Key Insights

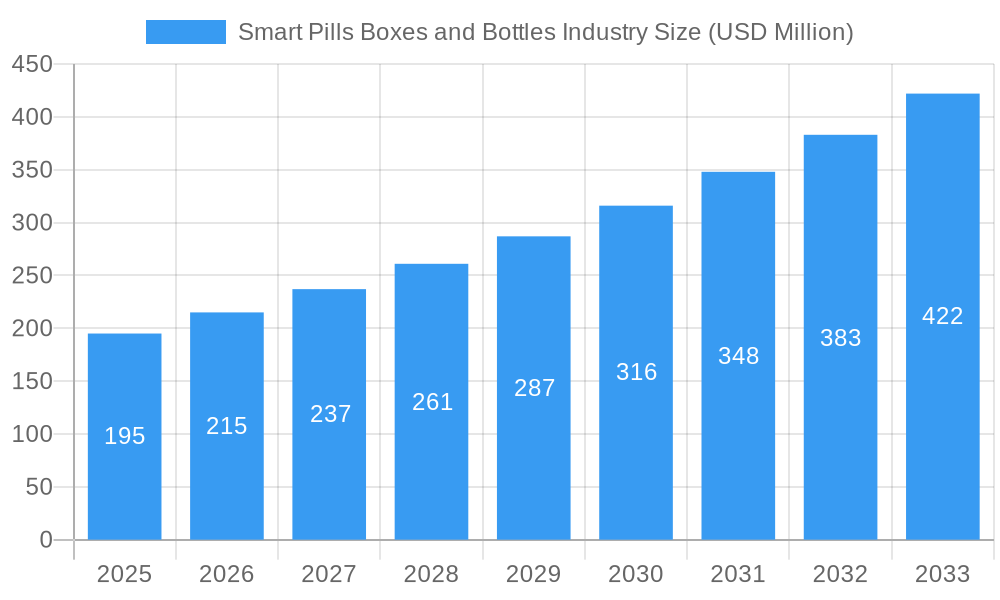

The global Smart Pill Boxes and Bottles market is poised for significant expansion, projected to reach $195 million by 2025. This robust growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 10.1%, indicating a dynamic and evolving industry. A primary driver for this upward trajectory is the increasing prevalence of chronic diseases such as diabetes and cancer, which necessitate meticulous medication management. The growing aging population worldwide, particularly in developed regions, also significantly contributes to market demand as seniors often require assistance with their medication regimens. Furthermore, the rising adoption of smart home technologies and a greater emphasis on personalized healthcare solutions are creating fertile ground for the integration of smart pill management devices. Technological advancements, including improved sensor capabilities, AI-driven reminders, and seamless connectivity with healthcare providers, are enhancing the functionality and appeal of these products, making them indispensable tools for improving patient adherence and therapeutic outcomes.

Smart Pills Boxes and Bottles Industry Market Size (In Million)

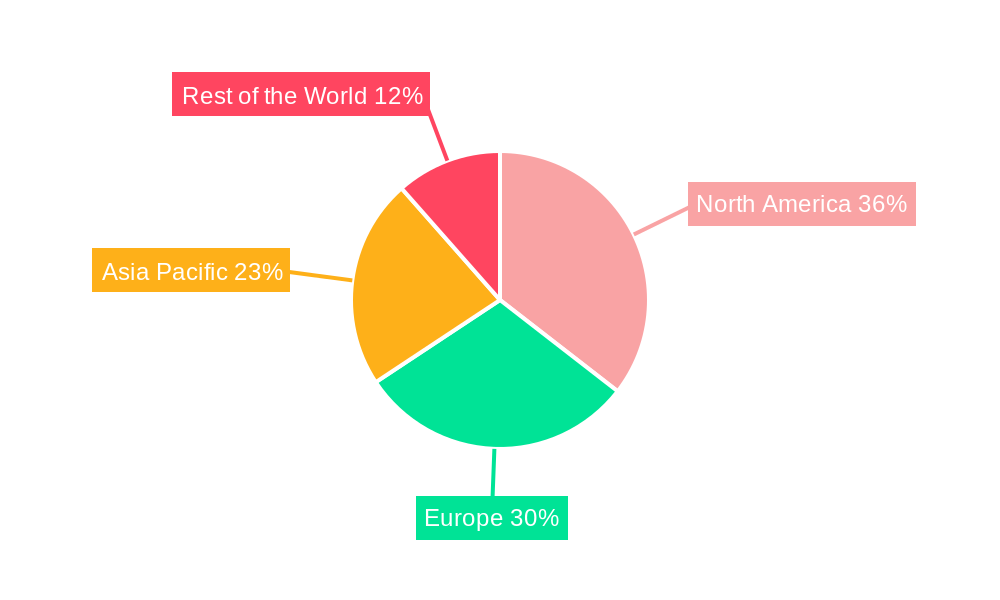

The market is segmented across various product types, including smart pill boxes and smart pill bottles, catering to diverse user needs. Key indications addressed by these smart devices span dementia, cancer management, and diabetes care, highlighting their critical role in managing complex health conditions. The end-user landscape is equally varied, encompassing home care settings, long-term care centers, and hospitals, underscoring the versatility and widespread applicability of smart pill management solutions. North America and Europe are expected to lead market share due to advanced healthcare infrastructure, high disposable incomes, and early adoption of technology. The Asia Pacific region is anticipated to witness rapid growth, driven by increasing healthcare expenditure, a burgeoning elderly population, and a growing awareness of digital health solutions. While the market benefits from these strong growth drivers, potential restraints such as the initial cost of smart devices and concerns regarding data privacy and security need to be strategically addressed to ensure sustained and widespread adoption.

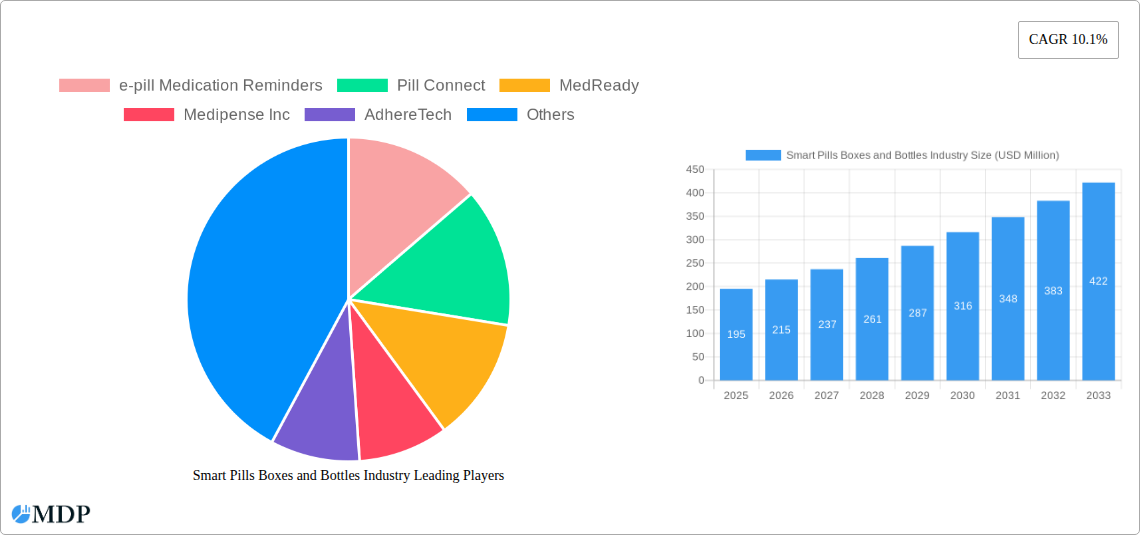

Smart Pills Boxes and Bottles Industry Company Market Share

Smart Pills Boxes and Bottles Industry: Market Analysis, Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global Smart Pills Boxes and Bottles Industry. Spanning the historical period of 2019-2024, base year of 2025, and an extensive forecast period of 2025-2033, this study offers crucial insights into market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and the competitive landscape. With an estimated market size projected to reach xx million by 2025 and a CAGR of xx% during the forecast period, this report is an indispensable resource for industry stakeholders seeking to navigate this rapidly evolving sector. Our analysis incorporates high-traffic keywords such as "smart pill dispenser," "medication adherence solutions," "digital health devices," and "pharmaceutical packaging technology" to maximize search visibility.

Smart Pills Boxes and Bottles Industry Market Dynamics & Concentration

The Smart Pills Boxes and Bottles Industry is characterized by moderate market concentration, with a growing number of innovative startups and established healthcare technology companies vying for market share. Innovation drivers are primarily fueled by the increasing global prevalence of chronic diseases, the aging population, and the growing demand for convenient and reliable medication management solutions. Regulatory frameworks, while evolving, are largely supportive of digital health technologies that enhance patient safety and adherence. Product substitutes, such as traditional pill organizers and manual reminder systems, are gradually being displaced by the enhanced capabilities of smart devices. End-user trends indicate a strong preference for user-friendly interfaces, remote monitoring capabilities, and seamless integration with other healthcare platforms. Mergers and acquisition (M&A) activities, with an estimated xx deal counts between 2019-2024, are prevalent as larger companies seek to acquire innovative technologies and expand their product portfolios. The market share of leading players is currently estimated at xx%, indicating room for further consolidation and growth.

Smart Pills Boxes and Bottles Industry Industry Trends & Analysis

The Smart Pills Boxes and Bottles Industry is poised for significant expansion, driven by a confluence of technological advancements and societal needs. The escalating burden of chronic diseases globally, including diabetes, cardiovascular conditions, and neurological disorders, necessitates enhanced medication adherence, a core function of smart pill solutions. This trend is projected to propel market growth, with an estimated market penetration rate of xx% by 2025. Technological disruptions, such as the integration of IoT capabilities, AI-powered adherence tracking, and data analytics for personalized medication regimens, are revolutionizing the industry. Consumers, increasingly tech-savvy and health-conscious, are actively seeking smart devices that simplify their lives and empower them in managing their health. This escalating consumer preference for convenience and proactive health management is a key growth driver. The competitive landscape is dynamic, marked by continuous product innovation and strategic partnerships between technology providers and pharmaceutical companies. The market is also experiencing a growing demand for smart pill bottles that offer features like tamper-evidence and automated refill reminders, complementing the functionality of smart pill boxes. The overall CAGR for the industry is projected to be xx% during the forecast period, reflecting robust expansion.

Leading Markets & Segments in Smart Pills Boxes and Bottles Industry

The Smart Pills Boxes and Bottles Industry is witnessing robust growth across various geographical regions and demographic segments.

- Dominant Region: North America currently leads the market, driven by a high prevalence of chronic diseases, strong healthcare infrastructure, and early adoption of digital health technologies. The United States, in particular, represents a significant market share due to favorable reimbursement policies and a concentration of key industry players.

- Dominant Country: The United States, within North America, stands out as the dominant country due to its advanced healthcare system and high disposable income, enabling greater investment in smart health devices.

- Product Type Dominance: Smart Pill Boxes are currently the leading product type, owing to their established functionality in organizing and reminding users of medication schedules. However, Smart Pill Bottles are rapidly gaining traction with their added features like tracking consumption and providing real-time data.

- Indication Dominance: Dementia care represents a significant market segment. The challenges associated with memory loss and complex medication regimens in dementia patients make smart pill solutions invaluable for caregivers and patients alike. Cancer Management and Diabetes Care also represent substantial segments, with smart devices aiding in adherence to critical treatment plans.

- End User Dominance: Home Care Settings are the primary end-users, reflecting the growing trend of aging in place and the need for remote monitoring solutions for elderly individuals and those managing chronic conditions independently. Long Term Care Centers and Hospitals are also increasingly adopting these technologies to improve patient safety and reduce medication errors.

Key drivers of dominance in these segments include:

- Economic Policies: Government initiatives promoting digital health adoption and reimbursement for remote patient monitoring.

- Infrastructure: The availability of reliable internet connectivity and supportive healthcare IT infrastructure.

- Awareness and Education: Increased awareness among patients and caregivers about the benefits of smart medication management.

- Technological Advancement: Continuous innovation in device features and integration capabilities.

Smart Pills Boxes and Bottles Industry Product Developments

Product development in the Smart Pills Boxes and Bottles Industry is characterized by a focus on enhanced user experience and expanded functionalities. Innovations include the integration of AI for personalized adherence coaching, advanced tamper-evident features in smart pill bottles, and seamless connectivity with wearable devices and electronic health records (EHRs). Competitive advantages are being carved out through superior battery life, intuitive mobile applications, and robust data security measures. The market is witnessing a trend towards aesthetically pleasing designs that blend seamlessly into home environments, moving beyond purely functional medical devices. Applications range from simplifying daily medication regimens for individuals with chronic conditions to supporting complex treatment protocols for oncology patients.

Key Drivers of Smart Pills Boxes and Bottles Industry Growth

The growth of the Smart Pills Boxes and Bottles Industry is propelled by several key factors. Technologically, the proliferation of IoT, miniaturization of sensors, and advancements in cloud computing enable more sophisticated and interconnected devices. Economically, the increasing healthcare expenditure worldwide, coupled with a growing demand for cost-effective solutions to manage chronic diseases, fuels adoption. Regulatory bodies are increasingly recognizing the value of digital health tools in improving patient outcomes and reducing healthcare system strain. Furthermore, the aging global population and the rise of home-based care models create a fertile ground for smart medication management solutions. The increasing prevalence of medication non-adherence, a significant public health concern, further amplifies the demand for these innovative tools.

Challenges in the Smart Pills Boxes and Bottles Industry Market

Despite its promising growth, the Smart Pills Boxes and Bottles Industry faces several challenges. Regulatory hurdles, particularly concerning data privacy and medical device approvals in different regions, can slow down market entry and product deployment. Supply chain disruptions, exacerbated by geopolitical events and manufacturing complexities, can impact production and availability. Competitive pressures from both established players and new entrants necessitate continuous innovation and cost optimization. Furthermore, achieving widespread consumer adoption requires overcoming the initial cost barrier of these advanced devices and ensuring user-friendliness for diverse demographics, including the elderly who may have limited technological proficiency.

Emerging Opportunities in Smart Pills Boxes and Bottles Industry

Emerging opportunities in the Smart Pills Boxes and Bottles Industry are vast and largely driven by technological breakthroughs and evolving healthcare paradigms. The integration of smart pill solutions with telehealth platforms presents a significant opportunity for remote patient monitoring and intervention. Advancements in personalized medicine, where medication dosages and schedules are tailored to individual genetic makeup and lifestyle, can be significantly supported by smart pill devices that precisely track adherence. Strategic partnerships between smart device manufacturers, pharmaceutical companies, and insurance providers can unlock new distribution channels and reimbursement models. Furthermore, the expansion into emerging economies with growing middle classes and increasing access to healthcare presents a substantial untapped market potential.

Leading Players in the Smart Pills Boxes and Bottles Industry Sector

- e-pill Medication Reminders

- Pill Connect

- MedReady

- Medipense Inc

- AdhereTech

- Group Medical Supply LLC

- Pillo Inc

- PillDrill Inc

- Koninklijke Philips NV

- Medminder Inc

- PharmRight Corporation

Key Milestones in Smart Pills Boxes and Bottles Industry Industry

- January 2023: Oxfordshire County Council's Innovation Hub team launched a smart box that reminds people to take their medication on time and a mobile device with a fall sensor in United Kingdom.

- January 2022: A Vancouver-based company created its first smart pillbox, Loba, which combines aesthetics and functionality, featuring a slick design with detachable compartments storing a week's worth of pills, split into AM and PM sections.

Strategic Outlook for Smart Pills Boxes and Bottles Industry Market

The strategic outlook for the Smart Pills Boxes and Bottles Industry is exceptionally positive, characterized by robust growth accelerators. The increasing focus on preventative healthcare and value-based care models worldwide positions smart medication adherence solutions as crucial tools for improving patient outcomes and reducing long-term healthcare costs. Continued technological advancements, particularly in AI and data analytics, will enable more sophisticated and personalized patient engagement. Strategic collaborations between device manufacturers, healthcare providers, and pharmaceutical companies are expected to drive market penetration and expand the ecosystem. The growing demand for integrated health solutions, where smart pill devices seamlessly connect with other health monitoring tools, presents a significant opportunity for market expansion and innovation. The industry is poised for further consolidation and the emergence of comprehensive digital health platforms.

Smart Pills Boxes and Bottles Industry Segmentation

-

1. Product Type

- 1.1. Smart Pill Boxes

- 1.2. Smart Pill Bottles

-

2. Indication

- 2.1. Dementia

- 2.2. Cancer Management

- 2.3. Diabetes Care

- 2.4. Other Indications

-

3. End User

- 3.1. Home Care Settings

- 3.2. Long Term Care Centers

- 3.3. Hospitals

Smart Pills Boxes and Bottles Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Smart Pills Boxes and Bottles Industry Regional Market Share

Geographic Coverage of Smart Pills Boxes and Bottles Industry

Smart Pills Boxes and Bottles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Chronic Disorders and Geriatric Population; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost Issues

- 3.4. Market Trends

- 3.4.1. Long-term Care Centers Segment is Expected to Witness Considerable Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Pills Boxes and Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Smart Pill Boxes

- 5.1.2. Smart Pill Bottles

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Dementia

- 5.2.2. Cancer Management

- 5.2.3. Diabetes Care

- 5.2.4. Other Indications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Home Care Settings

- 5.3.2. Long Term Care Centers

- 5.3.3. Hospitals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Smart Pills Boxes and Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Smart Pill Boxes

- 6.1.2. Smart Pill Bottles

- 6.2. Market Analysis, Insights and Forecast - by Indication

- 6.2.1. Dementia

- 6.2.2. Cancer Management

- 6.2.3. Diabetes Care

- 6.2.4. Other Indications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Home Care Settings

- 6.3.2. Long Term Care Centers

- 6.3.3. Hospitals

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Smart Pills Boxes and Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Smart Pill Boxes

- 7.1.2. Smart Pill Bottles

- 7.2. Market Analysis, Insights and Forecast - by Indication

- 7.2.1. Dementia

- 7.2.2. Cancer Management

- 7.2.3. Diabetes Care

- 7.2.4. Other Indications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Home Care Settings

- 7.3.2. Long Term Care Centers

- 7.3.3. Hospitals

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Smart Pills Boxes and Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Smart Pill Boxes

- 8.1.2. Smart Pill Bottles

- 8.2. Market Analysis, Insights and Forecast - by Indication

- 8.2.1. Dementia

- 8.2.2. Cancer Management

- 8.2.3. Diabetes Care

- 8.2.4. Other Indications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Home Care Settings

- 8.3.2. Long Term Care Centers

- 8.3.3. Hospitals

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Smart Pills Boxes and Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Smart Pill Boxes

- 9.1.2. Smart Pill Bottles

- 9.2. Market Analysis, Insights and Forecast - by Indication

- 9.2.1. Dementia

- 9.2.2. Cancer Management

- 9.2.3. Diabetes Care

- 9.2.4. Other Indications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Home Care Settings

- 9.3.2. Long Term Care Centers

- 9.3.3. Hospitals

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 e-pill Medication Reminders

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Pill Connect

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MedReady

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Medipense Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 AdhereTech

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Group Medical Supply LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Pillo Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 PillDrill Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Koninklijke Philips NV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Medminder Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 PharmRight Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 e-pill Medication Reminders

List of Figures

- Figure 1: Global Smart Pills Boxes and Bottles Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Smart Pills Boxes and Bottles Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Smart Pills Boxes and Bottles Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: North America Smart Pills Boxes and Bottles Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Smart Pills Boxes and Bottles Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Smart Pills Boxes and Bottles Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Smart Pills Boxes and Bottles Industry Revenue (undefined), by Indication 2025 & 2033

- Figure 8: North America Smart Pills Boxes and Bottles Industry Volume (K Unit), by Indication 2025 & 2033

- Figure 9: North America Smart Pills Boxes and Bottles Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 10: North America Smart Pills Boxes and Bottles Industry Volume Share (%), by Indication 2025 & 2033

- Figure 11: North America Smart Pills Boxes and Bottles Industry Revenue (undefined), by End User 2025 & 2033

- Figure 12: North America Smart Pills Boxes and Bottles Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Smart Pills Boxes and Bottles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Smart Pills Boxes and Bottles Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Smart Pills Boxes and Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Smart Pills Boxes and Bottles Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Smart Pills Boxes and Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Smart Pills Boxes and Bottles Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Smart Pills Boxes and Bottles Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 20: Europe Smart Pills Boxes and Bottles Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: Europe Smart Pills Boxes and Bottles Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Smart Pills Boxes and Bottles Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Europe Smart Pills Boxes and Bottles Industry Revenue (undefined), by Indication 2025 & 2033

- Figure 24: Europe Smart Pills Boxes and Bottles Industry Volume (K Unit), by Indication 2025 & 2033

- Figure 25: Europe Smart Pills Boxes and Bottles Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 26: Europe Smart Pills Boxes and Bottles Industry Volume Share (%), by Indication 2025 & 2033

- Figure 27: Europe Smart Pills Boxes and Bottles Industry Revenue (undefined), by End User 2025 & 2033

- Figure 28: Europe Smart Pills Boxes and Bottles Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Smart Pills Boxes and Bottles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Smart Pills Boxes and Bottles Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Smart Pills Boxes and Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Europe Smart Pills Boxes and Bottles Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Smart Pills Boxes and Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Smart Pills Boxes and Bottles Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Smart Pills Boxes and Bottles Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Smart Pills Boxes and Bottles Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue (undefined), by Indication 2025 & 2033

- Figure 40: Asia Pacific Smart Pills Boxes and Bottles Industry Volume (K Unit), by Indication 2025 & 2033

- Figure 41: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 42: Asia Pacific Smart Pills Boxes and Bottles Industry Volume Share (%), by Indication 2025 & 2033

- Figure 43: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue (undefined), by End User 2025 & 2033

- Figure 44: Asia Pacific Smart Pills Boxes and Bottles Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Smart Pills Boxes and Bottles Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Asia Pacific Smart Pills Boxes and Bottles Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Smart Pills Boxes and Bottles Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Smart Pills Boxes and Bottles Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 52: Rest of the World Smart Pills Boxes and Bottles Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Rest of the World Smart Pills Boxes and Bottles Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Rest of the World Smart Pills Boxes and Bottles Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Rest of the World Smart Pills Boxes and Bottles Industry Revenue (undefined), by Indication 2025 & 2033

- Figure 56: Rest of the World Smart Pills Boxes and Bottles Industry Volume (K Unit), by Indication 2025 & 2033

- Figure 57: Rest of the World Smart Pills Boxes and Bottles Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 58: Rest of the World Smart Pills Boxes and Bottles Industry Volume Share (%), by Indication 2025 & 2033

- Figure 59: Rest of the World Smart Pills Boxes and Bottles Industry Revenue (undefined), by End User 2025 & 2033

- Figure 60: Rest of the World Smart Pills Boxes and Bottles Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: Rest of the World Smart Pills Boxes and Bottles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Rest of the World Smart Pills Boxes and Bottles Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Rest of the World Smart Pills Boxes and Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: Rest of the World Smart Pills Boxes and Bottles Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Rest of the World Smart Pills Boxes and Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Smart Pills Boxes and Bottles Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Indication 2020 & 2033

- Table 4: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 5: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Indication 2020 & 2033

- Table 12: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 13: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 14: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 24: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 25: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Indication 2020 & 2033

- Table 26: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 27: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 28: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: France Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Italy Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Spain Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 44: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 45: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Indication 2020 & 2033

- Table 46: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 47: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 48: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 49: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: China Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: India Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Australia Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: South Korea Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 64: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 65: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Indication 2020 & 2033

- Table 66: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 67: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 68: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 69: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Pills Boxes and Bottles Industry?

The projected CAGR is approximately 10.1%.

2. Which companies are prominent players in the Smart Pills Boxes and Bottles Industry?

Key companies in the market include e-pill Medication Reminders, Pill Connect, MedReady, Medipense Inc, AdhereTech, Group Medical Supply LLC, Pillo Inc, PillDrill Inc, Koninklijke Philips NV, Medminder Inc, PharmRight Corporation.

3. What are the main segments of the Smart Pills Boxes and Bottles Industry?

The market segments include Product Type, Indication, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Chronic Disorders and Geriatric Population; Technological Advancements.

6. What are the notable trends driving market growth?

Long-term Care Centers Segment is Expected to Witness Considerable Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost Issues.

8. Can you provide examples of recent developments in the market?

In January 2023, Oxfordshire County Council's Innovation Hub team launched a smart box that reminds people to take their medication on time and a mobile device with a fall sensor in United Kindom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Pills Boxes and Bottles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Pills Boxes and Bottles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Pills Boxes and Bottles Industry?

To stay informed about further developments, trends, and reports in the Smart Pills Boxes and Bottles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence