Key Insights

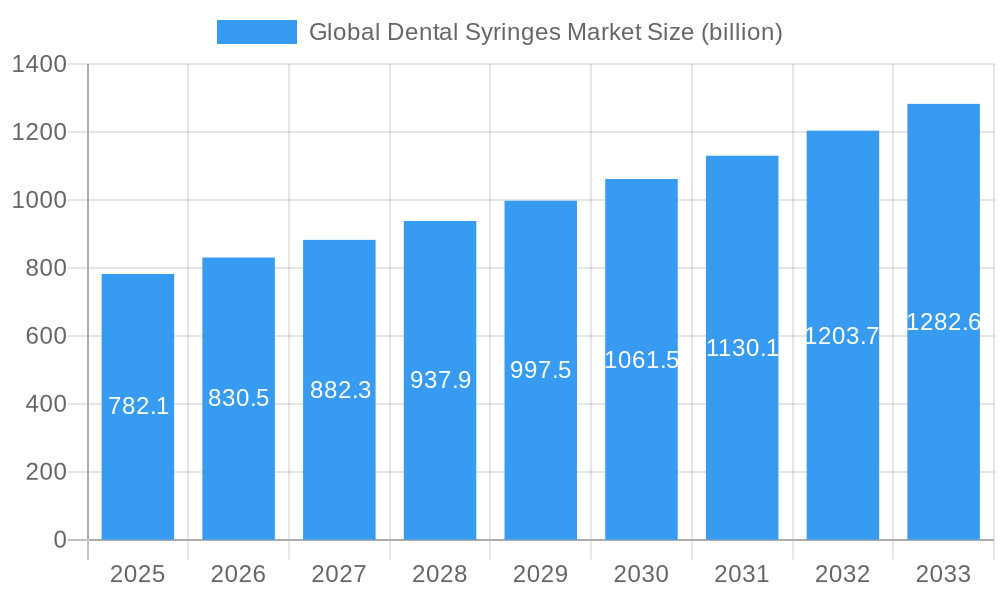

The global dental syringes market is poised for robust expansion, projected to reach USD 782.1 million in 2025 and grow at a compound annual growth rate (CAGR) of 6.1% through 2033. This sustained growth is propelled by several significant drivers. The increasing prevalence of dental caries and periodontal diseases worldwide, coupled with a rising global population, directly fuels demand for dental procedures and the essential tools they require, including syringes. Furthermore, advancements in dental technology, leading to the development of more sophisticated and user-friendly dental syringes, are also contributing to market expansion. The growing emphasis on preventive dental care and the increasing adoption of aesthetic dental treatments are further bolstering the market. The market is segmented by product into Reusable Dental Syringes, Disposable Dental Syringes, and Other Products. By type, it is divided into Aspirating Dental Syringes and Non-aspirating Dental Syringes. Material-wise, the market encompasses Metallic Dental Syringes and Plastic Dental Syringes. These segments reflect the diverse needs of dental professionals and patients.

Global Dental Syringes Market Market Size (In Million)

Key trends shaping the dental syringes market include a significant shift towards disposable dental syringes due to enhanced hygiene and reduced cross-contamination risks, which aligns with global healthcare standards. The development of ergonomic designs and advanced materials for both reusable and disposable syringes is also a notable trend, improving practitioner comfort and patient experience. While the market is experiencing strong growth, certain restraints exist. The high initial investment required for advanced dental equipment, including specialized syringe systems, can pose a barrier for smaller dental practices. Moreover, stringent regulatory frameworks governing medical devices necessitate significant compliance efforts, potentially increasing operational costs for manufacturers. Despite these challenges, the overarching positive outlook is supported by increasing dental healthcare expenditure, particularly in emerging economies, and a growing awareness among the public regarding oral hygiene and the importance of regular dental check-ups.

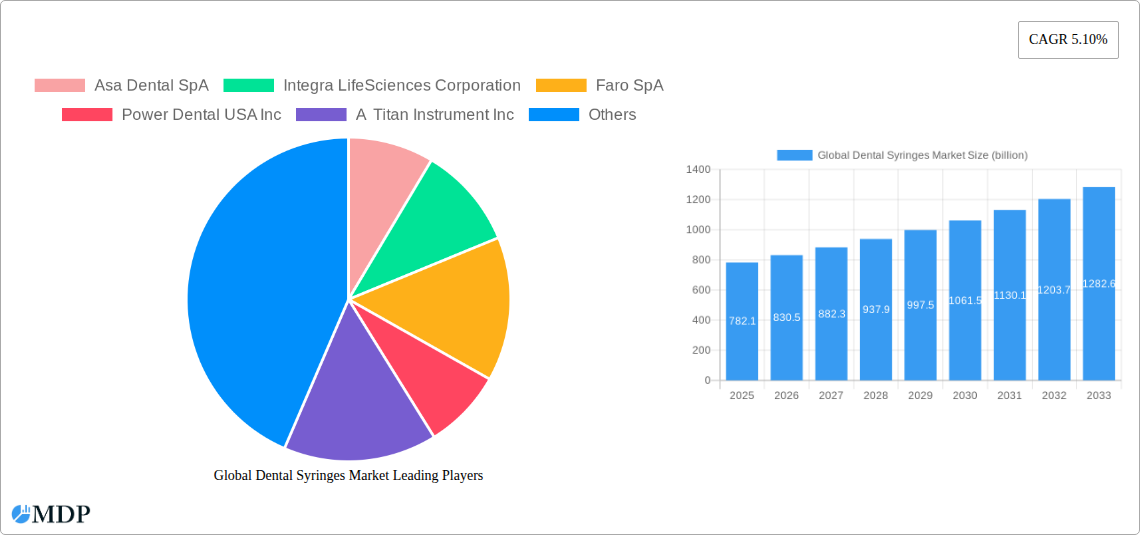

Global Dental Syringes Market Company Market Share

Global Dental Syringes Market: Comprehensive Analysis and Growth Forecast (2019-2033)

This report offers an in-depth analysis of the global dental syringes market, providing critical insights into market dynamics, trends, leading players, and future opportunities. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025, this study is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving dental supplies landscape. Our analysis delves into product types (reusable, disposable), syringe types (aspirating, non-aspirating), and material compositions (metallic, plastic), with a focus on high-growth segments and regions.

Global Dental Syringes Market Market Dynamics & Concentration

The global dental syringes market exhibits a moderately concentrated landscape, characterized by the presence of established global manufacturers and emerging regional players. Innovation drivers are primarily fueled by the demand for enhanced patient safety, improved procedural efficiency, and cost-effectiveness. The continuous evolution of dental materials and techniques necessitates advanced syringe designs, driving research and development in areas such as ergonomic handling and precision dispensing. Regulatory frameworks, including those governed by the FDA and EMA, play a crucial role in dictating product standards, sterilization protocols, and material biocompatibility, influencing market entry and competitive strategies. Product substitutes, while limited in the core functionality of local anesthetic delivery, exist in alternative pain management techniques and advanced restorative materials that might reduce the frequency of such procedures. End-user trends are increasingly leaning towards minimally invasive procedures and enhanced patient comfort, favoring disposable syringes for their sterility and single-use benefits. Mergers and acquisitions (M&A) activities, although not highly prevalent, serve as strategic moves for companies to expand their product portfolios, gain market share, and consolidate their positions. For instance, recent M&A activities, estimated at 3-5 significant deals annually, underscore this consolidation trend. Market share distribution indicates that disposable dental syringes hold a dominant share, estimated at over 65% of the total market value.

Global Dental Syringes Market Industry Trends & Analysis

The global dental syringes market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% between 2025 and 2033. This upward trajectory is primarily propelled by a confluence of factors, including the escalating global prevalence of dental caries and periodontal diseases, a growing demand for cosmetic dentistry procedures, and increasing oral health awareness worldwide. Technological disruptions are playing a pivotal role, with advancements in material science leading to the development of lighter, more durable, and biocompatible plastic syringes, which are gradually supplanting traditional metallic counterparts in certain applications. The integration of RFID technology for inventory management and counterfeit prevention, as exemplified by IMI's Prep-Lock Tamper Evident Cap, represents a significant technological leap, enhancing supply chain security and product traceability. Furthermore, the shift towards digital dentistry and the increasing adoption of advanced dental equipment are indirectly influencing the demand for specialized and high-precision dental syringes. Consumer preferences are evolving towards safer, more convenient, and aesthetically pleasing dental treatments. This translates into a preference for disposable syringes due to their inherent sterility, reducing the risk of cross-contamination and aligning with stringent infection control protocols. The rising disposable incomes in emerging economies are also contributing to increased access to advanced dental care, thereby fueling market expansion. Competitive dynamics are characterized by a blend of global giants and agile niche players, each vying for market share through product innovation, strategic pricing, and extensive distribution networks. The launch of cost-effective needle and syringe supplies, such as MediDent supplies by No Borders, Inc., highlights the market's responsiveness to demand for accessible and affordable dental consumables. Market penetration of advanced syringe technologies is estimated to reach 70% by 2030, driven by these evolving trends and innovations.

Leading Markets & Segments in Global Dental Syringes Market

The global dental syringes market is segmented by product, type, and material, each exhibiting distinct growth patterns and regional dominance.

Product Segmentation:

- Disposable Dental Syringes: This segment currently dominates the market, accounting for an estimated 68% of the market share by revenue. The primary drivers for this dominance include their superior sterility, convenience for single-use applications, and the increasing emphasis on infection control in dental practices worldwide. The growing number of dental clinics and a rise in routine dental procedures, such as fillings and extractions, further bolster demand for disposable options.

- Reusable Dental Syringes: While a smaller segment, reusable syringes retain a significant presence, particularly in specific applications and regions where cost-effectiveness and a focus on sustainability are paramount. Their market share is estimated to be around 30%.

- Other Products: This niche segment, comprising specialized syringes for orthodontics, endodontics, or specific drug delivery, holds a smaller but growing market share, driven by targeted innovations.

Type Segmentation:

- Aspirating Dental Syringes: These syringes, crucial for precise anesthetic delivery and minimizing intravascular injections, represent a significant portion of the market, estimated at 55% of the total market value. Their advanced functionality and safety features make them indispensable for many dental procedures.

- Non-aspirating Dental Syringes: These syringes are widely used for irrigation, medication delivery, and less critical injections, holding an estimated 45% market share.

Material Segmentation:

- Plastic Dental Syringes: This segment is experiencing the most rapid growth, projected to capture over 60% of the market share by 2030. The shift towards plastic is driven by their lightweight nature, reduced manufacturing costs, improved biodegradability (in some cases), and enhanced safety features, such as integrated needle-stick prevention mechanisms.

- Metallic Dental Syringes: While historically dominant, metallic syringes, typically made of stainless steel or aluminum, now represent a smaller but still substantial segment, estimated at 40%. They are valued for their durability and reusability in certain settings.

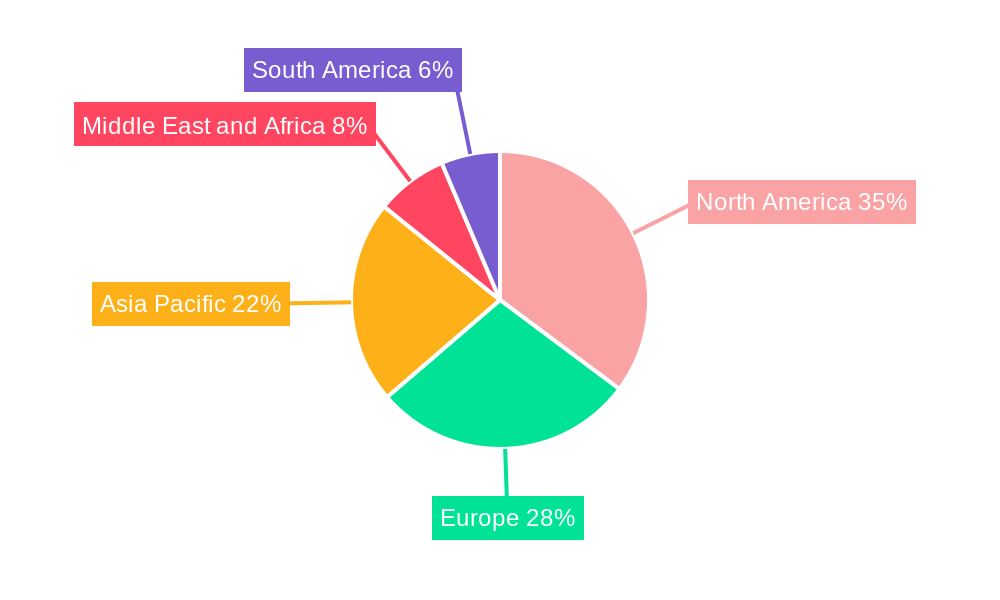

Regional Dominance: North America and Europe currently lead the global dental syringes market, driven by high dental healthcare expenditure, advanced technological adoption, and stringent regulatory environments that promote the use of safe and effective dental products. Emerging economies in the Asia Pacific region are exhibiting the fastest growth rates due to increasing oral health awareness, expanding dental tourism, and a growing number of dental practitioners. Economic policies supporting healthcare infrastructure development and government initiatives promoting dental health are key drivers in these rapidly expanding markets.

Global Dental Syringes Market Product Developments

Product developments in the global dental syringes market are characterized by a focus on enhancing user experience, patient safety, and procedural efficiency. Innovations include the introduction of syringes with improved ergonomic designs for enhanced grip and control, reducing practitioner fatigue during prolonged procedures. Advanced materials, such as high-grade plastics and biocompatible composites, are being utilized to create lighter, more durable, and cost-effective options. The integration of precision dispensing mechanisms and advanced needle-locking systems aims to minimize the risk of accidental needle-stick injuries and ensure accurate medication delivery. Furthermore, the incorporation of tamper-evident features and RFID technology, as seen with IMI's Prep-Lock Cap, is significantly improving product security and traceability within the supply chain, offering a competitive advantage to manufacturers leading these advancements.

Key Drivers of Global Dental Syringes Market Growth

The growth of the global dental syringes market is propelled by several key drivers. Firstly, the escalating global burden of dental diseases, including cavities, gum disease, and tooth loss, necessitates regular dental interventions, thereby increasing the demand for dental syringes. Secondly, the burgeoning cosmetic dentistry sector, with procedures like teeth whitening and veneers on the rise, also contributes to the demand for specialized dental syringes for anesthetic delivery and restorative material application. Thirdly, increasing oral health awareness and a growing emphasis on preventive dental care, particularly in developing economies, are leading to higher patient engagement with dental services. Technological advancements, leading to safer, more user-friendly, and cost-effective syringe designs, are also a significant growth accelerator. The continuous development of new dental materials and restorative techniques further fuels the need for innovative syringe solutions.

Challenges in the Global Dental Syringes Market Market

Despite the positive growth outlook, the global dental syringes market faces several challenges. Strict regulatory hurdles and the need for stringent quality control across different regions can increase manufacturing costs and slow down product launches. The pricing pressure from market competition, especially for disposable syringes, can impact profit margins for manufacturers. Moreover, the availability of counterfeit products in some markets poses a significant threat to both patient safety and the reputation of legitimate manufacturers. Supply chain disruptions, as witnessed during global health crises, can affect the availability of raw materials and finished goods, leading to potential shortages and price volatility. The gradual shift towards advanced digital dentistry and alternative pain management techniques might also present long-term challenges for traditional syringe manufacturers if they fail to innovate and adapt.

Emerging Opportunities in Global Dental Syringes Market

Several emerging opportunities are set to drive long-term growth in the global dental syringes market. The increasing demand for minimally invasive dental procedures presents an opportunity for specialized syringes designed for precision and targeted drug delivery. The growing adoption of teledentistry and remote patient monitoring could also open avenues for innovative syringe solutions facilitating at-home medication delivery or sample collection. Strategic partnerships between syringe manufacturers and dental technology companies can lead to the development of integrated solutions, such as smart syringes that provide real-time feedback on injection depth or volume. Furthermore, the untapped potential in emerging economies, with their rapidly growing middle class and increasing healthcare expenditure, offers significant market expansion opportunities for both standard and advanced dental syringe products. The increasing focus on eco-friendly materials and sustainable manufacturing practices also presents an opportunity for companies to develop and market greener alternatives.

Leading Players in the Global Dental Syringes Market Sector

- Asa Dental SpA

- Integra LifeSciences Corporation

- Faro SpA

- Power Dental USA Inc

- A Titan Instrument Inc

- Septodont

- Ultradent Products

- Dentsply Sirona

- Carl Martin GmbH

- Anthogyr SAS

- 3M Company

- Vista Dental Products

- Delmarks Surgico

- Diadent Group International

- Accesia

Key Milestones in Global Dental Syringes Market Industry

- March 2022: IMI (International Medical Industries, Inc.) bolsters expertise in secure drug delivery products with the release of the new Prep-Lock Tamper Evident Cap for ENFit and Oral Syringes with incorporated Radio Frequency Identification (RFID) technology, enhancing product security and traceability.

- February 2021: No Borders, Inc. launched of MediDent supplies needles and syringes, with millions of needles and syringes delivered to clients across the United States, addressing the demand for accessible and affordable dental consumables.

Strategic Outlook for Global Dental Syringes Market Market

The strategic outlook for the global dental syringes market is one of sustained growth and continuous innovation. Key growth accelerators include the increasing penetration of disposable syringes, driven by heightened hygiene standards, and the adoption of advanced plastic materials for enhanced safety and cost-effectiveness. Manufacturers are expected to focus on product differentiation through features like ergonomic design, improved needle-stick prevention, and integrated functionalities. Strategic partnerships with dental practitioners and research institutions will be crucial for understanding evolving clinical needs and developing tailored solutions. Expansion into emerging markets, coupled with a commitment to sustainability and the development of environmentally friendly products, will also be vital for long-term success. The market's future hinges on embracing technological advancements, such as smart syringe technology and RFID integration, to enhance efficiency, security, and patient outcomes, thereby securing a competitive edge.

Global Dental Syringes Market Segmentation

-

1. Product

- 1.1. Reusable Dental Syringes

- 1.2. Disposable Dental Syringes

- 1.3. Other Products

-

2. Type

- 2.1. Aspirating Dental Syringes

- 2.2. Non-aspirating Dental Syringes

-

3. Material

- 3.1. Metallic Dental Syringes

- 3.2. Plastic Dental Syringes

Global Dental Syringes Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Dental Syringes Market Regional Market Share

Geographic Coverage of Global Dental Syringes Market

Global Dental Syringes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Innovations in syringe technology

- 3.2.2 such as the development of self-aspirating syringes

- 3.2.3 disposable syringes

- 3.2.4 and safety-engineered syringes

- 3.2.5 are enhancing the efficiency and safety of dental procedures

- 3.3. Market Restrains

- 3.3.1 The development of alternative methods for pain management

- 3.3.2 such as computer-controlled local anesthesia delivery systems

- 3.3.3 may pose challenges for traditional dental syringes

- 3.4. Market Trends

- 3.4.1 The dental industry is becoming more focused on sustainability

- 3.4.2 prompting manufacturers to develop eco-friendly syringes and packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Syringes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Reusable Dental Syringes

- 5.1.2. Disposable Dental Syringes

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Aspirating Dental Syringes

- 5.2.2. Non-aspirating Dental Syringes

- 5.3. Market Analysis, Insights and Forecast - by Material

- 5.3.1. Metallic Dental Syringes

- 5.3.2. Plastic Dental Syringes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Global Dental Syringes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Reusable Dental Syringes

- 6.1.2. Disposable Dental Syringes

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Aspirating Dental Syringes

- 6.2.2. Non-aspirating Dental Syringes

- 6.3. Market Analysis, Insights and Forecast - by Material

- 6.3.1. Metallic Dental Syringes

- 6.3.2. Plastic Dental Syringes

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Global Dental Syringes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Reusable Dental Syringes

- 7.1.2. Disposable Dental Syringes

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Aspirating Dental Syringes

- 7.2.2. Non-aspirating Dental Syringes

- 7.3. Market Analysis, Insights and Forecast - by Material

- 7.3.1. Metallic Dental Syringes

- 7.3.2. Plastic Dental Syringes

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Global Dental Syringes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Reusable Dental Syringes

- 8.1.2. Disposable Dental Syringes

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Aspirating Dental Syringes

- 8.2.2. Non-aspirating Dental Syringes

- 8.3. Market Analysis, Insights and Forecast - by Material

- 8.3.1. Metallic Dental Syringes

- 8.3.2. Plastic Dental Syringes

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Global Dental Syringes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Reusable Dental Syringes

- 9.1.2. Disposable Dental Syringes

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Aspirating Dental Syringes

- 9.2.2. Non-aspirating Dental Syringes

- 9.3. Market Analysis, Insights and Forecast - by Material

- 9.3.1. Metallic Dental Syringes

- 9.3.2. Plastic Dental Syringes

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Global Dental Syringes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Reusable Dental Syringes

- 10.1.2. Disposable Dental Syringes

- 10.1.3. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Aspirating Dental Syringes

- 10.2.2. Non-aspirating Dental Syringes

- 10.3. Market Analysis, Insights and Forecast - by Material

- 10.3.1. Metallic Dental Syringes

- 10.3.2. Plastic Dental Syringes

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Asa Dental SpA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Integra LifeSciences Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Faro SpA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Power Dental USA Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 A Titan Instrument Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Septodont

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ultradent Products

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dentsply Sirona

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Carl Martin GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Anthogyr SAS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 3M Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vista Dental Products

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Delmarks Surgico

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Diadent Group International

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Accesia

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Asa Dental SpA

List of Figures

- Figure 1: Global Global Dental Syringes Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Dental Syringes Market Revenue (undefined), by Product 2025 & 2033

- Figure 3: North America Global Dental Syringes Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Global Dental Syringes Market Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Global Dental Syringes Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Global Dental Syringes Market Revenue (undefined), by Material 2025 & 2033

- Figure 7: North America Global Dental Syringes Market Revenue Share (%), by Material 2025 & 2033

- Figure 8: North America Global Dental Syringes Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Global Dental Syringes Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Dental Syringes Market Revenue (undefined), by Product 2025 & 2033

- Figure 11: Europe Global Dental Syringes Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Global Dental Syringes Market Revenue (undefined), by Type 2025 & 2033

- Figure 13: Europe Global Dental Syringes Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Global Dental Syringes Market Revenue (undefined), by Material 2025 & 2033

- Figure 15: Europe Global Dental Syringes Market Revenue Share (%), by Material 2025 & 2033

- Figure 16: Europe Global Dental Syringes Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Global Dental Syringes Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Dental Syringes Market Revenue (undefined), by Product 2025 & 2033

- Figure 19: Asia Pacific Global Dental Syringes Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Global Dental Syringes Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Asia Pacific Global Dental Syringes Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Global Dental Syringes Market Revenue (undefined), by Material 2025 & 2033

- Figure 23: Asia Pacific Global Dental Syringes Market Revenue Share (%), by Material 2025 & 2033

- Figure 24: Asia Pacific Global Dental Syringes Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Dental Syringes Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Global Dental Syringes Market Revenue (undefined), by Product 2025 & 2033

- Figure 27: Middle East and Africa Global Dental Syringes Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Global Dental Syringes Market Revenue (undefined), by Type 2025 & 2033

- Figure 29: Middle East and Africa Global Dental Syringes Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East and Africa Global Dental Syringes Market Revenue (undefined), by Material 2025 & 2033

- Figure 31: Middle East and Africa Global Dental Syringes Market Revenue Share (%), by Material 2025 & 2033

- Figure 32: Middle East and Africa Global Dental Syringes Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Global Dental Syringes Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Dental Syringes Market Revenue (undefined), by Product 2025 & 2033

- Figure 35: South America Global Dental Syringes Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: South America Global Dental Syringes Market Revenue (undefined), by Type 2025 & 2033

- Figure 37: South America Global Dental Syringes Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: South America Global Dental Syringes Market Revenue (undefined), by Material 2025 & 2033

- Figure 39: South America Global Dental Syringes Market Revenue Share (%), by Material 2025 & 2033

- Figure 40: South America Global Dental Syringes Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Global Dental Syringes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dental Syringes Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Dental Syringes Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Dental Syringes Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 4: Global Dental Syringes Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Dental Syringes Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 6: Global Dental Syringes Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Global Dental Syringes Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 8: Global Dental Syringes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Dental Syringes Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 13: Global Dental Syringes Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Dental Syringes Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 15: Global Dental Syringes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Dental Syringes Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 23: Global Dental Syringes Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 24: Global Dental Syringes Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 25: Global Dental Syringes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Dental Syringes Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 33: Global Dental Syringes Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global Dental Syringes Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 35: Global Dental Syringes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Dental Syringes Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 40: Global Dental Syringes Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 41: Global Dental Syringes Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 42: Global Dental Syringes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Global Dental Syringes Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Dental Syringes Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Global Dental Syringes Market?

Key companies in the market include Asa Dental SpA, Integra LifeSciences Corporation, Faro SpA, Power Dental USA Inc, A Titan Instrument Inc, Septodont, Ultradent Products, Dentsply Sirona, Carl Martin GmbH, Anthogyr SAS, 3M Company, Vista Dental Products, Delmarks Surgico, Diadent Group International, Accesia.

3. What are the main segments of the Global Dental Syringes Market?

The market segments include Product, Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Innovations in syringe technology. such as the development of self-aspirating syringes. disposable syringes. and safety-engineered syringes. are enhancing the efficiency and safety of dental procedures.

6. What are the notable trends driving market growth?

The dental industry is becoming more focused on sustainability. prompting manufacturers to develop eco-friendly syringes and packaging.

7. Are there any restraints impacting market growth?

The development of alternative methods for pain management. such as computer-controlled local anesthesia delivery systems. may pose challenges for traditional dental syringes.

8. Can you provide examples of recent developments in the market?

In March 2022, IMI (International Medical Industries, Inc.) bolsters expertise in secure drug delivery products with the release of the new Prep-Lock Tamper Evident Cap for ENFit and Oral Syringes with incorporated Radio Frequency Identification (RFID) technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Dental Syringes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Dental Syringes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Dental Syringes Market?

To stay informed about further developments, trends, and reports in the Global Dental Syringes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence