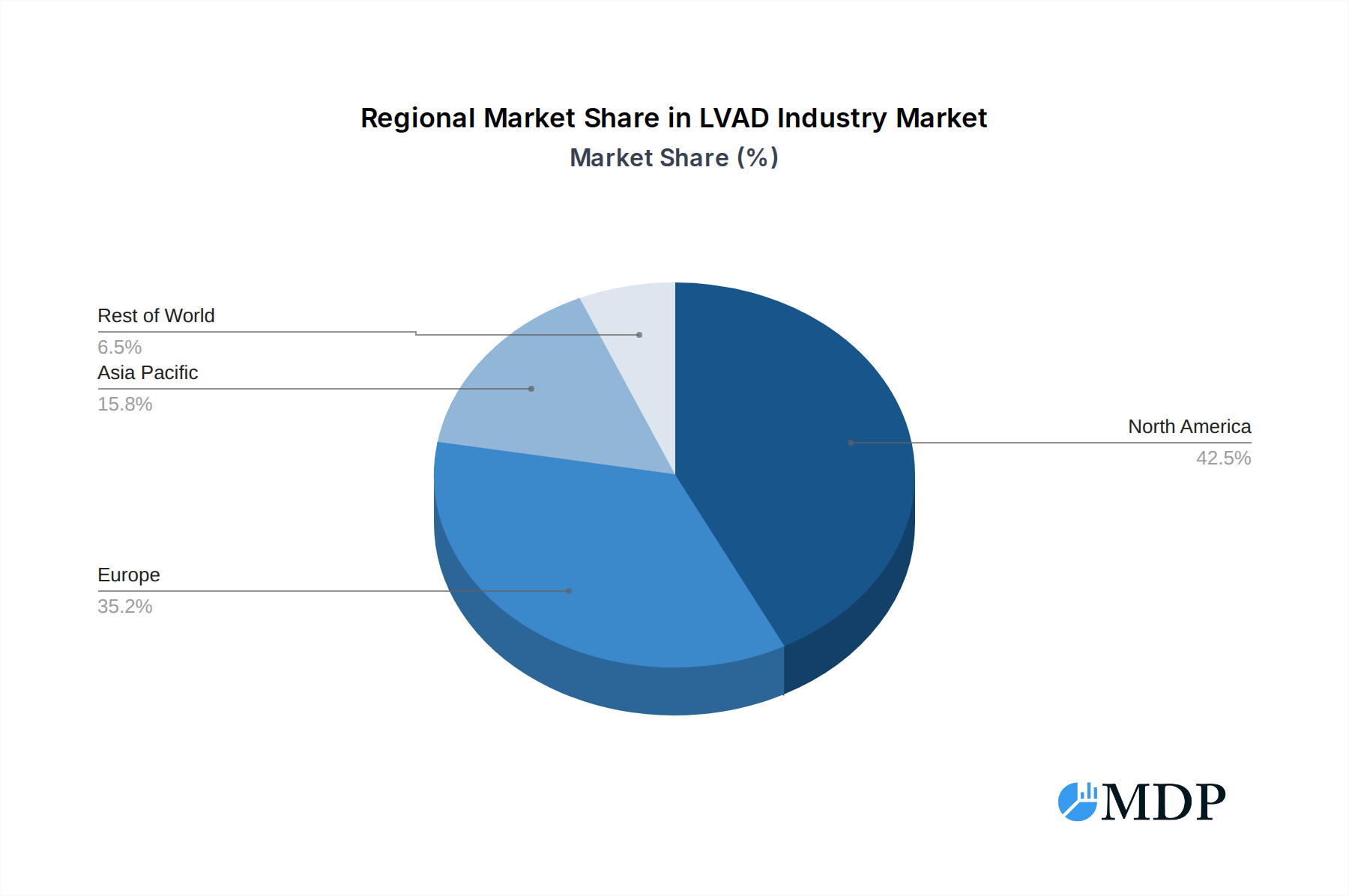

The VAD market is segmented into Left Ventricular Assist Devices (LVADs), Right Ventricular Assist Devices (RVADs), and Biventricular Assist Devices (BIVADs), with LVADs dominating the landscape due to their application in treating the most common form of heart failure. The primary applications driving market growth include Bridge-to-Transplant (BTT) therapy, which supports patients until a donor heart becomes available, and Destination Therapy (DT), providing long-term circulatory support for patients ineligible for transplantation. While technological innovation and increasing patient access are strong growth enablers, the high cost of VAD implantation and the need for lifelong patient monitoring and management present significant challenges. Geographically, North America and Europe currently lead the market, driven by high healthcare expenditure and established reimbursement policies, with the Asia Pacific region expected to witness substantial growth due to increasing awareness and improving healthcare infrastructure.

LVAD Industry Company Market Share

This in-depth report provides an unparalleled analysis of the Left Ventricular Assist Device (LVAD) market, a critical and rapidly evolving segment of the cardiac assist devices industry. Covering the study period from 2019 to 2033, with a base year of 2025 and an extensive forecast period of 2025–2033, this research delves into the intricate dynamics, key trends, and future trajectory of ventricular assist devices. Our analysis encompasses historical data from 2019–2024, offering a complete picture of market evolution. We explore the significant impact of mechanical circulatory support (MCS) in managing advanced heart failure, a field seeing substantial investment and innovation. This report is essential for medical device manufacturers, healthcare providers, investment firms, research institutions, and policy makers seeking to understand the global LVAD market size, CAGR, and the competitive landscape shaped by leading LVAD companies.

LVAD Industry Market Dynamics & Concentration

The LVAD industry exhibits a dynamic market concentration, characterized by a blend of established players and emerging innovators driving advancements in cardiac assist technology. The market is significantly influenced by innovation drivers, including the relentless pursuit of smaller, more efficient, and longer-lasting devices, alongside improved patient outcomes and quality of life. Regulatory frameworks, such as FDA approvals and CE marking, play a pivotal role in market entry and product lifecycle management, often leading to extended development timelines and substantial compliance costs. Product substitutes, while limited in the direct replacement of mechanical circulatory support for end-stage heart failure, can include therapeutic alternatives and advancements in other treatment modalities. End-user trends are increasingly focused on patient-centric solutions, emphasizing portability, reduced invasiveness, and enhanced remote monitoring capabilities. Mergers and acquisitions (M&A) activities are notable, reflecting a consolidation trend aimed at expanding product portfolios, gaining market share, and leveraging synergistic capabilities. For instance, recent years have seen a number of strategic acquisitions by larger medical device companies seeking to bolster their presence in the rapidly growing heart failure devices market. The overall LVAD market share distribution is shifting as new technologies gain traction and established companies adapt to evolving patient needs and competitive pressures.

LVAD Industry Industry Trends & Analysis

The global LVAD market is experiencing robust growth, propelled by a confluence of factors including the increasing prevalence of heart failure, advancements in medical technology, and expanding healthcare infrastructure. The CAGR for the LVAD industry is projected to remain strong throughout the forecast period, reflecting a sustained demand for effective cardiac assist devices. Key market growth drivers include the aging global population, which contributes to a higher incidence of cardiovascular diseases, and the growing recognition of LVADs as a viable alternative to heart transplantation, particularly for patients who are not transplant candidates. Technological disruptions are a significant trend, with ongoing research and development focused on miniaturization, wireless power transfer, and improved biocompatibility to reduce complications and enhance patient comfort. Left Ventricular Assist Device (LVAD) market penetration is steadily increasing in developed nations, and there is significant potential for growth in emerging economies as healthcare access and affordability improve. Consumer preferences are shifting towards less invasive procedures and devices that offer greater mobility and a better quality of life post-implantation. The competitive landscape is characterized by intense innovation, with companies striving to differentiate their offerings through superior device performance, reduced adverse event rates, and comprehensive patient support programs. The demand for ventricular assist devices is directly linked to the burden of heart failure, making it a critical area of focus for the cardiac medical devices market.

Leading Markets & Segments in LVAD Industry

The Left Ventricular Assist Device (LVAD) segment consistently dominates the market for Type of Ventricular Device. This dominance is attributed to the higher incidence of left ventricular dysfunction in advanced heart failure patients and the established efficacy of LVADs in improving survival and quality of life for these individuals.

- Left Ventricular Assist Device (LVAD):

- Dominant Application: Bridge-to-transplant (BTT) therapy remains a primary driver, offering a lifeline for patients awaiting organ donation. However, Destination Therapy (DT) is experiencing significant growth as LVADs become a more accepted long-term treatment option for patients ineligible for transplantation.

- Key Drivers: Technological advancements in pump design leading to smaller, more reliable, and durable devices; increased physician and patient awareness of LVAD benefits; favorable reimbursement policies in key markets like the United States; and a growing shortage of donor hearts for transplantation all contribute to LVAD dominance.

- Biventricular Assist Device (BIVAD):

- Growing Niche: While smaller in market share than LVADs, BIVADs are crucial for patients with severe biventricular failure where both ventricles require support.

- Key Drivers: Advancements in dual-pump technology; expanding indications for severe combined heart failure; and the development of more streamlined implantation procedures.

- Right Ventricular Assist Device (RVAD):

- Specific Indications: RVADs are typically used as a standalone therapy for isolated right heart failure or in conjunction with other therapies.

- Key Drivers: Improved understanding of right heart physiology and failure modes; development of targeted RVAD solutions for specific patient populations.

Geographically, North America, particularly the United States, leads the LVAD market due to its advanced healthcare infrastructure, high adoption rates of innovative medical technologies, and robust reimbursement frameworks for advanced heart failure treatments. Europe follows closely, driven by a similar trend of increasing heart failure prevalence and supportive healthcare policies. The Asia Pacific region presents the most significant growth potential, with expanding healthcare expenditure, a rising incidence of cardiovascular diseases, and a burgeoning demand for sophisticated medical devices. The market for advanced cardiac support is also influenced by economic policies promoting medical device innovation and accessibility, as well as investments in healthcare infrastructure that enable the widespread use of complex life-support technologies.

LVAD Industry Product Developments

Product development in the LVAD industry is characterized by a relentless focus on enhancing patient outcomes and device reliability. Innovations are geared towards developing smaller, more efficient, and less invasive devices, incorporating wireless power transmission and advanced sensing capabilities for better monitoring. Companies are also prioritizing biocompatible materials to minimize thrombus formation and infection risk. The integration of artificial intelligence for predictive analytics and personalized therapy management is an emerging trend, aiming to proactively address potential complications. These advancements are crucial for expanding the applicability of LVADs beyond bridge-to-transplant to destination therapy and other applications, solidifying their position as a cornerstone in the management of advanced heart failure.

Key Drivers of LVAD Industry Growth

The LVAD industry's growth is significantly driven by several interconnected factors. The increasing global burden of heart failure, exacerbated by an aging population and lifestyle-related conditions, creates a substantial unmet medical need. Technological advancements, including the development of smaller, more durable, and less invasive devices, are making LVADs a more attractive and accessible treatment option. Favorable regulatory pathways and increasing reimbursement coverage for both bridge-to-transplant and destination therapy in key markets are crucial economic drivers. Furthermore, the growing body of clinical evidence demonstrating improved patient survival rates and quality of life following LVAD implantation is building confidence among physicians and patients alike. The shortage of donor hearts for transplantation also naturally elevates the importance of LVADs as a life-sustaining therapy.

Challenges in the LVAD Industry Market

Despite its promising growth, the LVAD industry faces several significant challenges. Stringent regulatory approval processes and the need for extensive clinical trials can lead to long development cycles and high costs, acting as a barrier to market entry for newer technologies. The complexity of the implantation surgery and the lifelong management required by patients necessitate specialized healthcare infrastructure and trained personnel, which may not be readily available in all regions. High device costs and associated healthcare expenditures pose a challenge for reimbursement and patient affordability, particularly in emerging economies. Furthermore, the risk of device-related complications such as infection, stroke, and bleeding requires continuous monitoring and management, impacting patient quality of life and increasing healthcare burdens.

Emerging Opportunities in LVAD Industry

The LVAD industry is poised for significant expansion driven by several emerging opportunities. The increasing focus on destination therapy as a long-term solution for heart failure patients ineligible for transplantation represents a major growth avenue. Technological breakthroughs in miniaturization, wireless power, and improved biocompatibility are paving the way for even less invasive devices and enhanced patient mobility. Strategic partnerships between device manufacturers, research institutions, and healthcare providers can accelerate innovation and improve patient access to care. Furthermore, expanding market penetration in emerging economies, where the prevalence of heart failure is rising and healthcare infrastructure is developing, offers substantial long-term growth potential for advanced cardiac support solutions.

Leading Players in the LVAD Industry Sector

- Abiomed Inc

- Calon Cardio

- Terumo Corporation

- SynCardia Systems LLC

- Jarvik Heart Inc

- Medtronic PLC

- Abbott Laboratories (St Jude Medical Inc)

- BiVACOR Inc

- Berlin Heart GmbH

Key Milestones in LVAD Industry Industry

- June 2021: Abbott announced the company has the capacity and supply to effectively support the growing demand for mechanical circulatory support (MCS) devices for the effective treatment of advanced heart failure following Medtronic's decision to stop the global distribution and sale of the Medtronic HeartWare ventricular assist device (HVAD).

- January 2022: The School of Medical Research and Technology (SMRT) of IIT Kanpur launched Hridyantra, a challenge-based program to develop an advanced artificial heart, also called a Left Ventricular Assist Device (LVAD), for patients with end-stage heart failure.

Strategic Outlook for LVAD Industry Market

The strategic outlook for the LVAD industry is overwhelmingly positive, driven by continuous innovation and an increasing demand for advanced cardiac solutions. Future growth will be accelerated by the ongoing development of next-generation devices that offer enhanced patient safety, greater portability, and reduced invasiveness. Expanding the reach of destination therapy and actively pursuing market penetration in underserved regions, particularly in emerging economies, will be key strategic imperatives. Furthermore, fostering collaborations between technology developers, clinicians, and regulatory bodies will streamline the adoption of new advancements and ensure equitable access to life-saving LVAD therapies. The industry is well-positioned to address the growing global burden of heart failure, offering significant future market potential.

LVAD Industry Segmentation

-

1. Type of Ventricular Device

- 1.1. Left Ventricular Assist Device (LVAD)

- 1.2. Right Ventricular Assist Device (RVAD)

- 1.3. Biventricular Assist Device (BIVAD)

-

2. Application

- 2.1. Bridge-to-transplant (BTT) Therapy

- 2.2. Destination Therapy

- 2.3. Other Therapies

LVAD Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

LVAD Industry Regional Market Share

Geographic Coverage of LVAD Industry

LVAD Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Cardiac Diseases and Heart Failure; Technological Advancement of Devices for Cardiac Diseases Management; Growing Initiatives and Awareness Regarding Cardiovascular Diseases

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices and Procedures; Several Risks Associated to VAD Implant

- 3.4. Market Trends

- 3.4.1. Left Ventricular Assist Device (LVAD) is Expected to Hold the Major Share in the Type of Ventricular Device Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LVAD Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 5.1.1. Left Ventricular Assist Device (LVAD)

- 5.1.2. Right Ventricular Assist Device (RVAD)

- 5.1.3. Biventricular Assist Device (BIVAD)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bridge-to-transplant (BTT) Therapy

- 5.2.2. Destination Therapy

- 5.2.3. Other Therapies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East

- 5.3.5. GCC

- 5.3.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 6. North America LVAD Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 6.1.1. Left Ventricular Assist Device (LVAD)

- 6.1.2. Right Ventricular Assist Device (RVAD)

- 6.1.3. Biventricular Assist Device (BIVAD)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bridge-to-transplant (BTT) Therapy

- 6.2.2. Destination Therapy

- 6.2.3. Other Therapies

- 6.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 7. Europe LVAD Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 7.1.1. Left Ventricular Assist Device (LVAD)

- 7.1.2. Right Ventricular Assist Device (RVAD)

- 7.1.3. Biventricular Assist Device (BIVAD)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bridge-to-transplant (BTT) Therapy

- 7.2.2. Destination Therapy

- 7.2.3. Other Therapies

- 7.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 8. Asia Pacific LVAD Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 8.1.1. Left Ventricular Assist Device (LVAD)

- 8.1.2. Right Ventricular Assist Device (RVAD)

- 8.1.3. Biventricular Assist Device (BIVAD)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bridge-to-transplant (BTT) Therapy

- 8.2.2. Destination Therapy

- 8.2.3. Other Therapies

- 8.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 9. Middle East LVAD Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 9.1.1. Left Ventricular Assist Device (LVAD)

- 9.1.2. Right Ventricular Assist Device (RVAD)

- 9.1.3. Biventricular Assist Device (BIVAD)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bridge-to-transplant (BTT) Therapy

- 9.2.2. Destination Therapy

- 9.2.3. Other Therapies

- 9.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 10. GCC LVAD Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 10.1.1. Left Ventricular Assist Device (LVAD)

- 10.1.2. Right Ventricular Assist Device (RVAD)

- 10.1.3. Biventricular Assist Device (BIVAD)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bridge-to-transplant (BTT) Therapy

- 10.2.2. Destination Therapy

- 10.2.3. Other Therapies

- 10.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 11. South America LVAD Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 11.1.1. Left Ventricular Assist Device (LVAD)

- 11.1.2. Right Ventricular Assist Device (RVAD)

- 11.1.3. Biventricular Assist Device (BIVAD)

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Bridge-to-transplant (BTT) Therapy

- 11.2.2. Destination Therapy

- 11.2.3. Other Therapies

- 11.1. Market Analysis, Insights and Forecast - by Type of Ventricular Device

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Abiomed Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Calon Cardio

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Terumo Corporation*List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 SynCardia Systems LLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Jarvik Heart Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Medtronic PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Abbott Laboratories (St Jude Medical Inc )

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 BiVACOR Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Berlin Heart GmbH

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Abiomed Inc

List of Figures

- Figure 1: Global LVAD Industry Revenue Breakdown (Billion, %) by Region 2025 & 2033

- Figure 2: Global LVAD Industry Volume Breakdown (Piece, %) by Region 2025 & 2033

- Figure 3: North America LVAD Industry Revenue (Billion), by Type of Ventricular Device 2025 & 2033

- Figure 4: North America LVAD Industry Volume (Piece), by Type of Ventricular Device 2025 & 2033

- Figure 5: North America LVAD Industry Revenue Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 6: North America LVAD Industry Volume Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 7: North America LVAD Industry Revenue (Billion), by Application 2025 & 2033

- Figure 8: North America LVAD Industry Volume (Piece), by Application 2025 & 2033

- Figure 9: North America LVAD Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America LVAD Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America LVAD Industry Revenue (Billion), by Country 2025 & 2033

- Figure 12: North America LVAD Industry Volume (Piece), by Country 2025 & 2033

- Figure 13: North America LVAD Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America LVAD Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe LVAD Industry Revenue (Billion), by Type of Ventricular Device 2025 & 2033

- Figure 16: Europe LVAD Industry Volume (Piece), by Type of Ventricular Device 2025 & 2033

- Figure 17: Europe LVAD Industry Revenue Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 18: Europe LVAD Industry Volume Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 19: Europe LVAD Industry Revenue (Billion), by Application 2025 & 2033

- Figure 20: Europe LVAD Industry Volume (Piece), by Application 2025 & 2033

- Figure 21: Europe LVAD Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe LVAD Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe LVAD Industry Revenue (Billion), by Country 2025 & 2033

- Figure 24: Europe LVAD Industry Volume (Piece), by Country 2025 & 2033

- Figure 25: Europe LVAD Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe LVAD Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific LVAD Industry Revenue (Billion), by Type of Ventricular Device 2025 & 2033

- Figure 28: Asia Pacific LVAD Industry Volume (Piece), by Type of Ventricular Device 2025 & 2033

- Figure 29: Asia Pacific LVAD Industry Revenue Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 30: Asia Pacific LVAD Industry Volume Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 31: Asia Pacific LVAD Industry Revenue (Billion), by Application 2025 & 2033

- Figure 32: Asia Pacific LVAD Industry Volume (Piece), by Application 2025 & 2033

- Figure 33: Asia Pacific LVAD Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific LVAD Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific LVAD Industry Revenue (Billion), by Country 2025 & 2033

- Figure 36: Asia Pacific LVAD Industry Volume (Piece), by Country 2025 & 2033

- Figure 37: Asia Pacific LVAD Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific LVAD Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East LVAD Industry Revenue (Billion), by Type of Ventricular Device 2025 & 2033

- Figure 40: Middle East LVAD Industry Volume (Piece), by Type of Ventricular Device 2025 & 2033

- Figure 41: Middle East LVAD Industry Revenue Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 42: Middle East LVAD Industry Volume Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 43: Middle East LVAD Industry Revenue (Billion), by Application 2025 & 2033

- Figure 44: Middle East LVAD Industry Volume (Piece), by Application 2025 & 2033

- Figure 45: Middle East LVAD Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East LVAD Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East LVAD Industry Revenue (Billion), by Country 2025 & 2033

- Figure 48: Middle East LVAD Industry Volume (Piece), by Country 2025 & 2033

- Figure 49: Middle East LVAD Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East LVAD Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: GCC LVAD Industry Revenue (Billion), by Type of Ventricular Device 2025 & 2033

- Figure 52: GCC LVAD Industry Volume (Piece), by Type of Ventricular Device 2025 & 2033

- Figure 53: GCC LVAD Industry Revenue Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 54: GCC LVAD Industry Volume Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 55: GCC LVAD Industry Revenue (Billion), by Application 2025 & 2033

- Figure 56: GCC LVAD Industry Volume (Piece), by Application 2025 & 2033

- Figure 57: GCC LVAD Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: GCC LVAD Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: GCC LVAD Industry Revenue (Billion), by Country 2025 & 2033

- Figure 60: GCC LVAD Industry Volume (Piece), by Country 2025 & 2033

- Figure 61: GCC LVAD Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: GCC LVAD Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: South America LVAD Industry Revenue (Billion), by Type of Ventricular Device 2025 & 2033

- Figure 64: South America LVAD Industry Volume (Piece), by Type of Ventricular Device 2025 & 2033

- Figure 65: South America LVAD Industry Revenue Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 66: South America LVAD Industry Volume Share (%), by Type of Ventricular Device 2025 & 2033

- Figure 67: South America LVAD Industry Revenue (Billion), by Application 2025 & 2033

- Figure 68: South America LVAD Industry Volume (Piece), by Application 2025 & 2033

- Figure 69: South America LVAD Industry Revenue Share (%), by Application 2025 & 2033

- Figure 70: South America LVAD Industry Volume Share (%), by Application 2025 & 2033

- Figure 71: South America LVAD Industry Revenue (Billion), by Country 2025 & 2033

- Figure 72: South America LVAD Industry Volume (Piece), by Country 2025 & 2033

- Figure 73: South America LVAD Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: South America LVAD Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LVAD Industry Revenue Billion Forecast, by Type of Ventricular Device 2020 & 2033

- Table 2: Global LVAD Industry Volume Piece Forecast, by Type of Ventricular Device 2020 & 2033

- Table 3: Global LVAD Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 4: Global LVAD Industry Volume Piece Forecast, by Application 2020 & 2033

- Table 5: Global LVAD Industry Revenue Billion Forecast, by Region 2020 & 2033

- Table 6: Global LVAD Industry Volume Piece Forecast, by Region 2020 & 2033

- Table 7: Global LVAD Industry Revenue Billion Forecast, by Type of Ventricular Device 2020 & 2033

- Table 8: Global LVAD Industry Volume Piece Forecast, by Type of Ventricular Device 2020 & 2033

- Table 9: Global LVAD Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 10: Global LVAD Industry Volume Piece Forecast, by Application 2020 & 2033

- Table 11: Global LVAD Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 12: Global LVAD Industry Volume Piece Forecast, by Country 2020 & 2033

- Table 13: United States LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 14: United States LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 15: Canada LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 16: Canada LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 17: Mexico LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 19: Global LVAD Industry Revenue Billion Forecast, by Type of Ventricular Device 2020 & 2033

- Table 20: Global LVAD Industry Volume Piece Forecast, by Type of Ventricular Device 2020 & 2033

- Table 21: Global LVAD Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 22: Global LVAD Industry Volume Piece Forecast, by Application 2020 & 2033

- Table 23: Global LVAD Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 24: Global LVAD Industry Volume Piece Forecast, by Country 2020 & 2033

- Table 25: Germany LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 26: Germany LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 29: France LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 30: France LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 31: Italy LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 32: Italy LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 33: Spain LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 34: Spain LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 37: Global LVAD Industry Revenue Billion Forecast, by Type of Ventricular Device 2020 & 2033

- Table 38: Global LVAD Industry Volume Piece Forecast, by Type of Ventricular Device 2020 & 2033

- Table 39: Global LVAD Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 40: Global LVAD Industry Volume Piece Forecast, by Application 2020 & 2033

- Table 41: Global LVAD Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 42: Global LVAD Industry Volume Piece Forecast, by Country 2020 & 2033

- Table 43: China LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 44: China LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 45: Japan LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 46: Japan LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 47: India LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 48: India LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 49: Australia LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 50: Australia LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 51: South Korea LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 55: Global LVAD Industry Revenue Billion Forecast, by Type of Ventricular Device 2020 & 2033

- Table 56: Global LVAD Industry Volume Piece Forecast, by Type of Ventricular Device 2020 & 2033

- Table 57: Global LVAD Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 58: Global LVAD Industry Volume Piece Forecast, by Application 2020 & 2033

- Table 59: Global LVAD Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 60: Global LVAD Industry Volume Piece Forecast, by Country 2020 & 2033

- Table 61: Global LVAD Industry Revenue Billion Forecast, by Type of Ventricular Device 2020 & 2033

- Table 62: Global LVAD Industry Volume Piece Forecast, by Type of Ventricular Device 2020 & 2033

- Table 63: Global LVAD Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 64: Global LVAD Industry Volume Piece Forecast, by Application 2020 & 2033

- Table 65: Global LVAD Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 66: Global LVAD Industry Volume Piece Forecast, by Country 2020 & 2033

- Table 67: South Africa LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 68: South Africa LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 69: Rest of Middle East LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 70: Rest of Middle East LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 71: Global LVAD Industry Revenue Billion Forecast, by Type of Ventricular Device 2020 & 2033

- Table 72: Global LVAD Industry Volume Piece Forecast, by Type of Ventricular Device 2020 & 2033

- Table 73: Global LVAD Industry Revenue Billion Forecast, by Application 2020 & 2033

- Table 74: Global LVAD Industry Volume Piece Forecast, by Application 2020 & 2033

- Table 75: Global LVAD Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 76: Global LVAD Industry Volume Piece Forecast, by Country 2020 & 2033

- Table 77: Brazil LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 78: Brazil LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 79: Argentina LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 80: Argentina LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

- Table 81: Rest of South America LVAD Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 82: Rest of South America LVAD Industry Volume (Piece) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LVAD Industry?

The projected CAGR is approximately 7.23%.

2. Which companies are prominent players in the LVAD Industry?

Key companies in the market include Abiomed Inc, Calon Cardio, Terumo Corporation*List Not Exhaustive, SynCardia Systems LLC, Jarvik Heart Inc, Medtronic PLC, Abbott Laboratories (St Jude Medical Inc ), BiVACOR Inc, Berlin Heart GmbH.

3. What are the main segments of the LVAD Industry?

The market segments include Type of Ventricular Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 Billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Cardiac Diseases and Heart Failure; Technological Advancement of Devices for Cardiac Diseases Management; Growing Initiatives and Awareness Regarding Cardiovascular Diseases.

6. What are the notable trends driving market growth?

Left Ventricular Assist Device (LVAD) is Expected to Hold the Major Share in the Type of Ventricular Device Segment.

7. Are there any restraints impacting market growth?

High Cost of Devices and Procedures; Several Risks Associated to VAD Implant.

8. Can you provide examples of recent developments in the market?

In January 2022, the School of Medical Research and Technology (SMRT) of IIT Kanpur has launched Hridyantra, a challenge-based program to develop an advanced artificial heart also called Left Ventricular Assist device (LVAD) for patients with end-stage heart failure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in Piece.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LVAD Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LVAD Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LVAD Industry?

To stay informed about further developments, trends, and reports in the LVAD Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence