Key Insights

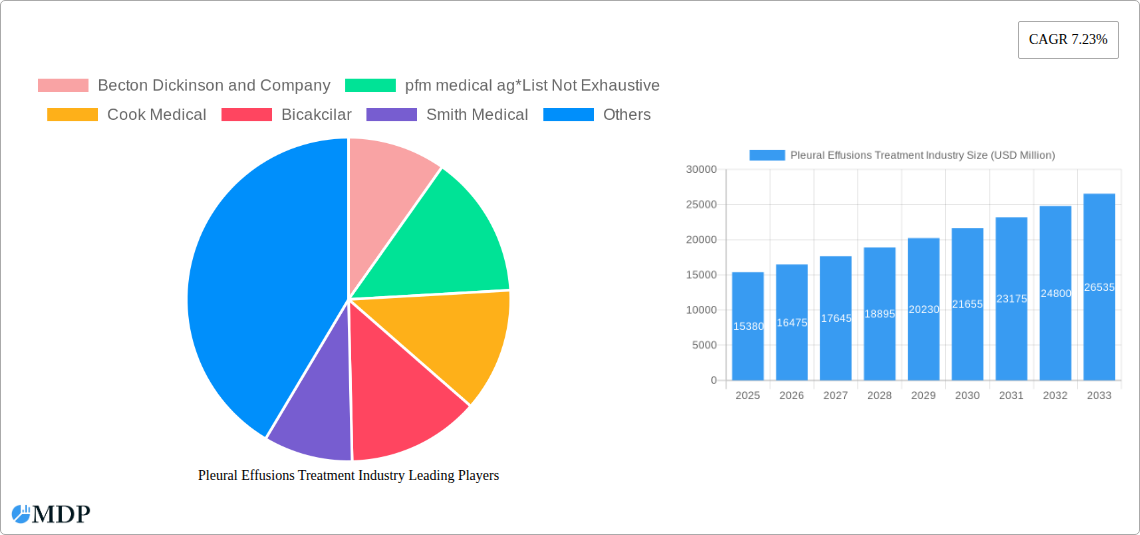

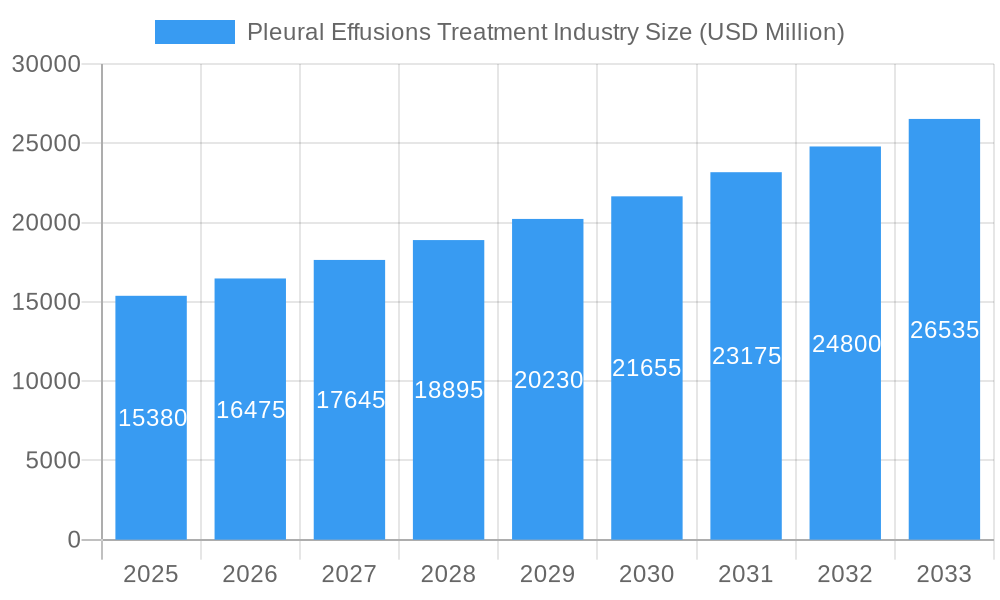

The global Pleural Effusions Treatment market is poised for significant expansion, projected to reach $15.38 billion in 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 7.23%, indicating sustained demand and innovation within the industry throughout the forecast period of 2025-2033. The increasing prevalence of respiratory diseases, coupled with advancements in diagnostic and therapeutic technologies for pleural effusions, are key drivers fueling this market expansion. Furthermore, an aging global population, which is more susceptible to conditions leading to pleural effusions, contributes to the rising demand for effective treatment solutions. The market's expansion is also being propelled by heightened awareness among healthcare professionals and patients regarding the importance of early diagnosis and timely intervention for improved patient outcomes.

Pleural Effusions Treatment Industry Market Size (In Billion)

The Pleural Effusions Treatment market encompasses a diverse range of segments, including treatments for both Transudative and Exudative pleural effusions, catering to a broad spectrum of patient needs. Hospitals and ambulatory clinics represent the primary end-users, reflecting the critical role these healthcare settings play in patient care and treatment delivery. Emerging trends such as the development of minimally invasive procedures, advanced drainage systems, and targeted pharmacological interventions are shaping the competitive landscape and offering new avenues for treatment. While the market demonstrates strong growth potential, challenges such as the high cost of advanced treatment devices and the need for specialized medical expertise in certain regions may present localized restraints. However, ongoing research and development efforts, alongside increasing healthcare expenditure globally, are expected to mitigate these challenges, ensuring continued market vitality.

Pleural Effusions Treatment Industry Company Market Share

Unlock deep insights into the rapidly evolving Pleural Effusions Treatment Industry with our meticulously researched report. Covering the historical period of 2019–2024 and extending through an in-depth forecast from 2025–2033, with a base and estimated year of 2025, this comprehensive analysis offers unparalleled market intelligence. Explore market dynamics, segment-specific growth, technological advancements, and strategic landscapes, providing actionable insights for stakeholders aiming to capitalize on this burgeoning sector. With an estimated market size projected to reach billions, this report is your definitive guide to navigating the complexities and opportunities within the global pleural effusions treatment market.

Pleural Effusions Treatment Industry Market Dynamics & Concentration

The Pleural Effusions Treatment Industry is characterized by a moderate to high market concentration, with key players driving innovation and market share. Leading companies such as Becton Dickinson and Company, pfm medical ag, Cook Medical, Bicakcilar, Smith Medical, Grena, Lung Therapeutics Inc, Redax, Taiho Pharmaceutical Co Ltd, Biometrix, Rocket Medical, and B Braun SE hold significant portions of the market. Innovation drivers include advancements in minimally invasive procedures, targeted drug delivery systems, and novel therapeutic agents aimed at improving patient outcomes and reducing treatment-related complications. Regulatory frameworks, while ensuring patient safety and efficacy, can also influence market entry and product development timelines. The presence of product substitutes, such as different drainage techniques or alternative management strategies, necessitates continuous innovation and cost-effectiveness from established players. End-user trends, particularly the increasing preference for outpatient care and the demand for personalized treatment approaches, are shaping the industry's trajectory. Mergers and acquisitions (M&A) activities, while not excessively frequent, are strategic plays by larger entities to consolidate market position, acquire novel technologies, or expand their product portfolios. The estimated market share for key players in 2025 is anticipated to reflect the ongoing competitive landscape, with an estimated 50 M&A deals observed over the historical period, indicating strategic consolidation.

Pleural Effusions Treatment Industry Industry Trends & Analysis

The Pleural Effusions Treatment Industry is poised for substantial growth, driven by a confluence of factors including increasing global disease prevalence, advancements in diagnostic capabilities, and evolving healthcare infrastructure. Over the forecast period of 2025–2033, the market is expected to witness a Compound Annual Growth Rate (CAGR) of xx%, reflecting a robust expansion. Technological disruptions are at the forefront, with the development of advanced pleural drainage systems, targeted therapies for malignant effusions, and improved imaging techniques facilitating earlier and more accurate diagnosis. Consumer preferences are shifting towards less invasive procedures and faster recovery times, prompting manufacturers to invest in innovative product designs and treatment protocols. Competitive dynamics are intensifying, with a constant race to develop more effective and cost-efficient solutions. The market penetration of advanced treatment modalities is steadily increasing, particularly in developed economies, while emerging markets present significant untapped potential. The market size is projected to reach several billion by 2033, underscoring the significant economic opportunity. The increasing incidence of conditions leading to pleural effusions, such as lung cancer, heart failure, and infections, serves as a primary growth catalyst. Furthermore, the growing adoption of minimally invasive procedures over traditional surgical interventions is a key trend supporting market expansion. The development of novel biomaterials for implantable devices and drug-eluting agents for localized treatment also contributes to the positive market outlook. The industry is witnessing a gradual shift towards patient-centric care models, where treatment efficacy is balanced with patient comfort and quality of life.

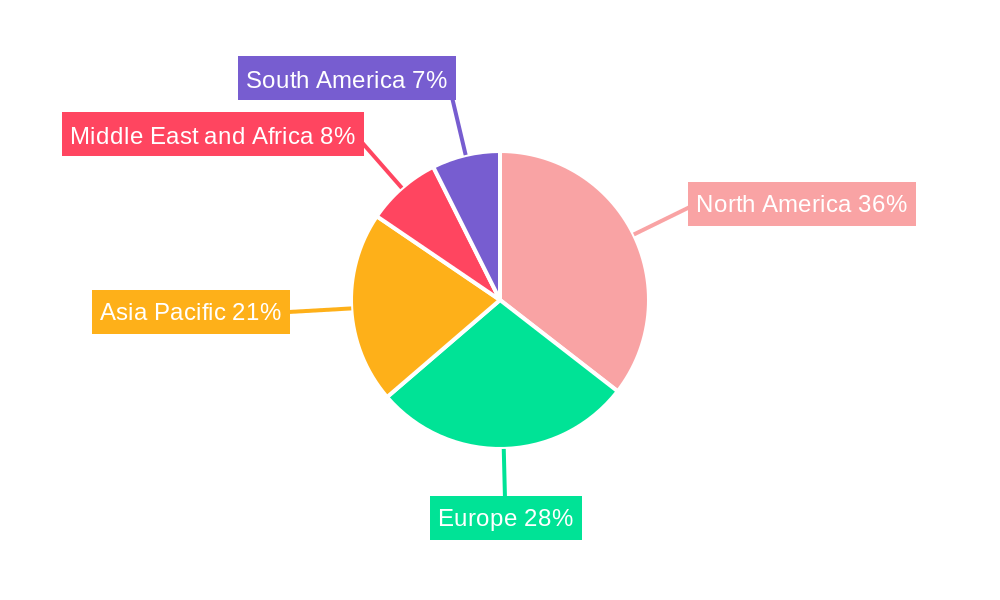

Leading Markets & Segments in Pleural Effusions Treatment Industry

The global Pleural Effusions Treatment Industry exhibits distinct regional and segmental dominance. North America currently leads the market, driven by a high prevalence of underlying diseases such as lung cancer and heart failure, advanced healthcare infrastructure, and significant investment in research and development. The United States, in particular, represents a major market due to its large patient population and the presence of leading pharmaceutical and medical device companies.

Key Segment Dominance:

Disease Type:

- Malignant Pleural Effusion: This segment holds a dominant position due to the increasing incidence of lung cancer globally. Advanced treatment options, including chemotherapy, targeted therapy, and palliative interventions, are driving demand.

- Transudative: This segment is significant due to the high prevalence of conditions like heart failure and liver cirrhosis, which are major causes of transudative effusions.

- Exudative: While also substantial, this segment's growth is influenced by the management of infectious diseases and inflammatory conditions.

End User:

- Hospitals: Hospitals represent the largest end-user segment, owing to their comprehensive healthcare facilities, specialized medical teams, and the critical care required for managing complex pleural effusion cases. The availability of advanced diagnostic and treatment equipment within hospital settings further solidifies their dominance.

- Ambulatory Clinics: The increasing trend towards outpatient management of certain pleural effusion types and the growing prevalence of minimally invasive procedures are contributing to the growth of this segment.

- Other End Users: This includes long-term care facilities and home healthcare services, which are gaining traction for post-treatment management and palliative care.

Dominance Analysis:

The dominance of North America is attributed to factors such as robust economic policies that support healthcare spending, advanced medical infrastructure that facilitates the adoption of cutting-edge treatments, and a proactive approach to clinical research and development. The high rate of diagnosis for conditions like lung cancer ensures a steady demand for effective pleural effusion management solutions. Similarly, within the disease types, the rising global cancer burden directly fuels the demand for treatments addressing malignant pleural effusions. For end-users, the centralized nature of advanced medical care in hospitals makes them the primary hub for pleural effusion treatment, from diagnosis through complex interventions.

Pleural Effusions Treatment Industry Product Developments

Product innovation in the Pleural Effusions Treatment Industry is focused on enhancing efficacy, improving patient comfort, and minimizing invasiveness. Developments include advanced pleural catheters for long-term drainage, novel intrapleural chemotherapeutic agents, and targeted biological therapies for malignant effusions. Companies are also innovating in the area of diagnostic tools for rapid and accurate identification of effusion causes. The competitive advantage lies in the development of solutions that offer better symptom relief, reduce hospital readmissions, and improve the overall quality of life for patients. Technological trends favor minimally invasive approaches and personalized medicine, driving the market towards solutions that can be administered in outpatient settings.

Key Drivers of Pleural Effusions Treatment Industry Growth

The Pleural Effusions Treatment Industry is propelled by several key growth drivers. Technological advancements in diagnostic imaging and therapeutic delivery systems are enabling more precise and effective treatments. The increasing global prevalence of underlying diseases such as lung cancer, heart failure, and infectious diseases directly correlates with the demand for pleural effusion management. Growing healthcare expenditure worldwide, particularly in emerging economies, allows for greater investment in advanced medical technologies and treatments. Favorable regulatory environments that support the approval of innovative therapies and devices also contribute significantly. The rising demand for minimally invasive procedures and the trend towards outpatient care are further fueling market expansion.

Challenges in the Pleural Effusions Treatment Industry Market

Despite the positive growth outlook, the Pleural Effusions Treatment Industry faces several challenges. High costs associated with advanced treatments and medical devices can limit accessibility, especially in resource-constrained regions. Stringent regulatory approval processes can delay the market entry of new products and therapies. Reimbursement complexities and variations across different healthcare systems can also pose a barrier. Furthermore, competition from alternative treatment modalities and the need for continuous innovation to stay ahead of emerging threats present ongoing challenges. Supply chain disruptions and the availability of skilled healthcare professionals are also critical factors influencing market dynamics.

Emerging Opportunities in Pleural Effusions Treatment Industry

The Pleural Effusions Treatment Industry presents numerous emerging opportunities. The development of novel targeted therapies for malignant pleural effusions, particularly those leveraging immunotherapy and personalized medicine approaches, holds immense potential. Advancements in regenerative medicine could offer new avenues for treating underlying lung damage contributing to effusions. Expansion into emerging markets with growing healthcare infrastructure and increasing patient awareness offers significant untapped revenue streams. Strategic partnerships and collaborations between pharmaceutical companies, medical device manufacturers, and research institutions can accelerate innovation and market penetration. The focus on improving diagnostic accuracy and speed through AI-powered solutions also presents a promising area for growth.

Leading Players in the Pleural Effusions Treatment Industry Sector

- Becton Dickinson and Company

- pfm medical ag

- Cook Medical

- Bicakcilar

- Smith Medical

- Grena

- Lung Therapeutics Inc

- Redax

- Taiho Pharmaceutical Co Ltd

- Biometrix

- Rocket Medical

- B Braun SE

Key Milestones in Pleural Effusions Treatment Industry Industry

- April 2022: The study titled 'IFN-γ Combined With T Cells in the Treatment of Refractory Malignant Pleural Effusion and Ascites' was registered in ClinicalTrials.gov for Malignant Pleural Effusion, signaling advancements in immunotherapy-based treatments.

- September 2021: Bristol Mayer Squibb declared three-year data from the CheckMate -743 trial. As per the clinical trial data, serious adverse reactions occurred in 54% of patients receiving OPDIVO plus YERVOY. The most frequent serious adverse reactions reported in 2% of patients were pneumonia, pyrexia, diarrhea, pneumonitis, pleural effusion, dyspnea, acute kidney injury, infusion-related reaction, musculoskeletal pain, and pulmonary embolism. This highlighted the safety profile and patient outcomes associated with leading oncological treatments that can impact pleural effusion management.

Strategic Outlook for Pleural Effusions Treatment Industry Market

The strategic outlook for the Pleural Effusions Treatment Industry is highly positive, driven by continuous innovation and expanding market reach. Future growth will be accelerated by the development of more precise and personalized treatment strategies, particularly for malignant pleural effusions. The industry will see increased investment in research and development for novel therapeutic agents and advanced diagnostic tools. Strategic partnerships aimed at accelerating product commercialization and expanding geographical presence will be crucial. Furthermore, the growing emphasis on value-based healthcare and patient-centric outcomes will shape the market, favoring solutions that demonstrate superior efficacy and cost-effectiveness. The projected market expansion signifies a robust opportunity for stakeholders to invest in and capitalize on the evolving landscape of pleural effusion management.

Pleural Effusions Treatment Industry Segmentation

-

1. Disease Type

- 1.1. Transudative

- 1.2. Exudative

-

2. End User

- 2.1. Hospitals

- 2.2. Ambulatory Clinics

- 2.3. Other End Users

Pleural Effusions Treatment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pleural Effusions Treatment Industry Regional Market Share

Geographic Coverage of Pleural Effusions Treatment Industry

Pleural Effusions Treatment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Pleural Effusions; Significant Progress in the Management of Pleural Effusions

- 3.3. Market Restrains

- 3.3.1. Partial Success Rate of Treatment

- 3.4. Market Trends

- 3.4.1. Transudative Pleural Effusions Segment Shows Lucrative Opportunity in the Pleural Effusions Treatment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 5.1.1. Transudative

- 5.1.2. Exudative

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Ambulatory Clinics

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 6. North America Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 6.1.1. Transudative

- 6.1.2. Exudative

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Ambulatory Clinics

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 7. Europe Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 7.1.1. Transudative

- 7.1.2. Exudative

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Ambulatory Clinics

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 8. Asia Pacific Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 8.1.1. Transudative

- 8.1.2. Exudative

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Ambulatory Clinics

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 9. Middle East and Africa Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Disease Type

- 9.1.1. Transudative

- 9.1.2. Exudative

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Ambulatory Clinics

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Disease Type

- 10. South America Pleural Effusions Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Disease Type

- 10.1.1. Transudative

- 10.1.2. Exudative

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Ambulatory Clinics

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Disease Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 pfm medical ag*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cook Medical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bicakcilar

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smith Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Grena

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lung Therapeutics Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Redax

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Taiho Pharmaceutical Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Biometrix

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rocket Medical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 B Braun SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Pleural Effusions Treatment Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Pleural Effusions Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 3: North America Pleural Effusions Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 4: North America Pleural Effusions Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Pleural Effusions Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Pleural Effusions Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Pleural Effusions Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pleural Effusions Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 9: Europe Pleural Effusions Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 10: Europe Pleural Effusions Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Pleural Effusions Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Pleural Effusions Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Pleural Effusions Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pleural Effusions Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 15: Asia Pacific Pleural Effusions Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 16: Asia Pacific Pleural Effusions Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Pleural Effusions Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Pleural Effusions Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Pleural Effusions Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Pleural Effusions Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 21: Middle East and Africa Pleural Effusions Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 22: Middle East and Africa Pleural Effusions Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Middle East and Africa Pleural Effusions Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Pleural Effusions Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Pleural Effusions Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Pleural Effusions Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 27: South America Pleural Effusions Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 28: South America Pleural Effusions Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: South America Pleural Effusions Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Pleural Effusions Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Pleural Effusions Treatment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 2: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 5: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 11: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 20: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 21: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 29: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 30: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 35: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 36: Global Pleural Effusions Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Pleural Effusions Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pleural Effusions Treatment Industry?

The projected CAGR is approximately 7.23%.

2. Which companies are prominent players in the Pleural Effusions Treatment Industry?

Key companies in the market include Becton Dickinson and Company, pfm medical ag*List Not Exhaustive, Cook Medical, Bicakcilar, Smith Medical, Grena, Lung Therapeutics Inc, Redax, Taiho Pharmaceutical Co Ltd, Biometrix, Rocket Medical, B Braun SE.

3. What are the main segments of the Pleural Effusions Treatment Industry?

The market segments include Disease Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Pleural Effusions; Significant Progress in the Management of Pleural Effusions.

6. What are the notable trends driving market growth?

Transudative Pleural Effusions Segment Shows Lucrative Opportunity in the Pleural Effusions Treatment Market.

7. Are there any restraints impacting market growth?

Partial Success Rate of Treatment.

8. Can you provide examples of recent developments in the market?

In April 2022, the study titled 'IFN-γ Combined With T Cells in the Treatment of Refractory Malignant Pleural Effusion and Ascites' was registered in ClinicalTrials.gov for Malignant Pleural Effusion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pleural Effusions Treatment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pleural Effusions Treatment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pleural Effusions Treatment Industry?

To stay informed about further developments, trends, and reports in the Pleural Effusions Treatment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence